Copy trading has exploded in popularity among Indian traders as an easy way to benefit from the success of more experienced investors. By automatically copying the trades of top performers, novice traders can leverage seasoned trading strategies without developing extensive technical expertise. India's leading copy trading platforms like eToro, AvaTrade, CMC Markets, Pepperstone, IC Markets, TickMill and Blackbull Markets allow you to mirror the portfolios of vetted experts with proven track records. This article will compare the best copy trading platforms in India across key factors like tradable assets, risk management tools, platform interfaces, and quality of strategy managers. Whether you're a new trader looking to learn or an experienced investor seeking to augment returns, this offers an innovative path to grow your capital by learning from the best.

Comparison of the Best Platforms for Copy Trading in India

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Platforms for Copy Trading in India Overall

| Brokers | Logos | Why are they listed as the Best Copy Trading Platforms in India? |

| eToro |  |

✅A global multi-asset broker with over 20 million users worldwide. ✅Regulated in several major jurisdictions, including Australia, UK and Cyprus, giving traders in India more confidence. ✅CopyTrader feature is very popular in India for copying forex and stock traders. |

| AvaTrade |  |

✅Regulated in 6 jurisdictions, including Australia, Japan and South Africa, a big player in the industry. ✅AvaTrade has a significant presence in India with local support and funding options. ✅Their copy trading technology allows mirroring trades across a wide range of markets. |

| CMC Markets |  |

✅A London Stock Exchange listed broker with regulatory oversight from top-tier agencies like ASIC and FMA. ✅CMC Markets has served Indian traders for over a decade and provides advanced copy features. |

| Pepperstone |  |

✅ An Australian broker with strong regulation that has expanded substantially in India. ✅ Highly raised for its fast execution speeds and user-friendly copy trading platform. |

| IC Markets |  |

✅Well-capitalized global broker with a focus on the Asian market, including a major presence in India. ✅IC Markets offers copy trading on an extensive range of tradable products. |

| TickMill |  |

✅Globally and heavily regulated, featuring a solid reputation globally, including in India. ✅TickMill's copy tool includes customization options that appeal to Indian traders. |

| Blackbull Markets |  |

✅An FMA-regulated broker gaining popularity in India for its tight spreads and transparent copy trading technology. ✅Blackbull's intutive and easy to use platform makes it easy to copy vetted successful traders. |

Overview of the Best Platforms for Copy Trading in India

eToro

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$10 |

Tradable Instruments |

Cryptocurrencies, stocks, ETFs, and more |

Trading Platforms |

eToro trading platform |

Trading Costs |

1% fee for cryptoassets trading |

Max. Leverage |

30:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

Debit Card, Bank Account, PayPal, Wire Transfer |

Customer Support |

24/7 |

eToro, established in 2007, is a social trading platform based in Israel, with registered offices in Cyprus, the UK, and Australia. The platform provides a variety of tradable instruments like stocks, cryptocurrencies, commodities, forex, and ETFs among others. eToro is best known for its exceptional social trading platforms available both on web and mobile, where traders can copy trades from other investors automatically. eToros customer support includes assistance via phone and ticketing system, though it does not offer a 24/7 service. The broker is widely recognized for its innovative social trading features, free stock trading, and user-friendly interface.

eToro stands out for its diverse tradable assets including stocks, ETFs, currencies, cryptocurrencies and commodities. Their innovative CopyTrader system allows investors to copy over 12,000 top-performing traders with vetted track records. eToro provides advanced risk management tools like customizable Stop Loss and risk scoring to protect copied capital. The platform interface makes it simple to monitor copied trades and strategy manager performance. eToro also facilitates portfolio diversification by making it easy to copy multiple successful traders.

✅ Where eToro Shines:

• eToro's pioneering social trading platform allows traders to follow and copy the trades of successful investors.

• eToro's platform has a highly intuitive and user-friendly interface designed to make trading accessible for both novice and experienced traders.

• eToro is known as one of the pioneers in cryptocurrency trading, offering access to a wide range of crypto assets, a feature which many professional traders find attractive.

• Another key advantage for eToro is their offer of free stock trading, a benefit not seen across all trading platforms.

