Are you a New Zealand resident looking for the best forex broker to help you navigate the dynamic currency markets? The forex market in New Zealand, overseen by the Financial Markets Authority (FMA), has witnessed a surge in popularity. The New Zealand Dollar's position as a top 10 traded currency globally underscores the market's significance.

We've conducted a thorough analysis of the New Zealand forex landscape, considering local regulations, market conditions, and broker offerings to provide you with a comprehensive guide.

While FMA authorization is a valuable indicator of legitimacy, it's important to note that some international brokers also offer services to New Zealand traders.

To identify the top brokers in New Zealand, our evaluation focused on key criteria, including:

New Zealand Accessibility: We selected brokers that accept New Zealand residents and offer localized features like NZD base currency, local payment methods, and offices or customer support.

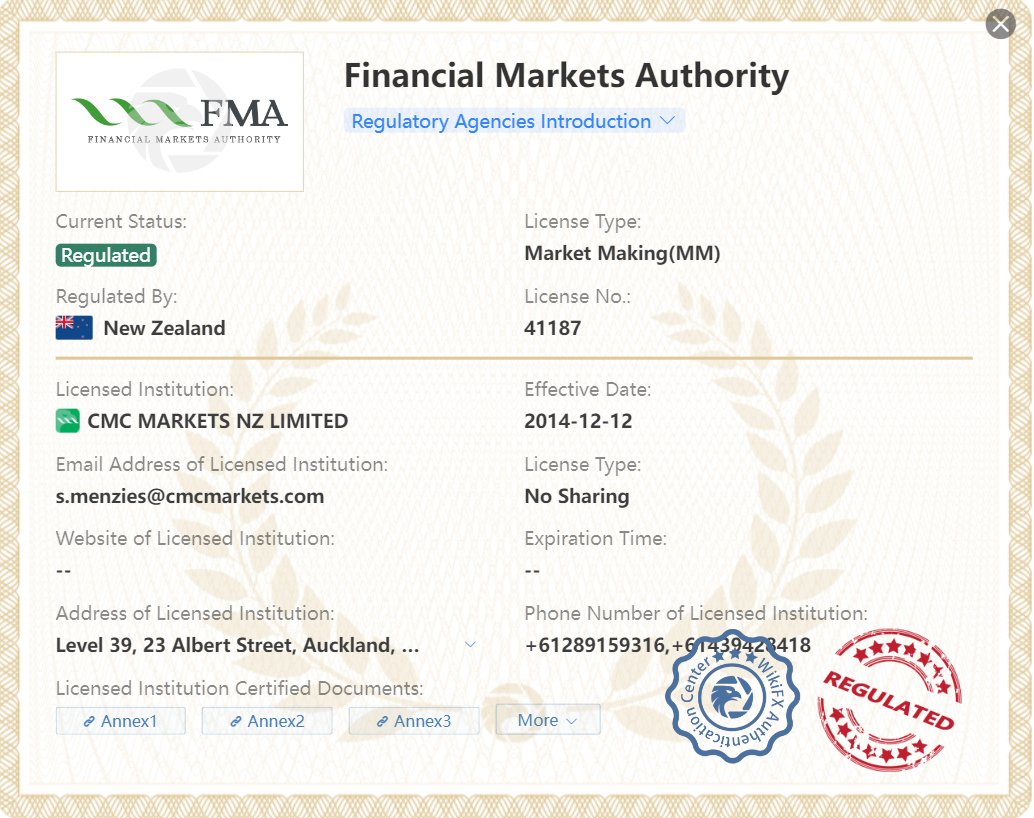

FMA Regulation: Compliance with FMA regulations was a crucial factor in our selection.

Trading Fees(Spreads and commissions): We sought brokers offering competitive trading fees to maximize profitability.

Platform User-Friendliness: We evaluated platforms for their ease of use, feature-richness, and overall trading experience.

Top 8 Best New Zealand Forex Brokers for 2024

Low spreads and competitive pricing, maximum leverage varies by assets, multiple trading platforms including MetaTrader 4 and Next Generation.

Extensive market coverage, comprehensive educational resources, advanced charting tools, and exceptional customer service.

