The foreign exchange market, due to its enormous scale and staggering transaction amounts, has become an attractive target for financial fraudsters. In recent years, cases of forex scams in South Africa have been on the rise. Once you fall victim to fraud, these forex trading scams can lead to significant financial losses, and the ability to recover funds is often limited. Therefore, detecting the worst/fake forex brokers early on is the best defense.

Based on publicly available information and investigations by WikiFX experts, we have compiled a list of the top ten worst/fake forex brokers that trouble forex traders in South Africa in this article. Additionally, we have provided corresponding excellent brokers as alternatives for readers to consider.

For more information, please visit our website (https://www.wikifx.com/en) or download the WikiFX APP immediately.

10 Worst and Fake Forex Brokers in South Africa

more

10 Best Rated Forex Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Monfex

Monfex (https://www.monfex.com/) is an offshore brokerage firm that offers online trading services across multiple financial markets. The broker was established in 2018 and claimed to be a part of SWISS-SVG HOLDING LTD, purportedly regulated by the Financial Services Authority of Saint Vincent and the Grenadines (SVG FSA). However, after being exposed by several independent reviewers, the company appears to have removed this information from its website.

It is worth noting that SVG FSA does not issue licenses to forex traders or brokers and does not regulate, monitor, supervise, or grant licenses to foreign entities engaged in forex trading or brokerage activities. Therefore, even if it has not removed information about SVG FSA, Monfex remains an unregulated brokerage firm.

Monfex Alternative - IG

Founded in 1974, officially known as IG Markets ltd, IG has always been at the forefront of the industry and truly built the concept of financial spread betting that introduced online deals as early as 1998.

Under multiple top-tier regulations, including FCA in the UK, BaFin in Germany, and ASIC in Australia, IG is a large FX and CFD broker with a global presence and powerful trading technology. It exists to give traders access to hundreds of financial markets, allowing them to find possibilities that others cannot. IG has approximately 313,000 customers worldwide and operates in approximately 17,000 markets. And it currently has 17 sales locations on five continents, serving customers around the world.

| IG | Information |

| Registered Country/Region | Cyprus |

| Regulation | ASIC, FSA, DFSA, FCA, NFA, FMA, MAS |

| Founding Time | 1974 |

| Minimum Deposit | $0 |

| Maximum Leverage | 1:30 |

| Minimum Spreads | 0.6 pips on EUR/USD |

| Trading Platform | MT4, IG Proprietary |

| Trading Assets | currency pairs, commodities, indices, stocks, financial spread betting |

| Payment Methods | Bank Wires, ACH, Debit Cards |

| Customer Support | 5 /24 Live Chat, Phone, Emails |

Binomo

We have received over 40 requests for assistance from investors seeking help from WikiFX, complaining about their unpleasant experiences in the investment process with Binomo. Meanwhile, some investors and review websites believe it to be a reliable and convincing platform. In response to this, we have conducted a thorough investigation and research.

According to information provided on WikiFX (https://www.wikifx.com/en/dealer/9381559639.html), Binomo currently lacks a valid regulatory license and has a considerably low score of only 1.09/10!

Binomo claims to be headquartered in Grenada. Unfortunately, there is no information about “Binomo” in the database of the Financial Services Authority of Saint Vincent and the Grenadines. This implies that Binomo carries a high trading risk, and engaging in any financial activities not regulated by local regulatory authorities is illegal. Despite the company's claim to be a member of the International Financial Commission, this purported international institution lacks recognition and authority, offering no protection to investors.

Furthermore, the European Securities and Markets Authority (ESMA) has temporarily prohibited the sale of binary options to retail consumers across the European Union, including the UK, since July 2, 2018. Binomo, however, claims to be an online trading platform for binary options, indicating that it is likely a scam.

Lastly, Binomo only accepts deposits via credit cards, which is another red flag for fraud. According to financial regulations, credit cards are typically not allowed for use on forex trading platforms.

The above findings indicate that Binomo is a complete scam. Please refrain from using it for forex trading!

