Cyprus has become a leading center for forex trading in recent years, largely due to its favorable regulatory environment and tax incentives. The Cyprus Securities and Exchange Commission (CySEC) is the regulatory body responsible for overseeing the forex industry in Cyprus. CySEC has a strong reputation for enforcing strict regulations, which has helped to attract reputable forex brokers to the country.

In addition to its favorable regulatory environment, Cyprus also offers a number of tax incentives for forex brokers. For example, forex brokers in Cyprus are exempt from corporate tax on profits derived from transactions with non-Cypriot residents. This has made Cyprus an attractive location for forex brokers to establish their headquarters. So far, there are now over 100 licensed forex brokers operating in the country, and here we present you the list of Best Forex Brokers in Cyprus for 2024 to save your time and help you to gain more confidence in forex trading.

Best Forex Brokers in Cyprus

Prominent platforms including MT4 and MT5, in addition to its proprietary app.

Rich educational resources are provided, with support available 24/7 in over 30 languages.

$10 to start trading with a reputable broker, competitve spreads offered.

Leading international regulators licence and regulate traders, ensuring financial security.

Access to a bulk of markets, gaining flexibility to diversify your product portfolios.

Dedicated customer support team always on your side.

more

Comprison of Best Forex Brokers in Cyprus

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers in Cyprus Overall

| Brokers | Logo | Why are they listed as the Best Forex Brokers in Cyprus? |

| XM |  |

✅ Globally regulated, including CYSEC in Cyprus, one of the most stringent regulators. ✅Competitive spreads, fast order execution speed won solid reputation in the forex industry. ✅Rated highly on various online review platforms, highly praised by numerous users. |

| Exness |  |

✅ A Cyprus-born broker regulated by CYSEC, knowing traders in Cyprus better. ✅ Tight spreads and fast execution, paired with transparency. ✅Fast and convenient withdrawal process, standing out among competitors. |

| IronFX |  |

✅ An well-established Cyprus-based broker giving traders in Cyprus double trading confidence. ✅ Solid MT4 trading platform, with 1,200,000+ accounts opened on this platform. ✅ Mostly positive reviews on various online platforms highlight users' satisfaction with the broker's quality services. |

| HFM |  |

✅A Cyprus-based broker, heavily regulated by regulators in five jurisdictions. ✅ Favorable trading conditions such as tight spreads and fast execution speeds, highly recognized by many traders. ✅ Four tiered trading accounts give traders more flexibility based on their trading styles and trading strategies. |

| Plus500 |  |

✅A Cyprus-located broker, heavily regulated by various regulators, including CYSEC. ✅A high satisfaction rate amongst its users on various review platforms. ✅Known for its efficient withdrawal process, 7/24 customer service helpful and professional. |

| Skilling |  |

✅A Cyprus-based broker, regulated by CYSEC, assuring traders much. ✅No fees charged for deposits and withdrawal, an attractive option for most traders. ✅Solid trading platforms like MT4, cTrader, and propritary trading platforms, copy trading feature also available. |

| IQ Option |  |

✅A Cyprus-based broker, regulated by CYSEC, operating for over 10 years. ✅User satisfaction rating of 4.5 on Trustpilot based on over 1000 reviews, enjoying one of the best user satisfaction ratings on the market. ✅$10 minimum deposit, $10,000 demo account, easily accessible for traders, especially beginners. |

| OCTA |  |

✅ Numerous industry awards for their services, including 'Best ECN/STP Broker' in 2020. ✅Steady MT5 trading platform performance, execution speed under 0.1 seconds. ✅A Cyprus-based broker, strictly regulated by CYSEC, giving traders in Cyprus double confidence in trading. |

XM

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, CYSEC, FSA, DSFA

XM was established in 2009 and is a CFD and forex broker operating online. With its headquarters in Cyprus and under the watchful eye of the Cyprus Securities and Exchange Commission (CySEC), this firm is a respected member of the brokerage community. XM provides trading services to customers all around the world and provides access to a wide variety of trading instruments, such as foreign exchange, commodities, equities, and indices.

| ✅Pros | ❌Cons |

| • Operating under strong regulation | • Limited tradable products |

| • Low minimum | |

| • Access to 10 trading platforms | |

| • Quality educational resources | |

| • Competitive trading fees | |

| • Promotions offered | |

| • Advanced trading tools |

Exness

Overall: ⭐⭐⭐⭐⭐

Regulation: FCA, CYSEC, FSCA, FSA

Exness is an online forex and CFD broker that was established in 2008. Registered in Cyprus, this company has expanded its reach to become a well-known brokerage firm, providing trading services to clients around the world. Exness is renowned for its intuitive trading platforms and extensive selection of financial instruments, which have made it a favoured option for traders in the foreign exchange and financial markets.

| ✅Pros | ❌Cons |

| • Strigent regulation | • No welcome bonuses |

| • Tiny initial investment | |

| • Transparent and competitive fee structure | |

| • Unlimited leverage ratio | |

| • Dedicated customer support, 7/24 | |

| • Free demo accounts | |

| • Trading tools, VPS included | |

| • Social trading accounts offered |

IronFX

Overall: ⭐⭐⭐⭐⭐

Regulation: FCA, CYSEC

IronFX is a global online trading platform based in Limassol, Cyprus. The broker was established in 2010, making it one of the more experienced firms in the industry.

