In Brazil, the forex trading landscape presents a dynamic and evolving market, and the forex market continues to gain traction, with a growing number of traders participating in currency exchange activities.

The Brazilian Real (BRL) holds a central role in the local forex scene, with currency pairs like USD/BRL being actively traded. Economic factors, political developments, and global market trends are closely monitored by Brazilian traders as they navigate the currency markets. In terms of regulation, forex trading in Brazil is governed by the Comissão de Valores Mobiliários (CVM), the country's securities regulatory authority. CVM is responsible for overseeing and regulating financial activities, including forex brokerage firms.

Amidst the thriving forex markets in Brazil and the sea of brokers to choose from, we've compiled a list of 8 top-tier forex brokers for your reference to save your time and feel more confidence in trading.

8 Best Forex Brokers in Brazil

Nearly all trades are completed in within 0.4 seconds.

Free trading platform app – FBS Trader to trade from any place (for the non-ASIC regulated regions only)

A well-established broker offering strong trading platforms and rich educational contents.

24/7 Customer support available in 10+ languages.

Processing times for deposits and withdrawals are minimal.

FP Markets offers consistently tighter spreads from 0.0 pips, 24/7 Multi-lingual support.

more

Comparison of Best Forex Brokers in Brazil

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers in Brazil Overall

| Broker | Logo | Why are they listed as the Best Forex Brokers in Brazil? |

| FBS |  |

✅ An excellent score of 4.3 out of 5 on the most famous rating website from over 1000 reviews, based on its pricing, platform permance. ✅Providing local payment methods for added convenience. ✅Provides 24/7 customer service in multiple languages, ensuring global accessibility. |

| Capital.com |  |

✅Strictly regulated by FCA and CYSEC in Europe, chosen by 570K clients. ✅Received multiple awards for its trading platform, educational content and customer service. ✅Localized payment methods providing great convenience for clients from different countries, fast withdrawal speed. |

| FP Markets |  |

✅ Regulated by CYSEC, in accordance with European laws. ✅A long operation history of 15 years, favorable by traders all over the world. ✅Localized customer service and payment options, providing multilingual services and convenient deposit and withdrawal. |

| AvaTrade |  |

✅An influential broker regulated globally, giving clients more trading confidence. ✅An average score of 4.0 out of 5, derived from over 2,000 reviews, a good reputation for years. ✅ Multilingual customer support and localized payment options, few complaints on withdrawal process. |

| eToro |  |

✅Heavily regulated by multiple regulators, especially FCA and CYSEC, offering a degree of safety. ✅Famous for its social trading feature, chased by millions of traders, beginners and seasoned traders. ✅Over 20 languages for customer service and trading services |

| IC Markets |  |

✅ Fast order execution speed, greatly reducing the possibility of slippages. ✅ Competitive pricing, plus 7/24 customer support, high praised by traders from all over the world. ✅ Receives mostly positive reviews on various rating websites, a high score of 8.92 on WikiFX. |

| RoboMarkets |  |

✅Regulated by CYSEC, making it a popular choice in the European market. ✅12 payment methods providing great convenience for clients. ✅24/7 customer support in 12 languages, high user satisfaction |

| Doo Prime |  |

✅Over 20 global operation centers, an established broker with good operation. ✅ Working with top-tier liquidity providers to offer competitive pricing in the industry. ✅ Fast order execution speed of 50 milliseconds. |

FBS

Overall: ⭐⭐⭐⭐⭐

Regulation: CYSEC,FSC

FBS is a forex and CFD broker established in 2009. With its headquarters in Cyprus, the company maintains a global presence through offices in various countries like Indonesia, Malaysia, and Thailand. The broker offers access to a bulk of markets encompassing currency pairs, precious metals, CFDs on stocks, and cryptocurrencies. Clients of FBS have access to the widely respected MetaTrader 4 and MetaTrader 5 trading platforms to have a superb trading environement.

| ✅Pros | ❌Cons |

| • Low threshold to enter its markets | • Limited currency pairs compared to other brokers |

| • Both MT4 & MT5 offered | • No online chat support |

| • Cryptos offered | |

| • Competitive spreads | |

| • Global presence | |

| • Quality educational contents | |

| • Promotions and bonuses offered |

Capital.com

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, CYSEC, FCA, NBRB, FSA

Capital.com is a global online trading platform, registered and headquartered in Cyprus, and established in 2016. This broker is known for offering services in forex trading, spread betting, and Contracts for Difference (CFDs) on various financial instruments including stocks, indices, commodities, and cryptocurrencies. It offers access to advanced Metatrader 4 trading platform and tradingview, giving traders much confidence in trading.

| ✅Pros | ❌Cons |

| • Stringent regulation | • Inactivity fees charged |

| • Advanced trading platforms | |

| • Free deposit | |

| • Rich educational resources, a learning hub | |

| • Free currency conversion | |

| • Various markets to access | |

| • Negative balance protection offered |

FP Markets

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, CYSEC

FP Markets, an Australian forex and CFD broker, was established in 2005. Based in Sydney, FP Markets is regulated by the Australian Securities and Investments Commision (ASIC) and holds an Australian Financial Services Licence. Throughout its extensive history of more than 15 years, FP Markets has established itself as a trusted name in the industry, known for its highly competitive pricing, lightning-fast execution speeds, and top-notch trading platforms such as MetaTrader 4, MetaTrader 5, and Iress. FP Markets provides a wide range of trading options, including forex trading on over 60 currency pairs and CFDs across various assets such as indices, commodities, shares, and cryptocurrencies. Traders have the option to select between raw spread accounts that offer access to deep liquidity or ECN accounts that provide tight variable spreads. FP Markets welcomes clients from around the world and is renowned for its round-the-clock customer support in multiple languages.