❌ Where eToro Shorts:

• eToro charges relatively high forex and CFD trading fees which can eat into trading profits, especially for high-volume traders.

• The platform's customer support is not available 24/7 and some users have reported slow response times.

• eToro charges a fixed withdrawal fee of $5, unlike many other brokers, which can be a drawback for active traders who need to move money frequently.

AvaTrade

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

Stocks, indices, commodities, currencies (Forex), ETFs, and cryptocurrencies |

Trading Platforms |

MT4, MT5, AvaOptions, ZuluTrade and more |

Trading Costs |

Spreads from 0.9 pips, Equity CFDs with 0.13% markup over market spreads, cryptocurrencies ranging between 0.20% and 2.00% |

Spread Betting |

✅ |

Max. Leverage |

400:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

✅ |

|

Payment Methods |

Credit/Debit Cards and Wire Transfers, Skrill, Neteller, and WebMoney |

Customer Support |

5/24 |

AvaTrade, founded in 2006, is a renowned online trading broker based in Dublin, Ireland. Registered and regulated in several jurisdictions worldwide, they offer an extensive range of tradable instruments, covering forex, commodities, indices, stocks, bonds, ETFs, and cryptocurrencies, among others. AvaTrade offers its clients access to a variety of reliable trading platforms, including MetaTrader 4 and 5 and their proprietary AvaTradeGo and AvaOptions platforms. Their spreads are competitive, and they offer leverage up to 1:400. Unique features, such as DupliTrade for copy trading and AvaProtect for risk management, give AvaTrade an edge over many brokers. User recognition is high for their excellent customer service and extensive educational resources, contributing to their reputable standing in the trading world.

AvaTrade offers copy trading across a wide range of assets including forex, stocks, indices, commodities and cryptocurrencies. Their 'Copy Trading' dashboard allows detailed filtering to identify top-performing traders with proven expertise. Risk is managed through automated stop losses and the ability to allocate copied trades a different position size. The platform interface enables transparent monitoring of opened trades, trader metrics and customization of copying parameters. AvaTrade hand-selects profitable strategy managers to copy based on risk metrics and multi-year track records.

✅Where AvaTrade shines:

• Robust regulatory compliance with multiple international entities, providing an added level of trust and security to clients.

• Specialized trading platforms, including DupliTrade and ZuluTrade, which support social and copy trading.

• Providing access to options trading for cryptocurrencies, which is a plus for traders looking to diversify their trading strategy with alternative derivatives on digital currencies.

• Supporting various order types such as Limit Orders, Market Orders, Stop Loss Orders, Entry Orders and more for risk management.

❌Where AvaTrade shorts:

• Relatively longer processing times for certain types of withdrawals, which might lead to delays in accessing funds.

• While AvaTrade is available in several countries worldwide, it does not accept clients from certain jurisdictions.

• Inactivity fees of $50 are levied on accounts that remain inactive for a specified period, typically three consecutive months.

CMC Markets

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$0 |

Tradable Instruments |

Forex pairs, Indices, Cryptocurrencies, Shares & ETFs, Commodities, Treasuries |

Trading Platforms |

Next Generation platformMetaTrader 4 platformShare trading standard platformShare trading Pro platform |

Trading Costs |

Spreads on major FX pairs from 0.7 pips |

Spread Betting |

✅ |

Max. Leverage |

30:1 ( Retail traders), 500:1 ( Pro traders) |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

EFT, Wire Transfer, Personal Cheque, Mastercard/Visa, PayNow, Bank Transfer, MEPS (SGD$) and more |

Customer Support |

5/24 |

CMC Markets, established in 1989, is a well-known online trading broker headquartered in London, UK, regulated and registered in various jurisdictions around the globe and offers a wide range of tradable instruments such as forex, indices, commodities, shares, and treasuries. CMC Markets present their users with a proprietary trading platform known as Next Generation, along with the popular MetaTrader 4 platform. The broker is especially known for its competitive spreads, comprehensive charting tools, and a large product catalog. Unique features like Price Ladder Trading and client sentiment indicators have further elevated the broker's appeal. In addition, CMC Markets keep providing excellent customer service and extensive educational resources add to its exceptional reputation in the trading world.

