Investing can be exciting, but choosing the right platform can feel like a puzzle. There are lots of options, all claiming to be the best. Don't worry! This guide will break down the top brokerage trading platforms of 2025, helping you find the perfect fit for your money goals.

We'll compare things like costs, features, and how easy they are to use. Whether you're just starting out or a seasoned investor, you'll leave with clear answers and confidence to choose the platform that helps you grow your money.

What is a Brokerage Trading Platform?

A brokerage trading platform is a software application or a web-based program that traders and investors use to execute transactions in the financial markets. It essentially serves as an intermediary platform connecting buyers and sellers for various tradable assets, including forex, stocks, bonds, mutual funds, ETFs, cryptocurrencies, and more. These platforms typically offer various tools for managing and tracking portfolio performance, conducting analyses and research, and staying informed about market trends and news.

Best Brokerage Trading Platforms

| Logo | Broker | Best for |

|

Fidelity | Best for all-around investors seeking commission-free trades, strong research, and a powerful platform |

|

Interactive Brokers (IB) | Best for active traders and professionals needing advanced tools, low commissions, and global market access |

|

TD Ameritrade | Best for beginners and active traders with its user-friendly platform, research, and educational resources |

|

Robinhood | Best for casual investors wanting a simple, mobile-first experience with free stock & ETF trades |

|

E*TRADE | Best for active traders seeking a user-friendly platform with decent research and commission-free stock & ETF trades |

|

Charles Schwab | Best for long-term investors valuing low commissions, good research, and a reliable platform |

Tip: In October 2020, Charles Schwab completed the acquisition of TD Ameritrade, creating a behemoth in the brokerage industry. As part of the deal, the two firms agreed to integrate their services and offerings, pooling their resources to improve the user experience and broaden their product offerings. This includes merging trading platforms, research resources, and customer services.

Best Brokerage Trading Platforms Compared

| Brokerage Trading Platform | Commissions and Fees | Investment Assets | Trading Tools and Technology | Research and Education | Margin Trading | Fractional Shares | Mobile App |

| Fidelity | Free stock & ETF trades, $0.65 per options contract, other fees for mutual funds, margin interest | Stocks, ETFs, options, mutual funds, bonds, CDs, forex | Advanced charting, research tools, backtesting | Research reports, webinars, educational courses, stock screener | ✔ | ✔ | ✔ |

| Interactive Brokers (IB) | Tiered pricing, margin rates | Stocks/ETFs, options, futures, spot currencies, bonds, mutual funds | Professional-grade tools, market scanners, algo trading, steep learning curve | Fundamental and technical analysis, research reports | ✔ | ❌ | ✔ |

| TD Ameritrade | Commission-free stock & ETF trades, $0.65 per options contract, inactivity fee | Stocks, ETFs, options, mutual funds, bonds, futures | Advanced charting, trading tools | Research reports, educational videos, paper trading simulator | ✔ | ✔ | ✔ |

| Robinhood | Free stock & ETF trades, variable margin rates, crypto trading fees | Stocks, ETFs, options, cryptos | Simple, mobile-first interface, limited charting, basic research tools | Limited research, educational articles, basic stock screener | ❌ | ✔ | ✔ |

| E*TRADE | Commission-free stock & ETF trades, $0.65 per options contract, margin rates, inactivity fee | Stocks, ETFs, options, mutual funds, bonds, futures | Good charting, technical indicators, research tools | Research reports, educational articles, webinars | ✔ | ✔ | ✔ |

| Charles Schwab | Commission-free stock & ETF trades, $0.65 per options contract, margin rates, inactivity fee | Money market funds, bonds and fixed income products, mutual funds, ETFs, index funds, stocks, international stocks, options, futures, forex, cryptocurrency investing | Streamlined platform with basic charting, research tools | Research reports, educational articles, courses, workshops | ❌ | ❌ | ✔ |

Best Brokerage Trading Platforms Reviewed

① Fidelity

Best for all-around investors seeking commission-free trades, strong research, and a powerful platform

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Minimum Deposit | $0 |

| Investment Assets | Stocks, ETFs, options, mutual funds, bonds, CDs, forex |

| Trading Platforms | Fidelity Investments |

| Fees | Free stock & ETF trades |

| $0.65 per options contract | |

| Other fees for mutual funds, margin interest | |

| Open an Account | |

Fidelity Investments, as a brokerage platform, offers a comprehensive array of tools for new investors and long-term savers. It provides commission-free trade for stocks and ETFs, which makes it an affordable choice for traders. Also, it's known for its advanced charting, robust research tools, and backtesting capabilities, which is beneficial for investors making informed decisions.

