Being one of the biggest financial and trading hubs in the world, Singapore has a well-developed foreign exchange market catering to both institutional players and a large retail trader community. The Monetary Authority of Singapore (MAS) regulates financial companies and brokers, aiming to grow Singapore as a transparent FX hub while protecting consumers. Hundreds of forex brokers, unlicensed and licensed, operate actively in Singapore, so picking some reliable can be hard. Here we prepared you the best forex brokers in Singapore based on their regulatory status, trading platform, trading costs and more for your reference.

8 Best Forex Brokers in Singapore for 2024

A vast selection of financial instrments available with cheap commission rates.

Advanced market analysis tools, highly customizable trading platform.

Providing clients with a wide selection of leveraged and investment products to choose from.

Offering significant improvements compared to the industry standard MT4 and other competitors.

Strong regulatory framework, ensuring fund safety.

Patient customer service team always on your side to provide assistance.

more

Comparison of Best Forex Brokers in Singapore

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers in Singapore Overall

| Brokers | Logo | Why are they listed as the Best Forex Brokers in Singapore? |

| InteractiveBrokers |  |

✅Heavily and globally regulated, with a good operation of over 20 years in the world. ✅ Excellent execution speeds under 20 milliseconds due to advanced proprietary routing algorithms and direct market access. ✅ Responsive client support provided by knowledgeable Singapore account management team as well as 24/5 multilingual trade desks. |

| Saxo Bank |  |

✅Globally regulated, including MAS in Singapore, giving traders double trading confidence. ✅ User-friendly web and mobile platforms rated 4.5/5 stars, recommended by 94% of reviewers. ✅Multilingual 24/5 support, SGD payments acceptable, 93% satisfaction score. |

| IG |  |

✅ One of Singapore's longest established CFD providers, fully regulated locally by MAS licensing. ✅Top-tier client security measures include segregated accounts, shareholder equity transparency, negative balance protection. ✅ Noted for exceptional 24/5 multilingual support over phone, chat and email channels. |

| Plus500 |  |

✅ Authorized by MAS with segregated accounts at top-tier banks, fitting traders in Singapore more. ✅ No commissions on 2000+ instruments, unique intuitive platform ideal for beginners. ✅ 58-second average response time on 24/7 chat support. |