| ✅Pros | ❌Cons |

| • Operating under tier-1 ASIC | • No cent or micro accounts for beginners |

| • A well-established broker with a good reputation | |

| • Adavanced trading platforms, MT4, MT5, IRESS | |

| • A comprehensive suite of quality educational resources | |

| • 7/24 multilingual customer support | |

| • Over 60 currency pairs to trade |

AvaTrade

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, FSA, FFAJ, CBI, FSCA, FCA

AvaTrade is an international forex and CFD brokerage that was founded in 2006 in Dublin, Ireland. Regulated by the Central Bank of Ireland and licensed by financial regulators across Europe, Japan, South Africa, and Australia, AvaTrade provides retail traders, institutions, and fund managers access to trading instruments spanning forex, cryptocurrencies, bonds, commodities, indices, stocks, and ETFs. AvaTrade stands out for its comprehensive educational resources, multilingual customer support, and array of trading platforms including the popular MetaTrader 4 and AvaTradeGO. Traders can choose between floating or fixed spreads and leverage up to 1:400. AvaTrade also offers automated trading through Expert Advisors on the MetaTrader 4 platform. With its focus on trust, innovation, and empowering traders, AvaTrade has grown rapidly over the past 15+ years to serve over 200,000 accounts globally.

| ✅Pros | ❌Cons |

| • Operating under strong regulation | Limited promotions and bonuses offering |

| • Competitive spreads and fees | |

| • Multiple trading platforms | |

| • Access to advanced trading tools and features | |

| • Low slippage risks | |

| • Valuable trading tools and educational resources |

eToro

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, CYSEC, FCA

eToro represents one of the leaders in the global fintech revolution. Established in 2007 and headquartered in Cyprus, this innovative social trading platform allows users to connect, share strategies and replicate the performance of successful investors. eToro boasts unique features such as “CopyTrade,” which enables users to mimic the trades of top-performing traders, and a user-friendly trading dashboard with real-time charts, pricing alerts, and multi-asset support. eToro offers a broad range of assets from stocks, ETFs, and commodities to cryptocurrencies.

| ✅Pros | ❌Cons |

| • Stringent regulation | • Limited customer support options |

| • Advanced trading platforms | • Withdrawal fees |

| • Low minimum deposit required | |

| • Commission-free on most trading instruments | |

| • eToro Academy | |

| • Copy trading feature | |

| • Crypto staking offered |

IC Markets

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, CYSEC

IC Markets operates as an online forex and CFD broker, based in Australia. The company was established in 2007 and has its main office in Sydney, Australia. It is renowned for its diverse selection of trading instruments and competitive spreads, serving both individual and institutional traders worldwide. IC Markets is regulated by the Australian Securities and Investments Commission (ASIC) and is well-known for its transparent and high-speed trading environment.

| ✅Pros | ❌Cons |

| • Stringent regulation | • No Micro Accounts |

| • Advanced trading platforms | |

| • Low forex fees | |

| • 7/24 customer support | |

| • Quality educational contents | |

| • Social & Copy trading feature | |

| • Access to various markets |

RoboMarkets

Overall: ⭐⭐⭐⭐⭐

Regulation: CYESEC

RoboMarkets, a broker with a solid track record since its inception in 2012, operating under the regulatory oversight of Belize and Cyprus. This broker offers an extensive range of trading instruments, encompassing forex, cryptocurrencies, and more. As for trading platforms, RoboMarkets allows access to MetaTrader 4, MetaTrader 5, and Tradingview. Three tiered accounts are on offer, namely Cent account, ECN account and Prime account, target for both beginners and experienced traders.

| ✅Pros | ❌Cons |

| • Adanced trading platforms, MT4, MT5, Tradingview | • $100 for a cent account, a little bit high |

| • No commissions on stock | |

| • No overnight fees | |

| • Access to 3,0000 instruments | |

| • Free withdrawal twice a month | |

| • Algo trading feature |

Doo Prime

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, VFSC, FSA

Doo Prime is a wholly-owned subsidiary of Doo Prime Holding Group, founded in 2014, headquartered in London, UK, with operations offices in Hong Kong, Taipei, Dallas, Kuala Lumpur, and Singapore. Doo Prime offers a diverse selection of tradable assets, including forex, contracts for difference (CFDs), indices, and cryptocurrencies, with spreads starting at 0.1 pips. The platform provides access to MT4, MT5, Doo Prime InTrade, TradingView, and copy trading. In terms of customer support, Doo Prime provides 24/7 assistance through various channels, including email, live chat, and telephone.

| ✅Pros | ❌Cons |

| • Strong regulation | • Limited customization options for account types. |

| • Large markets to trade | • Promotions or bonuses not offered often |

| • Own trading platforms besides MetaTrader | |

| • Social trading features | |

| • Convenient deposit and withdrawal |

Forex Trading Knowledge Questions and Answers

What is the regulator for the forex markets in Brazil?

The regulatory authority responsible for overseeing the forex markets in Brazil is the Comissão de Valores Mobiliários (CVM), founded in 1976, tasked with governing and supervising various financial activities, including the operations of forex brokerage firms within Brazil.

What are some of the latest trends in forex trading in Brazil?

The landscape of forex trading in Brazil is continually evolving, and here are some of the latest trends in forex trading in Brazil:

Growing popularity of Social Trading: A noteworthy trend in Brazil's forex trading landscape is the surging popularity of social trading. This dynamic approach enables traders, especially newcomers, to emulate the strategies of seasoned professionals. By doing so, it eases the burden of extensive research and analysis, allowing them to embark on a profitable journey.

Increasing Use of Mobile Trading Apps:Surprisingly, an increasing number of Brazilian traders are embracing the use of mobile trading apps for their forex endeavors. The convenience of on-the-go trading and the growing selection of mobile trading apps offered by local forex brokers play a pivotal role in this trend.

Growing Interest in Cryptocurrency Trading: Cryptocurrency trading is witnessing a surge in popularity within Brazil's financial landscape. What's even more intriguing is that many forex traders are delving into the realm of cryptocurrencies. The allure lies in the exceptional volatility of these digital assets, potentially translating into substantial gains for astute traders.

The Rise of Algorithmic Trading:Algorithmic trading, a method employing computers to autonomously execute trades according to preset parameters, is steadily gaining traction in Brazil's trading landscape. This trend's appeal lies in its ability to assist traders in mitigating emotional interference and fostering more disciplined decision-making during the trading process.

Beyond these trends, Brazilian forex traders are placing a heightened emphasis on two crucial aspects: risk management and education.There's a growing recognition of the inherent risks in forex trading, leading traders to proactively adopt risk-mitigation strategies. Simultaneously, there's a noteworthy investment in education as traders seek to bolster their knowledge and enhance their trading proficiency.

What are scam brokers in Brazil that traders should avoid?

