In this article, we explore Forex trading under the oversight of the Cyprus Securities and Exchange Commission (CySEC). CySEC is renowned for its robust standards that ensure fairness and transparency in the Forex market.

Weve combined detailed research with both qualitative and quantitative analysis to bring you a curated list of the top 8 CySEC-regulated Forex brokers for 2026. Our evaluation considers essential factors such as regulatory compliance, trading conditions, transparency, risk management, and client support.

|

Established | 2001 |

| Country | Cyprus | |

| Website | https://www.cysec.gov.cy/en-GB |

Best CySEC Regulated Forex Brokers

more

Comparion of Best CySEC Regulated Forex Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best CySEC Forex Brokers Reviewed

① IC Markets Global

Offers tight spreads and wide market range

IC Markets Global is an Australian-based online forex broker that was established in 2007. It primarily caters to algorithmic traders through its offering of low spreads, fast execution, and strong international regulation. IC Markets provides a full suite of trading platforms catered to all levels of traders, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

The broker is known for its transparency, quality execution, and outstanding customer support. IC Markets is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), ensuring a high level of security for traders.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| CySEC No. | 362/18 |

| Regulation | CySEC, ASIC |

| Min. Deposit | $200 |

| Market Instruments | 2,250+, CFDs on 61 currency pairs, 24 commodities, 2,100+ stocks, 25 indexes, 9 bonds, 21 cryptocurrencies, 4 futures |

| Demo Account | ✅ |

| Max. Leverage | 1:1000 |

| Spreads & Commissions (Forex) | From 0.8 pips & commission-free (Standard account) |

| Trading Platforms | MT4/5, cTrader, TradingView (Windows, Web, Android, Mac, iOS) |

| Social Trading | ✅ |

| Payment Methods | MasterCard, Visa, PayPal, Neteller, Skrill, UnionPay, Wire Transfer, Bpay, Broker to Broker, POLi, Thai Internet Banking, Rapidpay, Klarna, Vietnamese Internet Banking |

| Customer Support | 24/7 - live chat, contact form, phone, email, Help Centre |

Pros:

√ Competitive Spreads and Commissions: IC Markets offers spreads from 0.8 pips and commission-free for the Standard account.

√ A Range Of Trading Platforms: IC Markets provides a wide range of platforms including MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

√ Strong Regulatory Oversight: IC Markets is regulated by leading financial authorities including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

Cons:

× High Minimum Deposit: IC Markets requires a high minimum deposit requirement of $200, while most brokers have no initial deposit threshold.

× Availability: IC Market services are not available in the United States of America, Canada, Brazil, Israel, New Zealand, Iran and North Korea (Democratic People's Republic of Korea).

② eToro

Known for its social trading platform

eToro is a global social trading platform that was launched in 2007. It is well-known for popularizing “social”, or “copy” trading, where users can follow and replicate the trades of successful individuals. With eToro, traders and investors have the ability to invest in 3000+ finaicial instruments including stocks, commodities, cryptoassets, currencies and indices.

Major features of eToro include social news feeds, copy trading options, and innovative investing tools. eToro's simplified trading platform is also suitable for beginners. It is regulated by the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC).

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| CySEC No. | 109/10 |

| Regulation | CySEC, ASIC, FCA |

| Min. Deposit | $10 |

| Market Instruments | 7,000+, 6,202 stocks, 703 ETFs, 42 commodities, 55 currences, 18 indices, 106 cryptocurrencies |

| Demo Account | ✅ ($100,000 in virtual funds) |

| Max. Leverage | 1:30 (retail)/1:400 (professional) |

| Spreads & Commissions (Forex) | Around 3 pips (EUR/USD) & commission-free |

| Trading Platforms | MT4, eToro proprietary platform |

| Social/Copy Trading | ✅ |

| Payment Methods | eToro Money, credit/debit cards, PayPal, Neteller, Skrill, Rapid transfer, iDEAL, Klarna / Sofort Banking, bank transfer, Online Banking – Trustly (EU region), Przelewy 24 |

| Withdrawal Fee | Free (GBP and EUR accounts) or $5 (USD investment account) |

| Inactivity Fee | $10/month applies to accounts with no logins in the previous 12 months |

| Customer Support | 24/5 live chat, email |

Pros:

√ Social Trading: eToro is known for its social trading feature, which allows users to follow and copy the trades of successful traders.

