Ready to start your forex trading journey and looking for the best platform to get started? Choosing a reliable forex broker can be challenging with so many options out there. But don't worry, this article will help you navigate through the choices and make a well-informed decision. We'll cover key factors to consider when picking a broker and highlight some of the most trusted names in the industry, helping you make a decision based on solid information rather than just advertisements.

How did we get the list of most trusted forex brokers?

Criteria Selection: We began by defining distinct criteria for trustworthiness. This included regulation by well-respected financial bodies like FCA or ASIC, positive customer reviews, strong protective measures for client funds, financial transparency, a history of reliable service, and robust security measures for data protection. The quality of their trading platform, range of tradable assets, customer support, as well as competitive spreads and fees also factored into our selection.

Data Collection: We collected data from varied sources such as broker websites, customer reviews, financial statements, and regulatory agency reports. Each broker was evaluated on each of these criteria.

Analysis: We compared and contrasted how each broker delivered on these pre-determined measures. This in-depth evaluation allowed us to scrutinize each one closely and fairly.

Broker Reviews: Individual reviews of each selected broker were conducted detailing how they satisfied each criteria. This gave us a clear snapshot of each broker's performance.

Comparative Discussion: Post-reviews, all brokers were compared against each other. This comparative analysis helped highlight the strengths and weaknesses of each broker.

List of Best Forex Brokers

more

Best Forex Brokers Compared

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers Reviewed

① Saxo

Saxo - Best overall broker, most trusted

|

||

| Trust Score | ⭐⭐⭐⭐⭐ | |

| Founded | 1991 | |

| Min. Deposit | $0 | |

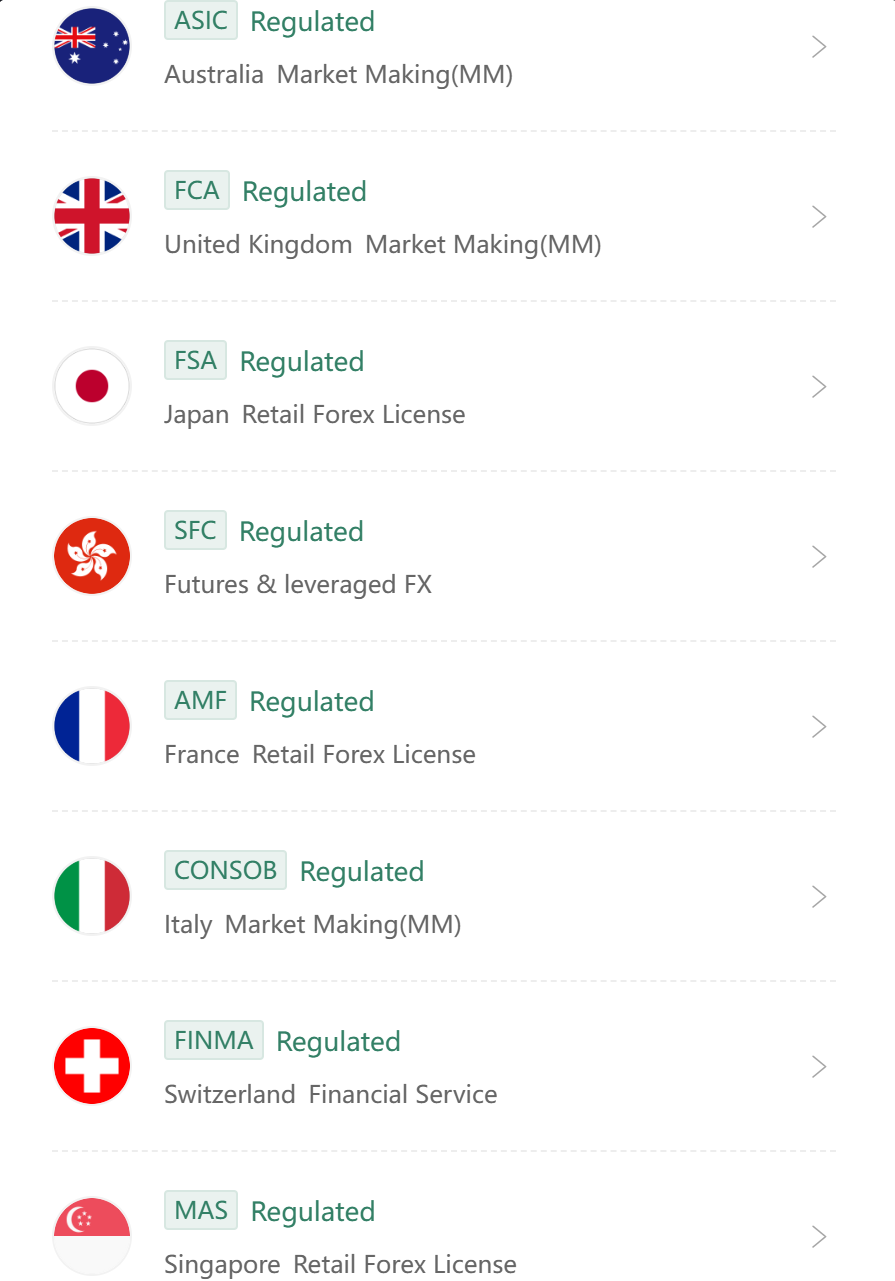

| Regulation | ASIC, FCA, FSA, SFC, AMF, CONSOB, FINMA, MAS | |

| Financial Instruments | Stocks, ETFs, bonds, mutual funds, forex, futures, forex options, listed options | |

| Demo Account | ✅(20 days with $100,000 virtual fund) | |

| Trading Platforms | SaxoTraderGo, SaxoTraderPRO, SaxoInvestor | |

| Max. Leverage | 1:100 | |

| Fees | Spreads & Commissions (Forex) | From 0.4 pips + commission-free (forex) |

| Customer Support | 24/5 - phone, email, Support Center | |

| Open Saxo Account | ||

Why Is Saxo Trustworthy?

