Score

OneTrade

United Kingdom|5-10 years|

United Kingdom|5-10 years| http://www.onetrade.com

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Thailand 2.65

Thailand 2.65Contact

Licenses

Licenses

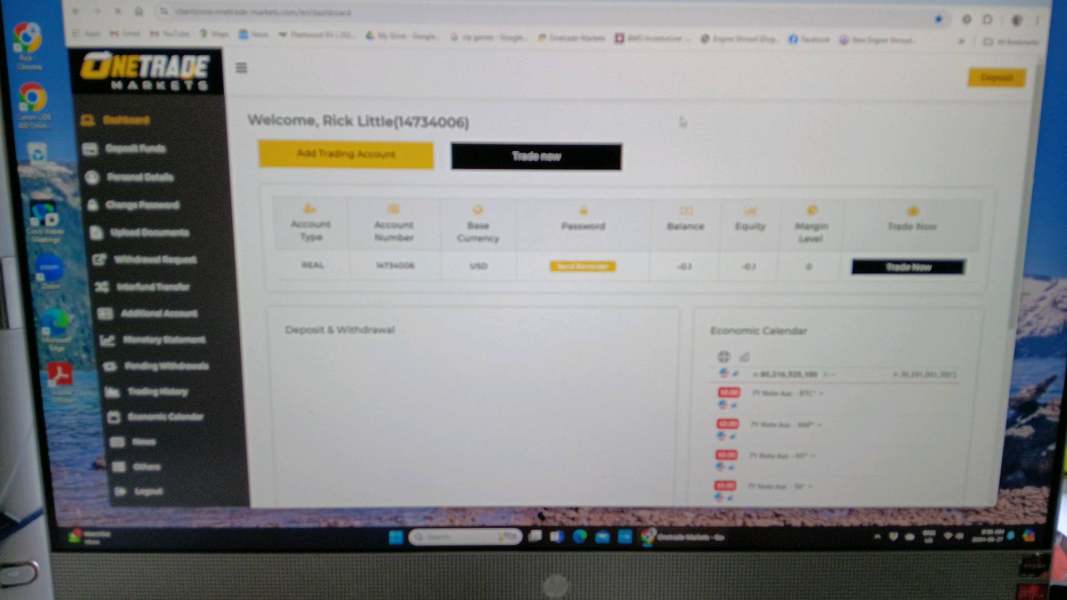

Licensed Institution:FxStat Ltd

License No.:537787

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomUsers who viewed OneTrade also viewed..

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

Most visited countries/areas

Russia

onetrade.com

Server Location

United Kingdom

Most visited countries/areas

Russia

Website Domain Name

onetrade.com

Website

WHOIS.GODADDY.COM

Company

GODADDY.COM, LLC

Domain Effective Date

1997-11-22

Server IP

178.79.132.4

Company Summary

| Aspect | Information |

|---|---|

| Company Name | OneTrade |

| Registered Country/Area | United Kingdom |

| Founded year | 2008 |

| Tradable Assets | Forex, Shares, Indices, Cryptocurrencies |

| Account Types | Standard Account, Professional Account |

| Minimum Deposit | $100 |

| Maximum Leverage | 30:1 for Retail Clients, Up to 500:1 for Professional Clients |

| Spreads | Variable, starting from 1.5 pips |

| Trading Platforms | MetaTrader 4, WebTrader |

| Demo Account | Available |

| Customer Support | Phone at +44 (0)203 582 3171; Email at support@onetrade.com |

| Deposit & Withdrawal | Bank Wire, Debit/Credit Cards, and some e-Wallets |

Overview of OneTrade

One Trade broker provides direct market access and access to over 90 instruments through the LD4 Equinix data center. The available trading markets include spot forex, metals, CFD indices, and commodities, utilizing aggregated pricing from global banks, non-banks, MTF, and ECNs for low-latency execution (average 10 milliseconds round-trip).

In 2010, the company became the first financial social networking provider in the UK, introducing a new way to trade on financial markets with access to information, analytics, and performance-sharing. Since then, One Trade has expanded internationally and is recognized as a player in financial technology solutions.

