Score

Tickmill

United Kingdom|5-10 years| Benchmark AA|

United Kingdom|5-10 years| Benchmark AA|https://www.tickmill-cn.com/

Website

Rating Index

Benchmark

Benchmark

AA

Average transaction speed (ms)

MT4/5

Full License

TickmillUK-Live03

Influence

AA

Influence index NO.1

Saudi Arabia 7.20

Saudi Arabia 7.20Benchmark

Speed:A

Slippage:A

Cost:AAA

Disconnected:D

Rollover:AA

MT4/5 Identification

MT4/5 Identification

Full License

Netherlands

NetherlandsInfluence

Influence

AA

Influence index NO.1

Saudi Arabia 7.20

Saudi Arabia 7.20Contact

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 51 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic information

United Kingdom

United KingdomAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed Tickmill also viewed..

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Benchmark

Total Margin Trend

| VPS Region | User | Products | Closing time |

|---|---|---|---|

Seoul Seoul | 803*** | XAUUSD | 12-24 07:00:01 |

| 253*** | XAUUSD | 12-24 03:23:47 | |

HoChiMinh HoChiMinh | 431*** | XAUUSD | 12-24 04:57:56 |

Stop Out

0.70%

Stop Out Symbol Distribution

6 months

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Cyprus

Tanzania

Ghana

cn-tickmill.com

Server Location

United States

Website Domain Name

cn-tickmill.com

Server IP

172.67.143.18

tickmill-cn.com

Server Location

United States

Website Domain Name

tickmill-cn.com

Server IP

104.21.32.217

tickmill.group

Server Location

United States

Website Domain Name

tickmill.group

Server IP

172.67.132.197

Genealogy

VIP is not activated.

VIP is not activated.Fake Tickmill

FXPB

LMAX International

Company Summary

| Tickmill Review Summary in 10 Points | |

| Founded | 2014 |

| Headquarters | London, UK |

| Regulation | FCA, CySEC, FSCA, LFSA |

| Market Instruments | Forex, stock indices, stocks & ETFs, bonds, commdities, cryptos, futuires & options |

| Demo Account | Available |

| Copy Trading | Yes |

| Leverage | 1:1-1:500 |

| Spread from | 0.0 pips |

| Trading Platforms | MT4, MT5, Tickmill Mobile App |

| Minimum deposit | $/€/£/R100 |

| Customer Support | Live chat, phone, email, social media, FAQ |

| Bonus | A $30 welcome bonus |

What is Tickmill?

Tickmill, the trading name of Tickmill Group of companies, is a regulated global forex and CFD brokerage company established in 2014, headquartered in London, UK. Tickmill offers trading in forex, stock indices, stocks & ETFs, bonds, commdities, cryptos, futuires & options, and provides clients with two choices of trading accounts, which are the Classic account and the Raw account. Tickmill also offers MetaTrader4/5 and proprietry mobile app platforms for trading, as well as a range of trading tools and educational resources.

What Type of Broker is Tickmill?

Tickmill operates as a no dealing desk (NDD) broker. This means that the broker doesn't take the other side of clients' trades but instead passes them on to liquidity providers. Tickmill offers both retail and institutional trading services and provides access to a wide range of financial instruments. They also offer various trading platforms and account types to suit different trading styles and needs.

Pros & Cons

| Pros | Cons |

| • Regulated by multiple reputable authorities | • Regional restrictions |

| • Tight spreads and low commissions | • No 24/7 customer support |

| • Wide range of trading platforms | |

| • Access to a variety of markets | |

| • Negative balance protection | |

| • Multiple account types to suit different traders | |

| • Rich educational resources |

Tickmill is a reputable and reliable broker that offers competitive trading conditions and a wide range of trading instruments. Its low spreads and fees, multiple account types, various trading platforms and rich tarding tools and educational resources are attractive to traders of all levels.

However, Tickmill is not available in all countries, and their customer support operates within specific working hours. It's important for potential users to verify these details ahead of registration.

Nonetheless, its overall transparency, security, and quality of service make it a popular choice among traders worldwide.

Is Tickmill Safe?

Tickmill is a regulated broker that holds licenses from respected financial authorities, including Financial Conduct Authority (FCA, No. 717270), Cyprus Securities and Exchange Commission (CYSEC, No. 278/15), Financial Sector Conduct Authority (FSCA, No. 49464), and Labuan Financial Services Authority (LFSA, No. MB/18/0028).

This indicates that it complies with the required regulations and standards to provide financial services to their clients. Additionally, Tickmill has been in operation since 2014 and has gained a good reputation in the industry, which suggests that they are a legitimate broker.

How are You Protected?

Tickmill uses segregated accounts to keep client funds separate from its operational funds, which provides an additional layer of protection in case of the company's insolvency.

Tickmill also uses advanced security protocols and encryption technology to protect clients' personal and financial information.

The company also offers negative balance protection, which ensures that clients cannot lose more than their account balance, and it has a compensation scheme in place that can provide additional protection to eligible clients in case of the company's insolvency.

More details can be found in the table below:

| Protection Measure | Detail |

| Regulation | FCA, CySEC, FSCA, LFSA |

| Segregated Accounts | Client funds are held in segregated accounts, separated from the company's operating funds |

| Negative Balance Protection | Ensuring clients' accounts cannot go below zero |

| Investor Compensation Scheme | Clients are covered by the Financial Services Compensation Scheme (FSCS) up to £85,000 per person in the event of the broker's insolvency |

| SSL Encryption | Protecting clients' personal and financial information from unauthorized access |

| Two-Factor Authentication | To add an extra layer of security to clients' accounts |

| Anti-Money Laundering Policy | To prevent money laundering and other illegal activities |

| Privacy Policy | Ensuring clients' personal information is kept confidential and used only for legitimate purposes |

Note that this table is not exhaustive and there may be other protections or security measures in place at Tickmill.

Our Conclusion on Tickmill Reliability:

Based on the information available, Tickmill appears to be a reliable and trustworthy broker. It is regulated by reputable authorities, has been in operation for several years, and has received positive reviews from many customers.

However, as with any investment, there is always some level of risk involved, and it is important for traders to do their own research and carefully consider their options before investing.

Market Instruments

Tickmill is a comprehensive trading platform that offers 180+ financial instruments. Their offerings include over 60 forex currency pairs, more than 15 stock indices, 500+ stocks and ETFs, bonds, various commodities including precious metals and energies, cryptocurrencies, as well as futures and options such as S&P 500, DJIA, and NASDAQ. These options provide users with the flexibility to diversify their investment portfolio.