Established History: Saxo Bank was founded in 1991, and since then it has built a reputation for being a reliable and stable financial institution.

Regulatory Oversight: Saxo Bank is regulated by several of the world's leading financial regulatory bodies, including the Danish Financial Supervisory Authority (FSA) and the UK's Financial Conduct Authority (FCA). It is also licensed by various regulatory authorities in the countries where it operates.

Transparency: Saxo Bank provides information about its financial performance, is publicly traded, and subject to the corporate governance and disclosure requirements that come with that status.

Client Protection: Saxo Bank offers protection for client funds in the event of bankruptcy or solvency issues, in accordance with regulatory standards.

Technology & Security: The bank uses advanced technological tools to secure transactions and protect users' data. It also provides strong encryption for online trading, ensuring safety and security for its users.

Product Range & Quality: It offers a comprehensive and high-quality range of products and services, and is recognized for its robust trading platforms.

② Interactive Brokers (IB)

Interactive Brokers (IB) - Best trusted forex broker for professionals

|

||

| Trust Score | ⭐⭐⭐⭐⭐ | |

| Founded | 1978 | |

| Min. Deposit | $0 | |

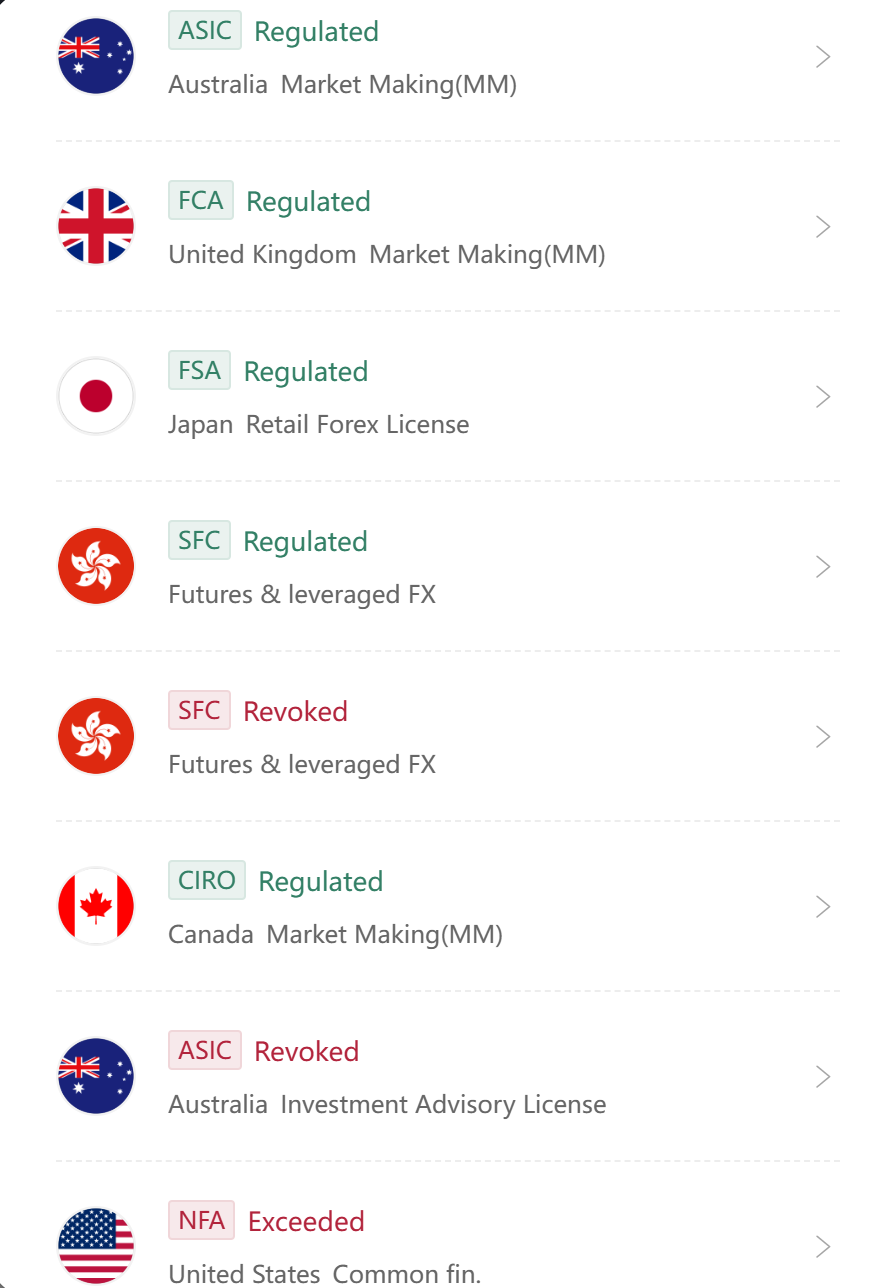

| Regulation | ASIC, FCA, FSA, SFC, CIRO | |

| Financial Instruments | 150 markets, stocks/ETFs, options, futures, spot currencies, bonds, mutual funds | |

| Demo Account | ✅ | |

| Trading Platforms | IBKR GlobalTrader (Mobile), Client Portal (Web), IBKR Desktop, IBKR Mobile, Trader Workstation (TWS) (Desktop), IBKR APIs (Desktop), IBKR ForecastTrader (Web), IMPACT (Mobile) | |

| Max. Leverage | 1:400 | |

| Fees | Spreads & Commissions (Forex) | From 0.1 pips + low commission |

| Inactivity Fee | ❌ | |

| Customer Support | Live chat, phone, email, FAQs | |

| Open IB Account | ||

Why Is IB Trustworthy?