CMC Markets offers copy trading across 5000+ financial instruments including forex, stocks, commodities, indices and treasuries. Their 'Next Generation' platform provides risk management through customizable position sizing and Stop Loss orders on copied trades. The interface enables clear monitoring of strategy manager performance, open positions and executed copy trades. CMC selects profitable traders and allocates copier funds across multiple managers to diversify risk.

✅Where CMC Markets shines:

• Regulated by top-tier regulators globally, ensuring a secure and trasparent trading enevironemnt, giving traders more trading confidence.

• CMC Markets is one of the few brokers to offer a quality news and analysis service integrated into its trading platform.

• Impressively portfolios, offering over 12,000 instruments spanning forex, commodities, indices, bonds, treasuries and more.

• CMC also enables spread betting, which allows tax-free trading for some residents - a perk not commonly offered.

❌Where CMC Markets shorts:

• Limited trading platforms choices, CMC Markets does not offer the popular MetaTrader 5 platform, cTrader and Tradingview.

• While CMC Markets has a diverse asset offering, their futures and options trading offerings are quite limited. • Lack of bonuses and promotions, which may discourage some potential traders.

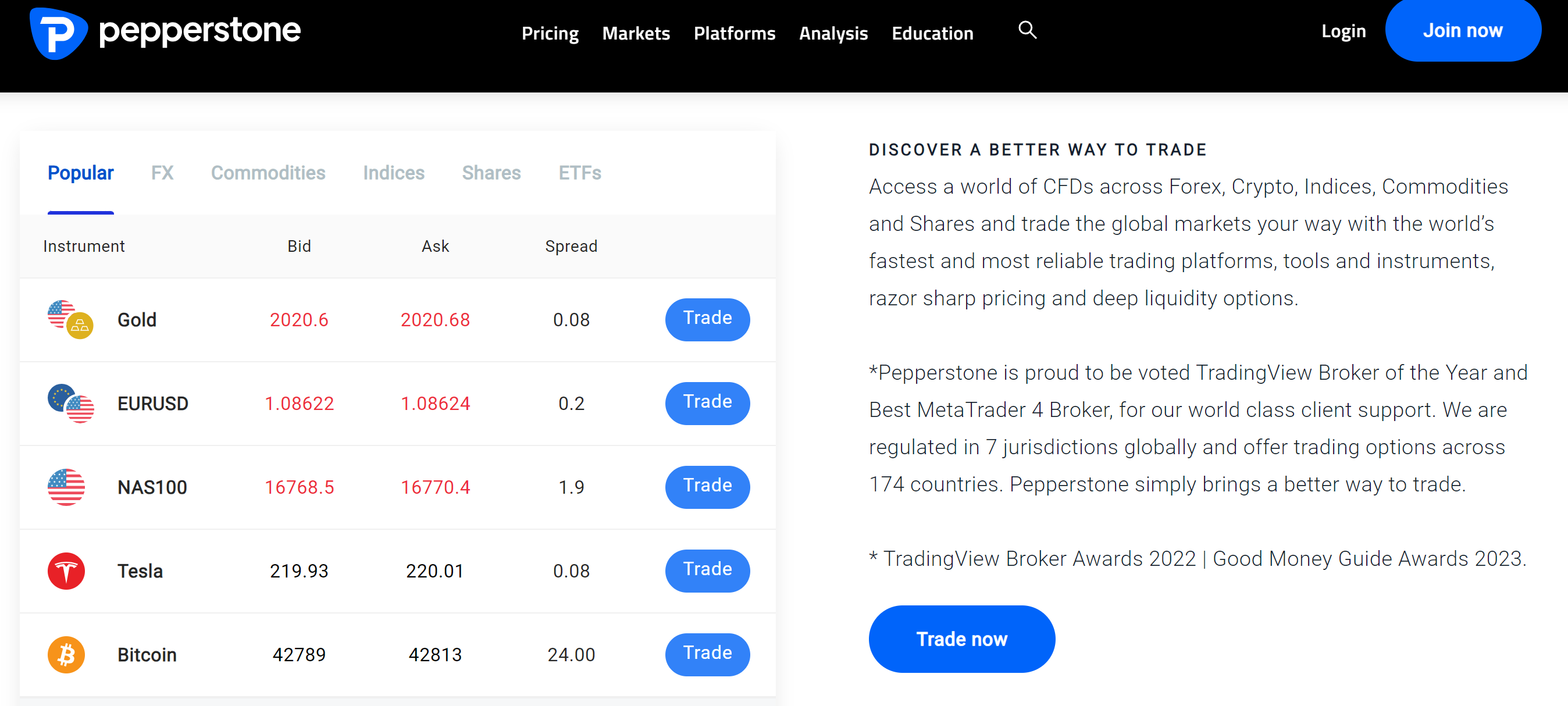

Pepperstone

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$200 |

Tradable Instruments |

Forex, Commodities,Indices, Currency Indices,Cryptocurrencies,Shares, ETFs,CFD Forwards |

Trading Platforms |

cTrader, MetaTrader 4, TradingView, |

Trading Costs |

Forex markups of 0.70 pips, average costs of 0.84 pips or $7.00 and $8.40 per 1.0 standard round lot |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

Visa, Mastercard, Bank transfer; PayPal, Neteller, Skrill, Union Pay |

Customer Support |

24/7 |

Pepperstone, founded in 2010, is an online forex and CFD broker based in Australia, with additional operations in the UK. It provides trading in over 150 instruments, spanning forex, index CFDs, commodities, cryptocurrencies, and share CFDs. The broker offers multiple trading platforms including MetaTrader 4, MetaTrader 5, and cTrader available on web, desktop, and mobile for convenient access. Pepperstone's customer support extends to 24/7 live chat, phone, and email services. Pepperstone is recognized for its low-cost access to global forex markets, superior customer service, extensive educational resources, and transparent fee structure.

Pepperstone's copy trading feature covers 60+ currency pairs, metals, indices and commodities. Risk guards include per-trade stop losses and position limits based on account equity. Their easy-to-use web interface and mobile app provide complete transparency on each copy trade's details and performance. Pepperstone's rigorous evaluation selects profitable traders with low-risk scores for copying.

