Score

Exclusive Markets

Seychelles|5-10 years| Benchmark AAA|

Seychelles|5-10 years| Benchmark AAA|https://www.exclusivemarkets.com/

Website

Rating Index

Benchmark

Benchmark

AAA

Average transaction speed (ms)

MT4/5

Full License

ExclusiveMarkets2-Live 2

Influence

A

Influence index NO.1

Brazil 7.97

Brazil 7.97Benchmark

Speed:AAA

Slippage:AA

Cost:AA

Disconnected:A

Rollover:AAA

MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomInfluence

Influence

A

Influence index NO.1

Brazil 7.97

Brazil 7.97Contact

Licenses

Licenses

Licensed Institution:Exclusive Markets Ltd

License No.:SD031

Single Core

1G

40G

1M*ADSL

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

Basic information

Seychelles

SeychellesAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed Exclusive Markets also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

VT Markets

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Benchmark

Website

globalexclusivemarkets.com

Server Location

United States

Website Domain Name

globalexclusivemarkets.com

Server IP

104.21.58.213

exclusivemarkets.com

Server Location

United States

Website Domain Name

exclusivemarkets.com

Server IP

172.67.128.53

Company Summary

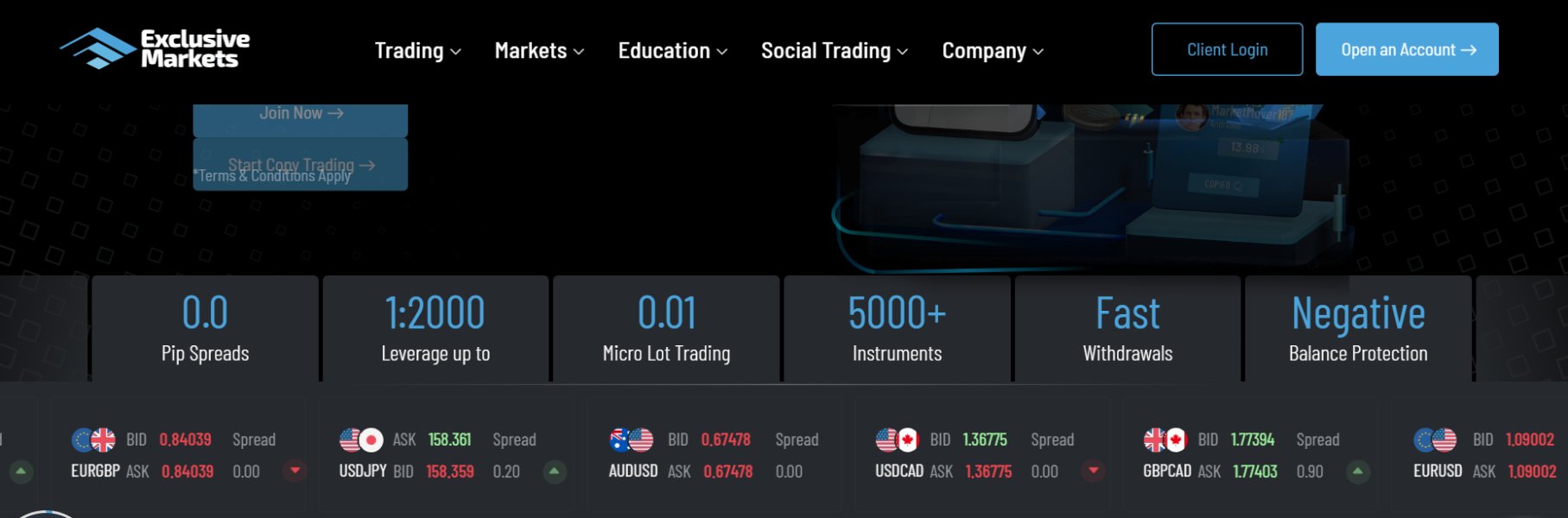

| Exclusive Markets Review Summary in 10 Points | |

| Founded | 2020 |

| Registered Country/Region | Seychelles |

| Regulation | FSA (offshore regulatory) |

| Market Instruments | Forex, Metals, Commodities, Indices, CFDs on Stocks, Equities, Bonds, ETFs, Cryptos |

| Demo Account | N/A |

| Leverage | 1:2000 |

| EUR/USD Spread | From 1.5 pips (Standard) |

| Trading Platforms | MT4/5 |

| Minimum deposit | $0 |

| Customer Support | Live chat, phone, email, WhatsApp, Line |

What is Exclusive Markets?

