Are you trying your hand at Forex trading in Malaysia? Be careful, because there are scam brokers out there. This guide will show you who to watch out for so you can keep your money safe. Plus, you'll learn tips about how to avoid scams. Get ready to learn about the Scam Broker Blacklist in Malaysia - the first step to safe Forex trading!

List of Forex Scam Brokers in Malaysia

| Scam Brokers | Date Added | Details on Bank Negara Malaysia | |

| RaiseFX |  |

6 Dec 2023 |  |

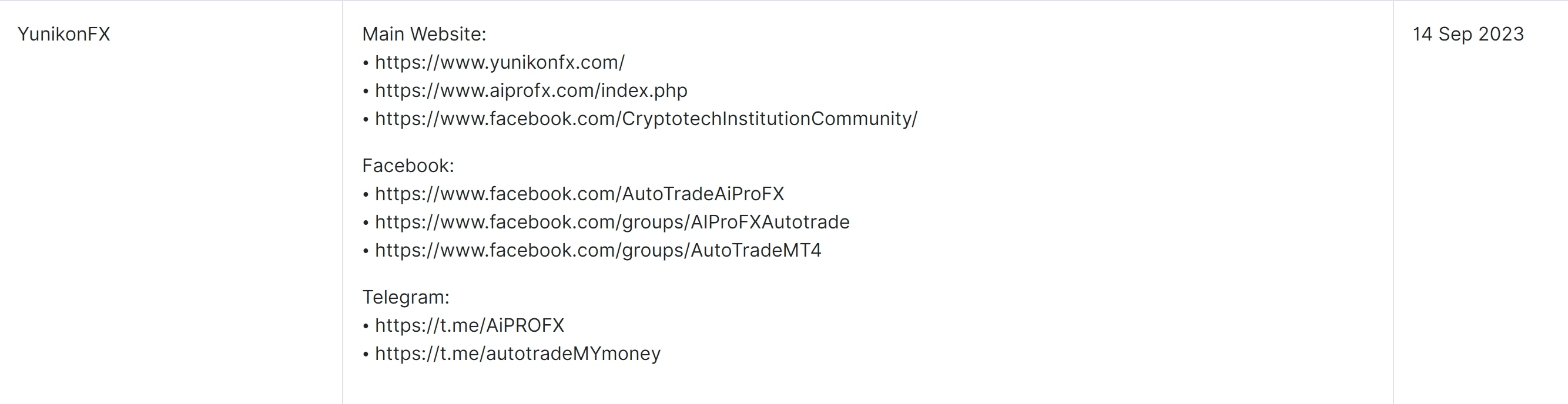

| Yunikon FX |  |

14 Sep 2023 |  |

| NordFX |  |

14 Sep 2023 |  |

| Herzen |  |

14 Sep 2023 |  |

| PTFX |  |

28 Aug 2017 |  |

| IGOFX |  |

31 Jul 2017 |  |

| BFSforex |  |

25 Jul 2014 |  |

This list offers a glimpse of scam brokers that have been added to the alert list. Some of these, such as RaiseFX, Yunikon FX, and , were added as recently as 2023. Note that this doesn't cover all scam brokers. For a more comprehensive and updated list, you can visit the official website of Bank Negara Malaysia, where you can access the full financial consumer alert list in Malaysia.

Malaysian Forex Scam Broker Blacklist FAQs

What is a Forex Broker?

A Forex broker is an intermediary between a trader and the currency market. These brokers provide the trading platform through which individuals or institutions can buy or sell foreign currencies. They often provide additional services, such as market analysis, trading education, and access to leverage (which allows trades to be made with borrowed funds). These brokers make money through commissions and spreads (the difference between the buy and sell price of a currency pair).

What is a Forex Scam?

A Forex scam is a fraudulent or deceptive scheme used in the foreign exchange market with the intention of causing financial loss to the trader. These scams often promise high returns with little risk to lure unsuspecting individuals into parting with their money.

Is Forex Trading Legal in Malaysia?

Yes, Forex trading is legal in Malaysia. However, there are strict regulations in place. Forex trading in Malaysia is regulated by the Central Bank of Malaysia (Bank Negara Malaysia). The central bank, in accordance with the Financial Services Act of 2013, closely regulates the financial industry to ensure all companies follow legal and ethical standards.

