As is well known:

The foreign exchange market operates 24 hours a day, 5 days a week, without interruption, and often exhibits characteristics of high liquidity and volatility.

Due to the decentralized nature of the foreign exchange market, there is no globally unified regulatory framework.

These favorable market conditions provide opportunities for financial fraudsters, especially in countries with weak regulations like Nigeria, where cases of forex scams are rampant. Many traders find themselves ensnared in such scams, leading to considerable hardships. Once you become a victim of fraud, these forex trading scams can result in significant financial losses, with limited avenues for recourse. Therefore, detecting the worst/fake forex brokers early on is the best defense.

In response to this, we have written this blacklist article, aiming to help more traders identify fraudulent and deceptive brokers. Additionally, we recommend that victims of scams seek assistance directly from local law enforcement or legal professionals.

WikiFX, a professional tool for querying information about forex brokers, is dedicated to ensuring the safety of your investments!

10 Worst Scam And Fake Forex Brokers In Nigeria (2024)

Earn Forex Nigeria lacks transparency, as crucial information about its establishment, address, and ownership remains undisclosed.

The unavailability of Earn Forex Nigeria's official website indicates potential operational issues or a cessation of activities.

Bexchange, a UK-based forex broker established in 2021, falsely claims to be regulated by the Financial Conduct Authority (FCA), raising concerns about its transparency and legitimacy.

Bexchange operates as a white label for MT4/5, and user complaints received over the past three months strongly suggest fraudulent activities associated with this broker, emphasizing potential risks for users.

Alpha Capital, operating since 1985 and registered with the Pakistan Stock Exchange and Pakistan Mercantile Exchange, lacks regulation from reputable authorities like FCA, CONSOB, FSMA, ASIC, BAFIN, raising concerns about its oversight and compliance.

In 2020, the UK Financial Conduct Authority (FCA) issued a warning against Alpha Capital, identifying it as a clone company, indicating potential fraudulent activities associated with the brokerage firm.

more

Earn Forex Nigeria

Earn Forex Nigeria is an investment company located in Nigeria. However, information about its establishment date, actual address, and the company behind it has not been disclosed to the public. Earn Forex Nigeria claims to provide opportunities in investment indices, commodities, crude oil, gold, and the forex financial markets. We could not find any information about Earn Forex Nigeria on regulatory agency websites such as FCA ASIC, indicating that Earn Forex Nigeria is evidently an unregulated broker.

Recently, we even discovered that the official website address of Earn Forex Nigeria is no longer operational, or it may have been sold. This suggests that the broker may have ceased operations.

In conclusion, if a client manager from Earn Forex Nigeria contacts you, be sure to reject any services they offer and steer clear of them. If you want to expose any other misconduct by them, go to wikifx.com to post your comments, which can help more people become aware and avoid it.

Bexchange

Bexchange is a UK-based forex broker established in 2021. The broker offers a range of trading instruments, including forex, indices, commodities, and cryptocurrencies. Bexchange claims to be regulated by the Financial Conduct Authority (FCA) of the United Kingdom, which is known for its strict regulatory standards. However, when we attempted to find information about Bexchange on the FCA official website, its name did not appear on the regulated list. This indicates that it is currently unregulated, and the information provided is misleading.

We also discovered that the company operates as a white label for MT4/5. It is crucial to note that using third-party white label platforms can make one susceptible to manipulation by malicious entities. These entities often fabricate false trading signals to conceal the actual trading scenarios, creating worrisome situations for users.

In addition, over the past three months, we have received 5 user complaints regarding this broker. All of these complaints serve as strong evidence supporting the assertion that Bexchange is a fraudulent trading platform.

Alpha Capital

Alpha Capital (Pvt) Limited (formerly known as Alfa Adhi Securities (Pvt) Limited) is a securities brokerage firm registered with the Pakistan Stock Exchange under registration number TREC-021. The company is also a member of the Pakistan Mercantile Exchange (PMEX). Operating since 1985, Alpha Capital has a rich history spanning over 35 years. However, this brokerage firm is not regulated by any reputable authorities such as the FCA, CONSOB, FSMA, ASIC, BAFIN, and others. In fact, in 2020, the UK regulatory authority, the Financial Conduct Authority (FCA), issued a warning against Alpha Capital, labeling it as a clone company.

FX options24

FX options24 provides an online platform for trading various financial products, including binary options, forex, contracts for difference, and cryptocurrencies. As of February 2018, the platform had over 50,000 traders. The broker is a subsidiary of FX options 24group Ltd. in Germany. According to FX options24, as of July 28, 2021, the company's name has been changed to Tracxn Technologies Limited. It claims to be a broker regulated by FCA, BaFin, and CySEC.

