The global financial market consists of various markets, including foreign exchange market, global stock, and equity markets, the international capital markets, the commodity market, as well as the market for forwarding contracts, options, and other derivative markets, Among which, the forex market is the largest financial market in the world, with a global network of financial centers that can trade 24 hours a day, 5 days a week (24/5), only closing on the weekends.

In this way, the forex market is just like a piece of a big cake, both investors and forex brokers (including lots of scammers) eager to have a finger in the pie. The forex market is typically divided into three peak activity times: Asian, European, and North American Sessions. Those three periods are also called the Tokyo, London, and New York sessions.

Occasionally, a fourth, Australian (Sydney). Since these cities represent the key financial hubs for each region, these national and city designations are interchangeable. However, since the forex market is decentralized, without a unified and defined governing authority, regulatory authorities launched are tasked with imposing rules and regulations on forex brokers in various jurisdictions to ensure its fairness.

Concerning forex regulation, some top-tier regulatory bodies across the world include the Australia Securities and Investment Commission (ASIC) in Australia, Financial Conduct Authority (FCA) in the U.K., Cyprus Securities and Exchange Commission (CySEC) in Cyprus, Commodity and Futures Trading Commission (CFTC), and National Futures Association (NFA) in the U.S., Financial Services Agency (FSA) in Japan, and more. Choosing a reliable forex broker for traders or investors who take participate in the forex world is vital, and here we prepare a Top 10 Best Forex Broker Ranking for your reference.

Top 10 Best Forex Brokers in the World

A long-established Broker, Strictly Regulated by Multiple Regulatory Bodies in Various Jurisdictions, Offering Sufficient Reliability.

Over 80 Currency Tradable, Competitive Pricing Structure with Tight Spreads from 0 Pips.

Competitive trading fees, including a tight spread of only 0.0 pips, potentially help traders save on their overall trading costs.

A variety of advanced trading platforms, including MetaTrader 4 and MetaTrader 5, with numerous features and tools that can help you to trade more effectively.

A Stringently Regulated Broker, Reliable and Safe to Trade With, The Choice of Over 3500,000 Clients from Over 190 Countries.

Quick & Easy to Start Your Real Trading by Funding As Low As 5 USD, Lower & Friendlier Cost Structure Available, Advanced Trading Platforms & Tools Drive You Succeed into the Forex World.

Strictly Regulated by ASIC and CYSEC, a Safe Broker to Trade With.

MT4 & MT5 Available, Plus Two Copy Platforms: Social Trading & Myfxbooks.

Licensed & Regulated in Multiple Jurisdictions: ASIC, CYSEC, FCA, DFSA, SCB.

Super-Low 1 USD Initial Deposit Quite Friendly to Active Traders.

more

Best Forex Brokers in the World Video

Comparison of the Best Forex Brokers in the World

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers in the World Overall

| Brokers | Logos | Why are they listed as the Best Forex Brokers in the World? |

| FOREX.com |  |

✅Regulated by top-tier authorities like the FCA, CySEC, IIROC, MAS and ASIC to ensure client funds safety. ✅Offers competitive spreads starting from just 0.0 pips on major currency pairs. ✅Powerful trading platforms including MetaTrader 4, MetaTrader 5, and FOREX.com Advanced Platform, featuring fast order execution. |

| ATFX |  |

✅Operating in a transparent and secure way, regulated by CYSEC, FCA, a well-established broker. ✅Robust account security measures including segregated client funds and SSL encryption. ✅ Featuring competitve spreads, fast withdrawal, highly recognized by profesional traders. |

| XM |  |

✅Licensed and regulated in many countries globally, like Australia, UK, Cyprus, South Africa, UAE, and more. ✅Ultra-low spreads starting from 0 pips on major forex pairs, transparent trading fees. ✅Advanced trading platforms like MetaTrader 4/5 and XM WebTrader, ensuring fast order execution. |

| FP Markets |  |

✅Regulated by ASIC in Australia, and CYSEC in Cyprus, operating under strict financial standards. ✅Raw ECN spreads starting from 0.0 pips on forex majors, greatly lowering trading costs. ✅Offers robust trading platforms, featuring solid performance, fast order execution. |

| Pepperstone |  |

✅Authorized by tier-1 regulators like the FCA, ASIC, BaFin, and DFSA, operating in a secure way. ✅Offering some of the tightest average spreads in the industry, as low as 0.0 pips. ✅ Offering of MetaTrader and cTrader designed for algorithmic traders and copy traders, making trading easier. |

| IG |  |

✅Goablly and heavily regulated, remaining one of the most respected brokers in the industry. ✅Competitive spreads from 0.6 pips plus commission pricing available, a budget-friendly choice for most traders. ✅Innovative proprietary web and mobile trading platforms, a great fit for professional traders, highly recognized. |

| InteractiveBrokers |  |

✅Heavily regulated in the US, UK, Switzerland, Canada, and Australia, offering traders great trading confidence. ✅Low and transparent commissions starting from $0.0035 per share, giving traders more potential to make profits. ✅High order execution quality, plus strong research and tools provided. |

