When I say that years of experience with Metatrader platforms—mostly MT4 and MT5—means a lot in foreign exchange trading, I mean it. Both have their advantages, and a stable performance on MT4 or MT5 can greatly improve my trading experience and my chances of making a profit. What else can I say besides that our traders are happiest when using metatrader platforms (especially MT4 and MT5) because of the automated trading features, advanced charting package, and multiple technical indicators available to them. It can be challenging to find reliable brokers among the more than 3,000 that provide support for the MT4 and MT5 trading platforms. To help you make a more educated decision, I'll be summarising the top MetaTrader Forex brokers in this article.

10 Best MetaTrader Brokers

Spreads for EUR/USD on the competitive Razor account average at 0.12 pips.

Top-tier trading platforms, such as MetaTrader 4, cTrader, and TradingView, among others.

Strong regulation ensures much security and tranparency.

Low minimum deposit to start trading, one-click order execution.

Advanced range of trading products, CFD trading, MT4, MT5 and cTrader platforms offered.

Up to 1:500 leverage, extensive trading liquidity, and flawless order execution.

more

Comparison of Best MetaTrader Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best MetaTrader Brokers Overall

| Brokers | Why are they listed as the best MetaTrader brokers? |

|

✅Access to 28 indicators and EAs ✅Execution as fast as 30ms (0.03 of second) ✅99.5% positve reviews on MetaTrader performance |

|

✅Average Execution Speed at 32 milliseconds ✅MT4 EAs and VPS available with your accounts ✅Partially close positions |

|

✅Average execution speeds of under 40 milliseconds ✅Raw pricing starting at 0.0 pips ✅No restrictions on trading strategies |

|

✅99.98% average execution ratio ✅Trade using EAs and trading robots ✅Open positions wont be closed automatically when you go offline |

|

✅99.5% positive reviews on MT4 and MT5 performance ✅Average orer execution speed under 300 milliseconds ✅EA for algoithmic trading, no delay, no slippage |

|

✅Most orders executed under 13 milliseconds ✅Automated trading with VPS ✅Able to manage multiple accounts simultaneously |

|

✅Average execution speed under 10 milliseconds ✅Dedicated analysis & charting suite ✅More data for back-testing |

|

✅Average order execution at 0.072 seconds ✅Metatrader platforms can be downloaded on PC, MAC, Mobile and tablet ✅Responsive and quick-answering customer service team |

|

✅Average order execution speed under 100 milliseconds ✅Both MT4 & MT5 with VPS support ✅99.3% positive reviews on Metatrader platforms |

|

✅Average execution speed as fast as 12 milliseconds ✅Spreads for typical trade sizes start from just 0.6 pips on EUR/USD ✅More than 50 built-in indicators |