✅ Where Pepperstone Shines:

• Known for its ultra-low latency and swift trade execution, which is a significant benefit for high-frequency traders.

• Offers MetaTrader 4, MetaTrader 5, and cTrader platforms, all of which are suited to the needs of professional traders.

• Exceptionally competitive forex pricing with low spreads, reducing costs particularly for high-volume traders.

• Providing high leverage up to 500:1 (subject to eligibility), which can enlarge trading capacity.

• Offering robust analytical tools and technical indicators aiding comprehensive market analysis.

❌ Where Pepperstone Shorts:

• Although Pepperstone offers a broad range of forex pairs, its CFD offerings are not as extensive, which can restrict trading diversification for some traders.

• Pepperstone does not regularly offer bonuses or promotional campaigns, which can lessen its appeal compared to other brokers.

IC Markets

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

Forex, Commodities CFDs,Indices, Bonds, Digital Currency.Stock, Futures |

Trading Platforms |

MetaTrader 4, MetaTrader 5, MetaTrader WebTrader, MetaTrader iPhone/iPad.MetaTrader Android, MetaTrader Mac |

Trading Costs |

Raw Spread ( cTrader): spreads from 0.0 pips, commissions at $3 Raw Spread ( MetaTrader): spreads from 0.0 pips, commissions at $3.5 Standard ( MetaTrader): spreads from 0.8 pips, no commissions charged. |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

Bank/Wire transfer, Paypal, Credit Card, Skrill, Neteller, UnionPay, Bpay, FasaPay and Poli |

Customer Support |

7/24 |

IC Markets, founded in Sydney, Australia, in 2007, is a highly commended broker recognized globally for its superior trading services. Registered with the Australian Securities and Investments Commission (ASIC), it also enforces strict regulatory compliance, assuring reliability and security. IC Markets, renowned for its wide assortment of tradable instruments, gives traders access to forex pairs, commodities, indices, bonds, and cryptocurrencies, among others. By offering both the MetaTrader and cTrader platforms, the broker cares about more traders, facilitating sophisticated charting, algorithmic trading, and more. IC Markets is celebrated for its competitive trading costs, notably for its low spreads and affordable commissions. With customer service held in high regard, you can expect prompt, multilingual assistance 24/7 via live chat, email, and phone. The recognition IC Markets boasts is solidified by its global reputation, network of international clients, and high recognization from professional traders.