In terms of educational resources, Fidelity offers research reports, webinars, educational courses, and a stock screener. These resources are extremely useful, especially for beginners trying to understand the market dynamics better.

The platform also supports margin trading and offers the option for fractional shares, thus allowing trading with less capital. Also, for convenience and easy access, Fidelity provides a user-friendly mobile app, enabling users to manage their investments on the go.

Fidelity Pros & Cons

| Pros √ | Cons × |

| Broad asset selection | Platform can be complex for beginners |

| Commission-free stock and ETF trades | Limited crypto options |

| Powerful platform | Margin rates |

| Excellent research and education | Inactivity fees |

| Strong reputation | |

| Low account minimum | |

| Multiple account types | |

| User-friendly mobile app |

Pros:

√ Broad asset selection: Trade stocks, ETFs, options, mutual funds, bonds, CDs, and forex all on one platform.

√ Commission-free stock and ETF trades: Save on trading costs, making it suitable for both passive and active investors.

√ Powerful platform: Access advanced charting tools, technical indicators, and research reports.

√ Excellent research and education: Get in-depth market analysis, webinars, educational articles, and courses.

√ Strong reputation: Established and reliable brokerage firm with a long track record of success.

√ Low account minimum: Start investing with as little as $1.

√ Multiple account types: Choose from individual, joint, and retirement accounts depending on your needs.

√ User-friendly mobile app: Manage your investments and trade on the go.

Cons:

× Platform can be complex for beginners: The abundance of features might feel overwhelming for new investors.

× Limited crypto options: Fidelity does not currently offer access to cryptocurrency trading.

× Margin rates: While competitive, they might be higher than some other platforms.

× Inactivity fees: You might be charged a fee if you don't make any trades for a certain period.

