While the Israel forex market may not match the scale of major global hubs such as London and New York, its growth has been noteworthy, driven by increasing interest in online trading platforms and the rising popularity of forex trading among Israeli investors.

In Israel, the Israeli Securities Authority (ISA) stands as the chief overseer of forex trading activities. Tasked with licensing and overseeing forex brokers in the nation, the ISA plays a pivotal role in establishing regulations to safeguard investors engaging in forex trading.

Forex trading is gaining traction in Israel, especially among the younger and tech-oriented population.This popularity is due to several factors,including the ease of access to online trading platforms, the allure of high returns, and the relative liquidity found in the forex market. However, with so many brokers out there, picking a proper one can be a daunting task. Yet, selecting the right broker amidst a large number can pose a significant challenge. Here we genuinely list the best forex brokers in Israel to provide investors with more confidence when trading.

8 Best Forex Brokers in Israel

$10 to start trading with a reputable broker, competitve spreads offered.

Top-tier regulators licence and regulate traders, ensuring financial security.

Processing times for deposits and withdrawals are minimal.

FP Markets offers consistently tighter spreads from 0.0 pips, 24/7 Multi-lingual support

Top-tier trading platforms, such as MetaTrader 4, cTrader, and TradingView, among others.

With latency of less than 30ms, this broker is ideal for day traders and scalpers.

more

Comprison of Best Forex Brokers in Israel

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers in Israel Overall

| Brokers | Why are they listed as the Best Forex Brokers in Israel? |

|

√ Heavily and globally regulated, including tier-1 FCA, giving clients lots of confidence in trading. √ Tight spreads and fast execution, paired with transparency, highly recognized by numerous traders. √ Fast and convenient withdrawal process, standing out among competitors. |

|

√ Regulated by CYSEC, in accordance with European laws. √ A long operation history of 15 years, favorable by traders all over the world. √ Localized customer service and payment options, providing multilingual services and convenient deposit and withdrawal. |

|

√ heavily regulated gloablly, a multi-tiered network of liquidity providers giving direct market access. √ Execution as fast as 30ms (0.03 seconds), minimizing slippages. √ Multiple payment options and multilingual customer support, targeting traders from all over the world. |

|

√Regulated by respected authorities, including FCA and CYSEC, with a long operation of over 20 years. √A large number of positive ratings on various review platforms, a high score of 9.13 (full score of 10) on WikiFX.√Transparent fees and fast order execution speed making it a big player in the forex industry. |

|

√ An excellent score of 4.3 out of 5 on the most famous rating website from over 1000 reviews, based on its pricing, platform permance. √ Providing local payment methods for added convenience. √Provides 24/7 customer service in multiple languages, ensuring global accessibility. |

|

√ A Cyprus-based broker, heavily regulated by regulators in five jurisdictions. √ Favorable trading conditions such as tight spreads and fast execution speeds, making trading easier. √ Four tiered trading accounts give traders more flexibility based on their trading styles and trading strategies. |

|

√Straightforward and fast account opening process. √ A score of 4.6 out of 5 based on over 100 reviews. √ Providing 24/5 customer service with most users citing a high degree of satisfaction with the quality of support received. |

|

√ Strictly regulated by FCA and CYSEC, a weighty player in the European market. √ Trustscore 4.6 based on over 20,000 reviews, high recommended by traders, over 2 million accounts opened on this platform. √ $1 to start trading, investing and deposit across 12 global currencies. |

Exness

Overall: ⭐⭐⭐⭐⭐

Regulations: FCA, CYSEC, FSCA, FSA

Best for experienced traders, all-round offerings

Exness is an online forex and CFD broker that was established in 2008. Registered in Cyprus, this company has expanded its reach to become a well-known brokerage firm, providing trading services to clients around the world. Exness is renowned for its intuitive trading platforms and extensive selection of financial instruments, which have made it a favoured option for traders in the foreign exchange and financial markets.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

