The world of online trading, particularly forex, has seen a surge in popularity, attracting both seasoned investors and newcomers alike. Unfortunately, this growth has also led to a proliferation of fraudulent brokers, preying on unsuspecting individuals. In the UK, despite stringent regulations, numerous fake forex brokers continue to operate, deceiving investors and causing significant financial losses.

One recent example is the “Kube Trading” scheme, which was exposed by the Financial Conduct Authority (FCA) in April 2024. The operators of this unauthorized investment scheme defrauded investors out of over £2.67 million by making false claims about the scheme's profitability and the safety of their funds.

This article will shed light on the tactics employed by these fraudulent brokers, provide a list of known fake forex brokers operating in the UK, and provide guidance on how to protect yourself from such scams.

10 Fake Forex Brokers in the UK

Pros: 500 times flexible and high leverage offered , allowing traders to have more trading flexibility.

Cons: A fake broker with fake license, hiding core trading conditions, operating in gray.

Pros: Friendly threshold to enter international markets, only $100 required, plus, generous leverage up to 1:1000.

Cons: A short-time operating broker with fake license established purely for clients' pockets.

Pros: Easily accessible, $1 to start real trading, allegedly competitive spreads from 0.3 pips.

Cons: Fake broker under no regulation, offering terrible trading conditions, high slipppage occur often.

more

Comparsion of 10 Fake Forex Brokers in the UK

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

10 Fake Forex Brokers in the UK Overall

So, here we begin to explore why they're labeled as fake. Among these 10 brokers are International Forex, Node Capital Group, INFINOX, CXM Trading, FXfortrade, PU Markets Ltd, OneTrade, Forexmax, Ava Trade MT5, and MahiMarkets. They all wear a mask of deceit, flaunting counterfeit licenses, providing abnormal trading conditions, and operating in a shady and furtive manner.

| Fake Brokers | Logo |

Why are they Fake Forex Brokers in the UK? |

| International Forex |  |

❌ Fake FCA License, extremely short of operation history. ❌ Unaccessible official website, worrisome contact information. ❌ A whopping of 94 scam exposures on WikiFX. |

| Node Capital Group |  |

❌ Fake NFA license, only operating 1-2 years, established purely for quick money. ❌ Unaccessible offcial website, poor customer support only available in email support. ❌ 12 pieces of scam exposure on WikiFX, a fake broker with a bad reputation. |

| INFINOX |  |

❌Fake FCA license, with a fake office address, born to scam traders. ❌ Unaccessible official website, a counterfeit MT4 platform, making it a dangerous broker to steel clear of. ❌ 7 scam exposures on WikiFX, a notorious forex broker operating in an injurious way. |

| CXM Trading |  |

❌Fake FCA license, operating for 1-2 years only, pure here to scam traders. ❌ Unknown minimum deposit and trading platform, casting significant shadows on its fakeness. ❌ High leverage up to 500:1, not a kind offering, aiming to drain traders' pocket. |

| FXfortrade |  |

❌ Multiple fake licenses, ASIC, FCA, CYSEC, NBRB, making it a 100% fake broker. ❌High minimum deposit of $5000, revealing its true face of extracting money from traders' pockets. ❌ Unknown trading software and inaccessible official website, operating blackheartedly. |

| PU Markets Ltd |  |

❌ A newly established broker with a fake NFA license, eyeing traders' pockets covetously. ❌ Official website no longer works, nakedly showing that this fake broker is operating in gray. ❌ High leverage of 500 times, not an abnormal option for a broker who claims to be registered in the UK |

| OneTrade |  |

❌Fake FCA License, a typical fake forex broker here to scam traders. ❌Undisclosed trading software and unknown minimum deposit, this broker operatin in sunless area. ❌ A disappointing on-site investigation revealing this fake broker's true face. |

| Forexmax |  |

❌ Fake FCA license, lack of core trading conditions, like trading software, minimum depsoit, a shady broker. ❌ High leverage up to 1:500, a disregard for clients profits, shady contact info. ❌ Unaccessible official website, purely here to scam traders for quick gains. |

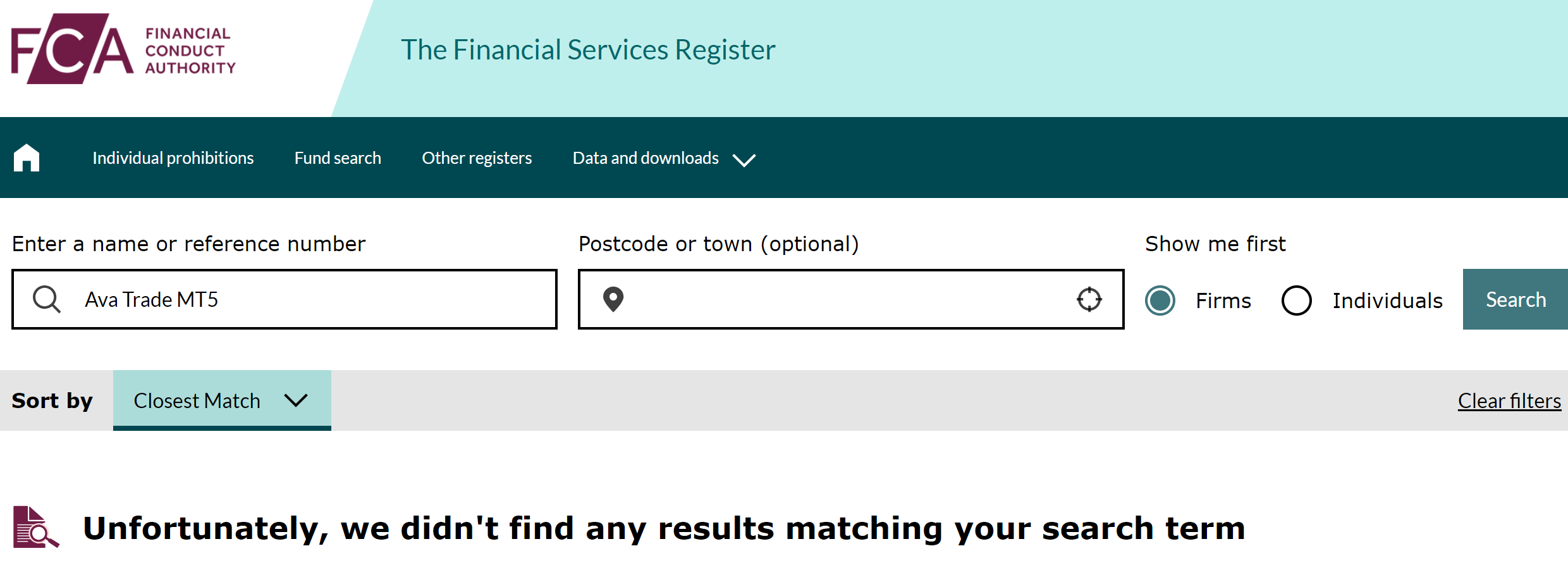

| Ava Trade MT5 |  |

❌An extremely young broker with fake ASIC and FSA License, purely established for extracting money. ❌ Fraud records have been exposed, citing that this broker restricted traders from withdrawing their funds. ❌High leverage without following FCA regulation, and inaccessible official website, illustrating this broker's shadiness. |

| MahiMarkets |  |

❌ Multiple fake licenses, indicating this broker's intent to deceive unsuspecting traders. ❌Confusing official websites, so typical of a fake broker. ❌ Several scam exposures cementing its deceptive nature. |

Overview of Top 10 Fake Forex Brokers in the UK

International Forex

| Broker |

International Forex |

Registered Country |

United Kingdom |

Establishment of Years |

2-5 Years |

Regulation |

No (Fake NFA license) |

Minimum Deposit |

Unknown |

Trading Platforms |

MT5 White Label |

Max. Leverage |

1:500 |

Official Website |

https://www.internationalforex.vip |

Scam Exposures on WikiFX |

94 Pieces |

Contact Information |

support@international-forex.co m+1 (318)491-8005 |

Fake NFA License: Holding an NFA fake regulatory agency license—an issue of concern. The company asserts possession of an NFA license, yet in truth, lacks the necessary certification. Moreover, while claiming registration in the UK, it operates without regulation by the FCA. The use of counterfeit regulatory licenses is a prevalent tactic in numerous scams, aimed at misleading customers into believing in their legitimacy and compliance. This presents a big red flag in the industry.

Short Operation History: Operating for a short duration, it claims to have been in operation for 2-5 years, yet this is highly likely a newly established company, leveraging an exaggerated operational tenure to bolster trust and authority. Typically, legitimate brokerage firms typically have a longer operating history, such as XM, Exness, FP Markets, which have been operating for at least 10 years or more.

Vast Scam Exposures: The Exposure section is posted as a word of mouth received from users on WikiFX. Horribly, the fake broker, International Forex, has up to 94 exposure records on WikiFX, indicating a substantial number of clients have reported significant issues and deliberate fraud. Victims have expressed their inability to withdraw funds from this platform, clearly indicating that this platform is far from being legitimate.

Unacessible Offcial Website: As a company professing 2-5 years of operation, one would expect a trove of genuine customer feedback and interaction records on its official forum. However, the closure of its official website has severed open channels for customer communication, making it notably arduous to ascertain its authenticity and credibility. There's a likelihood that it deliberately shut down its web servers to evade scrutiny while masking the fact that the official website was constructed using false information.

White Label MT4: International Forex applies the white-label MT5 platform, a concerning choice. This platform is easily manipulated and prone to fraudulent practices. Scammers can effortlessly exploit it, while customers find it challenging to scrutinize and authenticate transactions.