Binomo Alternative - FXCM

Founded in 1999, FXCM is regulated by 4 top-tier authorities , including UK's Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), the Financial Sector Conduct Authority of South Africa (FSCA), and the Cyprus Securities and Exchange Commission (CySEC).

FXCM is a leader in online foreign exchange (FX) trading, CFD trading, spread betting and related services. It is committed to providing global traders with access to the world's largest and most liquid markets. Clients can enjoy the advantages of financial mobile trading, one-click order execution and trading from real-time charts. In addition, FXCM offers FX trading education courses and provides trading tools, FX data and premium resources. FXCM Pro provides wholesale execution and liquidity opportunities to retail brokers, small hedge funds and emerging market banks, while providing primary brokerage services to high and medium frequency funds via FXCM Prime.

| FXCM | |

| Founded | 1999 |

| Headquarters | London, UK |

| Regulation | FCA, ASIC |

| Market Instruments | currency pairs, precious metals, commodities, global stock indices, treasury bonds |

| Demo Account | Available |

| Leverage | 1:30-1:400 |

| EUR/USD Spread | 1.3 pips |

| Trading Platforms | MT4 |

| Minimum deposit | $50 |

| Customer Support | 24/5 phone, email, and live chat |

HWFX

HWFX is a subsidiary of Holiway Investments Ltd, a company regulated and supervised by CySEC in Cyprus. HWFX seems to be attempting to establish its credibility by highlighting its CySEC regulation (License Number: 248/14). However, it's important to note that this license does not directly belong to HWFX itself but rather to its parent company, Haliway Investments Ltd. This is a significant indicator that suggests it might be a scam.

Furthermore, when we first encountered the withdrawal conditions hidden in some of the legal documents of the brokerage firm, the additional fees were surprisingly high. Apart from credit card withdrawals, fees seem to be everywhere. Any bank transfer incurs a fixed fee of $30, there is a $15 monthly charge for inactive accounts, a maintenance fee of 20 euros per year, and an “uncompleted” account is charged $30 every 15 days. This means that if you register but do not provide personal information other than credit card details, you will still be charged fees.

All of these factors combined indeed paint a picture of potential fraud with HWFX. We strongly recommend staying away from it!

HWFX Alternative - XM

XM is a large forex broker that commenced operations in 2009, with its main branch located in Cyprus. It is regulated and licensed by several top financial institutions, including CySEC, FCA, and ASIC. To date, its clientele spans over 196 countries, totaling over 10 million individuals, and its support staff is proficient in 30 languages. XM is recognized as one of the most reliable regulated brokers.

XM offers 1,429 different Contract for Difference (CFD) instruments, including 55 currency pairs. In addition, XM provides guaranteed execution, stop-loss, and limit orders for trades up to 50 lots (5 million currency units) – a unique feature that sets XM apart from numerous other forex brokers.

| XM | |

| Registered in | Cyprus |

| Regulatory status | ASIC, CYSEC, FSA, FSC and DFSA |

| Year(s) of incorporation | 10-15 years |

| Market instruments | Currency pairs, stocks, commodities, precious metals, energies, indices... |

| Minimum initial deposit | $5 |

| Maximum leverage | 1:1000 |

| Minimum spread | From 0.6 pips |

| Trading platform | MT5, MT4, own platform |

| Deposit and withdrawal methods | credit or debit card, Paypal, Skrill Moneybookers, Neteller, WebMoney, CashU, GiroPay |

| Customer Service | Email/phone number/address/live chat |

Vestle

Vestle, established in Cyprus in 2011 under the name iFOREX, operates in Limassol, Cyprus, where it has its offices. Vestle, formerly known as iFOREX, is the trading name of iCFD Limited. Its establishment was aimed at managing its operations for the European Economic Area (EEA). However, they also accept clients from China, Malaysia, Mexico, the United Arab Emirates, Indonesia, as well as the overseas territories of member countries of the European Economic Area.

Vestle is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 143/11. However, our investigation results indicate that this license appears to be suspiciously cloned.

