The Russian forex market Russia ranks among the largest and most dynamic globally, with an average daily trading volume of over $60 billion. More than 2 million Russians are thought to participate in forex trading. Notably, Russia's membership in the Group of Twenty (G20) has increased the country's appeal to international investors.

The Russian forex market falls under the governance of the Central Bank of Russia (CBR), which has introduced several regulations aimed at safeguarding investors. These regulations mandate broker licensing and regulation, the segregation of client funds, as well as the provision of risk warnings to clients.

Approximately 100 forex brokers, both internationally licensed and domestically registered, are active in Russia, with additional unregulated entities also present. Here, we compile a list of the Best Forex Brokers in Russia to enhance your trading confidence and offer better choices.

8 Best Forex Brokers in Russia for 2024

Advanced range of trading products, CFD trading, MT4, MT5 and cTrader platforms offered.

Up to 1:500 leverage, extensive trading liquidity, and flawless order execution.

Providing an NDD trading environment with easy digital account opening.

Options to diversify across asset classes and a large pool of assets to choose from.

Advanced platforms including MT4 and MT5, in addition to its proprietary app.

Rich educational resources are provided, with support available 24/7 in over 30 languages.

more

Comparison of the Best Forex Brokers in Russia

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers in Russia Overall

| Brokers | Why are they listed as the Best Forex Brokers in Russia? |

|

√ Regulated by ASIC, and CYSEC in Cyprus, a respected player in the forex industry.√ Russian Account Managers provide personalized trading guidance.√ Uses MT4/MT5 with virtual private servers (VPS) provided. |

|

√ Heavily and globally regulated, segregated Russian bank accounts.√ Average spreads are as tight as 0.9 pips on EUR/USD pair among the best in the industry.√ 24/5 multilingual support teams prompt to respond with Russian language available across trading platforms and key customer interfaces. |

|

√ A well-established broker with solid reputable, attracting over 1.5 million active traders globally.√ Consistently fast 4 millisecond trade execution speeds, proprietary Virtual Private Server (VPS) hosting services for complex algorithmic strategies.√ 7 days 24 hours a day online customer assistance available in the Russian language. |

|

√ User-friendly social trading platform popular among Russian investors.√ Multiple funding options like Paypal, Yandex, supported in Russia.√ Convenient and low-cost funding options include PayPal, Skrill, WebMoney in RUB without conversion fees. |

|

√ Swiss bank fully regulated in EU with license to operate in Russia.√ Advanced Trader platform ideal for experienced investors with 75+ indicators, automation, strategy backtesting.√ Localized Russian support & accept RUBLE payments. |

|

√ Trade execution speeds also impress to facilitate scalpers and high frequency traders.√ Funding options include localized Russian payment services with low 100 USD account minimums.√ Russian clients benefit from dedicated native speaking support teams that receive rave reviews with satisfaction ratings as high as 4.9 out of 5. |

|

√ Over 2 million clients from Russia drawn to floating spreads averaged at 0.4 pips for EUR/USD, applicable even for micro lots.√ Russian customer support team active 24/5 assisting clients in native language over email, calls and Telegram.√ Start trading in a familiar Ruble denomination from just $1 minimum deposit. |

|

√ Authorization from Russias Central Bank.√ xStation 5 platform offers advanced charting, custom indicators, risk management tools rated 4.8/5.√ Execution speeds up to 0.15 seconds aided by dedicated VPS services for algorithmic traders. |

Overall: ⭐⭐⭐⭐⭐

Best for high-volumes traders and scalpers

IC Markets operates as an online forex and CFD broker, based in Australia. The company was established in 2007 and has its main office in Sydney, Australia. It is renowned for its diverse selection of trading instruments and competitive spreads, serving both individual and institutional traders worldwide. IC Markets is regulated by the Australian Securities and Investments Commission (ASIC) and is well-known for its transparent and high-speed trading environment.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Overall: ⭐⭐⭐⭐⭐

