Forex trading is popular among Irish residents. While not mandatory, opting for a forex broker regulated by the Central Bank of Ireland (CBI) can provide Irish traders with a more secure trading environment.

The CBI, Ireland's primary financial regulator, oversees banks, insurance companies, and investment firms. Established in 1943, the CBI is responsible for maintaining financial stability, formulating monetary policy, and protecting consumers.

At WikiFX, we help investors choose the right brokers. If you're looking for top-tier brokers in Ireland, we encourage you to continue reading this article.

8 Best Forex Brokers in Ireland

Processing times for deposits and withdrawals are minimal.

FP Markets offers consistently tighter spreads from 0.0 pips, 24/7 Multi-lingual support .

Outstanding copy trading and social trading features.

Commission-free trading on stocks and ETFs.

Offering negative balance protection to prevent consumers from losing more than they deposit .

Guaranteed stop loss orders, which protect the trader from market gap risk.

more

Comprison of Best Forex Brokers in Ireland

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers in Ireland Overall

| Broker | Logo | Why are they listed as the Best Forex Brokers in Ireland ? |

| FP Markets |  |

✅ Regulated by CYSEC, in accordance with European laws. ✅ A long operation history of 15 years, favorable by traders all over the world. ✅ Localized customer service and payment options, providing multilingual services and convenient deposit and withdrawal. |

| eToro |  |

✅ Heavily regulated by multiple regulators, especially FCA and CYSEC, offering a degree of safety. ✅ Famous for its social trading feature, chased by millions of traders, beginners and seasoned traders. ✅Over 20 languages for customer service and trading services. |

| Plus500 |  |

✅ Globally regulated, including CYSEC in Cyprus, FCA in UK, in accordance with European laws. ✅ Competitive spreads, fast order execution speed won solid reputation in the forex industry. ✅ Rated highly on various online review platforms, highly praised by numerous users. |