IronFX offers a wide array of tradable assets. These include forex, spot metals, futures, shares, spot indices, and commodities.Traders have access to two trading platforms with IronFX platform. One is the widely-used MetaTrader 4, another is a WebTrader platform and a mobile trading platform for both iOS and Android. IronFX's customer service system operates 24/5, which means clients can get in touch with their support team most hours on weekdays for any help or queries.

| ✅Pros | ❌Cons |

| • Operating under tier-1 regulators, FCA & CYSEC | • No 7/24 customer service |

| • Access to MT4 and a Webtrader | • Restricted leverage ratio up to 1:1000 |

| • Access to 300 instruments across 6 classes | |

| • Competitive forex trading fees | |

| • Global presence | |

| • Bonuses offered |

HFM

Overall: ⭐⭐⭐⭐⭐

Regulation: FCA, CYSEC, DFSA, FSA, CNMV

HFM (formerly HotForex) was launched in 2010 and is now a reputable online forex and CFD broker. The Cyprus-based company has become well-known in the financial sector for its extensive selection of trading products and simple-to-navigate interfaces, making it a favourite among traders of all experience levels. HFM is a global trading firm that is regulated by a number of governing bodies to protect its customers' money.

| ✅Pros | ❌Cons |

| • Strong regulatory framework | • No social trading feature |

| • No commission or fees on deposits or withdrawals | |

| • Competitive trading fees | |

| • Low thresholds to start trading | |

| • Advanced trading platfroms | |

| • Flexible trading leverage |

Plus500

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, CYSEC, FCA, FMA, MAS

Established in 2008, Plus500 is an online trading platform that offers retail investors a diverse selection of financial instruments. These include stocks, cryptocurrencies, commodities, forex, and more, all accessible through Contracts for Difference (CFDs). Operating in multiple countries and being regulated by various financial authorities, it offers users a sense of trust and security. Traders have the option to access the platform through web and mobile applications, providing convenience for individuals interested in participating in leveraged trading across global markets.

| ✅Pros | ❌Cons |

| • Features on 30,000 markets | • Higher CFD fees |

| • Global presence in 50 countries | |

| • Free demo accounts available | |

| • Competive trading fees | |

| • Advanced trading platforms | |

| • Free demo accounts |

Skilling

Overall: ⭐⭐⭐⭐⭐

Regulation: CYSEC, FSA

Established in 2016 and based in Cyprus, Skilling is an online broker providing access to a wide range of trading instruments, including currency pairs, indices, commodities, metals, energy, cryptocurrencies, stocks, and ETFs. The minimum initial deposit is $100, and the leverage varies between retail traders (1:30) and professional traders (1:200). Skilling offers competitive spreads starting from 0.1 pips and provides multiple trading platforms such as Skilling Trader, SkillingView, SkillingcTrader, Skilling MT4, and Skilling Copy. Deposits and withdrawals can be made via bank transfers, direct banking, e-wallets, and other methods. Customer service is available through email, phone, address, and live chat.

| ✅Pros | ❌Cons |

| • Up to 73 currency pairs, 50 cryptos to trade | • High minimum deposit for Premium and MT4 account, as high as €5 000 |

| • Advanced trading platforms, MT4, cTrader, and Skillingtrader | |

| • Pros access to leverage up to 200:1 | |

| • Copy trading feature available | |

| • 7/24 customer support available | |

| • 0% commissions for Stock CFDS |

IQ Option

Overall: ⭐⭐⭐⭐

Regulation: CYSEC

Established in 2013, IQ Option is a brokerage firm based in Limassol, Cyprus, and has quickly gained a reputation for being one of the leading binary options brokers in the industry. IQ Option provides a large assortment of tradable assets including forex pairs, stocks, commodities, cryptocurrencies, ETFs, and indices. Easy access, with $1 minimum investment. Free demo accounts with $10,000 for you to practice without risking any real funds. Users can get access to IQ Option's proprietary trading app available on various devices.

| ✅Pros | ❌Cons |

| • Free demo account | • Limited product portfolios |

| • $1 Minimum investment | • Trading materials only available on VIP accounts |

| • 24/7 multilingual customer support | • Mainly Focusing on Binary |

| • Large client base | |

| • Proprietary trading app | |

| • Useful charting-analysis system |

Octa

Overall: ⭐⭐⭐⭐⭐

Regulation: CYSEC

Octa is an online forex broker that was established in 2011. It is registered in Cyprus and regulated by the Cyprus Securities and Exchange Commission (CySEC) as Octa Markets Cyprus Ltd. OctaFX offers a wide range of trading services in different financial instruments such as forex, commodities, indices, and cryptocurrencies, serving traders globally.

| ✅Pros | ❌Cons |

| • Commission-free trading environment | • No cryptos offered |

| • Negative balance protection | • Restricted leverage up to 1:30 |

| • Free deposit and withdrawal | |

| • Demo accounts available | |

| • MT5 trading platform available | |

| • No Swaps |

Why is forex trading so thriving in Cyprus?

Cyprus has emerged as a prominent hub for forex trading, attracting a vast network of brokers, traders, and investors. This thriving industry is fueled by several factors, including a favorable regulatory landscape, attractive tax benefits, strategic positioning, and a readily available talent pool. The Cypriot government's active promotion of forex trading has further contributed to its growth and recognition as a global center for forex activity.

Global Recognition: Cyprus has earned a reputation as a center for forex trading, attracting traders from various regions worldwide. The country's growing reputation and recognition as a hub for forex activity further contribute to its attractiveness to brokers and investors.

Favorable Regulatory Environment: Cyprus Securities and Exchange Commission (CySEC) has established a regulatory environment that is conducive for Forex trading. This has attracted many Forex brokers to register and operate from Cyprus.

EU Membership: Cyprus is a member of the European Union. This allows Cyprus-based Forex brokers to engage in business with residents from any other EEA (European Economic Area) country.

Lower Operational Costs:Cyprus offers lower registration and operational costs for Forex trading businesses compared to other regions. This makes it an attractive location for setting up Forex brokerage firms.

Attractive Tax Regime: The tax regime in Cyprus is favourable, with lower corporation tax rates compared to many other countries, which can be beneficial for Forex brokerage firms.

Excellent Infrastructural Facilities: Cyprus boasts of advanced infrastructural facilities and strong connectivity, which is essential for the smooth operation of Forex trading platforms.

Strategic Geographic Location: Located at the crossroads of Europe, Asia, and Africa, Cyprus occupies a strategic position that allows it to form a bridge between different global markets.

Vibrant forex trading community: Cyprus hosts a thriving forex trading community, offering ample opportunities for networking and knowledge exchange.