√ Wide Variety of Assets: eToro offers 7,000 tradable instruments, including 6,202 stocks, 703 ETFs, 42 commodities, 55 currences, 18 indices, and 106 cryptocurrencies.

√ User-Friendly Platform: eToro's platform is easy to use and suitable for beginners.

√ Strong Regulatory Oversight: eToro is regulated by several leading authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC).

Cons:

× Fees: eToro has higher fees compared to some other brokers, including withdrawal fees and inactivity fees.

× Limited Technical Analysis Tools: For advanced traders, eToro might lack in-depth technical analysis tools.

③ XM

User-friendly and rich education resources

XM is a multi-regulated and internationally recognized forex and CFD broker that was established in 2009. Based in Cyprus, XM provides a full-service trading experience by offering 1,000+ trading instruments, including forex, indices, commodities, turbo stocks, metals, energies, and thematic indices. In terms of platforms, they offer MetaTrader 4 and MetaTrader 5, catering to the needs of both beginner and experienced traders.

XM is known for its good quality educational resources, tight spreads, fast execution, and excellent customer service. The broker has strong regulatory oversight, being regulated by the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC) and the International Financial Services Commission (FSC) of Belize, the Dubai Financial Services Authority (DFSA) in the United Arab Emirates, and the Financial Sector Conduct Authority (FSCA) in South Africa, providing traders with a high level of security.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| CySEC No. | 120/10 |

| Regulation | CySEC, ASIC, DFSA, FSC (Offshore) |

| Min. Deposit | $5 |

| Market Instruments | 1,400+, forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, thematic indices |

| Demo Account | ✅ |

| Max. Leverage | 1:1000 |

| Spreads & Commissions (Forex) | From 1.6 pips & commission-free (Standard account) |

| Trading Platforms | MT4/5, XM App |

| Copy Trading | ✅ |

| Payment Methods | Credit/debit cards, bank transfers, e-wallets |

| Withdrawal Fee | ❌ |

| Customer Support | Live chat, phone |

Pros:

√ Wide Variety of Trading Instruments: XM offers 1,400+ trading instruments including forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, and thematic indices.

√ User-Friendly Trading Platforms: XM provides well-known and reliable platforms: MetaTrader 4 and MetaTrader 5.

√ Quality Educational Resources: XM is known for offering comprehensive educational materials, which can benefit both new and experienced traders.

√ Strong Regulatory Oversight: XM is regulated by several major financial regulatory bodies including CySEC, ASIC, DFSA, and FSC (Offshore).

Cons:

× Regional Restrictions: Clients from the United States of America, Canada, Argentina, Israel and the Islamic Republic of Iran are not allowed.

④ Pepperstone

Known for its trading platforms and competitive pricing

Pepperstone is an Australian-based online Forex and CFD Broker that was established in 2010. It's recognized as one of the premier brokers offering access to a range of markets including forex, commodities, indices, currency indices, cryptocurrencies, shares, and ETFs.

Known for its advanced technology, Pepperstone utilizes popular trading platforms such as MT4, MT5, cTrader, TradingView, and Pepperstone Trading Platform. They provide exemplary trading conditions, with tight spreads and a competitive commission structure. Pepperstone's commitment to transparency and customer service excellence differentiates it from its peers and positions it as a trusted choice for traders worldwide.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| CySEC No. | 388/20 |

| Regulation | CySEC, ASIC, FCA, DFSA, SCB (Offshore) |

| Min. Deposit | $0 |

| Market Instruments | Forex, shares, ETFs, indices, commodities, currency indices, cryptocurrencies, CFD forwards |

| Demo Account | ✅(30 days, $50,000 virtual funds) |

| Max. Leverage | 1:200 (Retail)/1:500 (Professional) |

| Spreads & Commissions (Forex) | Average 1.1 pips on EUR/USD & commission-free (Standard account) |

| Trading Platforms | TradingView, MT4/5, Pepperstone platform, cTrader |

| Social/Copy Trading | ✅ |

| Payment Methods | Apple Pay, Google Pay, Visa, MasterCard, Bank Transfer, PayPal, Neteller, Skrill, Union Pay, and USDT |

| Customer Support | 24/7 - phone, email, Help & Support |

Pros:

√ Access to Global Markets: Pepperstone provides low-cost access to a 1,200+ global markets, including forex, commodities, indices, currency indices, cryptocurrencies, shares, and ETFs.