Excessively High Leverage: Offering excessively high leverage, a risky proposition. A leverage of 500 times indicates customers are highly susceptible to margin calls, significant losses, and the daunting task of retrieving their principal funds. This aligns perfectly with the objectives of fraudulent schemes seeking financial gain.

Invalid Contact Info: Contradictions in the registration location and contact phone number—a may be glaring inconsistency indeed. The company asserts its registration in the UK, yet its contact number originates from the United States. Typically, a company registered in the UK would operate with a customer service phone number corresponding to a British or local UK number.

Node Capital Group

| Broker | Node Capital Group |

Registered Country |

United Kingdom |

Establishment of Years |

2-5 Years |

Regulation |

No (Fake NFA license) |

Minimum Deposit |

$100 |

Trading Platforms |

MT5 White Label |

Max. Leverage |

1:1000 |

Official Website |

http://www.ncgforex.com/zh-hk/ (Unaccessible) |

Scam Exposures on WikiFX |

12 Pieces |

Contact Information |

support@ncgforex.com |

Fake NFA License and No regulation: This company holds a counterfeit NFA regulatory agency license. While asserting possession of an NFA license, it remains uncertified. Furthermore, despite claiming registration in the UK, this brokerage lacks regulation by the FCA. The use of counterfeit regulatory licenses is a common ploy in many scams, aimed at deceiving customers by creating a false façade of legitimacy and regulatory compliance.

Short Operation Time:This brokerage claims to have been in operation for 2-5 years, yet based on its domain registration date, it's evident that this brokerage is actually newly established. Many fraudulent brokers have recently been founded, having a short operational history. Avoiding regulatory scrutiny and swiftly gaining profits within a short period are common objectives for many deceptive brokers.

12 Pieces of Scam Exposures: On WikiFX, “Exposure” is posted as a word of mouth received from users. This fake broker has been exposed in 12 scam cases, all of which are backed by tangible evidence. Victims have faced issues such as being unable to withdraw funds and experiencing threats from account managers. For more detailed information, you can check out WikiFX.

The lure of $100 to start: The extremely low entry deposit of $100 indicates their aim to swiftly lure customers into falling prey by easing requirements (“lowering the bar”).

Sky-high leverage up to 1:1000: This broker offers an unbelievable 1000:1 leverage—extremely risky in forex. With this sky-high leverage, even minor market swings can trigger catastrophic losses, plunging traders into a financial freefall without a safety harness.

White Label MT4: Using a third-party white-label MT5 platform, one must note, makes it susceptible to manipulation by unscrupulous individuals. These wrongdoers often fabricate false trading signals to mask the actual trading scenario, presenting a concerning situation for users.

Unacessible Offcial Website:The official website's failure to open or be accessed hints at a tactical move. It seems their intention might be to gain short-term profits through a counterfeit interface before potentially closing down or relocating operations. This maneuver allows them to dodge sustained public scrutiny, creating a precarious situation for potential clients.

Limited Customer Support: Providing solely an email as a contact method, I must emphasize, leads to significantly low transparency regarding genuine background information. This lack of communication channels hinders the verification of the company's legitimacy, leaving potential clients in the dark about essential details.

INFINOX

| Broker | INFINOX |

Registered Country |

United Kingdom |

Establishment of Years |

2-5 Years |

Regulation |

No (Fake FCA license) |

Minimum Deposit |

£1 (STP/ECN account), $5,000 (futures CQG account) |

Trading Platform |

MT4, a counterfeit version |

Official Website |

http://www.infinox-dealer.com/en (Unaccessible) |

Scam Exposures on WikiFX |

7 pieces |

Contact Information |

mail@infinox-dealer.com |

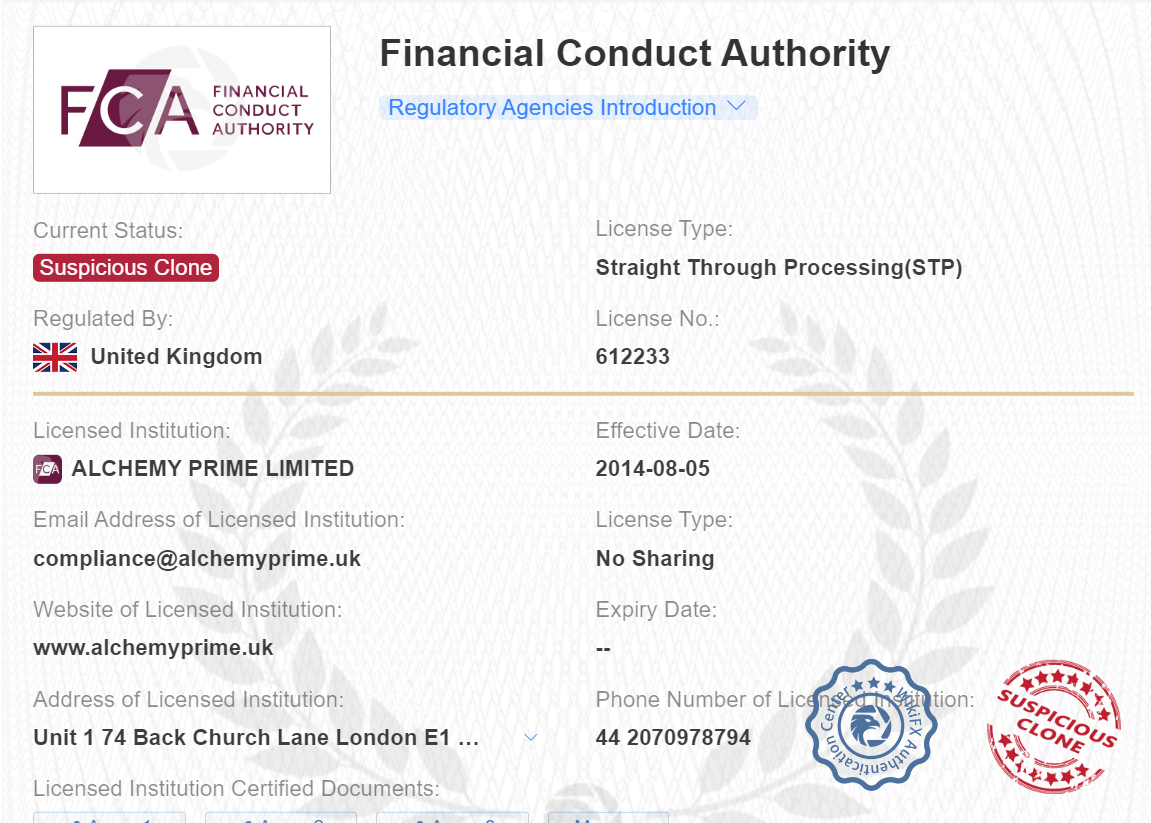

Fake FCA License: This INFINOX proclaims to have obtained a license from the UK's FCA, yet upon serious verification within the FCA database, no trace of its registration or regulation surfaces. This seemingly common tactics to a forged FCA license, designed to project a facade of legitimacy and compliance, ultimately facilitating a smoother path to deceive customers and access their funds. This counterfeit INFINOX entity has adopted the licensed identity of another authorized brokerage, INFINOX. However, it's crucial to note the distinction: the legitimate brokerage INFINOX's domain is https://infinox.co.uk/en, whereas this entity's domain is http://www.infinox-dealer.com/en.

Disappointing Field Survey: WikiFX's on-site investigation team visited the purported address of the counterfeit INFINOX, only to discover that the address provided by this brokerage simply does not exist.This means the operational address claimed by this brokerage does not have any physical existence. The operational address is closely linked to the tangible existence and asset structure of a company. The absence of an office or any physical operational space suggests that the company's scale and operations might be too small, rendering it insufficient to be deemed a trustworthy trading platform. Furthermore, the lack of an actual address could be a deliberate attempt to conceal information, as specific addresses are more susceptible to investigation and tracking by relevant authorities. Such evasive tactics aimed at avoiding regulatory scrutiny are common among various types of non-compliant or fraudulent companies.