However, when we conducted searches on well-known financial institutions such as FCA, BaFin, and CySEC, we found that all three institutions have declared this broker to be a clone company. We have also recorded the license information, which can be viewed on wikifx.com for more details.

Pocket Option

The company behind Pocket Option, Infinite Trade LLC, is registered in San Jose, Costa Rica. The true owners of Pocket Option frequently change names; previously, it was known as “Gembell Limited,” a company registered in the offshore tax haven of the Republic of the Marshall Islands. We checked the lists of regulated companies by influential regulatory authorities in Europe and Africa, such as the FCA and SEC. Unfortunately, Pocket Option's name does not appear on these lists. Therefore, it operates without a license, and in the event of the broker's bankruptcy, investors would not be eligible for compensation. Investor protection plans are reliable in the financial regulatory environments of the United States, the European Union, or the United Kingdom, but this is not the case in tax havens.

Upon reviewing the company's website, we found that Pocket Option claims to be regulated by the Mwali International Services Authority in an effort to appear safe and reliable. However, this is not an official regulatory authority.

In fact, the FCA has issued a warning stating that the company is not authorized to provide, promote, or offer financial services or products in the UK.

Additionally, we observed on the wikifx official website that we have received a total of 13 complaint records from investors, all accusing Pocket Option of fraudulent behavior.

Finally, when attempting to gather more information about the company from the internet, we were disappointed to find it challenging to locate any detailed information about the company. No LinkedIn company page, no employee information—nothing at all.

These unfavorable facts indicate that Pocket Option is a fraudulent trading platform, and wikifx has given it an extremely low rating (1.50/10). To safeguard your funds, it is advised to stay away from it.

BlaFX

BlaFX claims to be a trading platform that prioritizes regulatory compliance, providing a relatively user-friendly environment for traders engaging in forex activities. It asserts to hold three licenses: Vanuatu VFSC (license number: 14663), United States NFA (license number: 0555533), and Australia ASIC (license number: 001302684). However, our disappointment arises when checking the latest information on these three licenses, as they all appear to be in abnormal states. This suggests that the broker may be facing significant issues.

Continuing our in-depth investigation, we discovered over 200 complaint records in the last three months, primarily accusing BlaFX of withdrawal difficulties. WikiFX displays these complaint records to alert more traders to stay away from this broker. In fact, demanding a 15% account deposit before withdrawals is an alarming strategy and should be a red flag for any trader. Legitimate trading platforms do not impose such arbitrary and excessive requirements on their users.

Finally, after thorough verification from multiple sources, it has been confirmed that BlaFX is currently out of business, and WikiFX has listed it as closed. Once it resumes operations, we will continue our investigation and promptly update the information.

CappmoreFX

According to the provided information, CappmoreFX is a brand under Cappmore Wealth Managers LLC. Established in 2022, CappmoreFX is a regulated forex and contract for difference (CFD) broker registered in Saint Vincent and the Grenadines. This implies that CappmoreFX operates without specific regulation, despite being registered and authorized by the Saint Vincent and the Grenadines Financial Services Authority (FSA). This is because the local government, SVGFSA, does not oversee the forex market and does not regulate or control forex companies registered there in any way.

Upon checking the official website of CappmoreFX, the broker claims to be regulated by the U.S. National Futures Association (NFA). Unfortunately, this license appears to be suspiciously cloned.

In the last three months, we have received 29 complaint records, with the majority of complainants expressing concerns about withdrawal issues. The CappmoreFX official website does not provide specific information regarding withdrawals.

Finally, it has come to our attention that the broker seems to be taking the first steps to continue its fraudulent operations by changing the company name from CappMoreFX to CappFX. They have set up automatic replies to email addresses, indicating that investors wishing to continue trading with CappMoreFX can migrate their accounts to CappFX. Just a few days later, the broker announced the new official message for CappMoreFX via email.

Upon verification, it is confirmed that CappMoreFX is currently in a suspended operational state, and we have marked it as such on the WikiFX official website. We will continue to monitor the announcement of their new broker, CappFX, and strive to expose every case of forex fraud.

Deriv

Deriv is a company registered in Malta, commonly known as Deriv.com, with the official name Binary.com. In 2013, Binary.com rebranded as Deriv. It claims to hold three licenses from three different regulatory authorities, ostensibly showcasing the broker's legitimacy.