Regulations in Malaysia

When it comes to Forex trading, Malaysia has stringent regulations to protect consumers and maintain the stability of the financial market. The main body overseeing Forex trading activities in the country is the Central Bank of Malaysia, also known as Bank Negara Malaysia.

Licensing: All Forex brokers in Malaysia must be licensed by Bank Negara Malaysia. Trading with unlicensed brokers is considered illegal.

Risk Disclosure: Brokers are required to provide a risk disclosure statement to clients, to ensure that traders understand the high-risk nature of Forex trading.

Anti-money laundering: Forex brokers are required to comply with anti-money laundering (AML) laws, which include setting up procedures for identifying and reporting suspicious activities, carrying out client due diligence, and maintaining clear records of transactions.

Account Monitoring: Brokers are required to monitor their clients' accounts to ensure ethical trading practices.

In addition, the Securities Commission Malaysia, a statutory body tasked with the regulation of the securities and derivatives markets in the country, also oversees some aspects of Forex trading.

Types of Forex Scams in Malaysia

Forex scams manifest in several ways, depending on the creativity of the scammer, but the goal is always the same: to deceive traders into parting with their money. Here are some of the common types of Forex scams you're likely to come across in Malaysia and most other countries:

Signal Seller Scams

These are entities that charge a daily or monthly fee for trading signals. They promise these signals will yield a significant profit, but often these signals fail to live up to the expectation.

Robot Scams

Here, scammers sell an automated trading system or robot, promising it can perform trades that will yield high returns. Practically, the effectiveness and credibility of such robots are highly questionable.

Phony Forex Trading Investment Funds

These are companies that collect money from investors, promising they will trade on their behalf and generate high returns. Often, these are Ponzi schemes where the returns for older investors are financed through the capital of newer investors.

Unregulated Brokers

These are Forex brokers who are not registered or regulated by any financial regulatory authority. They might manipulate trade results, delay withdrawals, and engage in other fraudulent activities.

Fake Forex Trading software

Scammers sell counterfeit versions of popular Forex trading software platforms that are rigged to favor the scammer, often by distorting prices and payouts.

Forex Ponzi Schemes or High Yield Investment Plans

These schemes promise high returns (often fixed) from a small initial investment, where in reality the money from new investors is used to pay earlier investors.

Note that if a scheme promises returns that seem too good to be true and requires secrecy or for you to rush into investing, it might very well be a scam.

What are the Key Signs of a Scam Broker?

Unregulated: One of the first things to check is whether a broker is regulated by a reputable financial regulatory body. Unregulated brokers have much less oversight, making it easier for them to engage in fraudulent practices.

Too Good to Be True: Scam brokers often lure customers with promises of unrealistically high returns and guarantees of no financial risk. In the world of investing and trading, such claims are usually too good to be true.

Difficulties with Withdrawals: Traders should be able to withdraw their funds with ease. If a broker is constantly making excuses or placing barriers when you attempt to withdraw your money, this is a potential sign of a scam.

High Pressure Sales Tactics: If they're pressuring you to invest immediately, or offering bonuses for larger deposits, proceed with caution. Reputable brokers don't have to pressure customers to use their services.

Lack of Transparency: A reputable broker should be open about their fees, and terms and conditions should be plain and clear. Be wary if this information is difficult to find or understand.

Very High Leverage: Offering high leverage levels could be a way for scam brokers to attract clients. Extremely high leverage can be dangerous and lead to major losses.

Negative Online Reviews or Complaints: Take some time to research online reviews on the broker. Keep an eye out for any trends of complaints.

How to Avoid Forex Scams in Malaysia?

Know the Market: The more you understand about forex trading, the less likely you are to fall for a scam. Understanding the market allows you to ask the right questions and properly assess a broker's or platform's credibility.

Check Regulatory Status: Always check if the broker is regulated by a reliable financial regulatory body. For Malaysian forex brokers, that would be Bank Negara Malaysia or the Securities Commission Malaysia. Be aware, however, that having a license is not a guarantee against fraudulent activity, but licensed brokers are subjected to oversight that can offer a degree of protection.

