Score

JinDao

Hong Kong|5-10 years|

Hong Kong|5-10 years| https://pm.gwghk.com/hk/

Website

Rating Index

Influence

Influence

C

Influence index NO.1

United States 2.86

United States 2.86Contact

Licenses

Licenses

Licensed Institution:金道貴金屬有限公司

License No.:074

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Hong Kong

Hong KongUsers who viewed JinDao also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

Most visited countries/areas

Hong Kong

China

gwghk.com

Server Location

Hong Kong

Website Domain Name

gwghk.com

Website

GRS-WHOIS.CNDNS.COM

Company

SHANGHAI MEICHENG TECHNOLOGY INFORMATION DEVELOPMENT CO., LTD.

Domain Effective Date

2010-04-27

Server IP

45.195.255.74

24k.hk

Server Location

Hong Kong

Most visited countries/areas

China

Website Domain Name

24k.hk

Website

WHOIS.HKIRC.HK

Company

-

Server IP

116.251.230.61

Company Summary

| Key Information | Details |

| Company Name | JinDao |

| Years of Establishment | 5-10 years |

| Headquarters | Hong Kong |

| Office Locations | N/A |

| Regulation | Unregulated |

| Tradable Assets | Forex, Metal, Energy |

| Account Types | Standard, Pro, VIP |

| Minimum Deposit | $100 |

| Minimum Lot Size | 0.01 lots |

| Fees | Deposit fees, Withdrawal fee, Inactivity fee |

| Leverage | Up to 1:400 |

| Spread | As low as 0.8 pips |

| Deposit/Withdrawal Methods | Bank transfer, Credit/Debit card, E-wallet |

| Trading Platforms | Meta Trader 4 |

| Customer Support Options | Phone, Email |

Overview of JinDao

JinDao is an unregulated financial company established in Hong Kong within the past 5-10 years. They offer trading services primarily through the Meta Trader 4 platform, focusing on forex, metal, and energy instruments. The company provides three account types with a minimum deposit of $100 and all offering leverage up to 1:400, and spread starts from 0.8 pips.

JinDao does not charge deposit fees for most methods but imposes a 3% fee for credit card deposits. Withdrawals via most methods are fee-free, except for a $10 charge for bank transfers. An inactivity fee of $50 per month applies after six months of account dormancy. It should be noted that JinDao's website is inaccessible, meaning that users can not create an account with this service.

Regulatory Status

The Chinese Gold & Silver Exchange Society holds a Type A1 License (License No. 074) under the regulatory oversight of a governing body. Currently, the company is in an Unsubscribed status according to this regulatory authority. This Unsubscribed status signifies that the company's license is not currently active, as indicated by the regulator.

The Unsubscribed status is a designation that implies the company's license is temporarily inactive or has not fulfilled certain requirements set forth by the regulatory authority. This regulatory status poses inherent risks as it may indicate non-compliance with regulatory standards, potentially impacting the company's ability to operate in the regulated market.

Pros and Cons

| Pros | Cons |

| Market Instrument Specialization | Single Trading Platform (MT4) |

| Competitive Leverage and Low Spreads | Unregulated Status |

| Flexible Account Options | Inaccessible Website |

| Limited Deposit/Withdrawal Methods |

Pros:

Market Instrument Specialization: JinDao excels in specializing its offerings, concentrating on forex, metals (gold and silver), and energy commodities (crude oil). This focused approach can cater to traders seeking simplicity and precision in their trading strategies.

Competitive Leverage and Low Spreads: The company provides a competitive maximum leverage ratio of 1:400 across all account types, allowing traders to control larger positions. Additionally, JinDao offers spreads starting from 0.8 pips, indicating a relatively cost-effective trading environment compared to some competitors.

Flexible Account Options: With three distinct account types requiring varying minimum deposits, JinDao accommodates traders with different risk tolerances and capital levels. This flexibility can be advantageous for both novice and experienced traders.

Cons:

Single Trading Platform: JinDao offers only the Meta Trader 4 (MT4) platform, limiting traders who may prefer alternative platforms or require specialized features not available on MT4.

Unregulated Status: The company operates without regulatory oversight, potentially raising concerns about the lack of investor protection and security measures. Traders who prioritize regulatory compliance may hesitate to engage with an unregulated broker.

Inaccessible Website: JinDao's inaccessible website can be a significant drawback, as it hinders access to essential information, prevents potential traders from creating accounts online, and may impact the company's overall credibility.