However, as we delved deeper into our research, we obtained a contrasting impression. The three regulatory authorities are the Malta Financial Services Authority (MFSA), the Vanuatu Financial Services Commission (VFSC), and the British Virgin Islands Financial Services Commission (BFSC). All three have flagged Deriv as a suspected clone. These clone brokers often deceive traders by using the names, logos, and websites of well-known and reputable brokers.

Upon further investigation of the company's website, we found that Deriv omits many crucial details about its trading terms and conditions. Instead, it compensates for this lack of information through appearance and visual effects.

In the last three months, we have received 29 complaint records, all exposing Deriv's deceitful practices. These scams include issues such as withdrawal difficulties, arbitrary closure of trades, and the use of misleading advertisements to attract deposits.

In addition, we have also discovered that many regulatory authorities have blocked the Deriv.com domain. This further reinforces our belief in fraudulent activities by this broker.

Considering this negative information, WikiFX has placed Deriv on our blacklist (1.47/10), and investors are strongly advised to stay away.

Otto Forex

Otto Forex is a brokerage firm based in the United Kingdom with a history of 2-5 years. The broker claims to be regulated by the NFA; however, our inquiry into its regulatory status shows it to be unlicensed. This indicates that the broker is currently operating without regulation.

The actual address provided on their official website is not accessible, and customer support is unreachable. Additionally, the broker does not disclose a public phone number or email address. Legitimate investment brokers do not undermine public relations by hiding such essential information.

In the last three months, we have received 10 complaints from traders. While the number may not be substantial, each complaint strongly accuses the broker of fraudulent behavior, primarily related to withdrawal issues.

Considering this negative information, WikiFX has placed Deriv on our blacklist (1.33/10), and investors are strongly advised to stay away.

RallyTrade

The RallyTrade brand is managed by FRNG Nigeria, headquartered in Lagos. RallyTrade is an international online broker that offers services in emerging markets. RallyTrade claims to provide its clients with the latest technology, low trading fees, various financial instruments, extensive educational programs, trading platforms, and accounts tailored to individual client needs.

Due to the current absence of regulations governing online trading in Nigeria and the lack of a corresponding regulatory authority, RallyTrade has not obtained authorization from any other regulatory body. Consequently, RallyTrade has effectively been operating without a license.

During our review of the broker's official website, we noted that RallyTrade's customer promotional rewards are quite lucrative. They offer a 100% bonus for the first deposit, but the specific terms and conditions of this bonus are not easily accessible. A reputable broker does not conceal such important information.

Additionally, we observed some comments from online users, and these comments seem to suggest fraudulent activities by RallyTrade.

In conclusion, an unregulated broker never instills confidence. WikiFX has placed RallyTrade on its blacklist (2.21/10).

Is Forex Trading Legal in Nigeria?

Forex trading is legal in Nigeria and has become increasingly popular among Nigerian citizens in recent years. Brokers operating in Nigeria must comply with regulations and guidelines set by the government. The Central Bank of Nigeria typically oversees forex in the country, and forex brokers need to meet specific standards to operate there. However, unlike in other countries worldwide such as the UK or the US, forex regulation in Nigeria is not as stringent. Moreover, fraudulent brokers may operate without adhering to any regulatory rules. For traders, it is better to detect and avoid them early on than to recover losses afterward!

WikiFX provides traders with comprehensive ratings in five categories: License Index, Business Index, Risk Control Index, Software Index, and Regulatory Index. Before investing, it is advisable to check broker information and user reviews on WikiFX. You can also expose forex scams on WikiFX. WikiFX is committed to assisting you in exposing fraudulent activities and warning others to avoid falling victim. Additionally, it is recommended that scam victims seek assistance directly from local law enforcement or legal professionals.

WikiFX, a professional tool for checking forex broker information, is here to safeguard your investments!

How to View Complaints from Forex Traders?

Every day, thousands of forex traders post complaints on various social platforms. However, these complaints may not necessarily be truly helpful to you.

When traders incur losses, they often blame brokers, even if the brokers are regulated and treat them fairly. You should always approach former clients speaking ill of regulated companies with caution because, in most cases, clients are merely frustrated due to their own financial losses and are unwilling to accept responsibility. Their frustration is often misplaced, unrelated to the broker, and they need to reassess their trading strategies.

A common complaint involves brokers allegedly hunting for stop-loss levels. However, in most cases, the reality is that their stop-loss orders have already been executed, eliminated by normal market behavior.

