Score

TradeFills

Saint Vincent and the Grenadines|2-5 years|

Saint Vincent and the Grenadines|2-5 years| https://tradefills.com

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Saint Vincent and the Grenadines

Saint Vincent and the GrenadinesAccount Information

Users who viewed TradeFills also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

tradefills.com

Website Domain Name

tradefills.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

2009-05-28

Server IP

104.21.50.188

Company Summary

| TradeFills | Basic Information |

| Founded in | 2022 |

| Headquarters | Saint Vincent and the Grenadines |

| Regulation | Not regulated |

| Tradable Assets | Forex, CFDs, Indices, Commodities |

| Minimum Deposit | $5 |

| Maximum Leverage | Up to 1:1000 |

| Trading Platforms | MetaTrader 4 |

| Mobile Trading | Yes |

| Account Types | Micro, Standard, Professional, and ECN |

| Demo Account | Yes |

| Islamic Account | Yes |

| Deposit Methods | Visa, MasterCard, Awepay, B2BinPay, Help2Pay, Payment Asia, PayTrust88, PerfectMoney |

| Customer Support | Phone and Email support |

| Education and Resources | Glossary, Trading Tools |

| Bonuses and Promotions | N/A |

| Languages | English |

| Company Address | Suite 305, Griffith Corporate Centre, P.O. Box 1510, Beachmont Kingstown,, Saint Vincent And Grenadines |

*Note: The information in this table is based on the available data at the time of writing and may be subject to change.

Overview of TradeFills

TradeFills is a forex broker that is registered in Saint Vincent and the Grenadines.The broker was established in 2022, and offers a range of trading instruments such as forex currency pairs, metals, indices, and cryptocurrencies. TradeFills provides clients with a choice of account types, including a Standard account and an ECN account. Both account types require a minimum deposit of $5 and offer high leverage up to 1:1000.

The broker also provides clients with the popular MetaTrader 4 (MT4) trading platform, which is available for download on desktop and mobile devices. Deposits and withdrawals on TradeFills can be made using a variety of payment methods, including wire transfers, credit/debit cards, and e-wallets. The broker also offers customer support services via phone, email, and live chat, as well as educational resources such as webinars and tutorials.

Is TradeFills legit or a scam?

TradeFills is a relatively new broker, having been established in 2022, and there is limited information available about its reputation and regulatory status. As per the information available on its website, TradeFills claims to be registered in Saint Vincent and the Grenadines, and it is not clear whether it is regulated by any financial authority. Therefore, it is recommended to check for any red flags, such as unreasonably high promised returns or lack of transparency, and to only invest what you can afford to lose.

Pros and Cons of TradeFills

TradeFills has a low minimum deposit requirement, high leverage offered, and the availability of various trading instruments including forex, stocks, commodities, and cryptocurrencies. The broker also offers a user-friendly trading platform and multiple account types to cater to different trading needs.

However, TradeFills also has some potential drawbacks. One of the main concerns is the lack of regulation from reputable financial authorities. This may raise questions about the broker's credibility and trustworthiness. Additionally, the broker's spreads and commissions may be higher than some of its competitors, which could impact profitability for traders.

| Pros | Cons |

| Multiple trading instruments to choose from | Low minimum deposit requirements |

| Low minimum deposit requirements | Limited educational resources |

| Generous leverage up to 1:1000 | Limited trading instruments compared to competitors |

| MetaTrader 4 trading platform supported | No support for MT5 trading platform |

| Multiple payment methods | High spreads and commissions |

| Demo Accounts available | |

| Swap-free account available |

Market Intruments

TradeFills offers a wide range of tradable instruments for its clients. These include forex currency pairs, commodities, indices, stocks, and cryptocurrencies. The selection of forex pairs includes major, minor, and exotic currency pairs. Additionally, clients can trade CFDs on precious metals such as gold and silver, as well as energy commodities like oil and gas. A variety of popular global indices, such as the S&P 500 and the Nikkei 225, are also available for trading. Moreover, TradeFills offers CFD trading on some of the most well-known cryptocurrencies like Bitcoin, Ethereum, Litecoin, and Ripple.

| Pros | Cons |

| forex currency pairs, commodities, indices, stocks, and cryptocurrencies available | Limited selection of other asset classes such as commodities, indices, and cryptocurrencies |

| Limited availability of some exotic forex pairs | |

| No options or futures trading |

Account Types

There are four different account types to choose from, including Micro, Standard, Professional, and ECN accounts. Each account type has its own unique features, benefits, and trading conditions. Traders can choose the account type that suits their trading style, experience, and budget. One of the significant advantages of TradeFills is that all account types have a low minimum deposit requirement of only $5. This makes it easy and affordable for traders to start trading with TradeFills, even if they are new to trading or have limited funds.

Margin call: 50%, Stop Out: 25%. Besides, Swap-free options are applicable with all four trading accounts.

Aside from four types of live trading accounts, this broker also provides demo accounts. The demo account provides traders with virtual funds to trade with, allowing them to experience real-time market conditions without risking any actual capital. It is an excellent way for beginner traders to get started in the world of forex trading without the fear of losing money.

How to open an account?

Opening an account with TradeFills is simple and easy, with a few straightforward steps to follow:

1. Click on the “Open A Live account” Link and fill in the application form.

2. Upload your photo ID and Proof of Address document from inside your client portal which will be verified by this trading accounts.

3. After verification, your account is successfully registered. Fund your account and then start trading.

Leverage

TradeFills offers leverage up to 1:1000 for all four trading accounts - Micro, Standard, Professional, and ECN. This means that traders can open positions with a much larger value than their account balance, potentially increasing their profits. However, traders should also be aware of the risks of using high leverage, as it can also increase potential losses. It's important for traders to carefully consider their risk management strategies and use leverage responsibly.

Spreads & Commissions (Trading Fees)

One of the most important considerations when choosing a forex broker is the cost of trading, which includes spreads and commissions. For traders who prefer a zero-commission trading environment, the Micro, Standard, and Professional accounts are ideal. These accounts offer fixed and variable spreads that start as low as 1.4 pips, 1.4 pips, and 0.8 pips respectively.

For traders who are looking for even tighter spreads, the ECN account is the perfect choice. This account type offers spreads as low as 0.0 pips, and traders are charged a commission of $4 per lot. While the commission may seem like an added cost, tight spreads can more than make up for it, especially for traders who execute high-volume trades.