Limited Deposit/Withdrawal Methods: While JinDao supports multiple payment methods, the 3% fee on credit card deposits and the $10 fee for bank transfer withdrawals may deter some traders who seek fee-free alternatives. Additionally, the inactivity fee of $50 per month after six months of no trading activity could be a deterrent for infrequent traders.

Inaccessible Website

The website of this company is currently inaccessible, which poses significant challenges to its overall credibility. Inaccessibility of the website means that potential traders are unable to access crucial information, make inquiries, or engage with the company's services online. This limitation extends to the fact that interested traders cannot create trading accounts with the company through its website.

This situation presents several disadvantages. Firstly, the inability to access essential information or interact with the company's online services can erode trust and raise concerns about the company's reliability and transparency. Secondly, the inability to create trading accounts directly on the website hinders the convenience and accessibility that traders typically expect in the modern financial landscape. Additionally, it can deter potential clients who may opt for alternatives with functioning websites, potentially resulting in a loss of business opportunities.

Market Instruments

JinDao offers a focused selection of market instruments, including forex, metals (gold and silver), and energy (crude oil). Specifics are as follows:Forex: JinDao's forex trading options encompass major and minor currency pairs, allowing traders to engage in the speculative trading of global currencies. For example, traders can participate in transactions involving well-known pairs like EUR/USD, GBP/USD, and USD/JPY.

Metals: Within this category, JinDao offers access to the trading of precious metals, specifically gold and silver. These commodities are available for trading as Contracts for Difference (CFDs), enabling traders to speculate on price fluctuations in these valuable metals.

Energy: JinDao's energy market instruments center around crude oil, a vital global commodity. Through the company, traders can participate in speculative trading of crude oil through CFDs. This allows traders to take positions based on their expectations of oil price movements.

The following is a table that compares JinDao to competing brokerages:

| Broker | Market Instruments |

| JinDao | Forex, Metals, Energy |

| FXPro | Forex, Metals, Energy, Indices, Shares |

| IC Markets | Forex, Metals, Energy, Indices, Shares, Cryptocurrencies |

| FBS | Forex, Metals, Energy, Indices, Shares |

| Exness | Forex, Metals, Energy, Indices, Shares, Cryptocurrencies, Options |

Account Types

JinDao offers three distinct account types: Standard, Pro, and VIP, catering to traders with varying capital and risk tolerance. The differences primarily revolve around minimum deposits, spreads, commissions, and leverage ratios.

Standard Account: The Standard account offered by JinDao requires a minimum deposit of $100. It features spreads starting from 1.8 pips and commissions from $0.07 per lot. Traders using this account type can access leverage of up to 1:400.

Pro Account: JinDao's Pro account demands a minimum deposit of $500. This account type boasts narrower spreads, starting from 1.2 pips, and lower commissions, beginning at $0.03 per lot. Similar to the Standard account, Pro account holders can leverage their trades up to 1:400.

VIP Account: For more experienced traders or those with higher capital, JinDao offers the VIP account, requiring a substantial minimum deposit of $10,000. This account type features even tighter spreads, starting from 0.8 pips, and lower commissions, beginning at $0.01 per lot. Like the other account types, VIP account holders can also utilize leverage up to 1:400.

The specifics of the account types are as follows:

| Account Type | Minimum Deposit | Spreads | Commissions | Leverage |

| Standard | $100 | From 1.8 pips | From $0.07 per lot | Up to 1:400 |

| Pro | $500 | From 1.2 pips | From $0.03 per lot | Up to 1:400 |

| VIP | $10,000 | From 0.8 pips | From $0.01 per lot | Up to 1:400 |

Minimum Deposit

JinDao offers varying minimum deposit rates based on different account types. The Standard account requires a minimum deposit of $100, while the Pro account has a higher minimum deposit requirement of $500. For traders seeking more exclusive options, the VIP account necessitates a substantial minimum deposit of $10,000. These minimum deposit rates cater to a range of traders with different financial capacities, providing options that align with individual preferences and risk tolerance levels.

Minimum Lots

JinDao has a minimum lot size of 0.01 lots. This means that traders have the option to execute trades with a relatively smaller volume of currency units. This flexibility can be advantageous, especially for those who wish to manage risk more conservatively or engage in precise position sizing. It allows traders to participate in the market with smaller capital and fine-tune their trading strategies to meet their specific financial goals and risk tolerance levels.FeesJinDao imposes certain fees related to account activities. For deposits, the company typically does not charge fees for most payment methods, making it cost-effective for traders to fund their accounts. However, it's important to note that there is a 3% fee associated with deposits made via credit card. On the withdrawal side, JinDao does not charge fees for most payment methods, except for withdrawals made via bank transfer, which incurs a $10 fee. Additionally, the company enforces an inactivity fee of $50 per month if there is no trading activity on an account for six consecutive months.