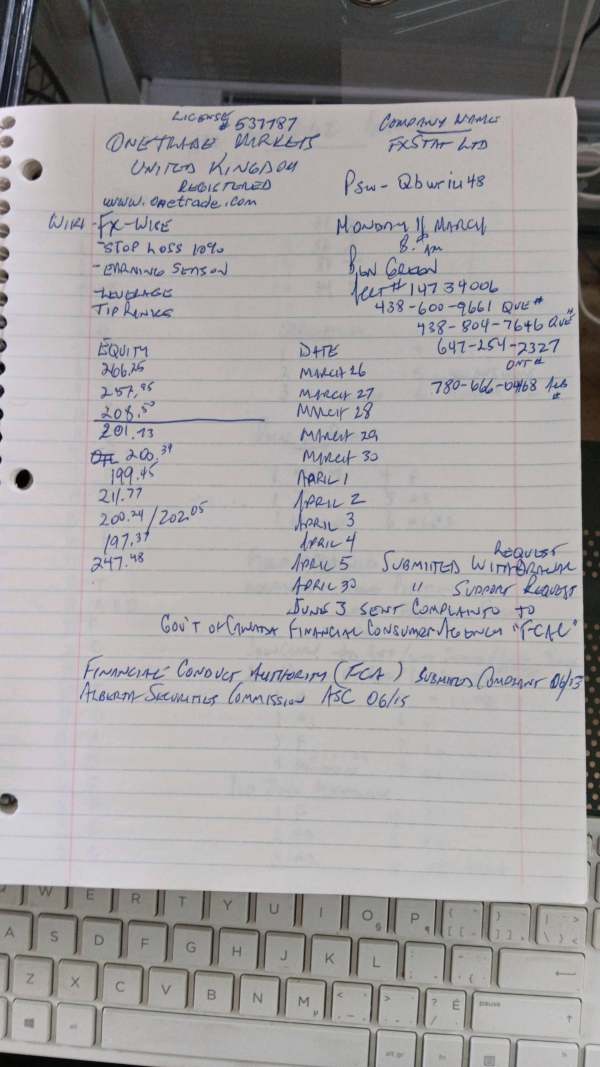

Regulatory Authority

OneTrade is currently under the regulatory purview of the Financial Conduct Authority (FCA). However, it's important to note that its current status is listed as “Suspicious Clone.” The license type associated with OneTrade is an Investment Advisory License. The regulatory oversight is conducted by the United Kingdom, and the specific license number is 537787.

Pros and cons

| Pros | Cons |

|---|---|

| Offers a wide range of tradable assets | Suspicious clone status |

| $100 minimum deposit is accessible for many traders | Spreads are variable and may not be the lowest in the industry |

| Provides option for high leverage for professional clients | High leverage can increase trading risk |

| 24/5 customer support | Lack of support during weekends |

| Demo account available for practice | Not suitable for beginners |

| MetaTrader 4 supported, a popular trading platform | Lack of MetaTrader 5 |

| Various methods for deposit and withdrawal |

Pros of OneTrade:

1. Wide Range of Tradable Assets: OneTrade provides its users with access to a wide array of assets for trade, which includes Forex, Shares, Indices, and Cryptocurrencies. This offers traders the freedom and flexibility to diversify their portfolio and find opportunities in various markets.

2. Accessible Minimum Deposit: With a minimum deposit of just $100, OneTrade makes it possible for many traders, including those with limited capital, to start trading and participate in the financial market.

3. High Leverage for Professional Clients: For professional clients, OneTrade provides high leverage of up to 500:1. This allows traders with sufficient knowledge and risk tolerance to potentially amplify their trading profits.

4. 24/5 Customer Support: OneTrade has a robust customer support system. They are ready to assist with traders' queries and issues five days a week through Email, Phone and Live Chat.

5. Support for MetaTrader 4: This platform is well-regarded in the industry and offers a blend of sophisticated and intuitive features that appeal to traders of various experience levels.

Cons of OneTrade:

1. Variable Spreads: OneTrade offers variable spreads starting from 1.5 pips. This means the spread can sometimes be less competitive compared to fixed spreads offered by other brokers.

2. High Leverage Risk: While offering high leverage for professional clients may result in higher potential profits, it also entails considerable risk as it could lead to significant losses if the market moves against the trader's position.

3. Lack of Weekend Support: The broker doesn't offer customer support during the weekends. Any issues arising during this time must wait until the next working week.

4. Incomplete Trading knowledge: While educational resources are provided, beginner traders might still find the information insufficient to fully understand the complexities of the financial markets.