Vestle Alternative - FxPro

Founded in 2006, FxPro has emerged as a key player in the online trading arena. The broker's commitment to transparency, innovation, and client satisfaction has propelled it to the forefront of the financial industry. With a focus on providing advanced trading solutions, FxPro caters to the diverse needs of traders worldwide.

FxPro is a well-regulated company with licenses from 5 different regulators and continues to grow, including the UK's FCA, the CySEC of Cyprus, the South Africa's FSCA , the SCB in the Bahamas and the FSCM of Mauritius. FxPro now serves retail traders and institutional clients from over 173 countries through more than 2 Million Trading accounts.

| FxPro | Basic Information |

| Company Name | FXPRO UK Limited |

| Founded | 2006 |

| Headquarters | London, UK |

| Regulations | FCA, CySEC |

| Tradable Assets | Forex, Stocks, Futures, Indices, Metals, Energies, Cryptocurrencies |

| Account Types | Demo Account, Live Account |

| Minimum Deposit | $100 |

| Maximum Leverage | 1:200 |

| Deposit & Withdrawal | Bank Transfer, Credit/Debit Cards, PayPal, Skrill, Neteller, China UnionPay, mPay, FasaPay, Webmoney |

| Trading Platforms | MetaTrader 4, MetaTrader 5, cTrader, FxPro Trading Platform |

| Customer Support | Multilingual customer support through Phone, Email, Live Chat |

| Education Resources | Webinars, Articles, Videos, eBooks, Tutorials |

FXtrade777

FXtrade777 is affiliated with Silver Wolf Limited, a company registered as an offshore entity in the Marshall Islands. The Marshall Islands are notorious for their lack of stringent requirements and regulations. The IT and financial management services of FXtrade777 are provided by Blond Bear OU, located in Tallinn, Estonia. This company has received multiple warnings from regulatory bodies such as FSMA.

Additionally, we have observed that the FXtrade777 website is inactive. This implies that the broker has ceased providing trading services and is no longer operational. Therefore, we strongly advise staying away from it and maintaining vigilance at all times.

FXtrade777 Alternative - Tickmill

Tickmill, founded in 2014, emerges as a reputable and client-centric forex broker, providing a secure and transparent trading environment. With a diverse range of accounts, competitive fees, advanced trading platforms, and a commitment to customer satisfaction, Tickmill stands as a reliable choice for traders seeking a comprehensive and rewarding trading experience.

Tickmill places a strong emphasis on regulatory compliance and security. Holding licenses from esteemed authorities such as the Financial Conduct Authority (FCA), Cyprus Securities and Exchange Commission (CySEC), and Seychelles Financial Services Authority (FSA), Tickmill prioritizes the protection of clients' funds and ensures adherence to strict industry standards.

| Tickmill | |

| Founded | 2014 |

| Headquarters | London, UK |

| Regulation | FCA, CySEC, FSCA, LFSA |

| Market Instruments | Forex, stock indices, stocks & ETFs, bonds, commdities, cryptos, futuires & options |

| Demo Account | Available |

| Leverage | 1:1-1:500 |

| Spread frm | 1.6 pips (Classic) |

| Trading Platforms | MT4, MT5, Tickmill Mobile App |

| Minimum deposit | $/€/£/R100 |

| Customer Support | Live chat, phone, email, social media, FAQ |

FX Options24

FX options24 provides an online platform for trading various financial products, including binary options, forex, contracts for difference, and cryptocurrencies. As of February 2018, the platform had over 50,000 traders. The broker is a subsidiary of FX options 24group Ltd. in Germany. According to FX options24, as of July 28, 2021, the company's name has been changed to Tracxn Technologies Limited. It claims to be a broker regulated by FCA, BaFin, and CySEC.

However, when we conducted searches on well-known financial institutions such as FCA, BaFin, and CySEC, we found that all three institutions have declared this broker to be a clone company. We have also recorded the license information, which can be viewed on wikifx.com for more details.

