Score

Price Markets

United Kingdom|5-10 years|

United Kingdom|5-10 years| https://pricemarkets.com/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

United States 2.52

United States 2.52Contact

Licenses

Licenses

Licensed Institution:Price Markets UK Ltd

License No.:725804

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomAccount Information

Users who viewed Price Markets also viewed..

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

Most visited countries/areas

Spain

pricemarkets.com

Server Location

United States

Most visited countries/areas

Spain

Website Domain Name

pricemarkets.com

Website

WHOIS.MONIKER.COM

Company

MONIKER ONLINE SERVICES LLC

Domain Effective Date

0001-01-01

Server IP

104.24.3.103

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

| Aspect | Information |

| Registered Country | United Kingdom |

| Company Name | Price Markets UK Ltd |

| Regulation | Revoked (Previously regulated by FCA) |

| Minimum Deposit | Standard Account: $5,000 |

| Maximum Leverage | Standard Account: Up to 30:1, FIX API: Up to 200:1 |

| Spreads | Standard Account: Starting from 0.3 pips, FIX API: Starting from 0.3 pips |

| Trading Platforms | MetaTrader 4, MT4 WebTrader, MT4 for Android and iOS |

| Tradable Assets | Forex, Indices, Commodities, CFDs, Cryptocurrencies, ETFs |

| Account Types | Standard Account, FIX API Account |

| Customer Support | Email and phone |

| Payment Methods | BankWire, Skrill, CardPay, Other Online Payment Systems |

| Educational Tools | Limited educational resources |

General Information

Price Markets is a UK-registered online forex and brokerage firm, established in 2013. Price Markets UK Ltd, once regulated by the FCA, now faces regulatory challenges. With a steep $5,000 minimum deposit requirement and an inaccessible website, it presents hurdles for traders. The broker offers limited educational resources, relying mainly on email and phone for customer support, which lacks a live chat option and 24/7 availability. In summary, Price Markets has regulatory and accessibility issues, limited educational support, and less diverse customer service, making it a challenging choice for traders.

Regulation

Unregulated. The current regulatory status of Price Markets UK Ltd, as indicated by the provided information, is “Revoked.” This means that their license to operate as a financial institution has been withdrawn or revoked by the regulatory authority, which in this case is the Financial Conduct Authority (FCA) in the United Kingdom. When a broker's license is revoked, it signifies that they are no longer authorized to provide financial services or engage in regulated financial activities in the jurisdiction covered by the regulatory authority.

Traders and potential clients should take this regulatory status seriously and exercise caution when dealing with a broker whose license has been revoked. It is advisable to thoroughly investigate the reasons behind the revocation and consider the potential risks associated with trading or conducting financial transactions with such a broker. Additionally, individuals should seek updated information from the relevant regulatory authority and consider alternative brokers with active and valid regulatory licenses to ensure the safety and security of their financial activities.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

Price Markets offers a diverse range of trading instruments across various financial markets, making it suitable for traders with different strategies. They provide tiered account types catering to various trader profiles and offer competitive spreads and commissions, enhancing the trading experience. The availability of multiple deposit and withdrawal options adds to the convenience. The user-friendly MetaTrader 4 platform further facilitates efficient trading. However, it's crucial to note the revoked regulatory status, which raises concerns about the broker's reliability. Additionally, the limited educational resources and customer support options may not fully meet the needs of all traders. Therefore, traders should exercise caution and consider their preferences and risk tolerance when choosing Price Markets as their broker.

Market Instruments

Price Markets offers a diverse range of trading instruments across various financial markets, catering to traders with different strategies and preferences. Here's a breakdown of the market instruments the broker provides:

Foreign Exchange (Forex): Forex is the most liquid market globally, with over $5 trillion traded daily. Traders can buy or sell different currency pairs at current or predetermined prices. Major, minor, and exotic currency pairs are available for trading.

Indices: Index trading involves groups of global stocks, such as NASDAQ, FTSE, and DAX. These indices represent the value of specific stock market sections. Trading indices allow diversification across multiple stocks.