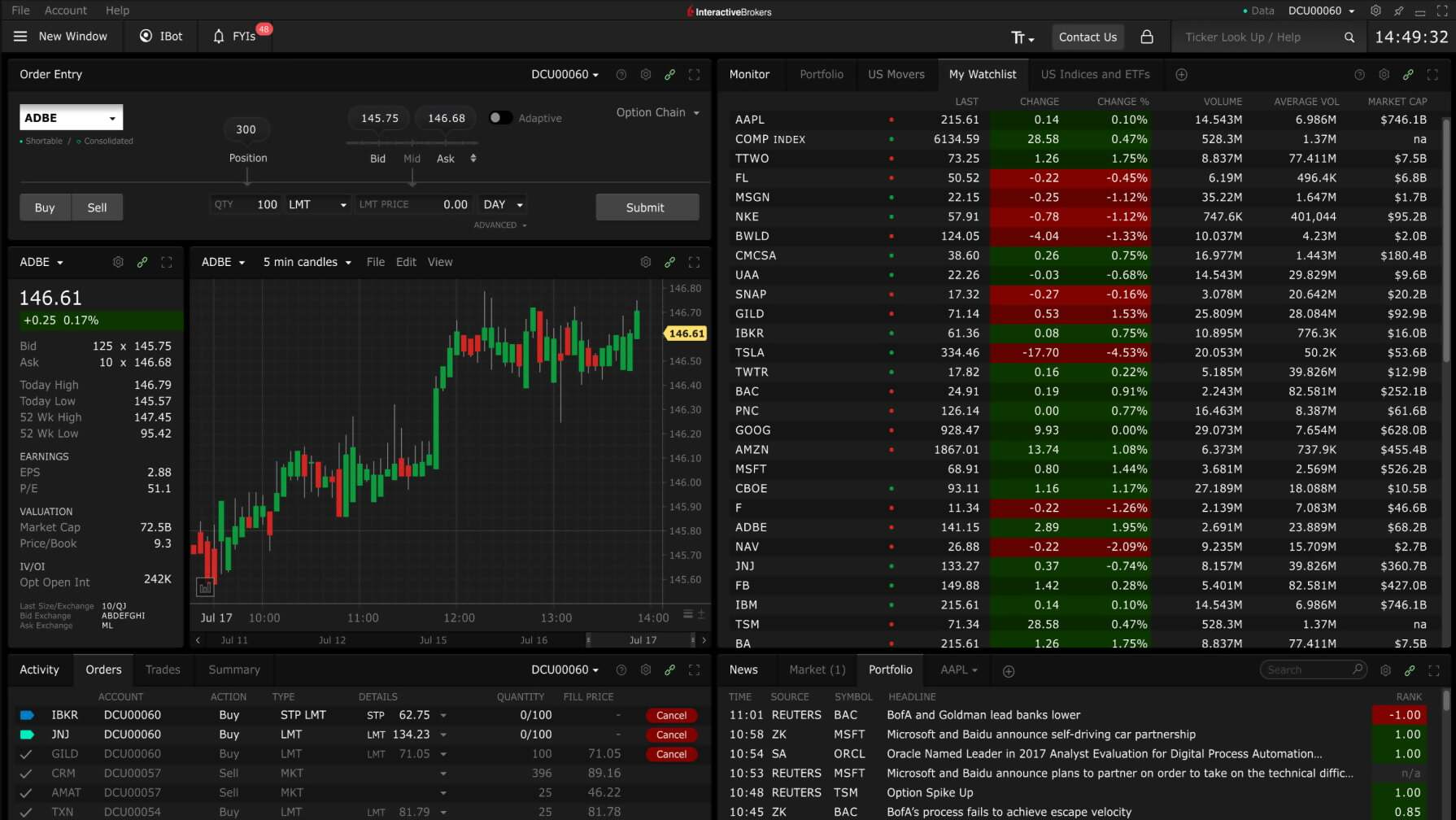

② Interactive Brokers (IB)

Best for active traders and professionals needing advanced tools, low commissions, and global market access

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Minimum Deposit | 0 |

| Investment Assets | 150 markets - stocks/ETFs, options, futures, spot currencies, bonds, mutual funds |

| Trading Platforms | IBKR GlobalTrader (Mobile), Client Portal (Web), IBKR Desktop, IBKR Mobile, Trader Workstation (TWS) (Desktop), IBKR APIs (Desktop), IBKR ForecastTrader (Web), IMPACT (Mobile) |

| Fees | From 0.1 pips + low commission for forex |

| No inactivity fee | |

| Open an Account | |

Interactive Brokers (IB) offers a highly comprehensive trading platform and is an excellent choice for serious traders due to its sophisticated tools and vast array of tradable securities. Its platform, often referred to as Trader Workstation (TWS), allows trading for stocks, ETFs, options, futures, spot currencies, bonds, and mutual funds.

TWS provides professional-grade trading tools and has an interface that can be highly customized to suit individual trading needs. It offers market scanners, algorithmic trading capabilities, and a plethora of charting options. However, its complex nature means that there can be a steep learning curve for new users.

Moreover, IB offers extensive research resources, including both fundamental and technical analysis as well as research reports from industry professionals. This aids its users in making informed trading decisions.

Interactive Brokers also provides support for margin trading, but does not currently offer fractional shares trading.

Cost-wise, it operates on tiered pricing, offering competitive rates though it has varying margin rates and does charge inactivity fees, which might not suit all types of investors.

Additionally, it offers a mobile app which allows users to trade on the go and access many of the tools available on the main platform. But like the main platform, the mobile app is also known for its high sophistication and complexity, and thus might be ideal especially for advanced traders.

Interactive Brokers (IB) Pros and Cons

| Pros √ | Cons × |

| Largest asset selection | Steep learning curve |

| Ultra-low commissions | Complex fee structure |

| Highly customizable platform | Not beginner-friendly |

| In-depth research and analysis | |

| Global market access | |

| Margin trading available | |

| Strong security and regulation |

Pros:

√ Largest asset selection: Trade stocks, ETFs, options, futures, spot currencies, bonds, and mutual funds, all on one platform. Ideal for diversifying your portfolio.