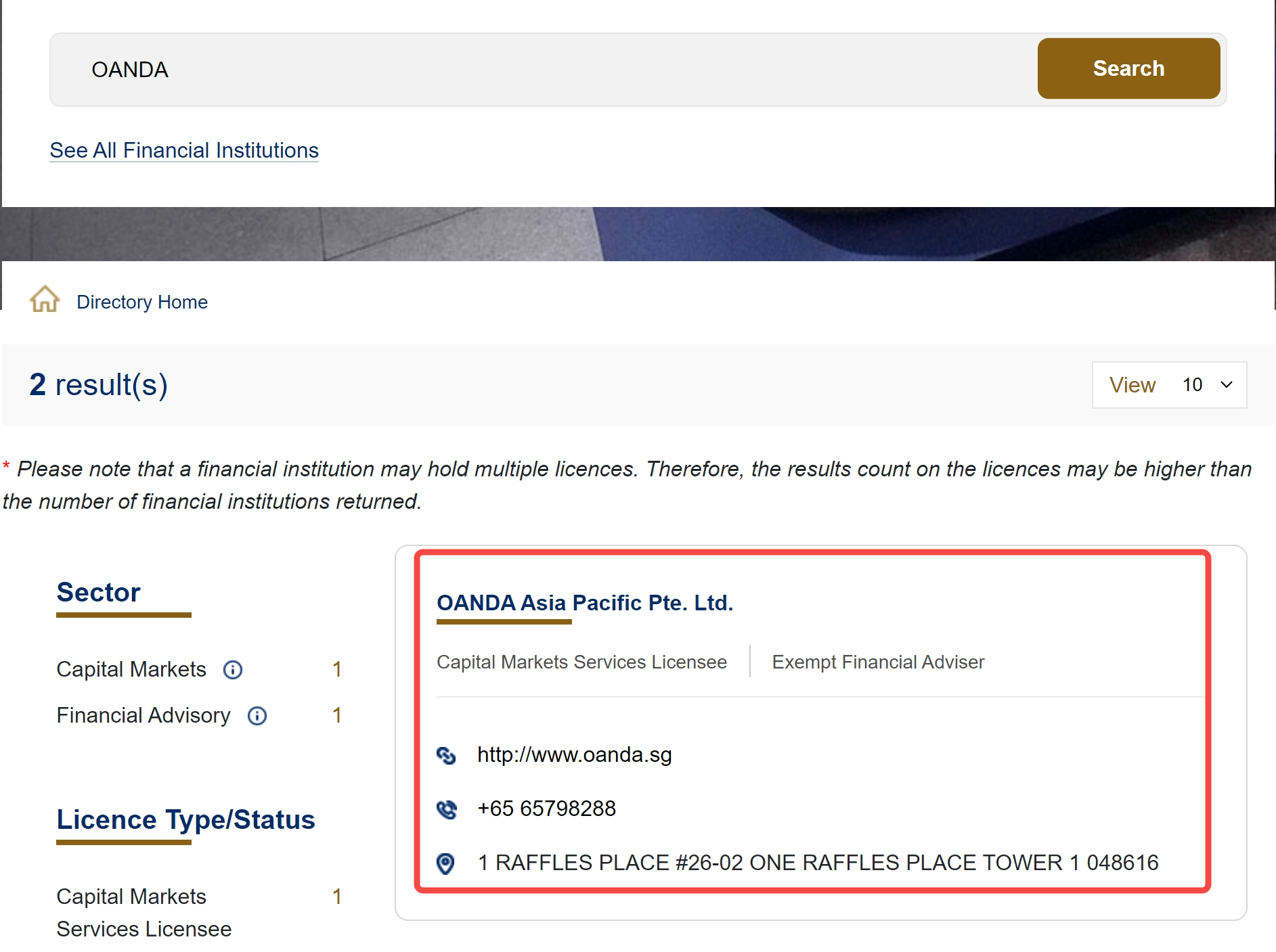

| OANDA |  |

✅ Registered with MAS with no trading restrictions. ✅ Free deposits/withdrawals via PayNow, PayPal etc. 85% client retention rate. ✅Responsive Singapore-based support in 7 languages. |

| Swissquote |  |

✅ MAS regulated Swiss bank, the only broker holding a banking license. ✅ User trust rating of 4.6/5 reflects Swissquote's transparency and commitment to security. ✅Client support also shines with multilingual teams providing personalized assistance via live chat, email and local Southeast Asia telephone support. |

| CMC Markets |  |

✅ Under MAS regulation, next gen platform offers customizable tools for experienced traders. ✅Local SGD support team with 4.4/5 client rating. ✅Low minimum deposit of SGD 10 to start trading. |

| TickMill |  |

✅Not directly regulated in Singapore but offers negative balance protection for Singapore accounts. ✅ Solid MT4& MT5 platforms performance favoured by active traders in Singapore. ✅Extremely competitive pricing includes zero spread accounts on over 23 currency pairs including EUR/USD. |

InteractiveBrokers

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, FCA, FSA, SFC

Best for experienced traders with large trading volumes

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

InteractiveBrokers is a reputable brokerage firm based in the United States. Established in 1978 by Thomas Peterffy, it has expanded its reach to become a prominent player in the online brokerage industry. It provides a diverse array of financial products and trading platforms to cater to the needs of individual and institutional investors worldwide. Interactive Brokers is renowned for its cutting-edge technology and highly competitive pricing, which has made it a favoured option among traders and investors across the globe.

Saxo Bank

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, FCA, FSA, SFC, AMF, CONSOB, FINMA, MAS

Best for advanced traders perferring various product portfolios

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

Saxo Bank is an online multi-asset trading and investment specialist that was established in 1992 and is based in Copenhagen, Denmark. Saxo Bank is authorised across Europe, Asia, and Australia and holds banking and investment banking licences issued by the Danish Financial Supervisory Authority. Saxo provides a wide range of trading options, including forex, CFDs, stocks, futures, options, bonds, and other asset classes. These can be accessed through the user-friendly SaxoTraderGO platform and the advanced SaxoTraderPRO platform. With a single margin account, clients have the convenience of accessing over 35,000 instruments across global markets.

IG

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, FCA, FSA, NFA, AMF, FMA, MAS, DFSA

Best for professional traders

Founded in 1974, IG is a British multinational over-the-counter (OTC) derivatives trading services company and trading broker, operating from five global offices as IG Group Holdings Plc. IG Trading is considered a safe platform because it is highly regulated by several top-tier regulators. Notably, the Financial Conduct Authority (FCA) in the UK, Australian Securities and Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS) are among these regulatory bodies. IG provides individual retail investors the opportunity to trade a diverse range of CFDs, including major stocks, cryptocurrencies, indices, forex, and commodities worldwide.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

Plus500

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, CYSEC, FCA, FMA, MAS

Best for low-cost trading in currencies

Established in 2008, Plus500 is an online trading platform that offers retail investors a diverse selection of financial instruments. These include stocks, cryptocurrencies, commodities, forex, and more, all accessible through Contracts for Difference (CFDs). Operating in multiple countries and being regulated by various financial authorities, it offers users a sense of trust and security. Traders have the option to access the platform through web and mobile applications, providing convenience for individuals interested in participating in leveraged trading across global markets.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

OANDA

Overall: ⭐⭐⭐⭐⭐

Regulations: ASIC, FCA, FSA, NFA, IIROC, MAS

Best for beginners and experienced traders alike

OANDA was started in 1996 and is now a reputable FX and CFD broker. An early leader in the field of foreign exchange trading online. Aanda is a global company with registrations in multiple jurisdictions, including the USA, Canada, Japan, the UK, Australia, and Singapore. It has a worldwide presence and provides a full spectrum of trading services to clients all over the globe. When it comes to cutting-edge technology and dedicated service, nobody does it better than OANDA.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