Commodities: Commodity markets include products like oil, gas, metals, and agricultural goods. Commodity trading often involves futures contracts and can be a safe haven during economic uncertainty.

CFD Trading (Contract for Difference): CFDs offer speculation on price movements in various financial markets, including currencies, shares, commodities, and indices. Traders can profit from both rising and falling markets without owning the underlying assets.

Cryptocurrencies:Cryptocurrencies involve trading digital tokens like Bitcoin and Ethereum. Price Markets allow speculation on cryptocurrency price movements via CFDs.

Exchange-Traded Funds (ETFs): ETFs are investment funds traded on stock markets. They hold various assets such as bonds, commodities, and stocks, providing diversification options.

Price Markets Account Types

There are two types of trading accounts set up on the Price Markets platform, the standard account and the FIX API account. The minimum initial deposit for a Standard account is $5,000, while the minimum initial deposit for a FIX API account is $50,000. Objectively speaking, the minimum initial deposit set by Price Markets seems too high, and investors should be aware of the risks.

Price Markets offers a tiered approach to trading accounts, providing traders with options that suit their experience level and trading preferences. These accounts are designed to offer different features and benefits to cater to a wide range of traders. Here's a detailed description of the account types:

Standard Account: The Standard Account is suitable for retail customers looking to start their trading journey. It requires a minimum deposit of $5,000, making it accessible to traders with a moderate initial capital. Currencies available for account denomination include GBP, USD, EUR, CHF, and JPY. Traders can access a variety of trading instruments, including forex, commodities, and indices. The account offers access to the popular MetaTrader 4 platform, available on web and mobile devices. Additional benefits include negative account balance protection, up to £50,000 FSCS protection, low-latency NY4 ECN execution, and competitive commissions.

FIX API Account: The FIX API Account is designed for elective professional traders with a higher level of trading experience. It requires a minimum deposit of $50,000, making it suitable for traders with a substantial capital base. Similar to the Standard Account, it supports account denominations in GBP, USD, EUR, CHF, and JPY. Traders have access to a wide range of trading instruments, including forex, commodities, and indices. The FIX API Account provides flexibility by offering access to FIX, MetaTrader 4, and web or mobile platforms. It boasts low-latency NY4 or LD4 ECN execution and competitive commissions, starting as low as $8 per million USD traded.

Price Markets offers Percentage Allocation Management Module (PAMM) and Multi-Account Manager (MAM) accounts, ideal for licensed professional traders looking to manage multiple client accounts efficiently. These options provide flexibility and support for various strategies.

Here's a summary table of the Price Markets trading account types:

| Account Type | Minimum Deposit | Account Denominations | Trading Instruments | Platform Options | Key Features |

| Standard Account | $5,000 | GBP, USD, EUR, CHF, JPY | Forex, Commodities, Indices | MetaTrader 4 (Web/Mobile) | Negative balance protection, FSCS protection, low-latency execution, competitive commissions |

| FIX API Account | $50,000 | GBP, USD, EUR, CHF, JPY | Forex, Commodities, Indices | FIX, MetaTrader 4 (Web/Mobile) | Low-latency execution, access to multiple liquidity providers, competitive commissions |

Price Markets' tiered account structure allows traders to select the account type that aligns with their trading goals, experience level, and capital resources. Whether you're a retail trader or an experienced professional, Price Markets provides options tailored to your needs.

Price Markets Leverage

The Minimum trading leverage can reach 30 times for Forex, Commodities, and Indices for Standard accounts and 200 times for FIX API accounts.

Spreads & Commissions

Price Markets offers spreads of 0.3 pips on EURUSD, 1.5 pips on EURGBP, with the commission of $3.5 per side, 5 pips on AUS200 with the commission of 25 basis points per lot per side, 0.04 pips on USOil, and 5 pips on UKOil (both $3.5 per lot ). Gold & Silver, both come with a commission of $3.5 per lot per side.

Trading Platforms

Price Markets offers four trading platform options for investors, namely the popular MT4 trading platform, WEB trading platform, API trading platform, iOS & Android trading platform.