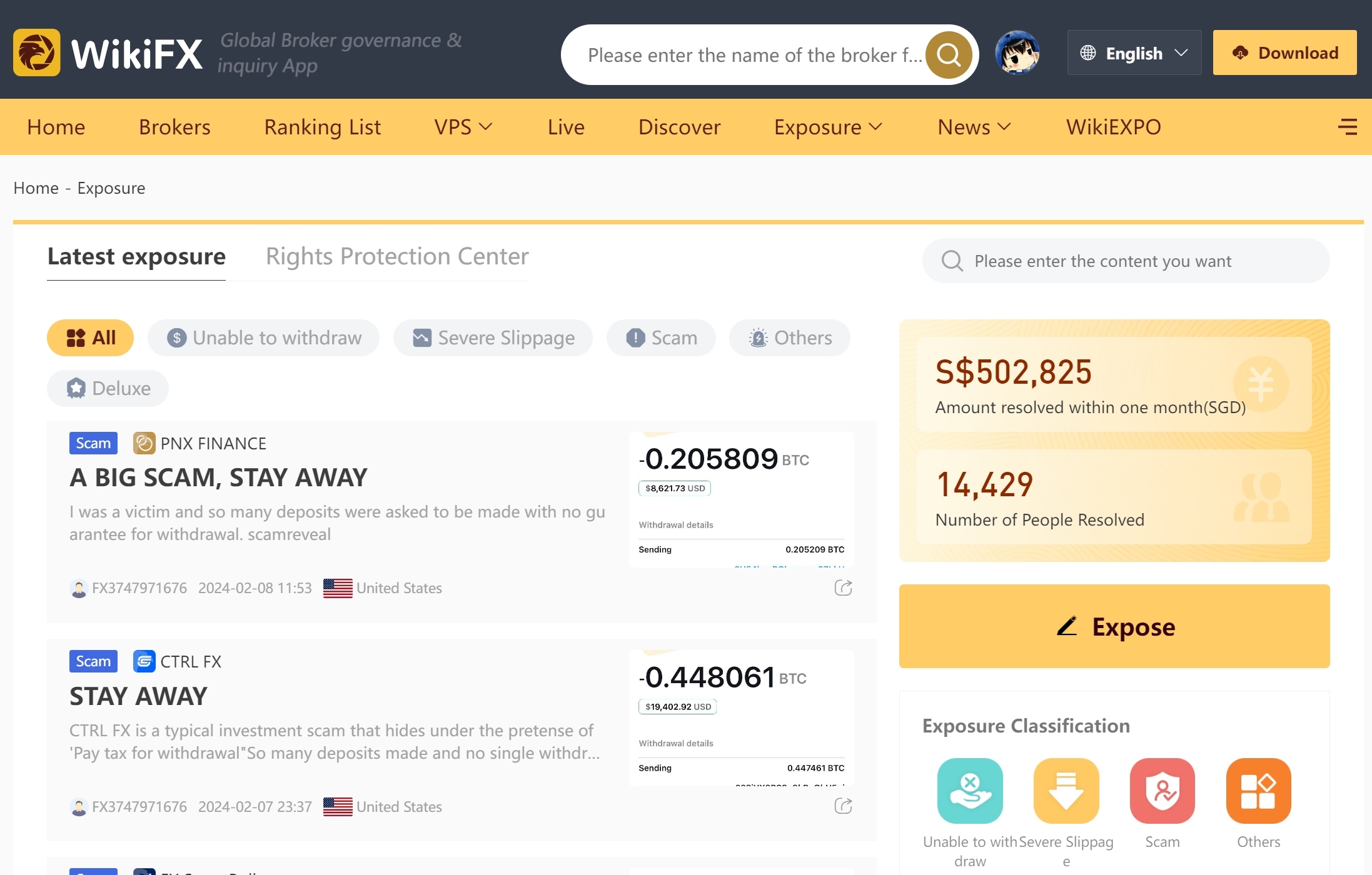

On WikiFX, we strive to deliver the most relevant and up-to-date regulatory information about forex brokers. We understand how vital it is to know your broker's regulatory status before investing your hard-earned money. Our team conducts an extensive background check on forex brokers from around the globe to provide you with their regulatory data and other critical aspects.