FP Markets

Overall: ⭐⭐⭐⭐⭐

Regulations: ASIC, CYSEC

Best for copy trading, VPS hosting provided

FP Markets, an Australian forex and CFD broker, was established in 2005. Based in Sydney, FP Markets is regulated by the Australian Securities and Investments Commision (ASIC) and holds an Australian Financial Services Licence. Throughout its extensive history of more than 15 years, FP Markets has established itself as a trusted name in the industry, known for its highly competitive pricing, lightning-fast execution speeds, and top-notch trading platforms such as MetaTrader 4, MetaTrader 5, and Iress. FP Markets provides a wide range of trading options, including forex trading on over 60 currency pairs and CFDs across various assets such as indices, commodities, shares, and cryptocurrencies. Traders have the option to select between raw spread accounts that offer access to deep liquidity or ECN accounts that provide tight variable spreads. FP Markets welcomes clients from around the world and is renowned for its round-the-clock customer support in multiple languages.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

Pepperstone

Overall: ⭐⭐⭐⭐⭐

Regulations: ASIC, CYSEC, FCA, SCB

Best for scalping trading and hedging

Pepperstone, an online forex and CFD broker, was established in 2010 in Australia. The company is based in Melbourne, Australia, and has become a favoured option for traders around the globe. It provides access to a wide range of financial markets and trading instruments through its easy-to-use trading platforms. Pepperstone is renowned for its competitive pricing, tight spreads, and unwavering dedication to delivering a dependable trading environment for its clients.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

FxPro

Overall: ⭐⭐⭐⭐⭐

Regulations: CYSEC, FCA

Best for MetaTrader Users, Commission-Free Trading

FxPro is a prominent online forex and CFD broker based in the United Kingdom. Founded in 2006, FxPro has established itself as a trusted and well-regulated financial services provider, offering trading services in various markets, including foreign exchange, stocks, indices, commodities, and more. The company is known for its user-friendly trading platforms and commitment to providing a secure and transparent trading environment to its clients.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

FBS

Overall: ⭐⭐⭐⭐⭐

Regulations: CYSEC,FSC

Best for mobile trading, easy account opening

FBS is a forex and CFD broker established in 2009. With its headquarters in Cyprus, the company maintains a global presence through offices in various countries like Indonesia, Malaysia, and Thailand.The broker offers access to a bulk of markets encompassing currency pairs, precious metals, CFDs on stocks, and cryptocurrencies. Clients of FBS have access to the widely respected MetaTrader 4 and MetaTrader 5 trading platforms to have a superb trading environement.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

HFM

Overall: ⭐⭐⭐⭐⭐

Regulations: FCA, CYSEC, DFSA, FSA, CNMV

Best for High-Frequency Trading, Market Maker

HFM (formerly HotForex) was launched in 2010 and is now a reputable online forex and CFD broker. The Cyprus-based company has become well-known in the financial sector for its extensive selection of trading products and simple-to-navigate interfaces, making it a favourite among traders of all experience levels. HFM is a global trading firm that is regulated by a number of governing bodies to protect its customers' money.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

Fusion Markets

Overall: ⭐⭐⭐⭐⭐

Regulations: ASIC, FSA

Best for Low-Cost Trading

Fusion Markets, established in 2010, is a cutting-edge online forex and CFD broker rooted in Australia. It's designed to help clients trade on the financial markets at significantly lower costs. Its exclusive features include offering two account types to cater to all kinds of traders, ultra-low commissions, extensive educational resources, and responsive customer support. It is regulated by the Australian Securities and Investments Commission (ASIC), ensuring the utmost level of safety for client funds.

| Pros | Cons |

|

|

|

|

|

|

|

Trading 212

Overall: ⭐⭐⭐⭐

Regulations: FCA, CYSEC

Best for Zero-commission on stock trading

Trading 212 is a financial services company that offers a commission-free online trading platform for stocks, ETFs, CFDs, and forex. The company was founded in 2006 and is based in London, United Kingdom. Trading 212 is regulated by the FCA in the UK, and CYSEC in Cyprus. Trading 212 is an ideal chocie for zero-commission tarding on stock trading.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

Forex Trading Knowledge Questions and Answers

Is forex trading legal in Israel?

Yes, forex trading is legal in Israel.The Currency Control Law of 1978, which previously restricted foreign exchange transactions, was largely abolished in the 1990s, allowing for a more open and liberalized forex market. Nowadays, Israeli residents are generally free to engage in forex trading, both domestically and with foreign brokers.

