Score

IG

United Kingdom|Above 20 years| Benchmark D|

United Kingdom|Above 20 years| Benchmark D|https://www.ig.com/en

Website

Rating Index

Benchmark

Benchmark

D

Average transaction speed (ms)

MT4/5

Full License

IG-LIVE2

Capital Ratio

Great

Capital

Influence

AAA

Influence index NO.1

Japan 8.88

Japan 8.88Benchmark

Speed:A

Slippage:D

Cost:B

Disconnected:AA

Rollover:A

MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomCapital Ratio

Capital Ratio

Great

Capital

Influence

Influence

AAA

Influence index NO.1

Japan 8.88

Japan 8.88Contact

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 40 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic information

United Kingdom

United KingdomA Visit to IG in Australia – No Office Found

The survey team went to Australia to visit broker IG as scheduled, but didn’t find the company at its regulatory address. This denotes that the broker doesn’t have a physical business office at the place. Accordingly, investors are advised to make an informed decision following much deliberation.

Australia

AustraliaA Visit to IG in UK - Office Found

The investigators went to London, UK to visit the foreign exchange broker IG as scheduled, and spotted the broker’s name at its currently registered business address, indicating that the broker has a physical business office here. Unfortunately, the survey personnel were not able to enter the company for a special visit, so the specific scale of its business is unknown. Investors are advised to ma

United Kingdom

United KingdomA Visit to IG in Dubai UAE -- Office Found

The investigators went to Dubai, UAE to visit the foreign exchange dealer IG as planned, and found the dealer’s office at its foreign exchange regulatory address. The office location is real. Investors are advised to choose the dealer carefully.

United Arab Emirates

United Arab EmiratesA Visit to IG in Japan -- Office Confirmed Existed

The survey team went to visit the dealer IG in Tokyo, Japan as planned. The dealer’s logo can be found on the publicly displayed address, indicating that the dealer had a real business place. However, the surveyors failed to enter the company for further visit, so the specific scale of the business remained unknown. Please be prudent when trading with this broker.

Japan

JapanA Visit to the Singapore Broker IG

The visit by surveyors confirmed the authenticity of IG’s regulatory address. The surveyor was informed from a website that the broker held three full licenses issued by ASIC, FCA and FMA, as well as two retail forex licenses issued by FSA and MAS.Investors are advised to resort to their good judgement after consulting the said above.

Singapore

SingaporeA Visit to IG in Australia – No Office Found

The survey team went to Australia to visit broker IG as scheduled, but didn’t find the company at its regulatory address. This denotes that the broker doesn’t have a physical business office at the place. Accordingly, investors are advised to make an informed decision following much deliberation.

Australia

AustraliaA Visit to IG in UK - Office Found

The investigators went to London, UK to visit the foreign exchange broker IG as scheduled, and spotted the broker’s name at its currently registered business address, indicating that the broker has a physical business office here. Unfortunately, the survey personnel were not able to enter the company for a special visit, so the specific scale of its business is unknown. Investors are advised to ma

United Kingdom

United KingdomA Visit to IG in Dubai UAE -- Office Found

The investigators went to Dubai, UAE to visit the foreign exchange dealer IG as planned, and found the dealer’s office at its foreign exchange regulatory address. The office location is real. Investors are advised to choose the dealer carefully.

United Arab Emirates

United Arab EmiratesA Visit to IG in Japan -- Office Confirmed Existed

The survey team went to visit the dealer IG in Tokyo, Japan as planned. The dealer’s logo can be found on the publicly displayed address, indicating that the dealer had a real business place. However, the surveyors failed to enter the company for further visit, so the specific scale of the business remained unknown. Please be prudent when trading with this broker.

Japan

JapanA Visit to the Singapore Broker IG

The visit by surveyors confirmed the authenticity of IG’s regulatory address. The surveyor was informed from a website that the broker held three full licenses issued by ASIC, FCA and FMA, as well as two retail forex licenses issued by FSA and MAS.Investors are advised to resort to their good judgement after consulting the said above.

Singapore

SingaporeAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed IG also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Benchmark

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Singapore

United Kingdom

South Africa

ig.com

Server Location

United Kingdom

Most visited countries/areas

United States

Website Domain Name

ig.com

Website

WHOIS.MARKMONITOR.COM

Company

MARKMONITOR INC.

Domain Effective Date

0001-01-01

Server IP

195.234.39.132

Genealogy

VIP is not activated.

VIP is not activated.Company Summary

Company Summary

Company profile

| Basic | Information |

| Registered Country/Region | Cyprus |

| Regulation | ASIC, FSA, DFSA, FCA, NFA, FMA, MAS |

| Founding Time | 1974 |

| Minimum Deposit | $0 |

| Maximum Leverage | 1:30 |

| Minimum Spreads | 0.6 pips on EUR/USD |

| Trading Platform | MT4, IG Proprietary |

| Trading Assets | currency pairs, commodities, indices, stocks, financial spread betting |

| Payment Methods | Bank Wires, ACH, Debit Cards |

| Customer Support | 5 /24 Live Chat, Phone, Emails |

General Information & Regulation

IG is a trading name of IG Markets Ltd (a company registered in England and Wales under number 04008957) and IG Index Ltd (a company registered in England and Wales under number 01190902). IG was founded in 1974 in London, U.K. is the world's first broker to actually built the concept of financial spread betting that introduced online dealing as early as in 1998. IG headquartered in London (UK) and including operations in the USA, Australia, Japan, New Zealand, registered among European countries and Singapore.