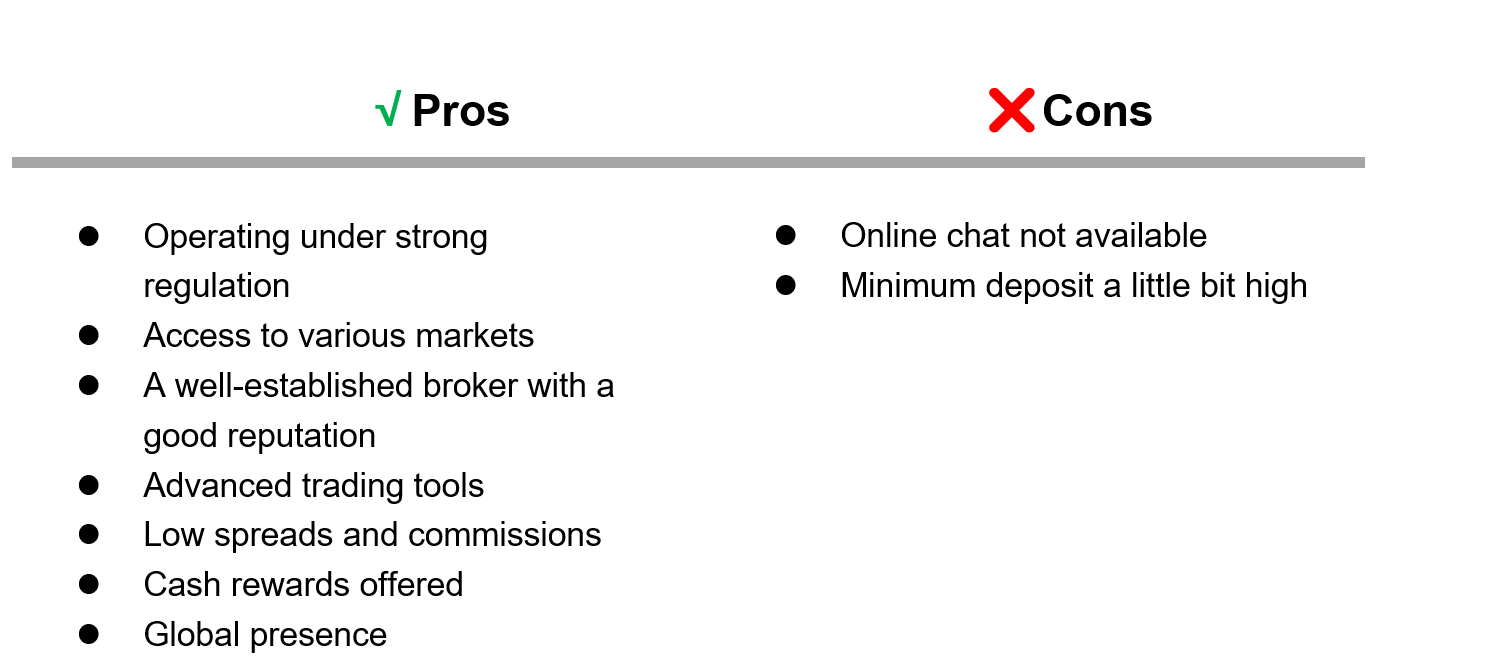

| AvaTrade |  |

✅An Ireland-born broker under global regulation, knowing traders in Ireland better. ✅An average score of 4.0 out of 5, derived from over 2,000 reviews, a good reputation for years. ✅Multilingual customer support and localized payment options, few complaints on withdrawal process. |

| XM |  |

✅ Globally regulated, including CYSEC in Cyprus, one of the most stringent regulators. ✅ Competitive spreads, fast order execution speed won solid reputation in the forex industry. ✅ Rated highly on various online review platforms, highly praised by numerous users. |

| IG |  |

✅ Globally regulated, including FCA in UK, AMF in France. ✅A well-established broker with a long operation history of over 20 years. ✅ Transparent trading fees, responsive customer service, highly recognized by a large number of traders. |

| Saxo Bank |  |

✅Heavily regulated in European areas, like France, Italy, and locally regulated. ✅An average rating of 4.2 out of 5 based on over 1,000 reviews, very rare among brokers. ✅ Traders in Austria trust this broke a lot for its solid performance. |

| FXCM |  |

✅ Heavily regulated, including FCA and UK, a big player in the forex industry in European areas. ✅ Powerful trading platforms and trading app, fast order execution, minimizing slippage. ✅ Extensive educational materials, including free webinars, video tutorials, market research, demo accounts. |