Long-standing History: Founded in 1978, Interactive Brokers has a long-standing history in the financial markets, which typically suggests stability and reliability.

Strict Regulation: IB is regulated by many high-level financial authorities worldwide, including the Australia Securities & Investment Commission (ASIC), the UK's Financial Conduct Authority (FCA), and others.

Financial Transparency: As a publicly-traded company listed on the NASDAQ, IB is subject to rigorous financial reporting requirements, providing transparency into its financial health.

Customer Protection: Client funds are protected by the Securities Investor Protection Corporation (SIPC) up to $500,000 (including $250,000 for claims in cash).

Technological Superiority: IB provides advanced, secure technology for trading and protecting customer data. Its trading platform, Trader Workstation (TWS), is recognized as one of the best in the industry.

Wide Offerings: IB offers a wide range of financial products for trading, including stocks/ETFs, options, futures, spot currencies, bonds, and mutual funds.

Good Reputation: Interactive Brokers has a strong reputation within the industry, and it has won multiple awards for its quality of services.

③ IG

IG - Best for active traders

|

||

| Trust Score | ⭐⭐⭐⭐⭐ | |

| Founded | 1974 | |

| Min. Deposit | $0 | |

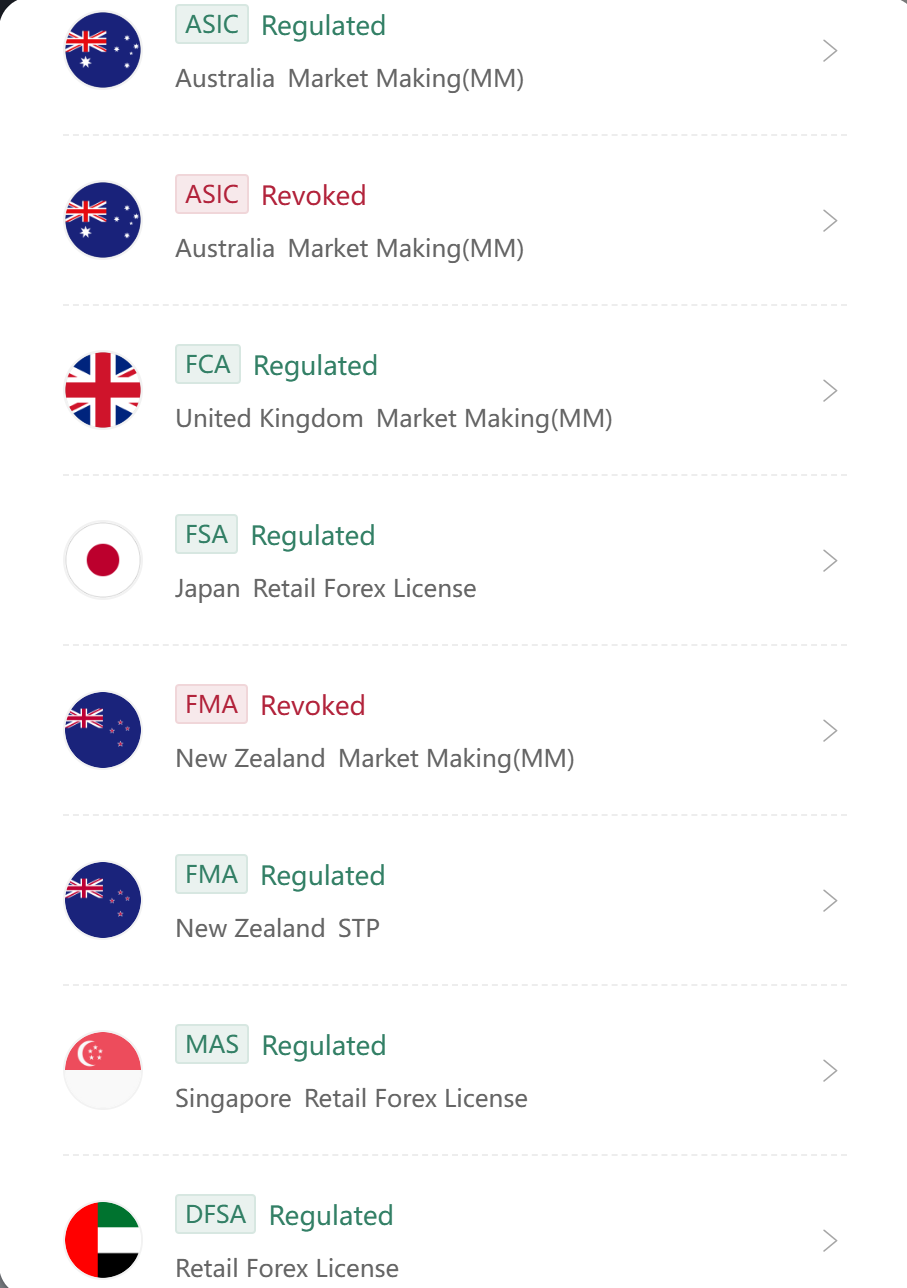

| Regulation | ASIC, FCA, FSA, FMA, MAS, DFSA | |

| Financial Instruments | 17,000+, forex, indices, shares, commodities, cryptocurrencies | |

| Demo Account | ✅ ($20,000 in virtual capital) | |

| Trading Platforms | L2 dealer, ProRealTime, MT4, TradingView | |

| Copy Trading | ✅ | |

| Max. Leverage | 1:400 | |

| Fees | Spreads & Commissions (Forex) | From 0.6 pips (EUR/USD) |

| Customer Support | 24 hours a day, except 6 am - 4pm on Saturday (UTC+8) - live chat | |

| Open IG Account | ||

Why Is IG Trustworthy?