Swissquote

Overall: ⭐⭐⭐⭐⭐

Regulations: FCA, MSFA, FINMA, DFSA

Best for low-cost trading and crypto trading

Swissquote is a Swiss-based online banking and financial services provider that is well-known for its online trading and investment platforms. Founded in 1996, Swissquote offers a wide range of financial services, including online trading of various assets like stocks, forex, commodities, and cryptocurrencies. Swissquote provides a user-friendly interface, extensive research and analysis tools, and a variety of account options to cater to the needs of different investors.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

CMC Markets

Overall: ⭐⭐⭐⭐⭐

Regulation: FCA, FMA, IROC, MAS

Best for low-cost trading and copy trading

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

CMC Markets is a brokerage firm established in 1989 and based in Australia, currently, with a bussiness operation of over 20 years. The company provides online trading services for a wide range of financial instruments, such as forex, commodities, and indices. CMC Markets is known for its user-friendly trading platforms and is regulated by financial authorities in multiple countries, making it a popular choice for retail traders and investors.

TickMill

Overall: ⭐⭐⭐⭐⭐

Regulation: FCA, CYSEC, FSCA, LFSA

Best for copy trading, featuring advanced trading tools

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

Established in 2014, TickMill is a well-established forex and CFD broker that has garnered a reputation for its transparent trading practices, competitive pricing, and unwavering commitment to client satisfaction. Headquartered in the United Kingdom, TickMill is regulated by multiple Tier-1 financial authorities, ensuring the highest standards of security and investor protection.

Forex Trading Knowledge Questions and Answers

Is forex trading legal in Singapore?

Actually, forex trading in Singapore is not only legal but also meticulously regulated by the Monetary Authority of Singapore (MAS). Singapore stands out as a key global hub for foreign exchange trading, owing to its embrace of capital flows, robust financial sector infrastructure, stringent regulatory supervision, and strategic positioning that links Asian and European markets.

Retail forex brokers in Singapore must obtain a Capital Markets Services (CMS) license issued by MAS to provide leveraged currency trading services in compliance with strict conduct of business rules.

How can I verify a broker's MAS regulation?