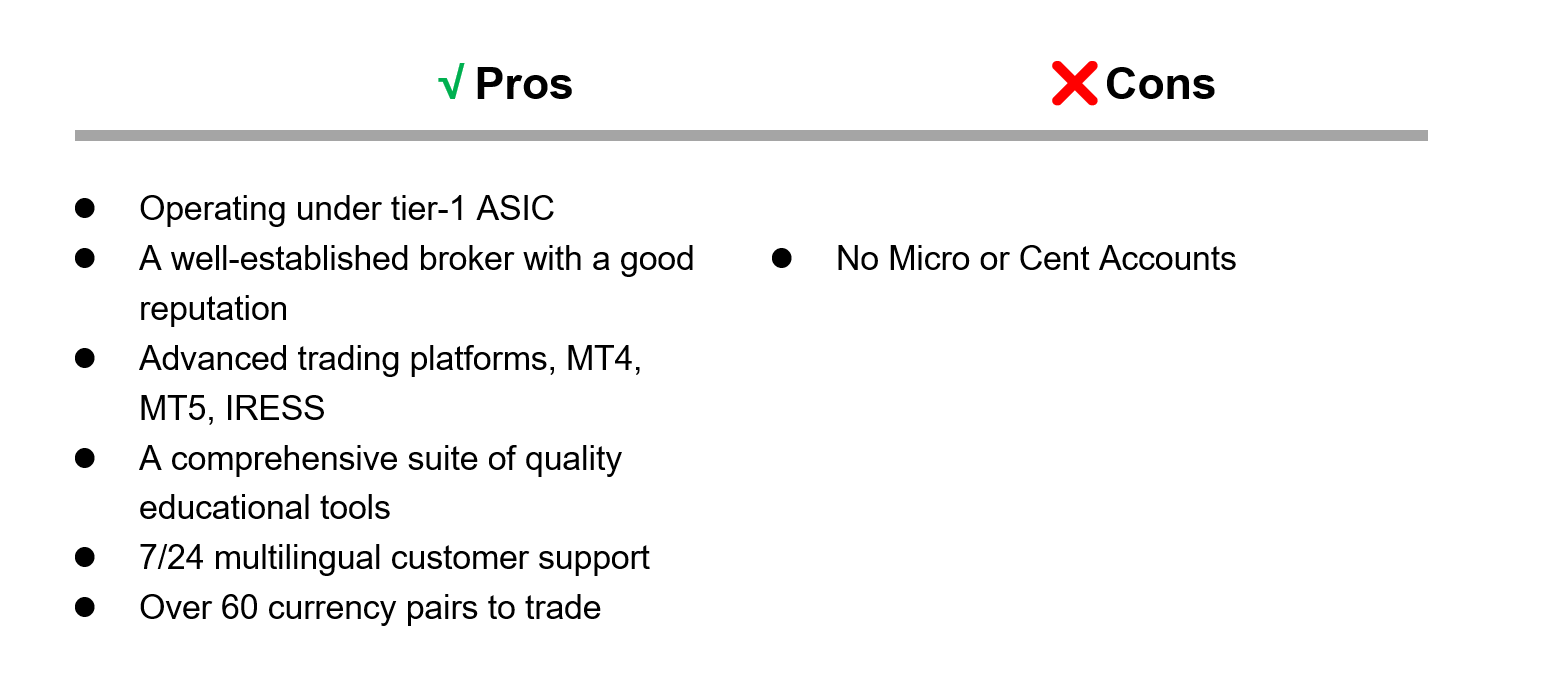

FP Markets

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, CYSEC

Best for trading platform offerings, most trusted

FP Markets, an Australian forex and CFD broker, was established in 2005. Based in Sydney, FP Markets is regulated by the Australian Securities and Investments Commision (ASIC) and holds an Australian Financial Services Licence. Throughout its extensive history of more than 15 years, FP Markets has established itself as a trusted name in the industry, known for its highly competitive pricing, lightning-fast execution speeds, and top-notch trading platforms such as MetaTrader 4, MetaTrader 5, and Iress. FP Markets provides a wide range of trading options, including forex trading on over 60 currency pairs and CFDs across various assets such as indices, commodities, shares, and cryptocurrencies. Traders have the option to select between raw spread accounts that offer access to deep liquidity or ECN accounts that provide tight variable spreads. FP Markets welcomes clients from around the world and is renowned for its round-the-clock customer support in multiple languages.