Regulatory Information

IG Markets have 9 entities under stringent regulation in their own jurisdictions:

IG MARKETS LIMITED, authorized and regulated by the Australia Securities and Investment Commission (ASIC), with Regulatory License No. 220440

IG AUSTRALIA PTY LTD, authorized and regulated by the Australia Securities and Investment Commission (ASIC), with Regulatory License No.515106

IG Markets Limited, authorized and regulated by the Financial Conduct Authority (FCA), with Regulatory License No.195355

IG証券株式会社, authorized and regulated by the Financial Services Agency (FSA) in Japan, with Regulatory License No. 9010401051715

IG US LLC, authorized and regulated by the National Futures Association (NFA), with Regulatory License No. 0509630

IG MARKETS LIMITED, authorized and regulated by the Financial Markets Authority (FMA), with Regulatory License No. 18923

IG ASIA PTE LTD, authorized and regulated by the Monetary Authority of Singapore (MAS), with Regulatory License Number Unreleased.

IG Limited, authorized and regulated by the Dubai Financial Services Authority (DFSA), with Regulatory License No. F001780

Pros & Cons of IG

To ensure greater openness and compliance with strict regulations, IG is publicly traded on the Stock Exchange. Low Forex trading fees, a comprehensive teaching center, a wide variety of powerful trading tools, and solid research are just some of IG's many positives as a trading partner.

However, the selection of products available for trade is somewhat restricted, with Forex and CFDs being the primary vehicles for doing so.

some advanatges and disadvantages of IG are listed below:

| Pros | Cons |

| Multiple Regulation | Limited payment methods |

| Wide range of trading assets | Relatively high minimum deposit |

| Low minimum deposit requirement | Conservative leverage in some areas |

| Quality choice of trading platforms, including MT4 | |

| Educational tools for beginner traders | |

| Autochartist signals integrated with the proprietary web-based platform | |

Market Instruments

IG claims that it offers a wide range of tradable financial instruments for global investors, over 18,000 instruments, including Forex, indices, CFDs on stocks, digital cryptocurrencies, options trading for investors to choose from.

Account Types

IG seems only offer a basic account, and this broker requires no minimum initial deposit, which means investors can fund their IG account any money to start trading with this broker. Most other brokers would, in most cases, ask a minimum depsit of $100 ~$200 to open a standard account.

IG Leverage

In accordance with the new ESMA regulation, which tightened the restrictions on trading in Europe, European citizens and residents can now only use a certain multiplier in their transactions. Depending on the specifics of the local regulations, IG trading accounts may be subject to additional ratio restrictions.

So, while European traders are restricted to a maximum leverage of 1:30 on Forex instruments, Australian authorities permit a much higher 1:200 leverage. Check out the table below for a full look at the leverages available for cryptocurrency, commodity, share, and index instruments.

IG Spreads & Commissions

The minimum spread is around 0.6 pips on the EURUSD pair, 0.6 pips for AUDUSD, 0.9 pips for GBPUSD, 0.9 pips for EURGBP, 0.3 pips for spot gold, 2 pips for spot silver, 0.5 pips for emerging market indices, 2.8 pips for Brent crude oil and 2.8 pips for US light crude oil. Stock CFDs commissions: The minimum commission for US stocks is 2 cents per share per side(minimum $15), 0.18% for Hong Kong stocks (minimum HKD15), 0.10% for UK stocks (minimum £10), and 0.08% for Australian stocks (minimum AUD$7).

IG Trading Platform

IG offers traders an award-winning trading platform that makes trading faster and smarter, featuring an online trading platform, a trading app, a tablet app, an MT4 trading platform, and ProRealTime advanced charting. The web-based platform allows traders to open, close, and adjust positions more quickly in just a few seconds, split charts to view the same market in multiple time frames simultaneously, and upgraded smart mode to automatically save trade sizes and stop-loss levels. ProRealTime's advanced charts cover price, volatility, and more than 100 other indicators, allowing you to trade directly from the charts, including setting buy and sell orders.

Trading Tools

Additionally, all IGs platforms are enhanced with 18 free add-ons and indicators, Autochartist, technical analysis tools, and a free VPS for an expert advisor, and a range of small detailed settings that enhances trader deal.

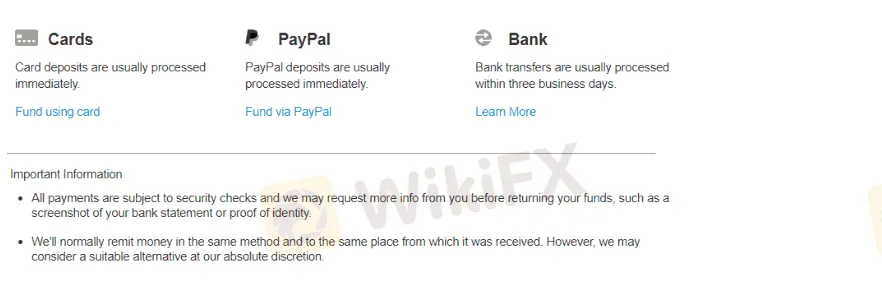

Deposit & Withdrawal

You won't have to worry about meeting any sort of minimum deposit or paying any sort of transfer charge. However, before you start trading, you should check the deposit requirements and margin for the instruments you plan to use.