Overview of the Best MetaTrader Brokers

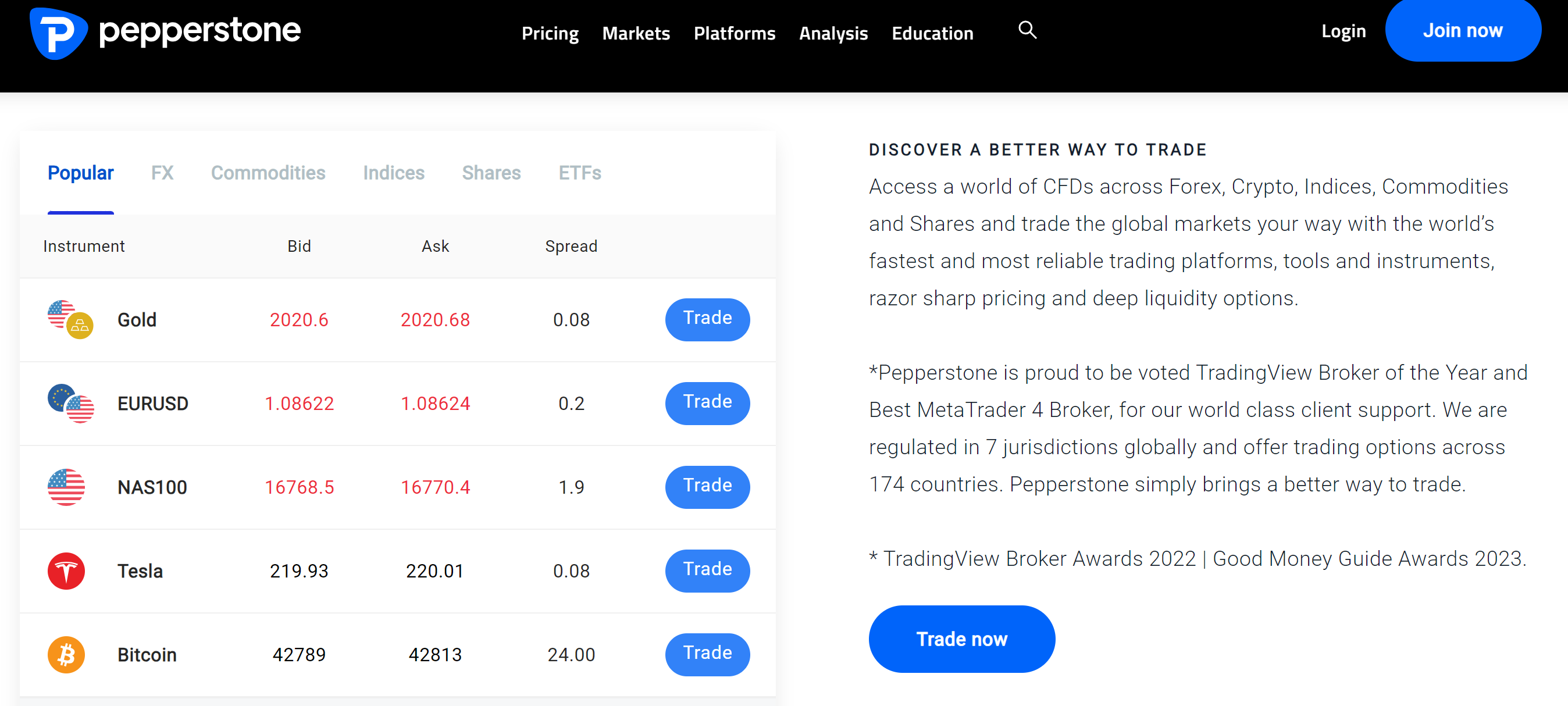

Pepperstone- Best MetaTrader broker for low cost trading and scalping

|

|

Overall Rating: ⭐⭐⭐⭐⭐ |

|

Broker |

|

Regulated by |

|

Min. Deposit |

$200 |

Tradable Instruments |

Forex, Commodities,Indices, Currency Indices,Cryptocurrencies,Shares, ETFs,CFD Forwards |

Trading Platforms |

cTrader, MetaTrader 4,MetaTrader 5, TradingView, |

Trading Costs |

Forex markups of 0.70 pips, average costs of 0.84 pips or $7.00 and $8.40 per 1.0 standard round lot |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

Visa, Mastercard, Bank transfer, PayPal, Neteller, Skrill, Union Pay |

Customer Support |

24/7 |

Ideal for |

Active and experienced traders |

Pepperstone, founded in 2010, is an online forex and CFD broker based in Australia, with additional operations in the UK. It provides trading in over 150 instruments, spanning forex, index CFDs, commodities, cryptocurrencies, and share CFDs. The broker offers multiple trading platforms including MetaTrader 4 (MT4) , MetaTrader 5 (MT5) , and cTrader available on web, desktop, and mobile for convenient access. Pepperstone's customer support extends to 24/7 live chat, phone, and email services. Pepperstone is recognized for its low-cost access to global forex markets, superior customer service, extensive educational resources, and transparent fee structure.

| ✅Pros | ❌Cons |

| • Stringent Regulations | • No Micro accounts |

| • Competitive Pricing | • Unfriendly Minimum Depoists |

| • Multiple Trading Platforms | |

| • Scalping & Hedging Allowed | |

| • 7/24 Customer Service | |

| • Both MetaTrader 4 & MetaTrader 5 supported |

FXCM-Best MetaTrader broker for copy trading

|

|

Overall Rating: ⭐⭐⭐⭐⭐ |

|

Broker |

|

Regulation |

|

Minimum deposit |

$50 |

Tradable Instruments |

currency pairs, precious metals, commodities, global stock indices, treasury bonds |

Trading Platforms |

MetaTrader 4, Trading Station, ZuluTrade, Captalize AI, Tradingview Pro |

Trading Costs |

Commission-free, average a minimum of 1.2 pips or $12.00 per 1 standard round lot |

Leverage |

Up to 400:1 |

Copy Trading |

✅ |

Demo Account |

✅ |

❌ |

|

Payment Methods |

Bank transfer, Credit/debit cards, Neteller, Skrill, Unionpay |

Customer Support |

24/5 phone, email, and live chat |

Ideal for |

Both Novices and seasoned traders |

FXCM, operated by FXCM Australia Pty Limited, is a well-known Forex broker based in Australia. The company was founded in 1999 and has since become a prominent player in the financial industry. FXCM offers a range of financial services and trading platforms, primarily focused on foreign exchange (Forex) trading. With its headquarters in Sydney, Australia, FXCM provides traders with access to global currency markets and a suite of tools and resources to support their trading activities. When it comes to trading software, FXCM give many choices, including MetaTrader 4 (MT4) , Trading Station, ZuluTrade, Captalize AI, Tradingview Pro.

| ✅Pros | ❌Cons |

| • Global and heavy regulations | • No Online Chat Support |

| • Promotion Programs | • Unfriendly Minimum Depoists |

| • Multiple Trading Platforms | • No Tiered Accounts |

| • Copy trading feature offered | • Limited product portfolio |

| • Ideal for both novices and seasoned traders |

IC Markets - Best MetaTrader broker for offering decent customer support and quality educational tools

|

|

Overall Rating: ⭐⭐⭐⭐⭐ |

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

Forex, Commodities CFDs,Indices, Bonds, Digital Currency.Stock, Futures |

Trading Platforms |

MetaTrader 4, MetaTrader 5, cTrader |

Trading Costs |

Raw Spread ( cTrader) : spreads from 0.0 pips, with commissions at $3.0 Standard Account: spreads from 0.8 pips, with no commissions charged Raw Spread ( MetaTrader): spreads from 0.0 pips, with commissions at $3.5 |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

Wire transfer, Paypal, Credit Card, Skrill, Neteller, UnionPay, Bpay, FasaPay and Poli |