| CMCMarkets |  |

✅Regulated by top-tier bodies like the FCA, FMA, IIROC, MAS, one of the most stringently regulated brokers. ✅Over 12,000 tradable instruments offered, with tight spreads from just 0.7 pips on forex pairs and 0 points on indices. ✅Powerful platforms including Next Generation web and mobile trading, ensuring fast order execution. |

| Exness |  |

✅Top-tier licensing with the FCA and CySEC and a strong reputation with over 10 years in the industry. ✅Ultra-competitive spreads from 0.0 pips on major forex pairs, highly recognized by traders, not promises. ✅Robust MetaTrader 4 and 5 platforms, accurate trading signals, providing a superb trading environment. |

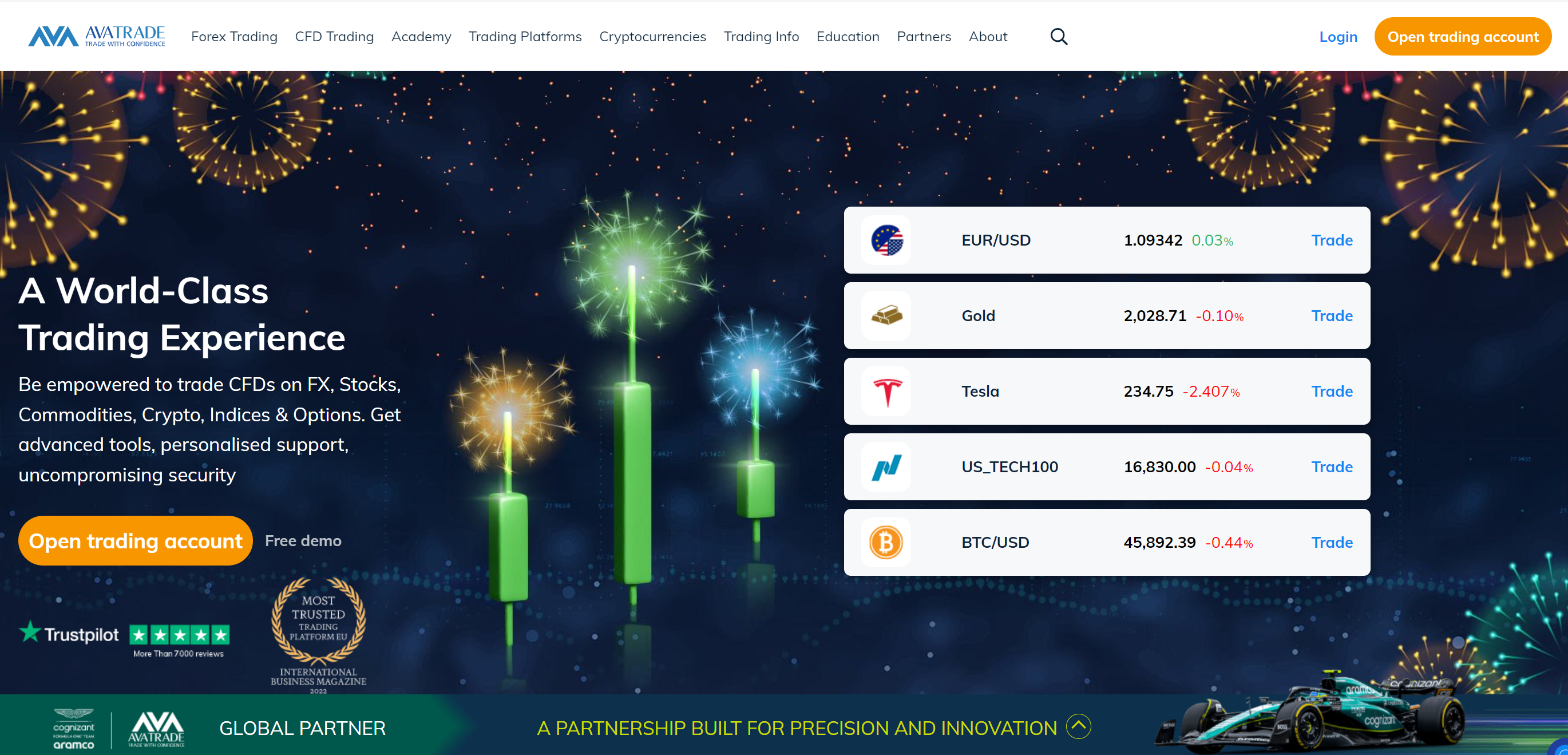

| AvaTrade |  |

✅One of the most trusted forex brokers in the industry, heavily regulated, with a strong reputation. ✅ Unique risk management tool, AvaProtect, easily activates on the platform, safeguarding against losses up to $1 million. ✅Advanced MetaTrader 4 & 5 platforms, as well as copy trading solutions via various trading apps, like Zulutrade and copytrade. |