√ Advanced Platforms: It offers advanced trading platforms including MT4, MT5, cTrader, TradingView, and Pepperstone App Trading Platform.

√ Competitive Spreads and Commissions: Pepperstone provides average EUR/USD spreads of 11 pips and commision-free on the Standard account.

Cons:

× High minimum deposit: The minimum deposit requirement to open a swap-free account is AUD$200 or equivalent.

× No clear info on deposits and withdrawals: Pepperstone does not specifically set the 'Deposit & Withdrawal' on the menu like other brokers. Traders can only get fragmented information from their website.

⑤ FP Markets

Great platform selection and fast execution

FP Markets is a top-tier, highly regarded online forex and CFD broker that was established in 2005. Based in Australia, FP Markets offers a wide array of trading instruments including forex, shares, metals, commodities, indices, digital currencies, bonds, and ETFs. It provides bMetaTrader 4, MetaTrader 5, cTrader, TradingView, WebTrader, and MT5 Mobile Trader platforms.

FP Markets is known for its tight spreads, fast execution speed, and extensive educational resources, making it a good fit for novice and experienced traders alike. The broker operates under the regulation of the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), which underscores its reliability and commitment to upholding high standards of business conduct.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| CySEC No. | 371/18 |

| Regulation | CySEC, ASIC |

| Min. Deposit | $100 AUD or equivalent |

| Market Instruments | 70+ forex currency pairs, 10,000+ stocks, 19 indices, commodities, bonds, metals, digital currencies |

| Demo Account | ✅ (free for 30 days) |

| Max. Leverage | 1:500 |

| Spreads & Commissions (Forex) | From 1.0 pips & commission-free (Standard account) |

| Trading Platforms | MT4/5, TradingView, cTrader, FP Markets Trading App |

| Social/Copy Trading | ✅ |

| Payment Methods | Visa, MasterCard, BPAY, UnionPay, POLi, PayPal, Skrill, Neteller, Fasapay, Bank Transfer |

| Deposit Fee | ❌ |

| Withdrawal Fee | ✔ |

| Customer Support | 24/7 live chat, phone, email |

Pros:

√ Multiple Trading Platforms: It provides MT4, MT5, cTrader, TradingView, and FP Markets Trading App platforms.

√ Competitive Spreads and Fast Execution: FP Markets is known for its tight spreads and quick execution speed.

√ Strong Regulatory Oversight: FP Markets is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

√ Extensive Educational Resources: FP Markets provides a variety of educational materials, useful for both new and experienced traders.

Cons:

× Region Restrictions: FP Markets does not offer services to residents from Afghanistan, Cuba, Islamic Republic of Iran, Iraq, Liberia, Libya, Myanmar, Palestine, Russian Federation, Somalia, Syrian Arab Republic, Sudan, Yemen, and United States.

⑥ FxPro

Flexible accounts and trading tools

FxPro is an online broker that offers trading in forex and a diverse range of CFDs, including those in forex, indices, shares, futures, energy, metals, and crypto. It was established in 2006 and has its headquarters in London, UK.

FxPro has won several awards over the years and is well known for its excellent execution speed and diverse trading platform options. The broker offers a variety of platforms, including the popular MetaTrader 4, MetaTrader 5, and cTrader, as well as FxPro Mobile App and FxPro WebTrader.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| CySEC No. | 078/07 |

| Regulation | CySEC, FCA |

| Min. Deposit | $100 |

| Market Instruments | Forex, crypto CFDs, metals, indices, futures, energy, shares |

| Demo Account | ✅ (up to 100k in virtual funds, 180-day life span) |

| Max. Leverage | 1:500 |

| Spreads & Commissions (Forex) | From 1.2 pips & commission-free (Standard account) |

| Trading Platforms | FxPro Mobile App, FxPro WebTrader, MT4/5, cTrader |

| Social/Copy Trading | / |

| Payment Method | FxPro Wallet |

| Deposit Fee | ❌ |

| Withdrawal Fee | ✔ |

| Customer Support | 24/5 - live chat, request a callback, phone, email |

Pros:

√ Strong Regulation: FxPro is regulated by multiple well-respected regulators, including the UK's Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC).

