Score

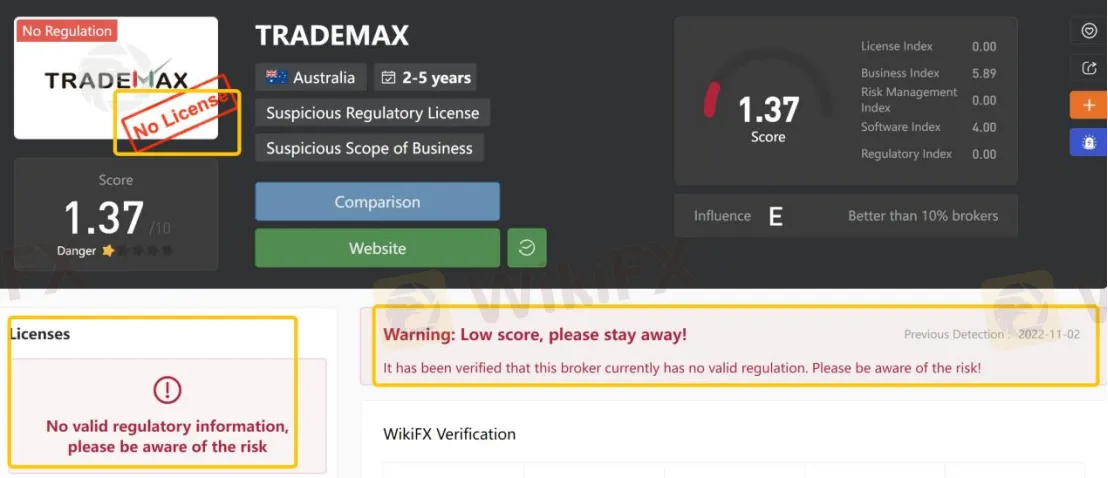

TRADEMAX

Australia|2-5 years|

Australia|2-5 years| https://www.tmgm.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Australia

AustraliaUsers who viewed TRADEMAX also viewed..

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

Website

tmgm.com

Server Location

Singapore

Website Domain Name

tmgm.com

Server IP

170.33.12.141

Company Summary

Note: TRADEMAX is to operate via the website - https://www.tmgm.com/, which is currently not yet functional and no information about the company was immediately available. Therefore, we could only gather relevant information from the Internet to present a rough picture of this broker.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information contained in this article is for general information purposes only.

General Information & Regulation

| Feature | Detail |

| Regulation | No Regulation |

| Market Instrument | forex | shares | indices | precious metals | energies | futures |