Deposit & Withdrawal

Deposit Options:

Price Markets offers several deposit methods for traders to fund their accounts. These methods include:

BankWire: Traders can make deposits via bank wire transfers. This method allows for secure and direct transfers from the trader's bank account to their trading account. BankWire deposits are a reliable option for larger sums of money.

Skrill: Skrill is an online payment system that allows traders to fund their accounts quickly and securely. Skrill is known for its convenience and accessibility, making it a popular choice for online transactions.

CardPay: CardPay offers the ability to deposit funds using credit or debit cards, including Visa, Maestro, and Mastercard. This option is convenient for traders who prefer using their cards for transactions.

Other Online Payment Systems: Price Markets also supports various other online payment systems, including iDeal, EPay, Przelewy24, Rapid Transfer, Nordea Solo, Klarna (formerly Sofort), POLi, Giropay, and Allied Irish Bank.

Each deposit method may have its own associated fees and processing times, so traders should review the specific details for the method they intend to use.

Withdrawal Options:

Price Markets provides options for traders to withdraw funds from their trading accounts. The withdrawal methods include:

BankWire: Similar to deposits, traders can choose to withdraw funds via bank wire transfers. BankWire withdrawals offer a secure way to transfer funds from the trading account to the trader's bank account.

Skrill: Skrill can also be used for withdrawals, providing a convenient way for traders to access their funds.

CardPay: CardPay allows for withdrawals, offering flexibility for traders who initially used their cards for deposits.

It's important to note that withdrawal fees and processing times may vary depending on the chosen withdrawal method. Additionally, Price Markets typically does not allow third-party bank deposits or withdrawals to enhance security and prevent unauthorized transactions.

Customer Support

Price Markets head office is located in the City of London, United Kingdom. Clients get 24/5 support and can reach the support team via live chat, telephone or email. You can connect with them through Google, Facebook, Twitter and LinkedIn. There is also a contact form on the website if you would like to send them a message that way.

Accepetd Regions

Price Markets can accept clients from all over the globe apart from the USA and some other countries where there are restrictions in place that prevent them from doing so.

Customer Support

Price Markets offers customer support primarily through email and phone. However, it's important to note that the availability of customer support in a negative tone is limited when compared to some other brokers in the industry. Here's a description of Price Markets' customer support in a critical tone:

Price Markets primarily relies on email and phone for customer support, which may not meet the expectations of traders who prefer more diverse and immediate communication channels. While they do offer a phone number, the lack of a live chat option or a dedicated customer support portal could be seen as a drawback for traders seeking quick assistance or access to a comprehensive knowledge base. Additionally, the absence of 24/7 customer support might inconvenience traders in different time zones who require assistance outside standard business hours. Overall, Price Markets' customer support options may not fully align with the preferences and needs of all traders.

Educational Resources

Price Markets offers a limited selection of educational resources to assist traders in their trading endeavors. These resources include user manuals, guides, tutorials, and FAQs, which cover essential trading concepts and platform navigation. However, it's important to note that the depth and variety of educational materials may not be as extensive as those offered by some other brokers. Traders seeking comprehensive educational content, such as webinars or video tutorials, may find Price Markets' offerings somewhat limited. While these resources provide a starting point for traders looking to enhance their knowledge, there is room for expansion to better cater to traders with diverse learning preferences and experience levels.

Summary

Price Markets offers a diverse range of trading instruments, including Forex, Indices, Commodities, CFDs, Cryptocurrencies, and ETFs. They have tiered accounts like Standard and FIX API for various traders. Leverage ranges from 30:1 to 200:1, depending on the account and instrument. Spreads start at 0.3 pips, with commissions varying by account and asset.

Deposits are possible through bank wire, Skrill, and CardPay, with withdrawals using bank wire and Skrill. They offer MetaTrader 4 for trading.

However, their customer support mainly relies on email and phone, lacking live chat and 24/7 service. Educational resources are limited, including manuals, guides, tutorials, and FAQs. Price Markets caters to traders but may not fully meet the needs of those seeking extensive educational content and diverse support options.