Extensive Track Record: IG has been a leader in the financial markets since its foundation in 1974, making it one of the longest-operating brokers in the industry.

Comprehensive Regulation: IG is regulated by several well-known regulatory bodies, including the Financial Conduct Authority (FCA) in the UK and the Australian Securities and Investment Commission (ASIC) in Australia.

Financial Transparency: IG is a publicly traded company listed on the London Stock Exchange, which means it must meet stringent financial reporting standards, affording clients a high degree of transparency.

Client Protection: IG ensures the safety of client funds through segregated accounts and is a member of the Financial Services Compensation Scheme (FSCS), which can provide compensation to customers if IG is unable to fulfill its financial obligations.

Wide Range of Instruments: IG offers 17,000+ tradable instruments, including forex, indices, shares, commodities, and cryptocurrencies.

Technological Innovations: IG provides a state-of-the-art trading platform that includes advanced charting tools, prorealtime algorithms, and direct market access to help traders effectively navigate the markets.

Good Reputation: IG has a strong reputation in the broking industry, consistently receiving high rating scores in user reviews and industry awards for their service.

④ XM

XM - Best for customer service

|

||

| Trust Score | ⭐⭐⭐⭐⭐ | |

| Founded | 2009 | |

| Min. Deposit | $5 | |

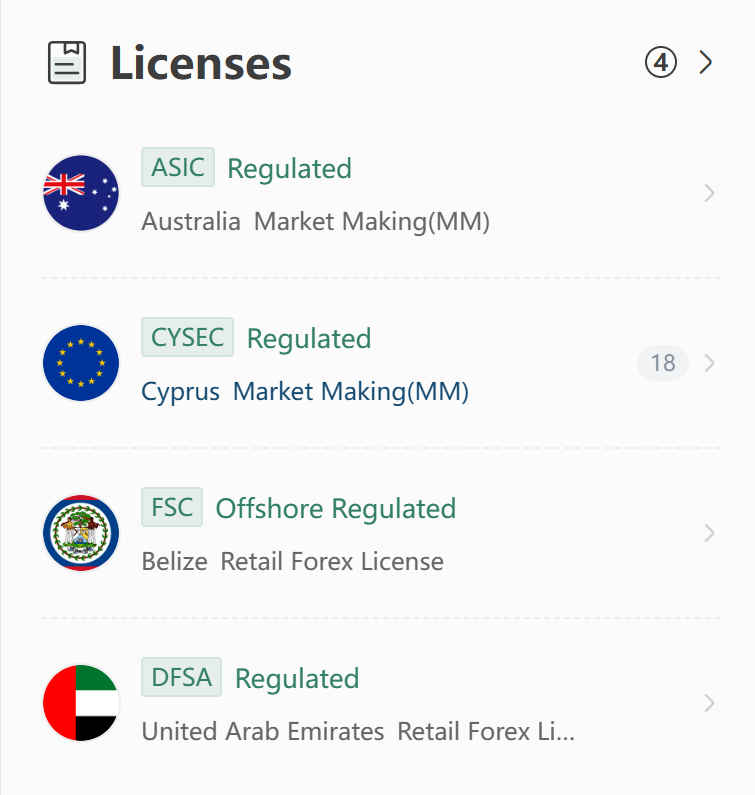

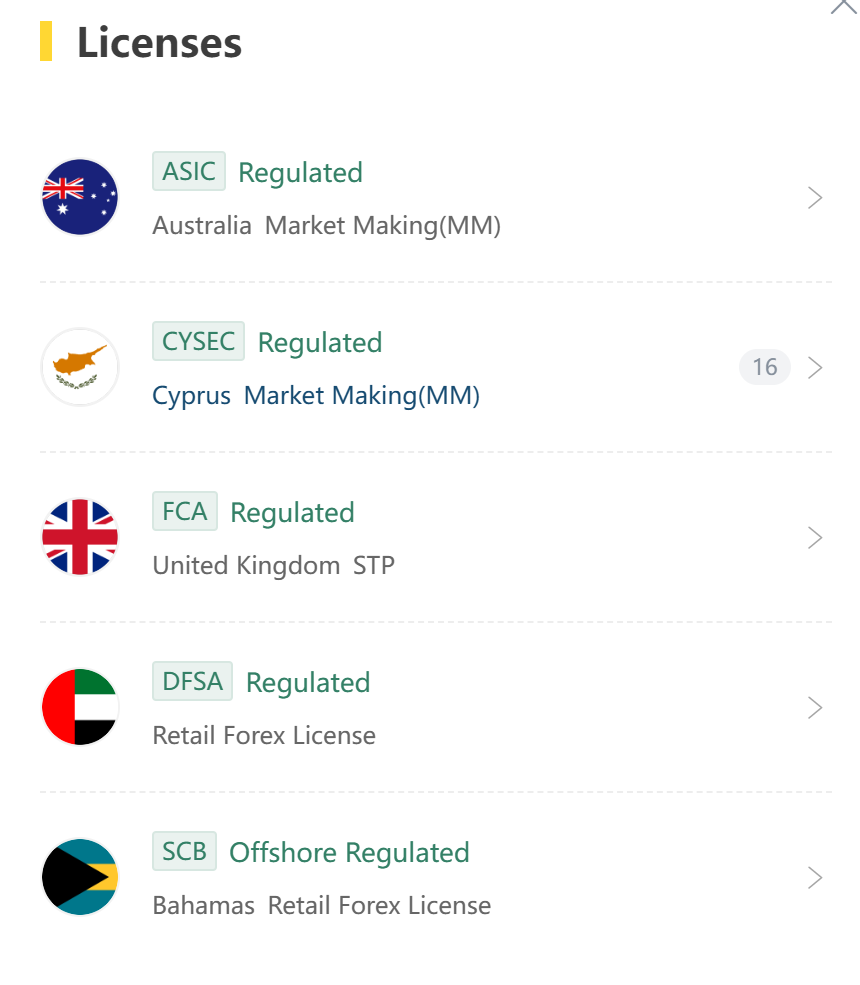

| Regulation | ASIC, CySEC, DFSA, FSC (Offshore) | |

| Financial Instruments | 1,400+, forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, thematic indices | |

| Demo Account | ✅ (30 days | |

| Trading Platforms | MT4/5, XM App | |

| Copy Trading | ✅ | |

| Max. Leverage | 1:1000 | |

| Fees | Spreads & Commissions (Forex) | From 1.6 pips + commission-free (Standard account) |

| Withdrawal Fee | ❌ | |

| Customer Support | Live chat, phone | |

| Open XM Account | ||

Why Is XM Trustworthy?