Overview of the Best Forex Brokers in the World

FOREX.com

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

forex, stock CFDs, indices or commodities, |

Trading Platforms |

MT4, MT5, Mobile App, Webtrader |

Trading Costs |

Standard account: No commissions are charged on any instruments. RAW account: $$7 per $$100,000 USD traded on all instruments. |

Max. Leverage |

50:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

credit card, debit card, Skrill and Neteller e-wallets and wire transfer |

Customer Support |

5/24 |

Forex.com, founded in 1999, is a US-based online broker that operates globally. The broker offers trading in over 80 currency pairs, along with numerous other instruments including indices, commodities, and stock CFDs. Forex.com provides a proprietary platform called “Advanced Trading”, and supports MetaTrader 4 platform, both accessible from web, desktop and mobile devices. Their customer support team is available 24/5 via phone, email, and live chat. The broker is recognized for its performance and reliability, comprehensive research tools, and a well-rounded service in general.

✅ Where Forex.com Shines:

• Forex.coms robust regulatory infrastructure across multiple jurisdictions assures professional traders of a safe and secure trading environment.

• The average-to-competitive spreads coupled with an active trader program that cuts costs for high-volume traders is an advantageous offer.

• U.S. based clients cannot trade cryptocurrencies, restricting the options for traders based in the United States.

• Forex.com supports advanced order types such as trailing stops, stop loss, and limit orders, allowing professionals to implement complex strategies.

• Regular provision of market insights and technical analysis helps professional traders plan their strategy more accurately and stay informed about market trends.

❌ Where Forex.com Shorts:

• Although the broker offers over 80 currency pairs, it has a relatively limited range of other assets, which might deter traders seeking a diverse asset selection.

• Forex.com charges inactivity fees of $15 for accounts that have been dormant for a year, which can increase the costs for occasional traders.

ATFX

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

Markets, Forex, Indices, Commodities, ETF CFDs, HK Shares CFDs, US & European Share CFDs |

Trading Platforms |

MT4, ATFX Mobile Trading App |

Trading Costs |

Minimum spread on the EUR/USD from 0.6 pips |

Max. Leverage |

400:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

Neteller, Sticpay, Skrill, Perfect Money, Credit Card, Debit Card, and Cryptocurrency |

Customer Support |

5/24 |

Established in 2006 and headquartered in the UK, ATFX is a globally renowned broker specializing in various markets including, Forex, Indices, Commodities, ETF CFDs, HK Shares CFDs, US & European Share CFDs. The broker is distinguished for its award-winning trading platforms, including MetaTrader 4, and ATFX mobile trading app. ATFX delivers 24/5 multilingual support, responsive and professional, thus winning high user recognition. Offering tight spreads starting from 0 pips, zero commissions, and convenient deposit and withdrawal, this broker has gained widespread popularity, particularly among professional investors.

✅ Where ATFX Shines:

• Operating Under stringent regulation of CYSEC, giving its traders a lot of assurance.

• ATFX boasts award-winning trading platforms, including MetaTrader 4 and ATFX mobile trading app.

• Providing innovative features such as copy trading and Islamic accounts.

• No fees on deposits with fast processing within 30 minute

❌Where ATFX Shorts:

• ATFX currently not accepting retail clients, only institutional clients supported.

• The demo account offered by ATFX has a somewhat limited virtual fund of $10,000.

• No 7/24 customer support, which may lead to some inconvenience for traders who have trading problems during weekends.

XM

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$5 |

Tradable Instruments |

forex, commodities, equity indices, precious metals, and energies |

Trading Platforms |

MT4, MT5, XM WebTrader |

Trading Costs |

XM Ultra Low Micro Account: spreads from 0.6 pips, no commission charged. XM Ultra Low Standard Account: spreads on all majors from 0.6 pips, no commission charged. XM Zero Account: spreads on all majors from 0 pips, commissions charged |

Max. Leverage |

1000:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

Deposit bonus up to $5,000 |

|

Payment Methods |

Credit and Debit Cards, Bank Transfers, e-Wallets |

Customer Support |

7/24 |

Established in 2009, XM is a well-regarded broker headquartered in Cyprus. The platform provides an extensive tradable instruments, over 1000, covering forex, commodities, equity indices, precious metals, and energies. Operating on the MetaTrader 4, MetaTrader 5 trading platforms, and XM WebTrader, XM ensures a reliable and user-friendly trading experience. With dedicated 24/5 customer support, the broker emphasizes timely and effective assistance. Recognized for its client-centric approach, XM has earned several recognitions, highlighting its commitment to excellence. Unique features include a loyalty program that provides cash rewards and bonuses, showcasing XM's focus on enhancing the overall trading experience for its users.

✅ Where XM Shines:

• Regulated by several reputable authorities, including CySEC (Cyprus), FCA (UK), and ASIC (Australia).

• Starting with as little as $5 allows beginner traders to test the platform.

• Offers over 1,400 CFDs, including forex, stocks, indices, and commodities.