Account Types

Two trading account options available with TickMill: the Classic Account and the Raw Account. The Classic Account requires $100, featuring spreads starting from 1.6 pips, a maximum leverage of 1:1000, a minimum lot size of 0.01, and zero commissions. Available base currencies include USD, EUR, GBP, and ZAR.The Raw Account, on the other hand, provides raw spreads from 0.0 pips with a commission of $3 per lot per side, while maintaining the same minimum deposit, leverage, minimum lot size, and base currency options as the Classic Account. Both account types allow all trading strategies and offer a swap-free Islamic account option.

All account types at Tickmill offer access to the same range of trading instruments. Additionally, all accounts can be opened as Islamic accounts, which are swap-free accounts for traders who follow Sharia law.

Prior to committing to various live trading accounts, clients have the option to explore Go Markets' offerings through the provided demo accounts, allowing them to familiarize themselves with the trading environment before engaging in real trading activities.

How to Open an Account?

Step 1: Register

Click on ‘Create account’. Enter your personal details and check your email for verification.

Step 2: Upload Documents

Submit your Proof of Identity and Proof of Address to complete registration.

Step 3: Fund and Choose Platform

Open a trading account, deposit to your Tickmill wallet, transfer funds from your Tickmill wallet to your live trading account and download the trading platform of your choice to start trading.

Leverage

Tickmill offers flexible leverage ranging from 1:1 to 1:1000, depending on the account type and the instrument traded. The maximum leverage available for forex trading is 1:1000. For stock indices, commodities and bonds, the maximum leverage is 1:100. For cryptocurrencies, the maximum leverage is 1:200.

Bear in mind that higher leverage levels increase the potential profits but also increase the potential losses, so it's important to use leverage carefully and manage risk appropriately.

Spreads & Commissions

The Classic Account provides spreads starting from 1.6 pips with no commissions charged, making it a suitable choice for traders seeking competitive spreads without additional trading fees. Alternatively, the Raw Account caters to those preferring raw spreads from 0.0 pips, accompanied by a commission of $3 per lot per side.

| Account Types | Spread | Commission |

| Classic Account | From 1.6 pips | No commissions charged |

| Raw Account | From 0.0 pips | $3 per lot per side |

Bonuses Offered

TickMill extends a genuine welcome bonus of $30 to new traders, manifested as an automatic complimentary deposit of $30 into the Welcome Account upon account opening. However, the Welcome Account is denominated exclusively in US Dollars (USD).

Trading Platforms

Tickmill offers several trading platforms for its clients, including:

- MetaTrader 4 (MT4): This is a popular trading platform among forex traders due to its advanced charting capabilities, numerous technical indicators, and ability to run automated trading strategies.

- MetaTrader 5 (MT5): This is an upgraded version of MT4, offering additional features such as more timeframes, depth of market, and the ability to trade other instruments such as stocks and commodities.

- Tickmill Mobile App: This is a proprietary platform developed by Tickmill, offering a user-friendly interface, advanced charting tools, and the ability to trade directly from charts.

Overall, Tickmill's trading platforms are well-designed, user-friendly, and offer a range of advanced features suitable for both beginner and experienced traders.

Copy Trading

Tickmill offers copy trading features. This allows less experienced traders to copy the trades of more experienced traders, potentially increasing their chances of making profitable trades. It's a strategy often used by new traders or those looking to diversify their trading. You can copy top traders on Tickmill's website.

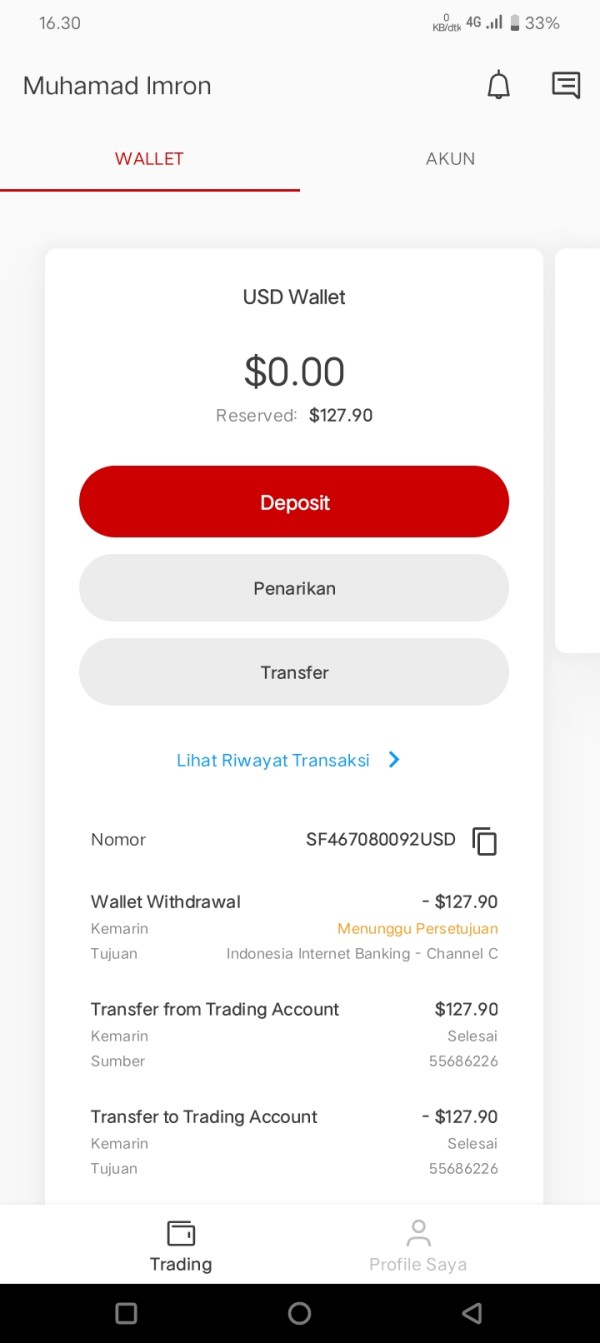

Deposits & Withdrawals

Another crucial factor while selecting a Forex broker is to see how to transfer money to or from your trading account. Obviously, regulated brokers adhere to best practices and are regulated by their authority in terms of money management.