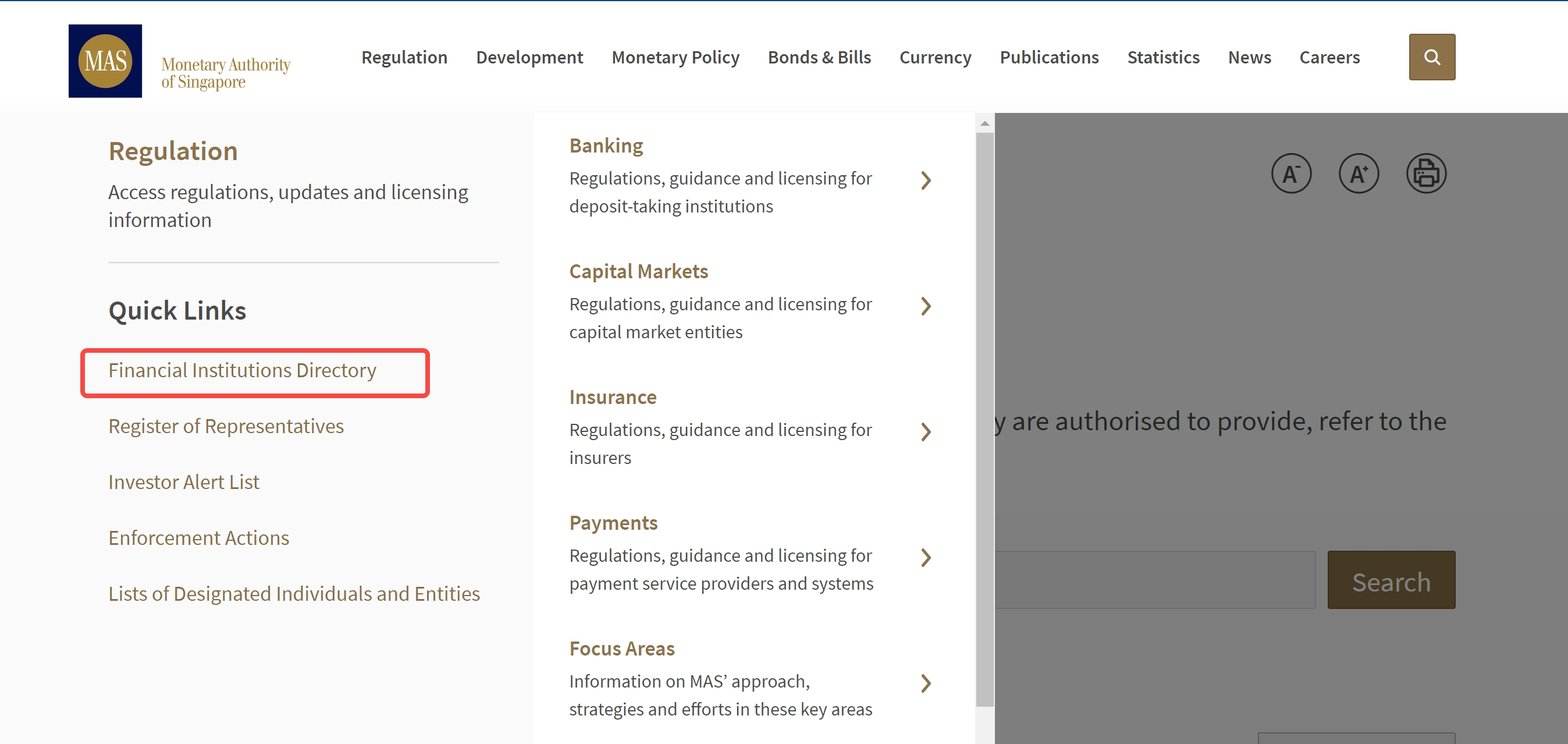

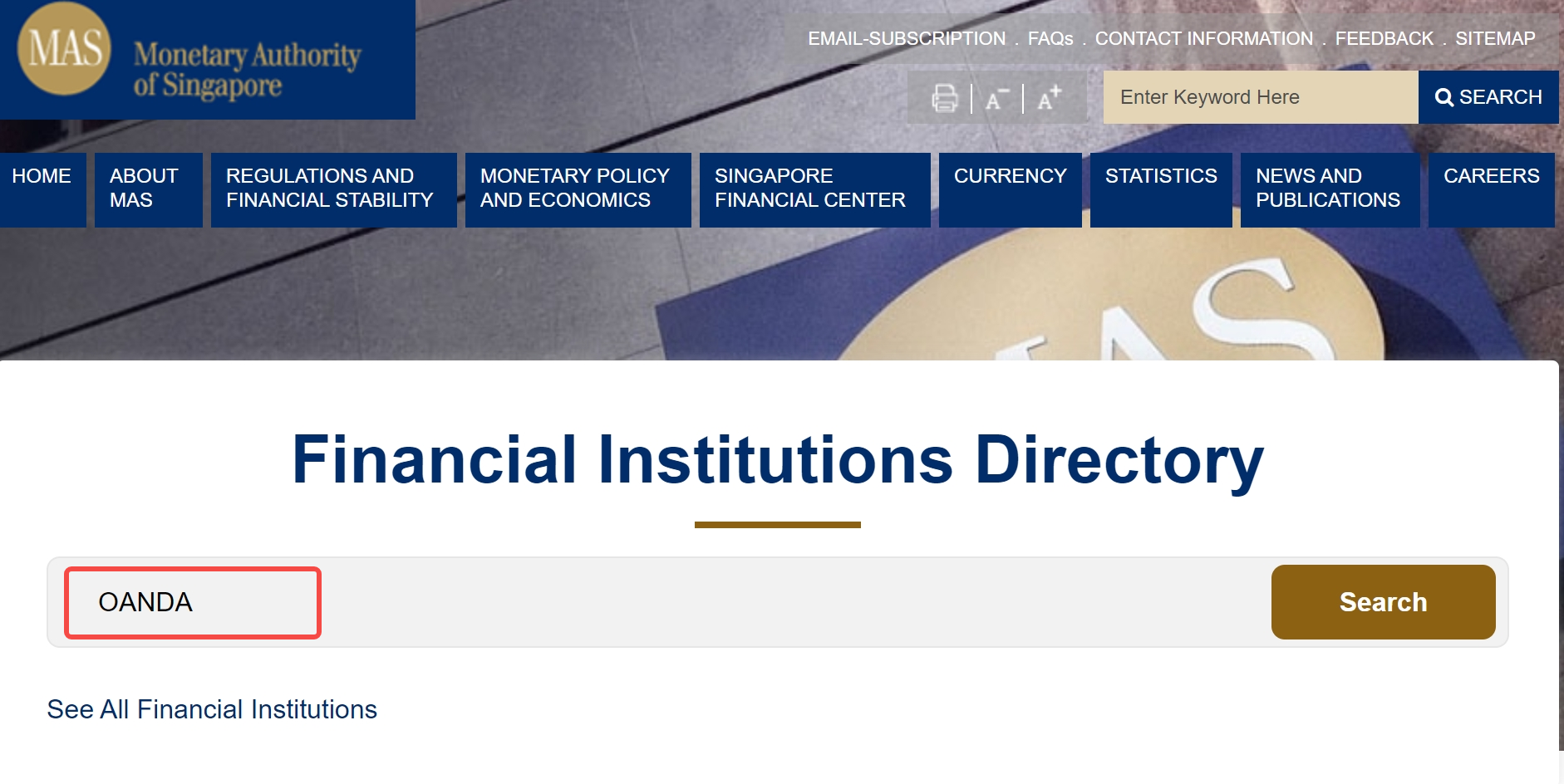

To begin with, access the official MAS website at https://www.mas.gov.sg/ and navigate to the section titled “Financial Institutions Directory.”

Next up, enter the desired broker's name into the provided search bar. For instance, let's consider OANDA as an example.