Regulations: ASIC, FSA, FFAJ, CBI, FSCA, FCA

Best for automated trading and CFD trading

AvaTrade is an international forex and CFD brokerage that was founded in 2006 in Dublin, Ireland. Regulated by the Central Bank of Ireland and licensed by financial regulators across Europe, Japan, South Africa, and Australia, AvaTrade provides retail traders, institutions, and fund managers access to trading instruments spanning forex, cryptocurrencies, bonds, commodities, indices, stocks, and ETFs. AvaTrade stands out for its comprehensive educational resources, multilingual customer support, and array of trading platforms including the popular MetaTrader 4 and AvaTradeGO. Traders can choose between floating or fixed spreads and leverage up to 1:400. AvaTrade also offers automated trading through Expert Advisors on the MetaTrader 4 platform. With its focus on trust, innovation, and empowering traders, AvaTrade has grown rapidly over the past 15+ years to serve over 200,000 accounts globally.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

Overall: ⭐⭐⭐⭐⭐

Regulations: ASIC, CYSEC, FSC, DFSA

Best for fast order execution and no requote

XM was established in 2009 and is a CFD and forex broker operating online. With its headquarters in Cyprus and under the watchful eye of the Cyprus Securities and Exchange Commission (CySEC), this firm is a respected member of the brokerage community. XM provides trading services to customers all around the world and provides access to a wide variety of trading instruments, such as foreign exchange, commodities, equities, and indices.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

Overall: ⭐⭐⭐⭐⭐

Regulations: ASIC, CYSEC, FCA

Best for copy trading and crypto trading

Founded in 2007, eToro is a social trading platform and multi-asset broker. It's based in Cyprus and has become well-known for its cutting-edge trading platform, which lets users buy and sell stocks, cryptocurrencies, and commodities, and which also includes a social networking feature that lets them track the investments of other traders and mimic their moves. By fusing together the worlds of online trading and investing with those of social networking, eToro has had a profound impact.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

Overall: ⭐⭐⭐⭐⭐

Regulations: FCA, MSFA, FINMA, DFSA

Best for low-cost trading and crypto trading

Swissquote is a Swiss-based online banking and financial services provider that is well-known for its online trading and investment platforms. Founded in 1996, Swissquote offers a wide range of financial services, including online trading of various assets like stocks, forex, commodities, and cryptocurrencies. Swissquote provides a user-friendly interface, extensive research and analysis tools, and a variety of account options to cater to the needs of different investors.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

Overall: ⭐⭐⭐⭐

Regulations: FCA, CYSEC, FSCA, LFSA

Best for high-volume trading on FX and CFDs

Registered in the United Kingdom, TickMill was founded in 2011 and has since grown to become one of the leading forex brokers in the world. TickMill, this forex and CFD broker, offers opportunity to access to various international markets, including forex pairs, indices, commodities, and bonds. This broker is multi-regulated by several regulatory authorities acorss th world, which could give clients some confidence when trading with it.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

|

|

Overall: ⭐⭐⭐⭐

Regulation: CYSEC

Best for low-cost Metatrader trading

OctaFX is an online forex broker that was established in 2011. It is registered in Cyprus and regulated by the Cyprus Securities and Exchange Commission (CySEC) as Octa Markets Cyprus Ltd. OctaFX offers a wide range of trading services in different financial instruments such as forex, commodities, indices, and cryptocurrencies, serving traders globally.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

Overall: ⭐⭐⭐⭐

Regulations: CYSEC, FCA, CNMV

Best for stock trading with zero commissions

XTB stands as a global online trading and investment brokerage firm, specializing in the provision of contracts for difference (CFDs) across a wide spectrum – from forex, indices, commodities, stocks, ETFs, to cryptocurrencies. With a founding year of 2002, XTB boasts a rigorous regulatory standing, accredited by numerous financial authorities across the globe. These include the UK Financial Conduct Authority (FCA) and the Cyprus Securities and Exchange Commission (CySEC). For traders seeking diverse trading platforms, XTB extends an array of choices. Among them, the award-winning xStation 5 web and mobile platforms take the spotlight.

| ✅Pros | ❌Cons |

|

|

|

|

|

|

|

|

|

|

|

Forex Trading Knowledge Questions and Answers

Is forex trading legal in Russia?

Forex trading in Russia, like in many other countries, is completely legal. Oversight of forex trading falls under the jurisdiction of the Central Bank of Russia. For brokers and dealers to provide forex trading services, they are required to be authorized and possess a license from the CBR, the Russia Central Bank. Both Russian citizens and foreign nationals can lawfully participate in forex trading by utilizing the services of licensed Russian forex brokers or dealers.