√ Ultra-low commissions: Tiered pricing structure rewards active traders with low fees, making it cost-effective for frequent trading.

√ Highly customizable platform: Access professional-grade tools like advanced charting, market scanners, and algo trading, ideal for active strategies.

√ In-depth research and analysis: Receive fundamental and technical analysis, research reports, and educational resources to make informed decisions.

√ Global market access: Trade on various international exchanges, expanding your investment opportunities.

√ Margin trading available: Borrow capital to leverage your trades, potentially amplifying profits (and losses).

√ Strong security and regulation: Secure platform with multi-factor authentication and regulated by multiple financial authorities.

Cons:

× Steep learning curve: The advanced features and interface can be complex for beginners, requiring a significant learning investment.

× Complex fee structure: The tiered pricing system can be confusing for some users, requiring careful calculation of trading costs.

× Not beginner-friendly: The lack of basic tutorials and a simple interface might discourage new investors.

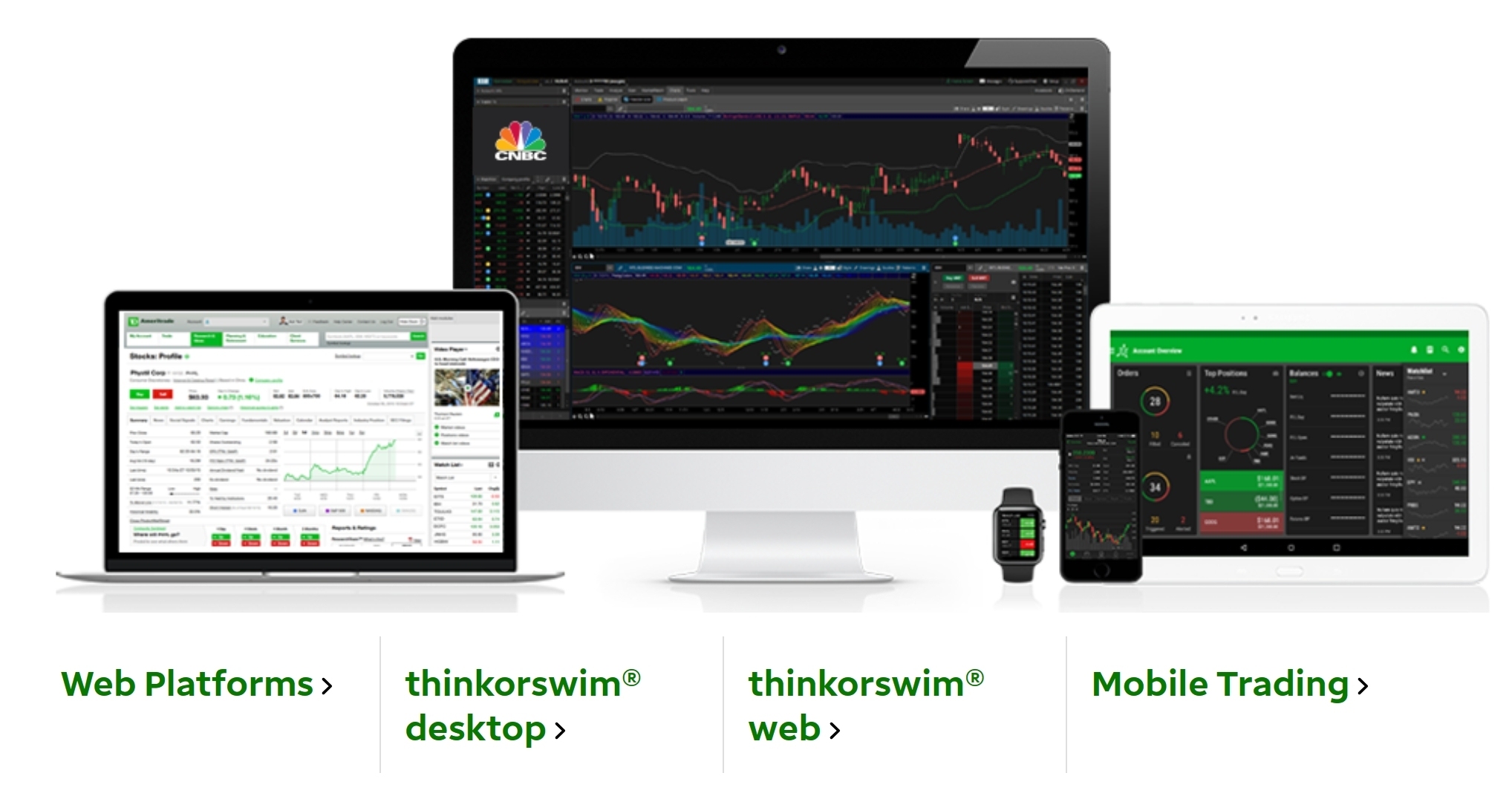

③ TD Ameritrade

Best for beginners and active traders with its user-friendly platform, research, and educational resources

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Minimum Deposit | $2,000 |

| Investment Assets | Stocks, ETFs, options, mutual funds, bonds, futures |

| Trading Platforms | Web platform, Thinkorswim |

| Fees | Commission-free stock & ETF trades |

| $0.65 per options contract | |

| Inactivity fee | |

| Open an Account | |

TD Ameritrade's brokerage platform is well-regarded in the industry, offering an extensive range of investments including stocks, bonds, ETFs, forex, options, and futures.

For standard trading, TD Ameritrade uses a web-based platform that is easy to navigate and enables users to manage and monitor their investments, view account balances, create watchlists, screen stocks, and place trades, all from one interface.

For more advanced trading needs, it offers the thinkorswim trading platform, which provides professional-grade tools for in-depth charting, technical analysis, and derivatives trading. Thinkorswim is applauded for its sophisticated features such as customizable dashboards and trade alerts.