Scam brokers in Brazil, like in many regions, pose a significant risk to traders. Be wary of brokers with fake or unclear regulatory oversight, as well as those promising unrealistic returns or employing high-pressure sales tactics. Here we have a list of scam brokers that traders should avoid:

| Broker | Registered Country | Regulation | Establishment of Years | Trading Platform | Customer Support | Additional Notes |

|

Australia |  |

5-10 years | Counterfeit MT4 | Phone | 10 pieces of exposure |

|

United Kingdom |  |

5-10 years | Counterfeit MT4 | Field survey finding no office | |

|

The Virgin Islands |  |

2-5 years | Unknown | No | 10 pieces of exposure |

|

United Kingdom |  |

5-10 years | MT4 | Email Only | 35 pieces of exposure |

|

Australia |  |

5-10 years | MT4 (White Label) | Phone & Email | A Visit to GCG in Australia-Unfound |

|

United Kingdom |  |

Unknown | MT4 | Phone & Email | The Office of WistonFX in Australia is Bogus |

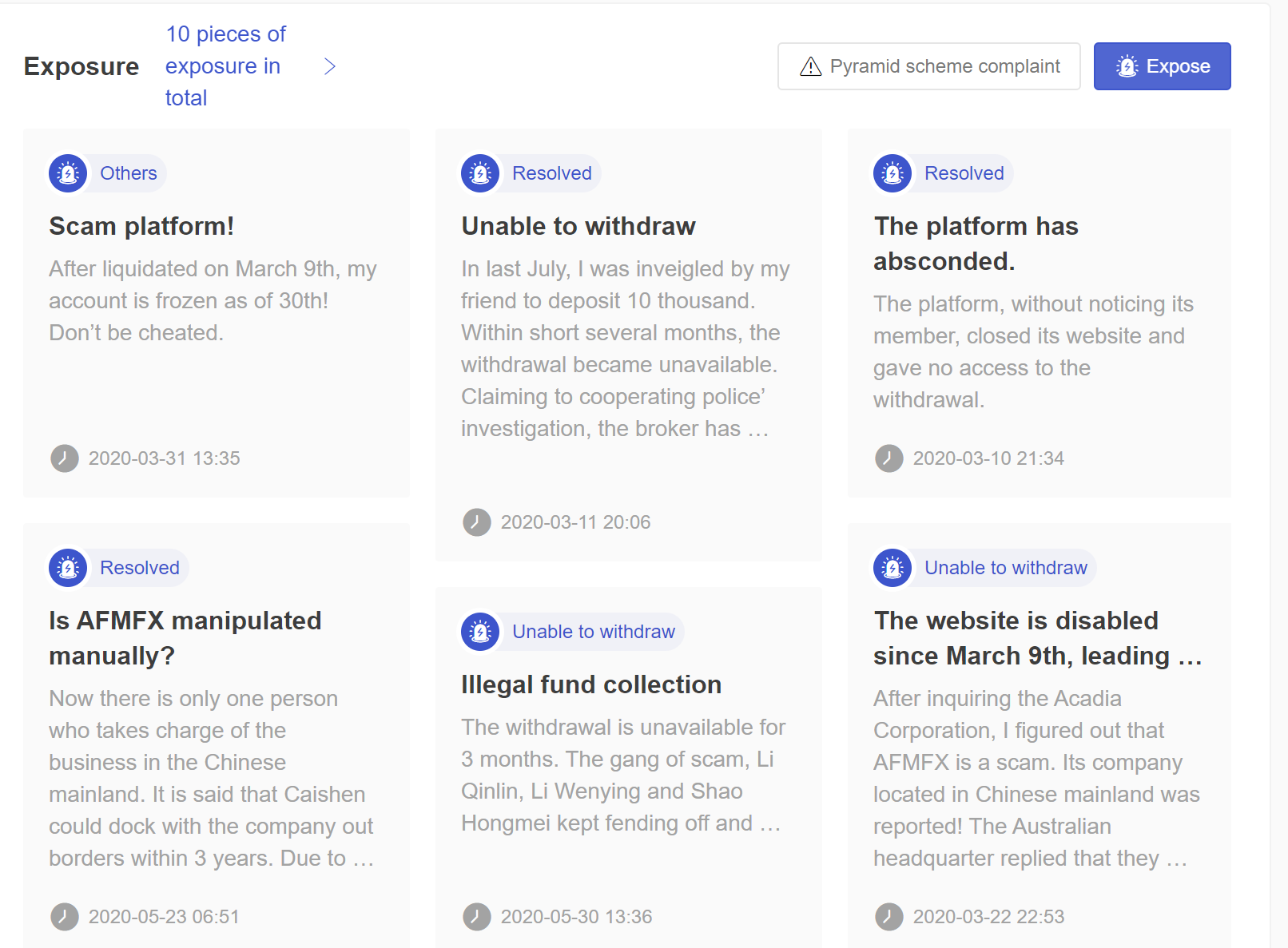

AFMFXhas been identified as a scam broker, its license expired, and it's included on WikiFX's list of scam brokers. Numerous investors have reported instances of fund withholding, manipulative deposit requests, and other unscrupulous tactics. Traders must steer clear of this deceitful broker.