Since there are a variety of deposit options, a trader may select the one that works best for them in terms of initial trading fees and get started trading practically immediately. In addition, double-check the availability of this and any other feasible alternatives in your area.

Major debit/credit cards,

bank transfer,

using the PayPal system,

Skrill or Neteller

Customer Support

IG customer support services can be reached through several methods, including live chats, social media, available on Phone 24h . Traders absolutely covered by responses to queries in different languages, since the variety of offices truly represents all variety of nationalities and countries.

Educational Resources

In addition to its many other benefits, IG's dedication to its clients' success shines through in the form of IG Academy's free trading classes, webinars, and other resources. You'll discover everything you need to get started trading with IG, thanks to the company's extensive educational resources that boost trading potential, allow you to improve your abilities if you already have them, and provide you with help at the beginning.

Being one of the largest firms in the world, IG makes substantial investments in the training of traders and other interested parties through its IG Academy, which is an integral part of its global offering. To ensure that its traders are well-educated, IG often hosts Live Seminars with prominent figures in the industry.

Keywords

- Above 20 years

- Regulated in Australia

- Regulated in United Kingdom

- Regulated in Japan

- Regulated in New Zealand

- Regulated in Singapore

- Regulated in United Arab Emirates

- Regulated in South Africa

- Regulated in Germany

- Market Making(MM)

- Retail Forex License

- Straight Through Processing(STP)

- Financial Service Corporate

- Investment Advisory License

- Common Financial Service License

- MT4 Full License

- Global Business

- New Zealand Market Making(MM) Revoked

- Australia Market Making(MM) Revoked

- Suspicious Overrun

- High potential risk

News

News IG Launches morning show called "Trade Live with IG"

IG recently launched a new morning show titled "Trade Live with IG." This show aims to provide viewers with real-time market analysis, expert insights, and trading strategies to help them navigate the financial markets effectively.

2024-09-05 14:00

News IG Replaces PayPal with Apple Pay for UK Users

IG replaces PayPal with Apple Pay for UK users following FCA discussions, ensuring instant transactions and high authorization rates for a smooth experience.

2024-08-06 18:18

News IG Group Posts Weak Results as Market Volatility Eases

IG Group reports declining financial performance amidst stable market conditions. Revenue falls, but interest income rises. Strategic cuts and new leadership aim for future growth.

2024-07-26 14:56

News IG Adds 25 Stocks for Extended Hours Trading

IG adds 25 new stocks for extended hours trading, available to UK clients from 9 am to 1 am Monday-Thursday, and 9 am to 10 pm on Fridays.

2024-07-08 11:13

News IG US Takes the Plunge with Rebranding to tastyfx

IG US, a leading forex broker, announced today a significant rebranding of its brokerage and platform technology to tastyfx. This strategic move aims to offer a more tailored experience for US-based customers.

2024-06-25 14:31

News IG Japan to Raise Margin Requirements for MXN Currency Pairs

IG Japan to increase margin for MXN currency pairs due to anticipated volatility from the upcoming Mexican presidential election.

2024-05-30 15:27

Review 67

Content you want to comment

Please enter...