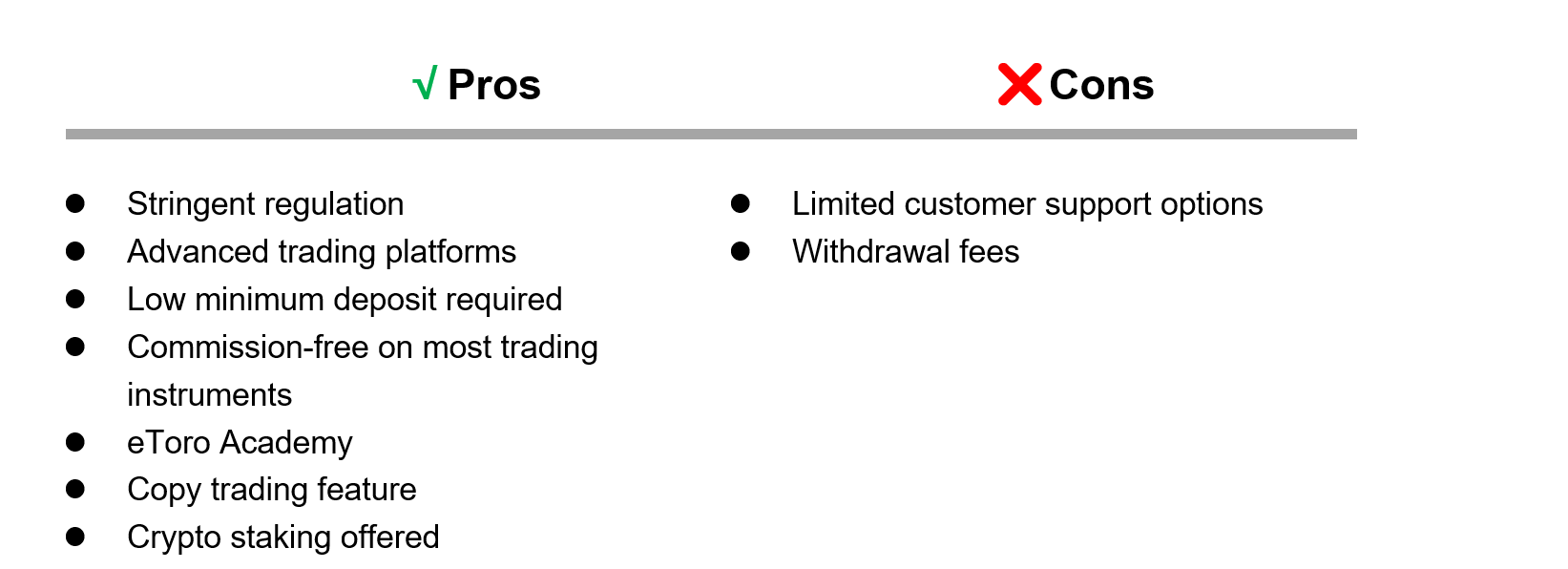

eToro

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, CYSEC, FCA

Best for copy and crypto trading

eToro represents one of the leaders in the global fintech revolution. Established in 2007 and headquartered in Cyprus, this innovative social trading platform allows users to connect, share strategies and replicate the performance of successful investors. eToro boasts unique features such as “CopyTrade,” which enables users to mimic the trades of top-performing traders, and a user-friendly trading dashboard with real-time charts, pricing alerts, and multi-asset support. eToro offers a broad range of assets from stocks, ETFs, and commodities to cryptocurrencies.

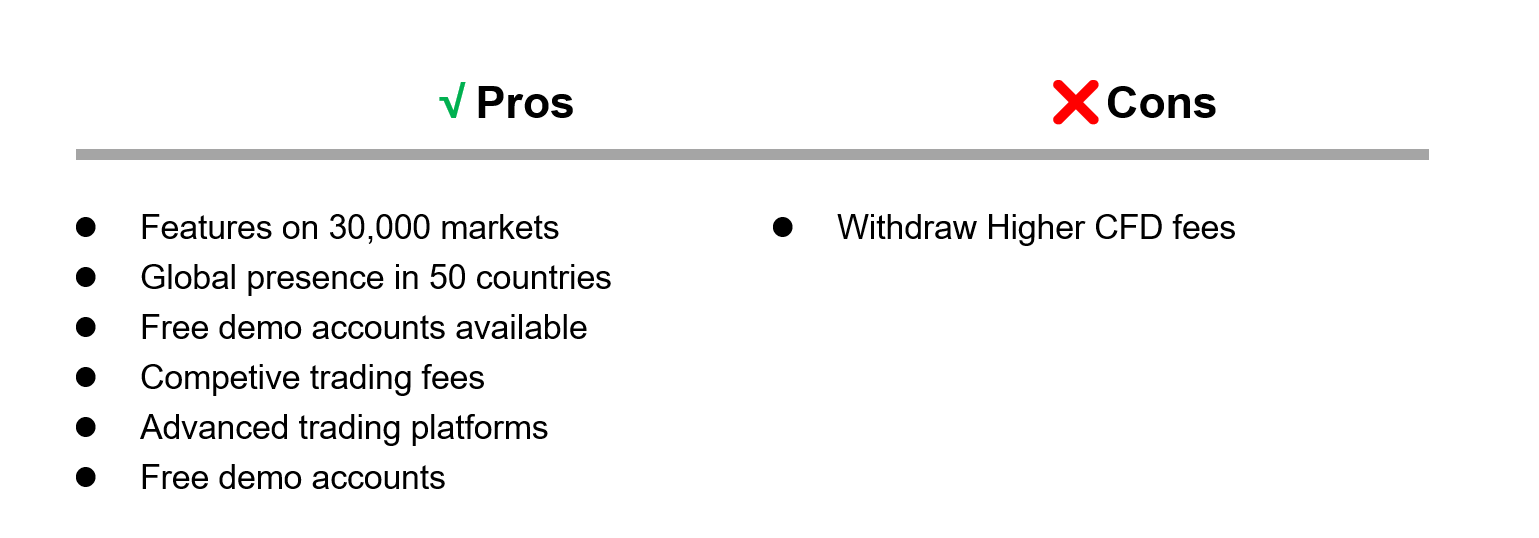

Plus500

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, CYSEC, FCA, FMA, MAS

Best for low-cost trading in currencies

Established in 2008, Plus500 is an online trading platform that offers retail investors a diverse selection of financial instruments. These include stocks, cryptocurrencies, commodities, forex, and more, all accessible through Contracts for Difference (CFDs). Operating in multiple countries and being regulated by various financial authorities, it offers users a sense of trust and security. Traders have the option to access the platform through web and mobile applications, providing convenience for individuals interested in participating in leveraged trading across global markets.

