Score

Maono Global Markets

South Africa|1-2 years|

South Africa|1-2 years| https://maonoglobalmarkets.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

South Africa

South AfricaAccount Information

Users who viewed Maono Global Markets also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

BlackBull

- 5-10 years |

- Regulated in New Zealand |

- Market Making(MM) |

- MT4 Full License

Website

maonoglobalmarkets.com

Server Location

United States

Website Domain Name

maonoglobalmarkets.com

Server IP

104.21.75.219

Company Summary

| Aspect | Information |

| Registered Country/Area | South Africa (claimed) |

| Founded Year | 2022 |

| Company Name | Maono Global Markets |

| Regulation | No Regulation |

| Minimum Deposit | Not specified (for Micro Account) |

| Maximum Leverage | Up to 1:500 |

| Spreads | Starting from 1 pip (Standard and BA accounts) |

| Trading Platforms | MetaTrader 5 (MT5) |

| Tradable Assets | Forex, Shares, Indices |

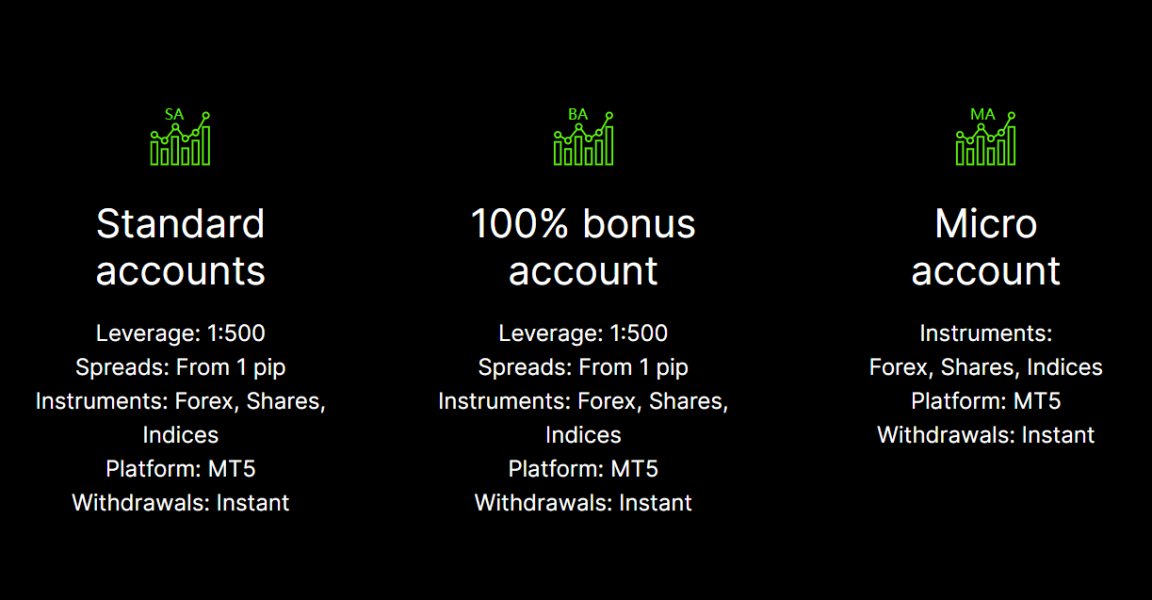

| Account Types | Standard Account, BA (100% Bonus Account), Micro Account |

| Customer Support | Phone: +27 21 207 2838, +27 65 291 3731;Email: support@maonoglobalmarkets.com, complaints@maonoglobalmarkets.com; |

| Payment Methods | OZOW, Paystack, Alphapo |

| Educational Tools | Not offered |

| Website Status | Website information provided, but no verification of regulatory claims |

Overview

Maono Global Markets is a brokerage firm that claims to be registered in South Africa and was founded in 2022. However, its regulatory status is questionable as it claims to hold an authorized representative license from the FSCA, but this cannot be verified. The company offers a range of trading accounts, including Standard, BA (100% Bonus), and Micro accounts, with leverage of up to 1:500 and spreads starting from 1 pip in some accounts. They provide access to Forex, Shares, and Indices trading on the MetaTrader 5 (MT5) platform. While they offer various contact methods for customer support and multiple payment options, they do not provide educational resources. The company's reputation online is unfavorable, with concerns about service quality, transparency, and fund security, primarily due to regulatory discrepancies and a lack of oversight. Traders are advised to exercise caution when considering Maono Global Markets as their trading platform.

Regulation

Maono Global Markets operates as a brokerage firm but lacks regulatory oversight. This absence of regulation means they are not bound by standard financial industry rules and safeguards. As a result, clients might face increased risks and fewer protections. It's essential for investors to be aware of these factors when considering doing business with unregulated entities like Maono Global Markets.

