Score

AmEquities

Malaysia|5-10 years|

Malaysia|5-10 years| https://www.amequities.com.my/

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Malaysia 6.85

Malaysia 6.85Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Malaysia

MalaysiaUsers who viewed AmEquities also viewed..

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

amequities.com.my

Server Location

Malaysia

Website Domain Name

amequities.com.my

Server IP

203.115.249.65

Company Summary

| Aspect | Information |

| Company Name | AmEquities |

| Registered Country/Area | Malaysia |

| Founded year | 2019 |

| Regulation | Not regulated |

| Market Instruments | Equities & derivatives trading; Foreign Investing Services (FIS); Islamic Stockbroking Window (ISBW); Securities Borrowing & Lending (SBL); Share Margin Financing (SMF). |

| Account Types | Individual Trading Account; Corporate Trading Account. |

| Trading Platforms | Web desktop interface for local and foreign market trades; Mobile app for on-the-go trading. |

| Demo Account | Yes |

| Customer Support | Multiple locations with telephone support |

| Deposit & Withdrawal | Starting from 0.05% trading fees |

| Educational Resources | Securities Awareness materials; Quick User Guide; Educational resources for equities trading and futures trading. |

Overview of AmEquities

AmEquities, a brokerage firm based in Malaysia, was founded in 2019 and operates without regulatory oversight. Despite lacking regulation, it offers a wide range of market instruments, including equities and derivatives trading, Foreign Investing Services (FIS), Islamic Stockbroking Window (ISBW), Securities Borrowing & Lending (SBL), and Share Margin Financing (SMF). The company satisfies both individual and corporate clients, offering Individual Trading Accounts and Corporate Trading Accounts. Clients can access trading platforms through web desktop interfaces for local and foreign market trades, as well as a mobile app for convenient on-the-go trading.

AmEquities provides a demo account for clients to practice trading strategies. Customer support is available via telephone across multiple locations, and deposit and withdrawal fees vary depending on the services availed. Additionally, the company offers educational resources such as Securities Awareness materials, a Quick User Guide, and educational content on equities and futures trading to empower investors with knowledge and skills for navigating financial markets effectively.

Pros and Cons

| Pros | Cons |

| Wide range of market instruments | Lack of regulatory oversight may pose risks for clients |

| Convenient trading platforms | Fees for deposit and withdrawal vary based on services |

| Demo account available for practice | Absence of specified minimum deposit and maximum leverage |

| Comprehensive customer support | |

| Robust educational resources |

Pros:

Wide range of market instruments: AmEquities offers a diverse array of market instruments including equities, derivatives, Foreign Investing Services (FIS), Islamic Stockbroking Window (ISBW), Securities Borrowing & Lending (SBL), and Share Margin Financing (SMF). This variety allows clients to diversify their investment portfolios and explore different opportunities in the financial markets.

Convenient trading platforms: The brokerage provides web desktop interfaces for both local and foreign market trades, as well as a mobile app for on-the-go trading. These platforms offer users flexibility and accessibility to manage their investments anytime, anywhere, enhancing convenience and responsiveness to market changes.

Demo account available for practice: AmEquities offers a demo account for clients to practice trading strategies without risking real money. This feature is valuable for novice traders to gain experience and confidence in trading before committing actual funds, thereby reducing the risk of potential losses during the learning process.

Comprehensive customer support: The company provides customer support across multiple locations via telephone. This ensures that clients can receive prompt assistance and personalized service to address inquiries, resolve issues, or seek guidance regarding investment opportunities, fostering strong relationships and trust with clientele.

Robust educational resources: AmEquities offers a range of educational resources such as Securities Awareness materials, a Quick User Guide, and educational content on equities and futures trading. These resources empower clients with knowledge and skills necessary to navigate the complexities of financial markets effectively, enhancing their ability to make informed investment decisions.

Cons:

Lack of regulatory oversight may pose risks for clients: Operating without regulatory oversight can potentially expose clients to risks such as lack of investor protection, inadequate compliance standards, and potential fraudulent activities. Clients may face challenges in seeking recourse or assistance in case of disputes or misconduct.