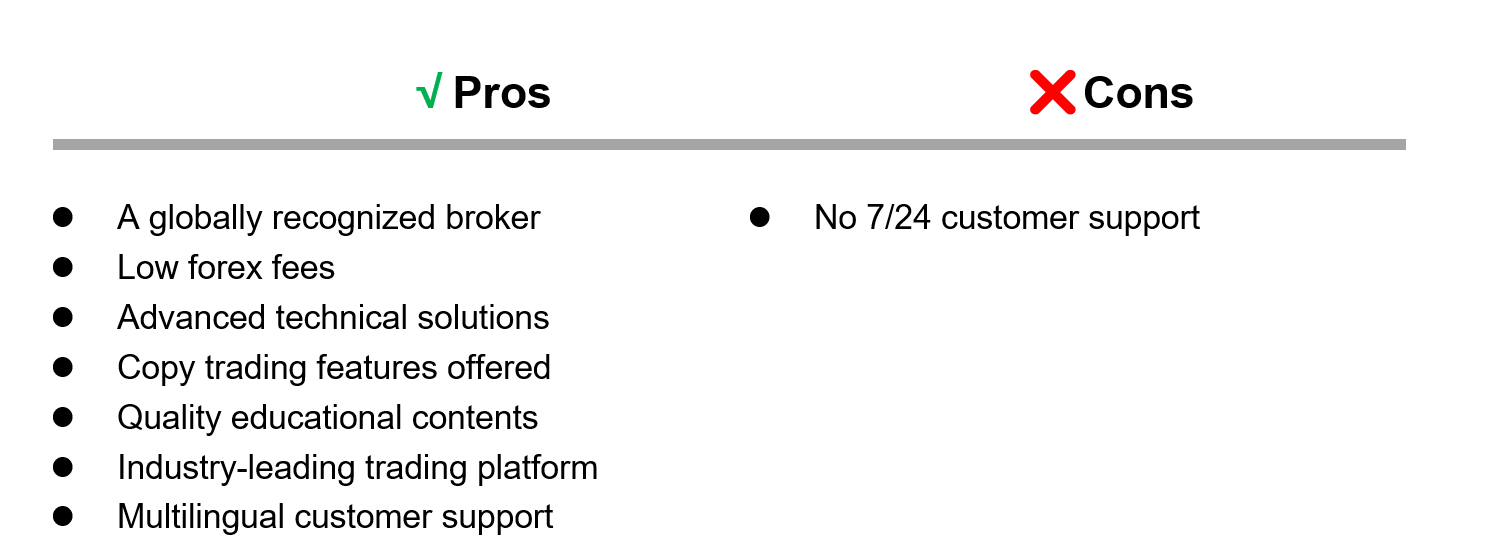

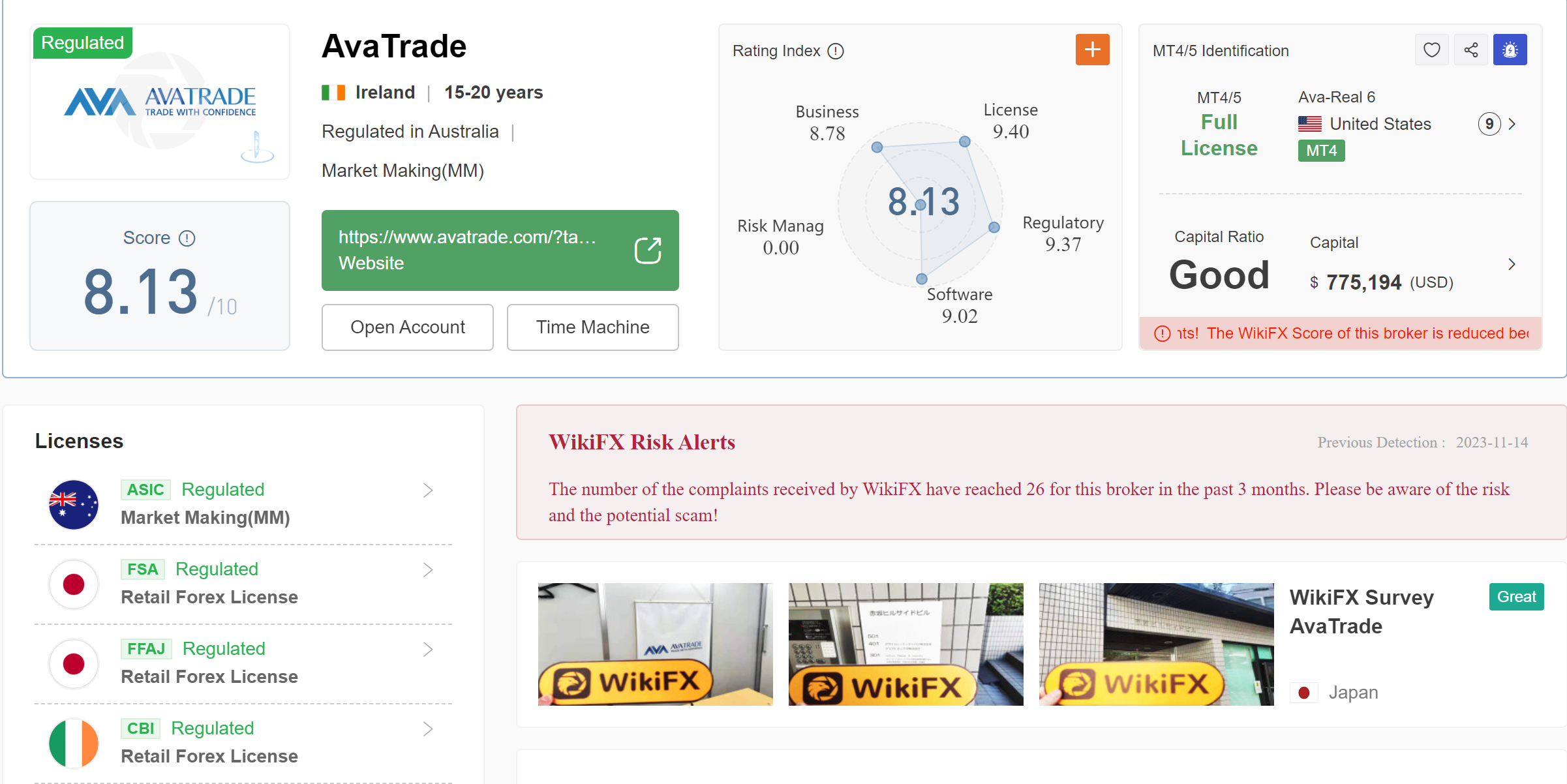

AvaTrade

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, FSA, FFAJ, CBI, FSCA, FCA

Best for educational resources offerings

AvaTrade is an international forex and CFD brokerage that was founded in 2006 in Dublin, Ireland. Regulated by the Central Bank of Ireland and licensed by financial regulators across Europe, Japan, South Africa, and Australia, AvaTrade provides retail traders, institutions, and fund managers access to trading instruments spanning forex, cryptocurrencies, bonds, commodities, indices, stocks, and ETFs. AvaTrade stands out for its comprehensive educational resources, multilingual customer support, and array of trading platforms including the popular MetaTrader 4 and AvaTradeGO. Traders can choose between floating or fixed spreads and leverage up to 1:400. AvaTrade also offers automated trading through Expert Advisors on the MetaTrader 4 platform. With its focus on trust, innovation, and empowering traders, AvaTrade has grown rapidly over the past 15+ years to serve over 200,000 accounts globally.

XM

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, CYSEC, FSA, DSFA

Best for educational content and market research offering

XM was established in 2009 and is a CFD and forex broker operating online. With its headquarters in Cyprus and under the watchful eye of the Cyprus Securities and Exchange Commission (CySEC), this firm is a respected member of the brokerage community. XM provides trading services to customers all around the world and provides access to a wide variety of trading instruments, such as foreign exchange, commodities, equities, and indices.