FX Options24 Alternative - Saxo

Saxo Bank, the Danish investment bank group, was founded in 1992 and serves as an international trading platform designed to offer multi-asset trading services to global traders. Embracing technological advancements of the late 1990s, the company launched its first online trading platform in 1998. Saxo Bank has been operating in the United Kingdom through its subsidiary, Saxo Capital Markets UK Ltd. (SCML), since 2006. Saxo Market is regulated by multiple institutions, including ASIC, FCA, FSA, SFC, BDF, CONSOB, FINMA, and MAS. These regulatory bodies are globally renowned for their strict enforcement of market practices to ensure fairness for individuals and businesses. Consequently, Saxo's security is robustly safeguarded.

In terms of the trading experience, Saxo is also at the forefront. When constructing its trading platforms, SaxoTraderPRO (downloadable) and SaxoTraderGO (web-based), Saxo Bank thoroughly considered the needs of end-users (traders), making significant upgrades beyond industry-standard MT4 and competitors' products. Moreover, seamless integration with third-party tools has opened up numerous possibilities for advanced traders.

| Saxo | |

| Founded | 1992 |

| Headquarters | Hellerup, Denmark |

| Regulation | ASIC, FCA, FSA, SFC, BDF, CONSOB, FINMA, MAS |

| Market Instruments | Forex, stocks, futures, options, bonds, ETFs and CFDs |

| Demo Account | Available |

| Leverage | 1:100 |

| EUR/USD Spread | 0.4 pips |

| Trading Platforms | SaxoInvestor, SaxoTraderGO, SaxoTraderPRO |

| Minimum deposit | HKD10,000 |

| Customer Support | 24/5 phone, email |

MaxiTrade

MaxiTrade is an unregulated forex broker lacking recognition from well-established regulatory bodies such as CFTC or FCA. The website does not provide an address, and the “About Us” page on its official site states that “Maxitrade was founded by Day Dream Investments.” However, a search on the WikiFX official website reveals that the actual previous parent company was Market Solutions, causing serious concerns about the transparency of information.

Additionally, on the WikiFX website, we found many traders reporting issues with this broker, including difficulties with withdrawals, unexpected fees, and poor customer service. The broker's aggressive marketing strategy, particularly targeting inexperienced traders with promises of high returns while downplaying risks, has raised further doubts about its credibility and ethics.

MaxiTrade Alternative - Forex.com

Forex.com is one of the most respected and trusted forex brokers in the forex trading industry. Established in 2001, Forex.com is a global company, with its parent company StoneX listed on Nasdaq (Nasdaq stock code: SNEX). Forex.com holds licenses and is regulated by several prominent regulatory bodies, including ASIC in Australia, FCA in the UK, FSA in Japan, NFA in the United States, IIROC in Canada, CIMA in the Cayman Islands, and MAS in Singapore. These regulatory bodies are known for their strict compliance and supervisory requirements, indicating that Forex.com must meet high ethical and operational standards to protect clients and ensure the safety of their funds.

In terms of the trading experience, Forex.com leads the industry with its extensive markets, and its multi-asset products perform exceptionally well on its flagship Advanced Trading (desktop) and Web Trading (browser) platforms. Its Web Trader features advanced charting capabilities from TradingView, seamlessly integrated for easy access with the same username. With the acquisition of Chasing Returns, real account holders at FOREX.com can now access performance analytics for free.

| Forex.com | |

| Registered in | USA |

| Regulated by | FCA (UK), IIROC (Canada), NFA(USA), ASIC (Australia), and CySEC (Cyprus), MAS ( Singapore), CIMA ( Cayman Islands) |

| Year(s) of incorporation | More than 20 years |

| Market instruments | currency pairs, precious metals, energies, indices, bonds, cryptocurrencies and equities |

| Minimum initial deposit | $100 |

| Maximum leverage | Variant |

| Minimum spread | Floating |

| Trading platform | Forex.com and MT5 |

| Deposit and withdrawal methods | credit card (Visa, Mastercard, Maestro), bank wire transfer, Skrill and Neteller |

| Customer Service | E-mail address/live chat |

Wigmarkets

Wigmarkets has not disclosed any information about the company behind the brand. Despite claiming to be located in Belfast, United Kingdom, Wigmarkets does not appear to be regulated by the Financial Conduct Authority (FCA) or any other regulatory body. Furthermore, the company's official website provides a contact phone number with a German code, adding to the confusion and suspicion. Additionally, the Italian regulatory authority CONSOB has issued warnings about Wigmarkets.