Subsequently, the search results will appear, enabling you to verify whether this broker is regulated by MAS or not.

Can I trade with brokers regulated abroad in Singapore?

Singapore has an open policy that allows residents to trade with overseas forex brokers, as long as they are properly regulated. International brokers in Singapore are commonly supervised by regulators like ASIC in Australia, FCA (UK), CYSEC (Cyprus), NFA (U.S.), and FSA (Japan). Regardless of whether traders lean towards local or international regulation, the key is choosing a broker regulated by a strong authority.

Which is the best broker for beginners in Singapore?

OANDA is recognized as the top pick among forex brokers for beginners in Singapore, beating its rivals. This position is credited to its robust regulations, accessible entry process, comprehensive trading tools, and secure withdrawal methods. Thus, for new traders in Singapore, OANDA serves as the ideal platform, ensuring a reliable and straightforward start to forex trading.

|

Best forex broker for beginners in Singapore |

| Regulated by | ASIC, FCA, FSA, NFA, IIROC, MAS |

| Trading Platforms | MetaTrader 4, Tradingview, OANDA Mobile, OANDA Web |

| Minimum Deposit | $0 |

| Tools & Resources | Advanced Charts, MT4 Premium indicators, Technical analysis, |

| Demo Account | Available |

| Deposit | PayNow, DBS Bill Pay, PayPal, FAST, Bank/Wire Transfer |

| Withdrawal | PayPal, Bank/Wire Transfer |

| Customer Support | 5/24 online chat |

What is the maximum leverage offered by brokers in Singapore?

The Monetary Authority of Singapore (MAS) has set the maximum leverage that brokers regulated by them can offer clients:

They offer a maximum leverage of 50:1 for major currency pairs like EUR/USD or USD/SGD.

For minor, exotic, or emerging market currency pairs like USD/MXN or EUR/CZK, the leverage limit is set at 20:1.

Trading gold and precious metals comes with a 5:1 leverage limit.