Customer Support |

7/24 |

Ideal for |

Both Novices and seasoned traders |

IC Markets, founded in Sydney, Australia, in 2007, is a highly commended broker recognized globally for its superior trading services. Registered with the Australian Securities and Investments Commission (ASIC), it also enforces strict regulatory compliance, assuring reliability and security. IC Markets, renowned for its wide assortment of tradable instruments, gives traders access to forex pairs, commodities, indices, bonds, and cryptocurrencies, among others. By offering both MetaTrader 4 (MT4) and MetaTrader 5 (MT4) , and cTrader platforms, the broker cares about more traders, facilitating sophisticated charting, algorithmic trading, and more. IC Markets is celebrated for its competitive trading costs, notably for its low spreads and affordable commissions. With customer service held in high regard, you can expect prompt, multilingual assistance 24/7 via live chat, email, and phone. The recognition IC Markets boasts is solidified by its global reputation, network of international clients, and high recognization from professional traders.

| ✅Pros | ❌Cons |

| • Over 2000 Trading Instruments | • Slow Live Chat support |

| • 30-day Demo Accounts for Practice | |

| • 24/7 Customer Support | |

| • Low Forex Fees | |

| • No Inactivity fees | |

| • Quality Educational Contents | |

| • Both MetaTrader 4 & MetaTrader 5 supported |

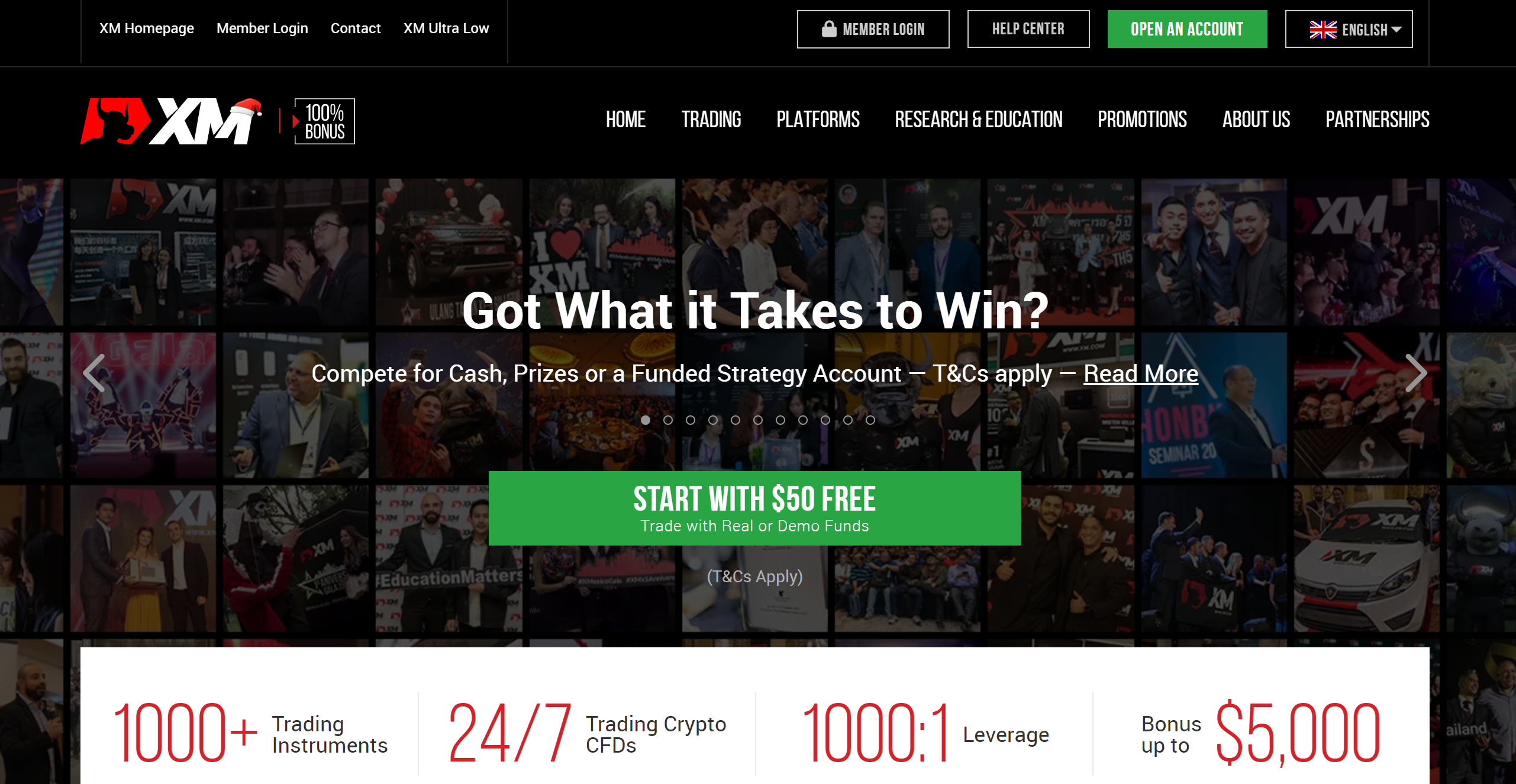

XM- Best MetaTrader broker for crypto trading

|

|

Overall Rating: ⭐⭐⭐⭐⭐ |

|

Broker |

|

Regulated by |

|

Min.Deposit |

$5 |

Tradable Instruments |

Forex, Cryptocurrencies, Stock CFDs, Turbo Stocks, CommoditiesEquity Indices, Precious Metals, Energies |