Due to the lack of regulation, opaque information, and warnings from regulatory authorities, the WikiFX official website gives Wigmarkets a very low rating (0.35/10). It is advised to stay away from it when choosing a forex broker.

Wigmarkets Alternative - IC Markets

IC Markets is an online forex and contract for difference (CFD) broker based in Australia, providing traders with opportunities to access global financial markets. The company was founded in 2007 and maintains regulatory compliance in Australia and Cyprus, adhering to the respective financial regulatory standards of these jurisdictions.

In terms of the trading experience, IC Markets offers a range of trading instruments, including forex, indices, commodities, and cryptocurrencies. It provides traders with advanced trading platforms such as MetaTrader 4, MetaTrader 5, and cTrader. IC Markets' low costs and scalable execution make it well-suited for traders looking to run algorithmic strategies. The company also offers 24/7 customer support and a variety of educational resources for traders at all levels.

| IC Markets | |

| Registered in | Australia |

| Regulated by | ASIC, CYSEC |

| Founded in | 2007 |

| Trading instruments | Forex pairs, commodities, stocks, cryptocurrencies, indices, bonds, futures |

| Minimum Initial Deposit | $200 |

| Maximum Leverage | 1:500 |

| Minimum spread | 0.0 pips onwards |

| Trading platform | MetaTrader4, MetaTrader5, cTrader |

| Deposit and withdrawal method | Neteller, skrill, bank transfer, VISA, Mastercard, paypal, credit card, debit card, unionpay, poli, wire transfer, rapidpay, klarna |

| Customer Service | Email, phone number, address |

iFXOption

iFXOption is an online trading broker under Elle LNavire Kft. According to the website, iFXOption claims to be a member of the Financial Services Compensation Scheme (FSCS) and the Investor Compensation Fund (ICF), the latter being governed by the laws of the Republic of Cyprus. Both FSCS and ICF supposedly protect clients when authorized financial service companies go out of business. However, we couldn't find any information about iFXOption being authorized. This suggests that iFXOption engages in false advertising, and traders may face substantial losses. iFXOption has been banned by the local regulatory authority CNMV in Spain.

Furthermore, after conducting research on various social media platforms (Facebook, Twitter, Instagram) and online trading forums, WikiFX found a common theme: users are dissatisfied with their experiences with iFXOption. Various indicators suggest that iFXOption does not appear to be a trustworthy broker, and the WikiFX official website gives it an extremely low rating (0.35/10). Therefore, it is advised to stay away from it.

iFXOption Alternative - Avatrade

Avatrade is an online forex and contract for difference (CFD) broker that was established in 2006. Headquartered in Dublin, Ireland, the company is regulated by various global financial institutions, including ASIC, CBI, FSA, FSCA, FSC, CBI, and FFAJ. These regulatory bodies ensure that Avatrade operates transparently, with integrity and compliance to regulatory requirements. Avatrade boasts 300,000 registered traders, conducting over 3 million trades per month, and has executed transactions worth over 1.47 trillion USD since its inception.

In terms of the trading experience, Avatrade excels in certain specific areas. For trading platforms, in addition to MetaTrader, Avatrade offers its proprietary platforms AvaTrade WebTrader and AvaTradeGO, along with innovative features like AvaProtect. In options trading, the AvaOptions application, supported by Sentry Derivatives, provides Avatrade customers with an excellent mobile trading platform for forex options.