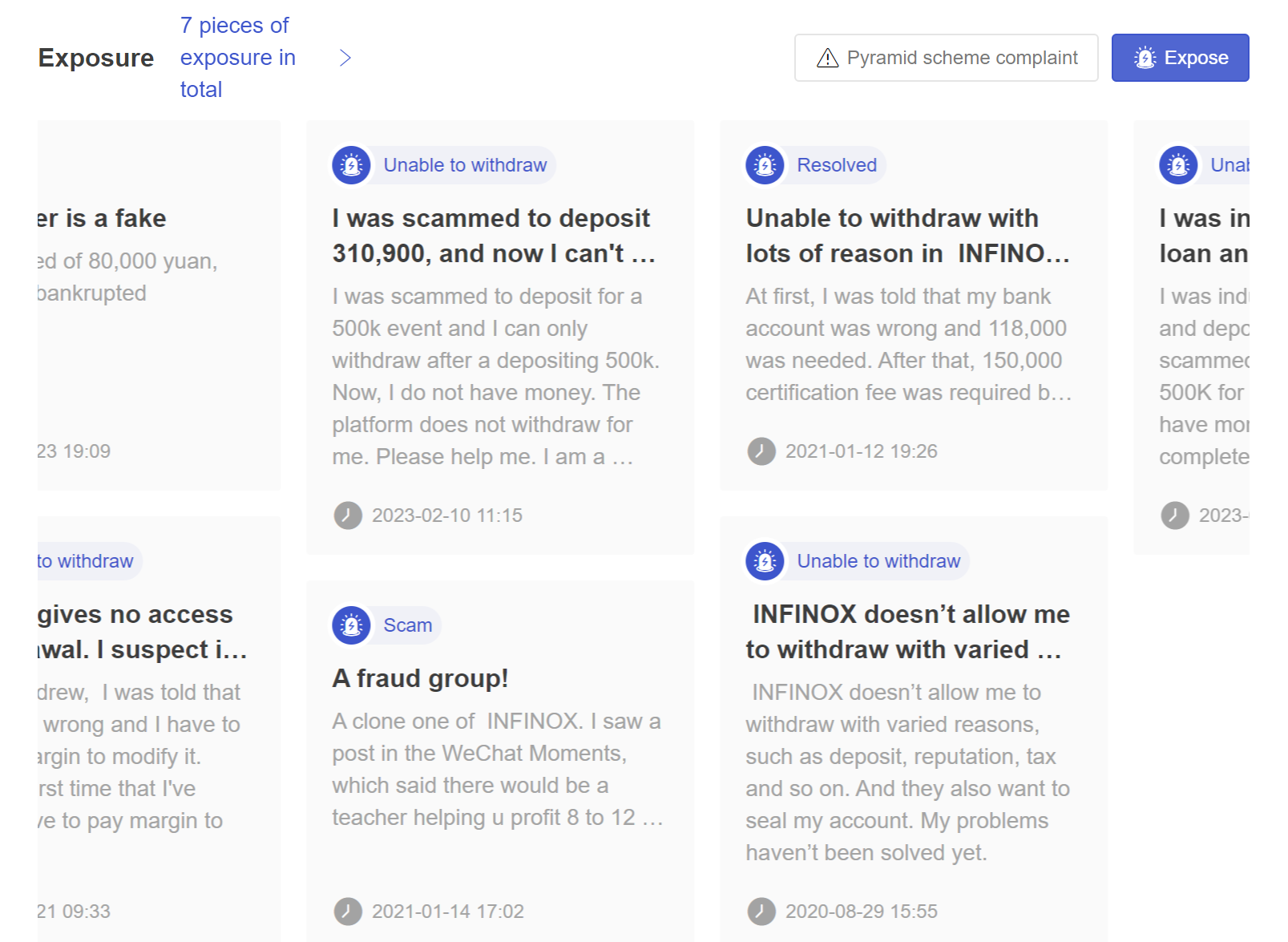

7 Scam Exposures: On WikiFX, “Exposure” is posted as a word of mouth received from users. INFINOX has accumulated seven scam exposures thus far, shedding light on a significant problem: the platform's obstruction of client withdrawals. This conduct is truly alarming, showcasing a blatant intention to withhold funds, essentially indicating a clear motive to abscond with clients' money.

Exaggerated Operational Experience: The tendency to fabricate experience often marks schemes aimed at swiftly attracting investors' funds. Take platforms like Infinox, claiming 2-5 years' establishment. Such claims commonly exaggerate to entice investors. The harsh reality might be a recently formed company, focusing solely on short-term financial gains.

Discrepancies in Minimum Deposits: Now, the disparity in minimum deposit requirements serves as a well-known ploy. While a standard account might require a mere £1, another account sets a high threshold, masquerading as a mark of expertise. In reality, the segregation of funds between accounts becomes bafflingly indistinguishable.

Counterfeit MT4 Trading Platform: The use of manipulated imitation software, such as a counterfeit MT4 platform, aids in fraud by generating deceptive trade records to perplex clients.

Inaccessible Official Website: The fact that you can't access the platform's website indicates they're not thinking long-term, showing they're only interested in quick profits before making an exit.

Solely Email Disclosure: The disclosure of only an email address conceals genuine background information, fostering an opaque environment ideal for executing fraudulent activities.

CXM Trading

| Broker | CXM Trading |

| Registered Country | United Kingdom |

| Establishment of Years | 1-2 Years |

| Regulation | No (Fake FCA license) |

| Minimum Deposit | Unknown |

| Trading Platforms | Unknown |

| Max. Leverage | 1:500 |

| Official Website | https://www.cxmtrader.com/# (Unaccessible) |

| Scam Exposures on WikiFX | No |

| Contact Information | support@cxmtrading.com |

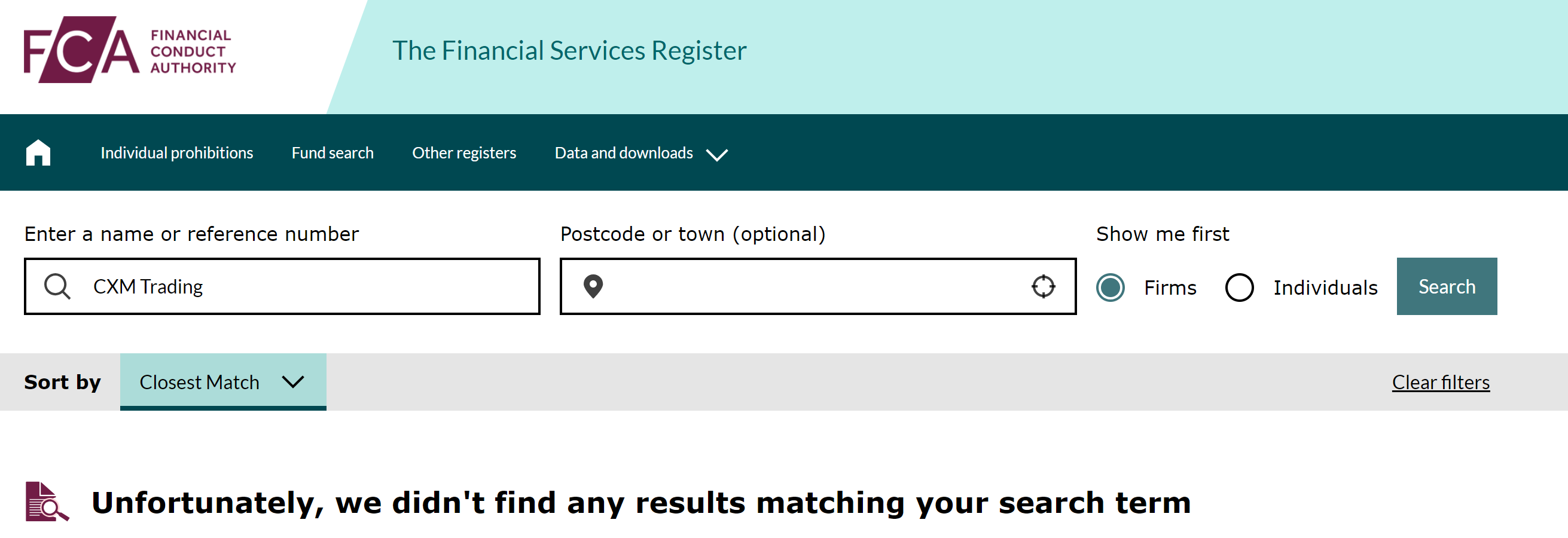

Fake FCA License: This CXM Trading claims to possess a UK FCA regulatory license, yet upon my additional check within the FCA's official disclosure system, I couldn't find any record of its registration. This practice of holding a fake FCA license is a common tactic employed by many fraudulent companies to create a facade of “legitimacy.”

Just 1-2 years of operation: This kind of short tenure for a new establishment clearly lacks the credibility that comes with time-tested performance and reputation. It's more susceptible to resorting to fraudulent practices for profit before building trust.

Undisclosed Minimum Deposit: The undisclosed minimum deposit requirement is quite telling. Institutions that avoid revealing this crucial information tend to lure in more clients who might fall prey to deception.

High Leverage Ratio-Offering an extremely high leverage of up to 1:500 is quite concerning. This puts clients at a higher risk of exceeding their limits, leading to potential losses and the fund recalls—an mumsan approach seemingly aligned with their profit-oriented motives.

Unknown Trading Software-Hiding details about the actual trading software platform—now, that raises red flags. It sparks suspicions about their possible tinkering with trade records, leaving us skeptical about their fair trading practices.

Unaccessible Offcial Website:The existence of a malfunctioning official website raises concerns about their long-term commitment. This circumstance implies a possible deficiency in either their intent or capability within the team to ensure sustained and smooth operations over an extended period.

Only Email Reachable: Relying solely on one email for contact is quite suspicious. This intentional concealment of genuine background information raises concerns about transparency and prompts serious inquiries into their legitimacy.