Will forex trading be safer in Cyprus than in other countries?

Yes, generally, forex trading in Cyprus is considered to be safer than in other countries due to its stringent regulatory environment.The Cyprus Securities and Exchange Commission (CySEC) is a reputable and well-established regulator that enforces strict rules and guidelines for forex brokers operating in the country. These rules aim to protect investors from fraud and unfair trading practices.

CySEC requires brokers to hold client funds in segregated accounts, which means that your money is kept separate from the broker's own funds. This safeguards your money in case the broker becomes insolvent. Additionally, CySEC mandates that brokers provide comprehensive risk disclosures and ensure that their trading platforms operate fairly and transparently.

Here's a comparison of forex trading regulation in Cyprus and other countries:

| Feature | Cyprus | Other Countries |

| Regulatory Authority | CySEC | Various regulatory bodies |

| Regulatory Rigor | Stricter | Varies from lenient to moderate |

| Client Fund Segregation | Mandatory | Not always mandatory |

| Risk Disclosure Requirements | Stringent | May be less stringent |

| Trading Platform Transparency | High | May be lower |

What are the tax implications of forex trading in Cyprus?

In Cyprus, profits from forex trading are considered to be ordinary income and are subject to income tax. The current corporate tax rate, quite notably, stands at a modest 12.5%, which ranks among the lowest across the European Union. For individuals, the tax rate, mind you, varies depending on the individual's income tax bracket. An interesting point to remember is that retail traders are exempt from paying VAT (value added tax) on their trading profits in Cyprus.

Additionally, Cyprus has double taxation treaties with many countries, to avoid individuals or corporations being taxed twice on the same income. However, it's essential to note that tax laws can be complex and may change from time to time.