• Solid educational resources, like unlimited access to Video Tutorials, free daily technical Analysis, and Daily Forex Market Outlook.

• Known for swift order execution with minimal slippage.

❌Where XM Shorts:

• Primarily focuses on CFDs, lacking options like futures or real stocks (except in the Shares account).

• Protection against negative balances isn't guaranteed outside the EU.

• No US clients accepted, unavailable for traders in the United States.

FP Markets

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

forex, shares, commodities, stock market indices and digital currencies |

Trading Platforms |

MetaTrader 4, MetaTrader 5, WebTrader, Iress |

Trading Costs |

Forex Standard account: spreads from 0.1 pips, with zero commissions charged Forex Raw account: spreads from 0.0 pips, with commissions at $3 per lot per side |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

Bank Transfer, PayPal, Debit/Credit Card |

Customer Support |

7/24 |

Established in 2005, FP Markets is an Australian regulated broker that has had an excellent operation for nearly 20 years, providing over 10,000 trading instruments across Forex, Shares, Metals, Commodities, Indices, Bonds, ETFs. Notably, FP Markets provide institutional grade liquidity and pricing by leveraging a Straight Through Processing (STP) model to route all client orders directly to tier-1 liquidity providers. Traders can access interbank spreads from 0 pips and fast ECN execution speeds on MetaTrader 4 and MetaTrader 5. With segregated client funds, dedicated account managers and 24/7 multilingual support, FP Markets combines the ideal blend of trading infrastructure, trust and service.

✅ Where FP Marrkets shines:

• A geniune STP broker, offering truly competitive spreads in the industry;

• Well-established, has operated for nearly 20 years;

• Social trading solutions introduced for easier forex trading;

• Robust Educational contents, covering Trading Courses Videos, Webinars, Podcasts, and more;

• Both MT4 & MT5, and Iress trading platforms on offer, a strong suite;

• Fast order execution, with average speed under 40 milliseconds;

• 7/24 customer service, Monday to Sunday

❌Where FP Markets Shorts :

• No free sign-up bonus offered

• Demo accounts incur a limited duration

Pepperstone

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$200 |

Tradable Instruments |

Forex, Commodities, Indices, Currency Indices.Cryptocurrencies, Shares, ETFs, CFD Forwards |

Trading Platforms |

MetaTrader 4, MetaTrader 5, cTrader. |

Trading Costs |

Standard account: variable spreads, with no commissionsRazor account: spreads from 0.0 pips, with commissions from $3 per lot per side |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

Credit / Debit Card, Bank Transfer, PayID/Osko, Bank Transfer, POLi |

Customer Support |

7/24 |

Founded in 2010 and regulated in multiple jurisdictions, Pepperstone has earned a strong reputation as a reliable and transparent Forex and CFD broker. They provide access to over 600 tradable instruments spanning currencies, indices, commodities, and shares across platforms like MetaTrader 4 & 5, cTrader, and their own proprietary platform. Notably, Pepperstone excels in tight spreads, often exceeding the industry average with raw spreads starting from 0 pips on major FX pairs. They also prioritize transparency with clearly outlined costs and no hidden fees. User recognition includes “TradingView Broker of the Year” and “Best MetaTrader 4 Broker,” solidifying their commitment to excellence. This, combined with their focus on educational resources and personalized support, makes Pepperstone a solid choice for both novice and experienced traders.

✅ Where Pepperstone Shines:

• Known for its ultra-low latency and swift trade execution, which is a significant benefit for high-frequency traders.

• Offers MetaTrader 4, MetaTrader 5, and cTrader platforms, all of which are suited to the needs of professional traders.

• Exceptionally competitive forex pricing with low spreads, reducing costs particularly for high-volume traders.

• Providing high leverage up to 500:1 (subject to eligibility), which can enlarge trading capacity.

• Offering robust analytical tools and technical indicators aiding comprehensive market analysis.

❌ Where Pepperstone Shorts:

• Although Pepperstone offers a broad range of forex pairs, its CFD offerings are not as extensive, which can restrict trading diversification for some traders.

• Pepperstone does not regularly offer bonuses or promotional campaigns, which can lessen its appeal compared to other brokers.

IG

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$250 |

Tradable Instruments |

Forex,Shares,Indices, Commodities, Thematic and basket,Options trading, Futures trading, Spot trading |

Trading Platforms |

Online, Mobile, Tablet & Apps |

Trading Costs |

Forex: Spreads on major FX from 0.6 pips CFD shares: Spreads on UK and US shares start from £3 or $3 per trade |

Max. Leverage |

40:1 |

Demo accounts |

✅ |

Copy Trading |

❌ |

❌ |

|

Payment Methods |

Debit Card, Wire Transfer, Bank Transfer (Automated Clearing House (ACH)) |

Customer Support |

7/24 |

IG Group, founded in 1974, is a UK-based company providing trading in financial derivatives such as contracts for difference and financial spread betting, and stockbroking to retail traders. It is recognized and regulated in multiple countries, thereby ensuring a smooth global operation. IG's customers can trade vast instruments including currencies, indices, commodities, stocks, ETFs, and more on its proprietary platform. This user-friendly platform is technologically superior, offering fast and reliable execution, real-time market updates, and advanced charting tools, all accessible on mobile and desktop. IG Group's 24/7 customer support is commendable, with a highly responsive team providing assistance via phone, email, or live chat. Moreover, IG is known for its educational offerings, providing a vast array of financial webinars and detailed market outlook articles.

