Booming in forex trading, Canada owes its success to the robust regulations from IIROC, with hundreds of licensed brokers available for traders. With an increasing tide of Canadian investors turning to forex trading, the task of picking a suitable broker, especially for beginners, can seem daunting. Here we've put forward a catalogue of the best forex brokers, well-suited for beginners in Canada, for your consideration.

Best Forex Brokers for Beginners in Canada

An established broker under stringent regulation, trusted and reliable.

Low minimum deposit for beginnes to access more easily.

A well-established broker that has operated for 50 years, with a high recognization globally.

Innovative and advanced trading features, attractive for advanced traders.

A globally recognized broker, providing clients with more confidence.

Free deposit and withdrawal, 7/24 customer support available

Providing an NDD trading environment with easy digital account opening.

A good range of trading education suitable for traders of all expertise levels.

Extensive assortment of over 12,000 different types of financial assets.

The educational resources on CMC Markets have considerable breadth and depth.

more

Comprison of Best Forex Brokers for Beginners in Canada

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers for Beginners in Canada Overall

| Broker | Logo | Why are they listed as the Best Brokers for Beginners in Canada? |

| OANDA |  |

✅ Globally regulated, including IIROC in Canada, giving traders double confidence when trading. ✅$0 to start real trading, perfect for beginners in Canada who are just starting out in the forex industry. ✅Both MT4 and Tradingview platforms provided, simple and intuitive for beginners to operate when tarding. |

| Interactive Brokers |  |

✅Regulated by IIROC in Canada, a well-established broker with an excellent reputation. ✅Comprehensive Education Resources, well received by beginners, including free webinars, courses, quizzes, brief informative videos, and articles. ✅24/7 Customer Service for beginners who need help during their trading curve. |

| MultiBank Group |  |

✅ Heavily and internationally regulated, client funds safety can be guaranteed to some degree. ✅ Demo accounts for beginners to test the trading environment and practice their trading skills. ✅ 24/7 technical and account support, social trading features provided for beginners to copy successful trades. |

| TMGM |  |

✅Regulated by two tier-1 regulators, ASIC and FMA, standing out among competitors. ✅Demo accounts provided for beginners aiming to gain risk-free trading experience. ✅ Extensive educational material designed to cater to beginners, covering e-books, tutorial videos, and articles, and more. |

| CMC Markets |  |

✅ Multi-regulated broker, especially regulated by IIROC in Canada. ✅Comprehensive and rich educational content suitable for beginners, including webinars, articles, tutorials, and a demo account. ✅ Reliable customer service, which is accessible through live chat, phone, and email. |

| Forex.com |  |

✅ Internationally regulated, including IIROC in Canada, giving traders lots of confidence in trading. ✅Compreensive and quality educational resources that are particularly helpful for beginner traders, including free demo accounts. ✅ Transparent pricing structure, highly recognized by numerous traders. |

| AvaTrade |  |

✅ Globally regulated in multiple jurisdictions, attaching great importance for beginners in the forex industry. ✅Fast trades execution speed, solid trading platform performance. ✅Large ositive feedback for its educational resources, user-friendly platforms, and strong customer support. |

ONADA

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, FCA, FSA, NFA, IIROC, MAS

ONADA was started in 1996 and is now a reputable FX and CFD broker. An early leader in the field of foreign exchange trading online. Oanda is a global company with registrations in multiple jurisdictions, including the USA, Canada, Japan, the UK, Australia, and Singapore. It has a worldwide presence and provides a full spectrum of trading services to clients all over the globe. When it comes to cutting-edge technology and dedicated service, nobody does it better than OANDA.

| ✅Pros | ❌Cons |

| • Low minimum deposit to start | • Restricted leverage on some regions |

| • Established broker with a long operation | |

| • Competitve fees | |

| • State-of-the-art trading platforms | |

| • Strong regulatory framework |

InteractiveBrokers

Overall: ⭐⭐⭐⭐⭐

Regulation: IIROC

InteractiveBrokers is a reputable brokerage firm based in the United States. Established in 1978 by Thomas Peterffy, it has expanded its reach to become a prominent player in the online brokerage industry. It provides a diverse array of financial products and trading platforms to cater to the needs of individual and institutional investors worldwide. Interactive Brokers is renowned for its cutting-edge technology and highly competitive pricing, which has made it a favoured option among traders and investors across the globe.

| ✅Pros | ❌Cons |

| • IIROC regulated broker | • High minimum deposit for some accounts |

| • With a good reputation | |

| • Competitive pricing | |

| • Outstanding trading tools and • research tools | |

| • Best option for indices, futures and stocks | |

| • Decent customer support |

MultiBank

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, CYSEC, MAS

Established in California in 2005, MultiBank has risen to prominence as one of the foremost forex trading brokers worldwide. Today, it stands as a global financial institution offering its customers cutting-edge, direct trading access to various banks and exchanges via state-of-the-art trading platforms.