FAQs

Q1: What trading instruments are available at Price Markets?

A1: Price Markets offers a wide range of instruments, including Forex, Indices, Commodities, CFDs, Cryptocurrencies, and ETFs.

Q2: What is the minimum deposit required for a Standard Account?

A2: The Standard Account requires a minimum deposit of $5,000.

Q3: How much leverage is offered for the FIX API Account?

A3: The FIX API Account provides leverage of up to 200:1 for eligible professional traders.

Q4: What deposit methods can I use at Price Markets?

A4: You can deposit funds via bank wire, Skrill, CardPay, and various other online payment systems.

Q5: What trading platform does Price Markets offer?

A5: Price Markets offers the popular MetaTrader 4 (MT4) platform, along with MT4 WebTrader for web-based trading and mobile apps for Android and iOS.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- United Kingdom Straight Through Processing(STP) Revoked

- High potential risk

Review 12

Content you want to comment

Please enter...

Review 12

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

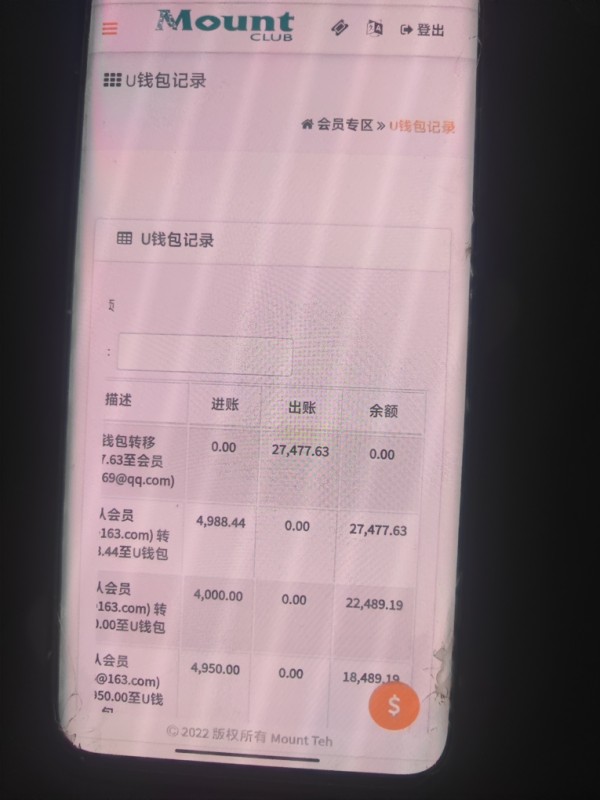

Final(终情)

Hong Kong

What can I do? There are more than 20 grand. Anyone has the same problem. Please leave a message so we can discuss.

Exposure

2023-05-13

杨芳885

Hong Kong

The company forcily transfer to nft and unable to withdraw money. The company has been cancelled, seek help

Exposure

2022-10-09

FX2990909955

Hong Kong

Today, I found out that the company has been cancelled on March 31, 2022. The funds cannot be withdrawn, and the principal is stuck. I cannot withdraw funds. I need help. What should I do?