Review 67

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX2861134112

Taiwan

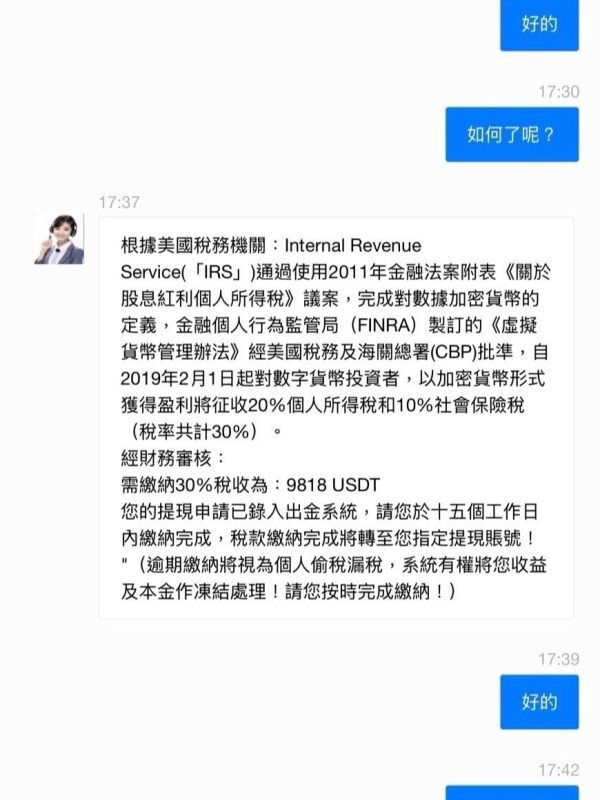

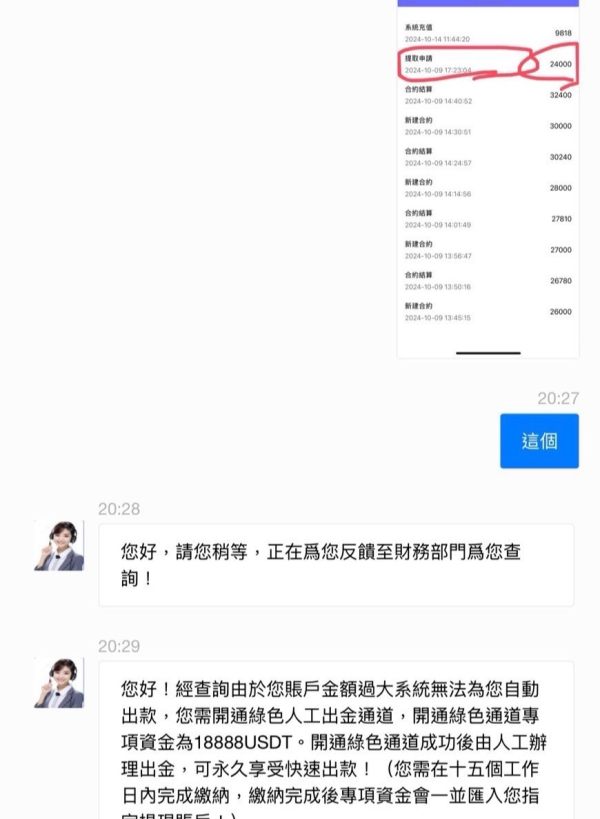

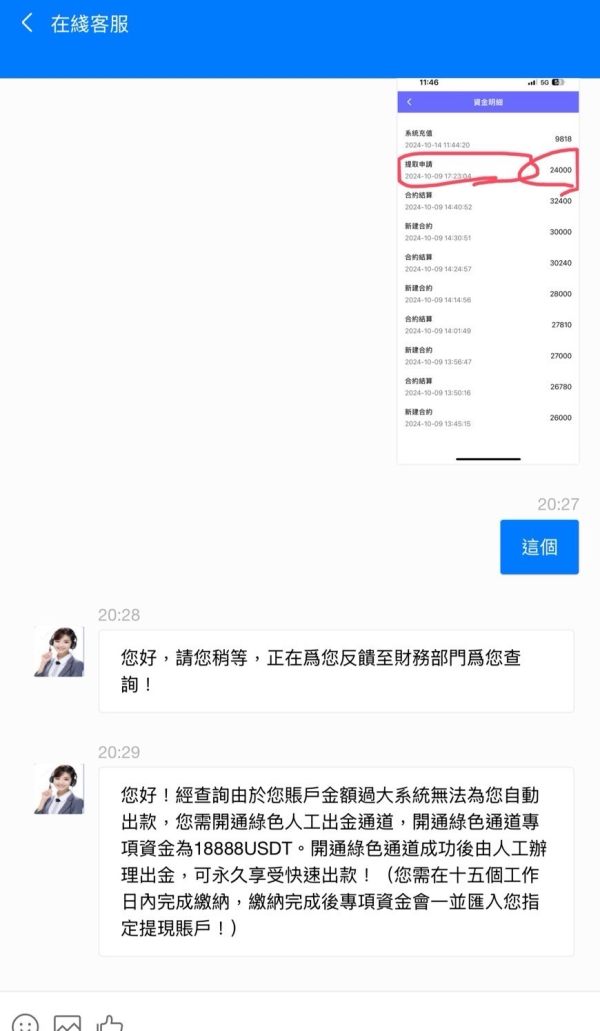

Just when my colleague saw that I was having a hard time, my mother had a major car accident on September 10th and has been in the hospital ever since. Then he started telling me about how he and his friends made a lot of money investing... At first, I just went along with it and invested 10,000 NTD. After I said I wanted to stop, they began harassing and threatening me in various ways. They even forced me to continue investing or else they would release my private photos and information and do something terrible. My colleague of over ten years even helped the scammers find me. Under duress, I deposited 100,000 NTD, but now I've lost a total of 1,099,900 NTD and still can't withdraw the money. The first time they said I needed to pay taxes: 9818 USDT. The second time they said the withdrawal amount was too large and needed to open a "green channel": 18888 USDT. The third time they claimed multiple IP deposits were suspected of money laundering and required a defrosting fee: 28888 USDT. It's an endless cycle. What’s ridiculous is that just a few days ago, right after I completed a transaction of 5014 USDT at 15:57, it was stolen by 16:03.

Exposure

11-27

FX2015418810

Turkey

I cannot withdraw my money and they are asking me to pay 375,000 TL again. I just want my money back. They are finding a lot of excuses. 🌲