Complaints that deviate from the situations described above are the ones you should pay attention to. For instance, reports about fraudulent forex brokers or exposure to scams are more relevant. Wikifx collects and organizes complaint information from various social platforms, presenting investors with the most genuine and reliable reviews. Utilizing wikifx can help you accurately filter out brokers engaged in unlicensed operations or poor regulatory practices.

What Are the Forms of Forex Scams?

In recent years, forex trading has rapidly gained popularity due to its high liquidity and potential for high returns. However, the decentralization and complexity of the forex market have also created opportunities for scams and fraudulent activities. Forex scams come in various forms, and fraudulent brokers may appear legitimate on the surface but employ various tricks to take advantage of unsuspecting traders.

Forex scams are commonly categorized into the following:

Unregulated, Unreliable Brokers Exploit Novice Traders:Unregulated and unreliable brokers often target inexperienced traders, taking advantage of their lack of knowledge and trust. These fraudulent brokers may engage in manipulative practices, such as sudden price spikes or delays in executing trades, leading to financial losses for unsuspecting beginners.

Ponzi Schemes/Pyramid Schemes: Deceptive Tactics Exploiting Deposits:Ponzi and pyramid schemes operate by using deposits from new investors to pay withdrawals for existing participants until the scheme collapses. These scams lure victims with promises of exceptionally high and consistent returns. It is crucial for traders to be cautious of investment opportunities that seem too good to be true and to conduct thorough due diligence before investing.

Bucket Shop Operations in Gambling:In bucket shop operations, illegal brokers position themselves against clients' trades and profit when clients incur losses. Essentially engaging in “bucketing” trades, these brokers do not execute trades on the open market, creating a conflict of interest that can lead to unfair practices and financial harm for traders.

False Trading Websites (Phishing):Fraudulent brokers may set up fake trading websites to deceive individuals, posing as legitimate brokers to trick users into providing sensitive information. This phishing technique involves creating imitation websites with similar designs and content to reputable brokers, making it challenging for traders to distinguish between the genuine and the fraudulent.

Self-Proclaimed “Gurus” Offering Expensive Seminars or Misleading Software:Individuals claiming to be “masters” may promote expensive seminars or software with exaggerated promises of foolproof trading strategies. These self-proclaimed experts often charge substantial fees for their services but deliver generic or inaccurate information. Traders should exercise caution and verify the credentials of anyone offering expensive educational programs or trading tools.

What is the Business Model of a Scam Forex Broker in Nigeria?

Scam forex brokers are companies established with the sole purpose of stealing funds from deposited clients. Their business model is quite straightforward:

A group of individuals engage potential clients 24/7 through social media.

Subsequently, “sales representatives” contact new traders via phone or messaging platforms like Messenger, Telegram, or WhatsApp, persuading them to deposit a small amount of funds with promises of six-figure profits.

Novice traders typically deposit only a few hundred dollars. Over the next few days, brokers inflate the available funds in your account to incredible amounts, such as $700,000. They claim to have executed profitable trades using your initial deposit to demonstrate the effectiveness of their trading system.

Sales tactics can be very aggressive, pressuring clients to deposit increasing amounts of funds. The catch is that you won't be able to withdraw a single dollar!

When attempting to withdraw the fictitious profits, they often inform you that you must first pay some form of tax and then prepay a certain amount, typically thousands of dollars.

Many fall for this trick, depleting their life savings. Most individuals panic and start seeking advice online. Often, it's too late, and at this stage, you have become a victim of an unregulated forex broker scam. Even if you report the case to local authorities, the chances of recovering your funds are minimal.

Unregulated forex brokers are elusive, with no headquarters, false contact information, and offshore bank accounts, leaving your funds lost without a trace.

How to Effectively Avoid Forex Scam?

To effectively avoid forex fraud, it is crucial to start by examining regulatory penalties. Pay attention to the following:

Is the Broker Regulated?Unregulated brokers are not required to report to regulatory authorities. If an unregulated broker deceives you in any way, be it through “minor glitches” or “malfunctions” causing system slippage, or unresolved fund withdrawals, you are left without recourse. Unregulated forex brokers operate without supervision and reporting to any regulatory body, leaving defrauded traders with minimal avenues for redress, aside from posting negative reviews.

If Regulated, How Credible is the Regulatory Authority?There are significant differences between various regulatory authorities. For example, licenses from authorities like the Financial Services Authority (FSA) in Seychelles have weaker regulatory efficacy compared to top-tier regulators like the Financial Conduct Authority (FCA) and the Australian Securities and Investments Commission (ASIC). Obtaining a license from the U.S. Commodity Futures Trading Commission (CFTC) for operations in the U.S. is more complex and costly, making it more critical than registration with the Financial Sector Conduct Authority (FSCA) in South Africa. Therefore, it's essential to thoroughly understand the level of scrutiny your chosen broker undergoes.