Exclusive Markets is a financial services provider founded in 2020, offering trading services in various financial markets, including forex, commodities, indices, stocks, bonds, ETFs, and cryptocurrencies with different account types through the leading MT4/5. As for regulation, Exclusive Markets operates in Seychelles and is registered with the Financial Services Authority (FSA) of Seychelles (License No. SD031), however, it is offshore.

In the following article, we will analyze the characteristics of this broker from various aspects, providing you with simple and organized information. If you are interested, please read on. At the end of the article, we will also briefly make a conclusion so that you can understand the broker's characteristics at a glance.

Pros & Cons

Exclusive Markets offers a wide range of trading instruments and multiple account types with low minimum deposits, making it accessible to traders of different levels. The availability of high leverage options and competitive spreads, including raw spreads on certain accounts, can be advantageous for experienced traders. However, the lack of regulation and the offshore license raise concerns about the safety of client funds.

| Pros | Cons |

| • Multiple trading assets and account types | • Offshore regulated by FSA |

| • Low minimum deposit requirement | • Regional restrictions |

| • MT4 and MT5 supported | • Residents of Canada, Cuba, Iraq, North Korea, Sudan, Syria, The United States, Russia, and Belarus are excluded |

| •Various deposit and withdrawal methods with no fees | • Limited trading tools and educational resources |

Exclusive Markets Alternative Brokers

CMC Markets - A reputable broker with a wide range of tradable instruments and advanced trading platforms.

RoboForex - A reliable broker offering multiple account types and competitive trading conditions.

Tickmill - A trusted broker known for its low spreads, fast execution, and strong regulatory framework.

There are many alternative brokers to Exclusive Markets depending on the specific needs and preferences of the trader. Some popular options include:

Ultimately, the best broker for an individual trader will depend on their specific trading style, preferences, and needs.

Is Exclusive Markets Safe?

As an unregulated broker, Exclusive Markets carries inherent risks for traders. The offshore regulatory license from the Seychelles Financial Services Authority (FSA, License No. SD031) is not as robust as licenses from reputable financial regulatory bodies. Traders should exercise caution when considering trading with an unregulated broker, as the lack of regulatory oversight may expose them to potential scams or fraudulent activities. It is important for traders to thoroughly research and assess the credibility and reliability of a broker before engaging in any financial transactions.

Market Instruments

Exclusive Markets offers investors access to 30,000+ trading instruments, covering various financial markets. Traders have the opportunity to engage in Forex trading, allowing them to trade major and minor currency pairs. Additionally, Exclusive Markets offers trading in precious metals like gold and silver, providing investors with exposure to these valuable commodities. Commodities such as oil, natural gas, and agricultural products are also available for trading.

Furthermore, traders can access a wide selection of global indices, enabling them to participate in the performance of major stock markets worldwide. CFDs on individual stocks, equities, bonds, and ETFs offer further opportunities for investment diversification.

Lastly, Exclusive Markets caters to the growing interest in cryptocurrencies, allowing traders to trade popular digital assets such as Bitcoin, Ethereum, and more. The extensive range of trading instruments offered by Exclusive Markets provides investors with the flexibility to explore different markets and diversify their investment portfolios.

Accounts

Exclusive Markets offers 5 kinds of account types to cater to the diverse needs of investors. The Cent account is designed for those who prefer to trade with smaller volumes and lower risk, with a minimum deposit requirement of just $5. The Standard and Standard Plus accounts are suitable for traders who are looking for a more traditional trading experience, with a minimum deposit requirement of $5. The Exclusive account is tailored for experienced traders or those who wish to access exclusive features and benefits, requiring a minimum deposit of $500.

Lastly, the Shares account is designed for investors interested in trading individual stocks, but the specific minimum deposit requirement is not specified. By offering different account types, Exclusive Markets aims to provide options that suit the preferences and trading goals of a wide range of investors, ensuring accessibility and flexibility in account selection.