Trading Platform(s) |

MetaTrader4, MetaTrader5, XM WebTrader |

Trading Costs |

0.6 pips on all major currency pairsNo commissions on FX accounts |

Leverage |

1:1000 |

Payment Methods |

credit and debit cards, bank transfers, e-wallets, and many more |

Copy Trading |

✅ |

Demo Account |

✅ |

$50 trading bonusDepsoit bonus up to $5,000 |

|

Customer Support |

7/14 live help |

Ideal for |

Both Beginners and Experienced traders |

XM, a Cyprus-based brokerage with an impressive 14-year operational history in the industry. XM provides access to an extensive array of over 1,000 markets, spanning Forex, Cryptocurrencies, Stock CFDs, Turbo Stocks, Commodities, Equity Indices, Precious Metals, and Energies. Beyond its diverse market offerings, XM distinguishes itself by offering favorable trading conditions. These include competitive spreads, a copy trading feature allowing replication of successful strategies, and an attractive deposit bonus of up to $5,000. Moreover, XM provides 7/24 customer support, placing clients' concerns above all else.

| ✅Pros | ❌Cons |

| • 7/24 Cryptos CFD trading | • only 50+, High withdrawal fees |

| • Micro accounts offered | • Focusing mainly on CFDs |

| • Rich educational resources | • Limited tradable assets |

| • Access to both MT4 & MT5 |

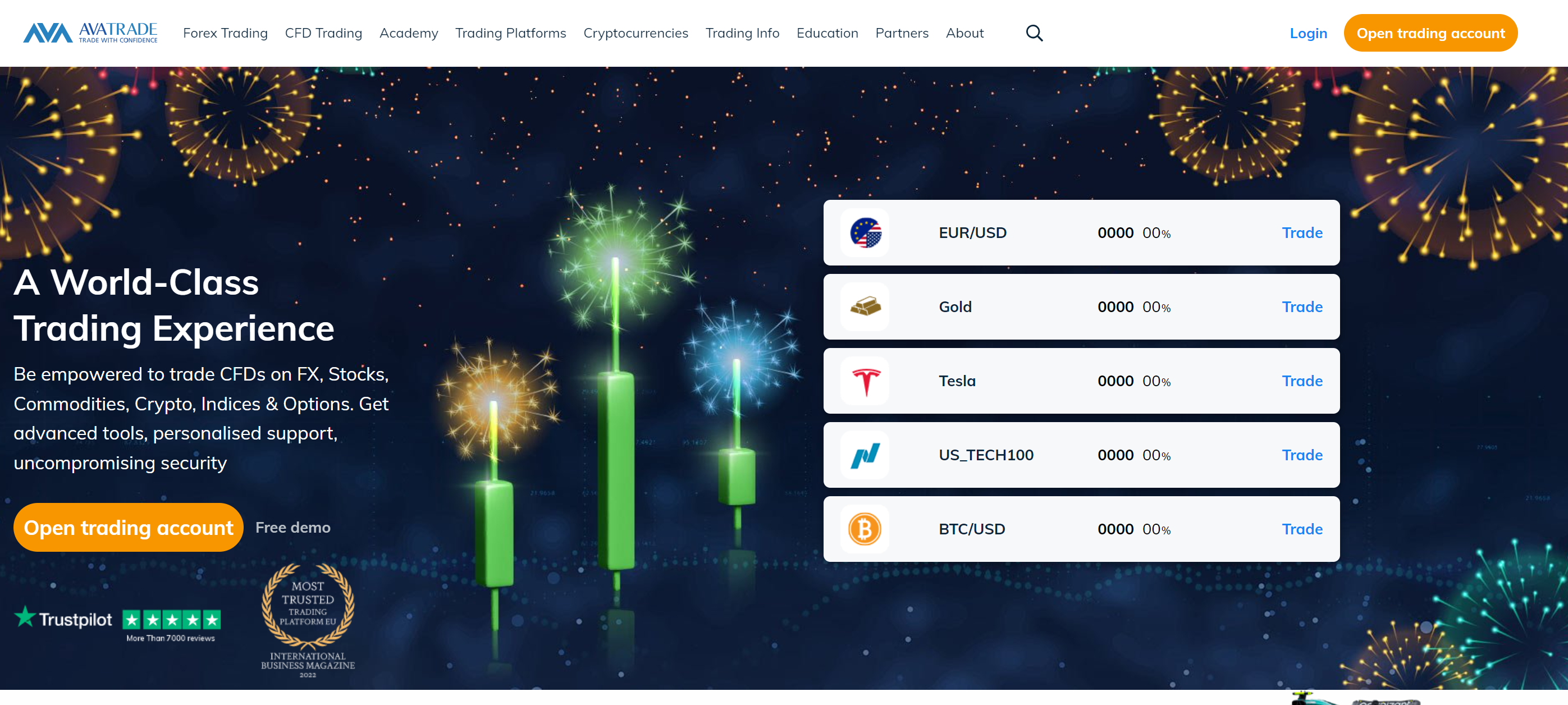

Avatrade - Best MetaTrader Broker for Copy and Social Trading

|

|

Overall Rating: ⭐⭐⭐⭐⭐ |

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

currency pairs, major stock indices, Cryptocurrencies, commodities (such as gold, silver, sugar, coffee), bonds, individual shares and ETFs |