✅Where IG shines:

• Globally and heavily regulated, a well-established forex broker, giving its traders an extra layer of security.

• Comprehensive trading platform which is feature-packed with advanced charting tools.

• Offering global market access allowing traders to engage in spread-betting on various markets from international stock indices to commodities.

• Providing robust customer support available 24/7, addressing traders' trading problems any time.

❌Where IG shorts:

• Features and tools on the trading platform can seem overwhelming for beginners.

• IG's trading costs may be higher in certain markets compared to many forex brokers.

• IG does not support the MetaTrader platforms, a pity for many MetaTrader lover.

InteractiveBrokers

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$250 |

Tradable Instruments |

global stocks, options, futures, currencies, cryptocurrencies, and more |

Trading Platforms |

IBKR Trader Workstation (TWS)IBKR DesktopIBKR MobileIBKR GlobalTraderIBKR Client Portal |

Trading Costs |

Tiered fee structure |

Max. Leverage |

40:1 |

Demo accounts |

✅ |

Copy Trading |

❌ |

❌ |

|

Payment Methods |

ACH, Bank Wire, Bill Pay, Check, Transfer from Wise Balance |

Customer Support |

5/24 |

Interactive Brokers LLC, founded in 1978, is a U.S.-based brokerage firm registered in Greenwich, Connecticut. It's a leading platform that offers a vast range of tradable instruments including stocks, options, futures, forex, bonds, ETFs and mutual funds, across over 135 markets in 33 countries. The broker provides powerful trading platforms like Trader Workstation (TWS), IBKR Mobile, and Client Portal, featuring sophisticated tools, charts, and analytics for advanced trading. Customer support involves numerous channels including chat, email, phone, and an extensive library of FAQs and educational resources. Interactive Brokers is widely recognized for its competitive fees, broad product range, and robust trading technology, making it a preferred choice for many seasoned investors and traders worldwide.

✅ Where InteractiveBrokers Shines:

• Heavily regulated by ASIC, FCA, SFC, FSA, IIROC, operating in a transparent way, adding an extra layer of security.

• Features advanced trading platforms with powerful tools, efficient order routing, and high-speed execution.

• Its tiered pricing structure is favourable for frequent traders, featuring low commissions and margin rates.

• Interactive Brokers affords investing in different currencies and in international markets, which allows more opportunities for diversification over the long term.

❌ Where InteractiveBrokers Shorts:

• Charges monthly inactivity fees if certain commission thresholds aren't met, negatively impacting infrequent traders or beginners with smaller portfolios.

• Despite multiple channels, customer support has been reported to be slow at times, possibly impacting traders who require immediate assistance.

• While direct margin rates are relatively low, tiered rates can be higher for some balances compared to competitors.

CMCMarkets

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$0 |

Tradable Instruments |

Forex pairs, Indices, Cryptocurrencies, Shares & ETFs, Commodities, Treasuries |

Trading Platforms |

Next Generation platform, MetaTrader 4 platformShare trading standard platformShare trading Pro platform |

Trading Costs |

0.7 points for EUR/USD |

Spread Betting |

✅ |

Max. Leverage |

30:1 ( Retail traders), 500:1 ( Pro traders) |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

EFT, Wire Transfer, Personal Cheque, Mastercard/Visa, PayNow, Bank Transfer, MEPS (SGD$) and more |

Customer Support |

5/24 |

CMCMarkets, established in 1989, is a UK-based financial services company that operates as an online broker, offering vast tradable instrument options including forex, shares, indices, commodities, treasuries, and cryptocurrencies. CMCMarkets provides a proprietary trading platform known as 'Next Generation', which is available on both web and mobile, and it also supports MetaTrader 4 for forex trading. Its customer support is comprehensive, offering 24-hour support via phone, live chat, and email. CMC Markets is highly regarded for its advanced trading platform, competitive spreads, exceptional charting tools, and a strong regulatory reputation.

✅ Where CMCMarkets Shines:

• Their 'Next Generation' platform is well-regarded for its powerful tools, customisable charts, and automated trading features catered towards professional traders.

• Competitive spread pricing is especially beneficial for high volume traders, often equating to significant cost savings.

• CMCMarkets supports a wide variety of order types, including guaranteed stop-loss orders, providing professionals with more control over their trading activities.

❌ Where CMCMarkets Shorts:

• CMCMarkets doesn't frequently offer promotions or bonuses, which can lessen its appeal compared to other brokers who do.

• While CMCMarketss Forex trading fees are competitive, their stock CFD fees tend to be on the higher side.