How to register with Exclusive Markets

Opening an account with exclusive Markets is a simple and straightforward process, and below is a reference video for traders to follow:

Leverage

The specified leverage for different account types at Exclusive Markets varies between 1:1 and 1:2000. The Shares account offers a conservative leverage of 1:1, allowing traders to have full control over their positions without the amplification of risk. The Cent account, on the other hand, provides a fixed leverage of 1:500, allowing traders to trade with a higher degree of leverage while still maintaining risk management. For the Standard, Standard Plus, and Exclusive accounts, the leverage goes up to an impressive 1:2000, which can potentially amplify gains but also increase the exposure to losses.

It's essential for traders to fully understand the implications of high leverage and exercise caution when utilizing it, as it can significantly impact the outcome of their trades. Risk management and responsible trading practices should always be a priority when considering the use of leverage.

Spreads & Commissions

At Exclusive Markets, traders can expect different spreads and commissions based on their chosen account type. The Cent and Standard accounts offer competitive spreads starting from 1.5 pips, providing traders with relatively affordable trading costs. The Standard Plus account offers even tighter spreads starting from 0.8 pips, which can be appealing for traders looking for more cost-effective trading options. The Exclusive and Shares accounts take it a step further by offering raw spreads from 0 pips, allowing traders to access the market with highly competitive pricing.

When it comes to commissions, the Cent, Standard, and Standard Plus accounts do not have any commissions, making them suitable for traders who prefer commission-free trading. However, the Exclusive account incurs a commission of $7 per round turn lot, while the Shares account has a commission starting from $2.5. Traders should carefully consider the spread and commission structure in relation to their trading strategy and preferences when selecting an account type at Exclusive Markets.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| Exclusive Markets | From 1.5 pips (Standard) | No commission (Standard) |

| CMC Markets | From 0.7 pips | No commission |

| RoboForex | From 0 pips | No commission |

| Tickmill | From 0.0 pips | $2 per lot |

Please note that spreads and commissions may vary depending on the account type, market conditions, and trading platform. It's always advisable to check the broker's official website or consult with their customer support for the most up-to-date information on spreads and commissions.

Trading Platforms

Exclusive Markets provides traders with a robust and versatile trading platform offering the popular MetaTrader 4 (MT4) and MetaTrader 5 (MT5) platforms. These platforms are available for WebTrader, allowing traders to access their accounts conveniently from any web browser without requiring any downloads or installations.

Additionally, traders can access the MT4 and MT5 platforms on their mobile devices, enabling them to trade on the go and stay connected to the markets at all times. The desktop version of the platforms offers a comprehensive range of trading tools, advanced charting capabilities, and a user-friendly interface, empowering traders to execute trades efficiently.

Overall, Exclusive Markets' trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders. See the trading platform comparison table below:

| Broker | Trading Platforms |

| Exclusive Markets | MT4, MT5, WebTrader |

| CMC Markets | Next Generation, MT4, Web Platform |

| RoboForex | MT4, MT5, cTrader, R Trader |

| Tickmill | MT4, MT5, WebTrader |

Exclusive Markets also offers Social Copy Trading, which allows traders to follow and automatically copy the trades of successful traders, benefiting from their expertise and potentially enhancing their own trading results. With a selection of powerful and flexible trading platforms, Exclusive Markets ensures that traders have access to the tools and features necessary for successful trading experiences.

Trading Tools

Exclusive Markets provides traders with a range of valuable trading tools to enhance their trading experience and decision-making process. Traders can benefit from Trading Central, a renowned technical analysis platform that offers in-depth market insights, research reports, and trading signals. This tool helps traders stay informed about market trends and make well-informed trading decisions.

Additionally, Exclusive Markets offers Trading Calendars, which provide important economic events, news releases, and key financial data that can impact the markets. These calendars help traders plan their trading strategies and adjust their positions accordingly.

Moreover, Exclusive Markets offers VPS hosting services, enabling traders to run their trading platforms and expert advisors smoothly without any interruptions or latency issues. The Web TV feature provides real-time market analysis, expert commentary, and educational videos to keep traders updated with the latest market developments.

Lastly, Exclusive Markets offers Trading Signals, which provide traders with trading ideas and recommendations generated by experienced analysts. These signals can assist traders in identifying potential trading opportunities and making timely trade decisions.

With these comprehensive trading tools, Exclusive Markets aims to empower traders with the resources they need to navigate the markets effectively and optimize their trading performance.