What is the most popular forex broker in Russia?

AvaTrade is the top choice among so many forex brokers in Russia. It secured this position due to its excellence in three areas: Order Execution, Customer Support Responsiveness, and Withdrawal Speed.

Let's explore the shining points of Avatrade:

Brokers offering high execution speeds,necessarily, can cut slippage, ensuring you secure the price you want. Moreover, the forex market is highly dynamic, with prices changing rapidly. In this fast-paced setting, swift execution speeds empower you to swiftly seize market chances. With the ability to promptly enter and exit trades, you can boost your profit potential and trim the risks of losses. Avatrade's trading platforms feature Expert Advisors and provide VPS services, aiming to enhance execution accuracy and diminish slippage for traders.

Here is a simple instruction of how to install a VPS:

Good customer service mattersa lot for customers, especially customers in the forex markets, as forex trading involves great volatility. If traders don't get timely help, they might end up losing money at each stage. Avatrade has great customer service, giving customers fast and relevant answers in many local languages.

Around 90% of a broker's ability to generate actual profits for you is tied to withdrawal speeds. What does that mean? The truth is that lots of forex brokers don't shine in this area. Frequently, these brokers impose additional fees upon exits or deliberately prolong the withdrawal process. Therefore, encountering a broker with sluggish withdrawal really remains a headache for many forex traders. However, Avatrade does excel in this respect, reportedly processing money within 24-48 hours – way faster than many other brokers.