Tickmill offers various deposit and withdrawal methods to its clients. Here are the most common methods:

- Bank wire transfer

- Crypto payments

- Credit/debit cards (Visa, Mastercard)

- Skrill

- Neteller

- Sticpay

- FasaPay

- Union Pay

- Web Money

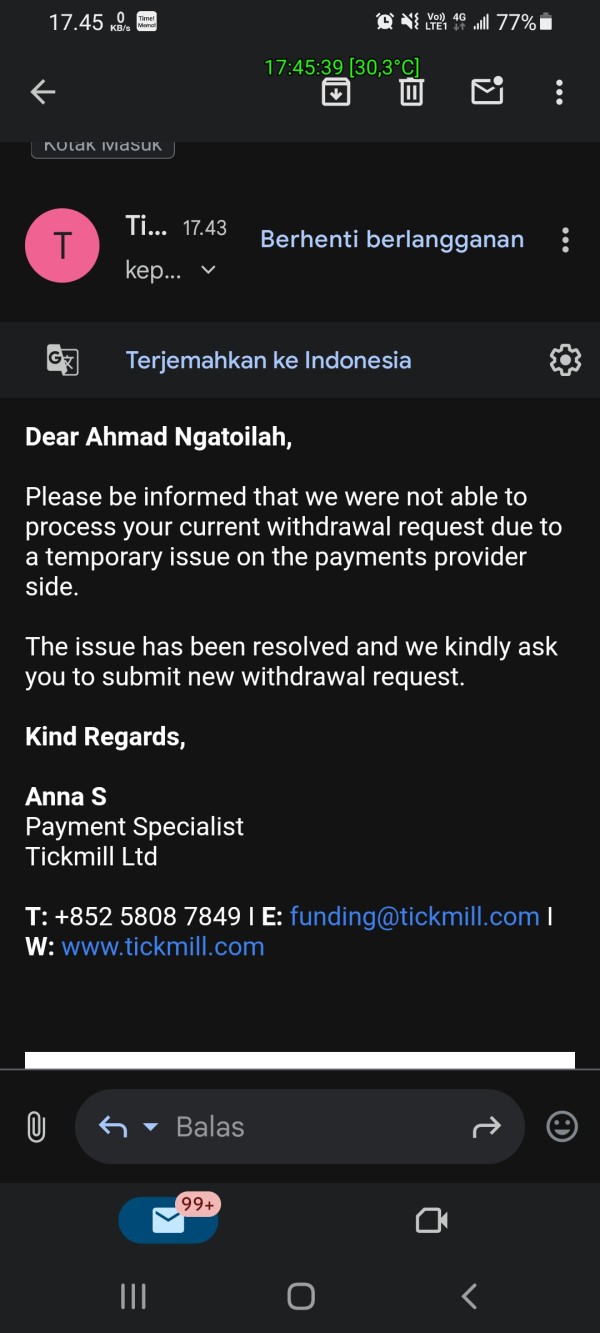

Tickmill does not charge any fees for deposits or withdrawals. However, clients are advised to check with their payment providers for any transaction fees that may apply at their end. Most deposits are instant, while the typical withdrawal processing time is within 1 working day.

Minimum deposit requirement

As we have mentioned before, the minimum deposit with Tickmill is $/€/£/R100 for the Classic and Pro accounts, while the higher-grade VIP accounts will require more money of up to $/€/£/R50,000, as designed for traders with experience.