| Trading assets | Leverage |

| Major Currencies | 50:1 |

| Minor & Exotic pairs | 20:1 |

| Precious Metals | 5:1 |

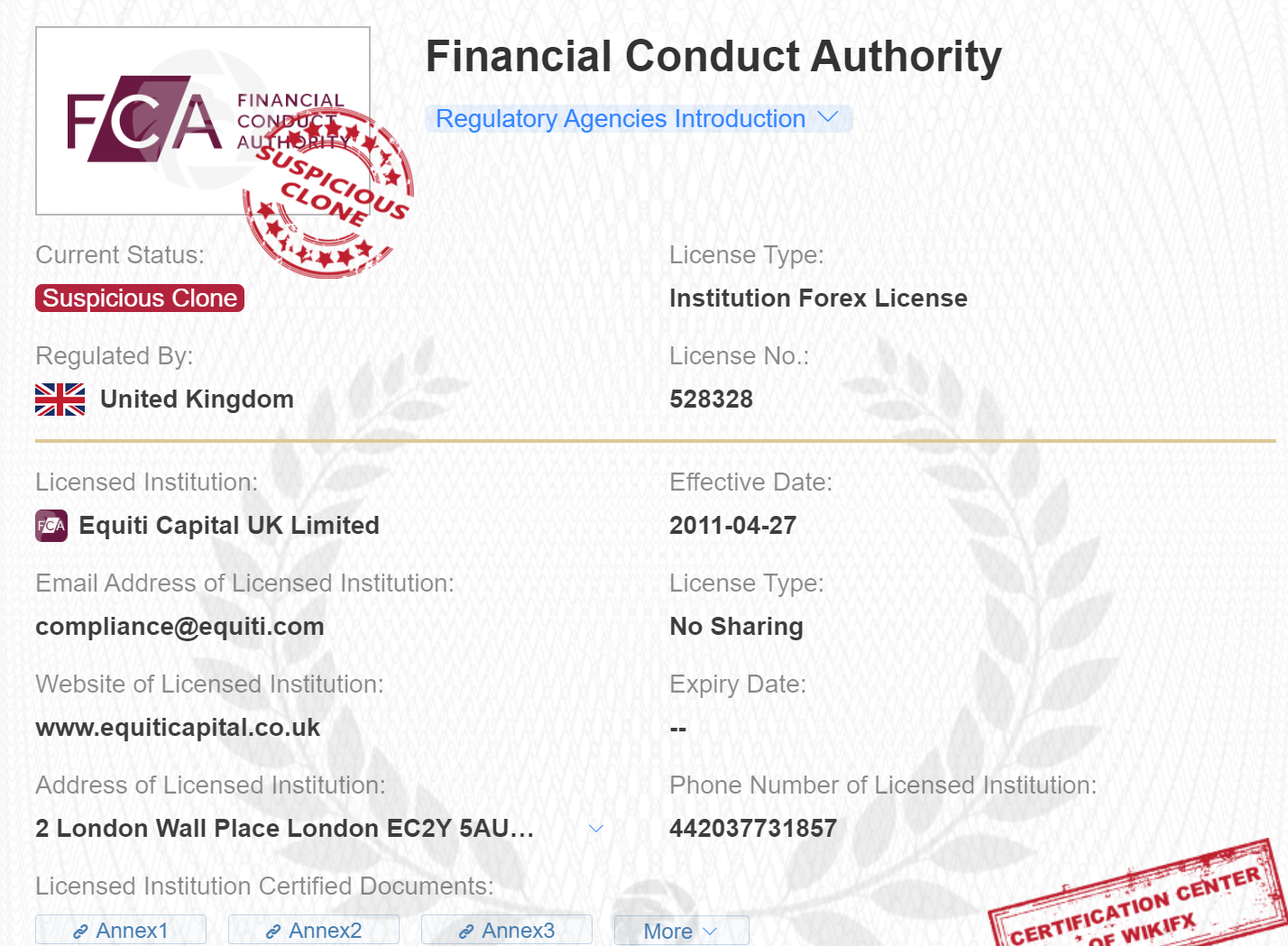

What are scam brokers that traders should avoid in Singapore?

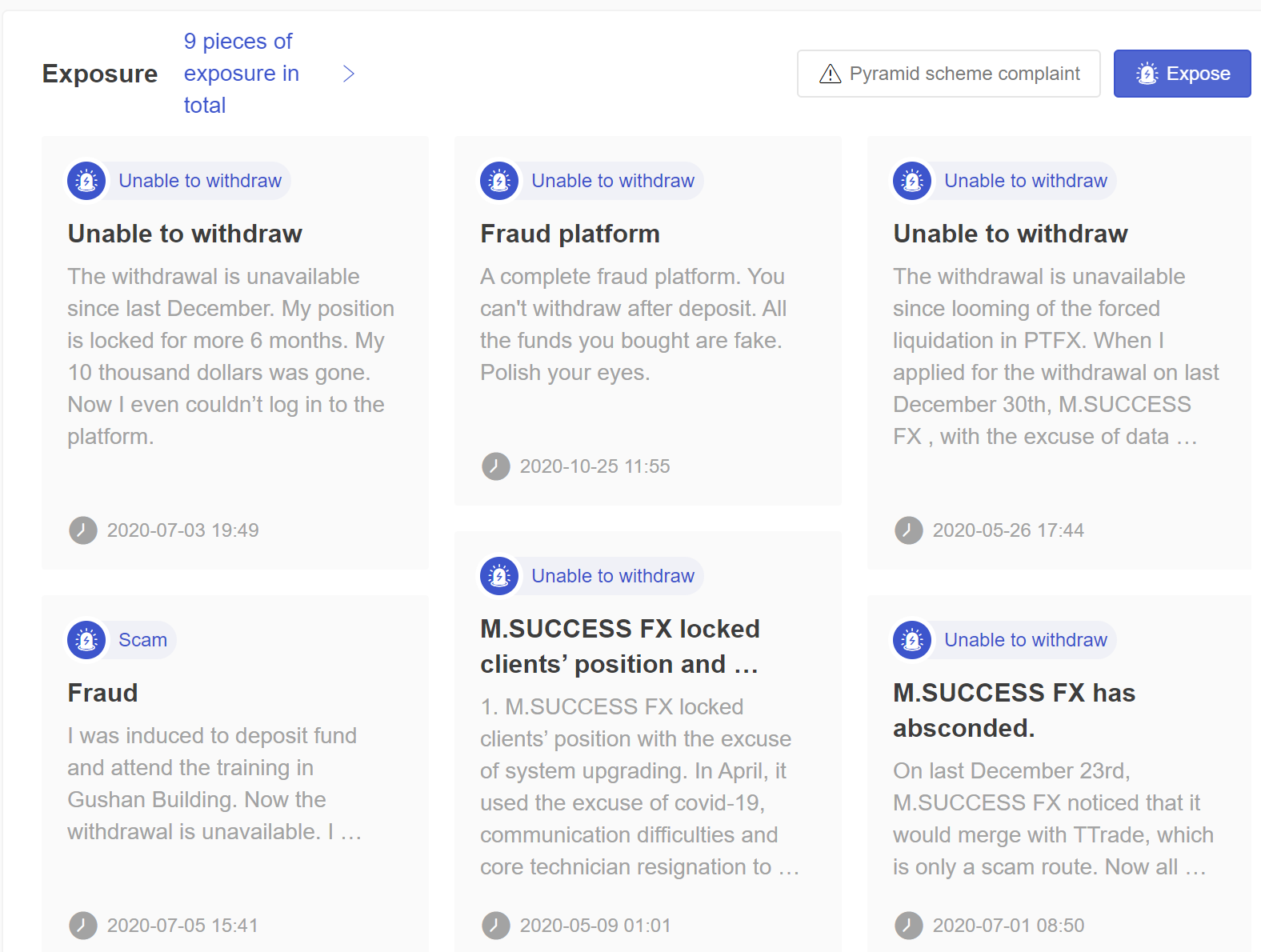

| Broker | Logo | Registered Country | Regulation | Establishment of Years | Trading Platform | Customer Support | Additional Notes |

| M.SUCCESS FX |  |

United States |  |

2-5 years | Unknown | Phone & Email | Fake license, no physical office, 9 scam exposures |