Regulatory Oversight: XM Group operates under robust regulations via various entities, including the highly respected Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), the International Financial Services Commission (FSC, offshore) of Belize, and Dubai Financial Services Authority (DFSA) of United Arab Emirates.

Client Fund Safety: XM Group is clear about the importance of client fund safety. They maintain segregated client accounts to ensure that client funds are not used for the company's operational expenses. Additionally, in the unfortunate event the company was to enter liquidation, client funds cannot be used to pay off creditors.

Transparent Trading Conditions: XM Group is well-known for providing clear, transparent information about their trading conditions. This includes everything from spreads to swaps, ensuring that clients fully understand the circumstances of their trades.

Positive Client Reviews: XM Group often receives positive feedback from its clients, citing its customer service, trading conditions, and educational resources as stand-out positives.

Extensive Range of Instruments: XM Group offers trading in more than 1,400 instruments, including forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, and thematic indices.

Education and Research Tools: XM Group is renowned for its high-quality educational material, including webinars, video tutorials, market research, forex seminars, and trading tools, which are considered a mark of a broker's commitment to its clients' success.

⑤ Pepperstone

Pepperstone - Best for trading platform and tools

|

||

| Trust Score | ⭐⭐⭐⭐ | |

| Founded | 2010 | |

| Min. Deposit | $0 | |

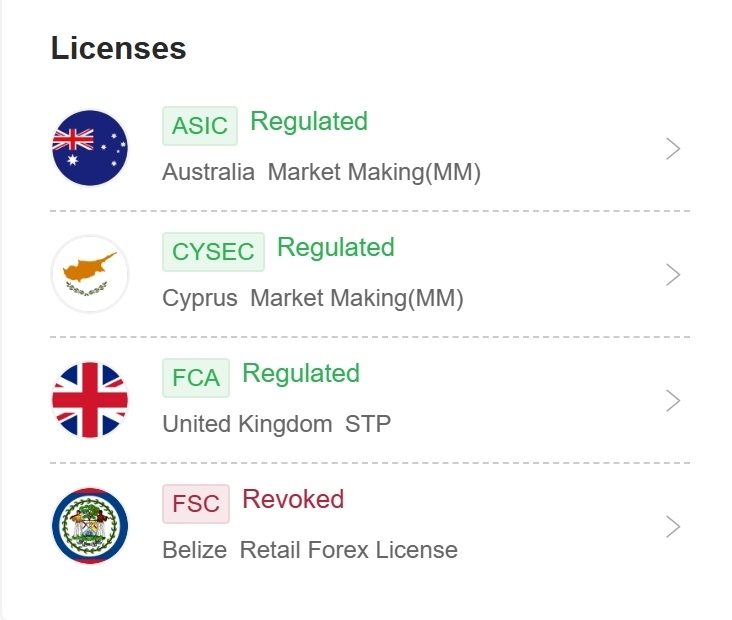

| Regulation | ASIC, CySEC, FCA, DFSA, SCB (offshore) | |

| Financial Instruments | Forex, shares, ETFs, indices, commodities, currency indices, cryptocurrencies, CFD forwards | |

| Demo Account | ✅(30 days, $50,000 virtual funds) | |

| Trading Platforms | TradingView, MT4/5, Pepperstone platform, cTrader | |

| Copy/Social Trading | ✅ | |

| Max. Leverage | 1:200 (Retail)/1:500 (Professional) | |

| Fees | Spreads & Commissions (Forex) | Average 1.1 pips on EUR/USD + commission-free (Standard account) |

| Customer Support | 24/7 - phone, email | |

| Open Pepperstone Account | ||

Why Is Pepperstone Trustworthy?

Strong Regulation: Pepperstone Limited is authorized and regulated by the UK's Financial Conduct Authority (FCA) while Pepperstone Group Limited is regulated by the Australian Securities and Investment Commission (ASIC). These are both highly regarded regulatory bodies in the financial industry.

Segregation of Client Funds: Pepperstone maintains segregated client accounts. This means traders' funds are kept in separate bank accounts, ensuring they are not used for any other purpose.

Auditing: Pepperstone's accounts are audited by the prestigious Ernst & Young, providing an extra layer of financial transparency and accountability.

Positive Reputation: Since its establishment in 2010, Pepperstone has quickly gained a strong positive reputation among Forex traders for its competitive spreads, efficient trade execution, and excellent customer service.

Technological Security: Pepperstone uses advanced encryption technology to ensure the safety and privacy of its clients' personal and financial information.

Wide Range of Trading Options: Pepperstone offers a comprehensive selection of financial instruments for trade, including forex, commodities, indices, currency indices, cryptocurrencies, shares, and ETFs.