Tickmill minimum deposit vs other brokers

| Tickmill | Most other | |

| Minimum Deposit | $/€/£/R100 | $/€/£100 |

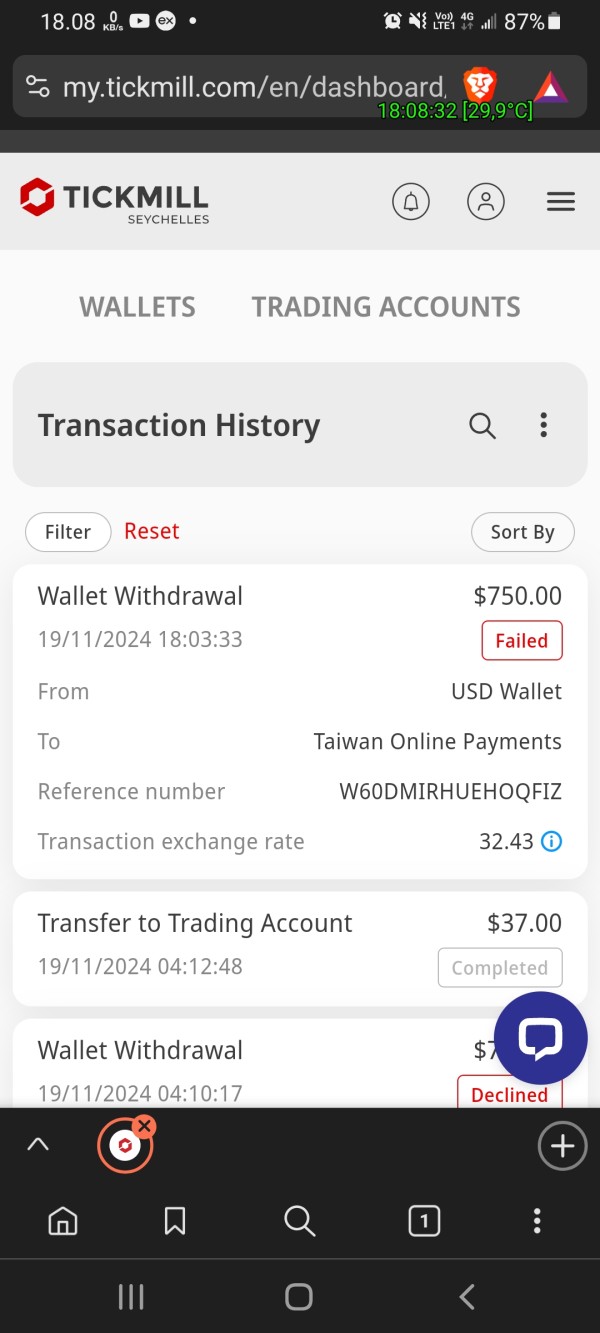

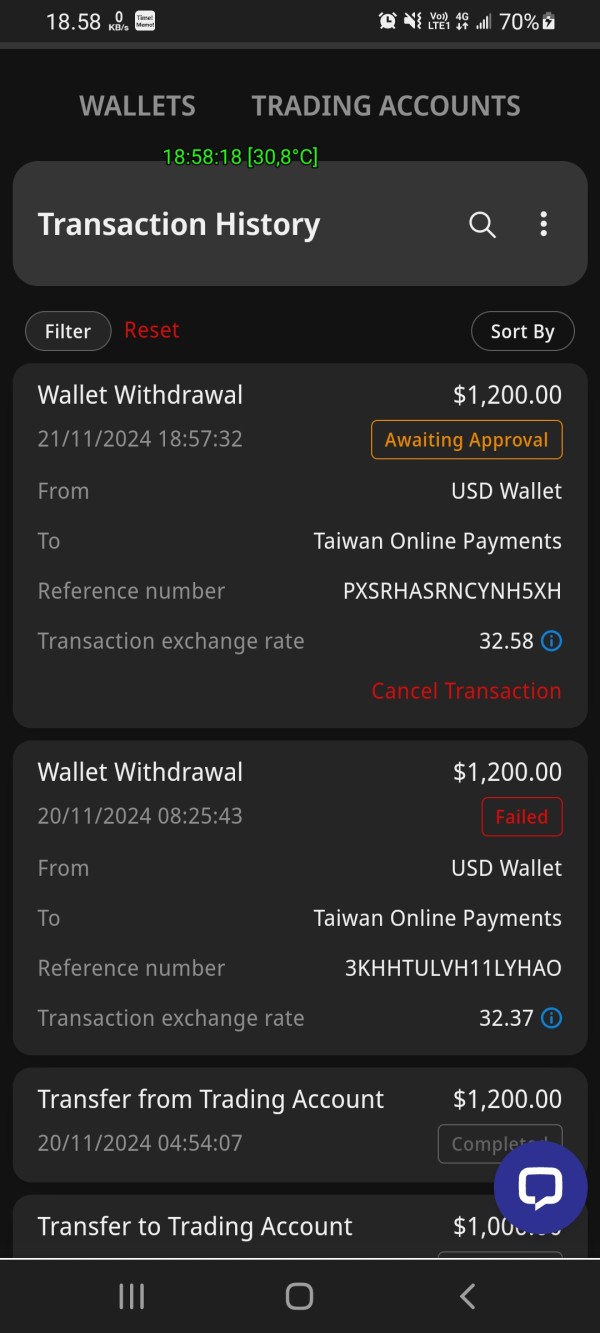

Tickmill Money Withdrawal

To withdraw funds from your Tickmill account, you need to follow these steps:

Step 1: Log in to your Tickmill Client Area.

Step 2: Select the “Withdraw Funds” option under the “Deposit & Withdraw” tab.

Step 3: Choose the payment method you want to use for withdrawal.

Step 4: Enter the amount you wish to withdraw.

Step 5: Fill out any necessary information related to your selected payment method.

Step 6: Submit your withdrawal request.

Once your withdrawal request is approved, the funds will be transferred to your selected payment method.

Fees

Tickmill does not charge deposit and withdrawal fees, but fees may be incurred by the payment method used. Also, inactivity fees of $10 per monthare charged on accounts that have been inactive for over six consecutive months.

Customer Service

Tickmill offers customer support services to its clients via various channels, including email, phone, live chat, and social media. The broker has a multilingual customer support team that provides assistance in several languages, including English, Spanish, Italian, Chinese, and more.

Tickmill's customer service has received positive feedback from traders for its prompt and helpful responses. The broker also provides an extensive FAQ section on its website, which addresses various queries related to trading, accounts, and other services.

Educational Resources

Tickmill is committed to providing a comprehensive education for traders at every level of experience. Their educational resources include webinars and seminars conducted by industry professionals, geared to enhance their clients' trading knowledge and skills. They offer extensive reading material such as eBooks, articles and infographics that cover a wide range of trading topics.

Tickmill also accommodates a detailed forex glossary for quick reference. They provide insights into market analysis both from a fundamental and technical perspective, offering daily market insights that help traders navigate the financial markets. This array of educational tools is designed to support traders in making informed trading decisions.

Conclusion

Overall, Tickmill is a good option for traders who are looking for a reliable and transparent broker with competitive trading conditions. Some of the advantages of Tickmill include its strong regulatory framework, low trading fees, a wide range of trading instruments, multiple trading platforms, and excellent customer support.

It is particularly suitable for experienced traders who are looking for a broker that provides access to a variety of markets and trading instruments, as well as competitive trading conditions. Additionally, Tickmill's demo account allows traders to test their strategies and trading skills before investing real money.

Frequently Asked Questions (FAQs)

Is Go Markets good for beginners ?

GO Markets can be a suitable choice for beginner traders, as it offers user-friendly trading platforms, comprehensive educational resources, and various account types to cater to different needs and experience levels.

What trading platforms does GO Markets offer?

GO Markets provides access to a suite of trading platforms, including the popular MetaTrader 4 and MetaTrader 5, as well as cTrader, MetaTrader Copy Trader, cTrader Copy Trading, and a web-based trading platform called GO WebTrader.

Does GO Markets charge any deposit or withdrawal fees?

Generally, GO Markets does not charge any internal fees for deposits or withdrawals.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

Keywords

- 5-10 years

- Regulated in United Kingdom

- Regulated in Cyprus

- Regulated in South Africa

- Market Making(MM)

- Retail Forex License

- MT4 Full License

- MT5 Full License

- Global Business

- High potential risk

Disclosure

"Bappebti Blocks 760 Website Domains, Reminds of the Risk of Transactions in Unlicensed PBK Entities"

Country/Region

ID BAPPEBTI

Disclosure time

2022-09-20

Disclose broker

Ministry of Trade Blocks 1,222 Illegal Commodity Futures Trading Websites

Country/Region

ID BAPPEBTI

Disclosure time

2022-02-02

Disclose broker

INVESTOR ALERT LIST

Country/Region

MY SCM

Disclosure time

2020-01-01

Disclose broker

News

News TICKMILL FREE WEBINAR ON US ELECTION 2024

The 2024 US election is expected to have a significant impact on the Forex market. Therefore, on November 3, 2024, the well-known broker Tickmill will host a free webinar on US Election 2024. There are only a few seats available.

2024-11-02 08:00

News Win US$ 8,000! with Tickmill IB GRAND PRIX

Are you looking for a trading competition with a reliable broker? If yes, you can join the Tickmill IB Grand Prix with a chance to win a share of $125,000 in cash prizes divided among five circuits. The contest began on October 1, 2024, and will run until July 1, 2025. The contest is available to all Tickmill IBs, both current and new.

2024-10-08 14:40

News Tickmill launches the US Elections – Traders Hub

Tickmill, a multi-asset broker renowned for being founded by traders for traders, has introduced the US Elections – Traders Hub. This comprehensive resource is designed to support traders of all levels in navigating the turbulent market conditions that often accompany such significant political events.