Exposure

09-19

aa4988

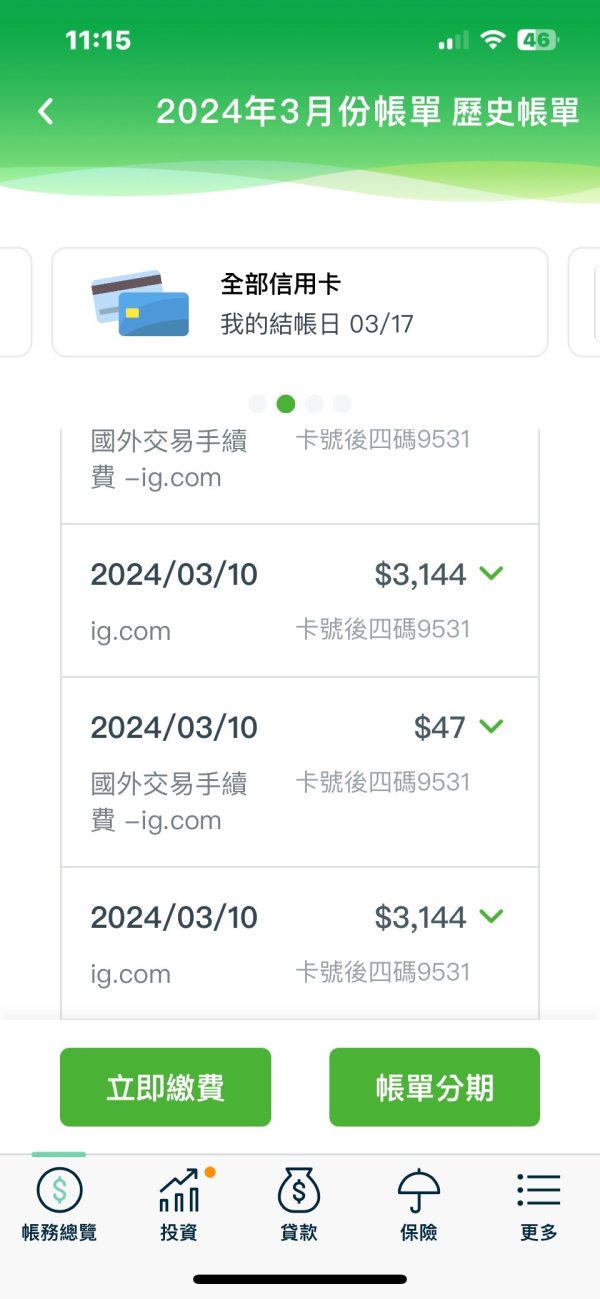

Taiwan

There is no name in the bank details. He said he couldn't confirm that the bank cardholder was me. So I can't withdraw the money I earned. My Taiwan bank details do not show my name, and the verification of my debit card never passes. So he said he couldn't verify that I was the bank account holder.

Exposure

03-26

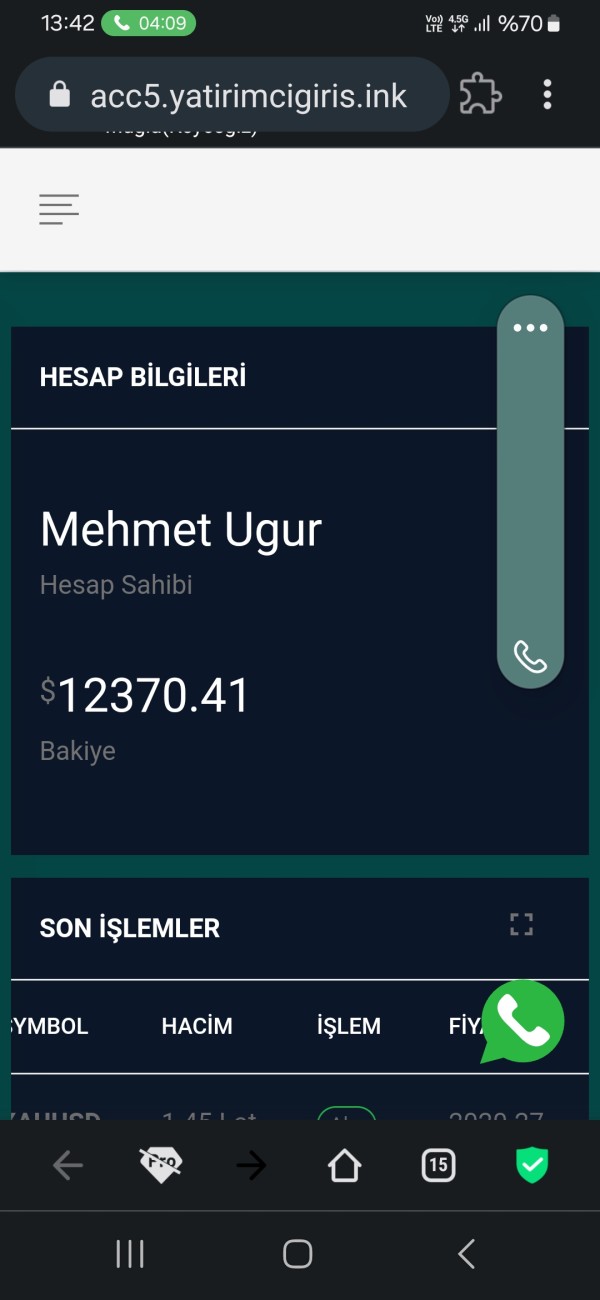

mehmet ugur

Turkey

I requested a withdrawal from this company about a month ago. I had to pay 4000 dollars for the bill I used. I paid it. They told me that I had to fund the bond again with 4,000 USD because you paid 2 pieces. I jumped up again and requested a withdrawal. This time they want an exchange rate difference of 100,000 TL. Is this legal? If so, this license is legal. What is it for? Please help.