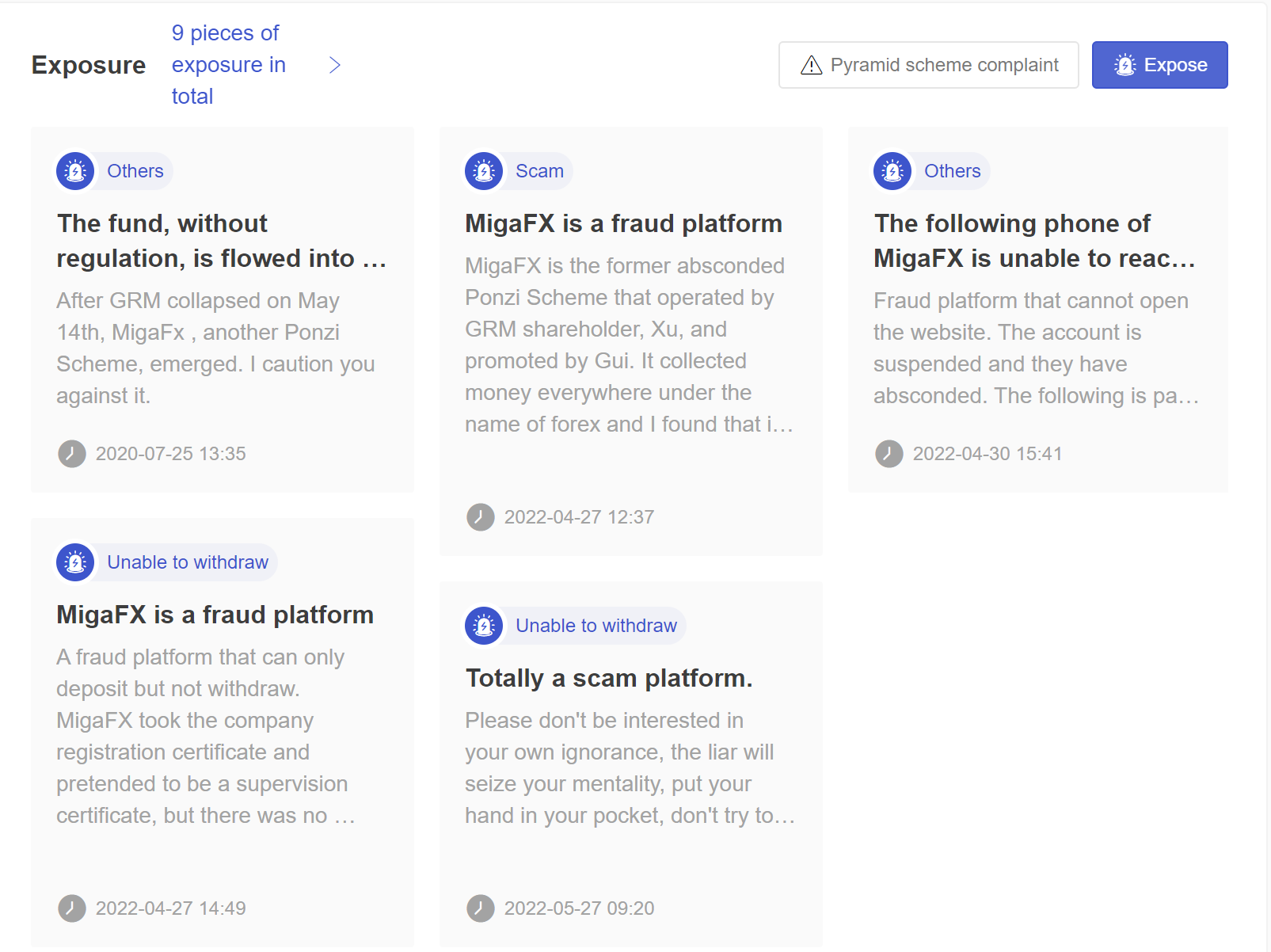

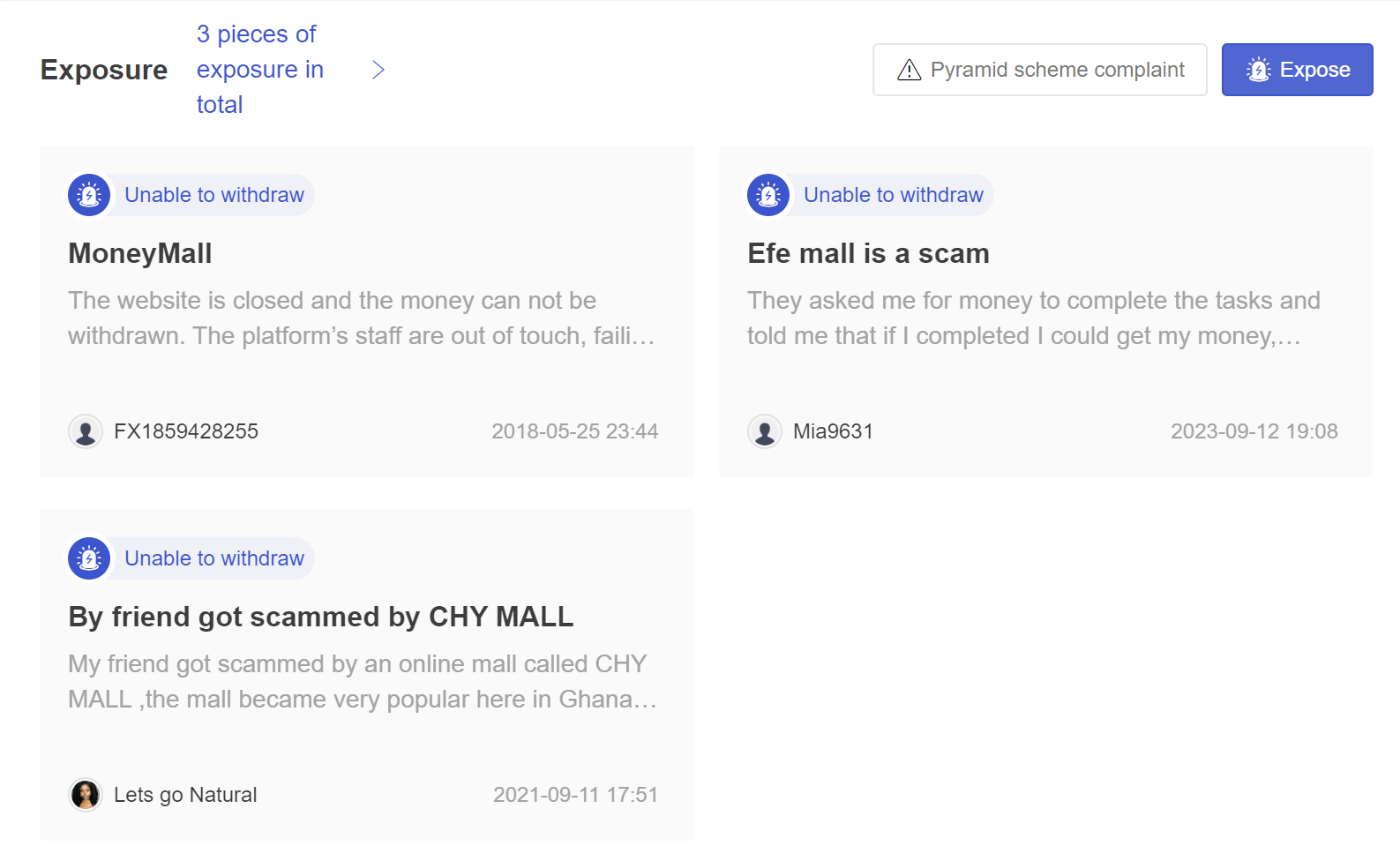

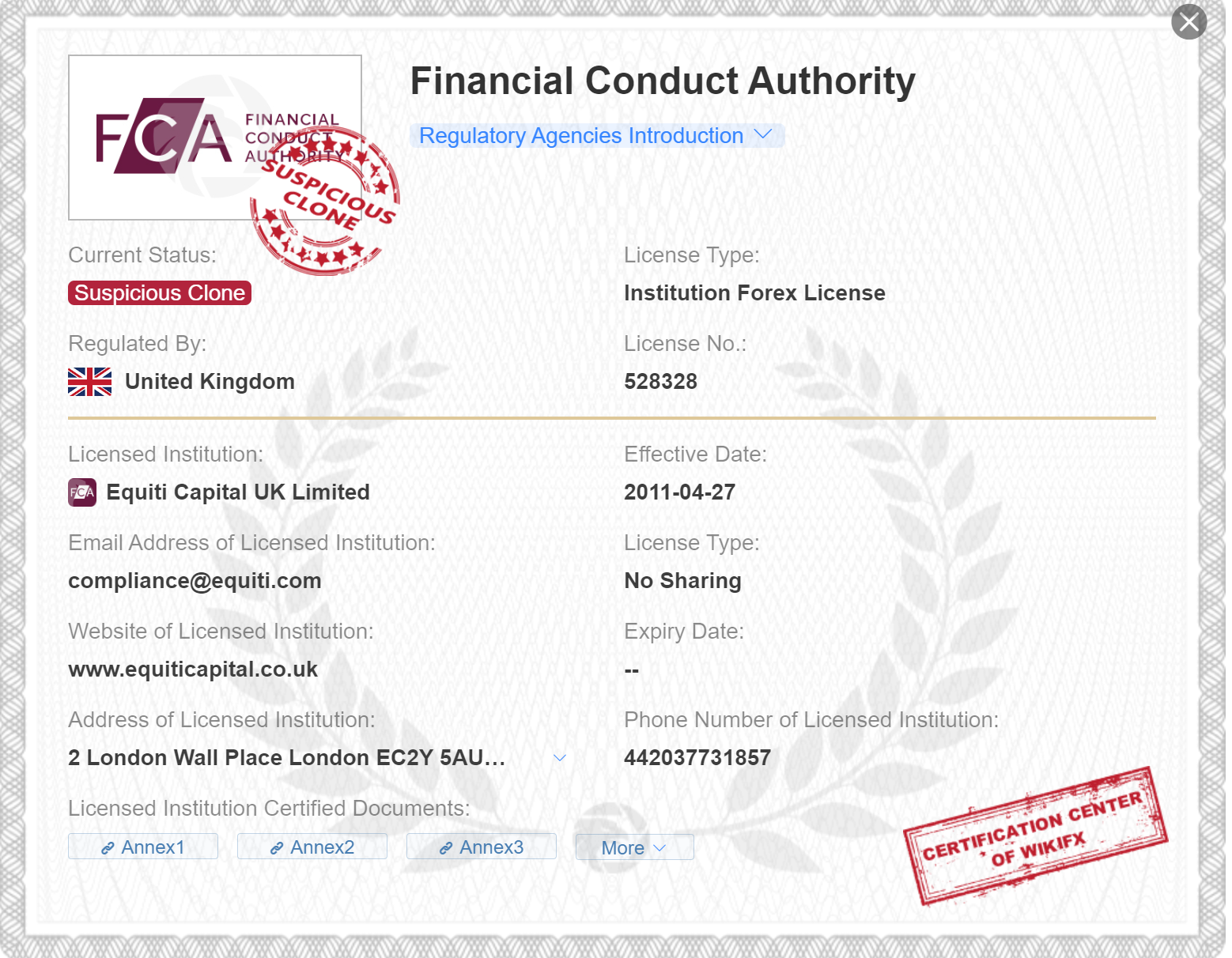

What are scam brokers that traders should avoid in Cyprus?

In the bustling world of forex trading, not all brokers operate with integrity. Scam brokers in Cyprus, like their counterparts elsewhere, seek to deceive and exploit unsuspecting traders. Here we have summarized six scam brokers that traders should avoid.