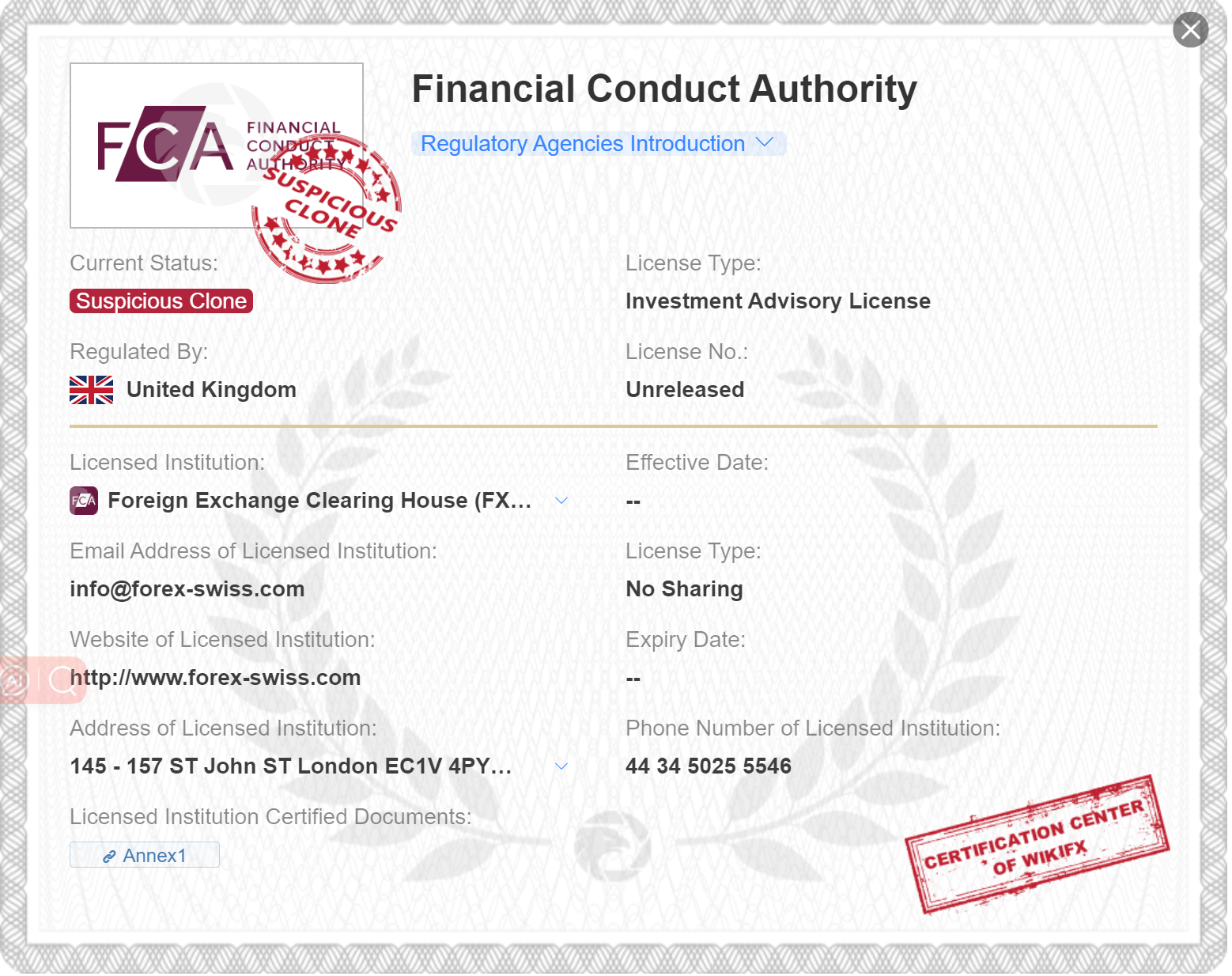

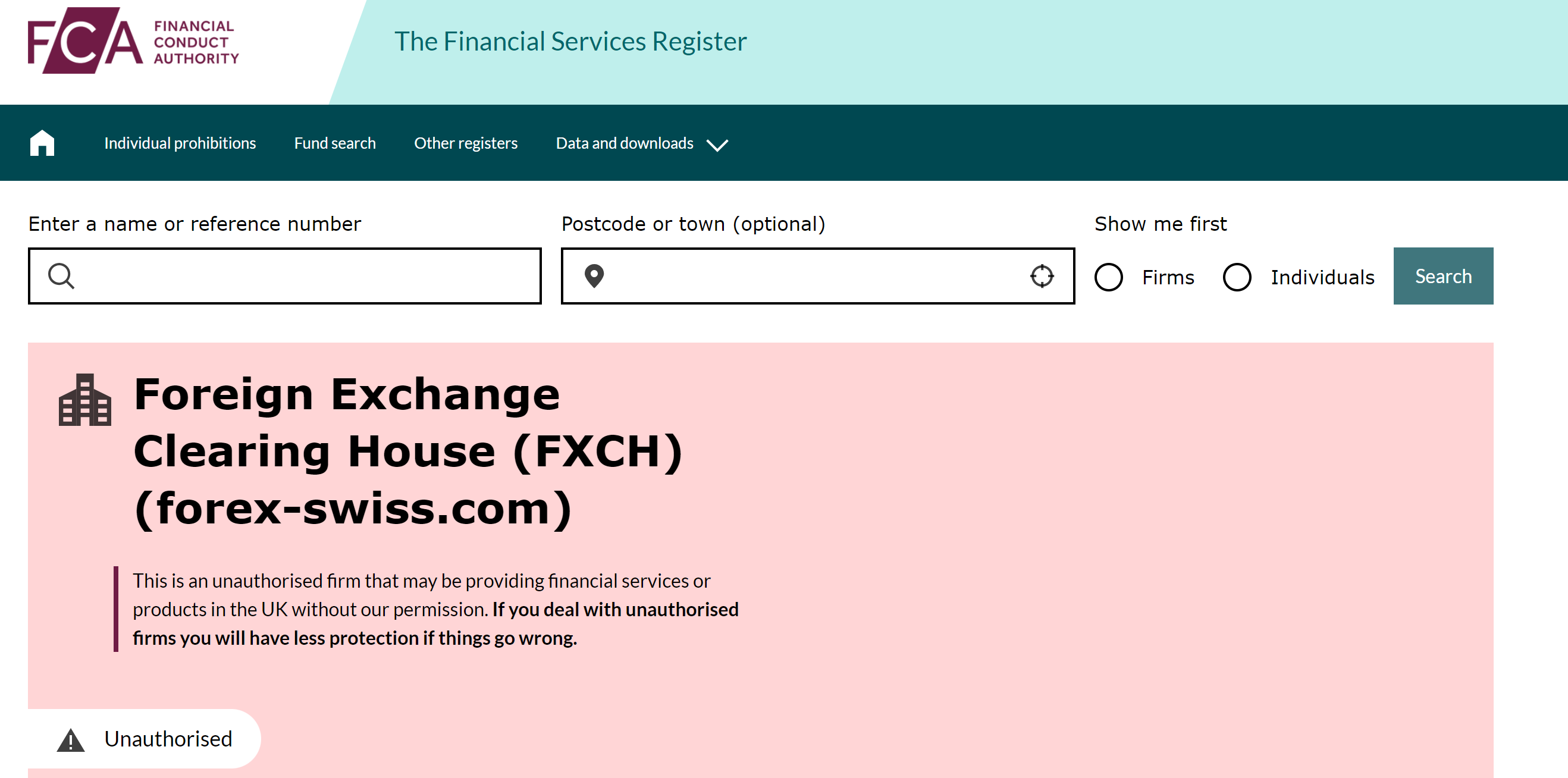

FXCHstands as another concerning addition to the list of scam brokers, demanding the vigilance of traders. This broker asserts to possess a license sanctioned by the FCA, operating under the banner of “Foreign Exchange Clearing House.” However, upon deeper scrutiny, it becomes evident that this entity lacks the necessary authorization, resorting to counterfeit regulatory licenses in a disconcerting charade.