⑥ IC Markets Global

IC Markets Global - Best for low fees

|

||

| Trust Score | ⭐⭐⭐⭐ | |

| Founded | 2007 | |

| Min. Deposit | $200 | |

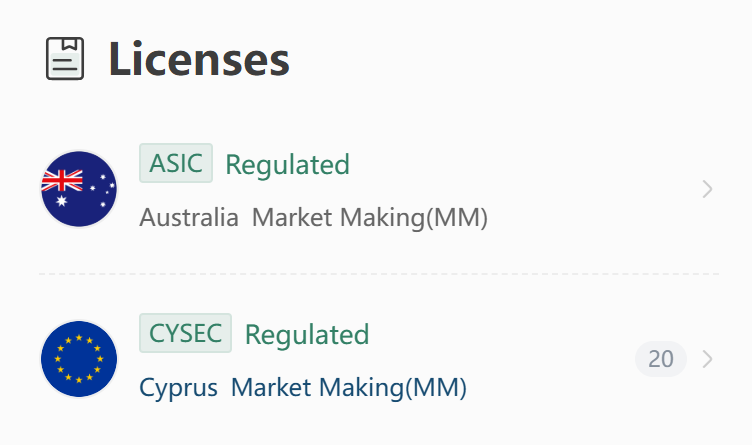

| Regulation | ASIC, CySEC | |

| Financial Instruments | 2,250+, CFDs on 61 currency pairs, 24 commodities, 2,100+ stocks, 25 indexes, 9 bonds, 21 cryptocurrencies, 4 futures | |

| Demo Account | ✅ (free for 30 days) | |

| Trading Platforms | MT4/5, cTrader, TradingView (Windows, Web, Android, Mac, iOS) | |

| Social Trading | ✅ | |

| Max. Leverage | 1:1000 | |

| Fees | Spreads & Commissions (Forex) | From 0.8 pips + commission-free (Standard account) |

| Deposit Fee | ❌ | |

| Withdrawal Fee | ❌ | |

| Customer Support | 24/7 - live chat, contact form, phone, email, Help Centre | |

| Open IC Markets Account | ||

Why Is IC Markets Trustworthy?

Regulatory Oversight: IC Markets is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies have strict guidelines and standards which brokers must adhere to, ensuring that they operate fairly and transparently.

Client Fund Safety: IC Markets hold client funds in segregated accounts with prestigious banks, separate from their own operating funds. This ensures that client money cannot be used for any other activities of the company.

Transparency: They are very transparent with their trading conditions, with detailed information about spreads, leverage, and other trading terms available on their website.

Established History: Founded in 2007, IC Markets has a long-standing history in the forex trading industry, adding to their credibility and reliability.

Positive Client Reviews: IC Markets generally receives positive client feedback, with many users praising its low spreads, fast execution speeds and responsive customer support.

Broad Product Offering: IC Markets offers trading on 2,250+ tradable instruments including CFDs on 61 currency pairs, 24 commodities, 2,100+ stocks, 25 indexes, 9 bonds, 21 cryptocurrencies, and 4 futures.

⑦ XTB

XTB - Best for educational resources

|

||

| Trust Score | ⭐⭐⭐⭐ | |

| Founded | 2002 | |

| Min. Deposit | £0 | |

| Regulation | CySEC, FCA | |

| Financial Instruments | 6,898, stocks, ETFs, forex, indices, commodities | |

| Demo Account | ✅ | |

| Trading Platforms | xStation5 (Mobile, Desktop, Tablet) | |

| Max. Leverage | 1:500 | |

| Fees | Spreads & Commissions (Forex) | From 0.5 pips + commission-free |

| Deposit Fee | ❌ | |

| Inactivity Fee | A monthly fee of 10 GBP will be charged if no purchase or sale transaction within 365 days | |

| Customer Support | 24/5 live chat, phone, email | |

| Open XTB Account | ||

Why Is XTB Trustworthy?

Regulation: XTB is regulated by some of the most respected financial regulatory bodies in the world, including the UK's Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).

Established History: XTB was founded in 2002 and has since maintained a strong reputation within the financial industry, enhancing their credibility and reliability.

Client Fund Protection: XTB holds clients' funds in segregated accounts separate from the company's own funds, ensuring that clients' investments are secure and cannot be used for any other purposes.

Transparency: XTB is known for its transparency when it comes to trading conditions, pricing, spreads, and fees.

Customer Satisfaction: XTB often receives positive client feedback highlighting their customer service, trading platforms, and educational resources.

Wide Range of Offerings: XTB offers a broad product portfolio that includes trading in stocks, ETFs, forex, indices, and commodities.

⑧ eToro

eToro - Best trusted forex broker for beginners

|

||

| Trust Score | ⭐⭐⭐⭐ | |

| Founded | 2007 | |

| Min. Deposit | $10 | |

| Regulation | ASIC, CySEC, FCA | |

| Financial Instruments | 7,000+, 6,202 stocks, 703 ETFs, 42 commodities, 55 currences, 18 indices, 106 cryptocurrencies | |

| Demo Account | ✅ ($100,000 in virtual funds) | |

| Trading Platforms | MT4, eToro proprietary platform | |

| Copy/Social Trading | ✅ | |

| Max. Leverage | 1:30 (retail)/1:400 (professional) | |

| Fees | Spreads & Commissions (Forex) | From 0.75 pips on EUR/USD + commission-free |

| Withdrawal Fee | Free (GBP and EUR accounts) or $5 (USD investment account) | |

| Inactivity Fee | $10/month applies to accounts with no logins in the previous 12 months | |

| Customer Support | 24/5 live chat, email | |

| Open eToro Account | ||

Why Is eToro Trustworthy?

Regulation: eToro operates in compliance with trusted regulatory bodies. It is regulated by the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC).

Transparency: eToro operates with high levels of transparency. It clearly outlines its charges and spreads to its customers, ensuring they have all the information they need to make decisions.

Social Trading: eToro has popularized social trading where users can follow and copy trades from experienced traders. This feature is seen as a commitment to customer success.