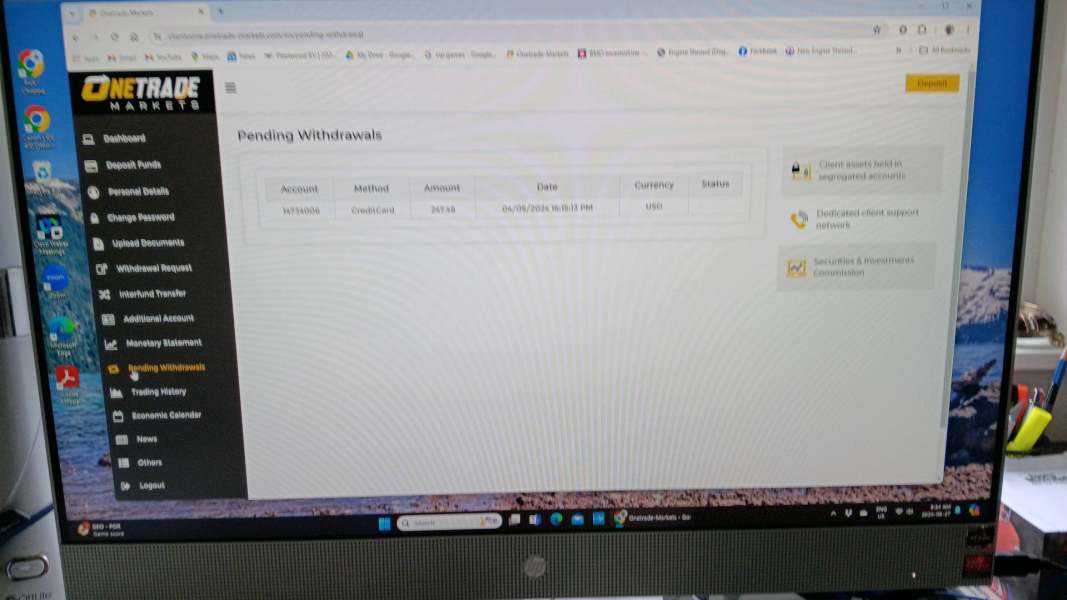

5. Unclear Withdrawal conditions: It's not specified whether OneTrade imposes any fees for withdrawals, which could potentially impact the overall profitability for a trader.

Market Instruments

OneTrade offers a wide selection of market instruments and financial services to its clients.

1. Forex: OneTrade offers trading on a broad selection of currency pairs, allowing traders to take advantage of fluctuating currency markets.

2. Shares: Traders can choose from a variety of shares from leading corporations across the world, allowing investment in their favorite companies.

3. Indices: Indices trading is available where traders can speculate on the price movements of whole sectors rather than individual companies.

4. Cryptocurrencies: OneTrade helps its clients ride the emerging wave of digital currencies with cryptocurrency trading options including all the major names.

Account Types

OneTrade offers two types of trading accounts to satisfy the varying needs of traders, the Standard Account and the Professional Account.

1. Standard Account: This account type is ideal for beginners or those with a moderate level of experience in trading. It offers a range of features and functionalities tailored to this group. The Standard Account requires a minimum deposit of $100, offering accessible entry into trading for many individuals. It also provides ample educational resources, helping traders equip themselves with the necessary knowledge to navigate the trading landscape.

2. Professional Account: The Professional Account, as the name indicates, is designed for professional traders who have a substantial level of experience and understanding of the market. These accounts provide more advanced features and the ability to handle a more significant volume of trades. One major distinguishing feature of the Professional Account at OneTrade is the leverage it offers. For professional clients, the leverage at OneTrade can go up to 500:1. This allows pro-traders to engage in high-volume trading and potentially amplify their profits. However, such high leverage also comes with an increased risk factor, making it more suitable for experienced traders.

How to Open an Account of OneTrade?

Opening an account with OneTrade involves the following steps:

1. Visit OneTrade's Official Website: The first step to opening a trading account with OneTrade is visiting their official website.

2. Find and Click on “Open an Account”: Once on the site, locate and click on the “Open an Account” button.

3. Fill in Personal Information: You will be guided to a registration form. Here, input your personal details including name, email address, phone number, date of birth, and country of residence.

4. Complete Financial Questionnaire: After the personal details, complete the financial questionnaire, where you will need to provide more specific information about your financial status and trading experience. This is to determine the type of account that best suits your financial capability and trading experience.

5. Choose Account Type: Choose between the Standard and Professional account based on your trading experience and knowledge.

6. Submit Documents for Verification: You will be required to submit some documents to verify your identity and address. Typically, this would be a government-issued identification and a recent utility bill or bank statement showing your full name and residential address.