In a subsequent revelation, the diligent field survey team from WikiFX ventured to the registered address associated with this license, only to encounter a disheartening reality-the address proved nonexistent. These findings reinforce the importance of remaining cautious and steering clear of such deceptive brokers.

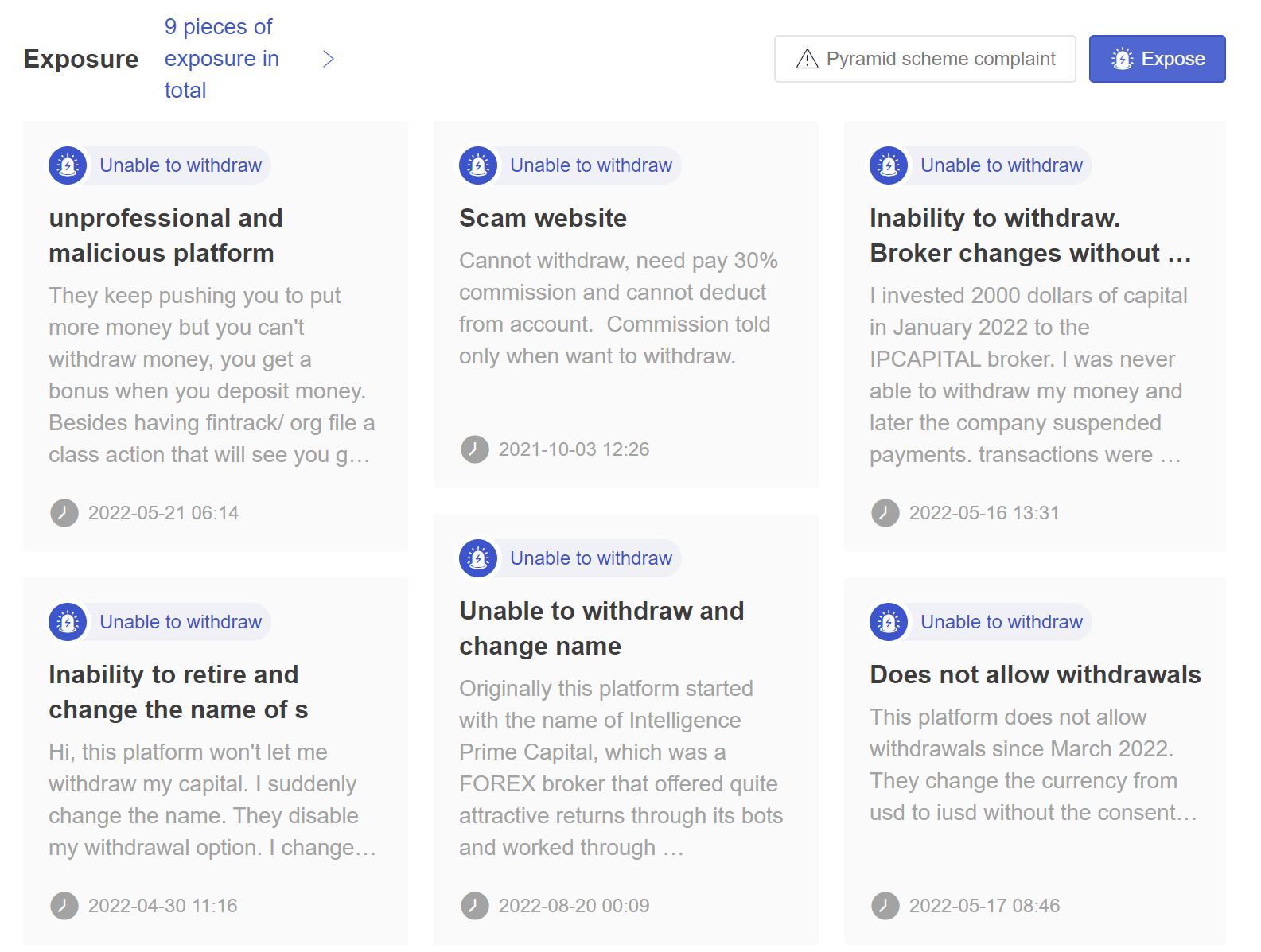

Billionext,a notorious broker, is synonymous with deplorable trading conditions and an unsavory reputation. With a track record of duping countless individuals, it's no wonder that this broker has garnered a staggering 9 instances of exposure.