Since inception, MultiBank has successfully expanded its reach to over 280,000 retail and institutional clients spanning more than 90 countries. The company's presence is also physically manifested through its offices in key locations around the world, including Sydney, Los Angeles, Vienna, Frankfurt, Madrid, Cyprus, and the UAE.

| ✅Pros | ❌Cons |

| • A reputable broker with a long operation | • Poor educational section |

| • Global presence | |

| • Advanced trading platforms | |

| • Free deposit and withdrawal | |

| • 7/24 customer support |

TMGM

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, FMA, VFSC

TMGM (TradeMax Group) is a renowned global online forex and CFD broker established in 2017. The company is based in the Republic of Vanuatu, a small island nation in the South Pacific, and it provides trading services to clients all around the globe. TMGM offers a diverse selection of financial instruments, such as forex, commodities, indices, and cryptocurrencies, accessible through its user-friendly online trading platform. TMGM strives to provide a contemporary and intuitive trading experience for investors in the financial markets.

| ✅Pros | ❌Cons |

| • Operating under tier-1 regulator | • No Cent or Micro accounts |

| • Low forex fees | |

| • Access to various markets | |

| • 7/24 customer support | |

| • Free demo accounts |

CMC Markets

Overall: ⭐⭐⭐⭐⭐

Regulation: FCA, FMA, IIROC, MAS

CMC Markets is a brokerage firm established in 1989 and based in Australia, currently, with a bussiness operation of over 20 years. The company provides online trading services for a wide range of financial instruments, such as forex, commodities, and indices. CMC Markets is known for its user-friendly trading platforms and is regulated by financial authorities in multiple countries, making it a popular choice for retail traders and investors.

| ✅Pros | ❌Cons |

| • A well-established broker with a good reputation | • No 7/24 customer support |

| • User-friendly trading platform | |

| • Access to various markets | |

| • Outstanding trading tools | |

| • Multiple trading platforms |

FOREX.com

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, FCA, FSA, NFA, IIROC, CIMA, MAS

FOREX.com is a reputable online forex and CFD broker based in the United States. Established in 2001, it has built a strong reputation in the industry. This broker offers a diverse selection of trading instruments, such as forex, commodities, and indices, to meet the needs of both individual and institutional traders. One of the standout features of this platform is its user-friendly and versatile trading interface. Traders can choose between the popular MetaTrader 4 (MT4) platform or the proprietary web-based platform. Both options offer a robust and intuitive experience for executing trades and managing portfolios.

| ✅Pros | ❌Cons |

| • Well established broker with a good reputation | • Robot online support |

| • A well-regulated broker | • Trading limitations on MetaTrader accounts |

| • Competitive fee structure | • No Micro accounts |

| • Cryptos offered | |

| • Zeor-commission model | |

| • Demo accounts offered |

AvaTrade

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, FSA, FFAJ, CBI, FSCA, FCA

AvaTrade is an international forex and CFD brokerage that was founded in 2006 in Dublin, Ireland. Regulated by the Central Bank of Ireland and licensed by financial regulators across Europe, Japan, South Africa, and Australia, AvaTrade provides retail traders, institutions, and fund managers access to trading instruments spanning forex, cryptocurrencies, bonds, commodities, indices, stocks, and ETFs. AvaTrade stands out for its comprehensive educational resources, multilingual customer support, and array of trading platforms including the popular MetaTrader 4 and AvaTradeGO. Traders can choose between floating or fixed spreads and leverage up to 1:400. AvaTrade also offers automated trading through Expert Advisors on the MetaTrader 4 platform. With its focus on trust, innovation, and empowering traders, AvaTrade has grown rapidly over the past 15+ years to serve over 200,000 accounts globally.

| ✅Pros | ❌Cons |

| • A globally recognized broker | • No 7/24 customer support |

| • Low forex fees | |

| • Advanced technical solutions | |

| • Copy trading features offered | |

| • Quality educational contents | |

| • Industry-leading trading platform | |

| • Multilingual customer support |

Forex Trading Knowledge Questions and Answers

Will forex trading be safer in Canada?

Forex trading is considered safer in countries with robust financial regulations, and Canada is one of those countries. In Canada, forex trading is regulated by the Investment Industry Regulatory Organization of Canada (IIROC), which is a self-regulatory organization that oversees all investment dealers and trading activity on debt and equity marketplaces in the country. However, like any kind of investing, forex trading involves risk, and it's important to fully understand those risks before involved in forex trading.

Why deter beginners from chasing high profitability?

As a beginner in the world of trading, the pursuit of high profitability might appear attractive. However, traders, especially beginners, should understand the inherent high-risk nature this entails.When the expected profit-loss ratio is high, it typically means a higher frequency of trading is involved, making the winning odds exceedingly low.