IC Markets offers mirror trading across 230+ tradable instruments. Risk management tools include individual trade SL/TP levels and position size control on copied trades. Their platform dashboards make it simple to analyze trader statistics and customize copying parameters. IC Markets thoroughly vets strategy managers, favoring those with 5+ years of verified profitability.

✅ Where IC Markets shines:

• Heavily regulated by ASIC, and CYSEC, operating in a transparent and secure way.

• IC Markets worldwide presence, supported by a diverse global client base, solidifying its reliable reputation.

• Grantingaccess to a broad range of tradable instruments from forex, commodities, to indices, giving traders more trading fexiblity.

• Recognized for offering some of the lowest spreads in the industry, starting from 0.0 pips on major Forex pairs.

• For oil traders, IC Markets' competitive edge lies in the low fees for oil trading supported by their raw spread accounts.

• With MetaTrader and cTrader on offer, traders can benefit from the detailed charting and algorithmic trading capabilities.

❌Where IC Markets Shorts :

• IC Markets primarily focuses on forex and CFDs, and may not be suitable for traders seeking to invest in other financial instruments such as stocks and ETFs.

• For certain CFD trades, IC Markets require a higher margin which might be intimidating to novice traders or those with limited capital.

TickMill

|

|

Broker |

|

Regulated by |

|

Min. Deposit |

$100 |

Tradable Instruments |

Forex, Stock Indices, Commodities, Bonds Cryptocurrencies and more |

Trading Platforms |

MetaTrader 5MetaTrader 4MetaTrader WebTrader PlatformMetaTrader for MacTickmill Mobile App |

Trading Costs |

Classic account: spreads from 1.6 pips , zero commissions Pro Account: spreads from 0.0 pips, 2 per side per lot VIP Account: spreads from 0.0 pips, 1 per side per lot |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

✅ |

|

Payment Methods |

Bank transfer, Credit/debit cards, Neteller, Skrill, dotpay, Paysafecard, Sofort, Rapid by Skrill, PayPal |

Customer Support |

5/24 |

TickMill, established in 2014, is a renowned broker with roots in the United Kingdom. The financial services firm operates under the strict regulation of UK's FCA, and CySEC in Cyprus. It provides wide access to tradable instruments, spanning a variety of asset classes including forex, stock indices, commodities, and bonds. Advanced platform offerings include the industry-favored MetaTrader 4, MetaTrader 5, and TickMill mobile app, known for its exemplary charting, analytical capabilities, and support for automated trading strategies. TickMill is recognized for its competitive trading costs, known to offer low spreads and meager commissions. Traders can access multilingual customer service, available during market operating hours via several channels, including live chat, email, and a call back service.

TickMill's 'Autochartist' copy tool covers 50+ forex and CFD assets. Key risk features include customizable loss limits and the flexibility to close copied trades independently. Their web-based platform enables intuitive monitoring and management of copied traders. TickMill focuses on verified experts who have generated steady profits over many market cycles.

✅ Where TickMill shines:

• Regulated by well-known, reputable agencies including Seychelles Financial Services Authority, UK's FCA, and CySEC.

• Offers extensive financial instruments across different asset classes which makes for a comprehensive trading environment.

• $30 welcome bonuses, giving traders more counrage to start trading without using their own money.

• TickMill stands out for its competitive conditions in oil trading, featuring low oil trading fees, thereby reducing overall trading costs for oil traders.

• Traders praise its customer support for its responsiveness and proficient multilingual service.

• Additional features like social trading, copy trading also provided, allowing beginner traders to trade with ease.

❌Where TickMill Shorts:

• Although it provides multilingual support, some users have reported delays in response times during non-market hours.

• The accounts offered by TickMill come in predefined forms, and no option is provided for customizing account conditions to better suit unique trading strategies.