Leverage

JinDao offers a consistent maximum leverage ratio of 1:400 across all of its available account types. This leverage allows traders to control larger positions relative to their initial deposits, potentially magnifying both gains and losses in their trading activities.

Here is a table comparing the maximum leverage ratios for the mentioned market instruments of JinDao with those of FXPro, IC Markets, FBS, and Exness:

| Broker | Maximum Leverage |

| JinDao | 1:400 |

| FXPro | 1:500 |

| IC Markets | 1:500 |

| FBS | 1:3000 |

| Exness | 1:2000 |

Spread

JinDao offers competitive spreads on its trading instruments. The company provides traders with spreads that start from 0.8 pips. These spreads are indicative of the difference between the buying (ask) and selling (bid) prices for the financial instruments available through JinDao. While the specific spread value may vary depending on market conditions and the type of account, the starting point of 0.8 pips suggests a relatively favorable cost structure for traders looking to engage in speculative trading activities.

Deposit & Withdrawal

JinDao offers several deposit and withdrawal methods to facilitate financial transactions for its clients. These methods include bank transfers, credit cards, debit cards, and e-wallets, including Neteller, Skrill, and UnionPay. Deposits through most of these methods do not incur additional fees. However, it's worth noting that there is a 3% fee applied to deposits made via credit card. When it comes to withdrawals, most methods are fee-free, with the exception of bank transfers, which have a $10 withdrawal fee. The availability of various payment options provides traders with flexibility in managing their accounts and financial transactions, catering to a range of preferences and needs.

Trading Platforms

JinDao offers a single trading platform, which is Meta Trader 4 (MT4). MT4 is a popular and widely used platform in the industry, known for its user-friendly interface and extensive charting and analysis tools.

JinDao has a single trading platform, which can be disadvantageous when compared to competitors who offer a broader range of platforms. This limitation may restrict traders who prefer alternative platforms or require specialized features not available on MT4, potentially leading them to consider alternative brokerages with more platform diversity.

Here is a table that compares the trading platforms offered by JinDao with those of FXTM, Exness, Pepperstone, and FP Markets:

| Broker | Trading Platforms |

| JinDao | Meta Trader 4 (MT4) |

| FXTM | MT4, MT5, FXTM Trader App, WebTrader |

| Exness | MT4, MT5 |

| Pepperstone | MT4, MT5, cTrader |

| FP Markets | MT4, MT5, IRESS, WebTrader |

Customer Support

JinDao offers customer support through both phone and email channels, catering to traders' preferences for direct or written communication when seeking assistance or information. Here is the specific information:

Phone: Traders can reach JinDao's customer support via phone by dialing 852 - 3719 2500 for Chinese (Simplified) support and (852) 3719-9980 for Traditional Chinese (HK) support. This provides a direct and immediate channel for inquiries and assistance.

Email: For written communication, traders can contact JinDao's customer support through the email address pmhkcs@gwghk.com. Email allows for detailed inquiries and correspondence, suitable for non-urgent matters.

Conclusion

JinDao, an unregulated brokerage with a track record of 5-10 years in the industry, presents traders with a focused selection of market instruments. These include forex, precious metals such as gold and silver, and energy commodities like crude oil. The company caters to various trader profiles by providing different account types with varying minimum deposit requirements, along with a consistent maximum leverage ratio of 1:400.

Traders can access these instruments through the Meta Trader 4 (MT4) platform, a renowned choice known for its user-friendly interface and robust charting tools. Furthermore, JinDao supports multiple deposit and withdrawal methods, with mostly fee-free transactions. The company's customer support is accessible through phone and email, offering direct and written communication options to address traders' inquiries and concerns. Lastly, JinDao has an inaccessible website, which paired with the lack of regulation, means that the risk factor for this service is high in the industry.

FAQs

Q: What is the company's regulated status?

A: The company operates as an unregulated entity.

Q: Can traders engage in precious metals trading?

A: Yes, traders can trade precious metals such as gold and silver.

Q: Is there a fee for credit card deposits?

A: Yes, credit card deposits incur a 3% fee.

Q: How many account types are available?

A: JinDao offers three account types: Standard, Pro, and VIP.

Q: What is the minimum lot size for trading?

A: The minimum lot size is 0.01 lots.

Q: What trading platform does JinDao provide?