One of the standout features of TD Ameritrade is its comprehensive educational resources. This platform provides webcasts, courses and articles that cater to beginner and advanced traders alike.

TD Ameritrade offers commission-free trades for stocks, ETFs, and options, with a fee of $0.65 per option contract. Also, the platform gives you access to extensive analysis and research, making it easier for investors to make informed decisions.

TD Ameritrade Pros and Cons

| Pros √ | Cons × |

| Commission-free stock and ETF trades | Limited crypto options |

| User-friendly Thinkorswim platform | Margin rates |

| Good asset selection | Mobile app |

| Excellent research and education | Limited advanced features |

| Paper trading simulator | |

| Fractional shares | |

| Strong customer support |

Pros:

√ Commission-free stock and ETF trades: Save on trading costs, suitable for both passive and active investors.

√ User-friendly Thinkorswim platform: Intuitive interface with powerful charting tools, customizable layouts, and educational resources.

√ Good asset selection: Trade stocks, ETFs, options, mutual funds, bonds, and futures, offering enough variety for most investors.

√ Excellent research and education: Get access to research reports, webinars, and tutorials to learn and make informed decisions.

√ Paper trading simulator: Practice your trading strategies with virtual funds before risking real money, ideal for beginners.

√ Fractional shares: Invest in expensive stocks with smaller amounts, perfect for diversifying your portfolio.

√ Strong customer support: Get help from knowledgeable representatives available through various channels.

Cons:

× Limited crypto options: Although offering futures contracts on some cryptocurrencies, TD Ameritrade doesn't currently provide direct crypto trading.

× Margin rates: While competitive, they might be higher than some other platforms like Interactive Brokers.

× Mobile app: While functional, some users find it less intuitive than the desktop platform.

× Limited advanced features: Compared to Interactive Brokers, the platform might lack some sophisticated tools for professional-level trading.