Fees for deposit and withdrawal vary based on services: The absence of standardized fee structures for deposit and withdrawal leads to ambiguity and unpredictability in costs for clients. Varying fees based on services availed could result in additional expenses for clients, impacting their overall investment returns.

Absence of specified minimum deposit and maximum leverage: The lack of specified minimum deposit and maximum leverage limits make it difficult for clients to plan and manage their investment capital effectively. Clear guidelines on these aspects are essential for clients to make informed decisions and assess the suitability of AmEquities' services for their individual investment goals and risk tolerance.

Regulatory Status

AmEquities operates without any regulated licenses. However, their privacy policy mentions adhering to relevant laws and regulations,but it doesn't explicitly list them.The absence of information about specific regulated licenses on their website doesn't necessarily mean they are not properly regulated. However, it's always advisable to be cautious and conduct thorough research before investing with any brokerage firm.

Market Instruments

AmEquities offers a diverse range of products and services tailored to meet the needs of modern investors.

At the core of their offerings is Equities & Derivatives trading, providing users with an integrated online platform to view and trade on Bursa Malaysia Equities and Derivatives. Additionally, their Foreign Investing Services (FIS) enable investors to diversify their portfolios across six prominent international exchanges, including SGX, HKEX, SET, IDX, NYSE, NASDAQ, and NYSE MKT LLC, all under a single trading limit and login ID for utmost convenience. F

or those adhering to Shariah principles, the Islamic Stockbroking Window (ISBW) ensures compliance through services provided by AmInvestment Bank with Shariah Advisors and AmBank Islamic. Moreover, their Securities Borrowing & Lending (SBL) program offers an enhanced lending model facilitating temporary loan transactions between lenders and borrowers. This allows investors to capitalize on short-term market movements while earning lending fees on borrowed securities, thus adding flexibility and potential returns to their investment strategies.

Moreover, Share Margin Financing (SMF) is available for investors looking to leverage their investments in quoted securities on Bursa Securities, providing a credit facility against acceptable collateral.

Account Types

AmEquities offers two account types: Individual Trading Account and Corporate Trading Account.

An Individual Trading Account with AmEquities is designed for individual investors who wish to trade equities, derivatives, and other financial instruments independently. With this account, individuals have full control over their investment decisions and can access a wide range of markets and products offered by AmEquities. Opening an Individual Trading Account typically involves providing personal information such as full name, date of birth, identification details, and contact information. Once opened, individuals can fund their accounts and begin trading according to their investment objectives and risk tolerance.

A Corporate Trading Account provided by AmEquities satisfies the needs of businesses, companies, and corporate entities interested in trading equities and derivatives. This account type allows corporations to execute trades on behalf of the entity, enabling them to manage their investment portfolios and capitalize on market opportunities. To open a Corporate Trading Account, entities typically need to provide corporate documents, such as incorporation certificates, business registration details, and authorization from relevant stakeholders. Once approved, the corporate entity can fund the account and start trading, utilizing the various tools and services offered by AmEquities to meet their financial objectives.

How to Open an Account?

Opening an account with AmEquities involves several straightforward steps:

Visit the AmEquities Website: Access the AmEquities website through your web browser.

Navigate to Account Opening Section: Once on the website, locate the section or page specifically dedicated to account opening. This is labeled as “Open an Account”.

Provide Personal Information: Fill out the required fields with accurate personal information such as your full name, date of birth, nationality, identification number (e.g., passport or national ID), residential address, email address, and contact number.

Agree to Terms and Conditions: Review the terms and conditions provided by AmEquities for opening an account. If you agree, you will typically be required to tick a box or click a button to confirm your acceptance.

Submit Documents: Depending on the regulatory requirements and the type of account you're opening, you need to upload or submit certain documents. Commonly required documents include identification proof (e.g., passport, national ID card) and proof of address (e.g., utility bill, bank statement).

Verification Process: After submitting your application and documents, there is a verification process. This could involve confirming your identity and reviewing the provided documentation. This step takes some time depending on the volume of applications and the efficiency of the verification process.