Let's say the beginner makes 10 trades, each with a win-loss ratio of 3:1, which means if they win, they gain 3 times the amount they risk losing. In an ideal trading situation, with successful trades, the trader could gain a significant profit. But the reality of trading is that losses are part of the game as well, and with high-frequency trading, a loss might come sooner rather than later.

For instance, if they were to lose just once on the 10th trade after 9 successful ones, the loss incurred might wipe out the gains made from all previous successful trades due to the high risk/reward ratio. This significant loss could be a severe blow to the beginners capital and morale.

Let's say the beginner makes 10 trades, each with a win-loss ratio of 3:1, which means if they win, they gain 3 times the amount they risk losing.

In an ideal trading situation, with successful trades, the trader could gain a significant profit. But the reality of trading is that losses are part of the game as well, and with high-frequency trading, a loss might come sooner rather than later. For instance, if they were to lose just once on the 10th trade after 9 successful ones, the loss incurred might wipe out the gains made from all previous successful trades due to the high risk/reward ratio. This significant loss could be a severe blow to the beginners capital and morale.

What should beginners do to improve their profitability?

Beginners wondering how to improve their profitability in trading should reframe their conception of success. Often, beginners consider the success of a trade based on whether the position made or lost money. In other words, closing a position that gains a single point could be considered a success. Under such circumstances, a strategy might involve setting a stop loss at 100 points, and exiting the trade as soon as a profit of 2-3 points is achieved. This approach could result in a high winning rate simply because the trade is exited almost as soon as it turns profitable.

Another method to increase the winning rate would be to seek out historic market trends. Opportunities from these trends may arise only once every 3-5 months. While the frequency might be low, these situations can offer good profitability and stability as they tap into enduring market patterns.

The key here is to focus less on the magnitude of profitability from each trade, but more on the consistency of profitability over time. Novices should aim for a systematic approach to secure modest but steady gains instead of chasing colossal, risky profits in one go. This way, they can slowly build their trading experience and wealth simultaneously.

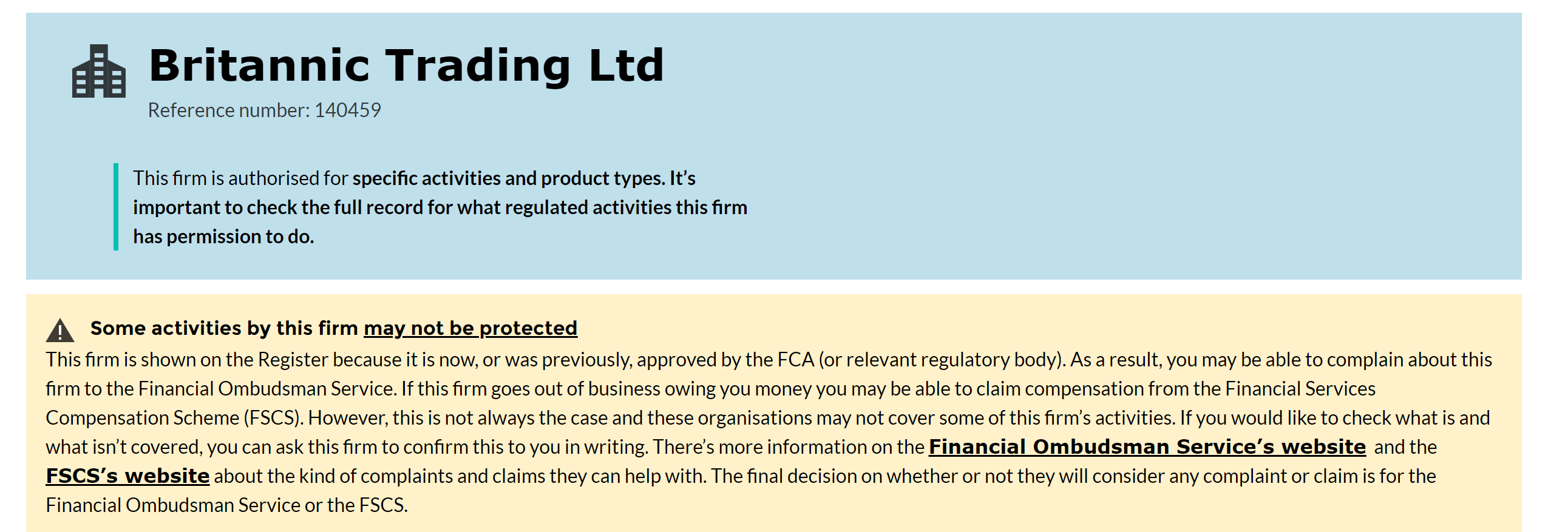

What are potential scam brokers that beginners should avoid in Canada?