A: The company offers the Meta Trader 4 (MT4) platform.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Hong Kong Type A1 License Unsubscribed

- High potential risk

Review 13

Content you want to comment

Please enter...

Review 13

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX4247393671

Hong Kong

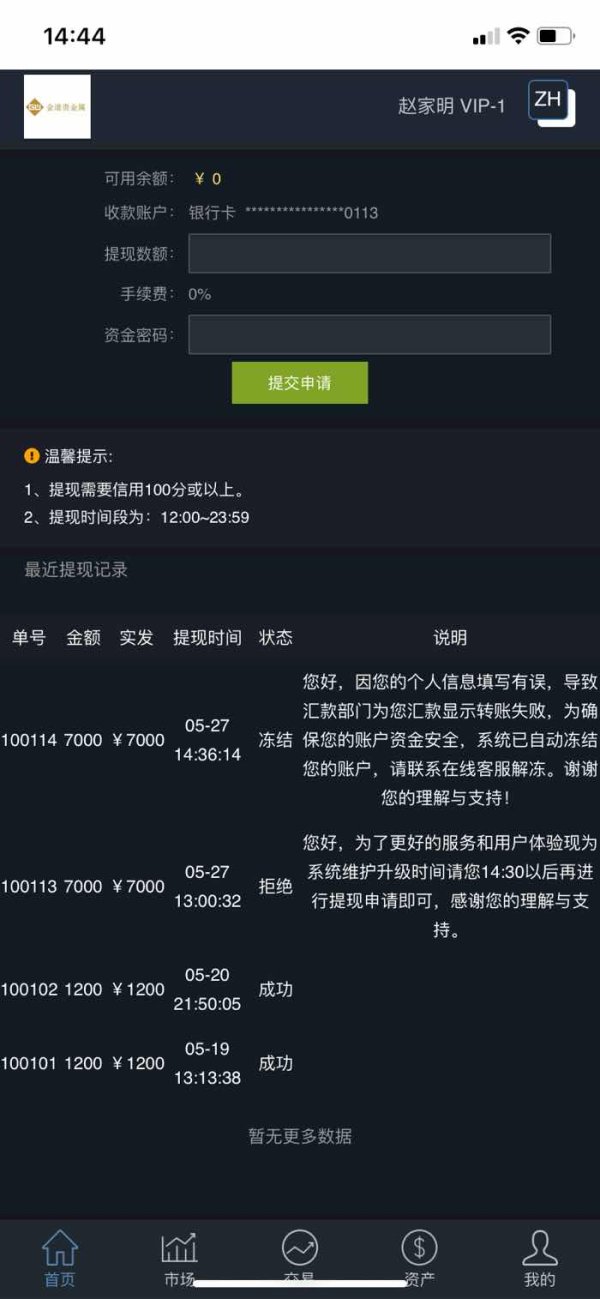

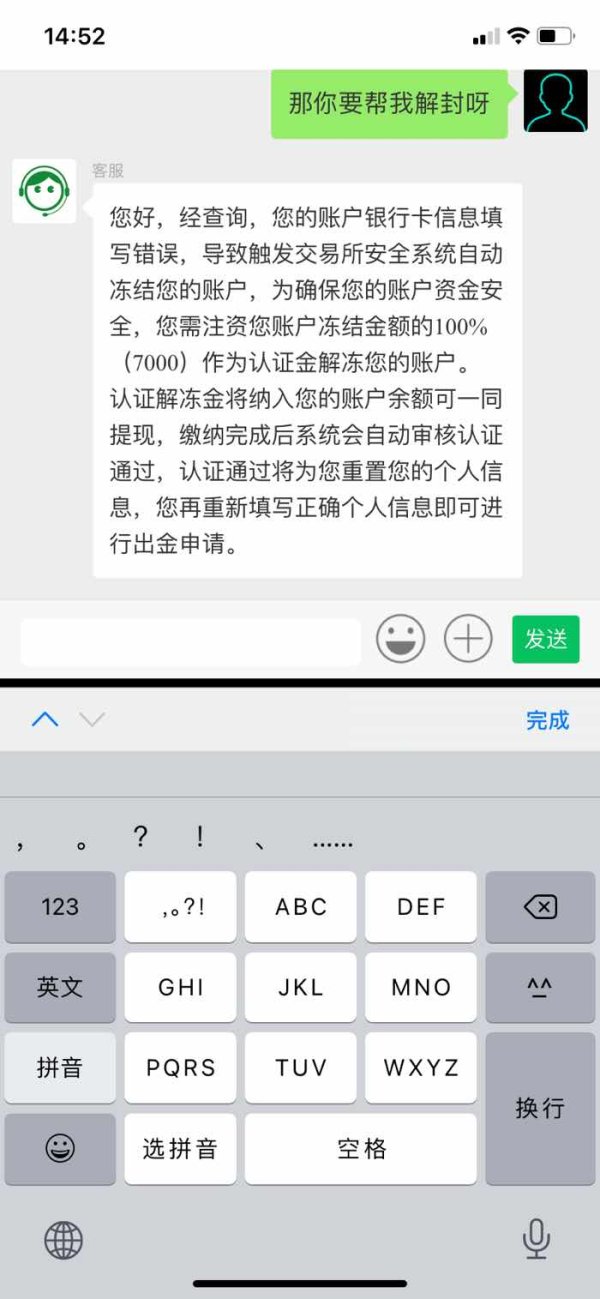

I applied for withdrawal of 7,000 while he said the system was under maintenance and I had to operate at two thirty. And I should refill my bank card info at that time. But I was told that my info was wrong and I should pay to unfreeze my account. I can make sure that my bank card info was right. But when I checked it, there was one more 0. Isn’t it a scam?

Exposure

2021-05-27

青苹果

Hong Kong

Scam platform cleared my account.

Exposure

2020-02-12

大鲸.余

Hong Kong

Unable to withdraw. Both the customer service and the website is unavailable. Garbage!

Exposure

2019-12-27

镜

Hong Kong

Both the funding page and the official website are unavailable.

Exposure

2019-12-23

田埂上的梦

Hong Kong

It ceased my trading account inexplicably.I was not satisfied with their bad manner!!!The company didn’t solve the my requirement timely,making me lose more than 800000 RMB.So irresponsible JinDao is!!!

Exposure

2019-11-14

一只丑陋的凸~

Hong Kong

After profiting a lot, my application for withdrawal was declined with the reason of wrong bank number.I was asked to pay 10% margin money to withdraw money.I was declined again with the reason of less-than 100 credit score and asked to deposit 35,200 in the platform.As I did so,it succeeded.I received a call from Hong Kong saying that I need to deposit 50,000 yuan to ensure the fund to my account.But the fund still hasn’t arrived.When I inquired if,I was told that a portion of my fund was stuck in the channel because of abnormal trade.Only by depositing 24,800 into the account, can the fund be abnormal.It is an absolute fraud platform.With upholding the banner of high profit,it induces investors to deposit money again and again .I have called the police.Hope you avoid being cheated.

Exposure