FXfortrade

| Broker | FXfortrade |

Registered Country |

United Kingdom |

Establishment of Years |

1-2 Years |

Regulation |

|

Minimum Deposit |

$5,000 |

Trading Platforms |

Unknown |

Official Website |

https://fxfortrade.com/ (Unaccessible) |

Scam Exposures on WikiFX |

No |

Contact Information |

https://www.facebook.com/FXFORTRADE |

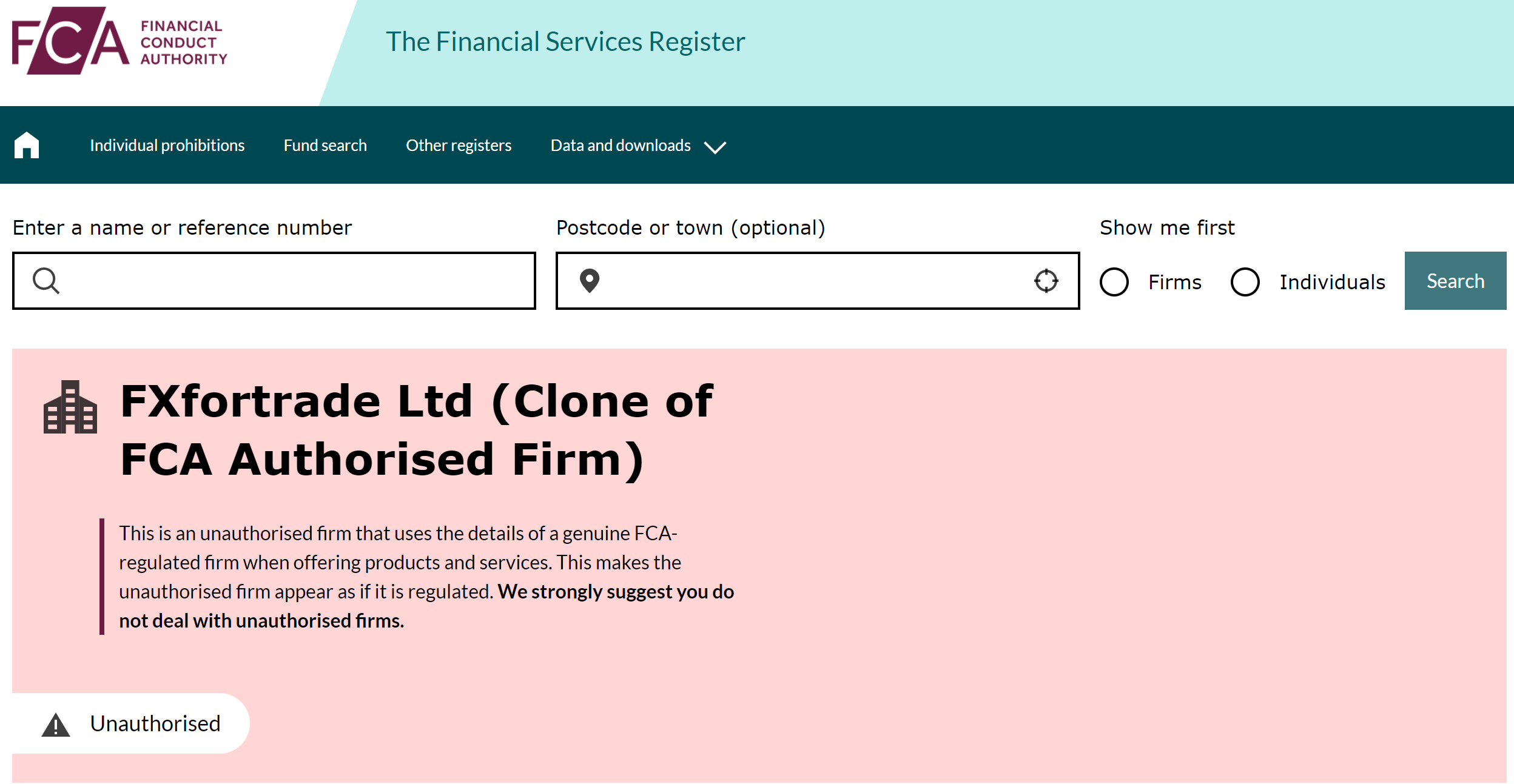

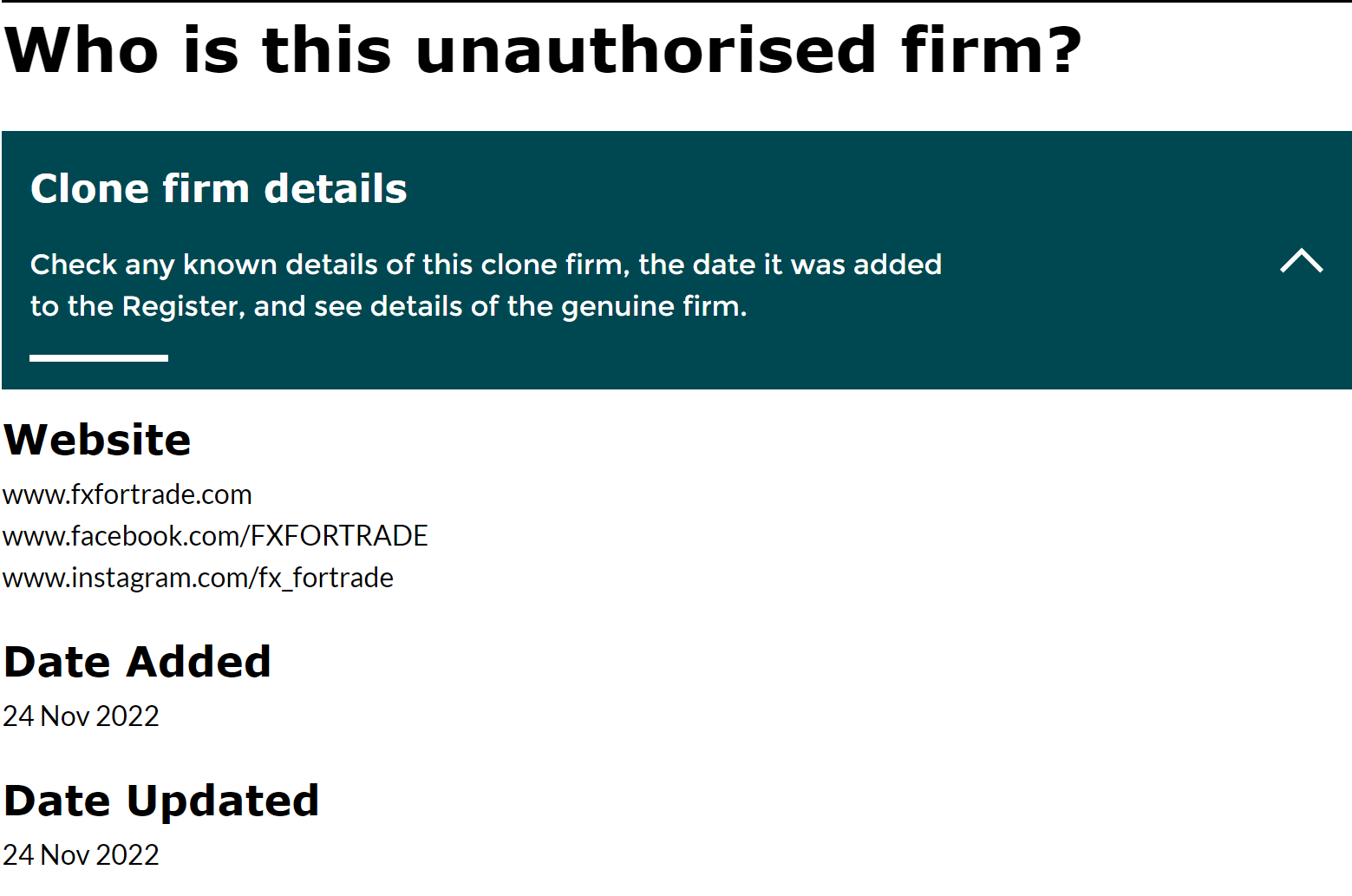

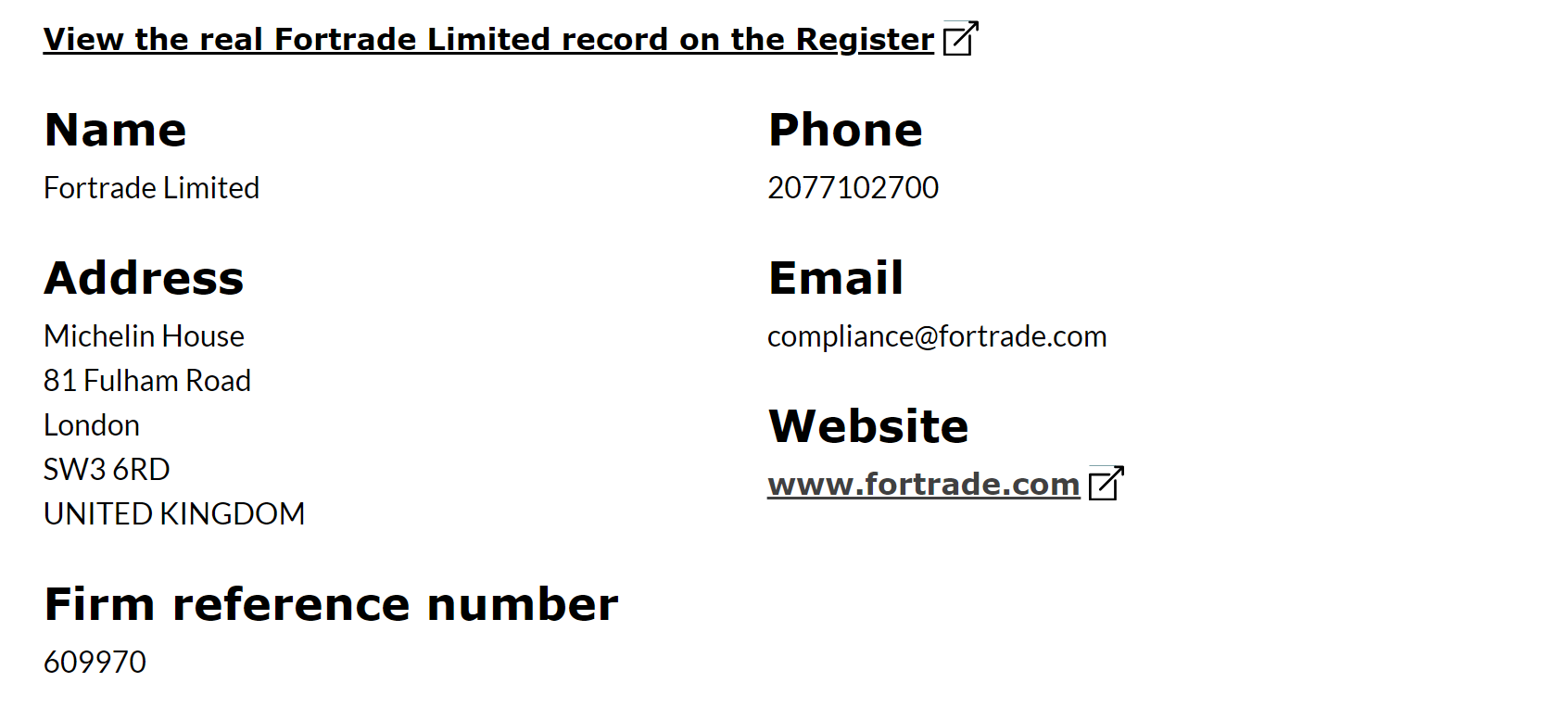

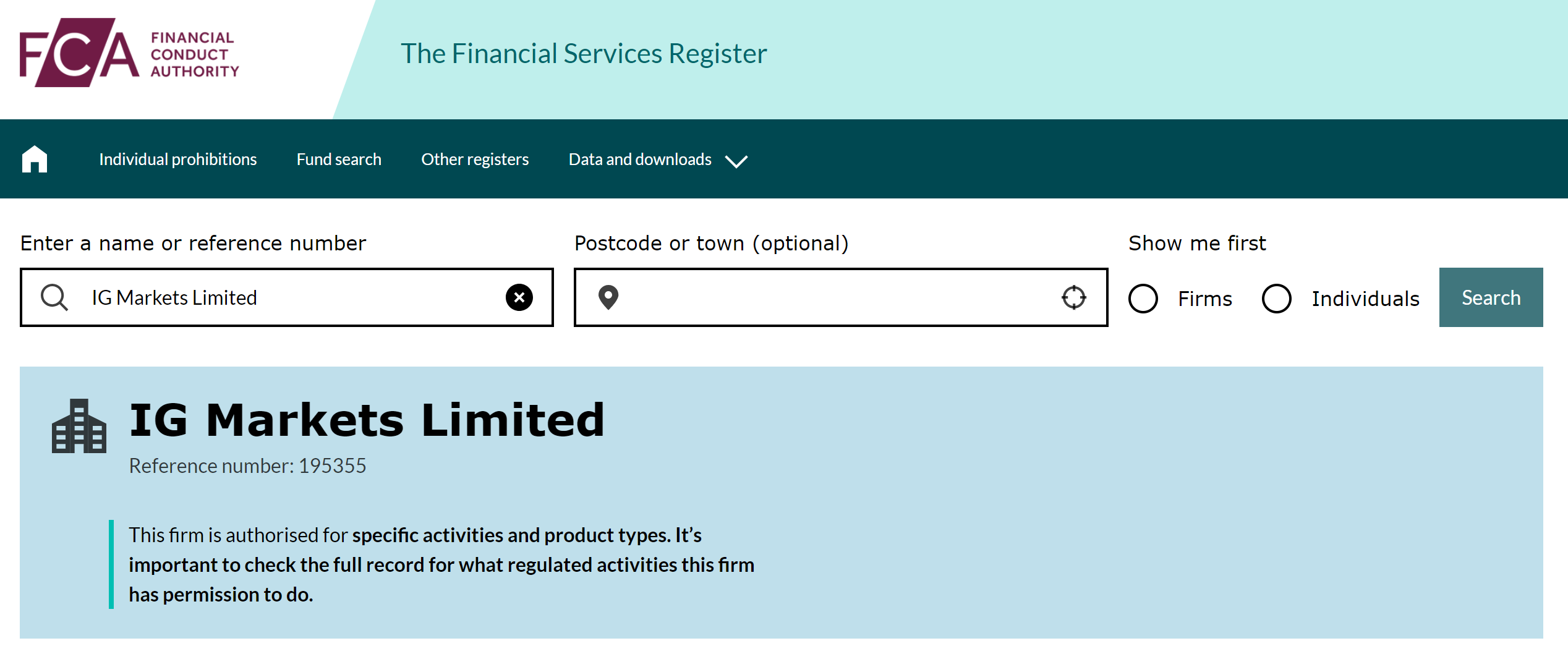

Multiple Fake Licenses: FXfortrade claims to hold licenses from multiple reputable regulatory bodies such as FCA, CYSEC, ASIC, NBRB, among others. However, upon verification within official databases, there is no record of its licensure. This practice of consolidating multiple “regulatory licenses” aims to visually mislead customers, creating a false impression of being exceptionally compliant. Yet, in reality, it is highly likely devoid of any genuine legitimacy.

Extremely Short Operation Time: Claiming an operational history of merely 1-2 years. Such a short tenure lacks credibility, seemingly designed for short-term fraudulent schemes aimed at quick gains while facilitating an escape before being exposed.

Sky-High Minimum Deposit: A notably high minimum deposit requirement of $5000 appears to create an illusion of “professionalism.” However, in reality, legitimate forex brokers seldom set such exorbitant thresholds. This tactic also facilitates swift closure after profiting from a select few high-deposit clients.

Unknown Trading Software: Complete non-disclosure of the actual trading software or platform provides ample room for illegitimate manipulation.

Unaccessible Official Website: The inability to access the official website similarly reflects its lack of intent for long-term business operations. Its primary objective seems to be the short-term creation of fraudulent schemes.

Unrelaible Customer Support: Relying solely on third-party social channels like Facebook and Instagram for promotion raises doubts. Legitimate brokers typically offer robust phone support, WhatsApp, or online chat services for solid client communication.

PU Markets Ltd

| Broker | PU Markets Ltd |

| Registered Country | United Kingdom |

| Establishment of Years | Within 1 Year |

| Regulation | Fake FCA License |

| Minimum Deposit | $20 |

| Trading Platforms | PU Markets Ltd Trading Central |

| Max. Leverage | 1:100 |

| Official Website | https://www.pufxmarkets.com/ (Unaccessible) |

| Scam Exposures on WikiFX | No |

| Contact Information | service@enjoypumarkets.com |

Fake FCA License: Despite its claim of holding an FCA license, a thorough check within the official registration system yielded no regulatory records. This use of potentially forged licenses is a red flag, often associated with fraudulent practices employed by dubious entities.

Short Exsistence: With a purported existence of less than a year, the entity's short operational history raises doubts about its ability to establish a robust track record or build credibility within the industry.

Unusual Low Minimum Deposit: The implementation of an unusually low minimum deposit requirement of $20 seems strategically aimed at appealing to a broad spectrum of potential customers with ease.

Anonymous Trading Software: While purportedly using the third-party Trading Central platform, there's no mention or recognition of their partnership status on the platform's official website. This situation heightens suspicions of potential manipulation through a self-created fraudulent platform.