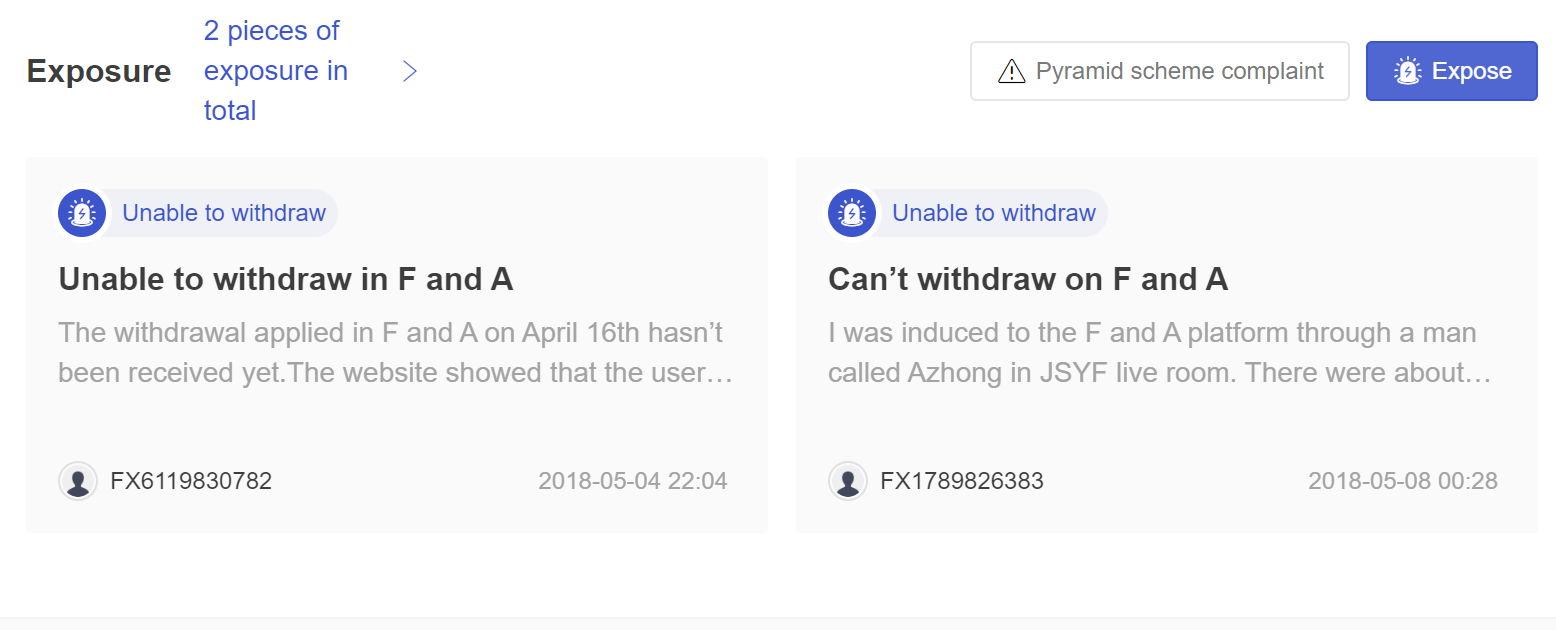

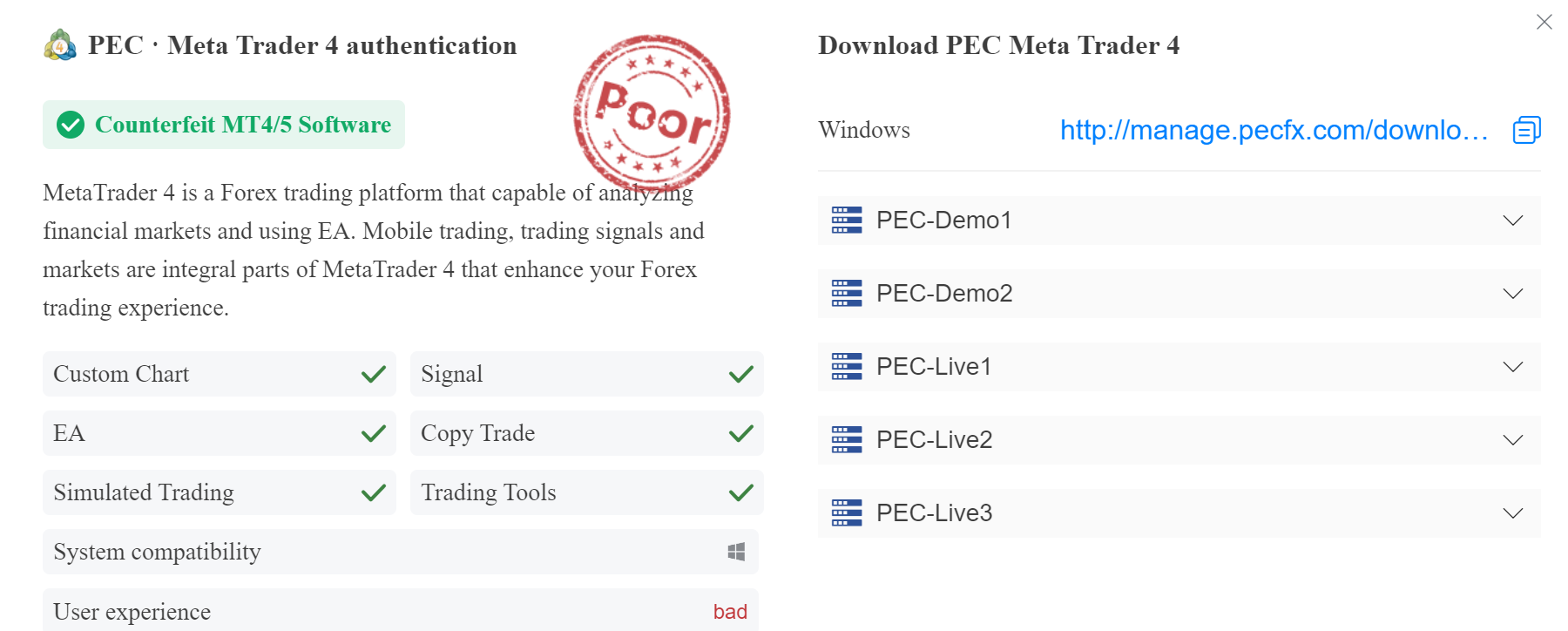

What are scam forex brokers that traders should avoid in Russia?

| Broker | Logo | Registered Country | Regulation | Establishment of Years | Trading Platform | Customer Support | Additional Notes |

| F and A |  |

Australia |  |

5-10 years | MT5 | Email Only | Unlicensed & 2 pieces of scam exposure |

| AME |  |

United States |  |

5-10 years | MT4 | Phone number only | Unauthorized & 1 piece of scam exposure on WikiFX |

| PEC Forex |  |

United Kingdom |  |

5-10 years | MT4 counterfeit | Email Only | Unlicensed |

F and Aoperates under F and A SERVICES PTY LTD, a company lacking any regulation. The official website of this broker consistently remains inaccessible. Numerous traders have lodged complaints, alleging being victims of fraud perpetrated by this deceitful entity. WikiFX has received two scam exposure reports supported by substantial evidence thus far.