Trading Platforms |

AvaSocial, Web trader, AvaTradeGO, MetaTrader 4,MetaTrader 5 |

Trading Costs |

Spreads from 0.9 pips |

Max. Leverage |

400:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

credit/debit cards and wire transfers, Skrill, Neteller, and WebMoney, and more |

Customer Support |

24/5 |

AvaTrade, established in 2006, is a globally recognized online brokerage based in Dublin, Ireland. The broker provides trading in a diverse range of instruments including over 50 currency pairs, numerous CFDs on indices, stocks, commodities, cryptocurrencies, and bonds. It supports various trading platforms including MetaTrader 4 (MT4), MetaTrader 5 (MT5) , and AvaTradeGo, available across web, desktop, and mobile devices. AvaTrade offers 24/5 customer support via live chat, telephone, and email, and boasts robust user recognition due to its wide range of educational resources, multiple trading platforms, and strict regulation.

| ✅Pros | ❌Cons |

| • Well-regulated and trusted broker | • Limited currency pairs to trade |

| • Great MetaTrader Platforms | • No tiered accounts |

| • Several automated and social trading tools | |

| • Glogally recognized | |

| • Advanced properiotory trading platforms | |

| • Both MetTrader 4 & MetTrader 5 supported |

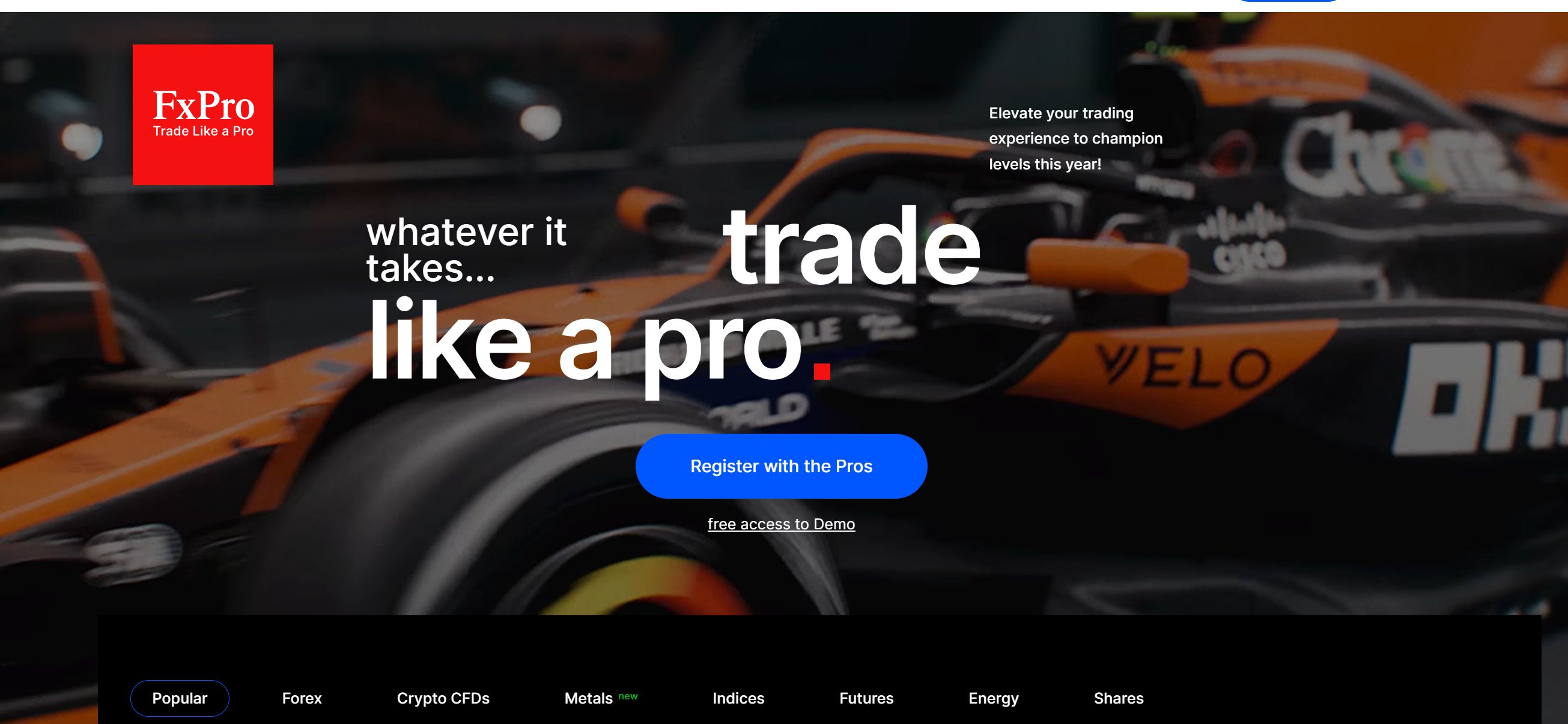

FxPro - Best MetaTrader broker for diversified products trading

|

|

Overall Rating:⭐⭐⭐⭐⭐ |

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

FX pairs, Futures, Indices, Metals, Energies and Shares |

Trading Platforms |

MetaTrader4, MetaTrader5, cTrader, FxPro Trading App |

Trading Costs |

Standard Account: average spread of 1.5 pipsPro Account: average spread of 1 pipsRaw+: Spreads from EURUSD, GBPUSD, USDJPY from 0 pipsElite: Spreads from EURUSD, GBPUSD, USDJPY from 0 pips |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