Exness

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$10 |

Tradable Instruments |

Cryptocurrencies,Forex, Commodities, Stocks, Indices and more |

Trading Platforms |

Exness Trade app, Exness Terminal, MetaTrader 5, MetaTrader 4,MetaTrader WebTerminal, MetaTrader mobile |

Trading Costs |

Raw Spread: Spreads from 0.0 pips, with commissions at $3.5 per lot Pro: Spreads from 0.1 pips, no commissions charged |

Max. Leverage |

Unlimited |

AED Accounts |

✅ |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

E-payment systems, bank cards, Bitcoin wallets, mobile banking methods, and even payments using bank cashiers |

Customer Support |

7/24 |

Exness is a well-established forex broker that was founded in 2008, with its main operational base in Limassol, Cyprus, providing a broad spectrum of tradable instruments, including forex pairs, metals, indices, cryptocurrencies, energies, and stocks. To suit varying trader requirements, Exness offers numerous trading platforms such as MetaTrader 4 and MetaTrader 5, Exness Trade App, readily accessible across desktop, web, and mobile devices. Standout features of Exness include superior customer support available 24/7 through multiple channels including live chat, email, and multilingual call services. The broker stands out for its transparency, providing key financial data directly via its official website, and has also gained recognition for its fast withdrawal processes, flexible leverage, and competitive spreads.

✅Where Exness Shines

• Globally and heavily regulated, a well-respected broker offers its clients great assurances.

• Offering access to popular platforms such as MetaTrader 4 and MetaTrader 5, across different devices.

• User reviews often praise Exness for its fast withdrawal processes, making it easier for traders to access their profits.

• Their round-the-clock customer service is highly responsive and available in over 20 localized languages.

• Experienced traders appreciate the low spreads offered by Exness.

• Unlimited leverage ratio giving scalping traders and high-frequency traders, giving them great encouragement in trading.

❌Where Exness Shorts

• Due to regulatory constraints, Exness's services are unavailable in certain countries, such as the U.S. and Japan.

• Though Exness does offer stock trading, the selection is quite limited as compared to some other industry players focused more on equity trading.

AvaTrade

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

currency pairs, major stock indices, Cryptocurrencies, commodities (such as gold, silver, sugar, coffee), bonds, individual shares and ETFs |

Trading Platforms |

AvaSocial, Web trader, AvaTradeGO, MetaTrader 4,MetaTrader 5 |

Trading Costs |

Spreads from 0.9 pips |

Max. Leverage |

400:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

credit/debit cards and wire transfers, Skrill, Neteller, and WebMoney, and more |

Customer Support |

5/24 |

Founded in 2006, AvaTrade is a well-established and trusted broker with its headquarters in Dublin, Ireland. The company is regulated in several jurisdictions, including Australia, Japan, the British Virgin Islands, and South Africa. AvaTrade offers a broad spectrum of more than 250 financial instruments, covering forex pairs, stocks, indices, commodities, cryptocurrencies, and bonds. The broker provides several advanced trading platforms, such as MetaTrader 4 and 5, AvaTradeGO, AvaOptions, and a variety of automated trading platforms. AvaTrade pride themselves on their competitive spreads and no commission structure, allowing traders to manage their trading costs effectively. They offer dedicated customer service support in multiple languages, reachable through various avenues such as phone, email, and live chat. AvaTrade's global standing is solidified by numerous international recognitions, including awards like 'Most Trusted Forex Broker' and Best Forex Trading Experience.

✅ Where Avatrade shines:

• Regulated by multiple top-tier regulatory bodies, providing traders with a safer and more secure trading environment.

• AvaTrade has received multiple awards, further cementing its reputation as a trusted and reliable broker in the forex trading industry.

• Multiple choices of MetaTrader 4 and 5, AvaTradeGO, AvaOptions, and several automated trading platforms provides flexibility for traders in choosing a platform that best suits their style.

• AvaTrade has a dedicated customer service team that is available in several languages and can be reached via various channels, including phone, email, and live chat.

• AvaTrade supports several social trading platforms like ZuluTrade and DupliTrade, allowing traders to copy the strategies of experienced traders.

❌Where Avatrade Shorts :

• Withdrawal requests usually take 1-2 business days to process, which is slower compared to some competitors.

• AvaTrade offers a limited range of cryptocurrencies for trading, which could disappoint traders interested in this area.

• AvaTrade requires a relatively high initial deposit to open an account, with no micro account offered, slightly disappointing beginners.

Forex Trading Knowledge Questions and Answers

What is Foreign Exchange Regulation?

Forex regulation is a financial regulation specifically for the Forex market. Since forex trading is decentralized without any uniformly recognized supervision authority, forex frauds come out everywhere preparing to extract all available funds from investors.

Forex regulation is to ensure that the forex market is a safe place to take part in.Each forex regulator operates within its own jurisdiction and regulation enforcement varies significantly from country to country.

For example, the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC) in the US, the Australian Securities and Investments Commission (ASIC) in Australia, and the Financial Conduct Authority (FCA) in the UK.