Beginners in forex trading are the first target of these scam broker, for they know little about the forex markets, and how broker operates. Therefore, these scam brokers may use deceptive tactics to attract beginners, such as offering unrealistic profits or guaranteed returns. Once they have attracted clients, they may steal their money or refuse to withdraw funds. Here we have listed 5 potential scam brokers that traders should avoid in Canada:

| Broker | Registered Country | Regulation | Establishment of Years | Trading Platform | Customer Support | Additional Notes |

|

Mauritius |  |

1-2 Years | MT4 | Email only | |

|

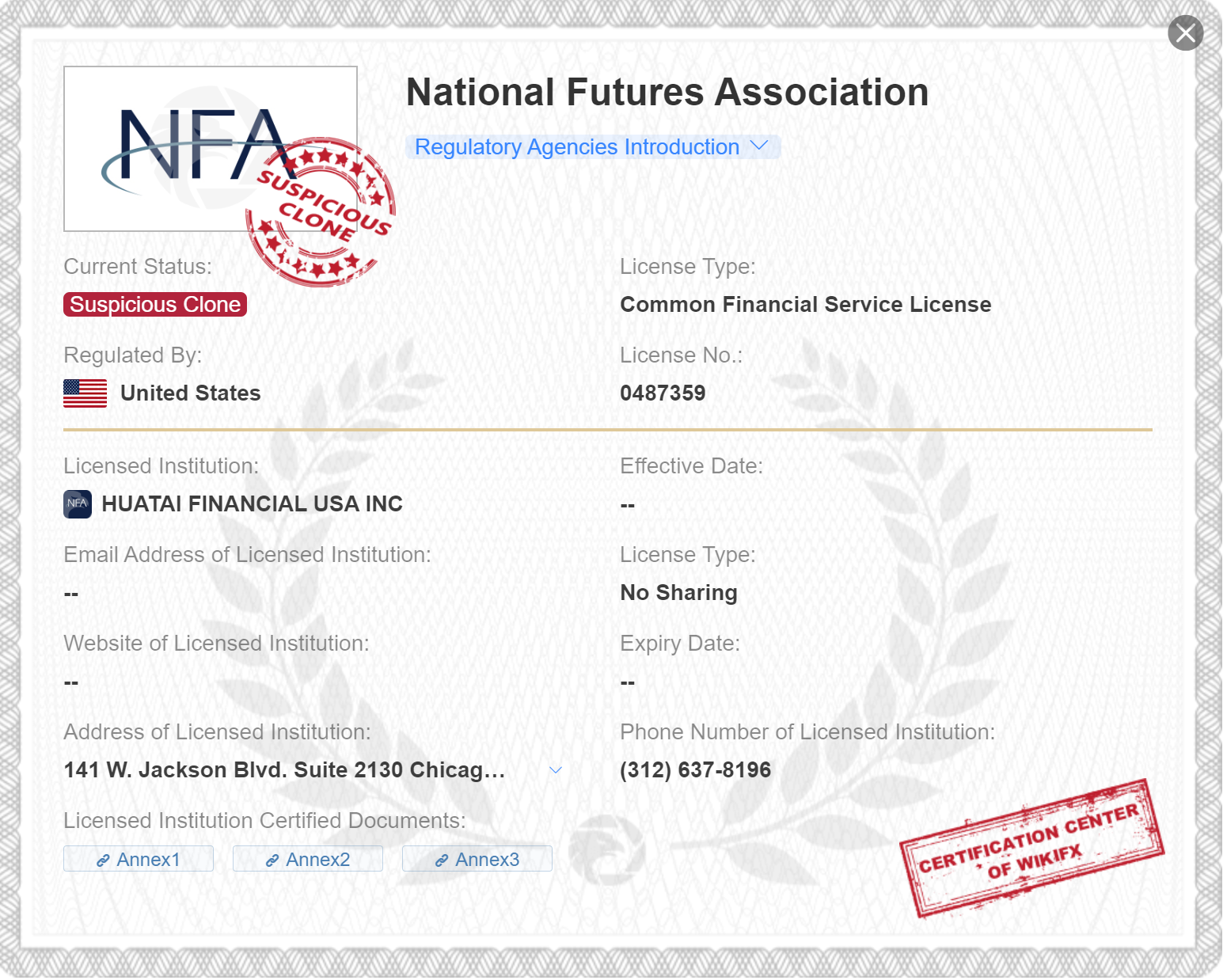

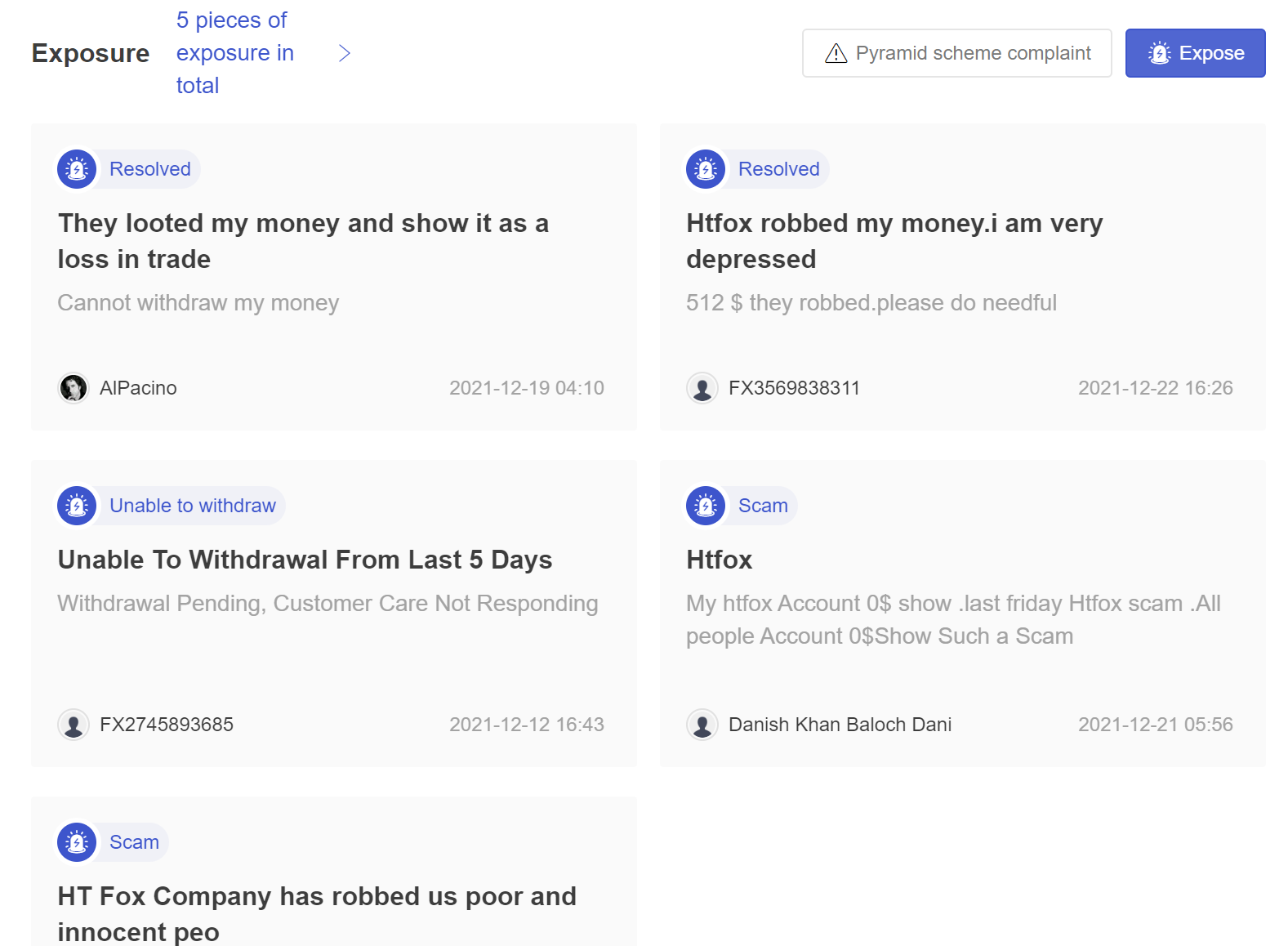