Security: eToro places a high emphasis on securing users' data and uses industry standard encryption practices to protect users against fraudulent activities.

Customer Feedback: Many users attest to eToro's trustworthiness, often citing positive experiences with the platform's features and support.

Range of Services: eToro offers 7,000+ tradable assets, including 6,202 stocks, 703 ETFs, 42 commodities, 55 currences, 18 indices, and 106 cryptocurrencies.

⑨ Forex.com

Forex.com - Best for forex trading

|

||

| Trust Score | ⭐⭐⭐⭐ | |

| Founded | 1999 | |

| Min. Deposit | $100 | |

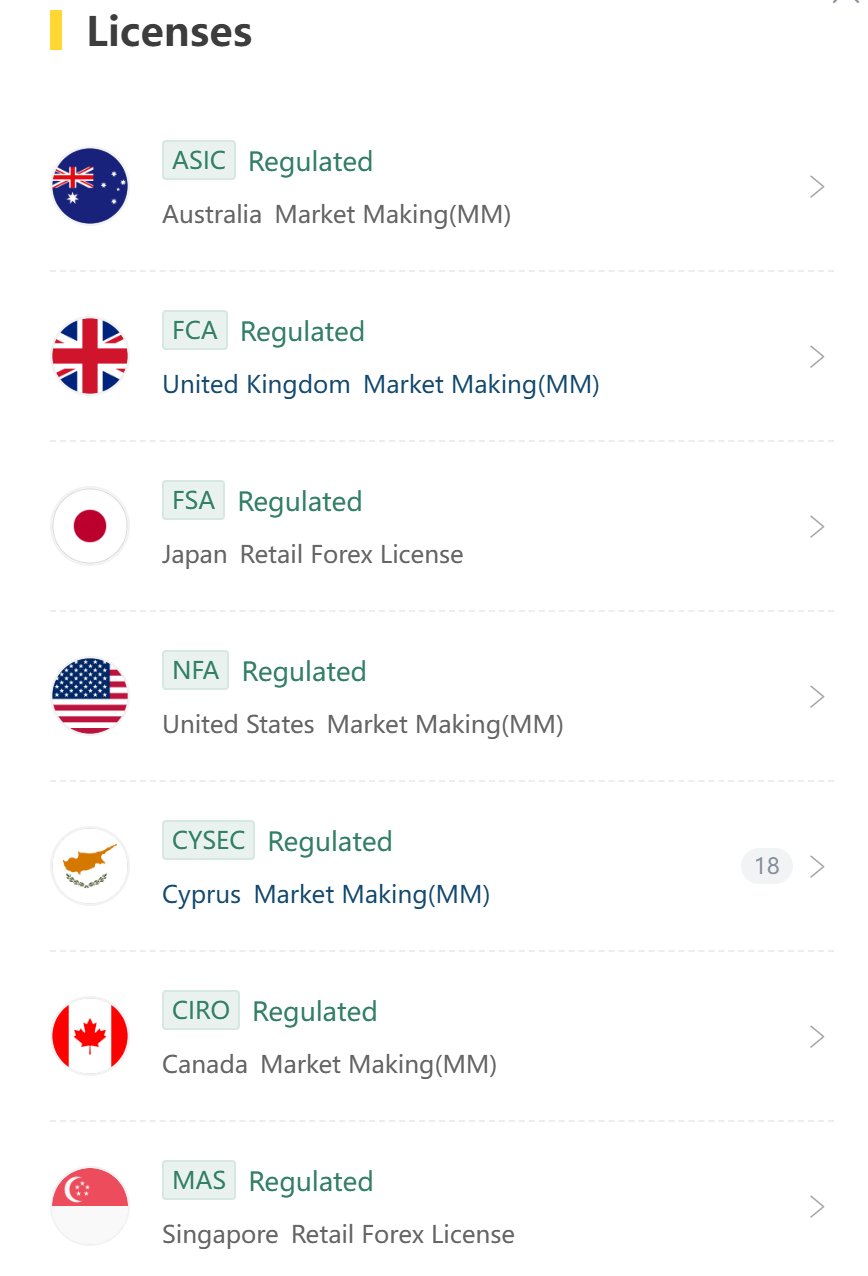

| Regulation | ASIC, FCA, FSA, NFA, CySEC, CIRO, MAS | |

| Financial Instruments | Forex, indices, stocks, cryptos, gold, oil & commodities, bullion | |

| Demo Account | ✅(90 days risk-free trading with $50,000 in virtual funds) | |

| Trading Platforms | Mobile app, Web Trader, TradingView, MT4/5 | |

| Max. Leverage | 1:200 | |

| Fees | Spreads & Commissions (Forex) | From 0.8 pips + commission-free (Standard account) |

| Deposit Fee | ❌ | |

| Withdrawal Fee | Credit/debit card: ❌ | |

| Wire transfer: additional fees may be applied by receiving bank | ||

| Customer Support | Live chat, contact form, phone, email | |

| Open Forex.com Account | ||

Why Is Forex.com Trustworthy?

Regulation: Forex.com is a trading name of GAIN Global Markets Inc. which is authorized and regulated by various other global bodies, including the UK's Financial Conduct Authority (FCA), the US's National Futures Association (NFA), and more.

Establishment: As one of the older online forex brokers, Forex.com has been serving clients since 1999. This long track record contributes to its perceived reliability.

Transparency: Forex.com is clear about fees, charges, and spreads, enabling traders to take these into account before making trading decisions.

Client Fund Protection: Forex.com holds client funds in segregated accounts separate from their own operational funds, ensuring that client money isn't used for the brokerage's business activities.

Technological Infrastructure: Forex.com offers robust and reliable trading platforms, including advanced platforms like TradingView and MT4/5, and its own proprietary platform.

