If you're looking to enter the forex market in Denmark, selecting the right currency broker is essential. Unlike stock trading, where many top platforms may not cater to forex traders, the forex market requires brokers that offer specific features tailored to currency trading. The Danish forex market, though not as widely recognized as others, presents unique opportunities for diversifying your investment portfolio. As a Contract for Difference (CFD) trader or forex investor in Denmark, understanding your platform, tools, and research needs is crucial for success. With the growing popularity of forex trading platforms in Denmark, now is a great time to explore the best options available for 2026.

Best Forex Brokers in Denmark

Unique social trading features, excellent for beginners or people who prefer a more hands-off approach

Award-winning platform and market analysis, great for strategy-developing traders

more

Comparison of Best Forex Brokers in Denmark

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers in Denmark Reviewed

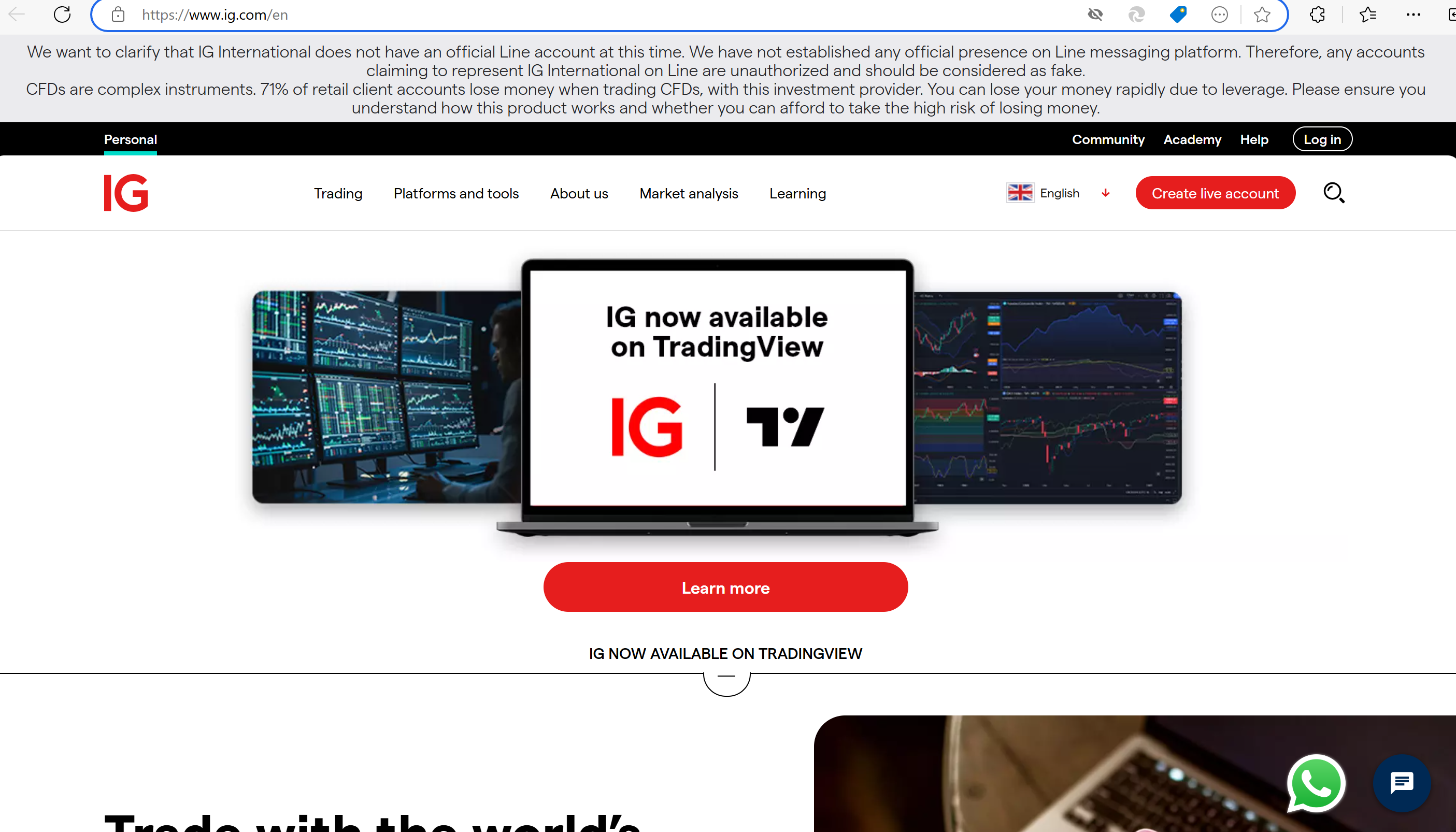

① IG

IG is a global leader in online trading, offering access to a vast range of markets and advanced trading technologies.

|

⭐⭐⭐⭐⭐ |

| Min Deposit | $0 |

| Tradable Instruments | 17,000+, forex, indices, shares, commodities, cryptocurrencies |

| Demo Account | ✅ ($20,000 virtual funds) |

| Costs | From 0.6 pips for EUR/USD |

| Trading Platforms | L2 dealer, ProRealTime, MT4, TradingView |

| Payment Methods | Credit/debit cards (MasterCard/Visa), bank transfer |

| Customer Support | 24 hours a day, except 6 am - 4pm on Saturday (UTC+8) - live chat |

Pros:

√ Wide range of markets and products

√ Proprietary and third-party trading platforms are available

√ Comprehensive educational resources

Cons:

× Limited payment options

× Complex platform for beginners

② IC Markets Global

IC Markets Global is an Australian broker known for its high-speed trade execution and deep liquidity.

|

⭐⭐⭐⭐⭐ |

| Min Deposit | $200 |