√ Multiple Trading Platforms: They offer several trading platforms to suit different trading styles, including MetaTrader 4, MetaTrader 5, cTrader, FxPro Mobile App, and FxPro WebTrader.

√ Execution Speed: FxPro is known for its fast trade execution speed, a crucial factor in trading.

Cons:

× Withdrawal Fee: Although FxPro does not charge deposit fee, withdrawal fee are required.

× Regional Restrictions: FxPro does not offer Contracts for Difference to residents of certain jurisdictions including the USA, Iran and Canada.

⑦ HFM (HF Markets)

Appreciated for customer service

HF Markets, also known widely as HotForex, is a multi-regulated international forex and commodities broker. They are known for offering a wide range of account types suitable for all kinds of traders. HF Markets provides trading services on numerous instruments including forex, commodities, metals, bonds, energies, ETFs, indices, cryptos, and stocks, across various platforms including MetaTrader 4 and MetaTrader 5. They stand out for their extensive educational resources, dedicated customer service, and competitive trading conditions.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| CySEC No. | 183/12 |

| Regulation | CySEC, FCA, DFSA, FSA (Offshore) |

| Min. Deposit | $0 |

| Market Instruments | 500+ CFDs on Forex, Commodities, Metals, Bonds, Energies, ETFs, Indices, Cryptos, Stocks |

| Demo Account | ✅ |

| Max. Leverage | 1:2000 |

| Spreads & Commissions (Forex) | From 1.2 pips & commission-free (Cent account) |

| Trading Platforms | MT4/5, HFM Trading App |

| Copy Trading | / |

| Payment Methods | UnionPay (only withdrawal), Wire Transfer, MasterCard, Visa, Crypto, Fasapay, Neteller, Skrill |

| Deposit & Withdrawal Fees | ❌ |

| Customer Support | 00:00 Monday to 23:59 Friday (Server Time) - live chat, contact form, phone, fax, email |

Pros:

√ Multi-regulated: Regulated by several top-tier regulatory bodies including CySEC, FCA, DFSA, and FSA (Offshore), which adds reliability.

√ Broad Offering: Provides access to 500+ CFDs on Forex, Commodities, Metals, Bonds, Energies, ETFs, Indices, Cryptos, and Stocks.

√ Multiple Platforms: Offers both MetaTrader 4 and MetaTrader 5 platforms.

√ Comprehensive Educational Resources: Webinars, videos, articles, and more for both beginners and experienced traders.

Cons:

× Regional Restrictions: Clients from the USA, Canada, Sudan, Syria, Iran, and North Korea are not allowed.

⑧ FBS

Offers competitive pricing and account variety

FBS is an international brokerage firm that specializes in providing online trading services primarily in the forex market. The company was established in 2009 and has grown significantly over the years, serving customers in more than 190 countries.

FBS offers a variety of account types to suit different trading styles, including Standard Accounts, Cent Accounts, and ECN Accounts. They also provide trading platforms including MetaTrader 4 and MetaTrader 5. FBS is known for offering competitive trading conditions such as tight spreads and high leverage.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| CySEC No. | 331/17 |

| Regulation | CySEC, ASIC, FSC (Offshore) |

| Min. Deposit | $5 |

| Market Instruments | 550+, currency pairs, metals, energies, indices, shares |

| Demo Account | ✅ |

| Max. Leverage | 1:3000 |

| Spreads & Commissions (Forex) | From 0.7 pips & from 0% commission |

| Trading Platforms | FBS app, MT4/5 |

| Social/Copy Trading | / |

| Payment Methods | Visa, MasterCard, Sticpay, etc. (vary by region) |

| Deposit Fee | ❌ |

| Withdrawal Fee | Visa/MasterCard (✔), Sticpay (❌) |

| Customer Support | 24/7 - live chat, Callback, Help Center |

Pros:

√ Broad Offering: FBS offers 550+ tradable instruments including currency pairs, metals, energies, indices, and shares.

√ Competitive Spreads: FBS provides competitive floating spreads from 0.7 pips, particularly on major Forex pairs.

Cons:

× Region Restrictions: Clients from the USA, the EU, the UK, Israel, the Islamic Republic of Iran, and Myanmar are not allowed.

CySEC Regulated Forex Brokers FAQs

What is CySEC?