Malfunctioning Offcial Website: The inaccessible official website further suggests an inclination toward abruptly severing connections after potentially reaping short-term fraudulent gains.

Weak Customer Support: Solely relying on a single email as the official contact method raises concerns about transparency and authenticity, hinting at a deliberate effort to conceal genuine background information.

OneTrade

| Broker | OneTrade |

| Registered Country | United Kingdom |

| Establishment of Years | 5-10 Years |

| Regulation | Fake FCA License |

| Minimum Deposit | Unknown |

| Trading Platforms | Unknown |

| Max. Leverage | 1:500 |

| Official Website | http://www.onetrade.com/ (Unaccessible) |

| Scam Exposures on WikiFX | No |

| Contact Information | support@onetrade.com+44(0)203 582 3171 |

Fake FCA License: First and foremost, this trading entity operates without any regulatory oversight, all the while pretending to fall under FCA regulation. However, upon thorough investigation on the official FCA platform, the broker's corporate identity is conspicuously absent, indicating a stark absence of regulatory oversight. The ostentatious display of a counterfeit FCA certification is, without a doubt, a prevalent deceitful tactic in the industry.

Disappointing Field Survey: The WikiFX investigative team visited the address claimed by this fake broker in the UK, only to be disappointed as the supposed location simply does not exist. This deliberate use of a false address by the company aims to confuse traders, a common tactic employed by such counterfeit entities. You can find detailed specifics in the investigation section on WikiFX.

Unaccessible Official Website:Legitimate trading firms typically offer easily accessible, high-quality official websites. Failure to access these sites often signals an attempt to conceal identity or evade regulatory oversight.

Undisclosed Minimum Deposit: OneTrade does not disclose its minimum deposit requirement. Indeed, the absence of this crucial trading detail further amplifies concerns of potential fraudulent activity.

500X High Leverage: With a maximum leverage ratio of 1:500, exceeding the FCA's allowed maximum of 1:30, this firm violates the stringent leverage restrictions set by the FCA to safeguard traders. Such exorbitant leverage displays a disregard for investor interests, a practice consistent with counterfeit trading entities.

Weak Customer Support: Providing only an email and virtual phone number as contact information without an office address or genuine phone number contradicts the operational norms of legitimate companies. This lack of transparency makes it challenging to trace the true identity of the firm.

Forexmax

| Broker | Forexmax |

Registered Country |

United Kingdom |

Establishment of Years |

5-10 Years |

Regulation |

Fake FCA License |

Minimum Deposit |

Unknown |

Trading Platforms |

Unknown |

Official Website |

https://www.pufxmarkets.com/ (Unaccessible) |

Scam Exposures on WikiFX |

No |

Contact Information |

max@forexmax.com info@forexmax.com +44 (0) 16 3436 487744 01634364877 |

Fake FCA License: The counterfeit FCA license is not listed on the official FCA website under this broker's name, indicating that this broker is not regulated by the FCA at all. It is an illegitimate trading entity.