Exposure

03-22

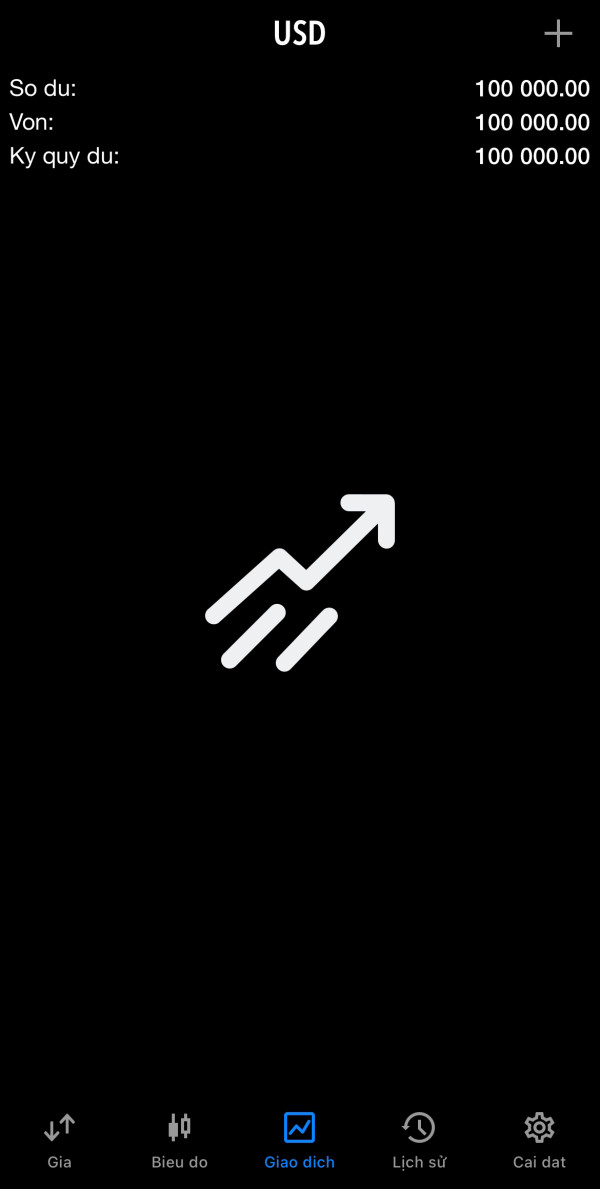

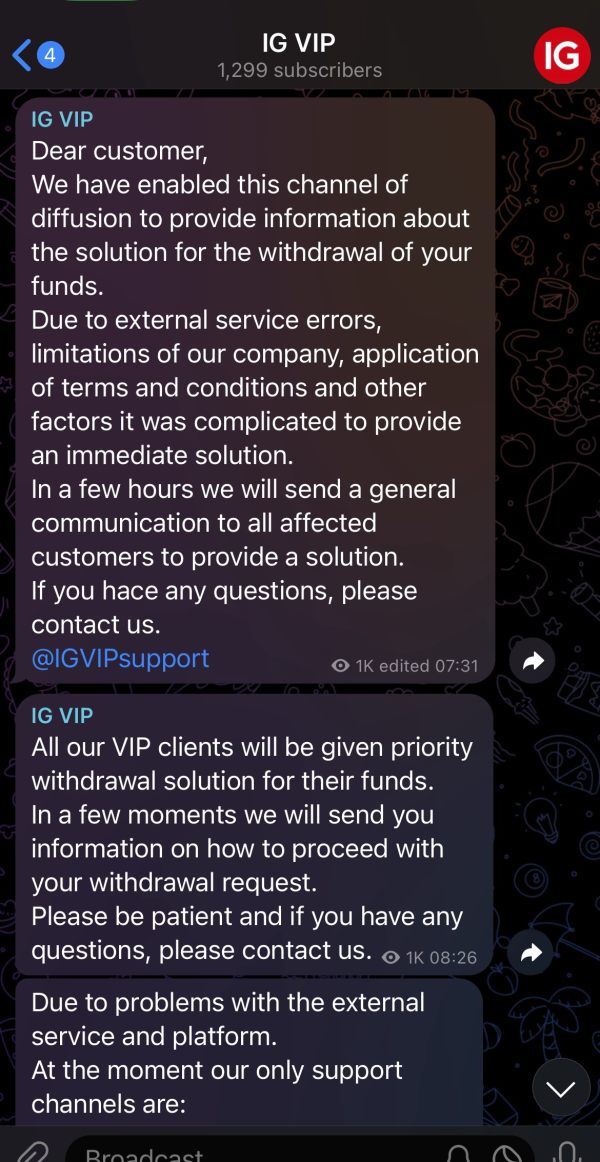

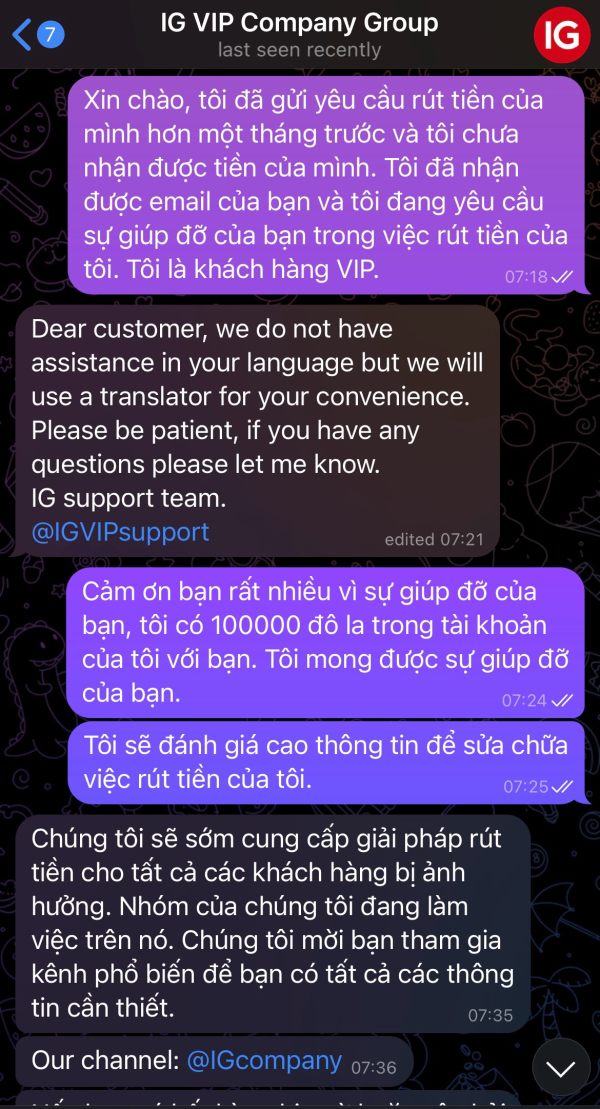

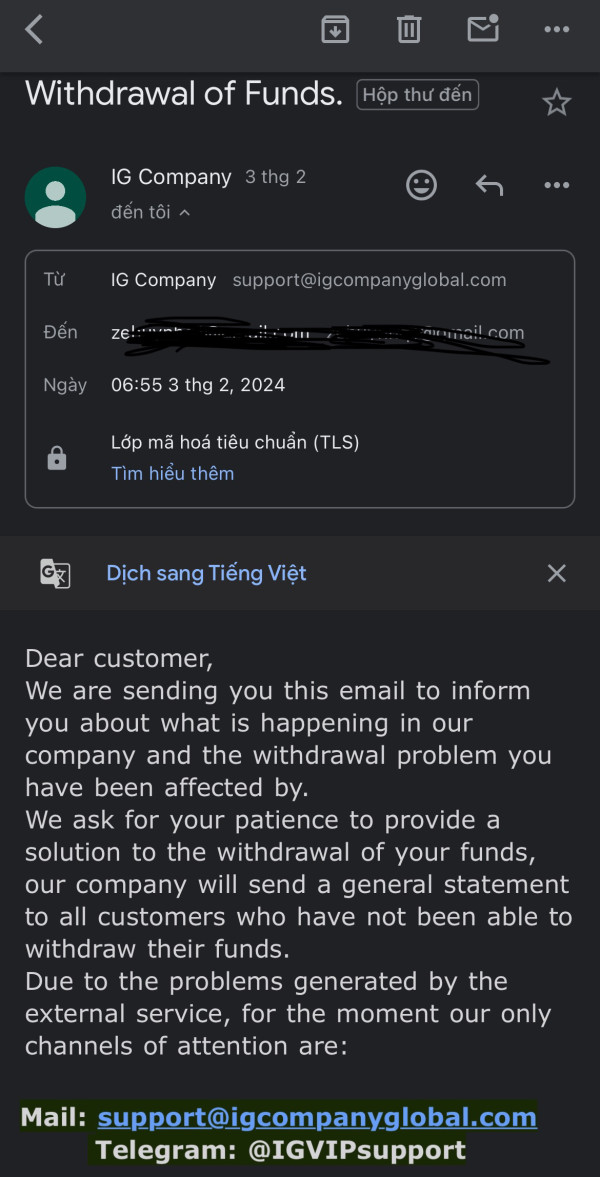

Huỳnh181

Vietnam

I requested a withdrawal from the IG VIP platform and I still haven't received it even though I'm a vip. After the complaint they sent me an email explaining that they would handle the withdrawal and that they had an issue on their platform, they asked me to wait as they would send a notification to all customers cannot withdraw their money. I'm just waiting for your IG VIP help so I can withdraw my money, please.

Exposure

02-04

Ngocha

Vietnam

I have used the IG VIP app to invest since December 28, 2023. After withdrawing money 2 times, the app asked me to upgrade to VIP before I could withdraw again. I deposited money to upgrade VIP but still can't withdraw money. They deducted my points and forced me to deposit more to increase my withdrawal points. Currently it is January 29, 2024

Exposure

01-30

HOÀNG THỊ THƯƠNG

Vietnam

I participated in trading on the IG platform from December 27, 2023 with account number 55565721 with a total deposit of about 12,000usd. Currently my account balance is 35k. I tried withdrawing a small amount of money on the IG 2 platform for the first time and it worked. When I made a profit, the third time I withdrew, the platform forced me to deposit money to upgrade to VIP before allowing me to withdraw. I found this extremely unreasonable. Why was my withdrawal limited by such unreasonable regulations? Now I don't have any money to deposit Vip because the deposit amount is too high, higher than the capital I deposited, so I can't deposit money to withdraw money, which means I will lose my entire account. Please assist me in withdrawing money. If I don't get it out I will die.