Blackbull Markets

|

|

Broker |

Blackbull Markets |

Regulated by |

|

Min. Deposit |

$0 |

Tradable Instruments |

Forex, Commodities, Equities, Indices, Metals |

Trading Platforms |

MetaTrader 4 and MetaTrader 5, Tradingview, cTrader, BlackBull copytrader |

Trading Costs |

ECN Standard: spreads from 0.8 pips, no commissions charged. ECN Prime: spreads from 0.1 pips, commissions at US$6.00 per lot. ECN Institutional: spreads from 0.0 pips, commissions at US$4.00 per lot. |

Max. Leverage |

500:1 |

Demo accounts |

✅ |

Copy Trading |

✅ |

❌ |

|

Payment Methods |

Bank transfer, Credit/debit cards, Neteller, Skrill, China UnionPay, Crypto, Astropay, FasaPay, PoLi and more |

Customer Support |

7/24 |

Blackbull Markets is an Australian FX and CFD broker founded in 2014. Regulated by FMA and FSA, Blackbull offers trading access to over 260000 financial instruments including forex, indices, commodities, shares and cryptocurrencies. Blackbull provides the popular MetaTrader 4 and MetaTrader 5, Tradingview, cTrader, along with advanced BlackBull copytrader. Their client support is available 24/7 via live chat, email and phone. Blackbull is well-known for its low spreads starting from 0 pips and fast execution speeds.

Blackbull Markets provides copy trading on forex, indices, shares, commodities and cryptocurrencies. Notable risk controls include automatic stop loss and take profit orders for each copied trade. Their platform delivers transparency on provider positions, trading activity and profile metrics. Blackbull's vetting emphasizes traders with low-risk scores and multi-year track records of outperformance.

✅ Where Blackbull Markets shines:

• Strictly regulated by FMA, giving traders an extra layer of security.

• Offering over 26, 000 tradable instruments, giving traders extensive options.

• Popular MetaTrader 4 and MetaTrader 5 trading platforms along with advanced copy trading feature.

• 7/24 client support, addressing trading problems in a responsive and timely manner.

• $0 to start real trading, making it easily accessible for beginners.

❌Where Blackbull Markets Shorts:

• Lacks extra tier-1 regulations outside New Zealand.

Frequently Asked Questions (FAQs)

What is copy trading?

Copy trading, simply put, allows investors to copy the trading strategies and positions of experienced traders. By mirroring the trades of successful traders, copy trading provides a simple way for beginners to start investing while leveraging the knowledge of more seasoned investors.

Copy trading typically involves three parties: copy trading provider, copier and a broker.

• Provider: The provider, also known as signal provider or master trader, is the investor whose trades are being copied. They are typically experienced, profitable traders who have consistently beaten market returns over many years. Providers allow copiers to duplicate their trading activity in exchange for a monthly subscription fee or performance fee. They provide access to their trading history, metrics, portfolio, and real-time trades through a copy trading platform.

• Copier: The copier is the individual investor who copies the trades of a provider. Copiers are often beginner or intermediate traders looking to benefit from the experience of proven experts. They browse provider profiles on copy trading platforms to identify masters with trading styles and risk tolerances aligned with their goals. Copiers copy providers using their own invested capital in a brokerage account.

• Broker: The broker refers to the copy trading platform that connects providers with copiers. Platforms like eToro provide the interface and software that allows automatic mirroring of providers' trades in copiers' accounts. Brokers handle transaction processing, record keeping, and facilitating the compensation of providers. They earn revenue by charging monthly subscription fees to copiers for access to the platform and its pool of providers.

Is there a minimum deposit required for copy trading?

Typically, there is a minimum capital requirement to engage in copy trading, although the exact amount can vary between platforms. Many copy trading platforms require a minimum deposit ranging from $500 to $1000 to start copying other traders. This minimum capital requirement helps ensure that investors have enough funds to properly diversify their portfolio across multiple traders and strategies. The minimum also acts as an initial filter to deter less serious investors who may lack the appropriate capital to properly take advantage of copy trading services. While the minimum capital may seem restrictive, it is often implemented to protect novice investors by encouraging adequate portfolio diversification.

How do I know which trader to copy?