Exposure

2022-07-04

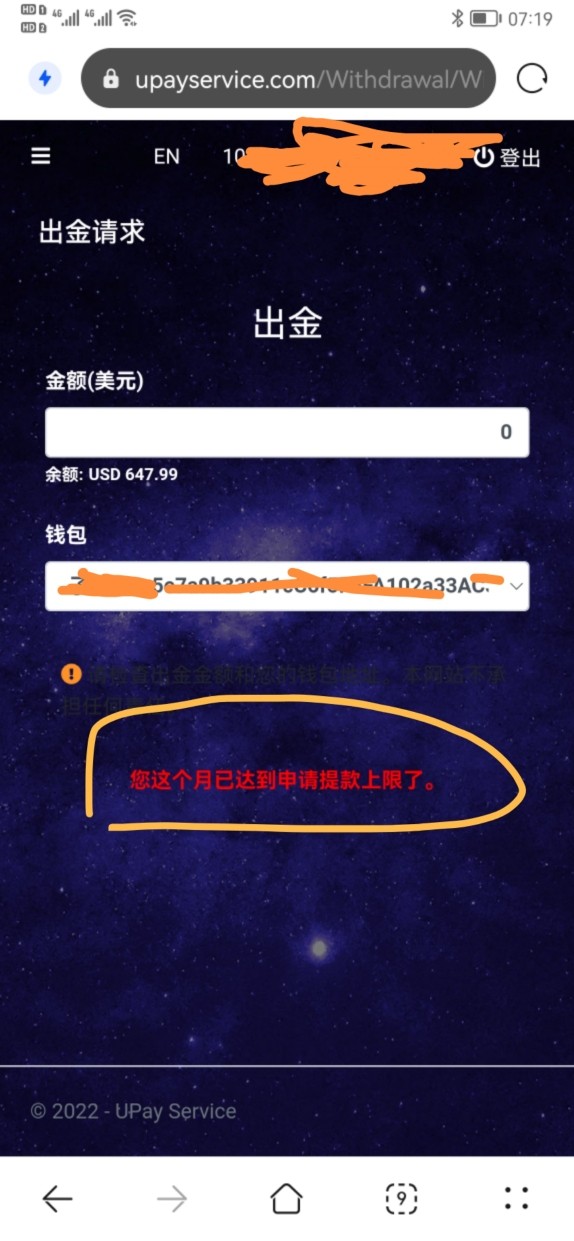

FX3698076374

Hong Kong

Do not allow to withdraw. Withdrawal is limited. It will crushed soon. All teams are left. Leave now.

Exposure

2022-04-28

FX1390876652

Hong Kong

I can not withdraw for a large sum of money. So, you should be careful to avoid being cheated.

Exposure

2021-10-01

FX2046354843

Philippines

Please pay attention to this romantic liar named Frank Jack (Jakki) whatsapp# (315) 362-1085 Email frank1765@gmail.com or jackk8292@gmail.com. Frank is a talkative person and always asks for money to make an investment that is said to double your investment within a week. He will tell you that the foreign exchange broker is registered, but he is not. An unregulated foreign exchange broker named Price Markets, he uses the email address jacobkk231@yahoo.com. There is no phone number or company website. Only communicate with Mr. Kimmuch via email. Frank said that investment is very low-key and does not want to advertise. If you know this man who claims to be from New York City, please do not believe his stories, false promises and lies. The latest investment he is promoting provides a higher return than the original investment. Great, this may be true. Said his birthday was April 18, 1971, and when I received my driving license, it said June 3, 1972. Another lie.

Exposure

2021-09-13

FX7359315392

Bangladesh

Besides, price market UK send out daily statement from Oct 1. Price market has responsibility to ensure trade details in statement is correct. Black and white. Oct 1 my first position is opened, but Oct 12 inform me the rate is incorrect ! Without prior notification and any warning are given. Price market suddenly require charge back swap charge in previous holding date. It is totally ridiculous and unfair for customers. All my profit of $44k is taken away from price increment.

Exposure

2021-09-13

弯弯乔

Hong Kong

Price Markets claimed that TR forex is their partner. Actually, it induced clients to open accounts in fraud TR.

Exposure

2020-05-08

光辉岁月14396

Hong Kong

This company’s regulatory information couldn’t be found in FCA.

Exposure

2020-03-06

小张张

Hong Kong

Why I couldn’t enter the this company’s website? The investigator explained that the company hasn’t domain. So does it own regulation license?

Exposure

2020-02-18

FX1141094681

United States

Price Markets has a reliable regulatory license, but it is also a liar. I am very afraid. Is there any reliable broker in the forex industry?

Neutral

2022-12-12

Asher Li

Singapore

Not sure when I first started trading with this broker—maybe 2 or 3 years ago...I can't remember the exact time. But I did remember that this broker's spreads were very low and that its MT4 never had problems, which is why I traded with it for so long.

Positive

08-07