2024-09-12 16:42

News Tickmill Continues to Elevate Safety Environment for All Traders

Tickmill strengthens its commitment to trader safety with renewed Lloyd's insurance, offering up to $1 million in coverage per client. Trade with confidence.

2024-08-09 17:23

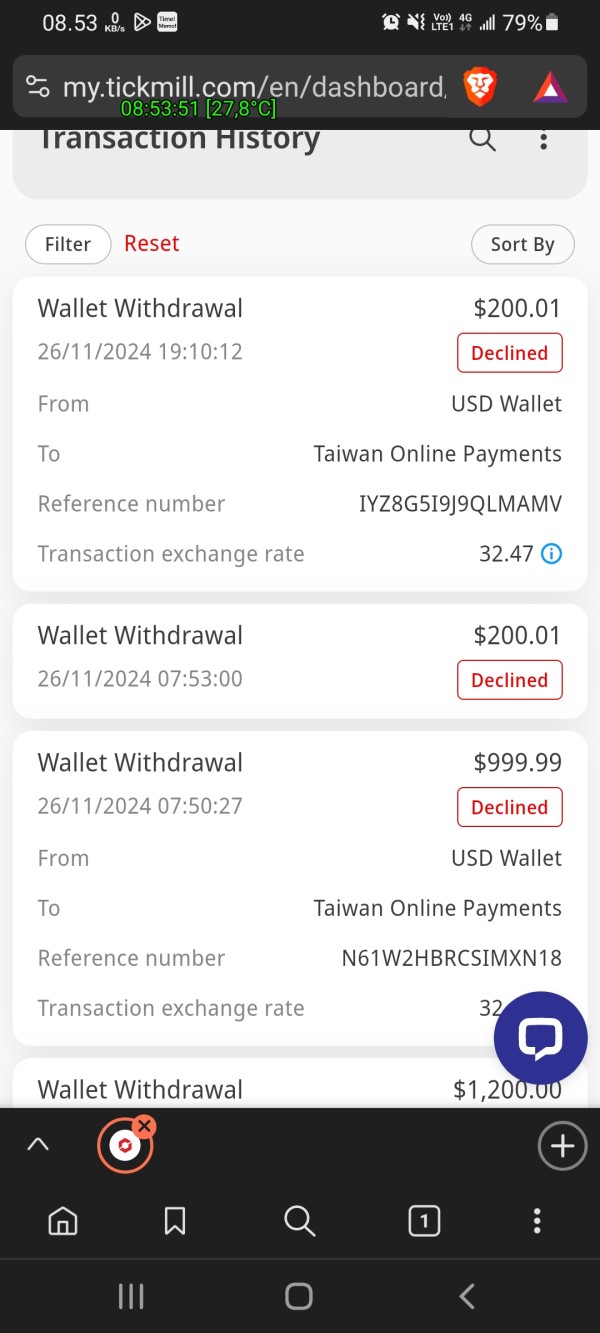

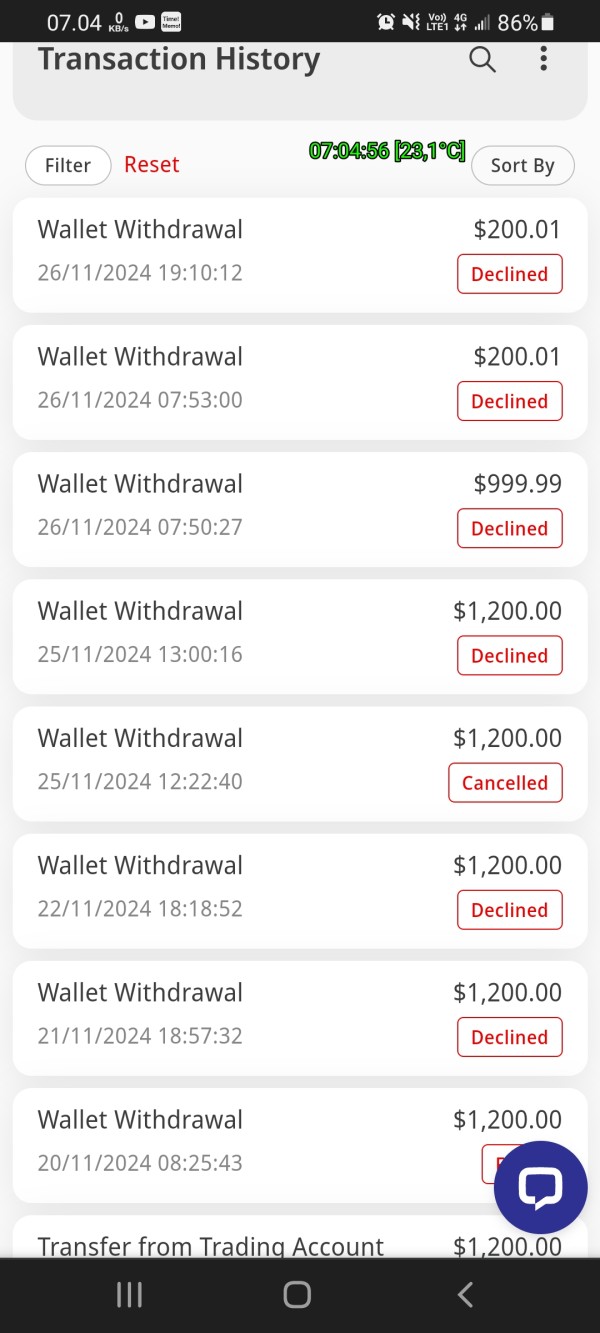

Exposure Beware of Tickmill, Unable to Withdraw Cases Have Rising

Trader struggles with Tickmill, facing blocked withdrawals and demands for fees, highlighting concerns about the broker's reliability and ethics.

2024-03-20 17:06

Exposure Account Blocked, No Withdrawal!! User regrets

Six months ago, a user invested with a well-known broker. Now he regrets. On February 20, 2024, an Indian user filed a complaint against Tickmill on WiKiFX.

2024-02-21 16:52

Review 78

Content you want to comment

Please enter...