| Tradable Instruments | 2,250+, CFDs on 61 currency pairs, 24 commodities, 2,100+ stocks, 25 indexes, 9 bonds, 21 cryptocurrencies, 4 futures |

| Demo Account | ✅ |

| Costs | From 0.8 pips & commission-free (Standard account) |

| Trading Platforms | MT4/5, cTrader, TradingView (Windows, Web, Android, Mac, iOS) |

| Payment Methods | MasterCard, Visa, PayPal, Neteller, Skrill, UnionPay, Wire Transfer, Bpay, Broker to Broker, POLi, Thai Internet Banking, Rapidpay, Klarna, Vietnamese Internet Banking |

| Deposit & Withdrawal Fees | ✅ |

| Customer Support | 24/7 - live chat, contact form, phone, email, Help Centre |

Pros:

√ Fast execution and deep liquidity

√ Advanced trading platforms like MetaTrader4/5, cTrader, and TradingView are all available

√ Competitive spreads

Cons:

× Limited educational resources compared to competitors

× Higher minimum deposit requirement than most brokers

× Clients from the United States of America, Canada, Brazil, Israel, New Zealand, Iran and North Korea (Democratic People's Republic of Korea) are not allowed

③ AvaTrade

AvaTrade is known for its emphasis on education and a diverse selection of trading platforms, along with offering a wide array of financial instruments.

|

⭐⭐⭐⭐⭐ |

| Min Deposit | $100 |

| Tradable Instruments | Forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, FX options |

| Demo Account | ✅ |

| Costs | Typical 0.9 pips on EUR/USD & commission-free |

| Trading Platforms | AvaTrade Mobile App, Mobile WebTrader, AvaSocial, AvaOptions, DupliTrade, MT4/5 |

| Payment Methods | MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, Boleto |

| Customer Support | Live chat, contact form, WhatsApp, phone |

Pros:

√ Extensive educational content

√ Wide selection of trading platforms

√ Diverse choice of financial instruments

Cons:

× The withdrawal process is slow compared to other brokers

× No 24/7 customer support

④ eToro

eToro is well-recognized for its social trading platform, allowing users to copy the trades of successful traders, along with a user-friendly interface.