United States |  |

2-5 Years | Unknown | Social Media only | 5 pieces of scam exposure |

|

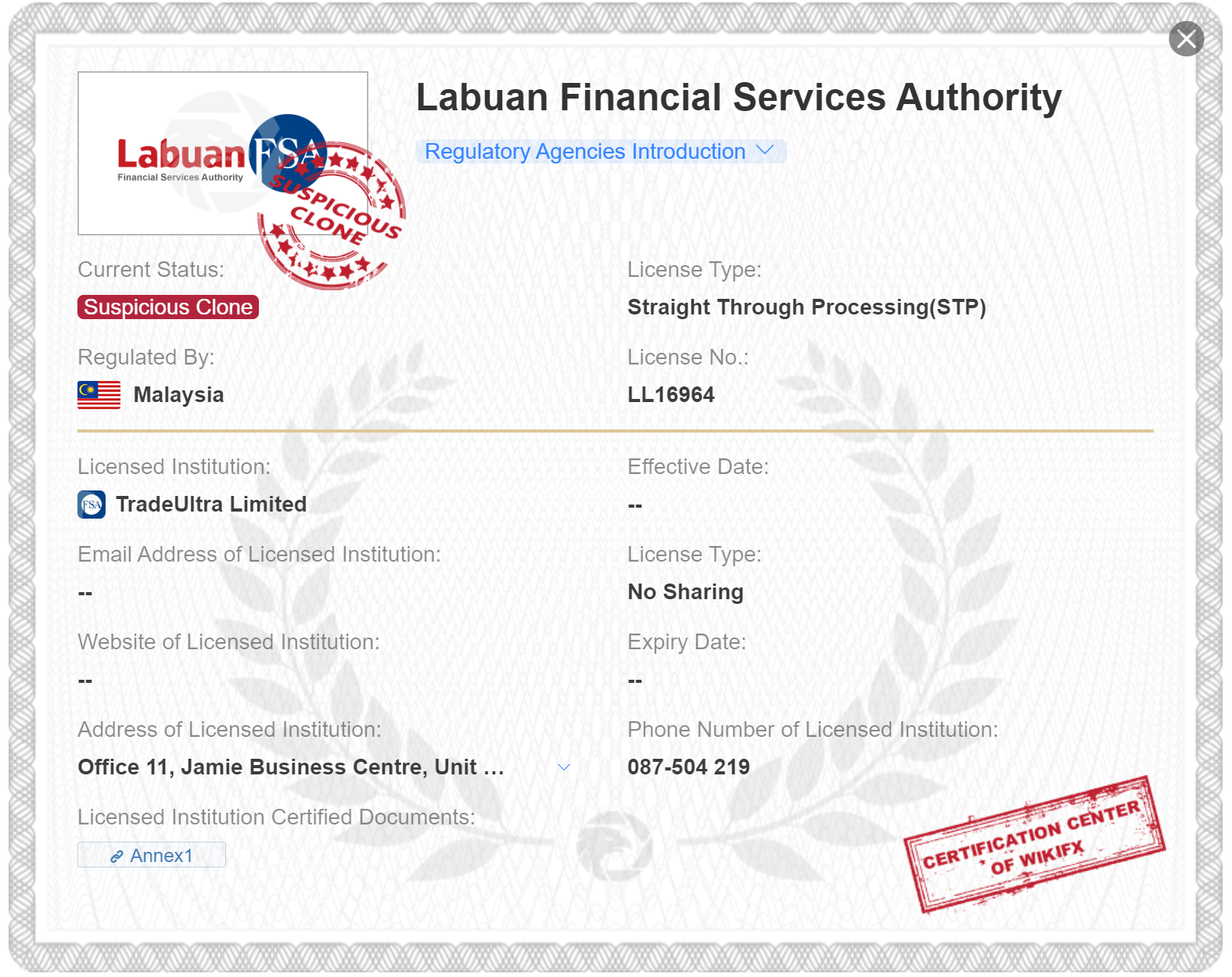

Malaysia |  |

1-2 Years | Unknown | Email only | |

|

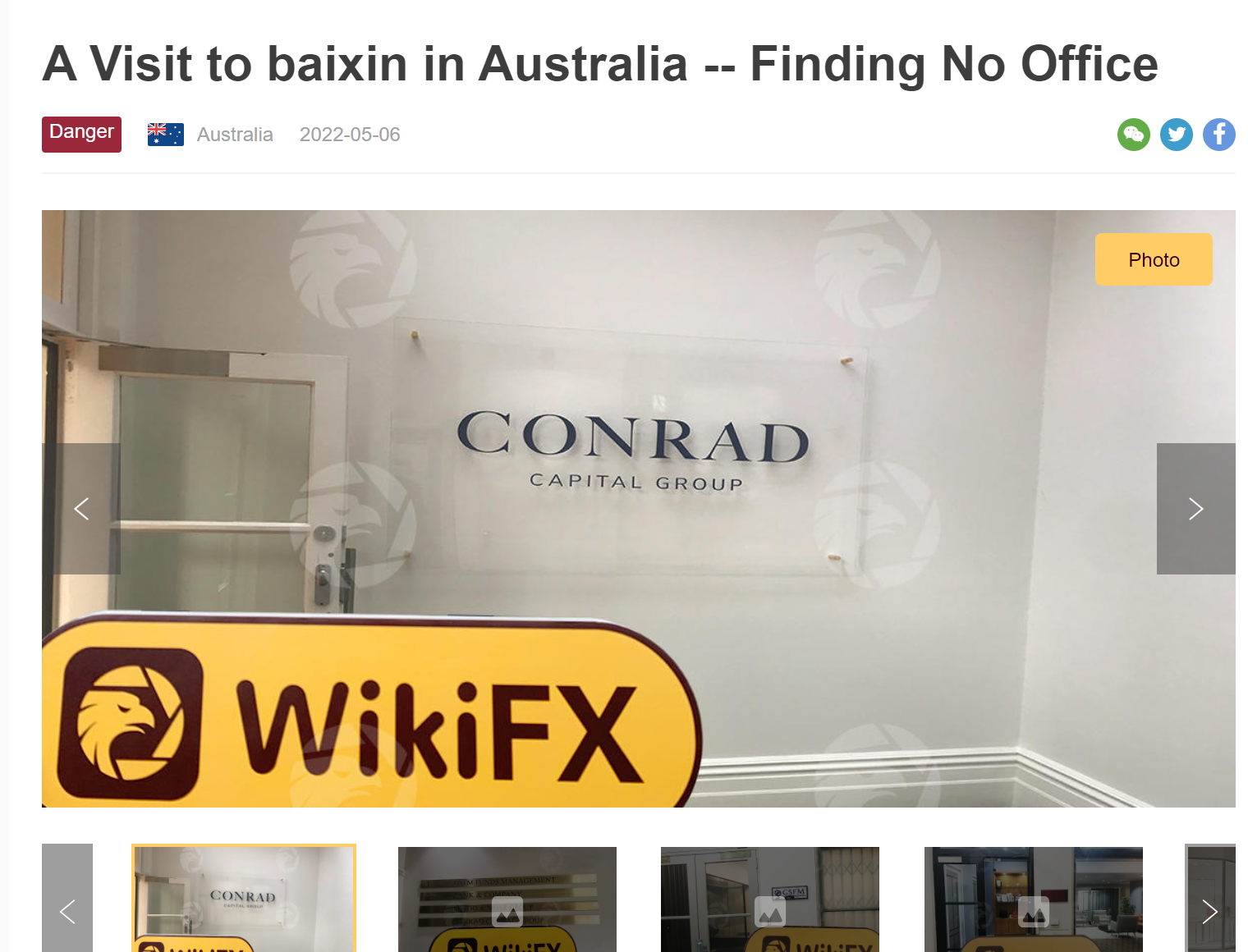

Australia |  |

5-10 years | Counterfeit MT4 | None | A Visit to baixin in Australia- Finding No Office |