Certainly, it's crucial to highlight that specific regulations are in effect to maintain the integrity and stability of Israel's financial system. Notably, the Israel Securities Authority (ISA) supervises forex trading activities and lays down distinct criteria for brokers functioning within the country.

What are differences between forex trading in Israel and other countries?

| Feature | Israel | United Kingdom | United States | Australia | Japan |

| Authorization Requirement | Not mandatory but recommended | Mandatory by Financial Conduct Authority (FCA) | Mandatory by the National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC) | Mandatory by Australian Securities and Investments Commission (ASIC) | Mandatory by Financial Services Agency (FSA) |

| Capital Requirements for Brokers | Specific requirements based on broker's activities | Minimum capital requirement of €730,000 | Minimum capital requirement of $20 million | Minimum capital requirement of AUD1 million | Minimum capital requirement of ¥100 million |

| Leverage Restrictions | Retail clients limited to 1:20 leverage | Retail clients limited to 1:30 leverage for major currency pairs and 1:20 for other pairs | Retail clients limited to 1:50 leverage for major currency pairs and 1:20 for other pairs | Retail clients limited to 1:30 leverage for major currency pairs | Retail clients limited to 1:25 leverage for major currency pairs |

| Segregation of Client Funds | Required | Required | Required | Required | Required |

| Client Protection Measures | Capital requirements and dispute resolution mechanisms,, etc | Capital requirements, leverage limits, and negative balance protection, etc | Capital requirements, leverage limits, and best execution practices, etc | Capital requirements, leverage limits, and complaint handling procedures, etc | Capital requirements, leverage limits, and margin closeout procedures,etc |

| Transparency Requirements | Brokers required to provide transparent information about their trading conditions, fees, and risks | Brokers required to provide transparent information about their trading conditions, fees, and risks | Brokers required to provide transparent information about their trading conditions, fees, and risks | Brokers required to provide transparent information about their trading conditions, fees, and risks | Brokers required to provide transparent information about their trading conditions, fees, and risks |

Can I make money with forex trading in Israel?

Making money through forex trading in Israel is possible, just as it is in any other country.However, the country in which you trade doesn't significantly impact the potential for profit. Forex trading inherently involves high risk, and profit isn't guaranteed. To enhance your chances, focus on selecting a reliable forex broker and educating yourself extensively about the fundamentals of forex trading. More importantly, steer clear of common trading errors that many traders fall into and avoid pursuing quick or high profits. In this way, you can significantly improve your profitability in the forex market.

Which is the most popular forex broker in Israel?

Picking the top forex broker in Israel can be quite a task since it often hinges on subjective factors and individual requirements. Nonetheless, when considering aspects like market presence, customer feedback, and industry accolades, Exness frequently emerges as the most favored brokers in Israel.

Exness, an well-established online forex and CFD broker established in 2008, stands out for its diverse trading instruments, competitive trading terms, and diverse account options to suit various trading styles and expertise levels. As one of the significant players in the forex sector, Exness boasts a stellar reputation and a widespread global footprint. It prides itself on user-friendly interfaces, making it particularly accessible for newcomers, while offering advanced trading platforms, stringent regulation, swift account setup, transparent fee structures, and prompt, reliable customer service—a combination that resonates well with traders in Israel.

What are the penalties for forex brokers who break the rules in Israel?

The penalties for forex brokers who violate regulations in Israel can be severe.The Israel Securities Authority (ISA), overseeing the forex trading industry, holds substantial enforcement powers, such as the ability to impose fines, revoke licenses, and initiate criminal charges.

These are some of the specific penalties that forex brokers may face for breaking the rules:

Administrative fines:The ISA can issue administrative fines of up to NIS 10 million (approximately $2.8 million) for violations of its regulations.

License revocation: The ISA can revoke a forex broker's license if it finds that the broker has violated the law or its regulations. This can effectively put the broker out of business.

Criminal charges: In serious cases, the ISA can refer forex brokers to the police for criminal prosecution. This can result in imprisonment and/or fines.

Besides these penalties, the ISA can also compel forex brokers to take remedial measures, such as reimbursing clients or adjusting their trading practices.