IG

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, FCA, FSA, NFA, AMF, FMA, MAS, DFSA

Best for professional traders

Founded in 1974, IG is a British multinational over-the-counter (OTC) derivatives trading services company and trading broker, operating from five global offices as IG Group Holdings Plc. IG Trading is considered a safe platform because it is highly regulated by several top-tier regulators. Notably, the Financial Conduct Authority (FCA) in the UK, Australian Securities and Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS) are among these regulatory bodies. IG provides individual retail investors the opportunity to trade a diverse range of CFDs, including major stocks, cryptocurrencies, indices, forex, and commodities worldwide.

Saxo Bank

Overall: ⭐⭐⭐⭐⭐

Regulation: ASIC, FCA, FSA, SFC, AMF, CONSOB, FINMA, MAS

Best for advanced trading tools provided

Saxo Bank is an online multi-asset trading and investment specialist that was established in 1992 and is based in Copenhagen, Denmark. Saxo Bank is authorised across Europe, Asia, and Australia and holds banking and investment banking licences issued by the Danish Financial Supervisory Authority. Saxo provides a wide range of trading options, including forex, CFDs, stocks, futures, options, bonds, and other asset classes. These can be accessed through the user-friendly SaxoTraderGO platform and the advanced SaxoTraderPRO platform. With a single margin account, clients have the convenience of accessing over 35,000 instruments across global markets.

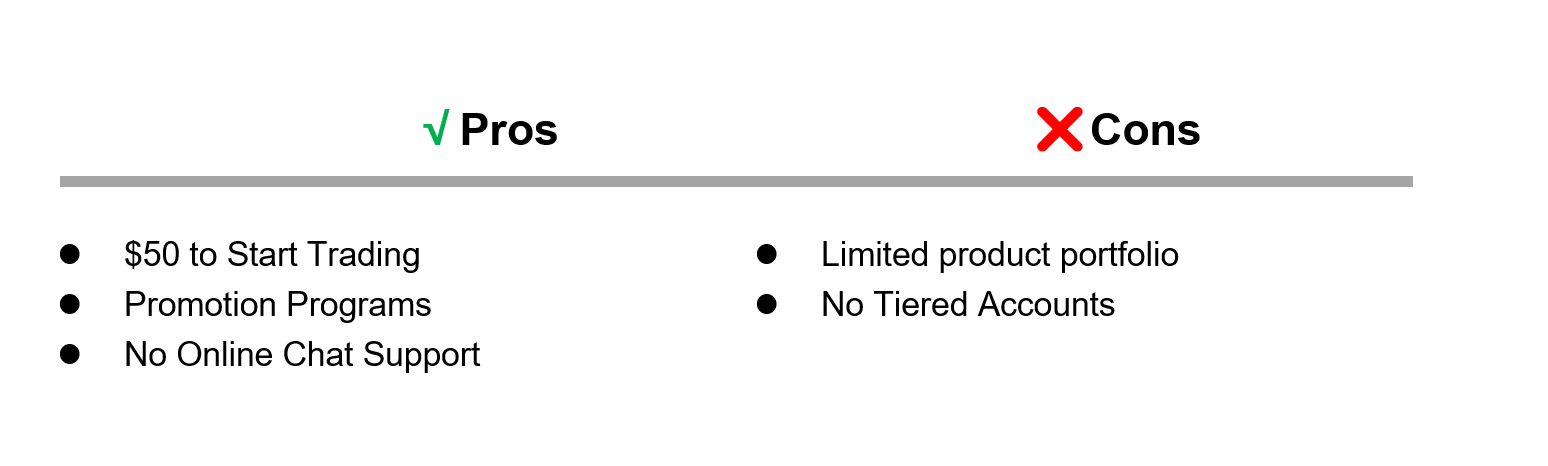

FXCM

Overall: ⭐⭐⭐⭐

Regulation: ASIC, FCA, CYSEC, FSCA

Best for algorithmic trading

FXCM, operated by FXCM Australia Pty Limited, is a well-known Forex broker based in Australia. The company was founded in 1999 and has since become a prominent player in the financial industry. FXCM offers a range of financial services and trading platforms, primarily focused on foreign exchange (Forex) trading. With its headquarters in Sydney, Australia, FXCM provides traders with access to global currency markets and a suite of tools and resources to support their trading activities.