Account Approval: Once your application has been reviewed and approved, you will receive confirmation that your account has been successfully opened. This notification is sent via email or through the online platform.

Start Trading: With your account funded, you are now ready to start trading equities, derivatives, or other financial instruments offered by AmEquities.

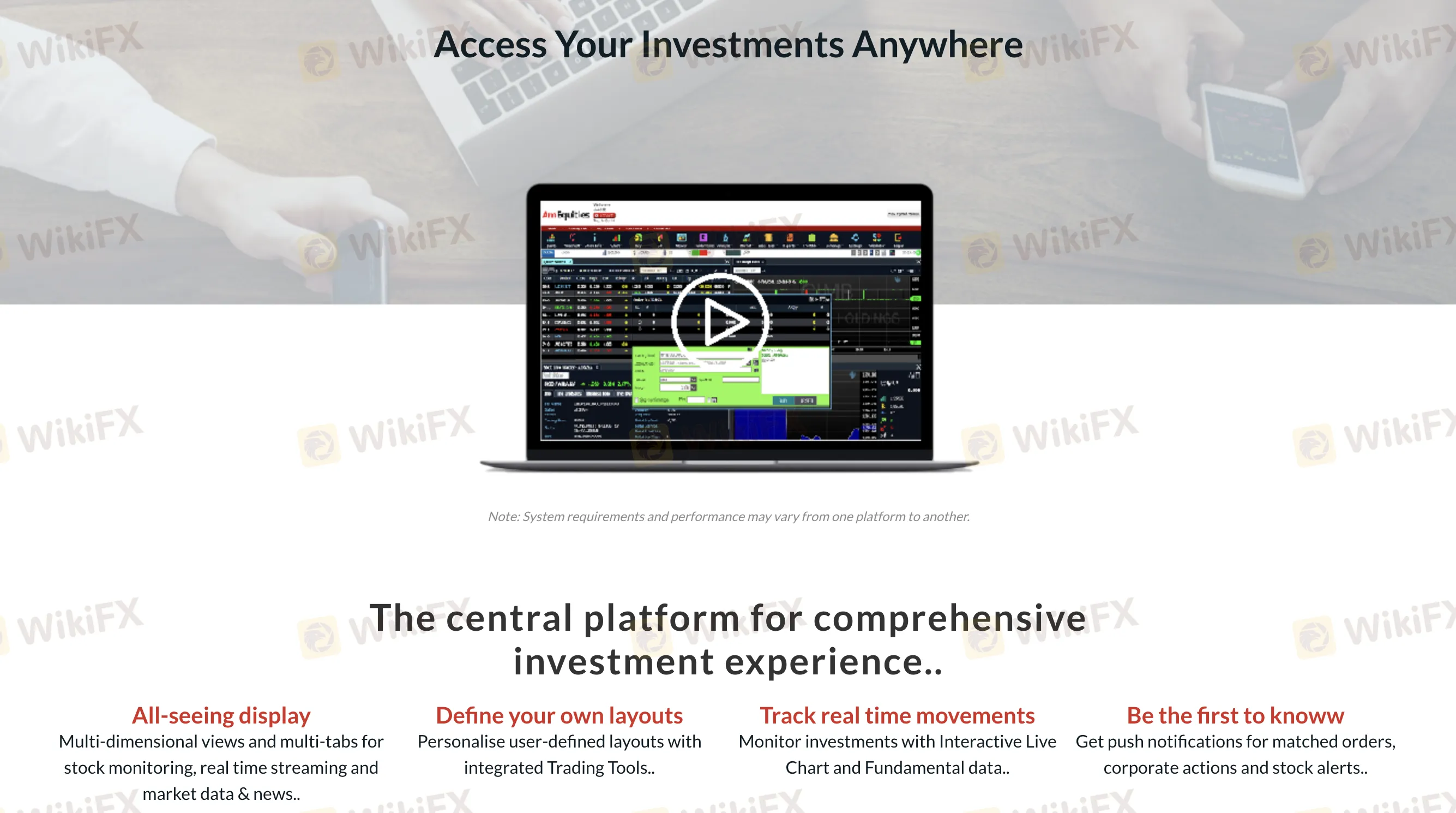

Trading Platform

The trading platform offered by AmEquities serves as the central hub for a comprehensive investment experience. With an all-seeing display, users can access multi-dimensional views and multi-tabs for stock monitoring, real-time streaming, and market data & news. The platform allows users to define their own layouts, personalizing user-defined layouts with integrated trading tools to suit their individual preferences and strategies. Real-time movements can be tracked with interactive live charts and fundamental data, ensuring users stay informed and responsive to market changes. Additionally, push notifications keep users updated on matched orders, corporate actions, and stock alerts, enabling timely decision-making.