| AvaTrade | Basic Information |

| Founded | 2006 |

| Headquarters | Dublin, Ireland |

| Regulation | ASIC, CBI, FSA, FSCA, FSC, CBI, FFAJ |

| Type of Broker | Market Maker |

| Minimum Deposit | $100 |

| Tradable Assets | Forex, CFDs, Stocks, Indices, Commodities, Cryptocurrencies |

| Leverage | 1:30 (for retail clients), 1:400 (for professional accounts) |

| Min. Spreads | 0.9 pips on the EUR/USD pair |

| Trading Platforms | AvaTradeGO, MT4, MT5, WebTrader, AvaOptions, DupliTrade |

| Mobile Trading | Yes |

| Payment Methods | Credit/Debit Card, Bank Transfer, E-wallets, Rapid Transfer |

| Customer Support | Live Chat, Phone, Email, Knowledge Base |

| Educational Material | Webinars, E-books, Trading Videos, Articles, Academy |

AM Broker

The AM Broker forex broker website leaves a very positive first impression. The design of the website is excellent, with no technical flaws and easy navigation. It is evident that the broker has invested sufficient funds to create a well-functioning website that provides good service to traders. Therefore, from the broker's website perspective, everything seems legitimate.

However, there is a mismatch between the company's regulation and its operational areas, which raises concerns. AM Broker is headquartered in Saint Vincent with the registration number 24863 IBC 2018 and approval from the local Financial Services Authority. However, the broker's main client base comes from several Asian and most African countries, where the broker lacks regulation or licensing.

WikiFX has noted these discrepancies, and the unregulated operations detract from the positive impression that the company's good website initially creates. Because it appears to be surface efforts made for potential fraudulent activities, we have given it an extremely low rating (0.35/10).

AM Broker Alternative - Exness

Exness is a leading forex broker founded in 2008 in Saint Petersburg, Russia. The company is headquartered in Cyprus and is regulated by the UK's FCA, Cyprus' CySEC, South Africa's FSCA, and Seychelles' FSA. Multiple regulatory approvals demonstrate its commitment to transparency and the security of client funds. You can find detailed regulatory information on the WikiFX website.

In terms of the trading experience, powerful trading platforms such as MetaTrader 4 and 5, Exness Web Terminal, and the Exness Trader application cater to various trading preferences. These platforms, combined with Exness's competitive spreads and fast execution times, create an efficient trading environment.

| Exness | |

| Registered in | Cyprus |

| Regulated by | FCA, CYSEC, FSCA, FSA |

| Founded in | 2008 |

| Market instruments | forex, precious metals, energy, indices, stocks |

| Minimum initial deposit | $10 |

| Maximum leverage | Unlimited |

| Minimum spread | From 0.0 pips |

| Trading platform | MT5, MT4, own platform |

| Deposit and withdrawal methods | Credit/debit cards, skrill, neteller, neteller |

| Customer Service | E-mail/phone number/address/live chat |

Forex Frequently Asked Questions

Is Forex Trading Legal in South Africa?

Forex trading is legal in South Africa, with the South African Reserve Bank overseeing currency exchange. However, traders are required to declare their forex income in their income tax. South Africa does not regulate unregulated brokers, and traders are not obligated to use regulated brokers. Consequently, many unregulated brokers are on the rise. Nevertheless, there are numerous regulated local and offshore brokers in South Africa. The worst forex brokers in South Africa, however, do not adhere to any rules, making traders more susceptible to scams. Therefore, being aware of forex trading scams in South Africa can help traders avoid fraud.