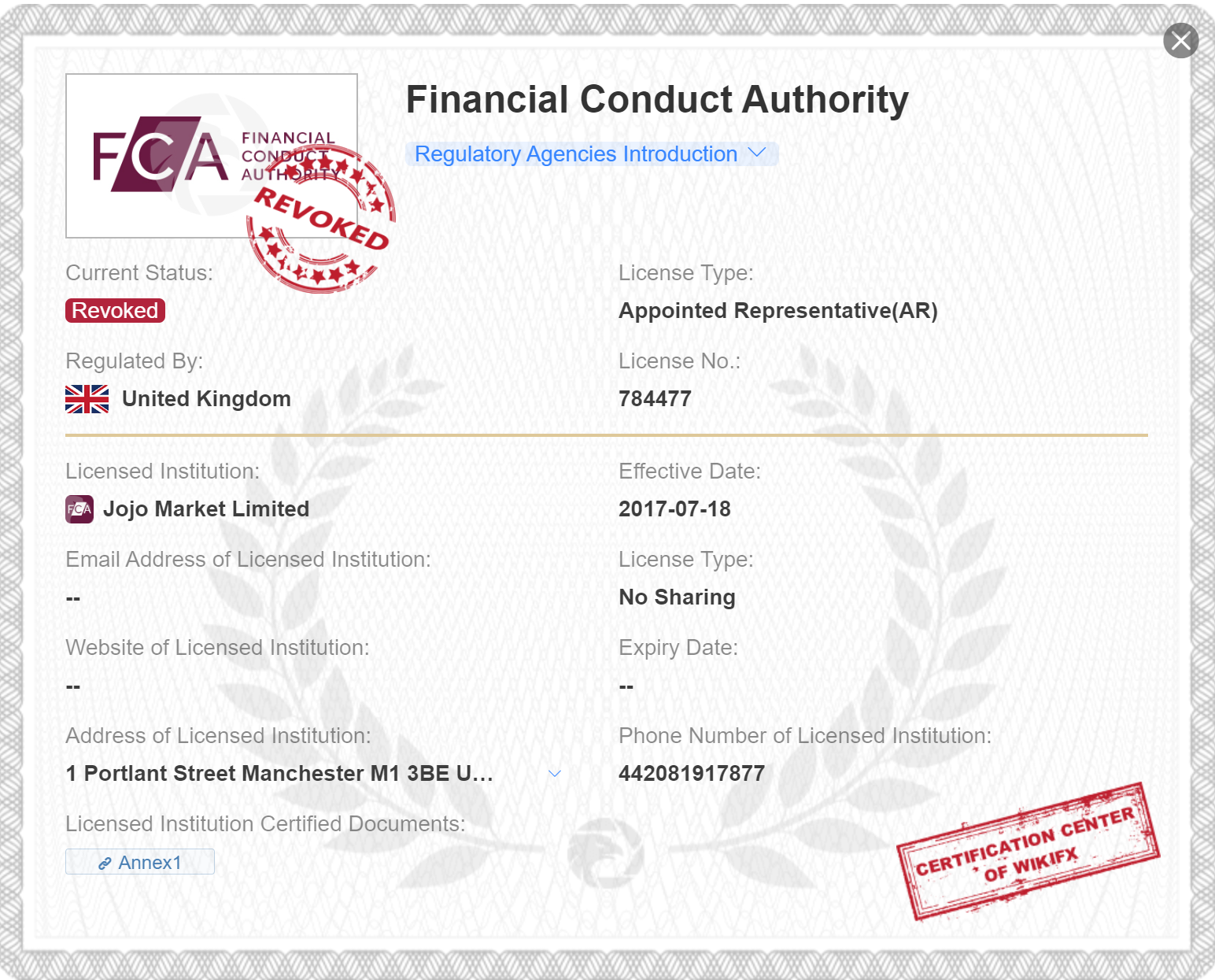

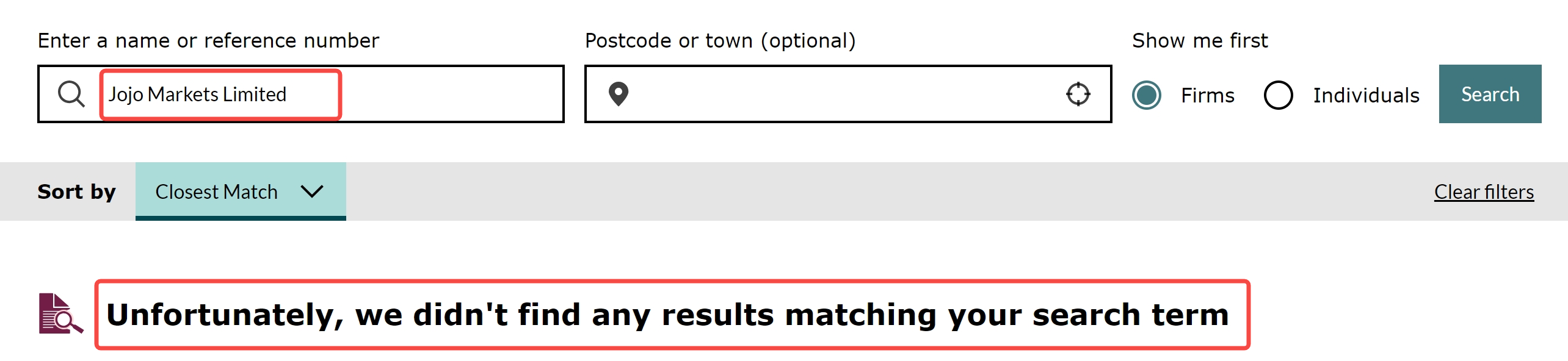

Jojo Markets, a notorious broker (with a track record of scams), claims FCA regulation under license number 784477, but a search on the FCA website reveals no trace of the company. Additionally, an astonishing 35 exposures (detailing various deceitful practices) underscore the widespread discontent and distrust surrounding this broker.

