Score

HGNH

Hong Kong|15-20 years|

Hong Kong|15-20 years| http://www.henghua.hk/henghuaEnglish/hgnhe.html

Website

Rating Index

Influence

Influence

C

Influence index NO.1

China 3.12

China 3.12Contact

Single Core

1G

40G

1M*ADSL

- China Hong Kong SFC (license number: BBT517) The regulatory status is abnormal, the official regulatory status is Revoked. Please be aware of the risk!

Basic information

Hong Kong

Hong KongUsers who viewed HGNH also viewed..

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

henghua.hk

Server Location

Hong Kong

Website Domain Name

henghua.hk

Website

WHOIS.HKIRC.HK

Company

-

Server IP

223.197.58.137

Company Summary

| Company Name | HGNH International |

| Registered In | Hong Kong |

| Regulated | Securities and Futures Commission of Hong Kong (SFC) |

| Years of Establishment | 2006 |

| Trading Instruments | Futures, Securities, Technology Services, Asset Management, Trading Business, Clearing, Credit Business |

| Account Types | Standard, VIP, Demo (details on official website) |

| Trading Platform | EPOLESTAR 9.3 Client and API versions, E-PAUL Global Trading (details may vary) |

| Deposit and Withdrawal | Bank transfers, credit/debit cards, e-wallets (details on official website) |

| Customer Service | Email, Phone |

Overview of HGNH

HGNH International, founded in 2006 in Hong Kong, regulated by SFC. With memberships in 16 futures exchanges across Hong Kong, Europe, Singapore, and the United States, HGNH International has established itself as a significant player in the industry.

The company comprises two main entities: HGNH International Futures Ltd., specializing in futures and derivatives, and HGNH International Securities Limited, focused on securities trading. Their presence in both futures and securities markets suggests a well-rounded approach to financial services. Nevertheless, individuals considering their services should conduct thorough research and due diligence to ensure they meet their specific investment needs.

Is HGNH Legit or a Scam?

HGNH International's regulation by the Securities and Futures Commission (SFC) in Hong Kong for dealing in futures contracts is an important aspect of its operation. This regulatory oversight signifies that the company operates within the legal framework established by the SFC, ensuring compliance with the necessary rules and regulations governing the futures market.

It's essential for traders and investors to acknowledge this regulatory status as part of their evaluation when considering HGNH International as their trading partner, as it reflects the broker's commitment to adhering to established financial regulations.

Pros and Cons

| Pros | Cons |

| Comprehensive Services | Limited Information |

| Global Market Access | Restricted Deposit Options |

| Transparent Commissions | Unclear Customer Support |

Pros:

Diverse Range of Financial Services: HGNH International offers a comprehensive suite of financial services, including futures, securities, technology solutions, asset management, clearing, and credit services.

International Reach: With memberships in various international exchanges, HGNH International provides access to global financial markets.

Transparent Commission Fees: The company provides detailed commission fee structures for various products, enhancing transparency for clients.

Cons:

Limited Information: The provided information lacks detail on account types, leverage, trading platforms, and educational resources.

Restricted Deposit Options: HGNH International does not support cash deposits at bank counters and has limitations on third-party bank account deposits.

Unclear Customer Support: Information regarding customer support options is not available.

Market Instruments

HGNH International offers an extensive range of financial instruments, encompassing international futures, securities, technology services, asset management, trading, clearing, and credit services. This diversity caters to the needs of a wide array of investors and traders.

Account Types

HGNH International offers a selection of account types to cater to different trading preferences:

Standard Account: This account type is suitable for most traders and provides access to the full range of products and services offered by HGNH International. It offers competitive spreads and commissions, making it an attractive choice for traders of all levels.

VIP Account: For high-volume traders or institutional clients, HGNH International offers a VIP account with enhanced features. This account may include lower spreads, personalized customer support, and exclusive research and analysis.

Demo Account: HGNH International provides a demo account option for traders who want to practice and familiarize themselves with the platform before committing real funds. It's an excellent way to test strategies without risk.