④ Robinhood

Best for casual investors wanting a simple, mobile-first experience with free stock & ETF trades

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Minimum Deposit | $0 |

| Investment Assets | Stocks, ETFs, options, cryptos |

| Trading Platforms | Basic web-based platform, Robinhood Gold |

| Fees | Free stock & ETF trades |

| Cariable margin rates | |

| Crypto trading fees | |

| Open an Account | |

Robinhood's brokerage platform is known for its straightforward and user-friendly interface. It supports the trading of a diverse range of assets including stocks, ETFs, options, and cryptocurrencies. One of the main attractions of Robinhood's platform is its commission-free trading, which makes it a popular choice especially among novice investors seeking lower costs.

The platform offers some basic analysis tools and real-time market data, however, it does not contain extensive advanced features or in-depth analysis tools that some other brokerage platforms provide. Hence, it's generally more popular among novice or casual investors, rather than sophisticated traders.

The Robinhood app is well-designed and intuitive, available on iOS and Android, making it convenient for users to monitor their investments and execute trades on the move.

In addition to their basic services, Robinhood offers a subscription-based service known as “Robinhood Gold” that provides access to premium features like professional research reports, extended trading hours, and margin trading.

Robinhood Pros and Cons

| Pros √ | Cons × |

| Commission-free stock and ETF trades | Limited asset selection |

| Simple and user-friendly interface | Limited research and education |

| Fractional shares | Margin trading not available |

| Cryptocurrency trading | Customer service limitations |

| Socially-driven features | |

| No account minimum |

Pros:

√ Commission-free stock and ETF trades: Save on trading costs, making it attractive for frequent trading and building fractional share positions.

√ Simple and user-friendly interface: Mobile app-focused platform with a clean design and straightforward navigation, ideal for beginners.

√ Fractional shares: Invest in expensive stocks with smaller amounts, perfect for diversifying your portfolio.

√ Cryptocurrency trading: Access a limited selection of popular cryptocurrencies for buying and selling.

√ Socially-driven features: Follow other users, see what they're investing in, and discover new ideas.

√ No account minimum: Start investing with any amount, making it accessible to everyone.

Cons:

× Limited asset selection: Focuses mainly on stocks and ETFs, lacking options like mutual funds, bonds, or futures.

× Limited research and education: Offers basic news and articles but lacks in-depth research reports or advanced analytical tools.

× Margin trading not available: Cannot leverage your trades by borrowing money, limiting potential gains (and losses).

× Customer service limitations: Phone support not available, relying primarily on email and chatbot assistance.

⑤ E*TRADE

Best for active traders seeking a user-friendly platform with decent research and commission-free stock & ETF trades

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Minimum Deposit | $0 |

| Investment Assets | Stocks, ETFs, options, mutual funds, bonds, futures |

| Trading Platforms | Power E*TRADE web, Power E*TRADE app, E*TRADE app, E*TRADE web |

| Fees | Commission-free stock & ETF trades |

| $0.65 per options contract | |

| Margin rates, inactivity fee | |

| Open an Account | |

ETRADE offers two main platforms for trading, catering to traders of different experience levels.

E*TRADE Web is the standard platform, accessible from a web browser. It offers a broad range of trading and investing features such as real-time market data, customizable watchlists, and comprehensive research tools. This platform supports trading of stocks, bonds, ETFs, options, and futures.

For more advanced and active traders, ETRADE offers a platform known as Power ETRADE. This is a more robust platform that includes advanced charting capabilities, live Bloomberg TV, risk-assessment tools, and other professional-grade tools.

Both platforms allow commission-free trading on stocks, ETFs, and options (Options contract, however, comes with a fee of $0.65 per contract). E*TRADE also has a mobile app available for iOS and Android, providing users the convenience to trade and monitor their investments on the go.

E*TRADE Pros and Cons

| Pros √ | Cons × |

| Commission-free trades | Limited advanced features |

| User-friendly platform | Higher margin rates |

| Wide range of assets | Inactive account fee |

| Robust research and education | |

| Paper trading simulator | |

| Fractional shares | |

| Strong customer support |

Pros:

√ Commission-free trades: Save on trading costs for stocks, ETFs, and options, making it suitable for both passive and active investors.

√ User-friendly platform: Web and mobile platforms are intuitive and straightforward, even for beginners.

√ Wide range of assets: Trade stocks, ETFs, options, mutual funds, bonds, and futures, diversifying your portfolio options.