Non-Trading Fees

TradeFills does not charge any deposit or withdrawal fees, but there may be some non-trading fees that clients should be aware of. For example, the broker charges an inactivity fee of $10 per month for accounts that have been inactive for more than 90 days. Additionally, TradeFills may charge a fee for currency conversion, which is 3% of the transaction amount.

Trading Platform

TradeFills does not charge any deposit or withdrawal fees, but there may be some non-trading fees that clients should be aware of. For example, the broker charges an inactivity fee of $10 per month for accounts that have been inactive for more than 90 days. Additionally, TradeFills may charge a fee for currency conversion, which is 3% of the transaction amount. It is important for traders to carefully review the non-trading fees of any broker they are considering, as these can add up over time and affect overall profitability.

Deposit & Withdrawal

TradeFills offers several convenient deposit and withdrawal methods for its clients. These methods include bank wire transfer, credit/debit cards, and popular e-wallets such as Skrill and Neteller. The minimum deposit amount for all account types is $5, making it accessible to traders of all levels.

Deposits are typically processed within 24 hours, and the funds are immediately available in the trading account. Withdrawals are also processed quickly, usually within 24 hours, but may take up to 5 business days to reflect on the account depending on the payment method used.

Customer Support

TradeFills offers customer support via multiple channels, including live chat, email, and phone. The customer support team is available 24/7 to assist traders with any issues or queries they may have. The website also includes an extensive FAQ section that covers a wide range of topics, including account opening, deposits and withdrawals, and trading platforms. The customer support team is multilingual, which allows traders from different parts of the world to communicate easily with the support team.

Telephone: +44 7888 872335

Email: support@tradefills.com

Educational Resources

Tradefills seems to understand the importance of educating its clients on the intricacies of forex trading. They offer some educational resources and trading tools to help traders at all levels improve their trading skills and knowledge. These resources include daily technical analysis reports, which provide valuable insights into market trends and trading opportunities, an economic calendar that keeps clients up to date on important economic events that may impact currency prices, and live trading webinars that allow clients to learn from experienced traders in real time.

Conclusion

TradeFills appears to be a relatively new forex broker that offers a range of trading accounts with low minimum deposits and high leverage options. The broker offers a variety of tradable assets, including forex, commodities, and cryptocurrencies, and provides its clients with a range of educational resources and trading tools. However, it is important to note that the broker is not regulated by any major regulatory authorities and operates from a jurisdiction that may not have stringent oversight of financial institutions. Additionally, the broker charges fees for some non-trading activities and offers limited educational resources compared to some other brokers.

FAQs

Q: Is TradeFills a regulated broker?

A: No, TradeFills is not currently regulated by any major financial regulatory authority.

Q: What trading platforms are available at TradeFills?

A: TradeFills offers the popular MetaTrader 4 (MT4) trading platform for desktop, web, and mobile devices.

Q: What is the minimum deposit to open a trading account with TradeFills?

A: The minimum deposit to open a trading account with TradeFills is $5 for all four account types.

Q: Does TradeFills offer a demo account?

A: Yes, TradeFills offers a demo account for traders to practice their trading strategies with virtual funds.

Q: What is the maximum leverage offered by TradeFills?

A: The maximum leverage offered by TradeFills is 1:1000 for all four account types.

Q: What kind of educational resources are available at TradeFills?

A: TradeFills offers a variety of educational resources including Daily Technical Analysis Reports, Economic Calendar, Live Trading Webinars, and Offline Seminars.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

News

News "This broker stolen money by attractive offers "- User complaint against Tradefills

Three days Ago On 27 March,2023. User of Broker called Tradefills from India got scammed by this Broker. He registered a complaint on our Website Wikifx against Tradefills.

2023-03-31 15:04

Exposure Tradefills Does Not Fulfil!

In today's article, WikiFX will take you on an in-depth review of TradeFills as we have received several Exposure cases from our users.

2023-03-21 17:52

Review 11

Content you want to comment

Please enter...