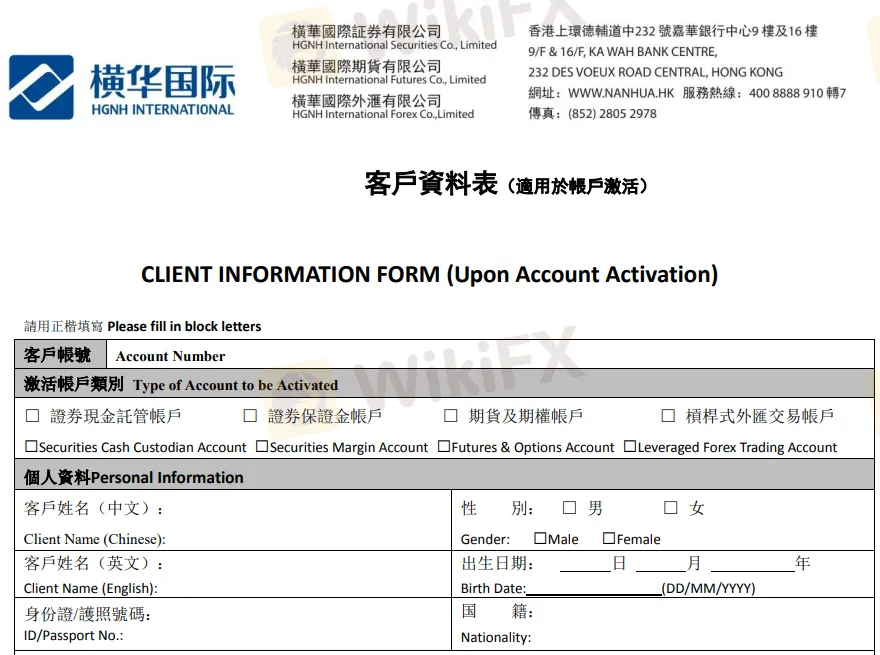

How to Open an Account?

Opening an account with HGNH International is a straightforward process:

Online Application: Start by visiting their official website and filling out the online application form. You'll need to provide personal information, financial details, and agree to the terms and conditions.

Verification: After submitting your application, you will be required to complete a verification process. This typically involves providing identification documents and proof of address.

Fund Your Account: Once your account is verified, you can fund it using the deposit methods available. HGNH International offers various funding options, including bank transfers and electronic payment methods.

Start Trading: With your account funded, you can access the trading platform and start trading a wide range of financial instruments.

Spreads & Commissions

HGNH International provides transparent information about spreads and commissions on its official website. Spreads can vary depending on the asset class and market conditions, but the broker aims to offer competitive pricing. Commissions are generally reasonable and may be based on a per-trade or volume-based structure.

Trading Platform

HGNH International's trading platform offers a comprehensive suite of tools and features designed to cater to the diverse needs of traders and investors. With the EPOLESTAR 9.3 Client version and API version, clients have access to a user-friendly and efficient interface for executing trades across various international exchanges. The platform provides real-time market data, advanced charting tools, and customizable indicators, enabling traders to make well-informed decisions.

One notable feature of HGNH International's trading platform is its support for E-PAUL Global Trading. E-PAUL Global Trading is a powerful solution that facilitates trading in global financial markets, including stocks, futures, and options. This platform offers access to a wide range of asset classes, allowing clients to diversify their portfolios.

Deposit & Withdrawal

Depositing funds into your HGNH International account is a hassle-free process. The broker supports various deposit methods, including bank transfers, credit/debit cards, and e-wallets. Withdrawals are typically processed promptly, and clients can request funds via the same methods used for deposits.

Customer Support

HGNH International appears to offer customer support through various channels, including email and a dedicated phone line. The provided email address, info@nanhua-usa.com, suggests that clients can reach out to the company via email for inquiries and assistance. This email contact is likely a convenient way to communicate with their customer support team, allowing clients to send detailed queries or requests for information.

Additionally, the phone number provided, +86 4008888910-2, indicates a dedicated customer support hotline that clients can call for assistance. The inclusion of both the international dialing code and the extension number suggests that clients can easily connect with a customer support representative who can address their questions or concerns.

Educational Resources

HGNH International understands the importance of education in trading. The broker provides a range of educational resources, including webinars, video tutorials, market analysis, and written guides. These resources are designed to help traders improve their skills and make more informed trading decisions.

Brokers Comparison

| Aspect | HGNH International | FXCM | IC Markets |

| Regulatory Status | Securities and Futures Commission of Hong Kong (SFC) | Various international regulators (e.g., FCA, ASIC) | Various international regulators (e.g., ASIC, CySEC) |

| Years of Establishment | 2006 | 1999 (FXCM) | 2007 |

| Trading Instruments | Futures, Securities, Technology Services, Asset Management | Forex, CFDs, Commodities, Indices, Cryptocurrencies | Forex, CFDs, Commodities, Indices, Cryptocurrencies |

| Trading Platform | EPOLESTAR 9.3, E-PAUL Global Trading | FXCM Trading Station, MetaTrader 4, NinjaTrader | MetaTrader 4, MetaTrader 5, cTrader |

Conclusion

HGNH International is a reputable and regulated broker that offers a comprehensive range of financial products and services. With a strong commitment to customer support and competitive offerings, it caters to both novice and experienced traders. However, traders should be aware of potential high spreads in certain market conditions and consider whether the available leverage suits their risk tolerance. Overall, HGNH International presents a viable option for those looking to engage in futures and securities trading.

FAQs

Q: What regulatory authority oversees HGNH International?