CySEC stands for the Cyprus Securities and Exchange Commission. It's a tier-2 financial regulatory body in Cyprus, falling under the jurisdiction of the European MiFID regulatory framework. Forex brokers regulated by CySEC are required to meet certain financial requirements and to provide regular reports to the Commission.

How does CySEC Work?

The Cyprus Securities and Exchange Commission (CySEC) operates by regulating and supervising the financial markets, companies, and professionals within Cyprus to ensure transparency, fairness, and compliance with legal standards. CySECs key responsibilities include:

CySEC grants licenses to investment firms, brokers, and other financial entities, ensuring they meet strict regulatory requirements before operating.

The commission monitors the activities of financial markets and firms to ensure compliance with regulations, promoting market integrity and investor protection.

CySEC enforces financial laws by investigating potential breaches, imposing penalties, and taking legal action against entities or individuals violating regulations.

CySEC is dedicated to safeguarding investors by ensuring that firms operate transparently, providing accurate information and fair dealing practices.

CySEC offers guidance to both the public and regulated firms, promoting understanding of financial regulations and ensuring ongoing compliance.

CySEC utilizes the information gathered from its regulatory activities, public reports, and other sources to develop strategies that maintain the integrity of Cyprus's financial markets. Through its robust regulatory framework, CySEC aims to foster a safe and reliable financial environment in the region.

What does CySEC-regulated Mean for Forex Traders?

CySEC-regulated means that a forex broker is overseen by the Cyprus Securities and Exchange Commission (CySEC), a reputable financial regulatory body in the European Union. For forex traders, this regulation provides several benefits:

Investor Protection: CySEC-regulated brokers must adhere to strict rules and standards, including maintaining segregated client accounts to protect traders' funds.

Transparency: These brokers are required to provide clear and honest information about their services, fees, and risks, ensuring transparency in their operations.

Dispute Resolution: CySEC offers a framework for resolving disputes between traders and brokers, providing an additional layer of security for investors.

Compliance with EU Laws: Brokers under CySEC regulation must comply with the EU's Markets in Financial Instruments Directive (MiFID II), which enhances investor protection and ensures fair trading practices across Europe.

In summary, trading with a CySEC-regulated broker offers traders peace of mind, knowing that their broker is held to high standards of financial integrity and client protection.

What are CySEC Requirements for Forex Brokers?

The Cyprus Securities and Exchange Commission (CySEC) has stringent requirements for Forex brokers who wish to be regulated by them.

Minimum Capital

Forex brokers must have a minimum operational capital set by CySEC. This is meant to ensure that the broker has enough funds to function smoothly without the need to touch client funds.

Segregated Accounts

CySEC mandates that all client funds be kept in segregated accounts. This means that the funds the traders deposit must be kept separate from the broker's operational funds. This is to ensure that if the broker were to go insolvent, the clients funds would still be safe.

Regular Audits

Forex brokers regulated by the CySEC are subject to regular audits. The purpose of these audits is to ensure that brokers are properly managing their financial and operational obligations.

Compliance with the Law

Brokers have to comply with all relevant laws and regulatory standards under the Markets in Financial Instruments Directive (MiFID).

Member of the Compensation Fund

A CySEC-regulated broker is required to be a member of the Investor Compensation Fund (ICF), which can provide compensation of up to 20,000 Euros per person if the broker becomes insolvent.

Complaints Procedure

Brokers must provide traders a secure and methodological procedure for any complaints or grievances.

Risk Management

Brokers are obligated to implement effective risk management procedures and protocols.

Anti-Money Laundering Measures

Forex brokers have to enforce anti-money laundering procedures to prevent any illegal activities.

How is CySEC Compared to Other Forex Regulators?

| Feature | Detail |

| Stringency | CySEC has strict regulatory standards, similar to the FCA in the UK and ASIC in Australia, though it might be seen as slightly less stringent compared to the NFA in the US. |

| Investor Protection | CySEC requires brokers to segregate client funds from their own operational funds, providing robust protection for traders' assets, akin to regulations enforced by the FCA. |

| Global Reach | CySEC-regulated brokers can operate across the European Economic Area (EEA) and other international markets, similar to the global reach of ASIC-regulated brokers. |

| Client Education | CySEC promotes investor education about forex trading, though its emphasis might not be as pronounced as that of the CFTC in the US. |

Why Trade with CySEC Regulated Forex Brokers?