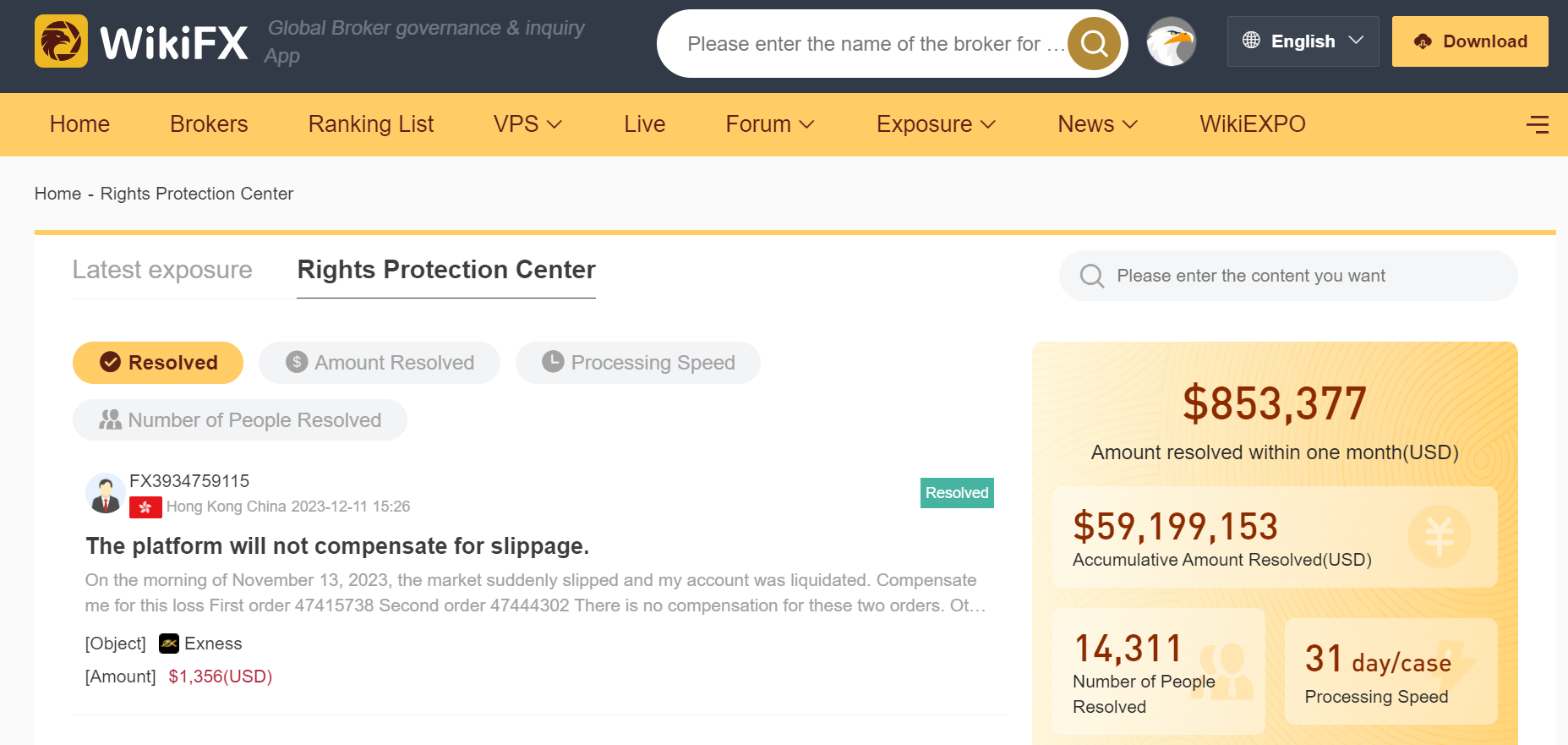

WikiFX provides comprehensive ratings in five categories, including License Index, Business Index, Risk Control Index, Software Index, and Regulation Index, to assist traders. Before investing, it is advisable to check broker information and user reviews on WikiFX. You can also expose forex scams on WikiFX. WikiFX strives to help you expose fraudulent activities and alert others to avoid falling victim. Additionally, it is recommended that scam victims seek assistance directly from local authorities or legal professionals.

WikiFX, a professional tool for querying forex broker information, ensures the safety of your investments!

What is the Business Model of a Scam Forex Brocker in South Africa?

Scam forex brokers are companies established with the sole purpose of stealing funds from deposited clients. Their business model is quite straightforward: A group of individuals engage potential clients 24/7 through social media.

Subsequently, “sales representatives” contact new traders via phone or messaging platforms like Messenger, Telegram, or WhatsApp, persuading them to deposit a small amount of funds with promises of six-figure profits.

Novice traders typically deposit only a few hundred dollars. Over the next few days, brokers inflate the available funds in your account to incredible amounts, such as $700,000. They claim to have executed profitable trades using your initial deposit to demonstrate the effectiveness of their trading system.

Sales tactics can be very aggressive, pressuring clients to deposit increasing amounts of funds. The catch is that you won't be able to withdraw a single dollar!