Offers the ultimate comprehensive trading package, featuring excellent trading and research tools

Industry-leading education, and an extensive range of tradeable markets

xclusive trading platform known for its risk management tools such as stop-loss and take-profit levels, coupled with a user-friendly interface that caters to both new and experienced traders

Subjected to extensive global regulation including ASIC, CySEC, and FCA, ensures a high level of fund security and protection to its clients with additional investor protection measures like negative balance protection and segregated client funds.

more

Comparison of the Best Forex Brokers in New Zealand

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers in New Zealand for 2024 Overall

| Overall Rating | Accepts NZ Residents | Regulated by FMA | Average Spread EUR/USD | Minimum Deposit | |

| CMC Markets | ⭐⭐⭐⭐⭐ | Yes | Yes | 0.7 pips | $0 |

| IG | ⭐⭐⭐⭐⭐ | Yes | Yes | 1 pips | $250 |

| Plus500 | ⭐⭐⭐⭐⭐ | Yes | Yes | 0.5 pips | $100 |

| BlackBull | ⭐⭐⭐⭐ | Yes | Yes | 0.9 pips | $0 |

| Saxo Bank | ⭐⭐⭐⭐ | Yes | No | 0.7 pips | $0 |

| VT Markets | ⭐⭐⭐⭐ | Yes | No | 0.2 pips | $200 |

| Vantage | ⭐⭐⭐⭐ | Yes | No | 1.0 pips | $50 |

| Admiral Markets | ⭐⭐⭐ | Yes | No | 0.6 pips | $1 |

CMC Market

CMC Markets is well-trusted across the globe and delivers a terrific trading experience thanks to its excellent pricing and selection of over 12,000 tradeable instruments.

| CMC Markets Snapshot⭐⭐⭐⭐⭐ | |

| Regulatory Authorities | FCA, FMA, CIRO, MAS |

| Minimum Initial Deposit | $0 |

| Maximum Leverage | N/A |

| Minimum Spread | 0.7 pips onwards for EURUSD |

| Pros | Cons |

| Wide range of trading instruments | May face platform stability issues during high volatility moments |

| Multiple trading platform | Higher stock CFD fees |

| Regulated by multiple reputable authorities | Not available in certain countries |

| No minimum deposit requirements | The high minimum deposit for guaranteed stop loss orders |

| Access to comprehensive market news and analysis | Overnight financing costs |

IG

PLUS500

Saxo Bank

VT Markets

Vantage

For New Zealand traders, IG offers a compelling platform with several key advantages.

Firstly, under our strict examination, IG is regulated by multiple regulatory authorities, including ASIC, FSA, FSA, and FMA. As we mentioned above, regulated by FMA——New Zealand Financial regulator. Additionally, other trading conditions of IG are also competitive, including a low minimum initial deposit of $0 and low spreads starting from 0.6 pips for EURUSD.

About trading Platforms, IG is also humanized for Android app version and iOS users. For clients trading on iOS, it have launched a progressive web app (PWA) that offers a seamless trading experience. The PWA enables clients anywhere in the world to monitor their trades and respond to market movements on the go.

| IG Snapshot⭐⭐⭐⭐⭐ | |

| Regulatory Authorities | ASIC, FSA, FSA, AMF, FMA, MAS, DFSA |

| Minimum Initial Deposit | $250 |

| Maximum Leverage | 1:200 (US clients) |

| EUR/USD Spread | Starting from 0.6 pips |

| Pros | Cons |

| Wide variety of markets and instrument options. | Fees and costs may not be clearly specified on the website. |

| Intuitive and customizable trading platforms. | Information on account types is limited. |

| Access to advanced technical analysis and charting tools. | The minimum transaction amount may be high for some markets. |

| Multilingual, multi-channel customer service. | No welcome bonuses or promotions are offered. |

| Demo account with virtual financing of $20,000. | Credit card deposit fees can be high compared to other brokers. |

Plus500 is an online trading platform that offers Contracts for Difference (CFDs) on a range of financial instruments including stocks, forex, commodities, cryptocurrencies, options, and indices.The platform is available in more than 50 countries and supports over 30 languages.

| PLUS500 Snapshot⭐⭐⭐⭐⭐ | |

| Regulatory Authorities | FCA, FSA, CySEC, ASIC, FMA, MAS |

| Minimum Initial Deposit | $/€/£100 |

| Maximum Leverage | 1:30 (forex), 1:20 (indices), 1:10 (commodities), 1:2 (cryptocurrencies), 1:5 (stocks) |

| EUR/USD Spread | 0.5 pips |

| Pros | Cons |

| • Simple and easy-to-use trading platform | • Limited product offering |

| • Commission-free trading | • Limited research and educational tools |

| • Tight spreads | • No support for MetaTrader platform |

| • Negative balance protection | • Limited customer support options |

| • Regulated by reputable financial authorities | • No phone support |

| • Free demo account | • Withdrawal fees for some payment methods |

| • Limited trading tools and features |

BlackBull is an STP (Straight Through Processing) forex broker that provides online trading services to retail and institutional clients. The company was founded in 2014 and is headquartered in Auckland, New Zealand. BlackBull is regulated by the Financial Markets Authority (FMA) of New Zealand and offers over 26,000 tradable instruments including forex, energy, indices, cryptocurrencies, equities, and metals. The broker provides clients with multiple trading platforms such as MetaTrader 4/5 and various trading tools.