These bodies act as watchdogs and provide financial licenses to organizations that comply with local regulations.

Which Forex Broker Is Best for You?

You will come across dozens of forex brokers eager to earn your business when you search online. The first thing you need to figure out is what kind of forex trader you want to be, your trading needs (like are you going to trade a lot or just a little?), and your trading goals.

Then you need to consider several key points, including regulation, the level of security, transaction fees, account opening, trading platforms, the ease of withdrawal, customer support services, and so on. Finding a proper broker is not that easy, and you need to take time to investigate which brokers can satisfy your trading goals most.

For instance, an experienced trader should choose a well-regulated forex broker with a low initial deposit, competitive trading costs, user-friendly trading platforms, dedicated and professional customer support in case of heavy funds losses.

An advanced broker can choose other brokers offering specific features to satisfy their more aggressive trading strategy.

How to Choose A Suitable Forex Broker?

There is no doubt that the forex market is one of the simplest financial markets to get started. However, finding a broker that suits your trading needs and experience level most is not that easy.

When it comes to how comfortable you should feel with your broker, financial transparency and regulation are both critical. It also matters whether different account features including leverage & margin, commission & spread, initial capital requirement, and ease of deposit and withdrawal can meet your trading needs.

For example, if you are a novice or inexperienced trader, it is preferable to choose these strictly regulated brokers who require a much lower minimum initial capital and low leverage. While seasoned traders have a broader selection of brokers to choose from to satisfy their more aggressive trading strategies.

Which forex brokers offer low spreads?

Nowadays, the vast majority of brokers will not charge commissions and will instead profit from wider spreads. Therefore, wider spreads mean high trading costs. Many forex brokers hype that they offer highly competitive spreads to attract brokers.

There are also some ranking lists of the lowest spreads forex brokers on the internet. Here we find a relatively trustworthy one for your reference:

Pepperstone requires no minimum initial deposit, offers floating spreads, with average EUR/USD spreads as low as 0.09 pips.

IC Markets, requires a minimum deposit of $0, offering floating spreads, with average EUR/USD spreads as low as 0.10 pips.

XM, requires a minimum deposit of $5, offering floating spreads, with average EUR/USD spreads as low as 0.10 pips.

Exness, requires a minimum deposit of $10 only, offering competitive spreads, with raw spreads as low as 0.0 pips.

CMCMarkets, requires a minimum deposit of $0, offering an average EURUSD spread at 0.7 pips.

FP Markets, requires a minimum deposit of $100, offering raw spreads from 0.0 pips.

Who Is the Biggest Forex Broker In the World?

IC Markets is considered the largest forex brokers in the world by trading volume. As of March 2023, they reported a total trading volume of US$1.2 trillion. They announced a 23% increase in Forex trading volume from Q2 to Q3 2023. They offer tight spreads, fast and quality execution, attracting high-volume traders.

Which forex broker offers the best copy trading solutions?

Avatrade's fully-featured and integrated copy trading system makes replicating trades from vetted managers easy and flexible within a regulated trading environment. Avatrade integrates their customized AvaSocial copy trading platform into MetaTrader 4 and 5 for automated, efficient trade execution. Traders can evaluate and copy from over 200 profitable managers using performance metrics and trading history. AvaSocial offers customizable copy trading settings like copy ratio adjustments and the ability to stop copying signals, which responds to individual risk management preferences.

Can I trade forex without a forex broker?

Of course, you can. Trading forex, however, without a broker, is strongly discouraged. Firstly, the forex interbank market demands high minimum trade sizes, often around $1 million, making it inaccessible for individual traders who lack such substantial capital. Here's where brokers come in – they offer leveraged trading, like 100:1 or 500:1, allowing regular traders to control larger positions with minimal margin. This makes profitable forex trading feasible for many. Additionally, brokers provide essential tools, platforms, and handle transaction settlement, saving traders from hefty investments risks. Therefore, simply put, trading with a broker is the wise and practical choice.

Which forex broker offers the most currency pairs?

With almost 10,000 CFDs available, CMC Markets stands out by offering the highest number of tradable currency pairs. With 158 pairs quoted in both directions (e.g., EUR/USD or USD/EUR), the total count reaches an impressive 330 pairs.

Which Forex Broker Offers the Best Platform?

Many forex brokers provide investors with superb offerings to attract more investors and earn their business.

When it comes to which forex broker offers the best platform, we would say IC Market is the winner. IC Market is an ASIC and CYSEC regulated multi-asset forex broker, offering more than 1780 trading instruments, with its average spreads of 0.1 pips best in the world.

Account types depend on what trading platforms you are choosing. IC Market features a transparent and competitive pricing structure, with spreads from 0.0 pips, easy to calculate, friendly both for novices and experienced traders.

Concerning trading platforms available, it offers industry-recognized MT4, MT5, and cTrader for traders to choose from. IC Market comes with professional 24/7 customer support available in Telephone, Email, and online chat to solve your problem quickly. With all these features, IC Market can be recognized as the best platform for beginners and experienced traders.