Review 11

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

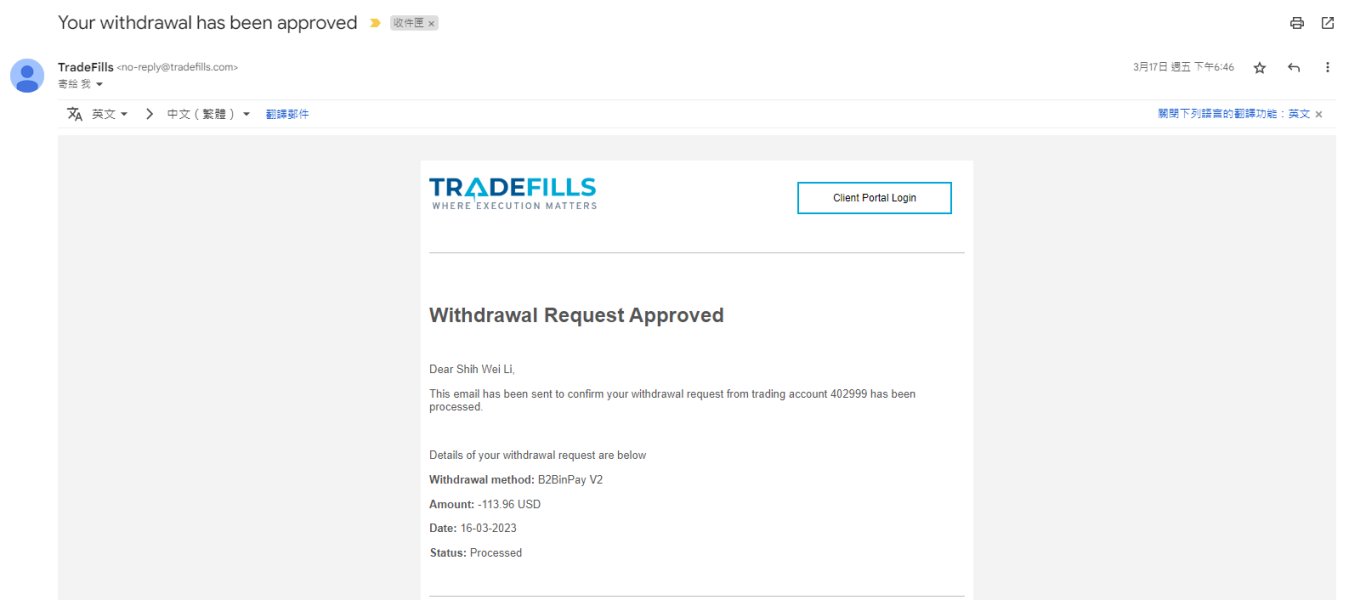

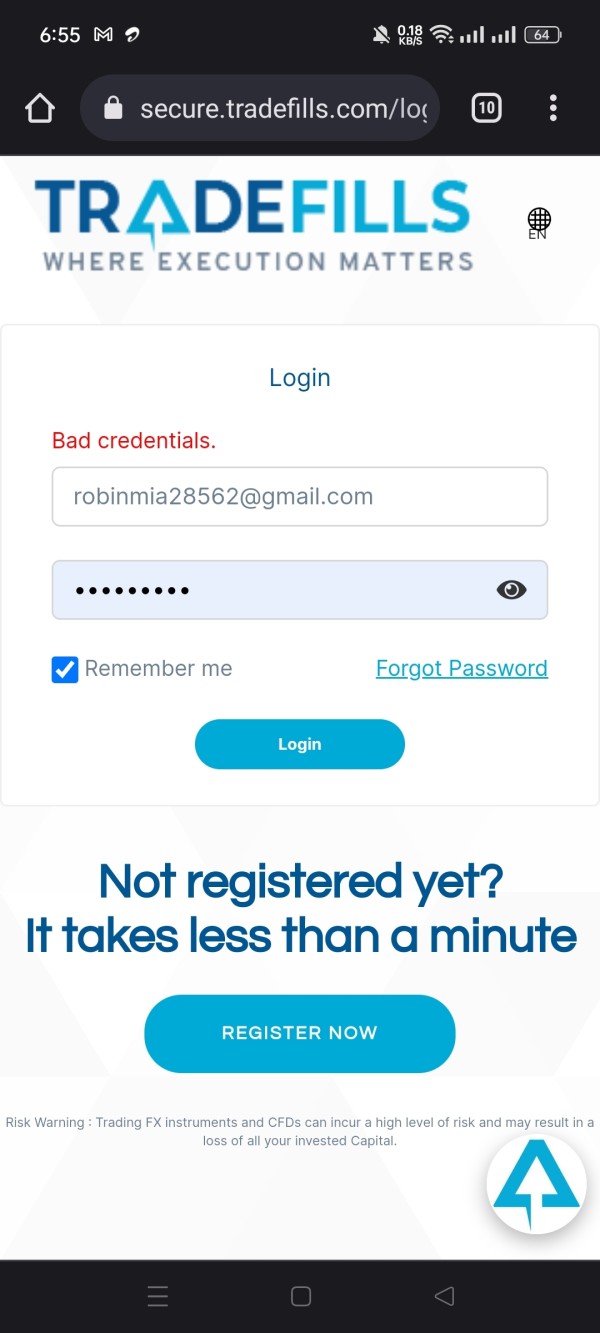

小偉

Taiwan

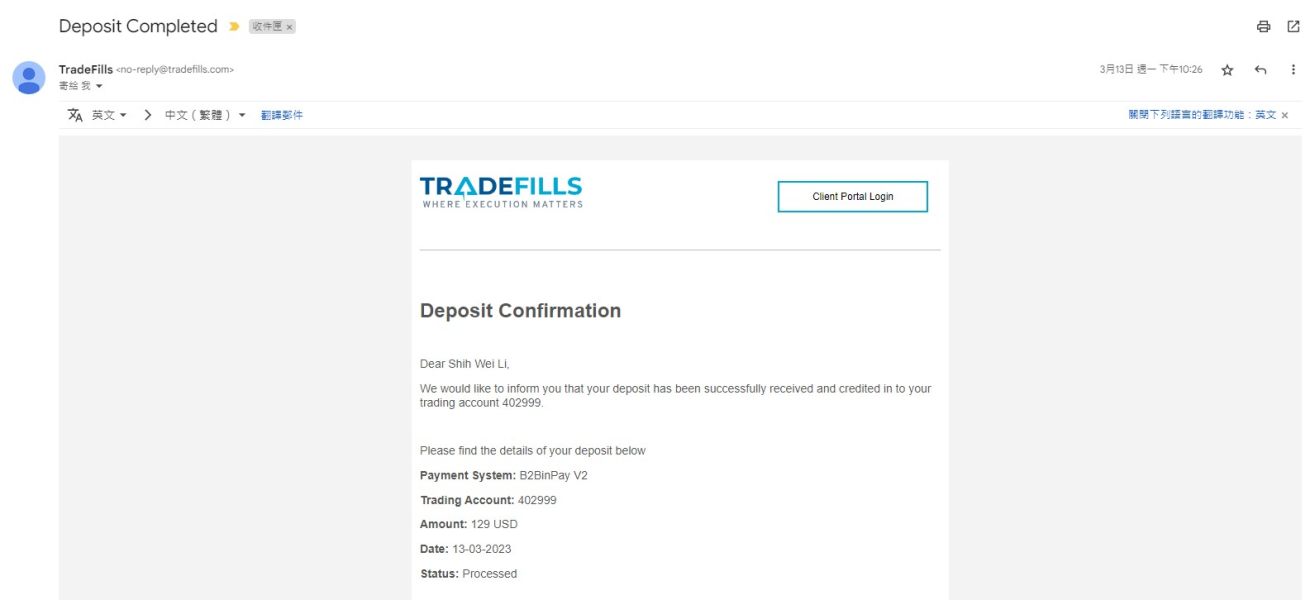

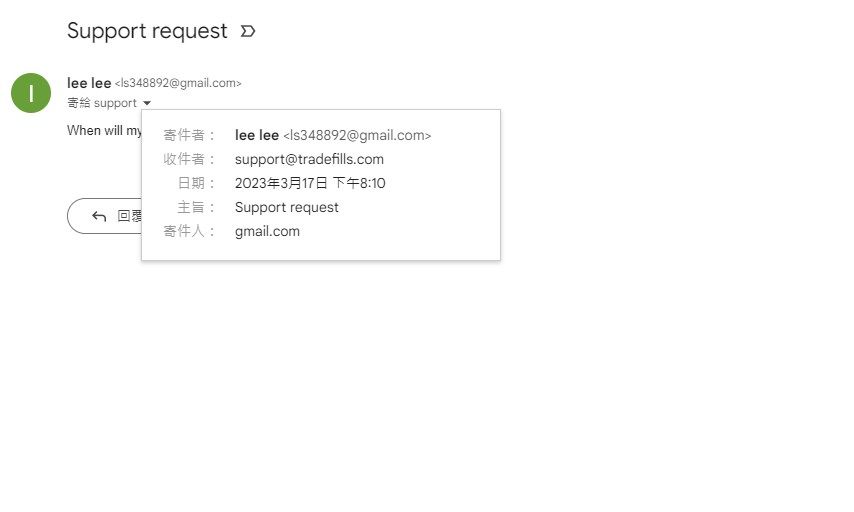

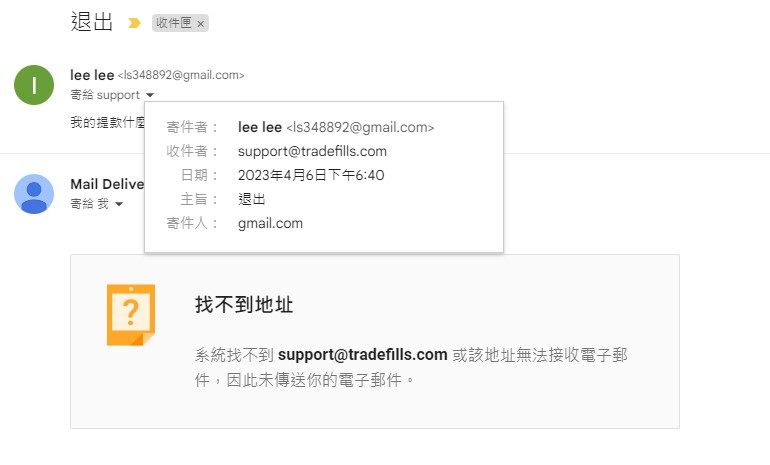

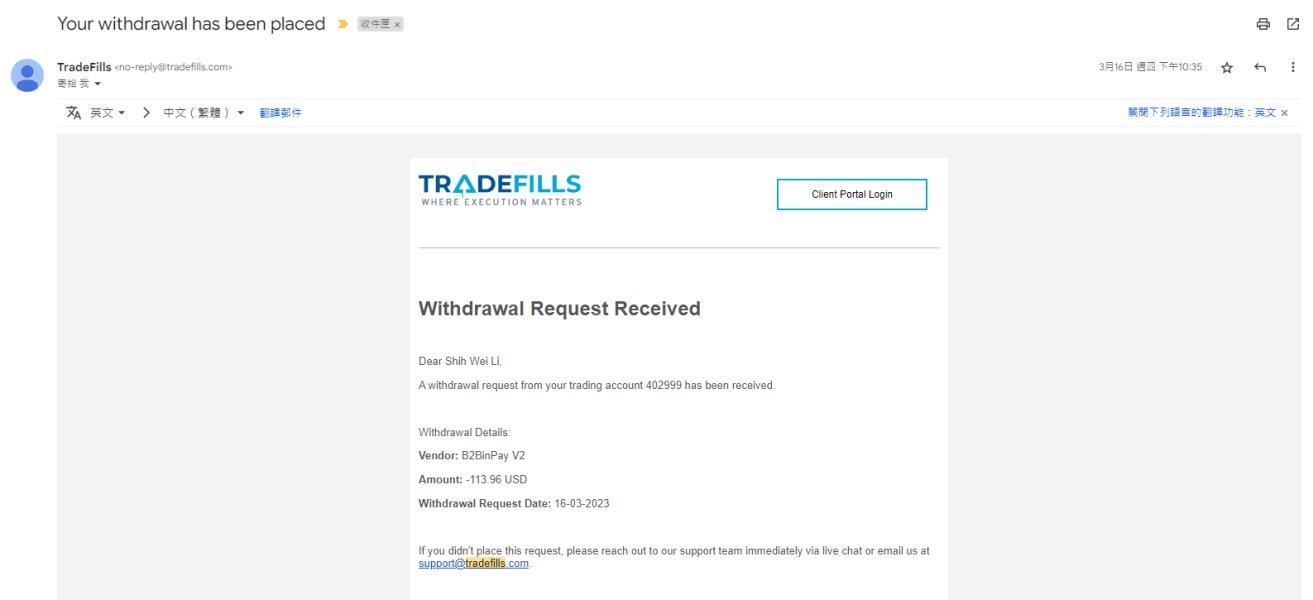

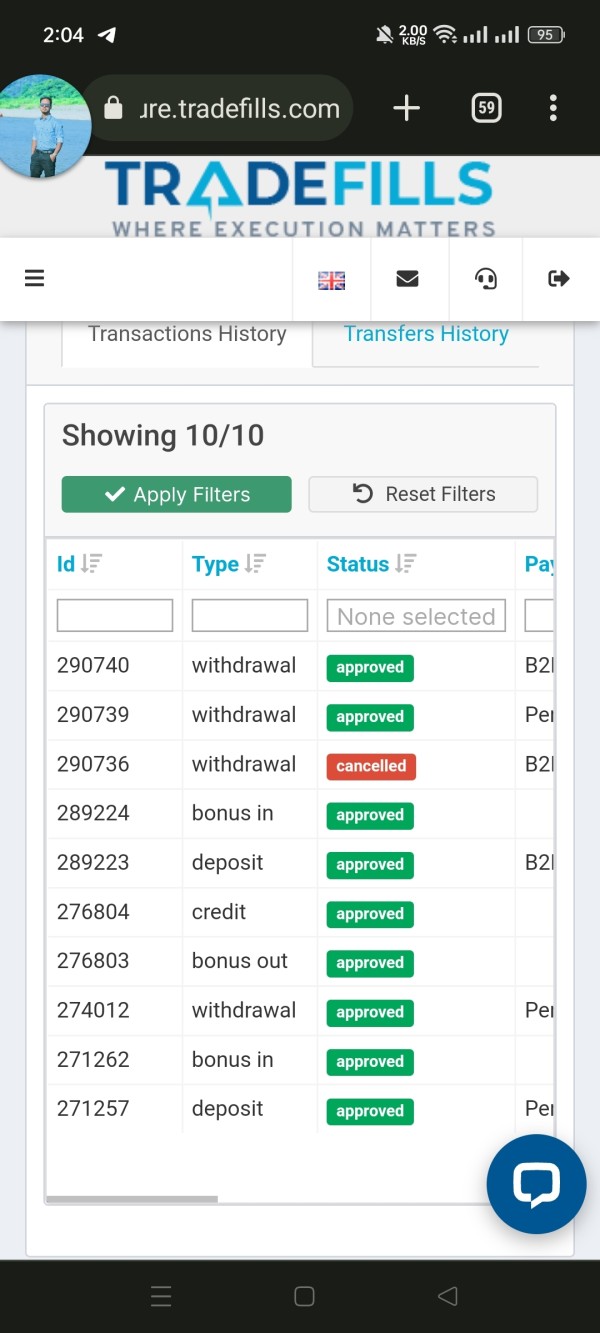

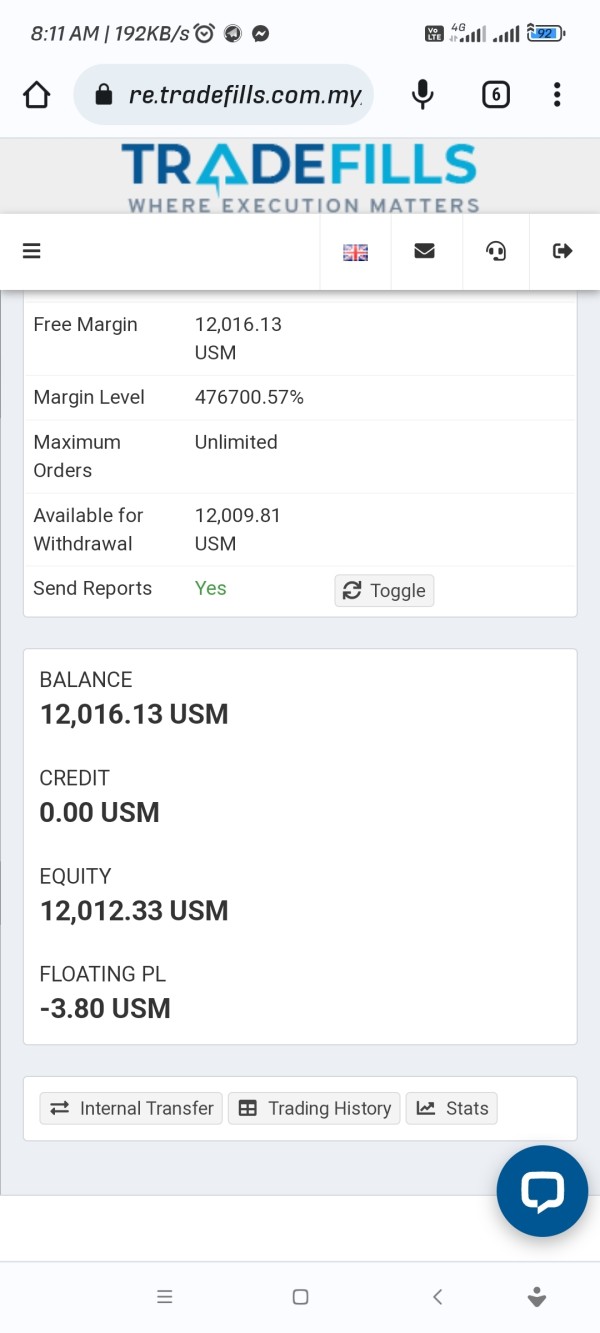