For desktop users, the platform provides access to both local and foreign market trades through the web desktop interface. Users can manage their investments across various markets, including AMEX, NYSE, NASDAQ, SGX, and HKEx, using a single trading account and limit. The platform offers features such as consolidated monthly statements, research reports, stock charts, latest financial news, and a consolidated stock portfolio and trust balance view. With the ability to settle contracts in local or foreign currency, users have flexibility in managing their investments.

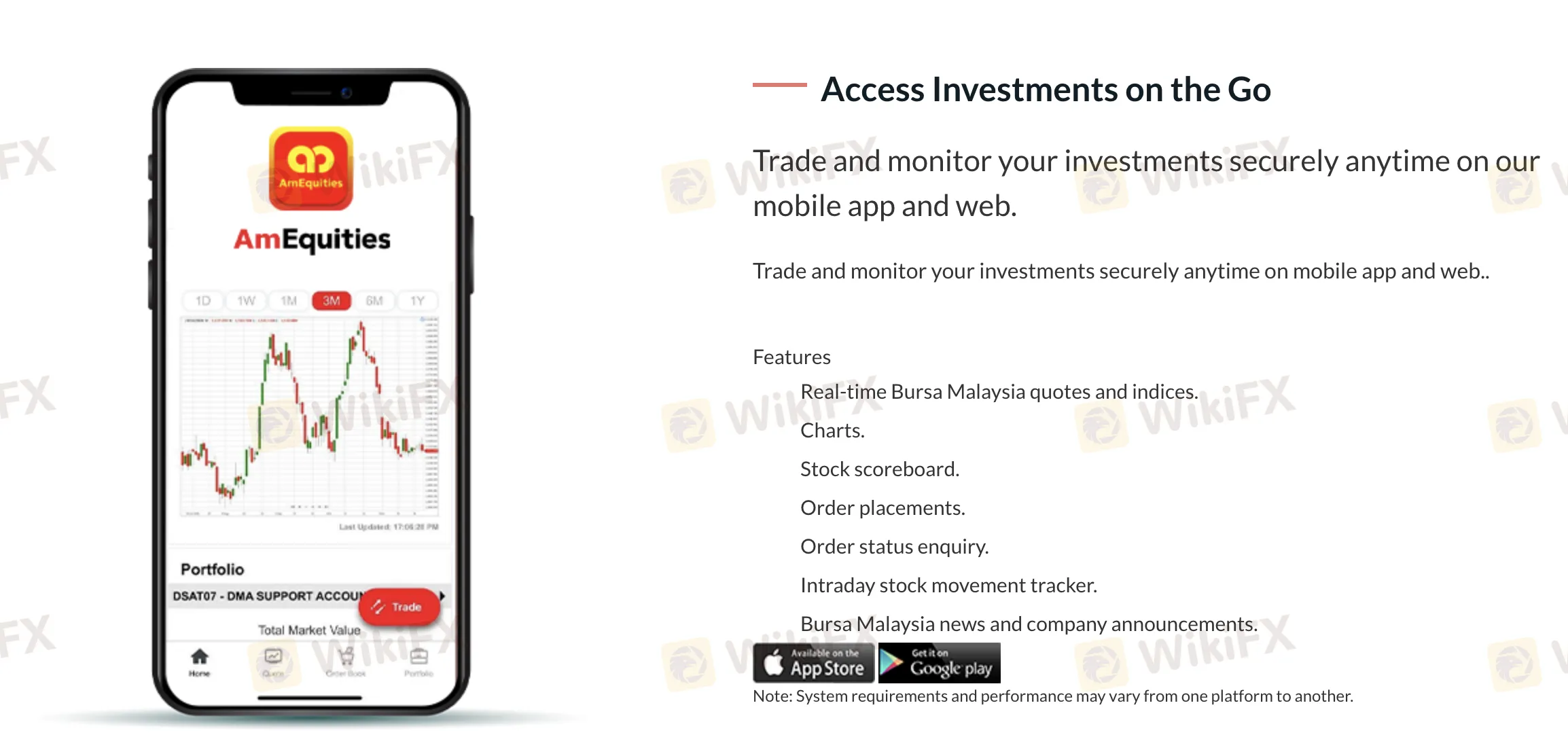