What Should Be Taken Into Account When Choosing An Online Broker?

Choosing an online forex broker is the first key step when you decide to start trading in the forex world. Some key aspects you should take into consideration are:

Regulation

This is the most important thing. Some top-tier regulatory jurisdictions include ASIC (Australia), FCA (UK), CFTC /NFA (US)-any of these can render confidence that the broker is legit.

Trading Platforms

Industry-Recognized trading platform like MT4, MT5, cTrader.

Minimum Deposit

Usually a lower amount. Illegal forex broker love to require a high initial deposit to extract innocent investors funds.

Ease of Withdrawal

You can withdraw your deposited funds quickly, easily, and without any fees.

Spreads/commission

Trading costs are transparent, no hidden fees. Spreads are not too wide.

Customer Support

A professional and responsive customer support attaches great importance in forex trading. You need contact this broker anytime anywhere if something goes wrong.

Which Forex Broker Is Best For Beginners?

It is vital for beginners who start to step into the forex market to choose a reliable forex broker, for the forex world is highly volatile.

A forex broker suitable for beginners typically requires a low initial deposit, not-too high trading costs, easy-to-use trading platforms, dedicated customer support, rich educational resources.

More importantly, it is stringently regulated.

IC Markets is super suitable for beginner traders, with its minimum deposit of as low as 100 USD, regulated by top-tier regulatory bodies: CySEC & ASIC.

Besides, IC Markets offers rich trading instruments through advanced MT4, MT5 trading platforms, as well as their proprietary platforms-FBS trader and CopyTrade.

A crucial point is that FBS offers responsive and professional 24/7 customer support, waiting to solve your problems once something goes wrong.

How to Choose the Proper Forex EA for You?

Expert Advisors (EA) in the forex trading market refers to a software that is capable of providing you with advice on the best possible buying and selling conditions in the market. EAs can be programmed to automatically generate trading signals and notify traders of trading opportunities. In most cases, forex EA are associated with trading platform like MT4 and MT5, so forex traders have numerous opportunity to use forex EA.

When it comes to the argument of whether EA really works or not, well, it does work technically. However, like most trading tools, the end result depends on what they are used for and how well they are used.

EAs have gained great popularity since the MetaTrader 4 trading platform was released. There are also many EA scams, so traders should take extra care when using EAs. Before you begin real trading, you must first test the robot using a demo account and do backtests on historical market data.

Choose an STP forex broker that allows you to trade micro lots to start real trading with the least amount of risk and also to see if the EA performs properly well with that broker.

Using Expert Advisors is like a double-sword, for it has both advantages and disadvantages. Pros and Cons of EAs are as follows:

Pros of EAs

1. Trade and manage various currency pairs simultaneously without a mistake;

2. Faster order execution;

3. Good for new traders who have little knowledge about forex trading;

4. Eliminates emotions;

5. Makes Blacktesting Easier;

Cons of EAs

1. Additional cost of VPS;

2. Technical Failures can Occur;

3. Over-Optimized Performance Results;

4. Black Box System;

The Importance of Forex Brokers' Customer Support

Traders need to consider a lot when choosing a forex broker, such as regulation, minimum initial deposit, trading platforms, and more, but customer support is no less important to check a forex broker is trustworthy or not.

If your customer support is easy and fast to access, then you wont have to worry about getting your concerns resolved swiftly later on. For instance, if you have difficulty in withdrawing your funds, you get in touch with your customer support in time, then you can get your money back with the help of its support staff in a short time.

However, if you encounter poor customer support, it may take a long time to get your money back, or it is likely to disappear forever.

Overall, poor customer support can be counted as a symbol of a cheating broker, while reliable forex brokers are always providing dedicated customer support.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like

7 Best Platforms for Copy Trading in India 2026

India's leading copy trading platforms allows you to automatically copy the trades of top performers, enhancing profitbility.

Beware: 10 Fake Forex Brokers in the UK in 2026

With the need for caution in the UK's flourishing forex market, this article points out 10 fake brokers to avoid amidst numerous reputable entities.

Best Forex Brokers in Denmark for 2026

Discover top regulated forex brokers, trading platforms and broker reviews for reliable trading in Denmark.

Best Forex Brokers Ireland in 2026

Compare top forex brokers in Ireland with robust regulation, excellent platforms and broker reviews for secure trading.

7 Best Platforms for Copy Trading in India 2026

India's leading copy trading platforms allows you to automatically copy the trades of top performers, enhancing profitbility.

Best Forex Brokers in Denmark for 2026

Discover top regulated forex brokers, trading platforms and broker reviews for reliable trading in Denmark.

Best Forex Brokers Ireland in 2026

Compare top forex brokers in Ireland with robust regulation, excellent platforms and broker reviews for secure trading.

Best Forex Brokers with Trading APIs for 2026

Dive into top Forex Brokers with exceptional trading APIs, offering benefits, security, and a variety of platforms.