7. Deposit Initial Funds: Once your documents have been verified, and your account has been approved, the next step is to deposit the initial funds into your account. OneTrade requires a minimum deposit of $100. You can do this via a variety of methods including Bank Wire, Debit/Credit Cards, and some e-Wallets.

8. Account Set Up: With the funds deposited, your account is now set up and ready to trade. You're free to log into your account, start exploring the platform, and make your first trade.

Please remember that the account opening process can vary by country due to different regulations. Always read through the provided instructions and information carefully.

Leverage

OneTrade offers different maximum leverage based on the account type. For retail clients, the maximum leverage offered is 30:1. However, for Professional Account holders, OneTrade provides much higher leverage, going up to 500:1. This high leverage allows professional traders to control large positions with a relatively small amount of capital. However, it's worth noting that while high leverage could potentially lead to higher profits, it could similarly result in greater losses if trades do not go as planned. Therefore, it is advised that traders with less experience exercise caution when using high leverage.

Spreads & Commissions

OneTrade offers variable spreads to its clients, with spreads starting from 1.5 pips. These spreads can adjust dynamically based on market conditions, and importantly, the liquidity and volatility of the particular asset being traded.

Trading Platform

One Trade presents a diverse array of platforms accessible through a single account, including the renowned MT4 (both software and hardware), MT4 web trader, CRM, social trading platforms, and a liquidity bridge. This unique proposition in the marketplace offers a cost-effective solution catering to the needs of retail and institutional traders, banks, and brokers alike. Whether clients prefer click-and-trade, social trading, algorithmic, copy trading, or FIX API, One Trade provides a platform that aligns with these varied requirements.

Deposit & Withdrawal

In compliance with regulatory requirements, deposits can be made through bank wire transfers from accounts held in the same name as the OneTrade account. Additionally, there are limited alternatives for fund transfers through Skrill, credit cards, or debit cards. Due to restrictions on card deposits, this method is primarily suitable for urgent deposits.

The minimum account deposit is also a favorable condition, with an initial deposit amount of $100 for account opening.

Withdrawals will be processed using the same method as the deposit, in accordance with regulations. Withdrawals via card can only be made to the same card within 30 days of the deposit, and the amount withdrawn is limited to the deposit amount, with no associated fees.

Customer Support

For any inquiries or assistance, feel free to reach out to One Trade through their dedicated helpline at +44 (0)203 582 3171. Alternatively, you can connect with them via email at support@onetrade.com. Their responsive support team is ready to address your concerns and provide assistance.

Conclusion

OneTrade, a forex broker, offers a good range of tradable assets and services, including two types of accounts (Standard and Professional), high leverage for professional clients, and robust support for MetaTrader 4 alongside a web-based trading platform. They have an accessible minimum deposit requirement and provide a variety of educational resources for traders. However, there are a few areas where OneTrade might benefit from improvements. Some of these include the current unavailability of weekend customer support, the lack of specific information about whether they support MetaTrader 5, an unclear regulatory situation, and potentially unclear costs associated with withdrawal methods. Still, on balance, OneTrade appears to offer a comprehensive set of tools and resources that can accommodate diverse trading needs.

FAQs

Q: What trading instruments can I trade with OneTrade?

A: OneTrade allows trading on Forex, Shares, Indices, and Cryptocurrencies.

Q: How can I open an account with OneTrade?

A: You can open an account by visiting their website, filling out a registration form with your personal details, and depositing a minimum of $100.

Q: What are the different types of accounts available at OneTrade?

A: OneTrade offers a Standard Account for beginners and a Professional Account designed for experienced traders.

Q: What is the maximum leverage available at OneTrade?

A: For retail clients using OneTrade, the maximum leverage is 30:1. For professional clients, leverage can go up to 500:1.

Q: What type of trading platform does OneTrade use?

A: OneTrade uses two trading platforms - MetaTrader 4 and WebTrader.

Q: Does OneTrade offer educational resources for traders?

A: Yes, OneTrade offers webinars, eBooks, video tutorials, and FAQs to help traders increase their trading knowledge.

Risk Warning

Online trading poses substantial risks, with the potential for complete loss of invested capital, rendering it unsuitable for all traders. It is imperative to comprehend the inherent risks and acknowledge that the information provided in this review is subject to change due to continuous updates in the company's services and policies.

Additionally, the review's generation date is a critical consideration, as information may have evolved since then. Readers are strongly advised to verify updated details directly with the company before making any decisions, as the responsibility for utilizing the information herein rests solely with the reader.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- Suspicious Overrun

- High potential risk

Review 3

Content you want to comment

Please enter...

Review 3

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now