Bank Wire transfers, Credit/Debit cards, PayPal, Neteller, Skrill and more |

Customer Support |

5/24 |

Ideal for |

Traders of all levels |

Established in 2006, FxPro is an online forex broker based in London and registered in the United Kingdom. This broker offers a wide variety of tradable instruments such as forex pairs, futures, indices, stocks, metals, commodities and cryptocurrencies. FxPro uses various trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5), FxPro cTrader and FxPro Edge. The broker is known for its tight spreads, quick execution, and leverage up to 1:500. Additional features of FxPro include algorithmic trading, adaptive algorithms with fully automated execution, and no dealing desk intervention. Users often appreciate the broker's transparency and quality customer service, contributing to its overall good reputation in the forex trading world.

| ✅Pros | ❌Cons |

| • Diversified products | • High inactivity fees |

| • Three tiered accounts to choose from | • No Micro Accounts |

| • A well-established broker with a good reputation | |

| • User-friendly trading app | |

| • Great educational resources | |

| • Both MetaTrader 4 & MetaTrader 5 Supported |

Swissquote - Best MetaTrader broker for secure trading

|

|

Overall Rating:⭐⭐⭐⭐⭐ |

|

Broker |

|

Regulation |

|

Min. Deposit |

$0 |

Tradable Instruments |

Forex, Stocks, Options, Futures, CFDs, ETFs |

Trading Platforms |

MetaTrader 4, MetaTrader 5 |

Trading Costs |

Spreads from starting from 0.6 pips, commissions depending on the account type and instrument traded |

Maximum Leverage |

1:500 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Payment Methods |

Wire Transfer, Debit Card |

Customer Support |

5/24 |

Ideal for |

Seasoned and advanced traders |

Swissquote is a Swiss-based online banking and financial services provider that is well-known for its online trading and investment platforms. Founded in 1996, Swissquote offers a wide range of financial services, including online trading of various assets like stocks, forex, commodities, and cryptocurrencies through popular MetaTrader 4 ((MT4) and MetaTrader 5 ((MT5) . Swissquote provides a user-friendly interface, extensive research and analysis tools, and a variety of account options to cater to the needs of different investors.

| ✅Pros | ❌Cons |

| • With a banking license | • Simple website design |

| • Autochartist available | • Limited product portfolios |

| • Solid trading platform perormance | • High forex fees |

| • Both MT4 & MT5 offered | |

| • Rich & Quality educational resources | |

| • Both MetaTrader 4 & MetaTrader 5 Supported |

FXTM - Best MetaTrader broker for copy trading and mobile trading

|

|

Overall Rating:⭐⭐⭐⭐⭐ |

|

Broker |

|

Regulated by |

|

Min. Deposit |

$10 |

Tradable Instruments |

Forex, Commodities, Metals, Stocks, Indices, and Stock CFDs |

Trading Platforms |

MetaTrader 4, MetaTrader5, FXTM Trader app |

Trading Costs |

Advantage account:Spreads from 0.0 pips, commissions:Average of $0.4-$2 based on volumeFor Cryptocurrencies: Average of $30-$150 based on volume Advantage Plus: Spreads from 1.5 pips, with no commissions charged |

Max. Leverage |

2000:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

Credit and Debit Cards, e-Wallets, crypto, Bank Wire transfers and local payment solutions |

Customer Support |

5/24 |

Ideal for |

Both beginners and experienced traders |

Founded in 2011 and headquartered in Limassol, Cyprus, ForexTime (FXTM) is a name synonymous with global excellence in the trading world. Extensively regulated by top-tier authorities like CySEC in Cyprus, the FCA in the UK, and FSCA in South Africa, it adheres to stringent standards enhancing its credibility. FXTM avails an array of tradable instruments to its clientele, constituting forex pairs, commodities, indices, equities, and cryptocurrencies. The borker relies on the robust MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms, known for their extensive charting tools, fast order execution, and support for automated trading systems. Regarding trading costs, FXTM stands competitive with its reasonably low spreads and commissions, especially on ECN (Advantage Plus) accounts. FXTM's client-centric approach is further emphasized by its responsive, multilingual customer service, reachable via live chat, phone, or email. Its strong reputation on the global stage is confirmed by numerous accolades, broad client base, and positive client testimonials.

| ✅ Pros | ❌Cons |

| • Huge markets to trade | • Simple website design |

| • Autochartist available | • Limited product portfolios |

| • Solid trading platform perormance | • High forex fees |

| • Both MetaTrader 4 (MT4) & MetaTrader 5 (MT5) offered | |

| • Rich & Quality educational resources |

Admiral Markets- Best MetaTrader broker for demo trading and low-cost trading

|

|

Overall Rating: ⭐ ⭐ ⭐ ⭐ ⭐ |

|

Broker |

|

Regulated by |

|

Min. Deposit |

$1 |

Tradable Instruments |

Forex, Indices, Stocks, Commodities, Bonds, ETFs |

Trading Platforms |

MetaTrader 4, MetaTrader 5, MetaTrader Webtrader, Admirals App |

Trading Costs |

Forex typically spreads from 0.6 pips (EURUSD) |

Max. Leverage |

1000:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

✅ |

|

Payment Methods |

Bank Wire, Skrill, Neteller, VISA, MasterCard, cryptocurrencies, Perfect Money |

Customer Support |

5/24 |

Ideal for |

Traders of all levels |

Established in 2001, Admiral Markets is a globally-recognized forex and CFD broker regulated by the UK's Financial Conduct Authority (FCA). The company also operates in Australia under Admirals AU Pty Ltd, holding Australian Financial Services Licence number 410681, regulated by the Australian Securities and Investments Commission (ASIC). It offers a comprehensive suite of trading products, including forex, indices, commodities, stocks, bonds and ETFs. With trading platforms like MetaTrader 4 and 5, and WebTrader, Admiral Markets stands out for its competitive spreads, prompt execution and exceptional customer support.