Trading with CySEC regulated Forex brokers offers several advantages:

Trust and Reliability

CySEC regulation provides an assurance that the broker operates under strict regulatory requirements, fostering trust and reliability.

Segregation of Funds

CySEC requires that brokers segregate client funds from the company's own operational funds, providing an extra level of safety for your deposits.

Compensation Scheme

Brokers regulated by CySEC are obliged to be part of the Investor Compensation Fund which provides protections to traders in case the company fails.

Transparency and Fairness

The transparency and fairness of trading operations are supervised by CySEC, which helps in preventing fraudulent activities.

Conflict Resolution

In case of a dispute between the trader and the broker, CySEC provides a mechanism for complaint resolution.

Regular Auditing

CySEC performs regular audits of its regulated brokers to ensure they continue to comply with the necessary regulations.

How to Check If a Forex Broker is Regulated by CySEC?

You can verify if a Forex broker is regulated by CySEC by following these steps:

Visit the CySEC website: Go to the official website of the Cyprus Securities and Exchange Commission.

Access the Regulated Entities list: On the website, look for a list of regulated entities.

Search for the Broker: In the list of regulated entities, search for the name of the broker you are interested in.

Verify the License: If you find the broker in the list, verify the status and number of their license. Active, valid licenses indicate that the broker is currently regulated by CySEC.