Pros and Cons

| Pros | Cons |

|

|

|

|

|

|

|

|

Overall, Maono Global Markets offers a range of trading instruments, high leverage, low spreads, and instant withdrawals. However, the absence of regulatory oversight, limited information on trading conditions, and unclear bonus terms raise concerns for potential clients. Traders should exercise caution and consider alternative options for their investments.

Market Instruments

Maono Global Markets offers trading in a variety of market instruments, specifically in the categories of Forex, Shares, and Indices. Here's a detailed description of each:

Forex (Foreign Exchange Market): This is a global marketplace for trading national currencies against one another. Forex trading involves pairs of currencies, like EUR/USD or GBP/JPY, where traders can speculate on the price movements between these currencies. Forex markets are known for high liquidity and 24-hour trading during weekdays, making them popular among traders. However, Maono Global Markets does not provide detailed information on the range of currency pairs offered, leverage, spreads, or other specific trading conditions.

Shares: Trading in shares involves buying and selling stocks of individual companies. This could range from large, well-known corporations to smaller, emerging companies. Shares are traded on stock exchanges, and their prices are influenced by a variety of factors including company performance, economic conditions, and market sentiment. Maono Global Markets offers share trading, but the specifics such as the range of stocks available, access to international stock markets, commission fees, and other trading conditions are not clearly detailed on their website.

Indices: Indices trading involves speculating on the price movements of stock market indices, which are measures of a section of the stock market. Common examples include the S&P 500, NASDAQ, and FTSE 100. These indices reflect the collective value of their constituent stocks, offering a broad market exposure. The information on which indices can be traded through Maono Global Markets, along with details about leverage, spreads, and other trading terms, is not comprehensively outlined on their platform.

In summary, while Maono Global Markets provides access to these instruments, the lack of detailed information about each category's specific offerings, such as the variety of instruments available, trading conditions, fees, and platform features, might make it challenging for traders to make informed decisions.

Account Types

Maono Global Markets offers a selection of three account types, each tailored to different trading needs and preferences:

Standard Account: The Standard Account is geared towards traders who seek high leverage and low spreads. With a leverage of up to 1:500, it allows traders to control a large position with a smaller capital outlay, though this also increases the risk of significant losses. The spreads start from as low as 1 pip, which can be beneficial in reducing trading costs. This account type grants access to a wide range of trading instruments, including Forex, Shares, and Indices. It operates on the MetaTrader 5 (MT5) platform, known for its advanced trading features and analytical tools. Additionally, the account promises instant withdrawals, a feature appealing to traders who prioritize quick access to their funds.

BA (100% Bonus Account): The BA Account offers similar features to the Standard Account, including the same high leverage of 1:500 and low spreads starting from 1 pip. It also provides access to the same range of instruments and operates on the MT5 platform. The standout feature of this account is the 100% bonus, which likely refers to a deposit bonus, though the specific terms and conditions of this bonus are not clear. Like the Standard Account, it also offers the convenience of instant withdrawals.

MA (Micro Account): The Micro Account appears to be designed for less experienced traders or those who prefer to trade with smaller amounts. While it offers trading in Forex, Shares, and Indices and operates on the MT5 platform, the specific details about leverage, spreads, and minimum deposit requirements are not explicitly stated. This account also features instant withdrawals, adding a level of convenience for traders.

Each of these account types is designed to cater to a range of trading strategies and experience levels. The consistent offering of high leverage, low spreads, and the use of the MT5 platform across all accounts indicates a focus on providing a robust and flexible trading environment. However, the lack of detailed information on certain aspects, such as the bonus terms in the BA account and the specific features of the Micro Account, suggests that potential clients might need to contact Maono Global Markets directly for more comprehensive details.

Leverage

Maono Global Markets offers a maximum trading leverage of up to 1:500. This high leverage ratio means traders can control positions up to 500 times their initial investment, amplifying both potential profits and risks. While it allows significant trading capacity, it also increases the potential for losses, sometimes exceeding the initial investment. This level of leverage is generally suitable for experienced traders with robust risk management strategies.

Spreads and Commissions

Maono Global Markets offers different spreads and commissions based on the account type. In the Standard and BA (100% Bonus) accounts, spreads start from 1 pip. The exact commission structure for these accounts is not detailed.

The Micro Account, aimed at new or small-scale traders, might have different spread and commission structures, but specific details are not provided. In such accounts, brokers often offer higher spreads but lower minimum trade sizes, and potentially lower or no commissions.

It's essential for potential clients to consider all trading costs, including spreads and commissions, which can vary depending on the account type. For accurate information, traders should consult Maono Global Markets for the exact spread and commission structure for each account type.