Review 78

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

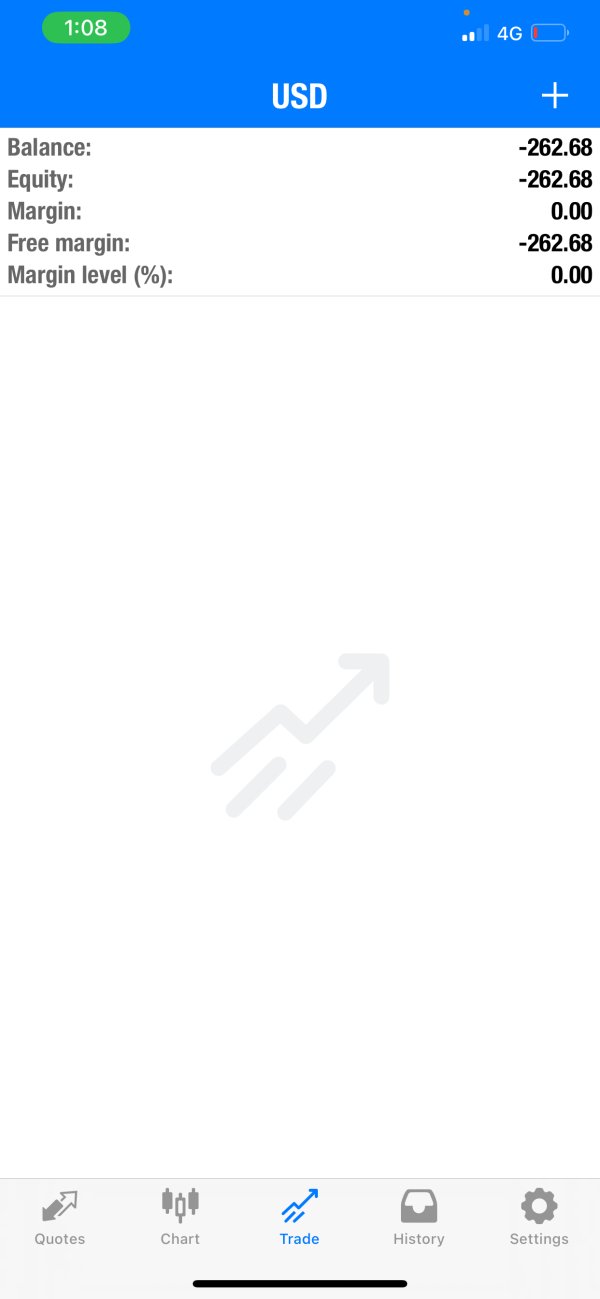

Ahmad182

Taiwan

The company for various reasons could not return my money after 10 days. I am very disappointed with this.

Exposure

11-27

mrkenn

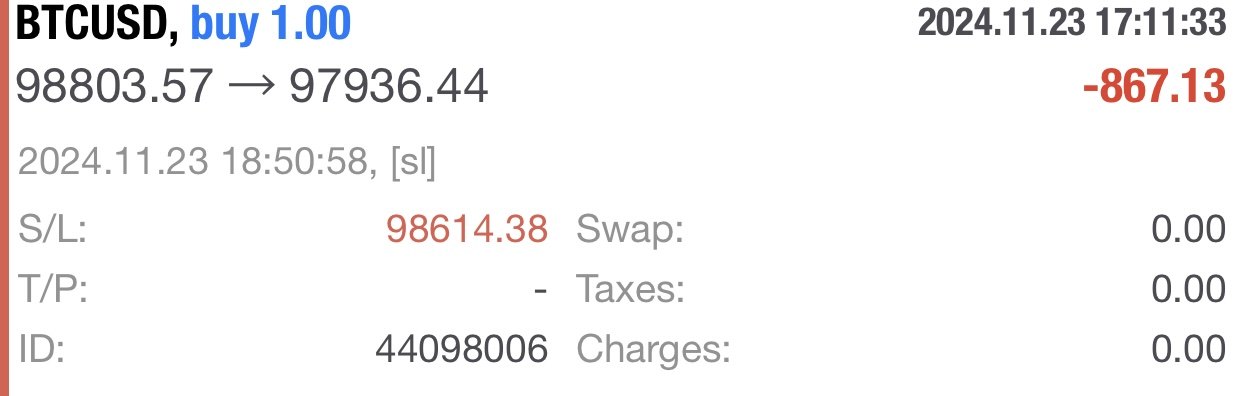

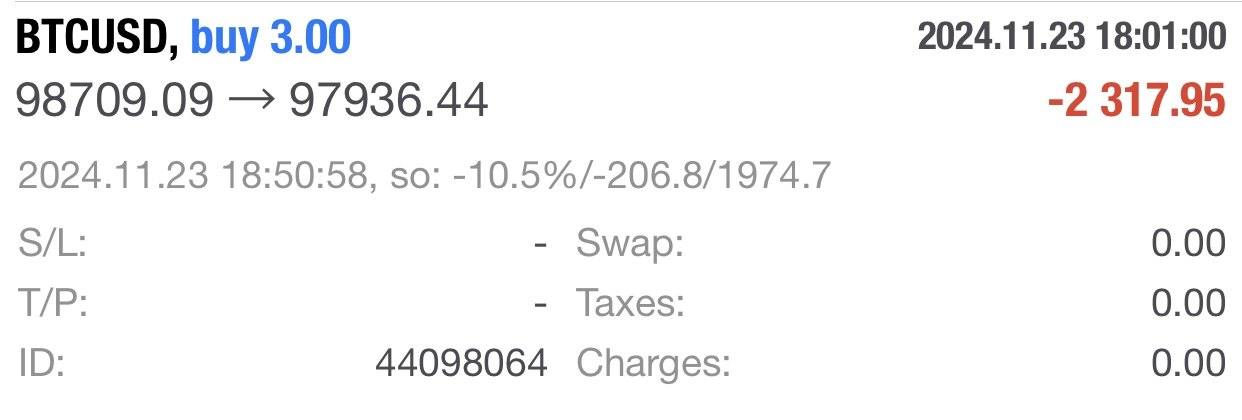

Malaysia

i went in to sell entry on btc/usd at 12:00 am 24/11/24 At 12:30 am the market suddenly stopped moving, I have already checked the news today, there is no news and I also tried to close but cant, "off quotes", even after switching to wifi it still doesn't work, I waited until 1 o'clock and the market moved and my account was lost/mc

Exposure

11-24

Ahmad182

Taiwan

can make a deposit. but can't withdraw with the same method.... I don't know whether the money will be returned or not..