| BlackBull Markets Snapshot⭐⭐⭐⭐⭐ | |

| Regulatory Authorities | FMA, FSA |

| Minimum Initial Deposit | $0 |

| Maximum Leverage | 1:500 |

| EUR/USD Spread | 0.9 pips |

| Pros | Cons |

| • Regulated by FMA | • Negative reviews from clients regarding withdrawal issues |

| • Wide range of tradable instruments | • Limited range of payment options |

| • Demo accounts available | |

| • Multiple trading platforms and tools | |

| • No minimum deposit requirement | |

| • Rich educational resources |

Tips: While the preceding four brokers are directly regulated by the FMA, the subsequent four, though not under FMA's jurisdiction, are subject to rigorous oversight by other regional regulatory bodies. This ensures a high degree of security and makes them a viable alternative for consideration.

Saxo Bank is an established Danish investment bank originating from 1992. Saxo Bank adheres to the regulations set by numerous financial authorities, including the Danish Financial Supervisory Authority, the UK Financial Conduct Authority, and the Monetary Authority of Singapore.

| SAXO Snapshot⭐⭐⭐⭐ | |

| Regulatory Authorities | ASIC, FCA, FSA, SFC, BDF, CONSOB, FINMA, MAS |

| Minimum Initial Deposit | Forex, stocks, futures, options, bonds, ETFs and CFDs |

| Maximum Leverage | 1:100 |

| EUR/USD Spread | 0.4 pips |

| Pros | Cons |

| • Wide range of financial instruments available | • High minimum deposit requirement |

| • Access to multiple markets and exchanges | • Fees and commissions may be higher than competitors |

| • User-friendly trading platforms | • Inactivity fee for dormant accounts |

| • Advanced trading tools and research | • Limited educational resources |

| • Regulated by top-tier financial authorities | • Limited customer support options |

VT Markets, headquartered in Sydney, is a regulated subsidiary of Vantage International Group with over a decade in global financial markets. Operating under the Financial Sector Conduct Authority (FSCA), it offers trading in a wide range of instruments including currencies, commodities, indices, and more. The broker ensures competitive trade conditions, a $100 minimum deposit, fast execution, and up to 1:500 leverage. Both MetaTrader 4 and 5 platforms are supported for a durable, flexible experience with extensive features, indicators, and automated trading options.

| VT Markets Snapshot⭐⭐⭐⭐ | |

| Regulatory Authorities | Regulated by FSCA |

| Minimum Initial Deposit | $200 |

| Maximum Leverage | 1:500 |

| EUR/USD Spread | |

| Pros | Cons |

| Wide range of trading instruments | Limited regulatory oversight |

| Low trading fees | Limited educational resources |

| Multiple account types | Limited customer support options |

| Multiple trading platforms, MT4, MT5 and Webtrader | No demo accounts |

| Flexible leverage up to 1:500 | Limited research and analysis resources |

| Swap-free options available | |

| Wide selection of payment methods | |

| Social Trading Available | |

| Deposit and welcome bonuses offered |

Vantage is an online forex broker that offers trading services for individuals and institutions around the world. The company was founded in 2009 and is headquartered in Australia, with additional offices in the United Kingdom, Cayman Islands, and China. Vantage provides a variety of trading instruments, including forex, commodities, indices, and cryptocurrencies, and offers multiple trading platforms, such as MetaTrader4 and 5.

| Vantage Snapshot⭐⭐⭐⭐ | |

| Regulatory Authorities | ASIC, FCA, CIMA, VFSC |

| Minimum Initial Deposit | $50 |

| Maximum Leverage | 500:1 |

| EUR/USD Spread | From 1.0 pips |

| Pros | Cons |

| • Wide range of trading instruments | • Too many complaints about withdrawals from clients |

| • Low minimum deposit requirement | • No Canada, China, Romania, Singapore, the United States clients allowed |

| • User-friendly trading platforms | |

| • Regulated by multiple top-tier authorities | |

| • Negative balance protection for clients |

Admiral Markets

Admiral Markets based in Australia and regulated by ASIC, FCA and CYSEC, has been providing services for 10-15 years with a variety of trading instruments. Minimum deposit is 1 USD, offering a flexible 1:10 to 1:1000 leverage. They offer multiple trading platforms and withdrawal methods.

| Admiral Markets Snapshot⭐⭐⭐⭐ | |

| Regulatory Authorities | ASIC/FCA/CYSEC |

| Minimum Initial Deposit | 1 USD or equivalent |

| Maximum Leverage | 1:1000 |

| EUR/USD Spread | From 0.6 pips |

| Pros | Cons |

| Diverse trading instruments covering Forex, shares, indices, metals, and energy | Limited range of cryptocurrencies |

| Innovative trading platforms | Charges for dormant accounts |

| Low minimum deposit requirement | Trading platform could be complex for beginners |

| Strong regulation by FCA, ASIC and CYSEC | Relatively slower withdrawal times |

| Access to market analysis and trading ideas | Non-trading fees could be high |

Forex Trading Knowledge Questions and Answers

What is FMA and what does it mean for forex traders?