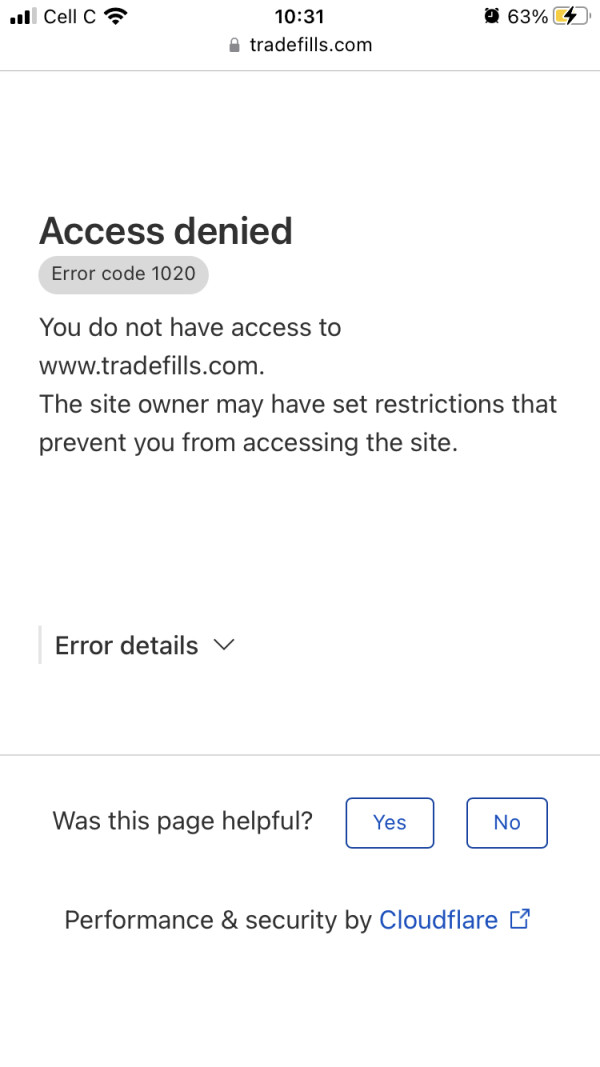

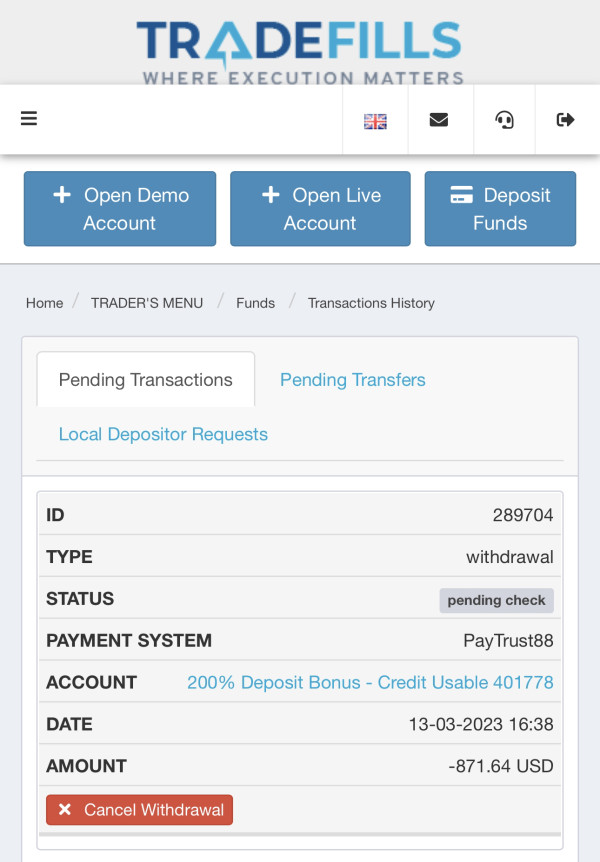

I registered a trading account on the Tradefills platform on 2023/03/13 and deposited 129 USD through USDT-TRC20 (as shown in the picture), and then applied for a withdrawal of 113.96 USD through USDT-TRC20 on 2023/03/16 (as shown in the picture). 2023/03/17 My withdrawal application was approved, but I did not receive the money. I did not get any reply after I wrote to the customer service (as shown in the attached picture). On 2023/03/24, the platform closed my client background and could not log in ,2023/04/06TradeFills official website https://www.tradefills.com/ is no longer accessible and the customer service mailbox support@tradefills.com is also unable to receive letters