For those on the go, AmEquities' mobile app and web platform offer secure access to trade and monitor investments anytime, anywhere. The mobile app features real-time Bursa Malaysia quotes and indices, interactive charts, stock scoreboard, order placements, order status enquiry, intraday stock movement tracker, and access to Bursa Malaysia news and company announcements. Whether on desktop or mobile, users can rely on the trading platform's robust features and intuitive interface to make informed investment decisions efficiently and effectively.

Fees

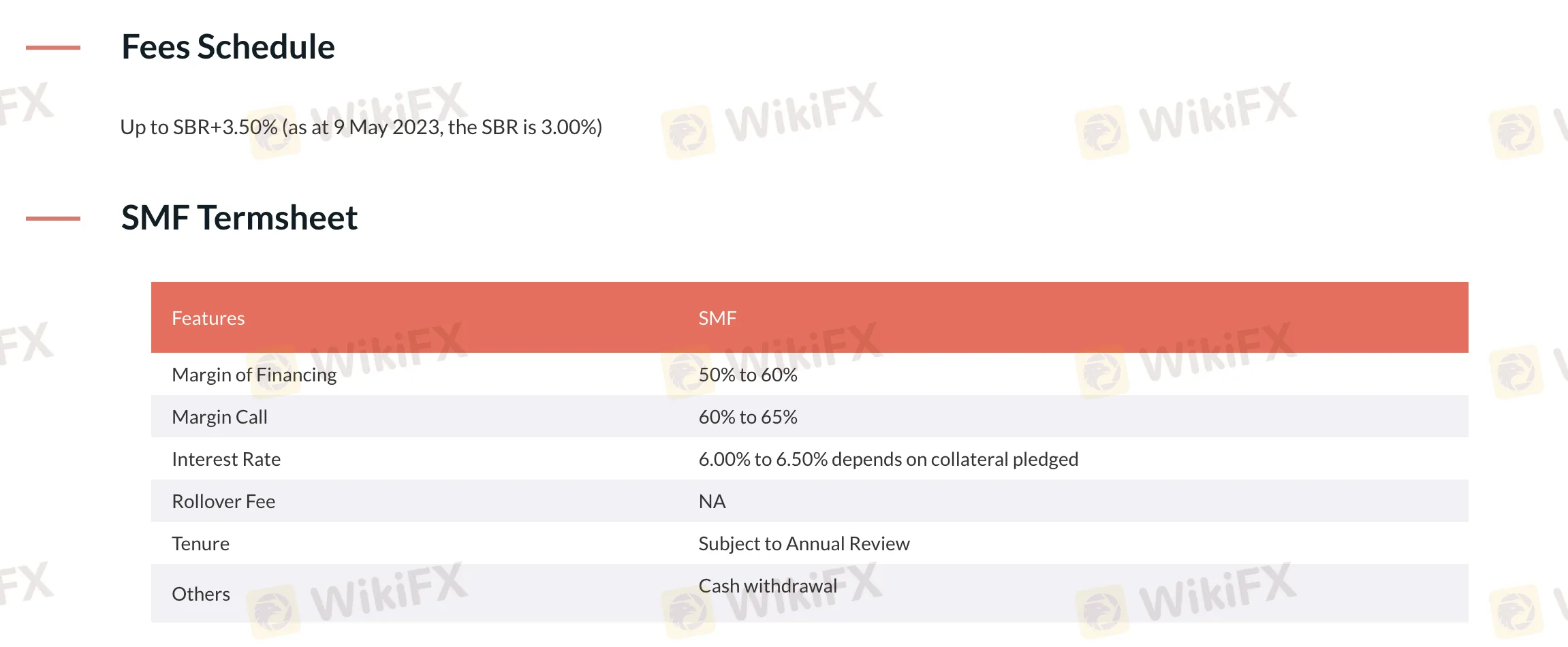

AmEquities offers various payment methods and fee structures tailored to different services they provide.