|

⭐⭐⭐⭐⭐ |

| Min Deposit | $10 |

| Tradable Instruments | 7,000+, 6,202 stocks, 703 ETFs, 42 commodities, 55 currences, 18 indices, 106 cryptocurrencies |

| Demo Account | ✅ ($100,000 in virtual funds) |

| Costs | Around 3 pips on EUR/USD & commission-free |

| Trading Platforms | MT4, eToro proprietary platform |

| Payment Methods | eToro Money, credit/debit cards, PayPal, Neteller, Skrill, Rapid transfer, iDEAL, Klarna / Sofort Banking, bank transfer, Online Banking – Trustly (EU region), Przelewy 24 |

| Withdrawal Fee | Free (GBP and EUR accounts) or $5 (USD investment account) |

| Inactivity Fee | $10/month applies to accounts with no logins in the previous 12 months |

| Customer Support | 24/5 live chat, email |

Pros:

√ Innovative social trading features

√ User-friendly platform

√ A wide range of assets for trade

Cons:

× Higher spreads compared to other brokers

× Limited technical analysis tools

⑤ XTB

XTB is renowned for its award-winning proprietary platform, and comprehensive educational resources.

|

⭐⭐⭐⭐⭐ |

| Min Deposit | £0 |

| Tradable Instruments | 6,898, Stocks, ETFs, forex, indices, commodities |

| Demo Account | ✅ |

| Costs | From 0.5 pips & commission-free |

| Trading Platforms | xStation5 (Mobile, Desktop, Tablet) |

| Payment Methods | Bank transfers, credit/debit cards (MasterCard/Maestro/Visa) |

| Deposit Fee | ❌ |

| Withdrawal Fee | Free for withdrawal above 50 USD/EUR/GBP |

| 5 USD/EUR/GBP for withdrawal below 50 USD/EUR/GBP | |

| Customer Support | 24/5 live chat, phone, email |

Pros:

√ The proprietary trading platform is highly rated for its performance and features

√ Excellent educational resources

√ A broad selection of financial instruments

Cons:

× No 24/7 customer support

× Some advanced research tools are limited to certain account types

⑥ XM

XM is known for providing a wide range of account types, making it suitable for different kinds of traders, and offering both MT4 & MT5 platforms.

|

⭐⭐⭐⭐ |

| Min Deposit | $5 |

| Tradable Instruments | 1,400+, forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, thematic indices |

| Demo Account | ✅ |

| Costs | From 1.6 pips + commission-free (Standard account) |

| Trading Platforms | MT4/5, XM App |

| Payment Methods | Credit/debit cards, bank transfers, e-wallets |

| Withdrawal Fee | ❌ |

| Customer Support | Live chat, phone |

Pros:

√ Provides multiple account types

√ Offers both MetaTrader 4 and 5 platforms

√ Decent educational materials for beginners

Cons:

× High spreads on some account types

× Commissions are applied to the share account

× Clients from the United States of America, Canada, Argentina, Israel and the Islamic Republic of Iran are not allowed

⑦ Tickmill

Tickmill is recognized for its competitive pricing and high-speed execution.

|

⭐⭐⭐⭐ |

| Min Deposit | 100 USD/EUR/GBP/ZAR |

| Tradable Instruments | 60+ currency pairs, 15+ indices, 500 stocks & ETFs, bonds, commodities (precious metals and energies), cryptos, futures & options |

| Demo Account | ✅ |

| Costs | From 1.6 pips & commission-free (Classic account) |

| Trading Platforms | MT4/5 (Windows, MacOS, Android, iOS, WebTrader), Tickmill Trader (Android, iOS) |

| Payment Methods | Bank transfer, crypto payments, Visa, MasterCard, Skrill, Neteller, Sticpay, Fasapay, UnionPay, WebMoney |

| Deposit & Withdrawal Fees | ❌ |

| Customer Support | Mon-Fri 7:00 - 16:00 GMT during Daylight Saving Time - live chat, contact, form, phone |

Pros:

√ Wide scope of trading instruments

√ Fast execution speeds

√ Free research tools and educational content

Cons:

× US clients are not accpeted

× No 24/7 customer support

⑧ Plus500

Plus500 is a platform known for its intuitive user interface and a wide range of financial instruments to trade.

|

⭐⭐⭐⭐ |

| Min Deposit | $/€/£100 |

| Tradable Instruments | 2,800 CFDs, cryptos, indices, forex, commodities, shares, ETFs |

| Demo Account | ✅ |

| Costs | Around 0.6 pips & commission-free |

| Trading Platforms | Own proprietary trading platform (desktop, web, and mobile) |

| Payment Methods | Visa, MasterCard, PayPal, Skrill, Apple Pay, Google Pay |

| Deposit & Withdrawal Fees | ❌ |

| Customer Support | 24/7 |

Pros:

√ User-friendly platform making it easy for beginners

√ Wide range of available financial instruments

√ Competitive spreads

Cons:

× Limited educational resources

× Does not offer MetaTrader platforms

⑨ Capital.com

Capital.com is known for its AI-driven market insight tools and a wealth of educational content.

|

⭐⭐⭐⭐ |

| Min Deposit | 10 USD/EUR/GBP |

| Tradable Instruments | 3,000+ CFDs, shares, forex, indices, commodites, cryptocurrencies, ESG |

| Demo Account | ✅ |

| Costs | 0.6 pips in EUR/USD & commission-free |

| Trading Platforms | Mobile Apps, Desktop, TradingView, MT4 |

| Payment Methods | Apple Pay, VISA, MasterCard, wire transfer, PCI, Worldpay, RBS, and Trustly |

| Deposit & Withdrawal Fees | ❌ |

| Inactivity Fee | 10 USD or equivalent if inactive for more than 1 year |

| Customer Support | 24/7 live chat, phone, email |

Pros:

√ AI-driven insights for market trends

√ Comprehensive educational resources

√ Competitive spreads

Cons:

× MetaTrader5 is not available

× Inactivity fee is charged

⑩ CMC Markets

CMC Markets is a well-established broker known for its large range of available trading instruments and advanced charting tools.

|

⭐⭐⭐⭐ |

| Min Deposit | $0 |

| Tradable Instruments | 10,000+, forex, indices, commodities, shares, ETFs, treasuries, shares baskets |

| Demo Account | ✅ |

| Costs | Average 0.6 pips (EUR/USD) + commission-free (Standard account) |

| Trading Platforms | MT4/5, CMC NextGen |

| Payment Methods | Credit/debit card, bank transfer, PayID, PayPal |

| Customer Support | 24 hours, Monday - Saturday morning - live chat, contact form, phone, email |

Pros:

√ Extensive product portfolio to trade from

√ Advanced research and charting tools

√ Decent educational resources

Cons:

× No clear info on deposits and withdrawals

Forex Brokers in Denmark FAQs

Is forex trading legal in Denmark?

Yes, forex trading is legal in Denmark.

The Danish Financial Supervisory Authority (DFSA) regulates forex trading in Denmark. It ensures that forex brokers comply with national and EU financial regulations.

Additionally, Denmark is a member of the European Union, so it also follows financial regulations outlined by the European Securities and Markets Authority (ESMA), which primarily governs Forex trading across EU member countries.

How to start trading forex in Denmark?

To start trading forex in Denmark, you'll need to take several essential steps to ensure you're well-prepared and compliant with local regulations.

Begin by immersing yourself in the fundamentals of forex trading. Understanding how currency pairs work, the concept of leverage, and the factors influencing exchange rates is crucial. This knowledge will be the foundation of your trading journey.

Next, selecting a reliable forex broker is key. In Denmark, brokers must be regulated by the Danish Financial Supervisory Authority (DFSA) or comply with broader EU regulations. Look for a broker offering a robust trading platform that suits your needs, alongside competitive fees and spreads.

Once you've chosen a broker, open a trading account. Start with a demo account to practice and refine your strategies risk-free. When you're ready to trade with real money, ensure you've met all account verification requirements and deposited the minimum amount specified by your broker.

As you begin trading, develop a solid trading plan. Set clear goals and establish risk management strategies to safeguard your investments. Regularly monitor the forex market for trends and news that could impact currency prices.

Lastly, stay engaged with continuous learning and market analysis. Adapt your strategies based on your trading experience and evolving market conditions to optimize your trading performance.

What is the best time to trade forex in Denmark?