| ✅Pros | ❌Cons |

| • Operates under two tier-1 regulators | • Inactivity Fees |

| • Demo Accounts | |

| • Various trading platforms | |

| • Negative Balance Protection | |

| • Both MT4, MT5 provided |

ONADA - Best MetaTrader broker for mobile trading

|

|

Overall Rating: ⭐⭐⭐⭐⭐ |

|

Broker |

|

Registered Country |

Australia |

Regulation |

|

Min. Deposit |

$0 |

Tradable Instruments |

Forex, CFDs, Indices, Commodities, Bonds |

Trading Platforms |

OANDA Mobile, OANDA Web, Tradingview, MetaTrader 4 |

Trading Costs |

From 0.6 pips (EUR/USD pair) |

Max. Leverage |

1:50 (US), 1:30 (EU), 1:200 (other regions) |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

Bank transfer, credit/debit cards, PayPal |

Customer Support |

24/7 phone, email, live chat |

Ideal for |

Both Novices and Seasoned traders |

Founded in 1996, OANDA is a well-known online forex broker that has been operating for over two decades. With a reputation for transparency and reliability, OANDA offers a wide range of trading products and services, including forex, CFDs, commodities, and indices. OANDA offers a range of trading platforms, including its proprietary platform, as well as the popular MT4 platform. The broker also provides a range of educational resources and tools to help traders improve their trading skills and stay up-to-date with market developments.

| ✅ Pros | ❌ Cons |

| • Offering mainstream and popular products | • Lack of Standard and Micro accounts |

| • No deposit fees | • Educational resources not that quality |

| • Strong MeteTrader platforms support | |

| • Access to mobile trading experience | |

| • Heavily regulated |

Forex Trading Knowledge Questions and Answers

What is a MetaTrader broker ?

A MetaTrader broker is an online trading firm offering traders access to the MetaTrader platform, which includes MetaTrader 4 and MetaTrader 5 (MT5). These platforms, part of a suite created by MetaQuotes Software Corp., cater to trading across various devices such as mobiles, web browsers, and desktops.

To provide traders with access to MT4 or MT5 trading platforms, brokers need to obtain a license from MetaQuotes Software, the developer of the MT4 and MT5 platforms. This will allow the broker to distribute the platforms to their clients and use the MetaQuotes branding. Besides this step, brokers will also need to set up a server infrastructure to support the MT4 or MT5 platforms includes installing the platform software, configuring it for the broker's specific needs, and ensuring that it is properly connected to the broker's trading environment.

Traders tend to choose an MT4 broker or MT5 broker due to their widespread adoption, extensive feature set, and robust trading environment. These platforms cater to both novice and experienced traders, offering a comprehensive suite of technical analysis tools, automated trading capabilities, and demo accounts for risk-free practice. Whether pursuing short-term or long-term trading strategies, MT4 and MT5 provide a versatile and reliable foundation for successful trading endeavors.

MetaTrader 4 VS MetaTrader 4: Which features quicker order execution?

The execution speed between MetaTrader 4 (MT4) and MetaTrader 4 (MT5) isn't inherently better or worse. It largely depends on specific trading instruments and volumes. However, overall, MT5 tends to be slightly faster than MT4.

Advanced Communication Protocols and Algorithms: With MT5's advanced protocols, when you place an order, the system uses highly efficient algorithms that swiftly transmit your request to the market. For instance, when executing a buy order for EUR/USD, MT5 processes and sends the trade request to the liquidity provider in milliseconds.

Memory Management and Multithreading: MT5's efficient memory management allows for smooth operation, especially when handling multiple trades or analyzing various markets simultaneously. For instance, when tracking multiple currency pairs and commodities, MT5 swiftly updates prices without lags, enhancing trade decision-making.

Optimized Code and Higher Data Processing Efficiency: MT5's optimized code significantly reduces latency. For example, when handling extensive historical data or conducting complex technical analysis on MT5, the platform quickly crunches the numbers, supporting traders who need to process vast amounts of information.

Additional Services in MT5: The signal and copy trading features on MT5 offer traders access to strategies from experienced traders. For instance, when a trader follows a signal provider's strategy on MT5, the system instantly replicates the signal provider's trades into the follower's account, facilitating a seamless trading experience.

For regular trading, the difference in execution speed between the two platforms isn't significant, unless it involves high-frequency trading. Moreover, the optimization level of MT platforms by different brokers also influences the final performance.

Why does MetaTrader 4 still gain more popularity than MT5?

Among traders, MetaTrader 4 (MT4) was more well-known and commonly used than MetaTrader 5 (MT5) for a long period because of its earlier release and familiarity. When it comes to forex trading, MetaTrader 4 (MT4) 's simplified interface makes it a better choice for newcomers than MT5, and the fact that it was built specifically for FX trading likely accounts for its greater popularity. Third, there is no need for more functionality because MetaTrader 4 already has them all. Insisting strongly on certain matters is always an application of the “less is more” idea.