√ Robust research and education: Get access to in-depth research reports, market analysis, and educational resources like webinars and tutorials.

√ Paper trading simulator: Practice your trading strategies with virtual funds before risking real money, ideal for beginners.

√ Fractional shares: Invest in expensive stocks with smaller amounts, perfect for portfolio diversification.

√ Strong customer support: Get help from knowledgeable representatives available through phone, email, and live chat.

Cons:

× Limited advanced features: Compared to platforms like Interactive Brokers, it might lack some sophisticated tools for professional-level trading.

× Higher margin rates: While competitive, they might be higher than some other platforms like Fidelity.

× Inactive account fee: You might be charged a fee if you don't make any trades for a certain period.

⑥ Charles Schwab

Best for long-term investors valuing low commissions, good research, and a reliable platform

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Minimum Deposit | $0 |

| Investment Assets | Money market funds, bonds and fixed income products, mutual funds, ETFs, index funds, stocks, international stocks, options, futures, forex, cryptocurrency investing |

| Trading Platforms | thinkorswim desktop/mobile/web, Schwab.com, the Schwab Mobile app |

| Fees | Commission-free stock & ETF trades |

| $0.65 per options contract | |

| margin rates, inactivity fee | |

| Open an Account | |

Charles Schwab's brokerage platform is known for its comprehensive range of investing options and advanced trading tools. It offers a variety of investment products including stocks, bonds, ETFs, mutual funds, options, and futures.

Investors on Charles Schwab's platform get access to quality research and insights. Their platform provides robust charting tools, customizable screeners, backtesting capabilities and real-time market news.

The standard web-based platform on Schwab.com - This platform has a customizable layout, allows for easy order entry, and offers a host of screeners, charting tools, and research resources.

Charles Schwab also offers a mobile app available for both Android and iOS devices allowing investors to execute trades, view account details, monitor the market, access research, and more.

In addition, they offer a robo-advisor service, the Schwab Intelligent Portfolios, that provides automated investing based on an investor's risk profile and goals.

Charles Schwab Pros and Cons

| Pros √ | Cons × |

| Strong reputation | Higher fees for options and other trades |

| Wide range of assets | Limited advanced features |

| Excellent research and education | No paper trading simulator |

| User-friendly platform | |

| Commission-free stock and ETF trades | |

| Fractional shares | |

| Multiple account types | |

| Strong customer support |

Pros:

√ Strong reputation: Renowned for its history, stability, and commitment to investor education.

√ Wide range of assets: Trade stocks, ETFs, options, mutual funds, bonds, and even currencies, providing ample diversification options.

√ Excellent research and education: Get access to in-depth market analysis, fundamental and technical research reports, educational webinars, and online courses.

√ User-friendly platform: Web and mobile platforms are intuitive and easy to navigate, even for beginners.

√ Commission-free stock and ETF trades: Save on trading costs for these popular assets, making it attractive for both passive and active investors.

√ Fractional shares: Invest in expensive stocks with smaller amounts, perfect for building diversified portfolios.

√ Multiple account types: Choose from individual, joint, retirement, and custodial accounts depending on your needs.

√ Strong customer support: Get help from knowledgeable representatives available through phone, email, and live chat.

Cons:

× Higher fees for options and other trades: While offering commission-free stock and ETF trades, fees for other asset classes can be higher compared to some platforms.

× Limited advanced features: Similar to E*TRADE, it lacks some sophisticated tools for professional-level trading compared to Interactive Brokers.

× No paper trading simulator: While offering educational resources, it doesn't provide a platform to practice trading with virtual funds, which might be valuable for beginners.

How to Choose a Brokerage Trading Platform?

Know Your Style

Beginner

You're just starting out and need a simple, friendly platform with low fees and educational resources. Robinhood, TD Ameritrade, and Fidelity are good options.

Day Trader

You make frequent trades and need a fast, powerful platform with advanced charting tools and low commissions. Interactive Brokers or E*TRADE might be your match.

Long-Term Investor

You're focused on long-term growth and value reliable research, good asset selection, and commission-free trades. Fidelity or Charles Schwab can offer a comfortable home.