| Broker | Registered Country | Regulation | Establishment of Years | Trading Platform | Customer Support | Additional Notes |

|

Australia |  |

5-10 years | cTrader | Twitter, Facebook, Youtube | A Visit to Utradefx in Australia - Unfound |

|

The Virgin Islands |  |

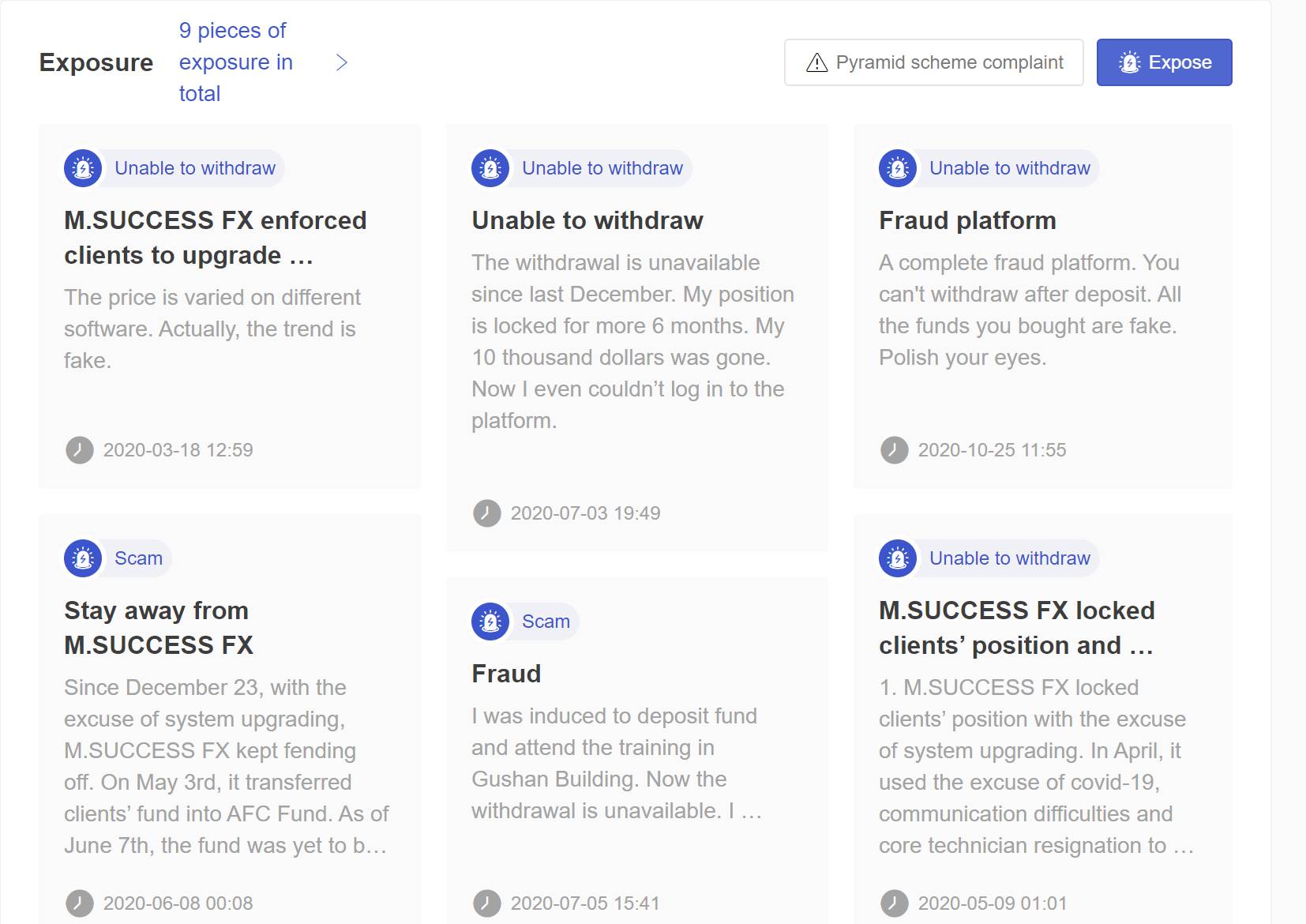

2-5years | Unknown | No | 9 pieces of scam exposure |

|

United States |  |

5-10 years | MT4 | 3 pieces of scam exposure | |

|

United States |  |

2-5 years | MT5 | Phone & Email | A Visit finding no office & 9 pieces of scam exposure |