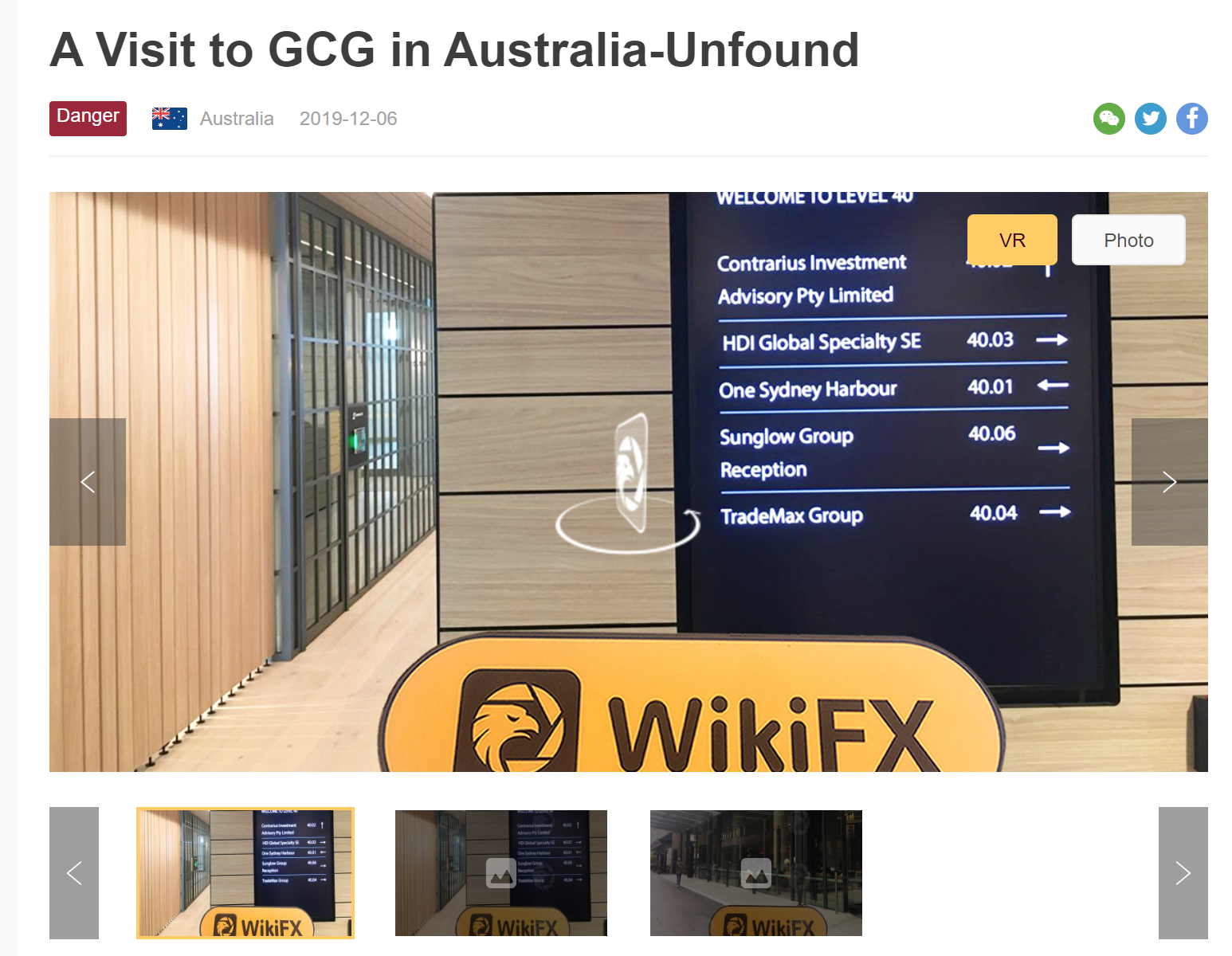

GCG, yet another in the string of letdown scam brokers, alleges ASIC regulation, but, unfortunately, this regulatory license is nothing more than a fake façade. Moreover, a visit to this broker (reveals that the registered address is non-existent), further strengthening suspicions of deceitful practices.

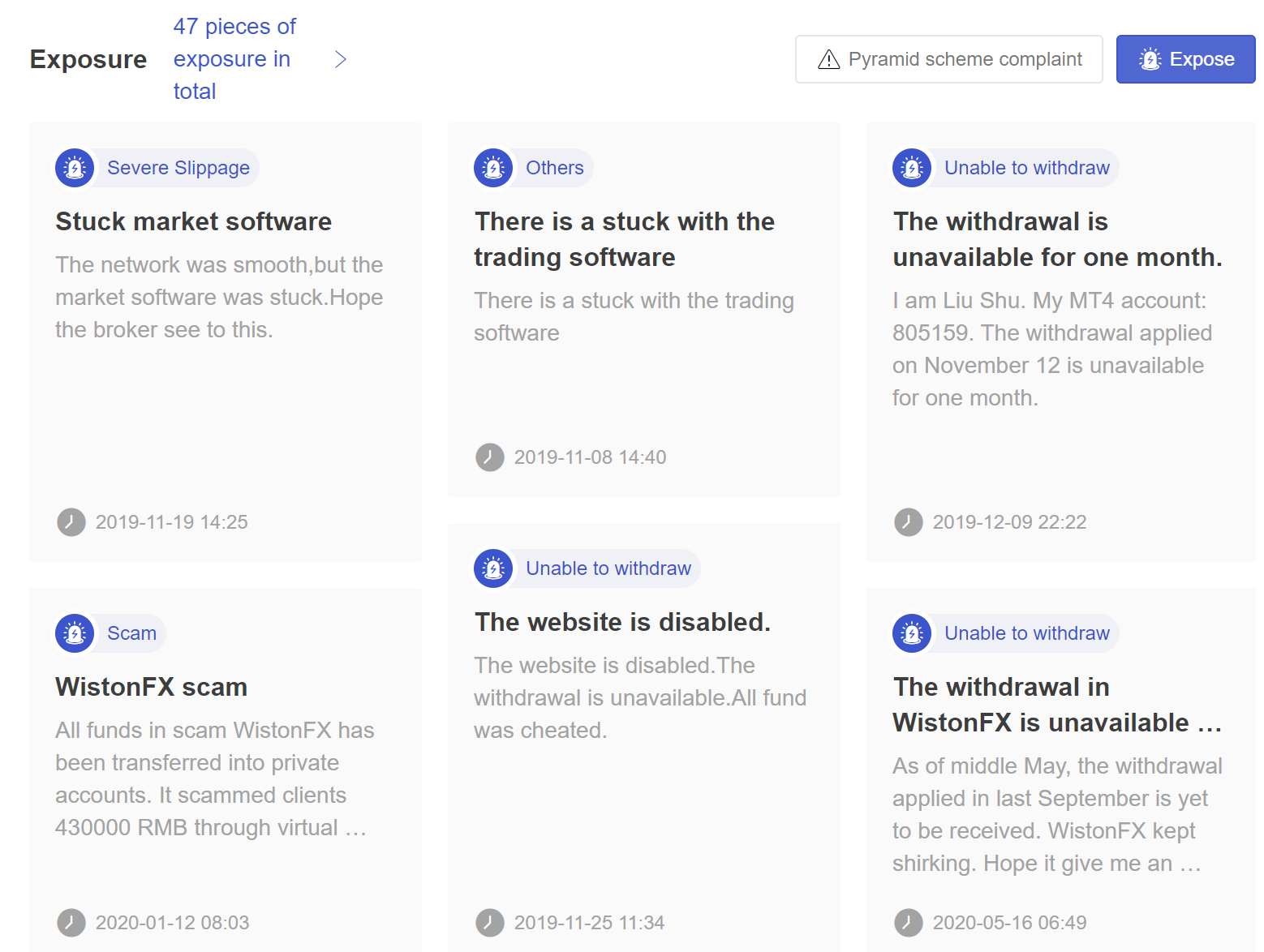

WistonFXis a broker to be avoided (given its revoked FCA license), as it lacks legitimate regulation. A visit to its registered address (reveals its fictitious nature), further emphasizing its deceptive practices. What's more, the considerable exposure (with a total of 47 pieces) paints a picture of widespread dissatisfaction and distrust within the trading community.