FMA stands for Financial Markets Authority. It's the government agency in New Zealand responsible for financial regulation. For Forex traders, the FMA provides a trusted regulatory framework. This means that it sets standards, monitors compliance, and takes action when these standards are not met, ensuring fair, efficient and transparent financial markets, which protects traders and contributes to the integrity of the Forex trading environment.

How to choose a forex broker in New Zealand?

Just like Forex trading in any country, there are a few nuances to consider with Forex trading in New Zealand as well, despite it having relatively few restrictions and a generous maximum leverage of 500:1.

Here are three key tips for choosing the best Forex broker:

Prioritize brokers regulated within New Zealand: Always ensure that your broker is regulated by the FMA. If you ever need to consider brokers outside this parameter, opt for those regulated by other top global regulators such as CySEC, FCA, and ASIC.

Choose a broker that keeps costs low: In Forex trading, keeping costs low is crucial. Choose a broker that offers a low spread and minimal non-trading fees. Preferably, the broker should also allow NZD deposits and base currencies to reduce currency conversion costs.

For beginners, choose a broker who offers negative balance protection:In the volatile Forex market, it's vital to protect yourself. In Europe, all brokers must apply negative balance protection due to ESMA regulations. This is not mandatory in New Zealand, which means a significant market swing could result in a negative balance. A broker providing negative balance protection will automatically close your position once your balance hits zero, preventing a negative balance.

What fees should you focus on when choosing the broker?

Typically, brokers charge spreads, commissions, swap/rollover fees, and inactivity fees.

1. Spread Costs:These are the differences between the buy and sell prices. Brokers either charge a wider spread or a commission for each trade. Some offer tighter spreads, but charge a separate commission.

2. Trading Commissions: Some brokers charge a trading commission on each trade, which can be a fixed fee or a percentage of the total trade volume.

3. Swap Rates or Overnight Financing: These are fees that you pay or receive for holding a trade open overnight.

4. Inactivity Fees:Some brokers charge a fee if your account is inactive for a specific period of time.

5. Withdrawal fees:Some brokers may charge a fee for withdrawing money from your account.

It's essential to read and understand a broker's fee structure before opening an account. The goal is to keep trading costs as low as possible while still receiving valuable services from your broker.

Do you need to pay taxes for forex trading in New Zealand?

Yes, Forex trading is likely to be subject to income tax in New Zealand. Any kind of trading that is conducted with the intent of gaining profit is usually classified as a business income and, thus taxable. However, the specifics of tax rates and regulations can vary.

Pros and Cons of forex trading in New Zealand

Forex trading in New Zealand offers benefits like a solid FMA regulatory framework, high 1:500leverage, favorable conditions for ECN brokers, excellent tech infrastructure and innovative fintech disruption.

Yet, drawbacks exist including fewer trading opportunities due to time zone variances, potential high trading costs during NZ business hours, and uncertainty regarding FMA leverage cap post-ASIC's reduction. Deciding to trade Forex in New Zealand requires careful consideration of these factors.

| ????Pros | ????Cons |

| FMA provides a trusted regulatory framework | Less frequent Forex trading opportunities |

| Maximum leverage of 1:500 | Trading costs can be higher |

| ECN brokers operate with favorable trading conditions and NZ maintains a business-friendly environment | New Zealand business hours do not match the highest liquidity periods in major Forex currency pairs |

| FinTech companies set to disrupt the traditional brokerage model | Relatively high personal tax rates |

To Summarize

WikiFX have included many brokers from around the world. When choosing brokers, we always follow professional and objective principles. We have discussed the best forex brokers in New Zealand. You will understand multiple aspects of these brokers through our analysis, and choose the one that suits you best.

You Also Like

Best Forex Brokers in Turkey for 2024

Review top 9 forex brokers in Turkey, elevating their trading pros and cons to give traders more useful guidance.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Swiss Forex Brokers for 2024

Explore top 10 forex brokers in Switzerland, elevating their trading pros and cons to give traders more useful guidance.

Best Stock Brokers in the US for 2024

When choosing an online broker, finding the platform that best fits your investment needs is crucial. With the rise in popularity of online trading, more brokers are offering free stock trading and commission-free transactions for various assets. It has become a challenge for users to select suitable brokers.

Best CySEC Regulated Forex Brokers 2024

Delving into CySEC-regulated forex trading, this article presents a top 9 list of brokers, spotlighting the benefits of regulatory compliance.

8 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 8 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Forex Brokers in 2024

Guide to the most trusted Forex brokers, with a thorough investigation into their quality, security measures, and financial transparency.