AME,operated by AME Global Limited, poses as yet another scam broker. Although asserting registration with the NFA, their name is absent from the NFA website. The presence of fake licenses, invalid contact details, and inaccessible official websites has brought this dubious broker into the spotlight.

PEC, posing as a regulated broker under the FCA, was discovered to hold a fraudulent license upon further investigation. Additionally, this broker operates without regulation from any legitimate regulatory body. Despite their official website being accessible, attempts to contact their customer support have failed as they seem to have vanished. Furthermore, PEC's MT4 has been detected as a counterfeit version.

What are frequently-traded trading instrument in Russia?

Ruble-denominated Currency Pairs: The Russian Ruble is frequently paired with major currencies such as USD, EUR, GBP, JPY, and CHF in forex trading. Pairs like RUB/USD and EUR/RUB are notably favored by Russian traders due to the considerable liquidity and volatility influenced by Russian macroeconomic factors.

Russian Stocks and Equities: Russia operates a significant stock exchange known as Moscow Exchange (MOEX), where substantial trading occurs in the shares of prominent Russian companies spanning various sectors such as energy, banking, technology, and more. Top stocks like Gazprom, Sberbank, Lukoil, and Rosneft witness considerable interest in retail trading.

Commodities:Russia remains a significant exporter of natural commodities, such as oil and gas. Therefore trading instruments based on underlying commodities like crude oil, natural gas, gold, silver and even wheat see strong trader participation because of exposure to Russian economy.

What is the best trading App in Russia?

eToro, an international platform with a presence in Russia, boasts a portfolio featuring more than 140 Russian stocks. Notably, its user-friendly copy trading feature gains significant popularity among retail traders in Russia. Renowned for its social investing platform, eToro enables traders to copy the trades of seasoned investors. Additionally, each eToro demo account provides newcomers with $100,000 in virtual funds, allowing them to hone their trading skills using play money.

Regarding fees, eToro imposes a 1% commission for crypto trading, while no commissions apply to stock and ETF trades. Moreover, the platform provides access to over 20 cryptocurrencies available for trading, offering enhanced security through the eToro wallet. Additionally, eToro's mobile app is accessible on both iOS and Android devices, featuring advanced charting tools, customization options, and alerts, gaining predominantly positive reviews.

Do I need to pay taxes for forex trading in Russia?

Profits derived from forex trading fall under Russia's personal income tax bracket, set at a rate of 13% This applies to both individual investors and self-employed traders. Unlike certain other personal income sources, forex trading profits do not enjoy a tax-free allowance in Russia. All generated profits must be declared and are thereby subject to taxation. Similar to other income sources, losses incurred from forex trading can be offset against total personal tax obligations. However, regulations impose limits on the deductible amount within a tax year. Notably, in addition to income tax, very high volume or frequent traders may also be liable to Russia's professional income tax though forex trading thresholds for this tax are not clearly defined.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

You Also Like:

Best Forex Brokers in Turkey for 2024

Review top 9 forex brokers in Turkey, elevating their trading pros and cons to give traders more useful guidance.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Swiss Forex Brokers for 2024

Explore top 10 forex brokers in Switzerland, elevating their trading pros and cons to give traders more useful guidance.

Best Stock Brokers in the US for 2024

When choosing an online broker, finding the platform that best fits your investment needs is crucial. With the rise in popularity of online trading, more brokers are offering free stock trading and commission-free transactions for various assets. It has become a challenge for users to select suitable brokers.

Best CySEC Regulated Forex Brokers 2024

Delving into CySEC-regulated forex trading, this article presents a top 9 list of brokers, spotlighting the benefits of regulatory compliance.

8 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 8 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Forex Brokers in 2024

Guide to the most trusted Forex brokers, with a thorough investigation into their quality, security measures, and financial transparency.