Exposure

11-22

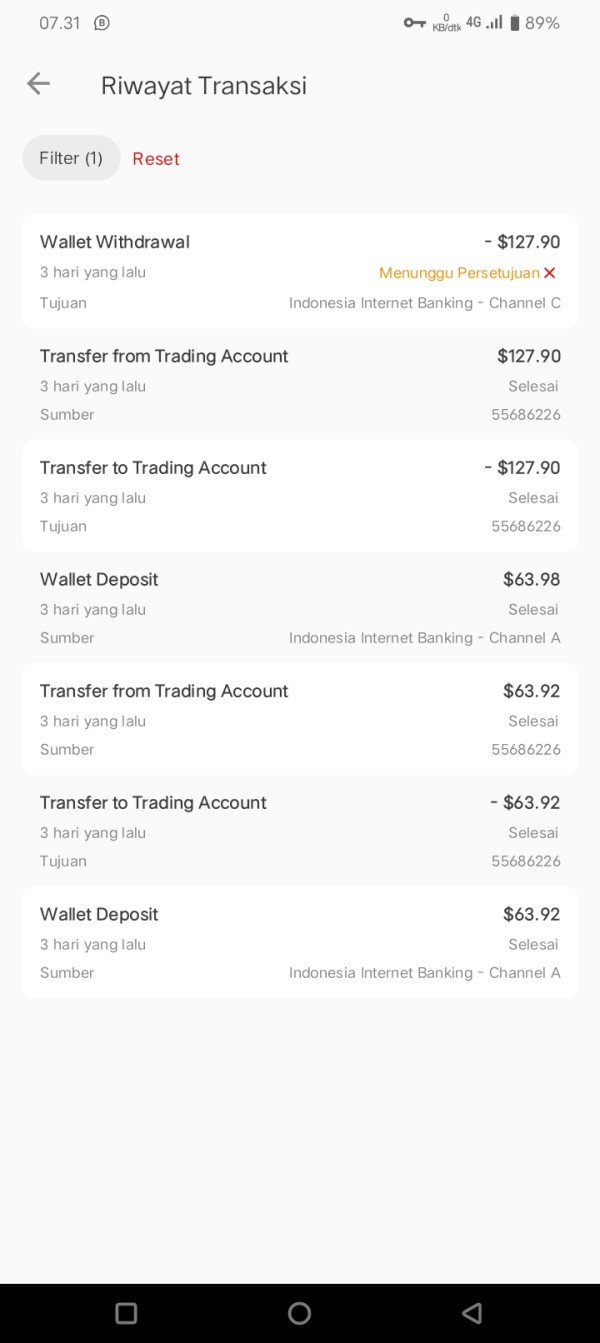

M I

Indonesia

It has been 3 days and there has been no response to the withdrawal process. I will proceed with legal action. They are not taking any responsibility at all.

Exposure

11-11

M I

Indonesia

Initially, I deposited a sum of 63 dollars. However, I was unable to trade on the server provided by Tickmill. Because of that, I haven't had the chance to trade, and in the end, I wanted to withdraw. But the minimum withdrawal amount is 80 dollars because I want to withdraw my money. I deposited again with a sum of 63 dollars. However, after 24 hours, they did not respond at all, and I feel this is a scam. I hope there will be a petition for legal action.

Exposure

11-09

黃先德

Taiwan

Deposit in four minutes Withdrawal request made three times without results and rejected Deposit operation takes about one week Failed to withdraw after one week Originally withdrew 1555 remittance 555usdt The platform rejected 555usdt and stated that the same deposit method should be used for withdrawal As a result, the withdrawal of this 1555 using the same method was also rejected (originally used remittance for withdrawal, still remittance) Reason for rejection as shown in the picture After consulting customer service and reapplying, the withdrawal was still rejected This time, the reason for rejection was not explained, and customer service and email did not respond Even a small amount of $2110 can encounter fraud

Exposure

08-17

Star2430

Taiwan

Hello, my MT4 account: 5090655, Order ID: 40550969 This order was established on 2024.07.08 at 15:41:22, and I did not execute the closure; this account is managed under a copy trading system, another account also managed was normally closed on 2024.07.09 at 08:58:08. This order incurred a holding fee, and the email daily report also showed it as open at that time. This order was closed without cause on 2024.07.09 at 00:08:41 at a price of 1.28236. Reviewing the historical data near 00:08 on 07.09 for GBPUSD, the price should have been between 1.28057~1.28067, which is significantly different from the closing price of 1.28236. Upon discovering the unwarranted closure of the order, I immediately contacted Tickmill customer service via the official website within two hours; having received no response, I again reported the issue on the official website on the following day, 2024.07.09, and ultimately only received two call-back request forms.

Exposure

07-18

FX1840849093

Uganda

They give me welcome account and l made profit of 86$..I was requested to create live account but they disapproved it saying I sent invalid document..I see it as being unfair because why reject account after making profit.

Exposure

07-10

ivan3366

Malaysia

On June 4, 2024, I sold at 1.76035 in EURNZD. Because I use H1/H4 to make orders with my own unprofessional analysis. The next day, June 5, the order was about to make a profit. So I made an order in another account, with 200 US dollars in the account. I placed an order for 0.10 sell, at around 1.76035. On the third day (June 6), when I got up and checked my phone, my account was liquidated. I set S/L at 1.76700. But when I looked at my order, S/L was 1.79135, as shown in the figure below. I was completely confused. I asked the customer service about this matter, and the customer service email came more than a dozen times. The same content: it was at the opening time, so "the spread was wide". I think the daily spread within 15 is proper, and only on the night of June 6 did a spread of 3000 pips appear. Here is my proof. I need to use H4/D1 pictures to see the buy and sell pips. It's outrageous, so I want to expose it. I hope someone can tell me how to deal with this matter, or I can only accept it.

Exposure

06-10

jikaytrader

Vietnam

Self-cut customer orders by lowering leverage. I was holding the order when I suddenly lowered the leverage from 1:1000 to 1:50. So stop out. However, when asked to interfere with the customer's orders, he refused. Scam

Exposure

05-07

Rick9759

Malaysia

No Action been taken from tickmill.

Exposure

03-28

JWF

United States

This website falsely promotes and clones the Tickmill platform. Everyone must be careful. This company has changed its company name 4 times.

Exposure

03-15

JWF

United States

They want my to pay 4000USD to eliminate my account then let me withdraw my 6000USD out normally.

Exposure

03-10

raveesh84

India

Tickmill is not giving withdrawal of 1186.27$ in our account and their support team is also not responding. The amount has been earned legitimately by offering copy trading using their own copy trade platform. They are very unprofessional and they often do such things with large amount withdrawals. I urge clients from India to stay away from this scam broker.