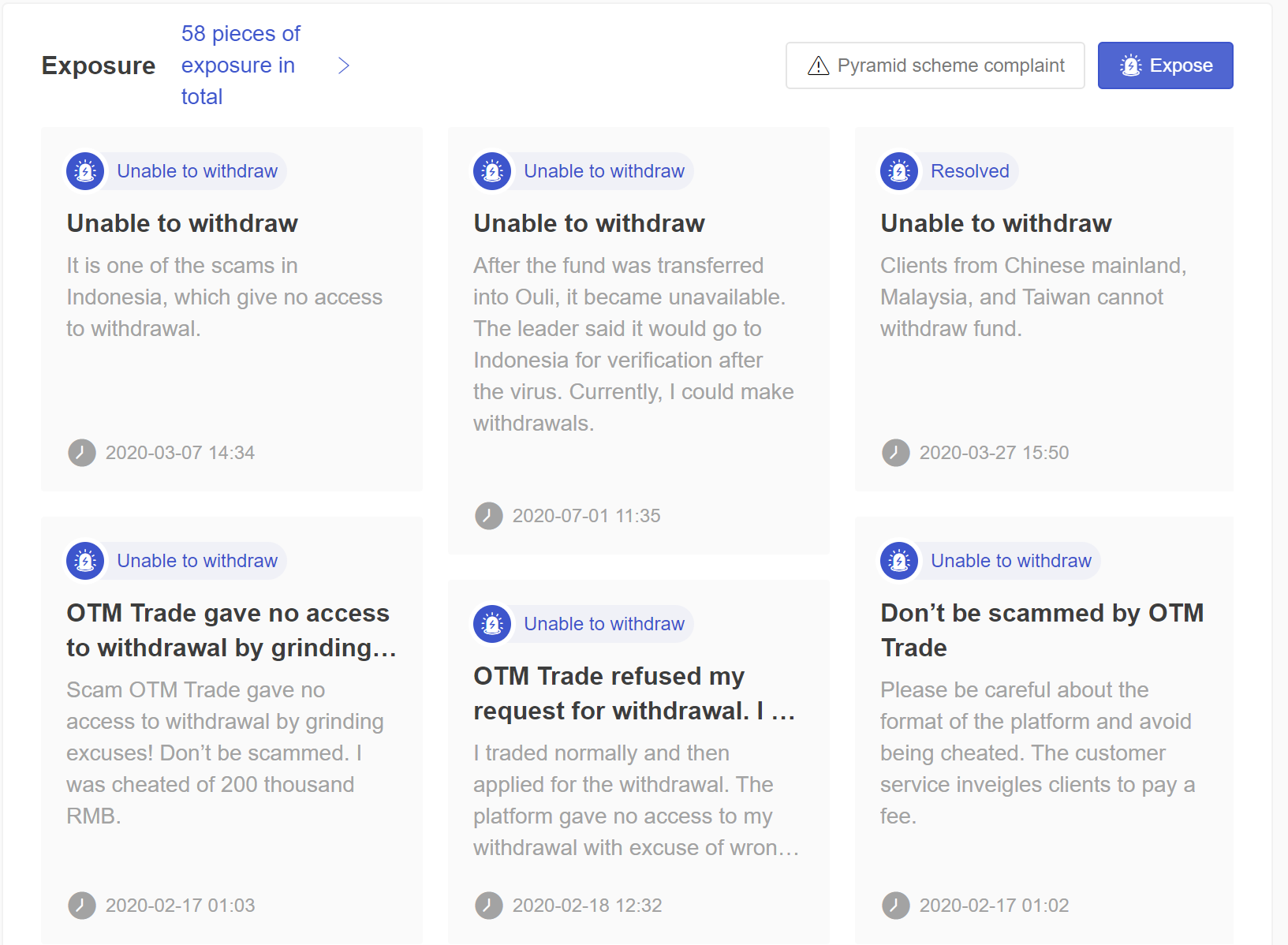

What are scam brokers that traders should avoid in Israel?