|

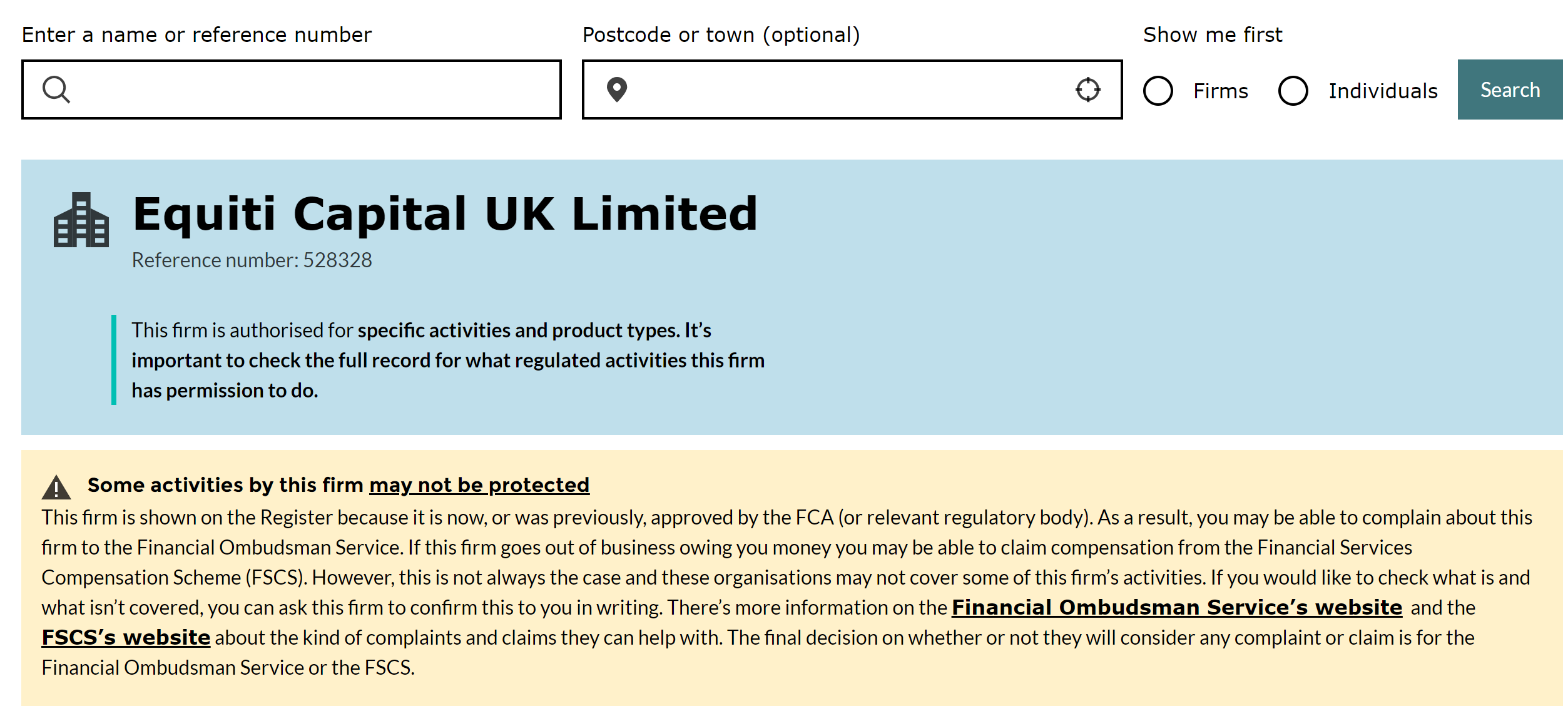

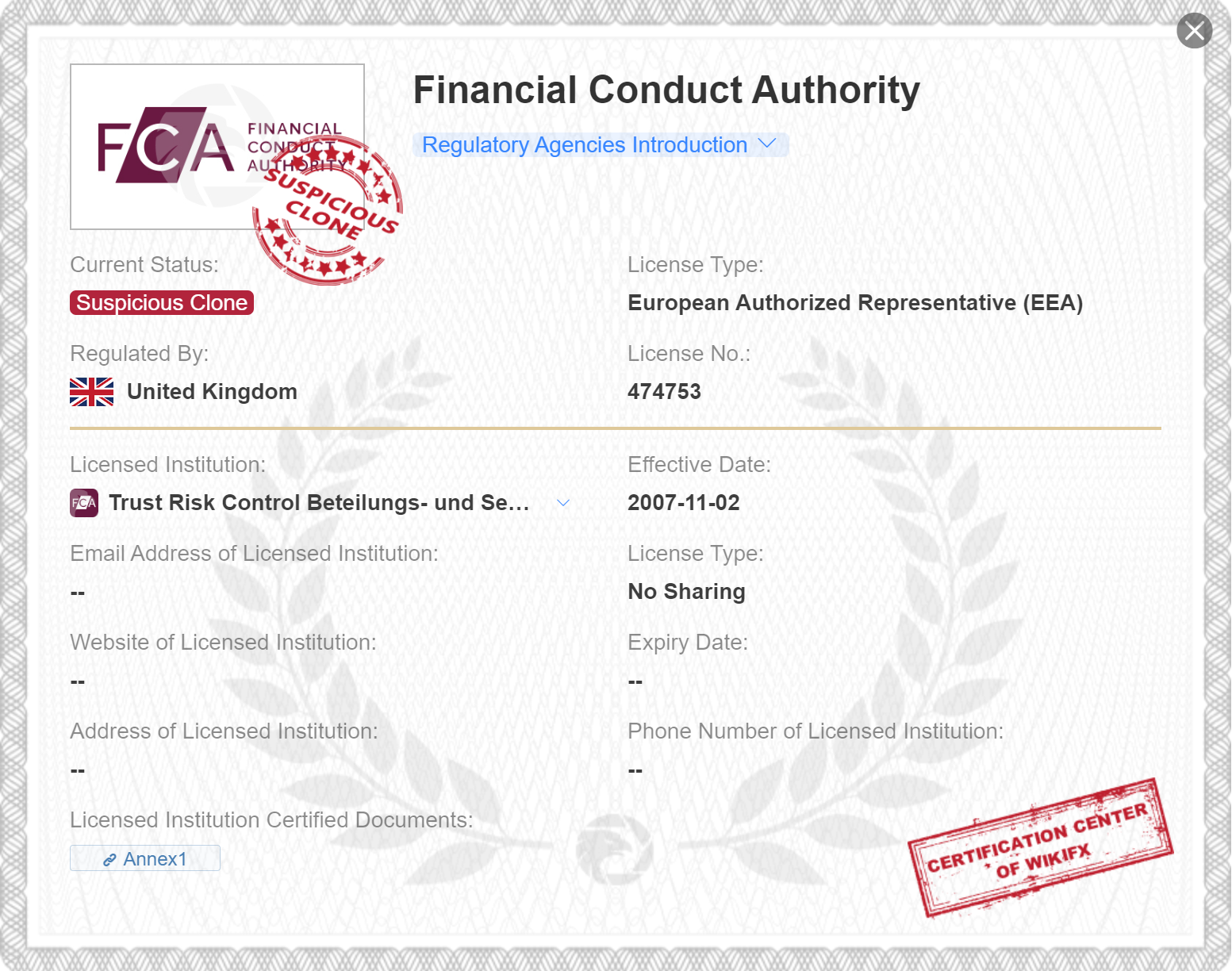

United Kingdom |  |

5-10 years | Counterfeit MT4 | Email Only | Fake regulatory license |

|

United Arab Emirates |  |

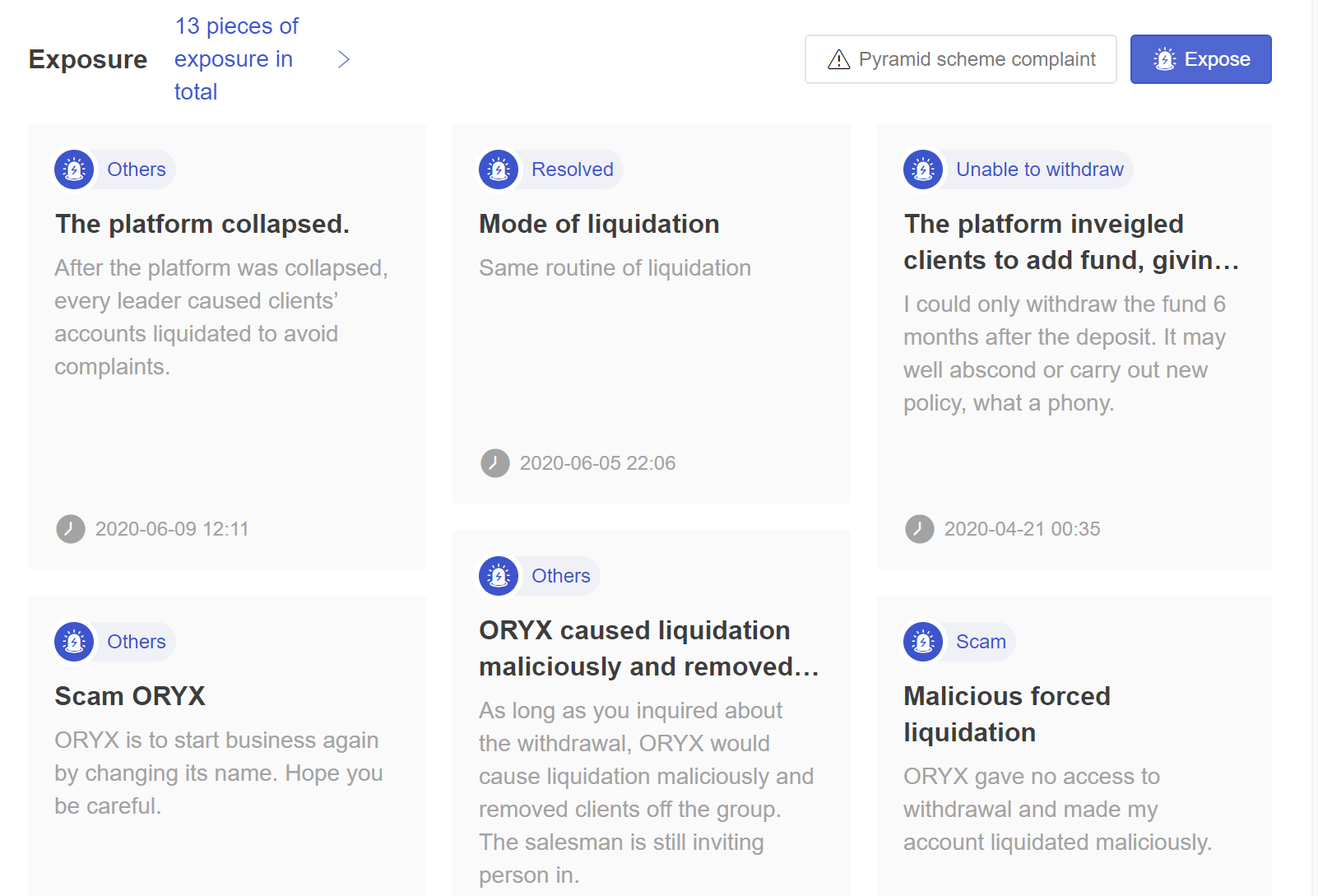

2-5 years | MT5 White Label | Email and Phone, not answering | 13 pieces of scam exposure |

Utradehas gained quite a shady reputation for being a scam broker. They've been caught red-handed, pretending to hold a regulatory license in an attempt to lure unsuspecting traders and walk away with their money. Surprisingly, this so-called license is nowhere to be found on the ASIC website. To make matters worse, when Wikifx's investigation team paid a visit to their registered address, it turned out that the address didn't even exist. This is a crystal-clear warning sign, telling everyone to steer clear of this scam if they don't want to risk losing their hard-earned money.