Unaccessible Offcial Website: The official website is inaccessible. A regulatory compliant trading platform should have a functional website providing sufficient company information, trading rules, and other details for customers to verify. The inability to access this website undoubtedly indicates suspicions of this trading platform being counterfeit.

Unknown Trading Software: Complete lack of information about the trading software. Failing to disclose the type of trading terminal used further increases the potential for fraudulent activities.

Weak Customer Service: Only providing email and virtual phone numbers as contact methods without a genuine office address. This practice does not align with the operations of legitimate companies, making it difficult to trace their real identity.

Ava Trade MT5

| Broker | Ava Trade MT5 |

Registered Country |

United Kingdom |

Establishment of Years |

1-2 years |

Regulation |

|

Minimum Deposit |

$100 |

Trading Platforms |

Unknown |

Max. Leverage |

1:400 |

Official Website |

https://forexealavaup.top/ (Unacessible) |

Scam Exposures on WikiFX |

3 Pieces |

Contact Information |

support@foreaxu-avatg.com |

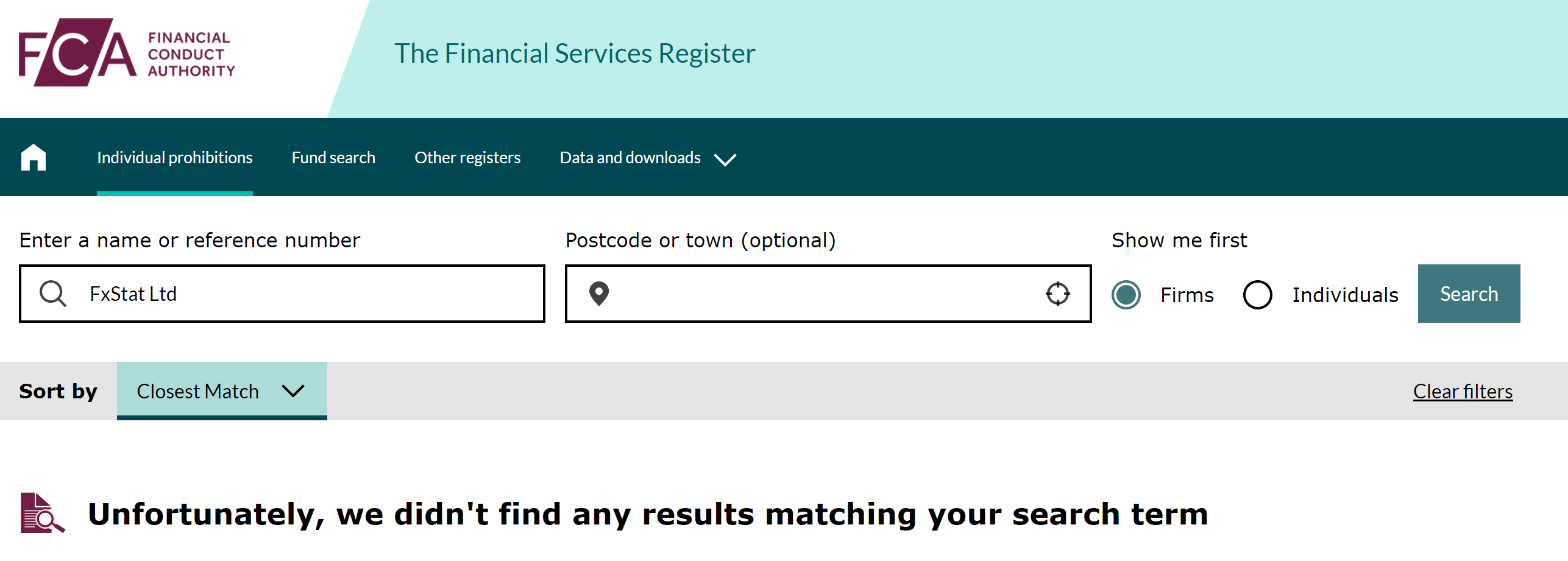

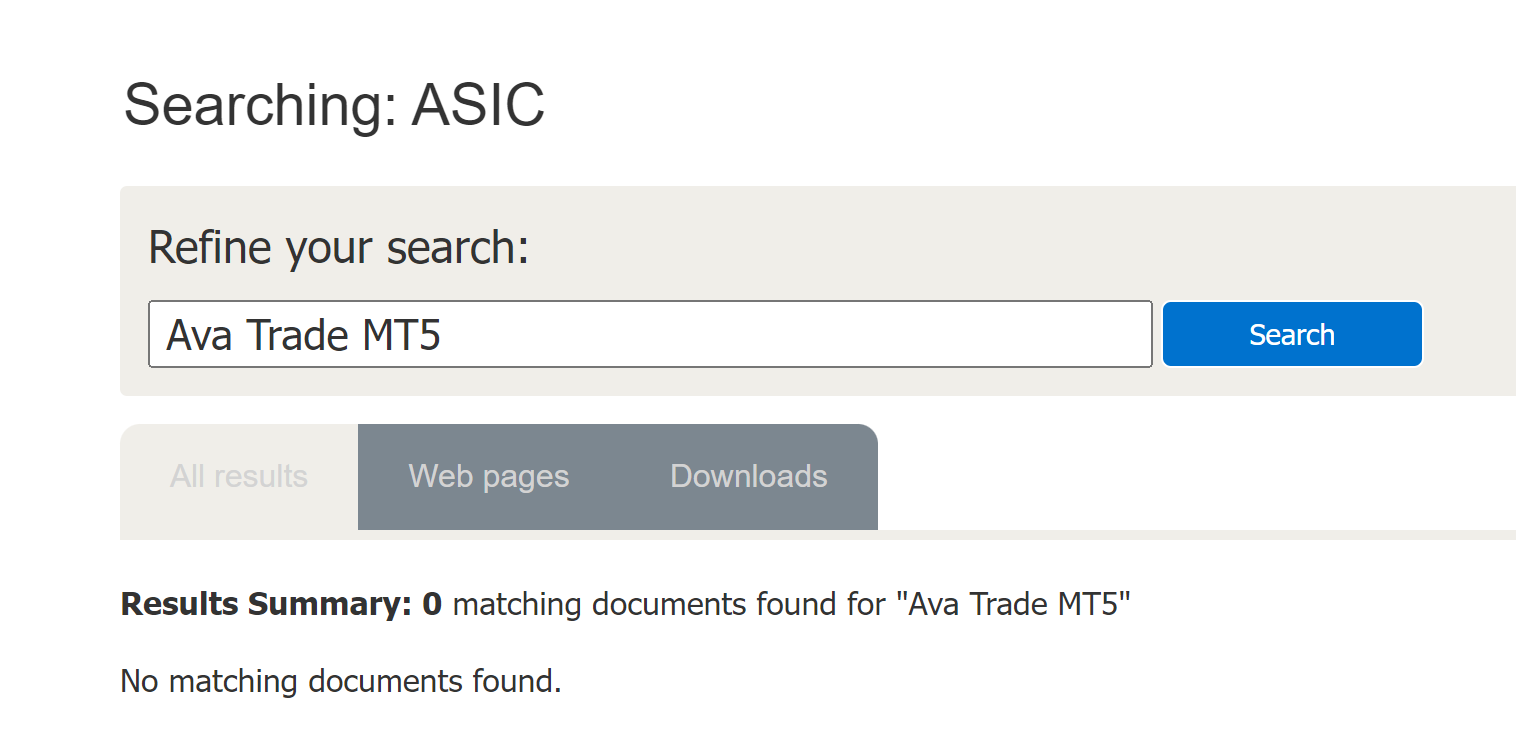

Fake ASIC & FSA License: Claims to hold regulatory licenses from both the Australian ASIC and the New Zealand FSA simultaneously. Considering the substantial time required for application, review, and acquisition of these licenses, this assertion is ridiculous. Furthermore, crucially, the name 'Ava Trade MT5' cannot be found registered under ASIC, FCA, or FSA, the regulatory bodies mentioned.

Short Operational Duration: Ava Trade MT5's operational duration is notably brief, claiming only 1-2 years in existence. This short timeframe does not align with the operational history expected of a legitimate trading platform. It appears highly probable that it was established with short-term fraudulent intentions.