Scam brokers in Israel often exhibit deceptive practices by claiming false regulatory licenses or operating without proper authorization. These brokers tend to use cloned websites, making it challenging to access or verify their legitimacy. Victims frequently report instances of fund withdrawals being denied or delayed, with substantial evidence of fraudulent activities. Here are five scam brokers that traders should avoid in Israel:

| Broker | Logo | Registered country | Regulation | Establishment of Years | Trading Platform | Customer Support | Additional Notes |

| OTM Trade |  |

Indonesia |  |

5-10 years | MT4 | Email Only | Up to 58 pieces of scam exposure, physical office scale uncertain |

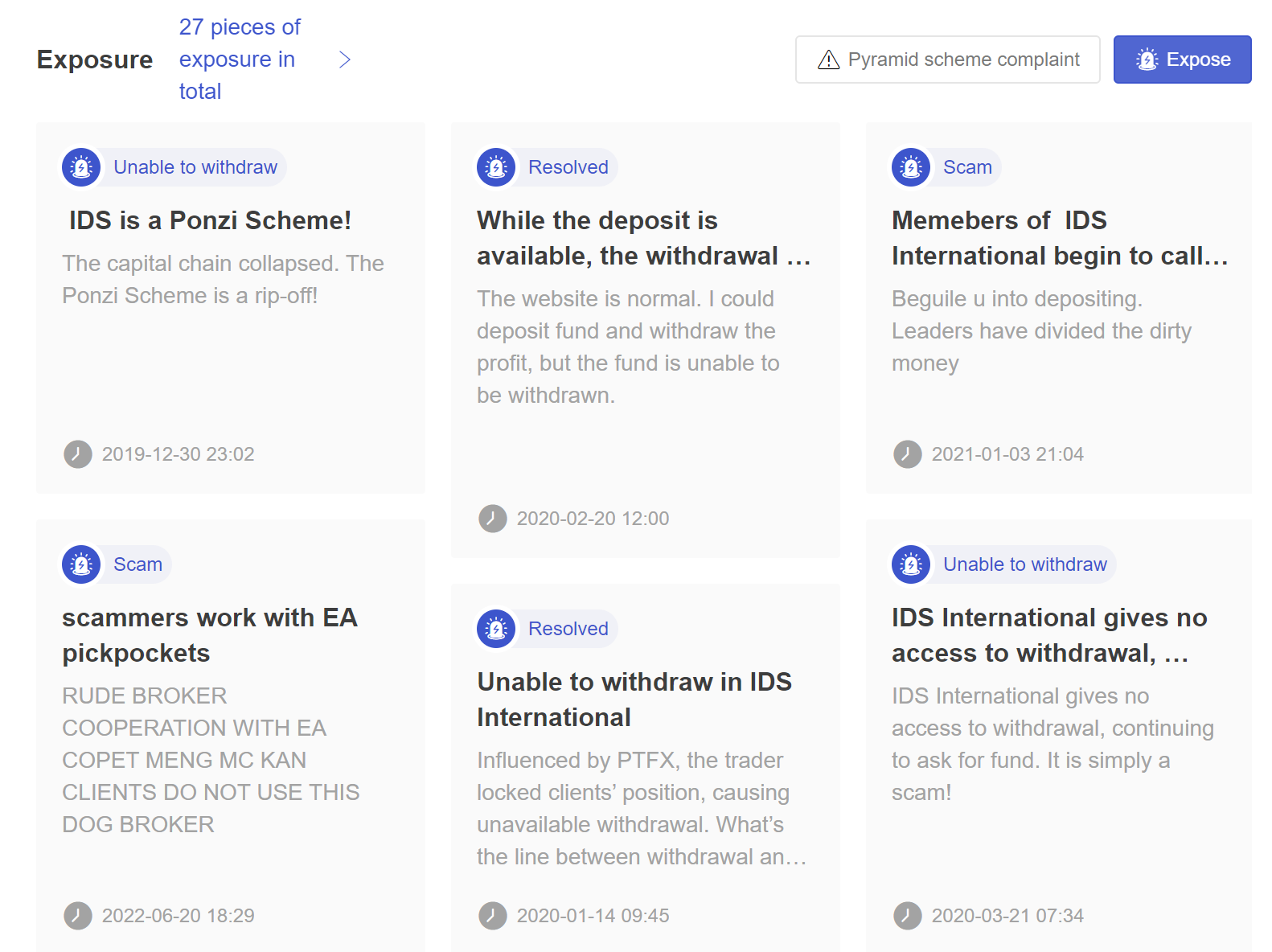

| IDS International |  |