Can I trade in MetaTrader without a broker?

The only way to trade foreign currency or other instruments is through a Metatrader broker, which is MetaTrader 4 (MT4) broker or MetaTrader 5 (MT5) broker. To do so, you must first open an account with a broker and then access the MetaTrader 4 (MT4) or MetaTrader 5 (MT5) trading platforms it makes available to its clients. Traders can not use MetaTrader without a broker.

What are Expert Advisors (EAs) in MetaTrader?

Expert Advisors, indeed, serve as highly efficient trading robots or algorithms. They automate the trading process, implementing strategies by generating both buy and sell signals, and subsequently executing trades on your behalf. Expert Advisors function based on scripts written in the MetaQuotes Language (MQL), specially designed for trading operations. To give an example, they can be coded to monitor real-time market data, identify key trading opportunities based on pre-set criteria (like price movements or time triggers), and perform actions such as opening, closing, and managing market positions without the need for manual intervention. This fosters consistent, objective trading, unhindered by human emotions.

Is it easy for beginners to get started with MetaTrader?

Yes, MetaTrader is generally considered to be beginner-friendly, making it relatively easy for newcomers to get started with the platform.

To start with, MetaTrader offers an inviting interface that even beginners find welcoming. Its straightforward menus and clear navigation make the process of executing trades, interpreting charts, and managing positions a breeze, ensuring an easy start for those new to trading.

Next up, MetaTrader extends a helping hand to beginners with the option of demo accounts. These virtual accounts are a safe playground for practice since they involve no real money. Here, newcomers can gain valuable experience and acclimate to the platform without putting their capital at risk.

Moving forward, count yourself in luck as a beginner with MetaTrader, for a wealth of brokers and online sources stand ready to be your mentors. They offer a treasure trove of tutorials, guides, and educational materials thoughtfully tailored for MetaTrader users. These resources are your compass, guiding you through the platform's features and unveiling the foundational principles of forex trading with ease.

Do I have to pay fees for using MetaTrader 4?

Fear not, the use of MetaTrader 4 won't dent your wallet. It's entirely cost-free. You can dive into the world of trading without any upfront charges. But do remember, while MetaTrader 4 itself doesn't come with a price tag, there might be trading costs imposed by your broker. These expenses typically take the form of spreads and commissions, so it's wise to acquaint yourself with your broker's fee structure. In essence, MT4 is your gateway to the markets without a subscription fee, but savvy financial planning entails keeping an eye on any associated trading costs.

How can MetaTrader help me become a more successful forex trader?

Here, you need to talk yourself into accepting the harsh reality that using metatrader does not guarantee that you will always make money. The world of trading is not as simple as you may think. In the end, becoming a successful trader depends on your own personal qualities as a trader and your skillful employ of the tools provided by MetaTrader 4.

Broker Options: With MetaTrader, you're not limited by one choice. Many brokers embrace this platform, giving you the freedom to pick the one that aligns perfectly with your unique trading preferences and requirements.

Advanced Charting and Analysis Provided: With MetaTrader at your side, you'll wield a diverse arsenal of technical indicators, oscillators, and drawing tools. These powerful tools open the gateway to in-depth technical analysis, making it easier for you to understand market trends and trade with confidence.

Automated trading with EA: Imagine having your very own trading assistant. MetaTrader allows you to create or employ Expert Advisors (EAs) to automate your trading strategies, ensuring your positions are managed even when you're not glued to the screen.

Mind Your Risk Management: MetaTrader isn't just a trading platform, your guardian instead. It empowers you to set stop-loss and take-profit levels, acting as a shield for your capital. These smart orders work tirelessly to safeguard your investments, automatically closing positions at your predetermined safety points.

What are the most popular indicators in MetaTrader Platforms?

MetaTrader platoforms offers a huge selection of indictors, but some are particularly popular among traders due to their effectiveness and versatility. Some most commonly used indictors in MetaTrader platforms include Moving Averages, Relative Strength Index (RSI), Stochastic Oscillator, Bollinger Bands, MACD (Moving Average Convergence Divergence), Average True Range (ATR), Volume Indicators, Average Directional Index (ADX), Commodity Channel Index (CCI).

Comparing MetaTrader 4 Brokers: What to consider?

When comparing MetaTrader 4 brokers, it's crucial to consider aspects beyond just spreads and commissions. Look at their customer support services, educational resources, and the overall quality of the trading experience they provide.

Spreads, Leverage, and Commission Rates

Competitive spreads and reasonable leverage options are important, but always assess them in conjunction with the broker's reliability and regulatory status.

Customer Support and Educational Resources

A broker that offers robust customer support and comprehensive educational materials can be invaluable, especially for new traders. This support can significantly impact your trading success and confidence in navigating the markets.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities, boosting confidence and simplifies trading experiences for your forex journey.

You Also Like:

Best MT5 Forex Brokers in 2024

Here is our pick of the best MT5 Forex Brokers and this list includes only regulated brokers that are highly ranked and come highly recommended for trading.

8 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 8 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Best Brokers with Smartwatch Apps for 2024

This guide compares the best brokers and their smartwatch app features- a quick way to manage your portfolio.

Best Mac Forex Trading Platforms for 2024

Forex traders, particularly Mac users, need suitable platforms. This article examines the top Mac Forex trading platforms' brokers.