When attempting to withdraw the fictitious profits, they often inform you that you must first pay some form of tax and then prepay a certain amount, typically thousands of dollars.

Many fall for this trick, depleting their life savings. Most individuals panic and start seeking advice online. Often, it's too late, and at this stage, you have become a victim of an unregulated forex broker scam. Even if you report the case to local authorities, the chances of recovering your funds are minimal.

Unregulated forex brokers are elusive, with no headquarters, false contact information, and offshore bank accounts, leaving your funds lost without a trace.

How to View Complaints From Forex Traders?

Every day, thousands of forex traders post complaints on various social platforms. However, these complaints may not necessarily be truly helpful to you.

When traders incur losses, they often blame brokers, even if the brokers are regulated and treat them fairly. You should always approach former clients speaking ill of regulated companies with caution because, in most cases, clients are merely frustrated due to their own financial losses and are unwilling to accept responsibility. Their frustration is often misplaced, unrelated to the broker, and they need to reassess their trading strategies.

A common complaint involves brokers allegedly hunting for stop-loss levels. However, in most cases, the reality is that their stop-loss orders have already been executed, eliminated by normal market behavior.

Complaints that deviate from the situations described above are the ones you should pay attention to. For instance, reports about fraudulent forex brokers or exposure to scams are more relevant. Wikifx collects and organizes complaint information from various social platforms, presenting investors with the most genuine and reliable reviews. Utilizing wikifx can help you accurately filter out brokers engaged in unlicensed operations or poor regulatory practices.

How Do I Get Money From a Fake or Scam Broker?

Typically, engaging with fake or scam brokers results in irreversible financial losses. These deceptive entities often establish transient domains to orchestrate trading manipulations, swiftly disappearing after defrauding substantial sums of money.

To help victims, I suggest contacting the WikiFX Exposure Center. By providing evidence of the fraud, WikiFX conducts in-depth investigations, reassesses the credibility of the risky platform, and aids in safeguarding investors' rights. Additionally, in addressing withdrawal challenges faced by legitimate brokers, WikiFX has introduced the EMC Rights Protection Channel, dedicated to advocating for swift resolutions. Notably, WikiFX has successfully exposed over 7000 illicit platforms, recovering more than $90 million for over 25,000 affected investors.

Disclaimer

Traders need to understand and remember that Contracts for Difference (CFDs) are leveraged and complex products, which may involve the risk of incurring losses exceeding the trader's initial deposit. Traders must ensure that they comprehend their own risk exposure and should assess whether the risks involved are suitable for them before making trading decisions that could potentially lead to capital losses.

Bottom Line

As the forex market continues to evolve, forex scams are becoming increasingly common, especially in South Africa. This article, based on comprehensive scores in five categories: license index, business index, risk control index, software index, and regulatory index, has identified the lowest-rated 10 junk brokers. It is strongly recommended to steer clear of them when selecting a broker.

Certainly, there are more junk brokers beyond the mentioned 10, and we cannot list them all. Therefore, we also provide you with 10 outstanding brokers as alternatives. You can choose a broker that suits your trading habits and location.

For more information, please visit our website (https://www.WikiFX.com/en) or download the WikiFX app immediately.

You Also Like

Best Forex Brokers in Turkey for 2024

Review top 9 forex brokers in Turkey, elevating their trading pros and cons to give traders more useful guidance.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Swiss Forex Brokers for 2024

Explore top 10 forex brokers in Switzerland, elevating their trading pros and cons to give traders more useful guidance.

Best Stock Brokers in the US for 2024

When choosing an online broker, finding the platform that best fits your investment needs is crucial. With the rise in popularity of online trading, more brokers are offering free stock trading and commission-free transactions for various assets. It has become a challenge for users to select suitable brokers.

Best CySEC Regulated Forex Brokers 2024

Delving into CySEC-regulated forex trading, this article presents a top 9 list of brokers, spotlighting the benefits of regulatory compliance.

8 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 8 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Forex Brokers in 2024

Guide to the most trusted Forex brokers, with a thorough investigation into their quality, security measures, and financial transparency.