|

United Kingdom |  |

5-10 years | Counterfeit MT4 | None |

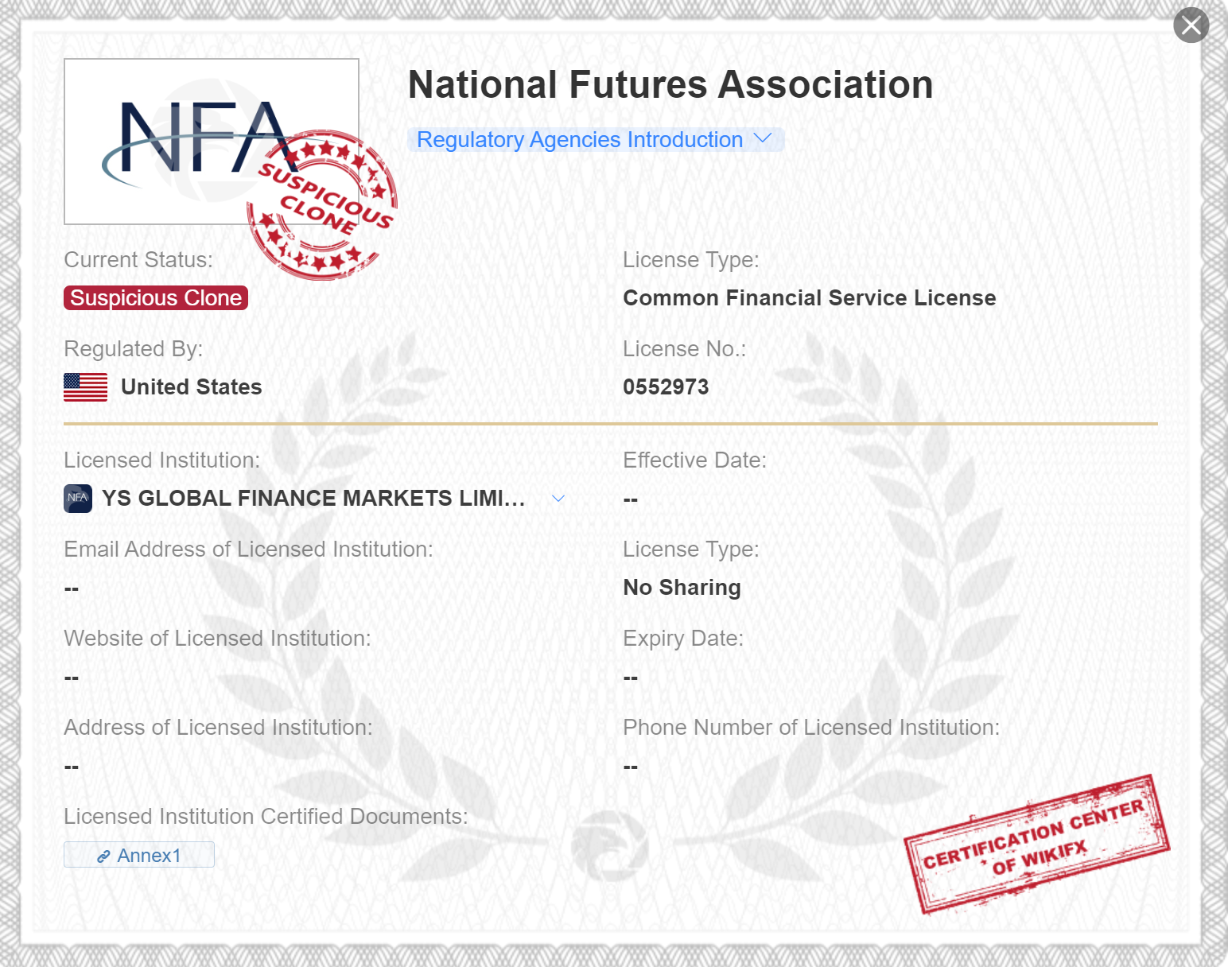

YS GLOBAL, which purports to be a forex broker overseen by the NFA, raises alarms when no corroborating information can be found on the NFA's official website. Compounding concerns are that this broker doesn't provide any contact details and maintains an unapproachable official website. Multiple negative reviews add fuel to the fire, signaling a clear caution - novices should avoid any engagement with this broker.

HTFOX claims to be an NFA-regulated forex broker. However, no proof is found on the NFA's website. The broker provides no contact info and has an inaccessible website. With plenty of negative reviews, it's advised that beginners should avoid this broker.

FXAlta purports to hold an LFSA license, which, upon scrutiny, we find does not exist at all. This implies that it operates in the absence of any legitimate regulation. With their website non-functional for an extended period and the customer support team unreachable, it is strongly advised that beginners maintain distance from this broker.

Baixin poses a serious risk as it holds a false regulatory license. On top of that, a check on Baixin's registered address reveals no office, indicating it uses deception to fool people.

BRTis a potential scam broker that claims to hold a fraudulent FCA regulatory license. The approved domain from the FCA institution is https://www.bp.com/en/global/bp-global-energy-trading.html, while BRT's domain (http://brtfca.com/) has no links with the FCA.

Do I need to learn more forex knowledge before trading?

Undeniably, gaining a solid master of forex trading principles and concepts before diving into the market, is necessary for the safety of your forex trading. Let's see why:

Here are some reasons why it's advisable to learn the basics before diving into the market:

Gain a foundation of knowledge:Forex trading can be complex, and understanding the fundamental concepts will provide you with a solid foundation for making informed trading decisions. This includes learning about the factors that influence currency prices, the different types of forex trades, and the tools and strategies used to analyze the market.