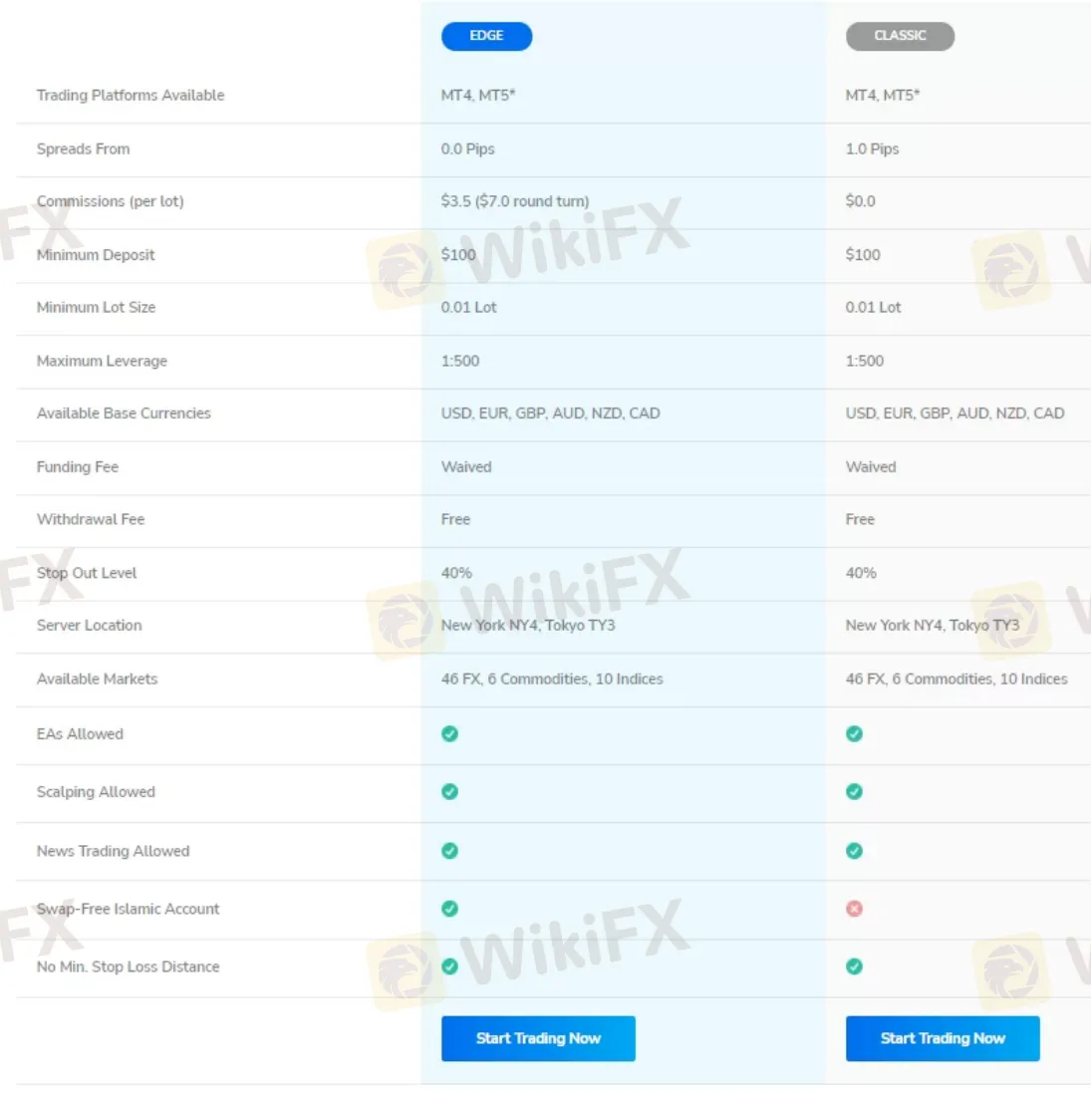

| Account Type | Edge & Classic |

| Demo Account | yes |

| Maximum Leverage | 1:500 |

| Spread | Edge: from 0.0 pips | Classic: from 1.0 pips |

| Commission | Edge: $3.5 ($7.0 round turn) | Classic: no |

| Trading Platform | MT4 & MT5 & web-based iRESS |

| Minimum Deposit | $100 |

| Deposit & Withdrawal Method | Visa | MasterCard | bank transfer | Neteller | Skrill | UnionPay | Revolut | WISE | RMB | FasaPay | SticPay | BrokerToBroker |

TRADEMAX, a trading name of TRADEMAX GLOBAL MARKETS, is allegedly a forex broker registered in Australia that claims to provide its clients with various tradable financial instruments with leverage up to 1:500 and floating spreads from 0.0 pips on the MT4, MT5 and web-based iRESS trading platforms via two different live account types.

As for regulation, it has been verified that TRADEMAX currently has no valid regulation. That is why its regulatory status on WikiFX is listed as “No License” and receives a relatively low score of 1.37/10. Please be aware of the risk.

Market Instruments

TRADEMAX advertises that it is a forex company that trades in forex, shares, indices, precious metals, energies, and futures.

Account Types

TRADEMAX claims to offer two types of trading accounts - Edge and Classic, each one of them accompanied by a demo account. The minimum initial deposit requirement for both account types is $100.

Leverage

The leverage provided by TRADEMAX is capped at 1:500. It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

All spreads and commissions with TRADEMAX are scaled with the accounts offered. Specifically, clients on the Edge account can enjoy raw spreads from 0.0 pips but have to pay a commission of $3.5 ($7.0 round turn), while the Classic account holders can experience spreads from 1.0 pips and commission-free trading.

Trading Platform Available

The platform available for trading at TRADEMAX is one of the most notable and preferred trading platforms the market offers - MetaTrader4 and MetaTrader5 trading platforms, as well as iRESS web trading platform. Mt4 and MT5 are highly praised by traders and brokers alike due to their ease of use and great functionality, offering top-notch charting and flexible customization options. They are especially popular for their automated trading bots, a.k.a. Expert Advisors.

Deposit & Withdrawal

TRADEMAX says to work with numerous means of deposit and withdrawal choices, consisting of Visa, MasterCard, bank transfer, Neteller, Skrill, UnionPay, Revolut, WISE, RMB, FasaPay, SticPay, and BrokerToBroker. The minimum initial deposit requirement is $100, and the minimum withdrawal amount is $100 as well. The withdrawal fee is said to be free and the processing time is 1 business day.

Customer Support

TRADEMAX‘s customer support can be reached by telephone: +61 2 8036 8388, email: support@tmgm.com. However, this broker doesn’t disclose other more direct contact information like the company address that most transparent brokers offer.

Pros & Cons

| Pros | Cons |

| • Demo accounts available | • No regulation |

| • Variable spreads from 0.0 pips | • Website inaccessible |

| • MT4 & MT5 supported | • Commission charged |

| • Multiple payment options |

Frequently Asked Questions (FAQs)

| Q 1: | Is TRADEMAX regulated? |

| A 1: | No. It has been verified that TRADEMAX currently has no valid regulation. |

| Q 2: | Does TRADEMAX offer demo accounts? |

| A 2: | Yes. |

| Q 3: | Does TRADEMAX offer the industry-standard MT4 & MT5? |

| A 3: | Yes. Both MT4 and MT5 are available at TRADEMAX. |

| Q 4: | What is the minimum deposit for TRADEMAX? |

| A 4: | The minimum initial deposit to open an account is $100. |

| Q 5: | Does TRADEMAX charge a fee? |

| A 5: | Yes. Like every forex broker, TRADEMAX charges a fee when you trade - either in the form of a commission fee or spread fee. But the broker appears to charge no deposit and withdrawal fees. |

| Q 6: | Is TRADEMAX a good broker for beginners? |

| A 6: | No. TRADEMAX is not a good choice for beginners. Although it offers demo accounts and the leading MT4 and MT5 trading platforms, as well as tight spreads and multiple payment options, the lack of legitimate regulation is the truth and the trading condition cannot be verified due to its broken website links. |

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now