Saint Vincent and the Grenadines |  |

2-5 years | MT4 | Phone & Email | |

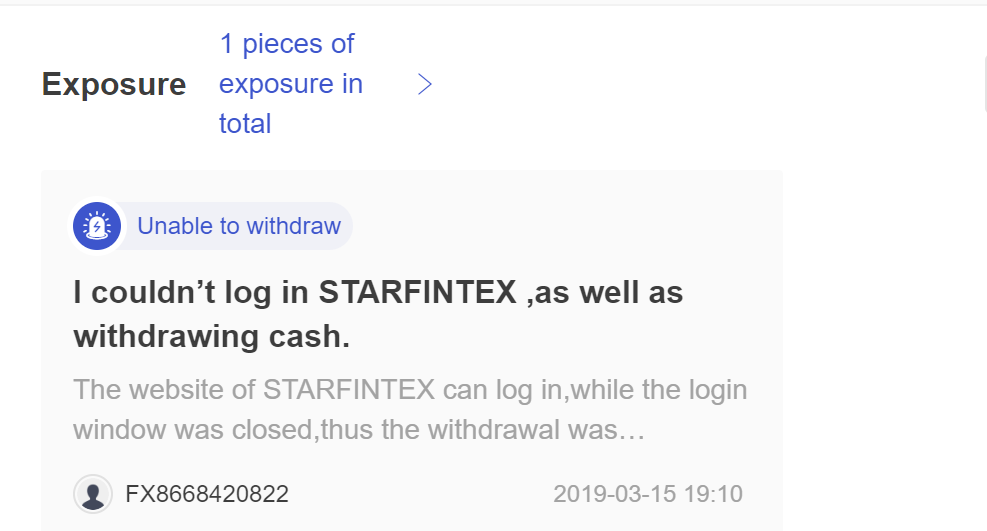

| STARFINTEX |  |

United States |  |

5-10 years | Unknown | Fake license, 1 piece of scam exposure | |

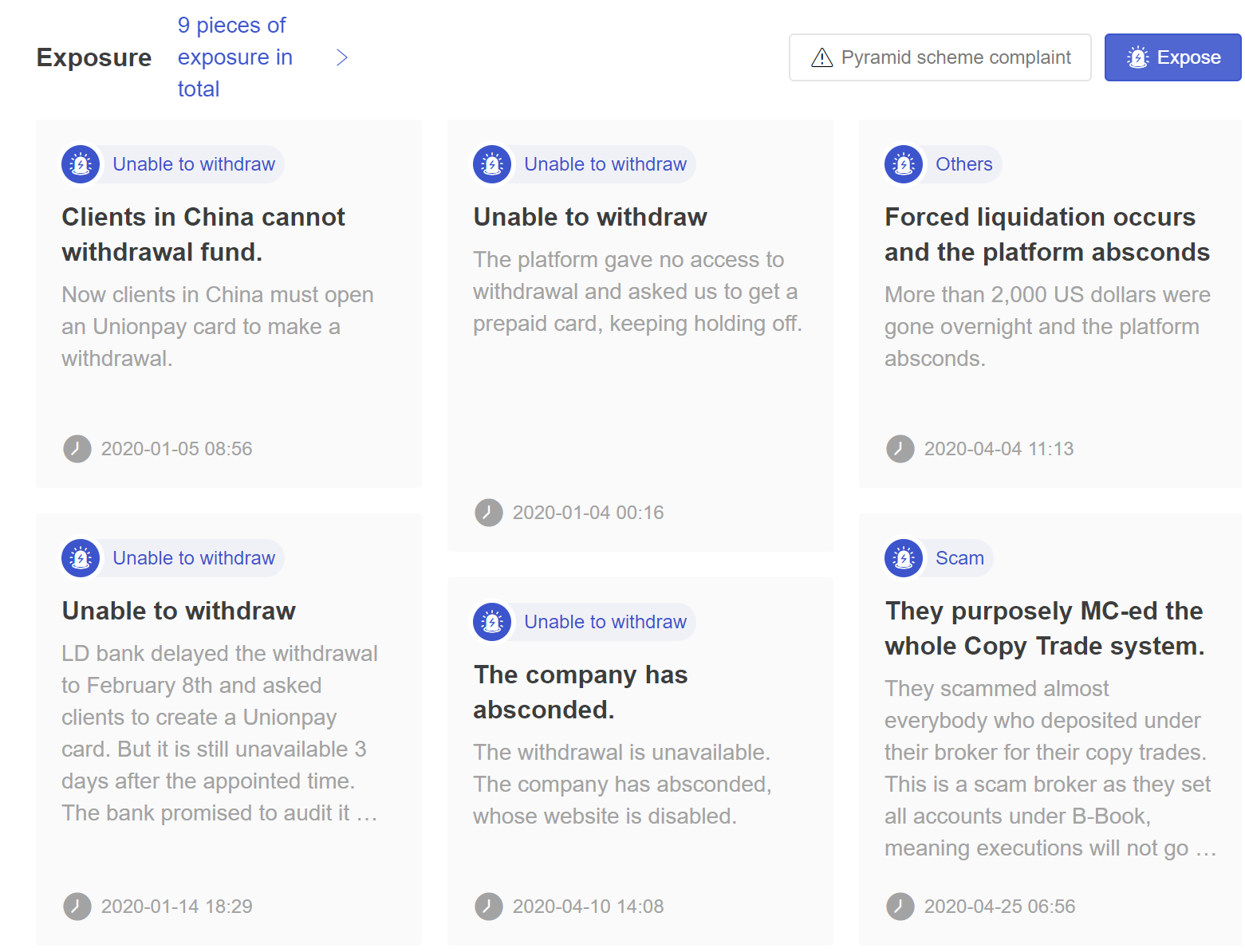

| GOLD TINKLE |  |

Malaysia |  |

2-5 years | MT4 | Phone & Email | 9 pieces of scam exposure, finding no physical office |