A: HGNH International is regulated by the Securities and Futures Commission of Hong Kong (SFC) and operates under its approval in Hong Kong.

Q: Can I trade a variety of financial instruments with HGNH International?

A: Yes, HGNH International offers a diverse range of financial instruments, including futures, securities, technology services, asset management, trading business, clearing, and credit services.

Q: What deposit and withdrawal methods are available with HGNH International?

A: HGNH International supports deposit and withdrawal methods such as bank transfers, credit/debit cards, and e-wallets for the convenience of its clients.

Q: Does HGNH International offer educational resources for traders?

A: While specific details are not provided, HGNH International is likely to offer educational resources, including webinars, tutorials, and market analysis, to assist traders in making informed decisions.

Q: What is the customer support contact information for HGNH International?

A: You can reach HGNH International's customer support team via email at info@nanhua-usa.com or by phone at +86 4008888910-2 for assistance.

Q: Are there multiple account types available for traders with HGNH International?

A: HGNH International offers a variety of account types, including Standard, VIP, and Demo accounts, catering to different trading preferences.

Keywords

- 15-20 years

- Regulated in Hong Kong

- Dealing in futures contracts

- Common Financial Service License

- Suspicious Scope of Business

- Hong Kong Leveraged foreign exchange trading Revoked

- Suspicious Overrun

- Medium potential risk

Review 6

Content you want to comment

Please enter...

Review 6

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX3420080831

Hong Kong

Refuse to withdraw money and freeze my account, and I need to pay unfreeze money

Exposure

2021-01-30

无悔76728

Hong Kong

At first, you can take some part of yur money but after you prodit, you can't

Exposure

2021-01-17

美乐公司赫宏梅

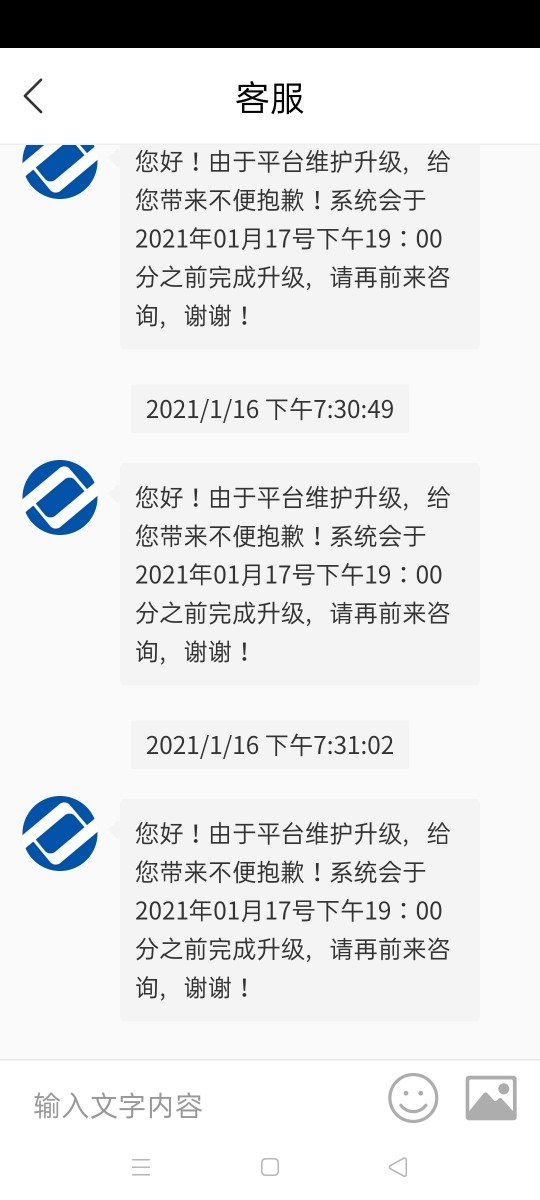

Hong Kong

The first few withdrawals can be taken out. But is the withdrawal is of large amounts, you can't withdraw it., The customer service asid the sustem is upgraded all along.

Exposure

2021-01-17

ONEDAY31658

Hong Kong

Have to pay margin for wrong bank card info. Pay checking fee for abnormal bank card. Pay 50% for risk control of CBRC. Pay unfreezing fee for protection mechanism. Pay money to improve credit score.

Exposure

2020-12-21

ONEDAY31658

Hong Kong

I've tried five times but I can't withdraw funds. Every time I was told my withdrawal was rejected. I didn't succeed in withdrawing funds, even once

Exposure

2020-12-20

lele_

Vietnam

…When I saw this company saying that it has been established for almost 20 years, I was still thinking that there must be no big problem if it can survive for so long. Then I saw the complaints of the victims on wikifx! It seems that the sharp eyes of the masses are always the most effective! Do not deal with this scammer!

Neutral

2022-12-14