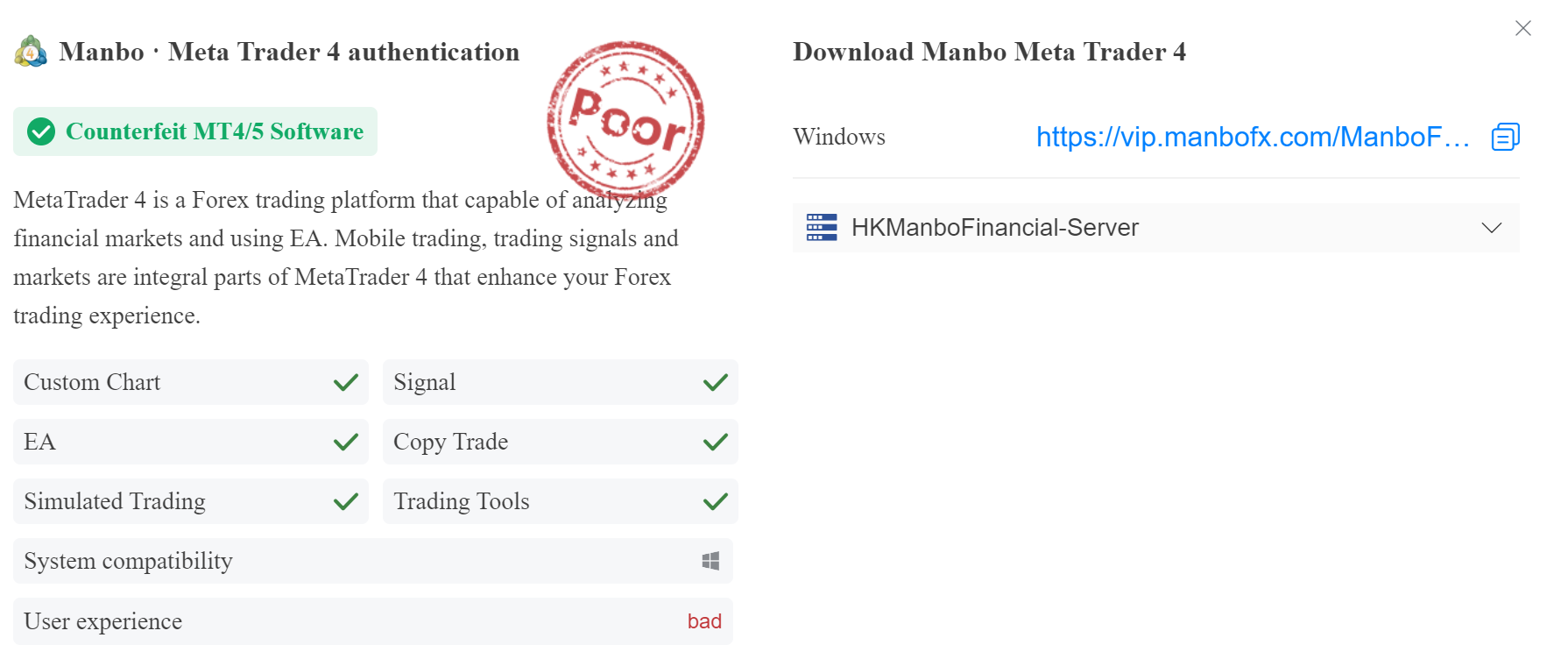

| Manbo |  |

Hong Kong |  |

5-10 years | Counterfeit MT4 | No | Unaccessible official website, counterfeit MT4 |