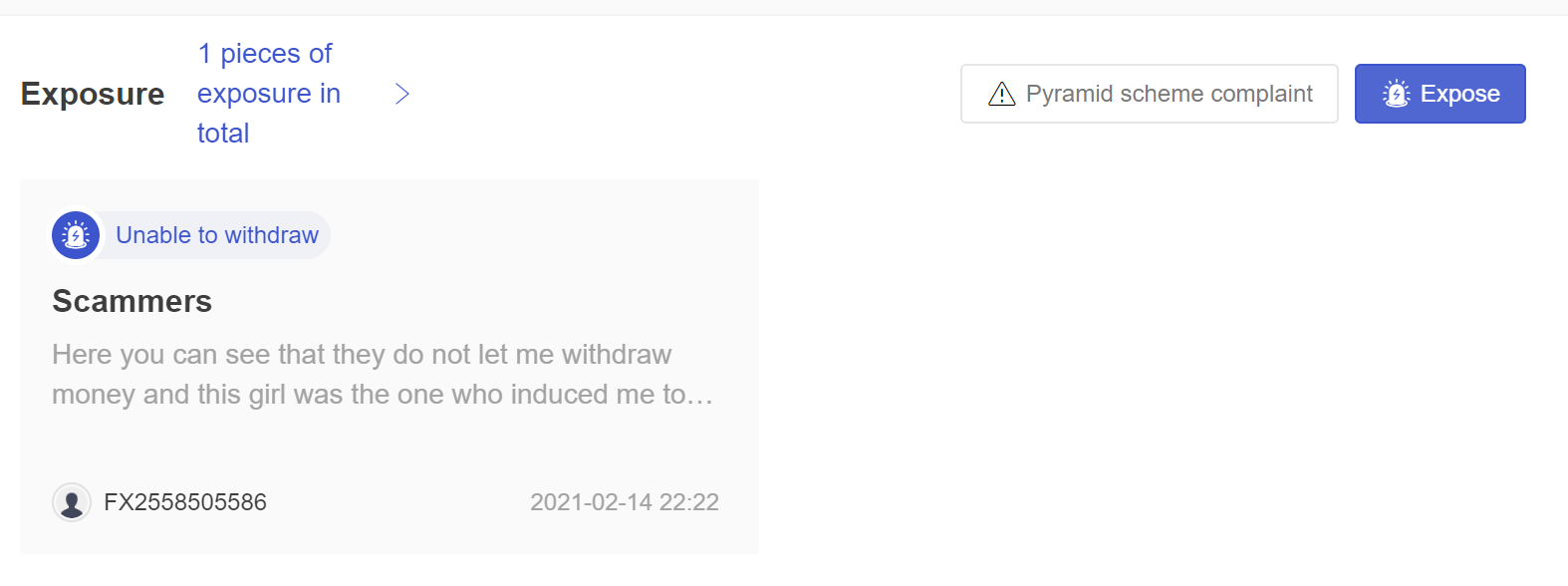

| Magking Forex |  |

Unknown |  |

5-10 years | MT4 | Email Only |

OTM Trade, an Indonesian brokerage firm, operates under the entity OTM Capital. The concerning issue with this broker lies in its usage of a cloned domain, rendering its website entirely inaccessible. Shockingly, this scam broker has amassed a staggering 58 scam exposures, indicating a high risk of financial loss once invested. A visit to its registered office unveiled a mysterious aspect regarding the company's scale, casting doubt on its legitimacy. Traders in Israel should unequivocally steer clear of engaging with this broker.

IDS International, an offshore online broker operated by IDS International Ltd, operates from Saint Vincent and the Grenadines, a notorious hotspot for several scam brokers. This broker, established in 2021, operates without regulation. They employed fake domains and contact information to trick investors into their schemes and swindle their money. Over 27 victims have been defrauded by this scam broker, and 27 scam exposures with strong evidence confirm this broker is unequivocally a scam. You can check the scam report about this broker here: https://www.wikifx.com/en/newsdetail/202106222594511519.html.

STARFINTEX, run by STARFINTEX smarter finance, supposedly registered in the United States, asserts to possess an NFA license. However, our investigation revealed that the institution on the license isn't an NFA member. This tactic attempts to deceive and entice unsuspecting investors. The broker's official website is no longer functional, and there have been reports from victims who were unable to withdraw their funds. It's a classic scam that traders should unequivocally avoid.

GOLD TINKLE, operated by Genesis Business Group Limited in Malaysia, lacks regulation from any governing authority. Its official website might be currently inaccessible, and there are 9 documented scam exposures with substantial evidence against this broker.

Magking Forex is an online forex broker claiming registration in an undisclosed location, supposedly established in 2020 and registered in Hong Kong. However, an intriguing observation arises: brokers registered in Hong Kong typically fall under the regulation of the SFC. Surprisingly, the broker's name doesn't appear on the SFC website. Complicating matters further, its official website is inaccessible, and it frequently alters its domain name to deceive individuals.

To Wrap Up

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain the leaderboard for the top broker series and provide in-depth forex guides for traders. We've catalogued over 50,000 brokers under the purview of more than 30 regulatory authorities. At WikiFX, our expertise empowers your forex trading journey, instilling confidence and facilitating ease of trading.

You Also Like:

Best Forex Brokers in Turkey for 2024

Review top 9 forex brokers in Turkey, elevating their trading pros and cons to give traders more useful guidance.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Swiss Forex Brokers for 2024

Explore top 10 forex brokers in Switzerland, elevating their trading pros and cons to give traders more useful guidance.

Best Stock Brokers in the US for 2024

When choosing an online broker, finding the platform that best fits your investment needs is crucial. With the rise in popularity of online trading, more brokers are offering free stock trading and commission-free transactions for various assets. It has become a challenge for users to select suitable brokers.

Best MT5 Forex Brokers in 2024

Here is our pick of the best MT5 Forex Brokers and this list includes only regulated brokers that are highly ranked and come highly recommended for trading.

8 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 8 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Best Brokers with Smartwatch Apps for 2024

This guide compares the best brokers and their smartwatch app features- a quick way to manage your portfolio.

Best Mac Forex Trading Platforms for 2024

Forex traders, particularly Mac users, need suitable platforms. This article examines the top Mac Forex trading platforms' brokers.