For Share Margin Financing, clients can utilize bank transfers or online payments to fund their accounts, with fees typically based on the interest rates charged on the margin loan.

Islamic Stockbroking Window (ISBW) adheres to Shariah principles, ensuring compliance with Islamic finance laws. Fees associated with ISBW vary depending on the services availed and are transparently communicated to clients.

Securities Borrowing and Lending (SBL) services entail fees related to temporary securities loans between lenders and borrowers, typically including a lending fee for the lender. These fees are designed to reflect the costs and risks associated with securities borrowing and lending transactions.

Customer Support

AmEquities provides comprehensive customer support across multiple locations to ensure that clients receive prompt assistance and personalized service.

At its head office, located at an undisclosed address, customers can reach out via telephone at +60320310102 to address inquiries, resolve issues, or seek guidance regarding investment opportunities. In Batu Pahat, clients have access to local support at +6074342282, while those in Damansara Utama can contact the branch at +60377106613 for assistance tailored to their needs. Additionally, the Penang branch extends its services through telephone support at +6042261818, ensuring accessibility for clients in the northern region. Similarly, clients in Kuching can rely on the local branch for assistance by calling +6082244791.

AmEquities prioritizes effective communication and support, utilizing these telephone channels to foster strong relationships and provide timely solutions to its clientele across various regions.

Educational Resources

AmEquities offers a robust array of educational resources aimed at empowering its clients with the knowledge and skills necessary to navigate the complexities of the financial markets effectively.

Securities Awareness materials provide insights into the fundamentals of investing, including key concepts such as risk management, portfolio diversification, and market analysis. The Quick User Guide serves as a handy reference tool, offering step-by-step instructions and tips for using AmEquities' platforms and services efficiently.

For clients interested in equities trading, dedicated educational resources delve into topics such as stock selection strategies, technical analysis techniques, and market order types to help investors make informed decisions. Moreover, AmEquities provides comprehensive resources for those interested in futures trading, covering essential aspects such as contract specifications, margin requirements, and hedging strategies.

Conclusion

In conclusion, AmEquities, a Malaysia-based brokerage firm founded in 2019, offers a wide range of market instruments, convenient trading platforms, a demo account for practice, comprehensive customer support, and robust educational resources. However, its lack of regulatory oversight pose risks for clients, and varying fees for deposit and withdrawal services, along with the absence of specified minimum deposit and maximum leverage limits, could impact clients' overall investment experience.

Despite these disadvantages, the brokerage's strengths lie in its diverse offerings and commitment to empowering investors with knowledge and tools to navigate financial markets effectively.

FAQs

Q: What services does AmEquities offer?

A: AmEquities provides a range of financial services tailored, including equities and derivatives trading, Foreign Investing Services (FIS), Islamic Stockbroking Window (ISBW), Securities Borrowing & Lending (SBL), and Share Margin Financing (SMF).

Q: How can I open an account with AmEquities?

A: To open an account with AmEquities, you can visit their website, navigate to the account opening section.

Q: What trading platforms does AmEquities offer?

A: AmEquities offers convenient trading platforms including web desktop interfaces for both local and foreign market trades, as well as a mobile app for on-the-go trading.

Q: Does AmEquities provide customer support?

A: Yes, AmEquities offers comprehensive customer support across multiple locations via telephone.

Q: Are there educational resources available for clients?

A: Yes, AmEquities provides a robust array of educational resources aimed at empowering clients with the knowledge and skills necessary to navigate financial markets effectively.

Keywords

- 5-10 years

- Suspicious Regulatory License

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now