Regulation

Choose a platform regulated by reputable financial authorities in your country. This ensures they adhere to strict standards for protecting your investments and client funds.

On WikiFX, we strive to deliver the most relevant and up-to-date regulatory information about forex brokers. We understand how vital it is to know your broker's regulatory status before investing your hard-earned money. Our team conducts an extensive background check on forex brokers from around the globe to provide you with their regulatory data and other critical aspects.

By using WikiFX, you can easily verify a broker's regulatory status and steer clear of potential frauds or unregulated platforms. Knowledge is power - stay informed, stay safe and always check a broker's regulatory status on WikiFX before investing. It's easy, fast, and can save you from unnecessary losses.

Others

Security

Verify the platform uses strong encryption protocols and multi-factor authentication to safeguard your login credentials and financial information.

Check for independent security audits and penetration testing to assess the platform's vulnerability to cyberattacks.

Reliability

Prioritize platforms with uptime guarantees and robust infrastructure to minimize platform outages and ensure reliable trade execution.

Consider user reviews and independent rankings to evaluate the platform's track record of technical stability and responsiveness.

Range of Assets

Does the platform offer the range of assets you wish to trade? This could be stocks, forex, ETFs, options, or futures.

Account Minimum

Compare the minimum deposit requirements of different platforms. Some cater to beginners with no minimums, while others might have higher thresholds for access to specific features or asset classes.

Choose a platform that aligns with your initial investment budget and future growth plans.

Fees and Costs

Check for commission rates on trades, and any hidden costs such as inactivity fees, withdrawal fees, or annual fees.

Ease of Use

Consider your technological comfort level and choose a platform with a user-friendly interface and straightforward navigation.

Look for platforms offering helpful onboarding resources, tutorials, and live chat support to guide you through the trading process.

Trading Tools

Does the platform provide tools to analyze stocks, forex, or other securities? A good platform should have charting capabilities, real-time price updates, and technical indicators at the very least. Platforms like Interactive Brokers and TD Ameritrade excel in this area.

Research and Education

Does the platform provide in-depth research reports, educational articles, and webinars? Fidelity and Charles Schwab are strong contenders here.

Additional Factors

User-friendly mobile app? Customer service quality? Global market access? Think about what matters most to you.

Ultimately, the best way to find the right brokerage trading platform for you is to try out a few different ones and see which one you like best. Many brokers offer free trials, so you can test out their platforms before you commit to one.

Brokerage Trading Platforms FAQs

Which platform is the best for beginners?

It depends on your learning style and priorities. Robinhood and TD Ameritrade offer user-friendly platforms and educational resources, but Fidelity and Charles Schwab have more research and tools.

Which platform is best for advanced traders?

Interactive Brokers (IB) offers professional-grade tools and market scanners, while TD Ameritrade has good charting and technical indicators. Fidelity and Charles Schwab have basic tools, but may be sufficient for many investors.

Which platform offers the widest range of assets?

Interactive Brokers (IB) has the largest selection, including stocks, ETFs, options, futures, forex, bonds, and crypto. Fidelity and Charles Schwab also offer a wide range, while Robinhood and have more limited choices.

Which platform has the best mobile app?

Risk Disclaimer

This information is for informational purposes only and should not be considered investment advice. Please consult with a qualified financial advisor before making any investment decisions. The specific risks associated with your investments will vary depending on the assets you choose and your overall investment strategy. Some common risks include market volatility, interest rate changes, inflation, and issuer default. Remember, diversification does not guarantee a profit or protect against loss.

You Also Like

7 Best Platforms for Copy Trading in India 2026

India's leading copy trading platforms allows you to automatically copy the trades of top performers, enhancing profitbility.

Best Forex Brokers in Denmark for 2026

Discover top regulated forex brokers, trading platforms and broker reviews for reliable trading in Denmark.

Best Forex Brokers Ireland in 2026

Compare top forex brokers in Ireland with robust regulation, excellent platforms and broker reviews for secure trading.

Best Forex Brokers with Trading APIs for 2026

Dive into top Forex Brokers with exceptional trading APIs, offering benefits, security, and a variety of platforms.