Wide Offerings: Forex.com offers a broad range of tradable products including forex, indices, stocks, cryptos, gold, oil & commodities, and bullion.

Best Forex Brokers FAQs

What is forex trading?

Forex trading, also known as foreign exchange trading or currency trading, is the buying and selling of currencies on the foreign exchange market with the aim of making a profit. forex is one of the largest and most liquid markets in the world, with traders including large banks, central banks, institutional investors, currency speculators, corporations, governments, and other financial institutions.

The forex market is open 24 hours a day, five days a week, and currencies are traded worldwide among the major financial centers of London, New York, Tokyo, Zürich, Frankfurt, Hong Kong, Singapore, Paris, and Sydney.

Traders speculate on the price movement of one currency against another, hoping to make a gain from currency fluctuations and market volatility. For example, if a trader believes the US Dollar will increase in value against the Euro, they will buy US Dollars and sell Euros, or vice versa if they believe the opposite will occur.

What are the terms in forex you should know?

Understanding forex terminology is crucial for successful trading. Below are some key terms you should be familiar with:

| Pip (Percentage In Point) | The smallest price move in the forex market, usually the fourth decimal place in most currency pairs (0.0001). |

| Lot | A standard unit of measurement in forex trading. The standard lot is 100,000 units of the base currency. There are also mini (10,000 units) and micro (1,000 units) lots. |

| Spread | The difference between the bid (selling) price and the ask (buying) price of a currency pair. |

| Leverage | The ability to control a large position with a relatively small amount of money. For example, a leverage ratio of 100:1 means you can control $100,000 with $1,000 of your own capital. |

| Margin | The amount of money required to open and maintain a leveraged position. It is a fraction of the total trade size. |

| Ask Price | The price at which you can buy a currency pair. |

| Bid Price | The price at which you can sell a currency pair. |

| Base Currency | The first currency listed in a currency pair. e.g., in EUR/USD, the base currency is the Euro. |

| Quote Currency | The second currency listed in a currency pair. In EUR/USD, the quote currency is the US Dollar. |

| Stop-Loss Order | An order placed to sell a currency pair when it reaches a certain price, used to limit potential losses. |

| Take-Profit Order | An order placed to sell a currency pair when it reaches a certain profit level. |

| Long Position | Buying a currency pair with the expectation that its price will rise. |

| Short Position | Selling a currency pair with the expectation that its price will fall. |

| Slippage | The difference between the expected price of a trade and the actual price at which the trade is executed, often due to high volatility. |

Which forex broker is best for beginners?

For beginners, eToro is the most suitable because of its social trading feature. This allows beginners to observe and learn from successful traders, which can be helpful when they are starting out and building their knowledge and trading strategy.

Which forex broker is best for professionals?

For professionals, Interactive Brokers (IB) is a great choice. It offers lower transaction fees which is beneficial for high volume trading. These cost savings can add up over time for an active professional trader. In addition, IB's comprehensive trading platform, Trader Workstation (TWS) can provide advanced tools and features that can be used by professional traders for complex trading strategies.

What should I look for in a forex broker in 2026?

When choosing a forex broker in 2025, consider the following:

Regulation and Security: Ensure the broker is regulated by a reputable authority to safeguard your funds.

Trading Fees: Look for brokers with competitive spreads and low commissions to minimize trading costs.

Trading Platforms: Check if the broker provides a user-friendly and reliable trading platform, essential for executing trades efficiently.

Customer Support: Good customer service is crucial for resolving issues quickly and effectively.

Account Types: Opt for brokers offering account types that suit your trading style and needs, such as those with various leverage options and account features.

How to choose the best forex broker for my needs?

To find the best forex broker for your needs, start by evaluating your trading goals and preferences. Below are a few key aspects to consider:

Type of Trading: Determine whether you prefer day trading, swing trading, or long-term investing. For example, brokers like Saxo and Interactive Brokers (IB) are excellent for traders seeking advanced tools for both short-term and long-term strategies.

Trading Tools and Features: Look for brokers that offer advanced trading tools and educational resources. IG and XTB are known for their user-friendly platforms and extensive market analysis tools, making them ideal for traders at all levels.

Leverage and Margin: Choose a broker that offers leverage levels and margin requirements that suit your trading strategy. Pepperstone and IC Markets provide competitive pricing with low spreads, which can be crucial for traders looking for efficient trade execution.

What are the top forex brokers in 2026?

In 2026, some of the best forex brokers include Saxo, Interactive Brokers (IB), IG, XM, Pepperstone, IC Markets, XTB, eToro, and forex.com. Each of these brokers has distinct features that cater to different trading needs, from advanced trading platforms to competitive spreads and extensive educational resources.

Why is Saxo a top choice for forex trading?

Saxo stands out as a top choice for forex trading due to its powerful trading platform and extensive research tools. It caters to both individual and institutional traders by offering a broad selection of forex pairs and advanced trading features.

If youre looking for a broker that provides detailed market analysis and a range of sophisticated tools to support your trading strategies, Saxo is an excellent option.

You Also Like

Beware: 10 Fake Forex Brokers in the UK in 2026

With the need for caution in the UK's flourishing forex market, this article points out 10 fake brokers to avoid amidst numerous reputable entities.

Best CySEC Regulated Forex Brokers 2026

Delving into CySEC-regulated forex trading, this article presents a top 9 list of brokers, spotlighting the benefits of regulatory compliance.

Best SCA-regulated Forex Brokers in the United Arab Emirates (UAE)2026

This article explores the best SCA-regulated forex brokers in the United Arab Emirates, which provides you the useful guidance when choosing a forex broker within this region.

Best Forex Brokers in Italy for 2026

Compare top forex brokers in Italy with robust regulation, excellent platforms and broker reviews for secure trading.