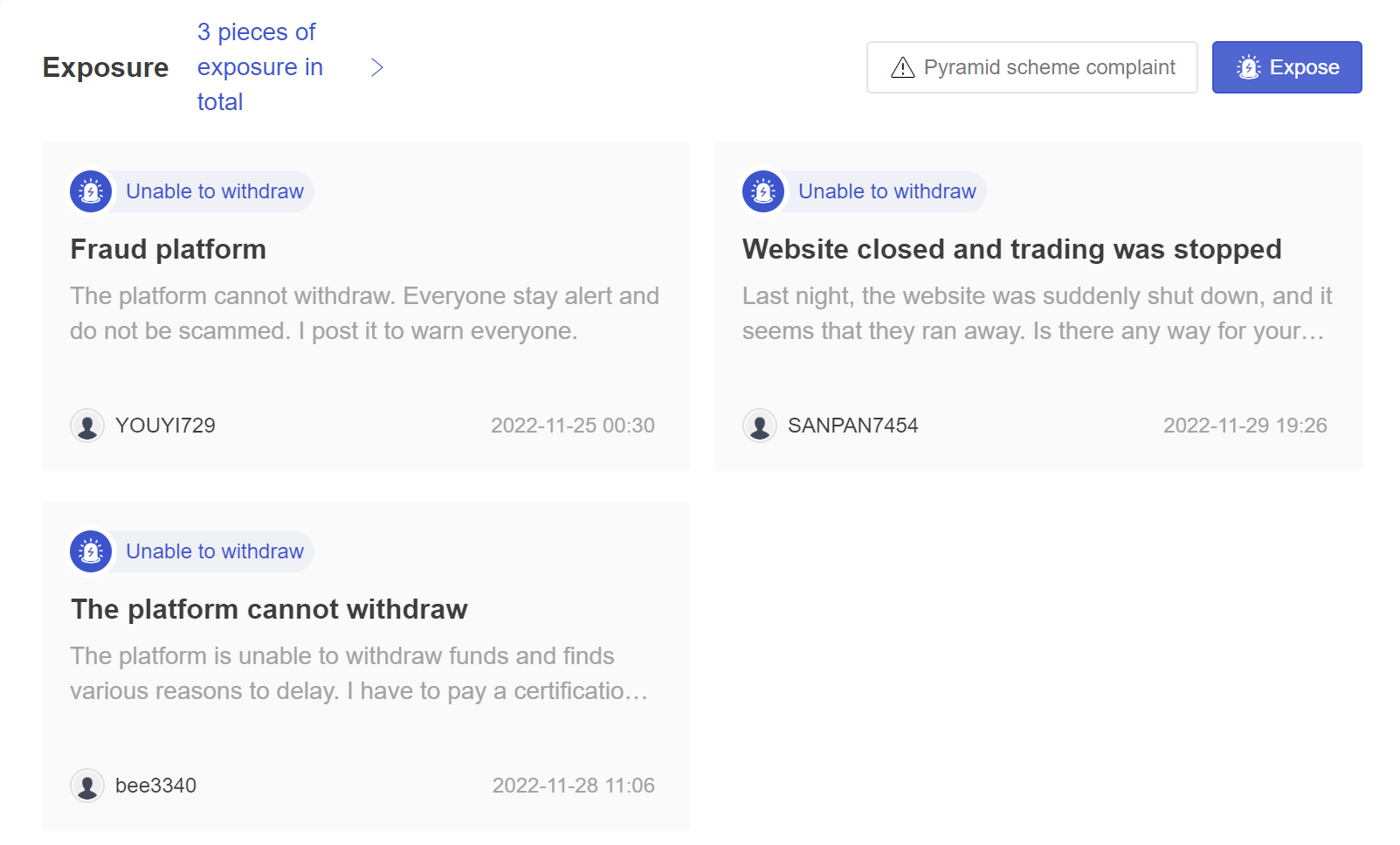

3 Scam Exposures on WikiFX: Three fraud records have been exposed on WikiFX. WikiFX stands as an authoritative global database for fraudulent trading entities. The exposure of multiple instances strongly indicates underlying issues.

Risk of High Leverage: Offering an exceptionally high leverage of 1:400, significantly surpassing regulatory requirements, demonstrates the platform's disregard for trading risks.

Shady Contact Info: Only providing an email as a contact method. The absence of a genuine office address or customer service telephone further escalates suspicions of potential fraudulent activities.

MahiMarkets

| Broker | MahiMarkets |

Registered Country |

United Kingdom |

Establishment of Years |

5-10 years |

Regulation |

|

Minimum Deposit |

$100 |

Trading Platforms |

Unknown |

Max. Leverage |

1:500 |

Official Website |

https://mahimarkets.com/ https://mahifx.com/ |

Scam Exposures on WikiFX |

3 Pieces |

Contact Information |

info@mahimarkets.com https://www.instagram.com/mahifx/ |

A series of Fake Licenses: Claiming to simultaneously hold licenses from the Australian ASIC, the UK FCA, and the New Zealand FMA regulatory bodies is essentially implausible. The application and acquisition process for these licenses are highly rigorous and time-consuming; therefore, asserting possession of all these licenses is far-fetched. Furthermore, the names of these trading entities cannot be found on the official websites of these regulatory bodies.

Poorly-rated Field Survey: The on-site inspection team from WikiFX conducted a physical survey based on the address claimed by this trading entity, only to discover that the actual address of this trader does not exist. This implies that the trading entity exaggerated and fabricated its real office location and operational scale to deceive traders. Therefore, in the WikiFX rating, this on-site inspection received an extremely poor evaluation.

9 Scam Exposures: On WikiFX, Exposure is posted as a word of mouth received from users. This trading entity has a total of 9 fraud records exposed, indicating a highly nefarious track record, portraying it as a fraudulent platform that does not allow users to withdraw funds.

High Leverage up to 1:500: Providing an excessively high leverage of up to 1:500 blatantly contravenes the maximum leverage requirements set by these regulatory bodies. This indicates substantial risks associated with its operational practices.

Confusing Official Website: There's conflicting information between websites, one being MahiMarkets and the other MahiFX. A legitimate company wouldn't display such confusion.

Poor Customer Service: The contact details only consist of email and vague social media accounts. Surprisingly, despite attempts to reach out, there's never any reply or response received.

Forex Trading Knowledge Questions and Answers

What are Common Signs of Fake Forex Brokers?

Fake brokers employ various tactics to confuse unsuspecting traders. Although each broker may wear a different facade, there are common signs that can help traders identify them:

Fake Licensing: Fake brokers often claim to be regulated by top-tier regulatory bodies such as FCA, ASIC, or NFA. However, their claims are false as these brokers' names cannot be found on the official websites of these regulatory bodies. They merely use the names of these reputable regulators without genuine authorization.

Fake Websites: These deceptive brokers mimic the content of legitimate broker websites, yet their domain names are entirely different. Their aim is to deceive by appearing legitimate while operating under a false identity.

Fake Minimum Deposit Requirements: Brokers often employ a bait-and-switch tactic at the outset to entice traders. Initially, they claim that trading can commence with minimal amounts. However, once users have registered and deposited funds, these brokers promptly raise the minimum deposit requirements. Subsequently, they allure traders with promises of high returns to encourage additional deposits.

Fake Trading Platforms: Counterfeit brokers often boast about providing access to renowned trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5). However, these claims are misleading, as their supposed offering of these platforms tends to be counterfeit and unauthorized. The versions presented by these dubious brokers lack the genuine credibility, reliability, and integrity associated with the authentic MT4 and MT5 platforms. Besides, fake platforms are often difficult to activate or log into, have basic interfaces, limited functionality, significantly higher spreads, unclear trading fees, frequent interruptions in trading data, and inconsistent prices.

Providing Excessive Leverage: Certain brokers make claims of offering exceptionally high leverage, particularly those purportedly registered in the UK. They advertise leverage ratios as lofty as 1:500 or even 1:1000. However, such assertions contradict the established maximum leverage limit set by regulatory bodies like the FCA, which typically caps leverage at 1:30.

Fake Company Backgroud: Their descriptions often contain vague or exaggerated details about their background. They might use false company names and fabricate board member identities. These brokers also claim to have a significant presence with fake addresses. WikiFX conducts on-site inspections to verify the legitimacy of forex brokers.

What are Major Differences between Fake and Legitmate Forex Brokers?

Features |

Fake Forex Brokers |

Legitimate Forex Brokers |

Regulation & Licensing |

❌ Unregistered illegally |

|

Reputation Online |

❌ Numerous negative reviews |

✅ Strong positive reputation |

Contact Information |

❌ Fake addresses provided |

✅ Real verifiable contact info |

Promised Returns |

❌ Unrealistically high returns |

✅ Reasonable or no stated promises |

Pressure Sales Tactics |

❌ High pressure “need to signup now” tactic |

✅ Let clients assess without pushing unnecessarily to deposit |

Trading Platform |

❌ Fake name or plagiarised platform |

✅ Recommended popular industry-leading platform, or propriety platform |

Trading Conditions |

❌ Hidden fee changes, reject withdrawals |

✅ Trustworthy no tricks in payouts or fees |

Customer Service |

❌ Unresponsive, unhelpful |

✅ Responsive, professional assistance |

Security of Funds |

❌ Money not segregated |

✅ Client funds kept safely in segregated account |

How do I Verify with a Forex Broker?

Confirm Regulation Status: Legit forex brokers should hold licenses from major regulatory bodies like Australia Securities & Investment Commission (ASIC) in Australia, or the Financial Conduct Authority (FCA) in the UK. You can check the regulator's website to validate they are registered before trading with them.