Deposits & Withdrawals

Exclusive Markets offers convenient and flexible options for depositing and withdrawing funds. Traders can choose from three main methods, including credit/debit cards (MasterCard), bank wire transfers, and various crypto wallets. This variety allows traders to select the most suitable option based on their preferences and needs.

The minimum initial deposit amount is unlimited, providing flexibility for traders with different investment capacities. Additionally, Exclusive Markets does not charge any fees for deposits and withdrawals, ensuring that traders can efficiently manage their funds without incurring unnecessary costs.

Exclusive Markets minimum deposit vs other brokers

| Exclusive Markets | Most other | |

| Minimum Deposit | $0 | $100 |

See the deposit/withdrawal fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee |

| Exclusive Markets | Free | Free |

| CMC Markets | Free | Free |

| RoboForex | Free | Free |

| Tickmill | Free | Free |

The company strives to provide prompt processing times, with typical deposits being processed instantly. Withdrawals are processed within 24 business hours, ensuring that traders can access their funds in a timely manner. For withdrawal requests made before 3 p.m. GMT, they will be processed on the same day, further expediting the withdrawal process.

Overall, Exclusive Markets prioritizes the convenience and efficiency of depositing and withdrawing funds, allowing traders to focus on their trading activities without unnecessary delays or fees.

Trading Hours

Exclusive Markets provides clients with access to their client portal and website at any time, allowing them to manage their accounts, access trading tools, and obtain important information whenever it is convenient for them. However, it is important to note that the trading hours for different markets may vary. Exclusive Markets provides specific opening hours for each asset in its product description.

For example, Forex trading is available 24 hours a day, Monday to Friday, as it is a global market that operates continuously across different time zones. By providing clear information about the trading hours for each asset, Exclusive Markets ensures that clients are well-informed and can plan their trading activities accordingly.

Customer Service

Exclusive Markets prioritizes excellent customer service and offers multiple channels for clients to reach out for support. Clients can communicate with the broker's support team through live chat, phone, email, WhatsApp, and Line, ensuring that they have various options to choose from based on their preferences.

Additionally, the broker provides a comprehensive Help Center, which serves as a valuable resource for clients to find answers to commonly asked questions and access relevant information about trading and account management. Exclusive Markets also maintains an open and transparent approach by openly disclosing its company address on the website, allowing clients to have a clear point of contact.

Furthermore, clients can stay connected with Exclusive Markets through various social media platforms, including Telegram, Twitter, Facebook, Instagram, YouTube, and LinkedIn, enabling them to receive updates, news, and insights from the broker.

With its multi-channel support and active social media presence, Exclusive Markets demonstrates a commitment to delivering responsive and accessible customer service to its clients.

| Pros | Cons |

| • Multiple communication channels | • No 24/7 customer support |

| Live chat support | |

| • Help Center available for self-service support | |

| • Social media presence for easy engagement |

Note: These pros and cons are subjective and may vary depending on the individual's experience with Exclusive Markets' customer service.

Conclusion

In conclusion, Exclusive Markets offers extensive trading opportunities with various account types and competitive trading conditions. The availability of multiple trading platforms and tools enhances the trading experience for users.

However, the lack of regulation and offshore license raises concerns about the safety of funds. Additionally, the limited educational resources may hinder the overall user experience. Traders should carefully evaluate the risks and benefits associated with trading on an unregulated platform before making a decision. It is advisable to conduct thorough research and consider alternative regulated brokers that offer a more comprehensive range of services and stronger regulatory oversight.

Frequently Asked Questions (FAQs)

Is Exclusive Markets legit?

No. Exclusive Markets Seychelles Financial Services Authority (FSA, License No. SD031) license is offshore regulatory.

At Exclusive Markets, are there any regional restrictions for traders?

Yes. Exclusive Markets does not provide services to residents of certain regions, such as Canada, Cuba, Iraq, North Korea, Sudan, Syria, The United States, Russia, Belarus.

Does Exclusive Markets offer the industry leading MT4 & MT5?

Yes. Both MT4 and MT5 are available.

Is Exclusive Markets a good broker for beginners?