2019-08-21

FX9669673574

Hong Kong

The money I deposited would arrive instantly. I applied for a withdrawal, but nothing happened after a day. They told me it would just take 2 hours. The service is cooling me.

Exposure

2019-01-16

FX9249301067

Hong Kong

2018/9/26, JinDao has permanently disabled my MT4, MT5, GTS accounts for no reason. I have been trade since April 2016 until 2018/9 months. The accounts were still in normal use, with a total loss of 700,000 yuan. Now, my accounts were disabled with any notice. I can't find any transaction records with losses before. I hope that JinDao will give me an explanation.

Exposure

2019-01-16

FX3119859718

Hong Kong

JinDaofroze my account for no reason. I contacted the customer service personnel, and they still don't recognize that is their account. They said they could not find the account. Aren’t the emails that informed the money were successfully deposited into the account sent by them? If the platform changes its name, it will not recognize the former clients, and it is too irresponsible. I hope FXEYES can expose them.

Exposure

2018-11-21

FX6009685181

Hong Kong

JinDao is a scam. I can’t withdraw on it. They produced some video-verification shit to prevent me from withdrawing. This is a scam!

Exposure

2018-11-17

FX3639864874

Hong Kong

I was induced by their agent to invest in their platform from June to October. They promised me a 100% profit. But I lost a lot after then. Those so-called instructors deliberately gave me wrong directions. I contacted the platform, who said I am not their client at all. This is a scam.

Exposure

2018-12-03

不忘初心--工艺礼品专供

Hong Kong

My account was banned after I made an inquiry about my money flow in JinDao. I still have money in it. Scam.

Exposure

2018-12-04

FX3219587820

Hong Kong

kindo permanently suspended my MT4,MT5 and GTS account for no reason on September 26, 2018/9/26. Since my operation in April 2016 till now, my account is still in normal use with a total loss of RMB 700,000. Now my account is suspended without any sign, and I cannot check any transaction records of previous losses.

Exposure

2018-10-17