Exposure

2023-04-07

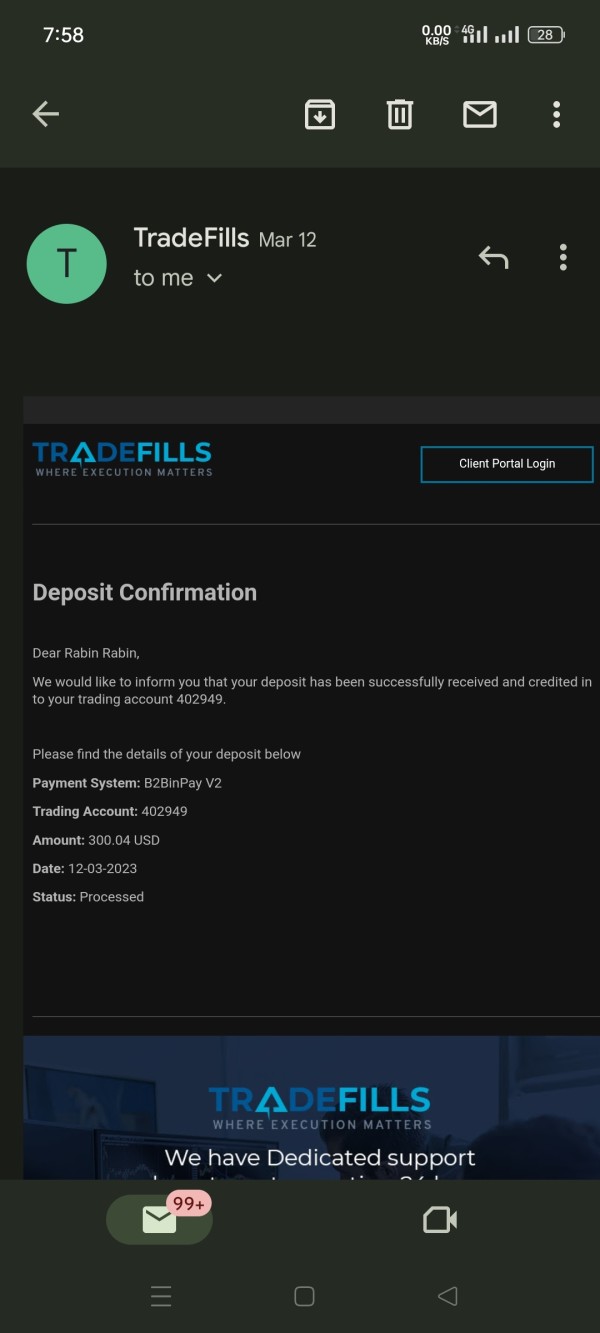

FX3330752799

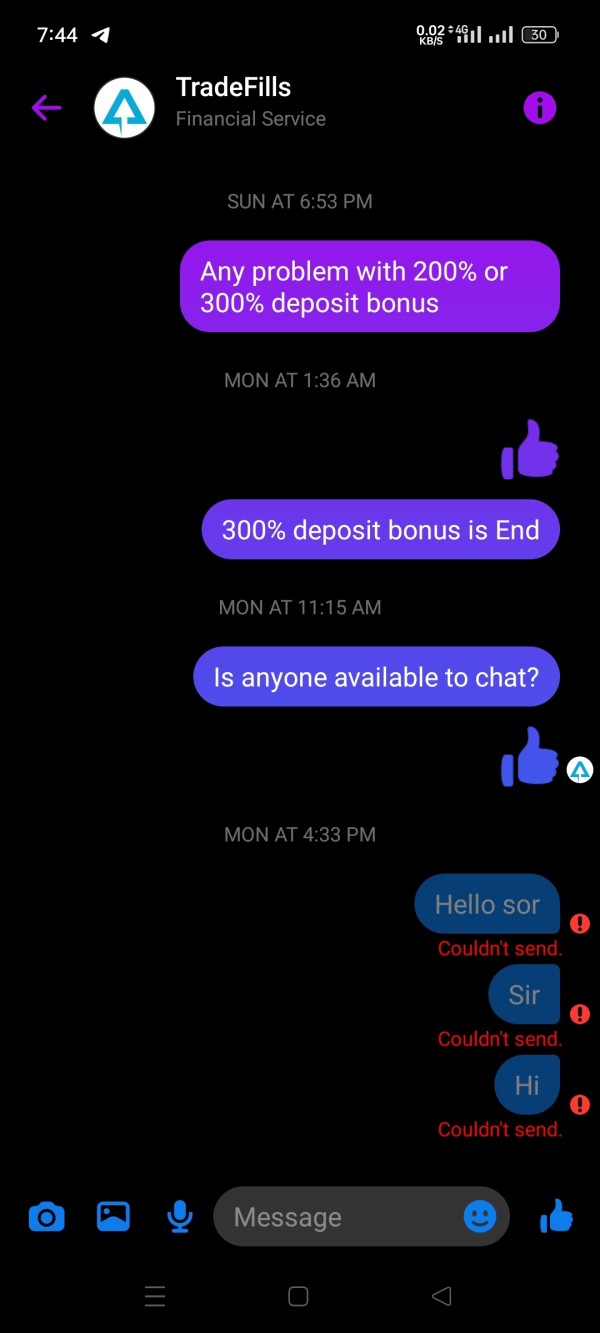

Bangladesh

Their promotion offer I deposit 300$ and give 489$ usd withdrawal request with profit but they blocked my account without processing my withdrawal request, they blocked me from Facebook, they have no contact with them. They have blocked all communication with them. They should be punished