When selecting which trader to copy in copy trading, it's important to consider factors like their risk profile, performance history, trading strategy, and number of copiers. Traders with lower risk scores and consistent positive returns over an extended period of time tend to be safer choices. Evaluating the trader's strategy and markets traded can ensure alignment with your goals and risk tolerance. Traders with a high number of copiers and strong past performance often indicate a successful strategy worth mimicking. Checking community feedback and profile transparency can further gauge the trustworthiness of a trader.

Is copy trading good for beginners?

Copy trading can be a good starting point for investing beginners, but it still requires knowledge and caution like any other trading approach. Before committing significant capital to copy trading, beginners should take the time to educate themselves on core concepts like risk management, portfolio allocation, and due diligence. Understanding these basic principles will allow beginners to research and evaluate potential traders to copy in an informed manner. It's also wise for beginners to start copy trading small amounts, rather than large sums right away. Making use of practice demo accounts to test copy trading platforms is another way for beginners to dip their toes in safely.

Does copy trading really work?

Copy trading can be an effective strategy for some investors, allowing novice investors to leverage the knowledge of experienced, successful traders. This gives investors access to sophisticated trading strategies without requiring extensive time or experience. For instance, copy trading platforms like eToro allow investors to view the track record, risk metrics, and trading style of top-performing traders on their platform. Investors can use these stats to identify traders with consistent success over many years and risk-adjusted returns that beat the broader market. By copying disciplined traders with proven profitability, investors can mirror the trading activity of experts without needing to develop that expertise themselves. Studies of top eToro traders show annual gains over multiple years in the 25-45% range are possible when copying the right traders.

Who is the best copy trader in India?

Rakesh Bhandari has emerged as one of the leading copy traders in India on platforms like TradeSmart. Bhandari is a professional trader with over 15 years of experience trading equities, derivatives and commodities. He has generated annual returns of 21-31% over the last 4 years by trading momentum stocks with a combination of fundamental and technical analysis. Bhandari maintains a relatively concentrated portfolio of 15-20 stocks and applies strict risk management with stop losses on every trade. With transparent performance metrics and consistent double-digit returns across market conditions, Bhandari represents the type of skilled trader that makes copy trading successful. His trading style aligns with active portfolio management while limiting overexposure through prudent position sizing and risk controls. For investors seeking to benefit from the experience of proven Indian traders, Rakesh Bhandari offers a prime example to evaluate.

Copy trading VS Social trading: what are differences?

Social trading focuses on the “social” feature, which means traders can interact with each other, share their thoughts, and discuss their trading strategies. Copy trading, on the other hand, is more focused on simply copying the trades of successful traders. Secondly, In social trading, traders have the ability to analyze and make their own trading decisions based on the information shared by other traders. They can choose to follow or ignore the trades suggested by others. In copy trading, traders simply select a successful trader to follow, and all the trades made by that trader are automatically replicated in their own trading account. Lastly, social trading allows traders to gain knowledge, learn more trading strategies and trading techniques, thus giving them a solid knowledge base, while in copy trading, traders are not required to be equipped with much relevant knowledge. They only need to choose the successful trader they want to follow.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects. We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

Best Forex Brokers in Turkey for 2024

Review top 9 forex brokers in Turkey, elevating their trading pros and cons to give traders more useful guidance.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Swiss Forex Brokers for 2024

Explore top 10 forex brokers in Switzerland, elevating their trading pros and cons to give traders more useful guidance.

Best Stock Brokers in the US for 2024

When choosing an online broker, finding the platform that best fits your investment needs is crucial. With the rise in popularity of online trading, more brokers are offering free stock trading and commission-free transactions for various assets. It has become a challenge for users to select suitable brokers.

Best MT5 Forex Brokers in 2024

Here is our pick of the best MT5 Forex Brokers and this list includes only regulated brokers that are highly ranked and come highly recommended for trading.

8 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 8 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Best Brokers with Smartwatch Apps for 2024

This guide compares the best brokers and their smartwatch app features- a quick way to manage your portfolio.

Best Mac Forex Trading Platforms for 2024

Forex traders, particularly Mac users, need suitable platforms. This article examines the top Mac Forex trading platforms' brokers.