Deposit & Withdrawal

Maono Global Markets provides a range of deposit and withdrawal methods, including OZOW, Paystack, and Alphapo. These options offer flexibility for clients looking to fund their accounts or access their funds. OZOW provides an online payment solution, while Paystack offers payment processing services. Alphapo ensures financial transactions for Maono Global Markets' customers. These multiple methods cater to diverse client preferences, enhancing accessibility in managing their financial transactions with the company.

Trading Platforms

Maono Global Markets offers MT5 as its trading platform. This platform is widely recognized and trusted in the financial industry for its advanced features and capabilities. MT5, short for MetaTrader 5, provides traders with a user-friendly interface, powerful charting tools, and a wide range of technical indicators for market analysis. Additionally, it supports various asset classes, including forex, stocks, commodities, and cryptocurrencies, allowing traders to diversify their portfolios. With its cutting-edge technology and accessibility, MT5 offers Maono Global Markets' clients a robust and efficient platform for their trading needs.

Customer Support

Maono Global Markets provides a comprehensive customer support system to assist clients with their inquiries and concerns. Clients can reach the support team at +27 21 207 2838 or +27 65 291 3731, or they can contact them via email at support@maonoglobalmarkets.com for general inquiries or complaints@maonoglobalmarkets.com for addressing specific issues. The company's physical address is Unit 3B Waterside Place, 19 Carl Cronje Drive, Tyger Waterfront, Western Cape, 7530. This commitment to accessible communication channels and a physical presence ensures that Maono Global Markets is dedicated to providing assistance and addressing the needs of its clientele effectively.

Educational Resources

Maono Global Markets does not offer educational resources as part of its services. While some financial institutions and trading platforms provide educational materials to help clients improve their trading knowledge and skills, Maono Global Markets may focus solely on its trading and financial services without an educational component. Clients seeking educational resources may need to explore alternative sources or institutions to enhance their understanding of the financial markets and trading strategies.

Summary

Maono Global Markets is a broker established in 2022, with its official website indicating registration in South Africa. However, the legitimacy of this registration cannot be verified through government sources. The broker claims to hold an authorized representative license from the Financial Sector Conduct Authority (FSCA) but is not permitted to engage in brokerage services for financial derivatives according to FSCA records. The website lacks crucial information regarding account types, trading products, deposit/withdrawal procedures, and has received unfavorable online sentiment, including concerns about service quality, transparency, and fund security. Due to these uncertainties and regulatory issues, investors are advised to exercise caution and consider alternative options for their financial investments.

FAQs

Q: What is Forex trading?

A: Forex trading involves trading global currencies. Traders speculate on currency pair price movements to make a profit.

Q: What is leverage in trading?

A: Leverage lets traders control larger positions with less capital, magnifying both gains and losses.

Q: How can I deposit and withdraw funds from my trading account?

A: You can deposit and withdraw funds using various methods like bank transfers, cards, e-wallets, or cryptocurrencies through your broker's platform.

Q: What is a trading platform?

A: A trading platform is software for executing trades and analyzing markets, providing real-time data, charts, and order execution features.

Q: How can I manage trading risk?

A: To mitigate risk, use stop-loss orders, diversify your portfolio, size positions correctly, follow a trading plan, and stay informed about market news and trends.

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 5

Content you want to comment

Please enter...

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

zhanzhihao

Netherlands

Despite offering a variety of financial products, the user interface proved to be unfriendly and navigating the website was cumbersome. The fee structure lacked transparency, and customer support responsiveness varied. While there are merits, improvements in UI, fee clarity, and customer service are necessary. Users should be prepared for a learning curve.

Neutral

2023-12-20

Cherrie

Malaysia

Maono Global Markets offers a wide range of trading instruments, making it a great choice for diverse investors. Plus, their spreads are competitive, which is a big plus when it comes to maximizing profits. Overall, I'm impressed with their trading options and pricing.

Positive

07-09

Michael Evans

Malaysia

Super easy to use, haven't had a single crash in the two weeks I've been messing around with their standard account. Plus, my account manager, Louise, a really good person, he's been dropping all sorts of helpful tips. Seriously, everything's been smooth sailing so far.

Positive

06-28

FX5617947502

South Africa

Brilliant CRM and easy verification. They seem to fix a lot of issues if they pop up which is very reassuring from a trader's perspective.

Positive

05-16

Jaco6847

South Africa

After they updated their CRM the overall quality has drastically improved. Having traded for almost 5 years I can confidently say they have some of the best spreads out there. Especially for Indices like Nasdaq and US30. Would highly recommend other traders to give them a shot.

Positive

05-15