What are the most popular forex pairs in Brazil?

The most popular forex pairs in Brazil are:

BRL/USD: The Brazilian real/US dollar pair is the most popular forex pair in Brazil, accounting for a significant portion of the country's forex trading volume.

BRL/EUR: The Brazilian real/euro pair is another popular forex pair in Brazil.

BRL/JPY: The Brazilian real/Japanese yen pair is also a popular forex pair in Brazil.

BRL/GBP: The Brazilian real/British pound pair is another popular forex pair in Brazil.

BRLMXN: The Brazilian real/Mexican peso pair is a popular forex pair in Brazil due to the close economic ties between the two countries.

What are the tax implications of forex trading in Brazil?

The tax implications of forex trading in Brazil fluctuate based on the trader's status, and here's where it gets interesting, the type of trading activity they're involved in.

For individual traders in Brazil,the tax landscape for forex trading introduces a few noteworthy factors. Capital gains derived from trading activities bear a tax rate of 15% for profits held for less than six months, which elevates to 17.5% for profits retained for six months or longer.

Nevertheless, within this tax framework, there are exceptions that deserve mention. Profits arising from day trading activities, defined as the swift buy and sell of a currency pair within the same day, enjoy exemption from capital gains tax.

On the corporate front, companies navigating the forex market in Brazil encounter a distinct taxation scenario. Forex trading profits are categorized as corporate income and are consequently subject to a corporate income tax rate. This rate stands at 25% for profits up to BRL 240,000 and rises to 34% for profits exceeding this threshold.

For non-resident traders engaging in the Brazilian forex realm, tax implications are also in play. The tax rate applicable to their forex trading profits is set at 34% of the net profit. Additionally, non-resident traders must designate a tax representative in Brazil, a requirement that adds a layer of complexity to their tax obligations.

What are some of the challenges of forex trading for beginners in Brazil?

Forex trading can be a challenging endeavor for beginners in any country, but there are some specific challenges that Brazilian beginners may face.

Lack of financial education:A significant challenge in Brazil is the lack of widespread financial education. This dearth of accessible financial knowledge can, in fact, pose a formidable obstacle for many individuals. It hinders their ability to grasp the intricate nuances of forex trading, which includes comprehending both the inherent risks and the potential rewards.

High inflation:Brazil, historically plagued by bouts of high inflation, a persistent issue that has, without a doubt, far-reaching consequences. One noteworthy impact is the gradual erosion of profits over time. For instance, if a trader converts 1,000 BRL to 200 USD at an exchange rate of 5 BRL to 1 USD, and inflation reduces the Real's value, the trader may end up with fewer BRL when converting back to the local currency.

Political instability: In Brazil, it's important to note a persistent issue—political instability. This factor has, on numerous occasions, cast a shadow over the country's economic landscape, and here's where it gets intriguing—it can significantly influence the value of the Brazilian real.

Limited access to reliable information: There is a limited amount of reliable information available about forex trading in Portuguese-a factor that can, without a doubt, make the learning process considerably more challenging. This shortage of accessible educational resources hampers the ability of novice traders to gain insights into the intricacies of the forex market.

How has the rise of cryptocurrencies affected forex trading in Brazil?

The burgeoning presence of cryptocurrencies, in Brazil's forex landscape, presents an intriguing dynamic. On one hand, it sparks heightened enthusiasm for cryptocurrency trading—diverting a portion of attention and capital away from traditional forex trading. Yet, on the flip side, we witness an interesting transformation within forex trading itself.

Some forex traders embark on a dual journey, venturing into cryptocurrency trading alongside their forex pairs. Simultaneously, a separate group harnesses cryptocurrencies to fund their forex trading accounts. This confluence of forex and cryptocurrencies introduces a unique and ever-evolving intersection in the trading sphere.

The rise of cryptocurrencies, with its far-reaching impact on forex trading in Brazil, has unfolded in several distinct ways.

Increased awareness of forex trading: The rise of cryptocurrencies has led to an increase in awareness of financial trading in general, including forex trading. This has resulted in more Brazilians becoming interested in forex trading.

New trading opportunities:Cryptocurrencies, a dynamic addition to the trading landscape, open up a world of fresh opportunities. What's captivating is their versatility—they. They can be traded against fiat currencies, other cryptocurrencies, and yes, even forex pairs.

New ways to fund forex trading accounts:Cryptocurrencies offer a nifty option: you can use them to fund your forex trading accounts, which can be convenient for traders who want to avoid the fees associated with traditional payment methods.

Increased competition among forex brokers:The rise of cryptocurrencies has led to increased competition among forex brokers, as many brokers are now offering cryptocurrency trading services. This has benefited traders by giving them more choices and lower fees.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like

Best Forex Brokers in Turkey for 2024

Review top 9 forex brokers in Turkey, elevating their trading pros and cons to give traders more useful guidance.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Swiss Forex Brokers for 2024

Explore top 10 forex brokers in Switzerland, elevating their trading pros and cons to give traders more useful guidance.

Best Stock Brokers in the US for 2024

When choosing an online broker, finding the platform that best fits your investment needs is crucial. With the rise in popularity of online trading, more brokers are offering free stock trading and commission-free transactions for various assets. It has become a challenge for users to select suitable brokers.

Best MT5 Forex Brokers in 2024

Here is our pick of the best MT5 Forex Brokers and this list includes only regulated brokers that are highly ranked and come highly recommended for trading.

8 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 8 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Best Brokers with Smartwatch Apps for 2024

This guide compares the best brokers and their smartwatch app features- a quick way to manage your portfolio.

Best Mac Forex Trading Platforms for 2024

Forex traders, particularly Mac users, need suitable platforms. This article examines the top Mac Forex trading platforms' brokers.