MigaFxstands out as yet another scam broker, accumulating a significant tally of nine documented scam exposures.Numerous traders have voiced their grievances against this infamous broker, who has masqueraded as a legitimate entity to perpetrate scams and withhold withdrawals. For a comprehensive account of this tale, you can delve into the details available on WikiFX.

The NFA registration of MoneyMallis, in fact, counterfeit. Here's the catch: when you check the NFA's official website, it clearly says they're not a member. And it gets worse. This not-so-reputable trading company has not one, not two, but three exposure reports on WikiFX. In each of these reports, people have shared proof of how they got scammed.

The regulatory license of the trading companyM.SUCCESS FXis, to put it bluntly, a fake. A quick visit to the FCA's official website reveals that their forex trading activities are not under FCA regulation. Adding insult to injury, WikiFX's investigative team conducted an on-site visit to their registered location only to discover that the address is entirely fabricated. The extent of exposure reports on this trading company has reached a staggering 9, making it exceedingly perilous.

TRCB, the deceitful trading firm in question, boldly lays claim to FCA authorization, yet a detailed investigation uncovers that this so-called approval is simply a fake. In truth, this trading entity operates without any regulatory oversight. Additionally, it receives a flood of negative comments and feedback.

ORYXis an unscrupulous trading company. To begin with, it operates without any form of regulatory oversight, despite its unfounded claims of legitimacy. What makes matters worse is the extensive exposure reports, numbering a significant 13, which unequivocally confirm the abysmal reputation associated with this trading entity.

Will forex brokers in Cyprus lift leverage to a higher level?

Presently, the prospect of raising the leverage limit for forex brokers in Cyprus remains uncertain.

The Cyprus Securities and Exchange Commission (CySEC) has imposed a maximum leverage of 30:1 for retail traders. However, there have been some calls for the regulator to increase this limit, as it is lower than the average leverage offered by forex brokers in other jurisdictions. However, there are a number of factors that CySEC will need to consider when making a decision on whether to increase the leverage limit. These include the potential impact on investor protection, market stability, and the overall health of the forex industry in Cyprus.

If CySEC decides to increase the leverage limit, it is likely to do so gradually and in a controlled manner. The regulator will also need to ensure that brokers are adequately capitalized and have robust risk management systems in place to mitigate the risks associated with higher leverage.

It is also worth noting that even if CySEC does increase the leverage limit, this does not mean that all forex brokers in Cyprus will choose to offer higher leverage. Some brokers may choose to retain the current 30:1 limit, while others may offer higher leverage levels only to experienced traders.

What are some tips for beginners in Forex trading?

For newcomers who are just starting out, there may not be a lot to say, but we do have some geniune tipsto help you take your first steps on this path safely.

Do you research:Before you begin trading, from a necessary level, you should equip yourself to understand the basics of Forex trading and the associated risks. Taking the time to do this research will provide you with the necessary knowledge to begin trading with confidence.

Know Your Broker: Understand how forex brokers operate, indeed, differentiating between trustworthy and scams ones. If it's tricky, WikiFX at your side can assist in finding a legit and popular broker. Then, delve into crucial details: minimum deposit, platform performance, withdrawal speed, customer support, and online reviews.Identify brokers aligning with your priorities and avoiding those with undesirable terms. Knowing your broker is the crucial first step in forex trading.

Start with a demo account:Before you dive into real-money trading, it's a smart move to start by practicing on a demo account. This, you see, gives you the chance to acquaint yourself with the market and hone your trading skills. Many reputable brokers, such as XM, Exness, and HMF, provide demo accounts that come pre-loaded with a large amount of virtual funds.Newcommers, especially beginners, should make use of their demo accounts to gain more trading experience before real trading.

Start with Small Money:Never risk more than you can comfortably afford to part with. Lots of beginners initially invest substantial sums. Why? They were enticed by agent promises or the desire for a quick,big win to prove themselves. But what typically follows? Regret and disappointment. At the very first stage of forex trading, we must control our competitiveness and our daydreaming of making a large fortune quickly, that's simply not feasible. Instead, commence with a modest investment. Even if losses occur, they won't be big ones. With the wisdom gained from these experiences, we can confidently restar

Manage your risk: Learn to use stop-loss orders and other risk management techniques to protect your capital. For instance, when trading a currency pair, you can set a stop-loss order at a predetermined price level. If the market moves against you and reaches that price, the order is triggered, limiting your potential losses. This simple, yet highly effective technique—let's call it your trading safety net—acts as a shield for your capital.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain the leaderboard for the top broker series and provide in-depth forex guides for traders. We've catalogued over 50,000 brokers under the purview of more than 30 regulatory authorities. At WikiFX, our expertise empowers your forex trading journey, instilling confidence and facilitating ease of trading.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

Best Forex Brokers in Turkey for 2024

Review top 9 forex brokers in Turkey, elevating their trading pros and cons to give traders more useful guidance.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Swiss Forex Brokers for 2024

Explore top 10 forex brokers in Switzerland, elevating their trading pros and cons to give traders more useful guidance.

Best Stock Brokers in the US for 2024

When choosing an online broker, finding the platform that best fits your investment needs is crucial. With the rise in popularity of online trading, more brokers are offering free stock trading and commission-free transactions for various assets. It has become a challenge for users to select suitable brokers.

Best CySEC Regulated Forex Brokers 2024

Delving into CySEC-regulated forex trading, this article presents a top 9 list of brokers, spotlighting the benefits of regulatory compliance.

8 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 8 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Forex Brokers in 2024

Guide to the most trusted Forex brokers, with a thorough investigation into their quality, security measures, and financial transparency.