No. Exclusive Markets is not a good choice for beginners. Though it advertises very well, it lacks legitimate regulations.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

Keywords

- 5-10 years

- Regulated in Seychelles

- Retail Forex License

- MT4 Full License

- White label MT5

- High potential risk

- Offshore Regulated

Disclosure

Unauthorized use of websites (the “unlawful website”)

Country/Region

SC FSA

Disclosure time

2023-08-14

Disclose broker

Blocking 218 Website Domains, CoFTRA Reminds Investment Risks in Illegal Entities

Country/Region

ID BAPPEBTI

Disclosure time

2023-04-20

Disclose broker

Bappebti Blocks 760 Website Domains, Reminds of the Risk of Transactions in Unlicensed PBK Entities

Country/Region

ID BAPPEBTI

Disclosure time

2022-09-20

Disclose broker

News

Exposure Warning against Exclusive Markets

Recently, the Securities Commission Malaysia warned against an unauthorized broker called Exclusive Markets. The authority stated that the firm is carrying on unlicensed capital market activities dealing in securities. This move is aimed at protecting investors and promoting a more inclusive and competitive market environment.

2024-10-11 17:59

News Exclusive Markets offers chance to win gold coins

Exclusive Markets Launches a new contest called Exclusive Golden Clash. Trading participants have the chance to earn gold coins in exclusive markets. All skill levels of traders, from seasoned pros to novices, are welcome to take advantage of this offer. The contest began on February 8, 2024, and it will run until March 31, 2024.

2024-02-13 20:14

Review 13

Content you want to comment

Please enter...

Review 13

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Dreams come True

United States

Exclusive Markets has its perks – low deposits, a variety of instruments, and MT4/5 support. But, the lack of regulation makes me nervous. It's a gamble, so tread carefully!

Neutral

2023-12-05

Cocowu

Peru

The trading platforms, especially MT5, are pretty solid, and the fixed spreads are clear. Customer support is decent, and they're available when I need them. All in all, Exclusive Markets is in my good books.

Neutral

2023-12-04

媛乐

Hong Kong

Honestly, I benefited from Exclusive’s social trading a lot, and I did make some profits. One issue needs to be pointed out: they process withdrawal requests so slow. Averagely, it takes one week to get your money withdrawn.

Neutral

2023-02-15

Um Lamar

Cyprus

Honestly, an excellent broker and I am surprised

Positive

08-21

Quket

Netherlands

Exclusive Markets offers traders excellent leverage options, making it easy to amplify your trading potential. Plus, their minimum deposit is very reasonable, making it accessible to traders of all levels.

Positive

07-16

bobo1

Australia

At Exclusive Markets, I appreciate their top-notch customer service, especially Nec's expertise. Their platform is well-organised, making trading seamless. Their execution is quick, perfect for scalping traders. Efficient handling of transactions and timely customer support only add to their reliability. Exclusive Markets provides a professional and satisfying trading experience.

Positive

04-19

David4833

United Kingdom

I've been trading with Exclusive Markets for 2 years, and I must say, it has been an exceptional experience from day one. Here's why I highly recommend them Transparency: Exclusive Markets shines in terms of transparency. They provide real-time market data, accurate spreads, and a clear fee structure. No hidden surprises, ever. Customer Support: Their customer support team deserves applause. They are available 24/5, responsive, and knowledgeable. They've helped me through various trading challenges with patience.

Positive

2023-09-14

Ja5344

Thailand

convenient for transactions Fast deposit-withdrawal Withdrawal in 2-3 hours OK

Positive

2023-06-01

我

South Africa

I love using Exclusive Markets’ VPS, which offers me the optimal execution speed, reducing latency and slippage. I strongly recommend that your guys should have a try.

Positive

2023-02-21

姚先生141319

Mexico

this exclusive markets company appears to be very well regulated and offering satisfactory services on its website.

Positive

2023-02-13

Hamzah Shahrin

Hong Kong

This platform’s trading conditions seem pretty good, rich trading assets, low initial investment amount… advanced mt5 trading platform, its demo account trading experience is also good, I haven’t made my decision yet, anybody give me some advice?

Positive

2022-11-23

金鑫23788

Colombia

To choose forex brokers I appreciate more security! I know there are many scams in the forex industry and even some of my friends have been scammed!!! So I chose exclusive markets, a platform regulated by FSA, and it has not failed me. I love both the high leverage, MT4, MT5, wide range of traded products and the copy trading feature.

Positive

2022-11-18

Hachikō Fx

Australia

the best platform ever .. im using start from 2020 until now .. and never get problem ..

Positive

2022-10-15