By using WikiFX, you can easily verify a broker's regulatory status and steer clear of potential frauds or unregulated platforms. Knowledge is power - stay informed, stay safe and always check a broker's regulatory status on WikiFX before investing. It's easy, fast, and can save you from unnecessary losses.

Do Research: Take your time to research the company and its reputation. Look for reviews and beware of user testimonials on the company's own site, which can be fabricated. Check whether the company's claims about its track record can be substantiated.

Beware of High Returns and Low Risks Claims: If a forex scheme promises high returns with little or no risk, it‘s a red flag. There’s no such thing as a risk-free investment – and especially not in the volatile world of forex. High yields usually come with high risk.

Understanding of Fee Structure: Be clear about the fees and commissions that the platform charges for trades. If these costs are unclear or hidden in the terms and conditions, it is often not a good sign.

Hesitate Before Sharing Personal Information: Scam artists often pretend to be forex brokers just to get your personal information. Be very careful before giving out personal or financial information over the internet.

How to Report a Forex Scam in Malaysia?

If you suspect you've been targeted by a Forex scam in Malaysia, you have several avenues to report it:

Bank Negara Malaysia: As the nation's central bank, BNM oversees all financial institutions, including Forex brokers in Malaysia. You can lodge a complaint via BNM MyLink portal available on the official BNM website or by calling their TELELINK hotline at 1-300-88-5465.

Securities Commission Malaysia: This commission oversees and enforces financial regulation for securities and futures markets. If you believe you have been scammed by an entity under their regulation, you can report the incident via their official website.

Royal Malaysia Police (PDRM): Serious cases of fraud can be reported directly to the police. Remember to bring all related evidences when making a report.

The Malaysian Communications And Multimedia Commission (MCMC): You can report scams that involve electronic communication, such as email or social media to MCMC.

Financial Fraud Alert Site by BNM: You can check and report financial scams via this site.

WikiFX Exposure: It is a useful platform that enables Forex investors to share their experiences and expose potential scams. It offers a user-friendly interface for detailed reporting of fraudulent activities, supports community interaction, and helps raise awareness and prevent further victims. Accessible to users worldwide, including Malaysia, WikiFX Exposure effectively contributes to the global fight against Forex fraud, empowering victims to turn their unfortunate experiences into valuable warnings for others.

Final Thoughts

In conclusion, turning the Forex market in Malaysia into a money-maker isn't just about smart buying and selling - it's about spotting scams too. Trading Forex can be a wild ride, but you can come out ahead if you play it smart. A lot of it comes down to picking the right broker to deal with. But it's just as key to be able to tell the good guys from the bad guys. So here's the big takeaway: keep your eyes open, know your stuff, and get ready to jump in!

As an additional resource and step toward safe Forex trading, you're encouraged to review our other article: “Best Forex Brokers in Malaysia for 2024”. Education and awareness are your best defenses in the Forex market - armed with these, you can explore the Forex world with confidence.

Disclaimer

Trading Forex (foreign exchange) carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, risk appetite, and the possibility of incurring losses. There is a possibility that you may sustain a loss of some or all of your initial investment and therefore you should not invest money that you cannot afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

You Also Like

Best Forex Brokers in Turkey for 2024

Review top 9 forex brokers in Turkey, elevating their trading pros and cons to give traders more useful guidance.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Swiss Forex Brokers for 2024

Explore top 10 forex brokers in Switzerland, elevating their trading pros and cons to give traders more useful guidance.

Best Stock Brokers in the US for 2024

When choosing an online broker, finding the platform that best fits your investment needs is crucial. With the rise in popularity of online trading, more brokers are offering free stock trading and commission-free transactions for various assets. It has become a challenge for users to select suitable brokers.

Best CySEC Regulated Forex Brokers 2024

Delving into CySEC-regulated forex trading, this article presents a top 9 list of brokers, spotlighting the benefits of regulatory compliance.

8 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 8 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Forex Brokers in 2024

Guide to the most trusted Forex brokers, with a thorough investigation into their quality, security measures, and financial transparency.