Exposure

02-20

server

Turkey

Hello,i am a trader who has been trading in the forex market for 9 years.i had xauusd and open positions on 03/12/2023. there were 0.30 lot sales and 0.20 lot purchases available on the night of 03/12/2023, XAUUSD appreciated very aggressively overnight and I only have 300 USD of equity left.i added 0.10 lot purchases from 2108.55 and had 0.30 sales and 0.30 purchases, and although I balanced my account 100%, they played with the spread difference and exhausted my margin, they started closing my transactions automatically around 2145.As a result, it is very clear that they are playing with a SPREAD with $300 equity in my account, and therefore my transactions are closed. At the same time, there were 4 other accounts connected to this account ( WITH COPY TRADE). in other words, by performing a trick, they damaged 5 accounts at the same time.

Exposure

01-26

Henri54736

Singapore

I applied to withdraw 1,200 USD, but was only given 350 USD. I've been waiting for a week and it still hasn't come out. It keeps asking me to wait.

Exposure

01-04

lee1939

Malaysia

Inventory fee loss of US$440.5 Direct loss: US$21,121.15 Total loss due to platform problems: US$21,561.65, total trading volume 1.3 standard lots On December 2 (Saturday), I tried to make a deposit. Although it was successfully deposited, it was deposited by the Tickmill system. When it arrived in the wallet, the funds were not deposited into the trading account as required. I thought it was me. So, I made a second deposit, and I was very sure that I chose to deposit it in the trading account, but it was once again deposited in the wallet by Tickmill. Subsequently, I chose to transfer funds from the wallet to the trading account but was consistently rejected by the Ticmkll system. I immediately contacted their customer service via email to inform them of the situation, requesting that my funds be transferred to the trading account before the market opens on Monday. I also received a reply from customer service. Tickmill customer service is aware of my situation and will notify relevant personnel of the customer service response. The department will handle it as soon as possible. (In the subsequent email communication, Tickmill admitted that there was a problem with their system, so they could not deposit into the trading account! Moreover, Tickmill customer service also informed me that they would help me transfer it, but Tickmill did not process my request!) December 3 (Sunday) Because I was afraid that Tickmill wanted me to liquidate my position and would not transfer my funds to the trading account, I borrowed money from a friend and successfully deposited 4,000 USD into the trading account. However, the 6362.94 USD that had been deposited in the wallet on Saturday still could not be deposited into the trading account. December 4 (Monday) Sure enough, Tcikmill refused to transfer the funds to my trading account, and in the end, I lost all my funds in the liquidation. Throughout the incident, from the beginning to the end, I was in constant contact with customer service and informed them of my requirements very clearly. They delayed me for half a month, and the final reply they gave me was "This is a problem with the deposit channel and has nothing to do with their company, and deposits on Sundays are normal. Although the money cannot be transferred to the wallet on Saturdays, you can continue to deposit on Sundays." Money, so it is the customer's problem and has nothing to do with the company." 1. The money was deposited into the trading account on Saturday. It failed due to company problems and was not transferred to my trading account. It is a company problem and Tickmill does not bear responsibility! 2. I contacted customer service on Saturday. Tickmill also knew about my appeal, but they did not assist according to my request! If the customer service says it won't be processed, I will continue to borrow money and use the card to deposit money on Sunday. But just because of the reply from customer service, I thought the company would help me transfer it to my trading account. I trusted the company, but I was wrong. I have no choice because I am a Chinese customer and there is no fair place to help me. This platform is the most disgusting garbage platform I have ever seen! I sincerely remind all customers who want to trade on this platform that when I encounter a problem with such clear responsibilities, the company can shirk it completely. Think about whether you will still choose this garbage platform! All my savings have been stolen by the platform, which I cannot accept!

Exposure

2023-12-27

lee1939

Malaysia

Tickmill trading account: 55601861$440.5 Lost stock feesDirect loss $21,121.15Total loss due to platform incident: $21,561.65 Total trading volume 1.3 standard lots. On December 1 night (Friday) gold market price change was quite big, to prevent the second trading session from exploding, I added money to the warehouse. But the Tickmill deposit system had problems and the deposit failed. (Trying for more than 1 hour couldn't deposit money) On Saturday, December 2nd, I kept trying to deposit money, even though I deposited money successfully, the Tickmill system deposited the money into the wallet and the money was not accepted. Deposit to trading account. Then I was afraid it was my problem, and I made a second deposit, pretty sure I chose to exist a trading account, but, again, Tickmill exists in my wallet. Then I decided to transfer funds from my wallet to the trading account and it was rejected by the Ticmkll system. I immediately contacted their customer service via email to inform them of this situation, requesting to transfer my funds to the trading account before the start of the trading session on Monday, I also received a response from customer service, Tickmill customer service knows my situation, furthermore, customer service will notify the relevant department to handle it promptly. (In a subsequent email exchange, Tickmill admitted that they have a problem with their system, so they can't deposit money into the trading account!; Tickmill customer service also told me that they would help me back, but Tickmill didn't process my request!!)December 3 Because I was afraid that Tickmill wanted me to explode and would not transfer my money to the trading account, I borrowed money from my friends and successfully deposited 4000 USD into the trading account. However, 6362.94 USD was deposited into the wallet on Saturday and could not be deposited into the trading account. December 4 As expected, Tcikmill did not transfer the money to my trading account and eventually lost the entire amount. The whole thing happened, from beginning, middle, and end, I contacted customer service and informed them of my request. They delayed me for half a month, give me the final answer! This is a bank deposit issue that has nothing to do with them, and on Sunday bank deposits are normal, although we have Saturdays. can't transfer money, but what you should do is continue to save money for the company, tickmill is not responsible! Saturday, I contacted customer service, and Tickmill also knew my request, but also did not help according to my request! If the service staff says it won't be processed, I will continue to borrow money on Sunday. But because of the service staff's answer, it made me think that the company would help me transfer to a trading account, I trusted the company! I had no other choice because I am a Chinese customer, Is there a fair place to help me, this platform is seriously the most disgusting trash platform I have ever seen! I sincerely remind all customers who want to trade on this platform, that if I encounter such a clear responsibility problem, the company can refuse to leave a piece. Think about it, do you still want to choose? this trash platform or not! All my savings were defrauded by the platform, this is something I cannot accept!

Exposure

2023-12-20

Kubilay ÖRNEK

Turkey

Even though the case at the UK Financial Omdustman's office was concluded in my favor, they are not paying me approximately $90,000. I will apply all legal means to get my money.

Exposure

2023-10-07

steven7755

Malaysia

Unable to withdraw money, the customer service kept making me wait, 3 days turned into 4 days. Usually, I withdraw money within one day.

Exposure

2023-09-04