The best time to trade Forex in Denmark typically falls within the trading hours of the major financial markets. There are four major Forex markets globally: New York, London, Tokyo, and Sydney. To make the best out of your trading, the hours when these markets overlap are usually the best time to trade, as this is when the market is most active, with the largest volume of trades. The biggest volume of currency trading happens during the London session (8:00 AM to 4:00 PM UK time), followed by the New York session (1:00 PM to 9:00 PM UK time). The period where these two sessions overlap (between 1:00 PM and 4:00 PM UK time) is typically the best time for trading, as this is when liquidity and volatility are at their highest, leading to potentially greater profit opportunities. However, Denmark, which is in the Central European Time zone (CET, UTC +1 or CEST, UTC +2 in summer), adjusts these times accordingly. This means that the London session is from 9:00 AM to 5:00 PM local Danish time, and the New York session is from 2:00 PM to 10:00 PM, with the overlap occurring between 2:00 PM and 5:00 PM.

Note that these times differ during Daylight Saving Time.

Time zones by CET

Here are the main forex trading sessions and their corresponding times in Denmark's Central European Time (CET):

| Session | Open | Close |

| Sydney Session | 11:00 PM CET | 8:00 AM CET |

| Tokyo Session | 1:00 AM CET | 10:00 AM CET |

| London Session | 9:00 AM CET | 6:00 PM CET |

| New York Session | 2:00 PM CET | 11:00 PM CET |

Overlaps:

Tokyo/London Overlap: 9:00 AM to 10:00 AM CET

London/New York Overlap: 2:00 PM to 6:00 PM CET

These overlaps often represent the most liquid and active periods for forex trading.

What are the terms in forex you should know?

Understanding forex terminology is crucial for successful trading. Below are some key terms you should be familiar with:

| Pip (Percentage In Point) | The smallest price move in the forex market, usually the fourth decimal place in most currency pairs (0.0001). |

| Lot | A standard unit of measurement in forex trading. The standard lot is 100,000 units of the base currency. There are also mini (10,000 units) and micro (1,000 units) lots. |

| Spread | The difference between the bid (selling) price and the ask (buying) price of a currency pair. |

| Leverage | The ability to control a large position with a relatively small amount of money. For example, a leverage ratio of 100:1 means you can control $100,000 with $1,000 of your own capital. |

| Margin | The amount of money required to open and maintain a leveraged position. It is a fraction of the total trade size. |

| Ask Price | The price at which you can buy a currency pair. |

| Bid Price | The price at which you can sell a currency pair. |

| Base Currency | The first currency listed in a currency pair. e.g., in EUR/USD, the base currency is the Euro. |

| Quote Currency | The second currency listed in a currency pair. In EUR/USD, the quote currency is the US Dollar. |

| Stop-Loss Order | An order placed to sell a currency pair when it reaches a certain price, used to limit potential losses. |

| Take-Profit Order | An order placed to sell a currency pair when it reaches a certain profit level. |

| Long Position | Buying a currency pair with the expectation that its price will rise. |

| Short Position | Selling a currency pair with the expectation that its price will fall. |

| Slippage | The difference between the expected price of a trade and the actual price at which the trade is executed, often due to high volatility. |

You Also Like

7 Best Platforms for Copy Trading in India 2026

India's leading copy trading platforms allows you to automatically copy the trades of top performers, enhancing profitbility.

Beware: 10 Fake Forex Brokers in the UK in 2026

With the need for caution in the UK's flourishing forex market, this article points out 10 fake brokers to avoid amidst numerous reputable entities.

Best Forex Brokers in Denmark for 2026

Discover top regulated forex brokers, trading platforms and broker reviews for reliable trading in Denmark.

Best Forex Brokers Ireland in 2026

Compare top forex brokers in Ireland with robust regulation, excellent platforms and broker reviews for secure trading.

7 Best Platforms for Copy Trading in India 2026

India's leading copy trading platforms allows you to automatically copy the trades of top performers, enhancing profitbility.

Best Forex Brokers in Denmark for 2026

Discover top regulated forex brokers, trading platforms and broker reviews for reliable trading in Denmark.

Best Forex Brokers Ireland in 2026

Compare top forex brokers in Ireland with robust regulation, excellent platforms and broker reviews for secure trading.

Best Forex Brokers with Trading APIs for 2026

Dive into top Forex Brokers with exceptional trading APIs, offering benefits, security, and a variety of platforms.