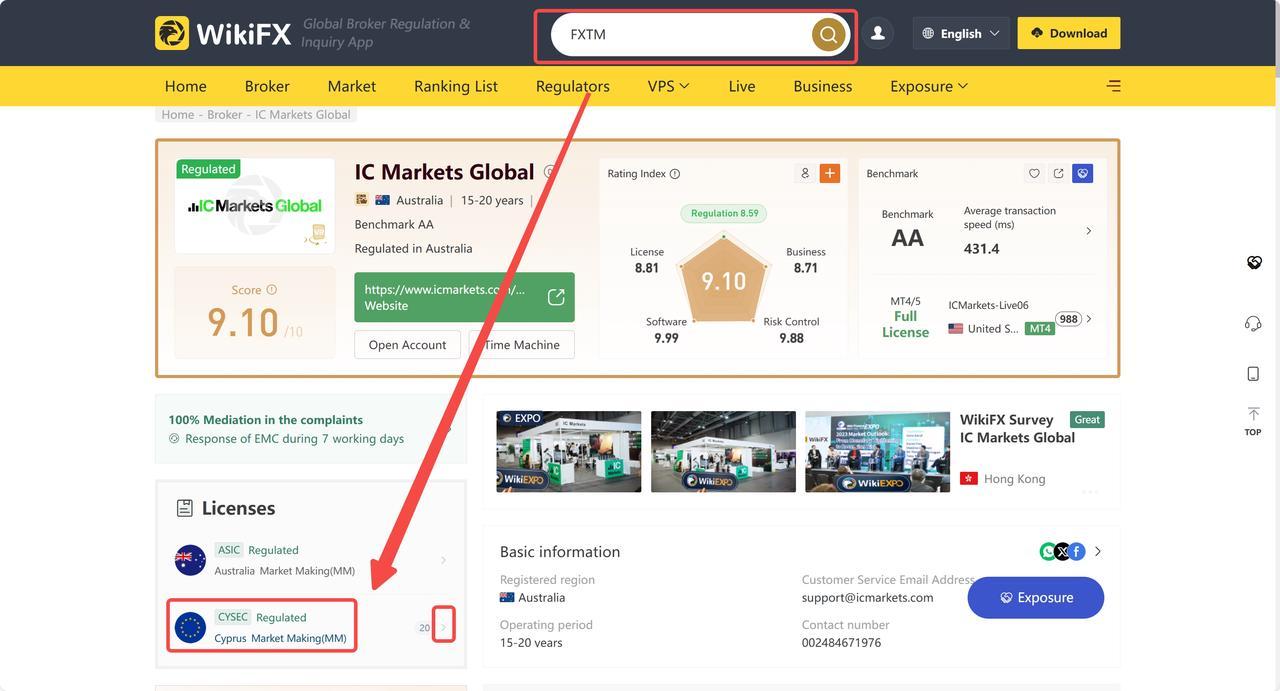

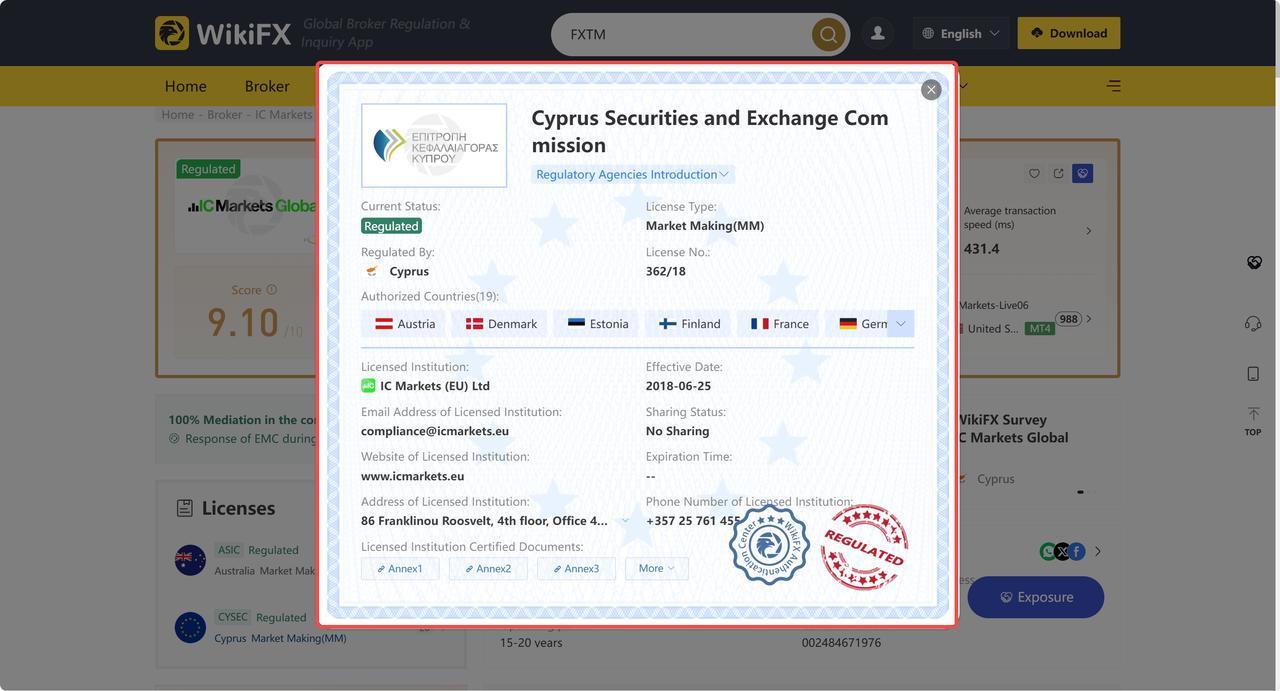

For a more straightforward approach, you can use WikiFX. Visit wikifx.com, type in the name of the broker in the search bar as shown in the screenshot below, and press enter.

In the broker's WikiFX page, look for the “Licenses” section on the left, locate the CySEC license, and click on it. Here, you can find the complete CySEC license. This method will help you conveniently verify your broker's CySEC regulation status.

Forex Risk Disclaimer

Trading Forex (foreign exchange) carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, risk appetite, and the possibility of incurring losses. There is a possibility that you may sustain a loss of some or all of your initial investment and therefore you should not invest money that you can not afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

You Also Like

Beware: 10 Fake Forex Brokers in the UK in 2026

With the need for caution in the UK's flourishing forex market, this article points out 10 fake brokers to avoid amidst numerous reputable entities.

Best CySEC Regulated Forex Brokers 2026

Delving into CySEC-regulated forex trading, this article presents a top 9 list of brokers, spotlighting the benefits of regulatory compliance.

Best SCA-regulated Forex Brokers in the United Arab Emirates (UAE)2026

This article explores the best SCA-regulated forex brokers in the United Arab Emirates, which provides you the useful guidance when choosing a forex broker within this region.

Best Forex Brokers in Italy for 2026

Compare top forex brokers in Italy with robust regulation, excellent platforms and broker reviews for secure trading.