Reduce risk and potential losses:By understanding the risks associated with forex trading, you can make more informed decisions and minimize the potential for losses. This includes understanding margin trading, stop-loss orders, and the impact of market volatility.

Develop trading strategies:Once you have a basic understanding of forex trading, you can start to develop your own trading strategies. This will involve identifying patterns, trends, and indicators that can help you predict future price movements.

Practice and gain experience: There are many resources available for practicing forex trading without risking real money. Demo accounts allow you to simulate real-world trading conditions and test your trading strategies without putting your capital at risk.

Continuous learning and improvement:Forex trading is a dynamic market, and it's important to stay up-to-date with the latest news, trends, and analysis. This will help you refine your trading skills and make informed decisions.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

7 Best Platforms for Copy Trading in India 2026

India's leading copy trading platforms allows you to automatically copy the trades of top performers, enhancing profitbility.

Beware: 10 Fake Forex Brokers in the UK in 2026

With the need for caution in the UK's flourishing forex market, this article points out 10 fake brokers to avoid amidst numerous reputable entities.

Best Forex Brokers in Denmark for 2026

Discover top regulated forex brokers, trading platforms and broker reviews for reliable trading in Denmark.

Best Forex Brokers Ireland in 2026

Compare top forex brokers in Ireland with robust regulation, excellent platforms and broker reviews for secure trading.

8 Best Forex Brokers With Segregated Accounts in 2026

Review the 8 Best Forex Brokers With Segregated Accounts. Analyze regulation, fund management practices, and compensation schemes for each.

4 Best $5 Minimum Deposit Forex Brokers in 2026

Explore forex trading with just $5 through the top four brokers, offering optimum services with minimal capital.

Best DMA Forex Brokers (Direct Market Access) for 2026

Delve into the world of DMA Forex Brokers with our guide. Discover top picks and know how DMA brokers operate, their pros and cons.

7 Best $10 Minimum Deposit Forex Brokers in 2026

Ultra-affordable Forex trading starts here! With only $10, join the Forex market with these seven champion brokers.