To assist investors in better discerning brokers, at wikifx.com, we have compiled information on over 50,000 forex brokers and more than 60 regulatory authorities. You can find comprehensive details about any broker you wish to investigate on our platform.

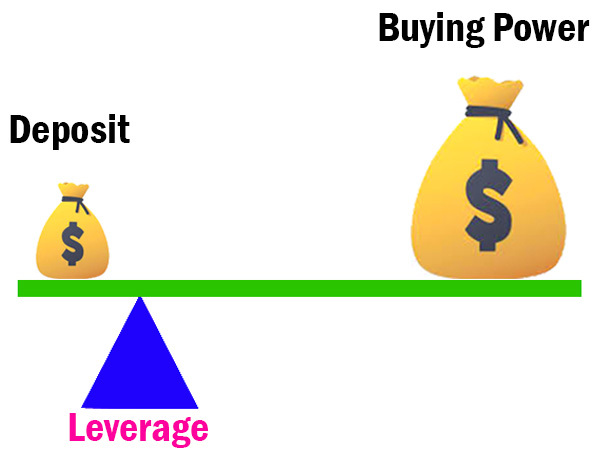

Why Do Scam Brokers Offer Excessively High Leverage?

Scam brokers offer excessively high leverage for several main reasons:

Attraction of Investors:Excessively high leverage serves as a tactic for false trading brokers to attract investors. By providing seemingly enticing leverage ratios, they aim to capture the interest of investors, leading them to believe they can easily achieve substantial profits.

Risk Concealment:False trading brokers may use high leverage to mask the actual risks associated with trading. Investors might be drawn in by the potential profits offered by high leverage, often overlooking the significantly elevated risks that come with such trading practices.

Boosting Trading Volume:High leverage can incentivize investors to engage in larger-scale trades, thereby increasing the overall trading volume for the broker. False trading brokers may leverage high ratios to stimulate investor activity, consequently augmenting their own income through increased trading volumes.

Appealing to Small Capital:High leverage can attract investors with limited capital, as it allows them to execute trades on a larger scale. False trading brokers may accumulate more funds by enticing a significant number of investors with relatively small capital.

Increasing Fee Revenue:Excessive leverage implies larger trade sizes, resulting in higher transaction fees. False trading brokers may utilize high leverage to enhance fee revenue, potentially compensating for legal and regulatory risks they might face.

Investors should remain vigilant against the excessively high leverage offered by false trading brokers, as it may serve as a potential red flag for risk. When selecting a trading platform, priority should be given to regulated and legitimate brokers rather than solely pursuing the potential returns associated with high leverage.

Disclaimer

Traders need to understand and remember that Contracts for Difference (CFDs) are leveraged and complex products, which may involve the risk of incurring losses exceeding the trader's initial deposit. Traders must ensure that they comprehend their own risk exposure and should assess whether the risks involved are suitable for them before making trading decisions that could potentially lead to capital losses.

Bottom Line

As the forex market continues to evolve, forex scams are becoming increasingly prevalent, especially in African countries like Nigeria. This article, based on comprehensive scores in five categories—License Index, Business Index, Risk Control Index, Software Index, and Regulatory Index—has identified the lowest-rated 10 scam and fake brokers. It is strongly advised to steer clear of them when selecting a broker.

Of course, junk brokers extend beyond these ten, with several others not listed here. We are unable to provide an exhaustive list. Therefore, for more information, feel free to visit our website (https://www.WikiFX.com/en) or download the WikiFX APP immediately.

You Also Like

Best Forex Brokers in Turkey for 2024

Review top 9 forex brokers in Turkey, elevating their trading pros and cons to give traders more useful guidance.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Swiss Forex Brokers for 2024

Explore top 10 forex brokers in Switzerland, elevating their trading pros and cons to give traders more useful guidance.

Best Stock Brokers in the US for 2024

When choosing an online broker, finding the platform that best fits your investment needs is crucial. With the rise in popularity of online trading, more brokers are offering free stock trading and commission-free transactions for various assets. It has become a challenge for users to select suitable brokers.

Best CySEC Regulated Forex Brokers 2024

Delving into CySEC-regulated forex trading, this article presents a top 9 list of brokers, spotlighting the benefits of regulatory compliance.

8 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 8 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Forex Brokers in 2024

Guide to the most trusted Forex brokers, with a thorough investigation into their quality, security measures, and financial transparency.