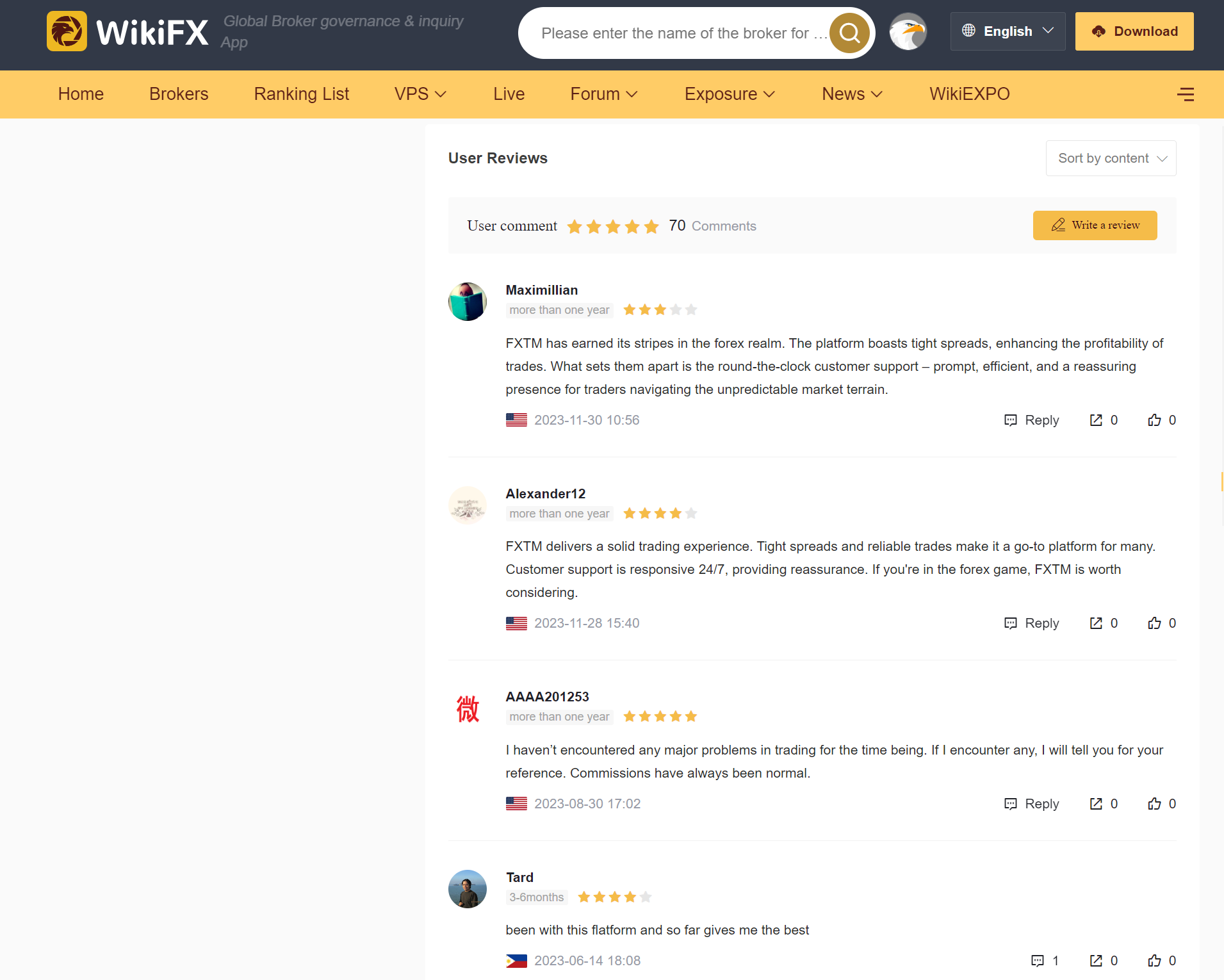

Research Online Reputation: Search for in-depth broker reviews on sites like TrustPilot, WikiFX. Look out for repeated mentions of issues like delayed withdrawals, poor customer service, technical problems on trading platforms etc. Avoid brokers with a trail of complaints. However, beware one negative review may not tell the whole story.

Compare Trading Conditions Side-by-Side: Major brokers usually offer similar trading conditions but the subtle differences matter. Scrutinize average spreads, commissions, account funding and withdrawal fees, platform features, leverage limits and more across 3-5 shortlisted brokers youre considering. List them out side-by-side in a table to compare easily.

Test Customer Support Response: As a novice, you‘ll likely need to tap on support often for questions. Contact each broker’s helpdesk by phone, email and live chat at different times of day to gauge responsiveness. Ask some basic questions you have and see if the agent provides satisfactory answers in a prompt and professional manner.

How do I Get Money from a Fake or Scam Broker?

Typically, engaging with fake or scam brokers results in irreversible financial losses. These deceptive entities often establish transient domains to orchestrate trading manipulations, swiftly disappearing after defrauding substantial sums of money.

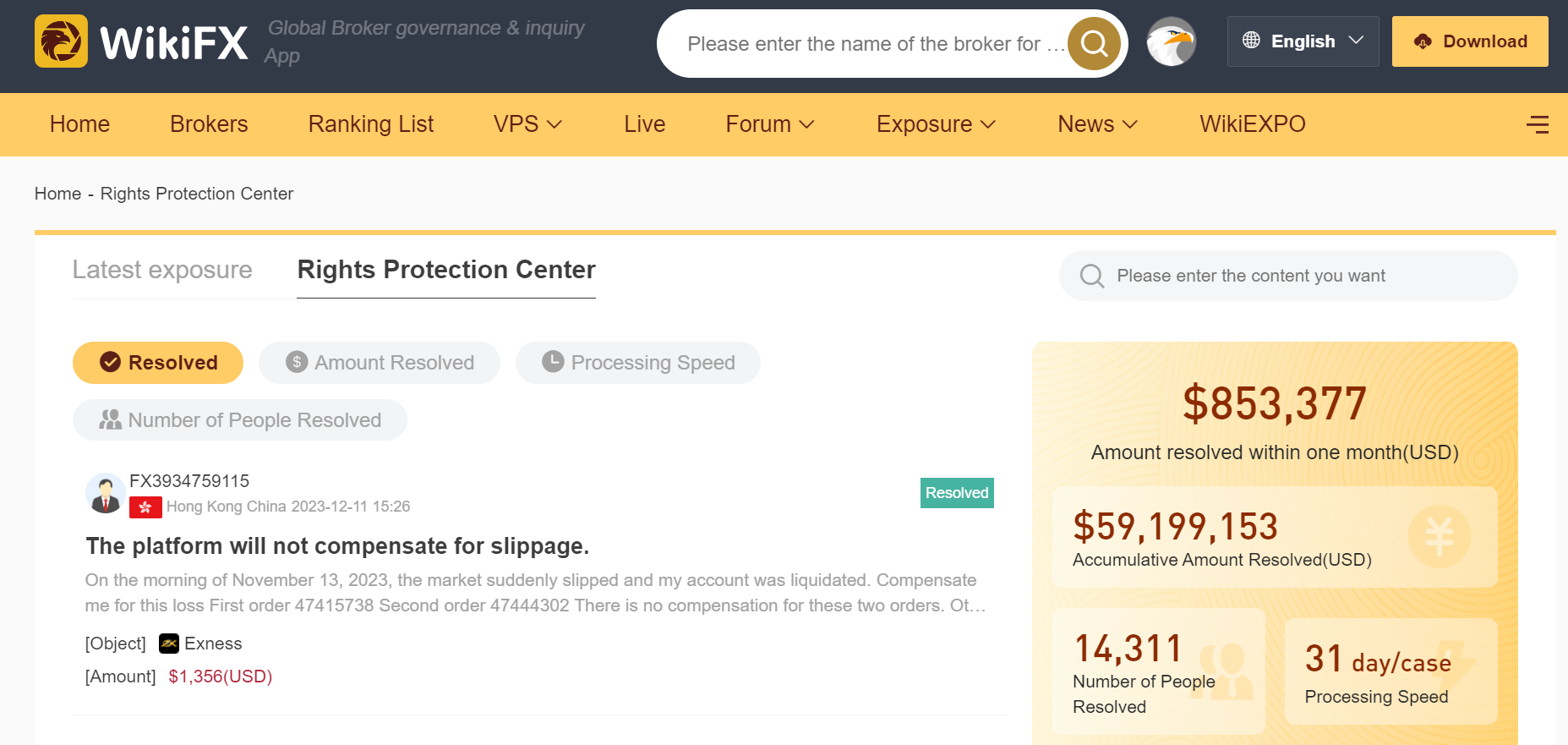

To help victims, I suggest contacting the WikiFX Exposure Center. By providing evidence of the fraud, WikiFX conducts in-depth investigations, reassesses the credibility of the risky platform, and aids in safeguarding investors' rights. Additionally, in addressing withdrawal challenges faced by legitimate brokers, WikiFX has introduced the EMC Rights Protection Channel, dedicated to advocating for swift resolutions. Notably, WikiFX has successfully exposed over 7000 illicit platforms, recovering more than $90 million for over 25,000 affected investors.

Why do Fake Brokers Love to Offer High Leverage?

Fake forex brokers often advertise dangerously high leverage ratios upwards of 1:500 to attract naive traders hoping to amplify profits. However, ultra-high leverage is mainly offered so they can rapidly wipe out trading accounts when inevitable losses occur. When traders face heavy losses early on due to high leverage, the fake broker will pressure them to deposit additional funds or face losing everything . Many fall into this trap and hand over more money, which eventually disappears too.

To Wrap Up

To conclude, we've now gained insights into 10 fake brokers operating in the UK based on multiple dimensions. Avoiding a fake brokers is crucial. It marks the initial step for traders to step on the right path in forex trading. Mastering the identification of fake brokers puts traders ahead by 60%. We genuinely hope you read this article thoroughly for a safer trading experience.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

Best Forex Brokers in Turkey for 2024

Review top 9 forex brokers in Turkey, elevating their trading pros and cons to give traders more useful guidance.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Swiss Forex Brokers for 2024

Explore top 10 forex brokers in Switzerland, elevating their trading pros and cons to give traders more useful guidance.

Best Stock Brokers in the US for 2024

When choosing an online broker, finding the platform that best fits your investment needs is crucial. With the rise in popularity of online trading, more brokers are offering free stock trading and commission-free transactions for various assets. It has become a challenge for users to select suitable brokers.

Best CySEC Regulated Forex Brokers 2024

Delving into CySEC-regulated forex trading, this article presents a top 9 list of brokers, spotlighting the benefits of regulatory compliance.

8 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 8 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Forex Brokers in 2024

Guide to the most trusted Forex brokers, with a thorough investigation into their quality, security measures, and financial transparency.