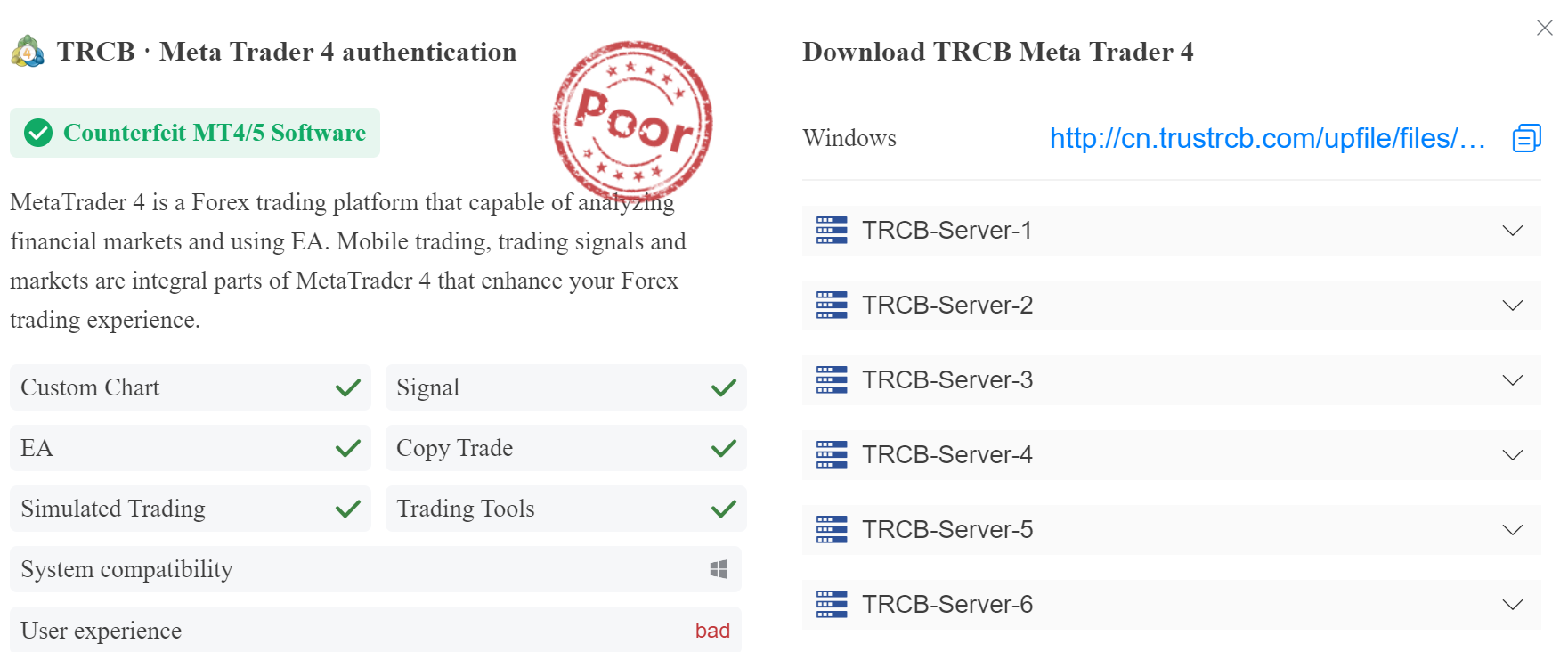

| TRCB |  |

United Kingdom |  |

5-10 Years | Counterfeit MT4 | Email only | Unaccessible official website, counterfeit MT4 |

M.SUCCESS FX, supposedly operated by American Lion International Holdings LTD, operates without any regulatory oversight. This fraudulent broker attempts to present itself as legitimate by using another broker's license. A visit to their supposed physical office reveals its non-existence. Presently, their official website is inaccessible, and they've garnered a troubling scam exposure count of 9. Traders in Singapore should steer clear of this broker to prevent significant financial losses.

Manbo, another unregulated scam, features an inaccessible official website. Their claimed MetaTrader 4 platform has been identified as a counterfeit version. Therefore, traders in Singapore should avoid this scam broker to safeguard their funds.

TRCB, a deceitful broker, pretends to be legitimate by using a fake license. Its official website is inaccessible, and the MT4 trading platform it offers has been identified as counterfeit. Hence, traders in Singapore must stay away from this broker.

Do I have to pay taxes on forex trading in Singapore?

Forex trading income is considered part of your personal income for residents in Singapore. It is subject to progressive resident tax rates. Tax rates range from 0% on the first S$20,000 of chargeable income to 22% on income above S$320,000. There is no separate capital gains tax levied in Singapore. Forex trading profits are categorized and taxed as income based on personal tax brackets.

What are the most used payment methods for forex trading in Singapore?

The most commonly used payment methods for funding forex trading accounts by Singapore-based traders are:

Wire Transfers from Local Singapore Banks: Using popular banks like DBS, UOB, and OCBC bank accounts provides convenient on-ramp/off-ramp of SGD as trading funds. Most homegrown retail brokers accept wire transfers. International brokerages typically have SWIFT details and accept forex wires.

Global Debit or Credit Cards:Internationally enabling a credit or multi-currency debit card issued by Singapore banks allows card-based deposits and withdrawals at offshore brokers. Visa and Mastercard networks dominate in this category.

Digital Wallets:Using channels like PayPal, Skrill or Neteller which interface with most global forex brokerages also works. Fees can be higher and limits apply, but they provide an easy online conduit.

To Wrap Up

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

You Also Like:

Best Forex Brokers in Turkey for 2024

Review top 9 forex brokers in Turkey, elevating their trading pros and cons to give traders more useful guidance.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Swiss Forex Brokers for 2024

Explore top 10 forex brokers in Switzerland, elevating their trading pros and cons to give traders more useful guidance.

Best Stock Brokers in the US for 2024

When choosing an online broker, finding the platform that best fits your investment needs is crucial. With the rise in popularity of online trading, more brokers are offering free stock trading and commission-free transactions for various assets. It has become a challenge for users to select suitable brokers.

Best CySEC Regulated Forex Brokers 2024

Delving into CySEC-regulated forex trading, this article presents a top 9 list of brokers, spotlighting the benefits of regulatory compliance.

8 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 8 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Forex Brokers in 2024

Guide to the most trusted Forex brokers, with a thorough investigation into their quality, security measures, and financial transparency.