Exposure

01-20

HOÀNG THỊ THƯƠNG

Vietnam

I participated in trading on the IG platform from December 27, 2023, account number 55565721 with a total deposit of about 12,000 USD. I tried withdrawing a small amount of money on the IG 2 platform for the first time and it worked. When I made a profit, I withdrew the third time and the platform forced me to deposit VIP money before allowing me to withdraw. I found this extremely unreasonable and cruel. Now I don't have any money to deposit VIP because the deposit amount is too high, higher than the capital I deposited, so I can't deposit money to withdraw money, which means I will lose my entire account. Please assist me in withdrawing money. I must get it out.

Exposure

01-19

HOÀNG THỊ THƯƠNG

Vietnam

The first time I withdrew money from the IG platform, it was normal. The third time I withdrew, the platform forced me to deposit VIP money to withdraw. I found this extremely unreasonable. I don't have VIP deposit money, so I can't withdraw money, which means I will lose my account. Please assist me in withdrawing money.

Exposure

01-18

12519

Hong Kong

After waiting for more than a month and no money being withdrawn, the website even threatened to sue me.

Exposure

2023-12-15

12519

Hong Kong

Every time the waiting time for withdrawing money has passed, the withdrawal is not allowed for various reasons.

Exposure

2023-12-14

12519

Hong Kong

After waiting for a month, I still cannot withdraw money, and I can no longer communicate with customer service.

Exposure

2023-12-14

小陳6116

Taiwan

I got scammed a few days ago. Their betting slips have been processed. The winning rate is high every time. In the end, I almost succeeded.

Exposure

2023-11-15

鱼1453

Hong Kong

The withdrawal on September 4th has not arrived in the account, and the problem has not been resolved after contacting customer service for more than 36 hours.

Exposure

2023-09-06

BIT5875610152

Taiwan

Can't withdraw if the account balance is lower than the minimum withdrawal amount. I send emails to customer service, but there is no reply.

Exposure

2023-07-31

xo2114

Taiwan

it has been several days since i applied for a withdrawal. i haven’t withdrawn the funds yet, and i have frozen my trading account without replying to you. you can’t trade. you even tampered with the transaction records of my account and changed my trading account from a profit to a loss. . Is this what a regular brokerage would do? this is what a world-renowned brokerage IG behavior?

Exposure

2023-04-04

欣欣

Taiwan

Please don’t trade with this platform. It’s terrible. I deposited almost $5,000 and earned over $800. But they refused my withdrawal application. Suddenly I can’t log in to your account. After two days, they sent a letter saying they wouldn’t allow to withdraw money.

Exposure

2023-03-30

adam2530

Taiwan

The spread of the pre- set order order wass 300 pips, which was too exaggerated. The order was placed at around 8:20 pm, and started to fall at 8:30. Then, the customer service staff told me that the price slipped by 300 pips.

Exposure

2022-10-14

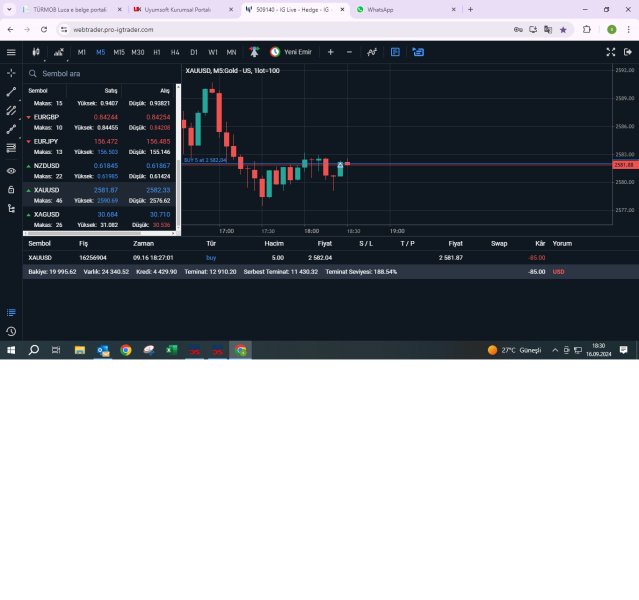

FX5264037022

Taiwan

IG-Live servers get errors frequently. These errors affect the normal operation of the MT4 terminal and causing losses. IG Market has no willing to be responsible for this. For example, the margin calculation error is 10 times higher and causing the order that can be placed will not be placed due to insufficient margin. It may also liquidatedation due to insufficient margin.

Exposure

2021-11-20

FX5264037022

Taiwan

IG MT4 CFD account ID: lwcdd. MT4 login: 172845. For EA's order failure due to quotation error, I have proved that IG-LIVE will make an error. I reported the complaint on August 13, 2021 compliance.igx@ig.com. The complaint has not been reasonably resolved so far. He only perfunctorily shirked his responsibility on the grounds of price change, and did not face the problem of wrong quotation or give a reasonable reply. At that time, the bid price quoted by IG-LIVE was far lower than the market price, so the order failed.

Exposure

2021-10-29