Exposure

2023-03-27

Singa

Malaysia

Very bad company,run with money even usd100

Exposure

2023-03-26

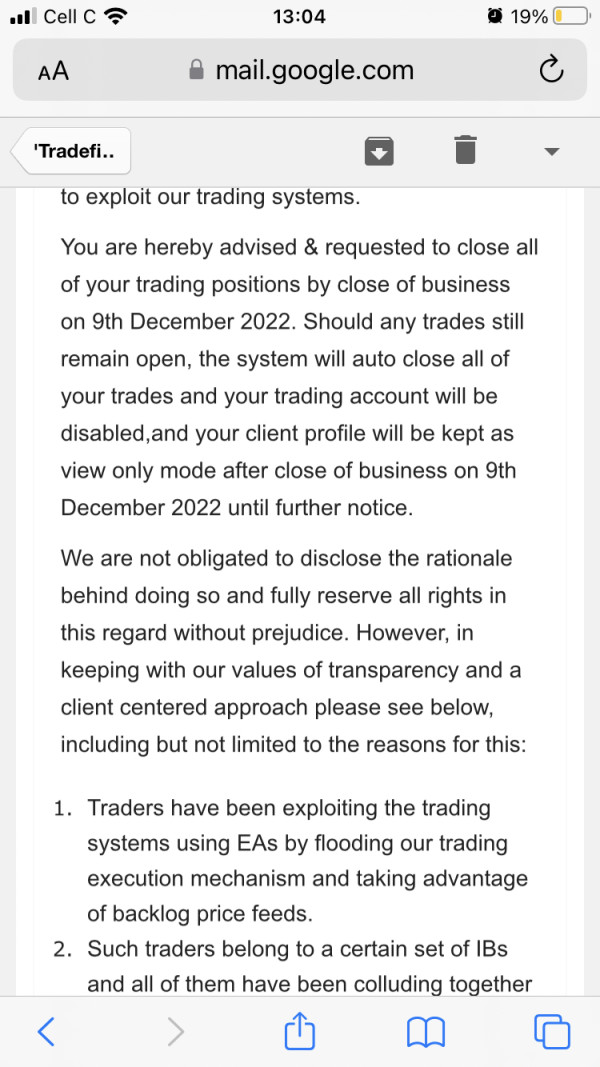

Blacc Cream

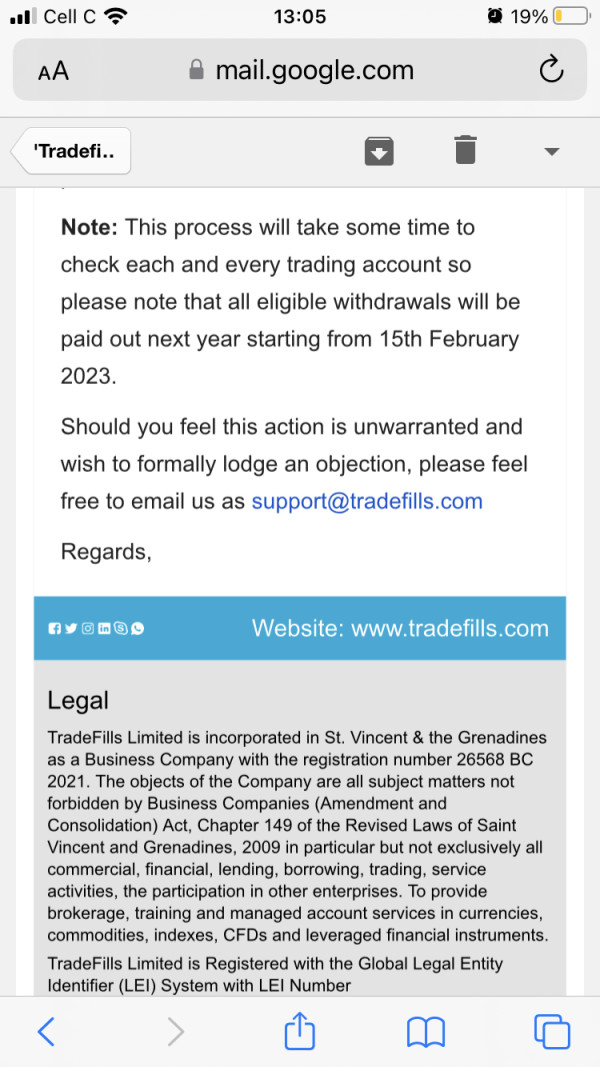

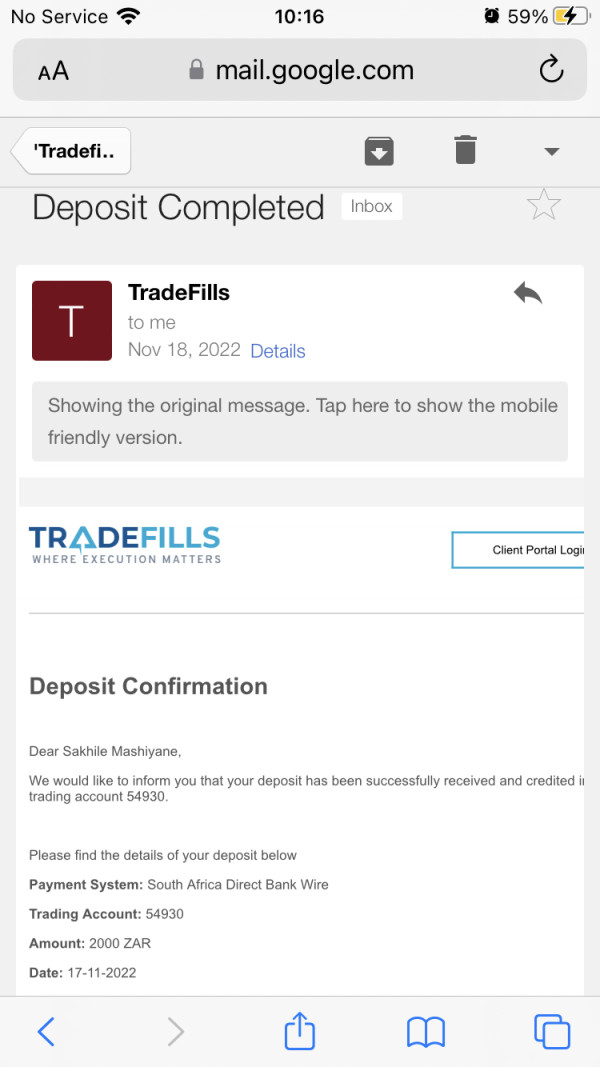

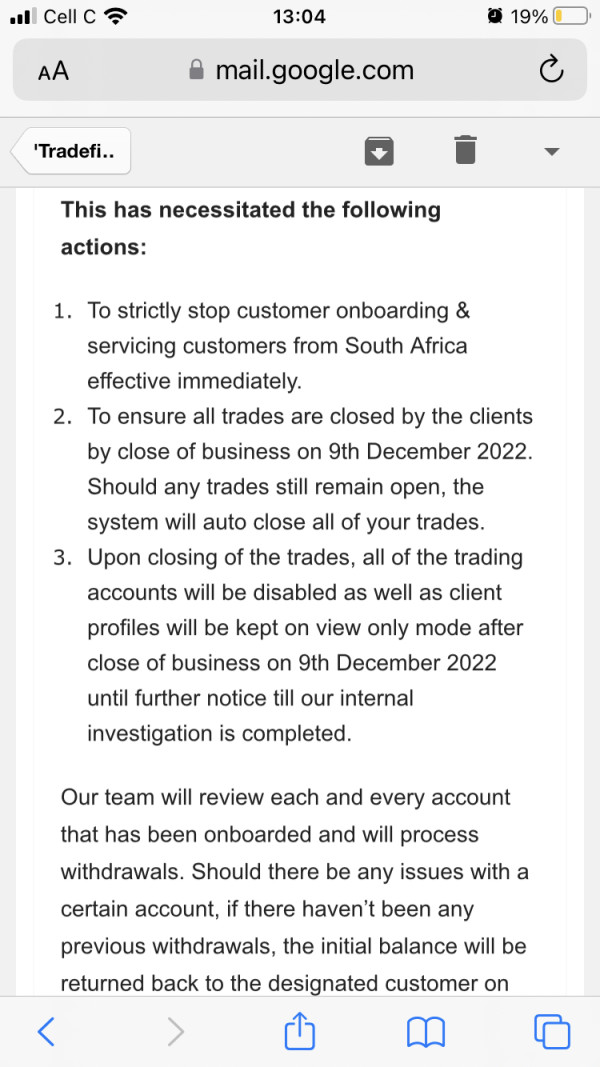

South Africa

17/11/22 I deposited funds so i could start trading but i got an email from the broker advising that all South Africans accounts are under investigation for fraud, couldnt understand why that has to do anything with me as i have not placed even a single trade . They advised that they will release and refund traders upon completion of the investigation by Feb 15th 2023. sent numerous emails following up but still no luck and now ive been locked out of their portal

Exposure

2023-03-15

Lucius Teo

Malaysia

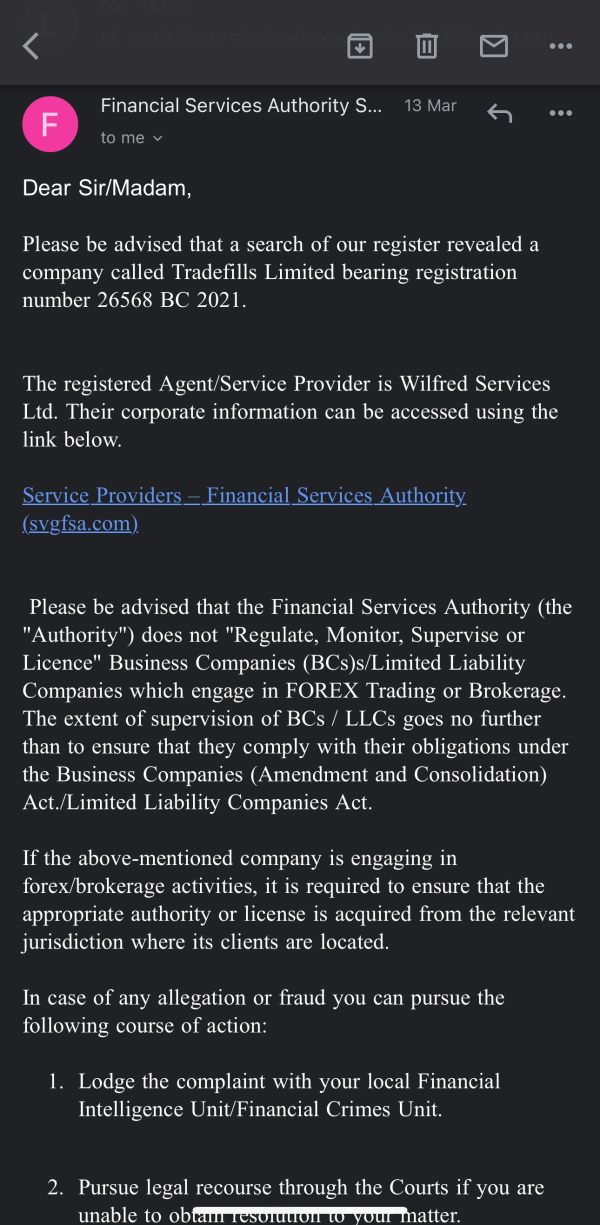

Tradefills Limited did not approve withdrawals from client since last week in Malaysia. MOST OF THE CLIENTS ARE BEING REJECTED BY LIVE SUPPORT. Also email, whatsapp is all down there is no one replying or giving response. but yet they still active in providing new promotion on their broker for 300% but did not even pay the clients withdraw for long time already!!! When texted the Financial Services Authority that provide license for Tradefills. They claim that they do not incharge for this issue !

Exposure

2023-03-14

cuong3853

Vietnam

Tradefills exchange locked accounts for no reason, sent unresponsive emails, did not reply. Scam both deposit and profit

Exposure

2023-02-16

hoai

Vietnam

my account has been suspended for no reason, and i have lost all the money in my account 594 usd.and I don't get a notification or reason

Exposure

2023-02-15

Waazi

South Africa

Good day my name is Nawaaz and I am a day trader, I have been with Tradefills broker for the past 3 months and our team as well. We are based in Sout Africa and have a group of around 300 traders, we all have been scammed by Tradefills as they have blocked all our accounts and refused to pay us our withdrawals. Please if you read this do not trust Tradefills because as soon as you become profitable they will stop sending your withdrawals If anyone has a way to report them in which we can take legal action against them please let me know as we have backing of around 300 members who has been scammed by this broker

Exposure

2022-12-07

Joppy Zhang

Indonesia

guys carefull with this scam broker they scam money from all Indonesia client. they stop server and block access from all client in indonesia country and they stole local depositor money. if you have a money in this broker, get out now, before they scam another country. i lose all my money in this broker. Alert!!!!

Exposure

2022-05-10

FlowerCool

United States

I am super thankful that there's a platform like this for an inexperienced Forex Trader like me. Various educational resources help me know more about the forex market. I like this broker.

Positive

2023-02-23

joey 562

United States

fenansal

Positive

2022-12-08