Forex Trading Knowledge Questions and Answers

Is Forex Trading Legal in Ireland?

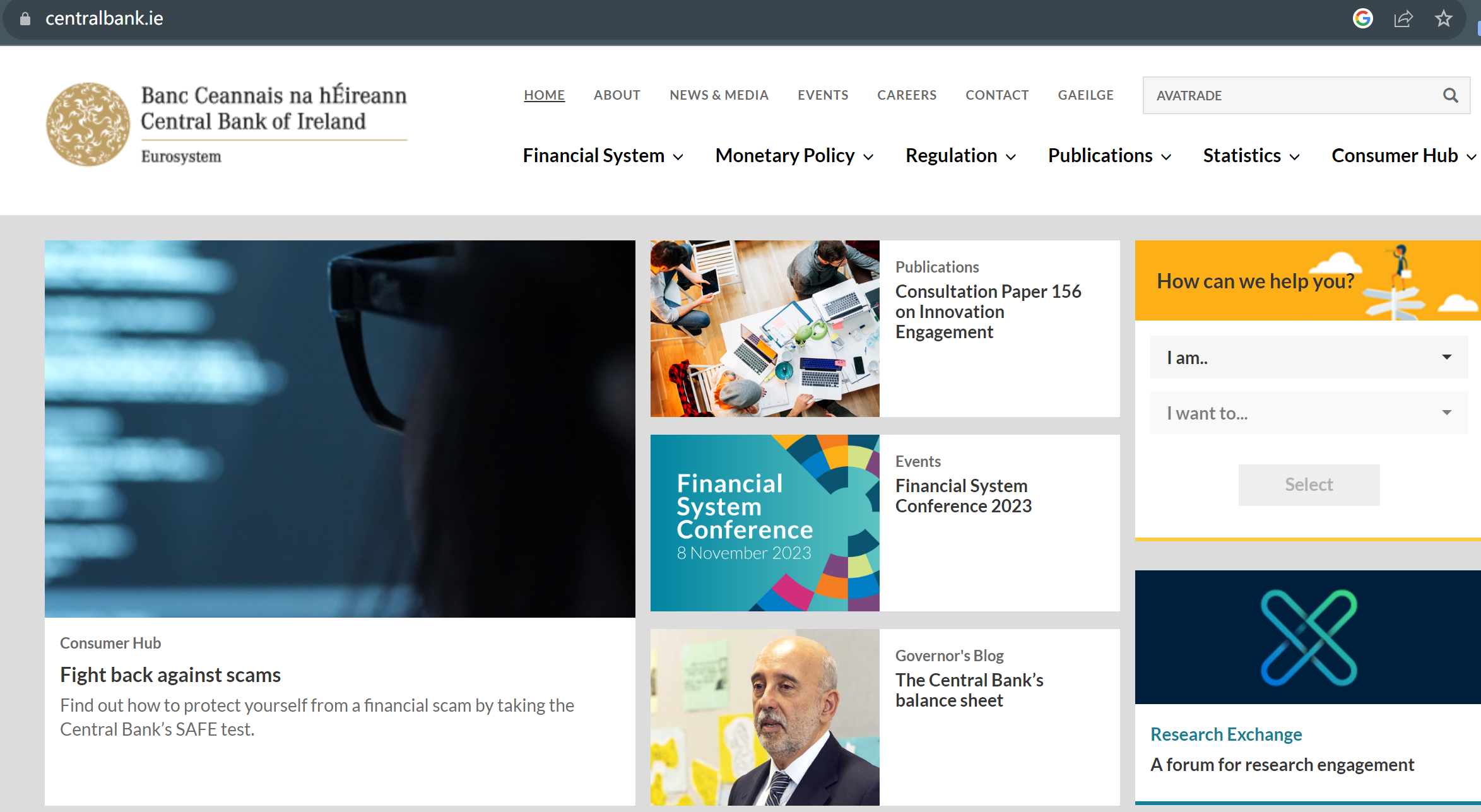

Indeed, forex trading is permitted and regulated in Ireland. The Central Bank of Ireland (CBI) oversees the forex market and ensures that brokers adhere to the necessary laws and regulations.Certainly, you can verify a forex broker's regulation status with the Central Bank of Ireland (CBI) by accessing their official website and looking up the broker's name in the register of authorized financial service providers.

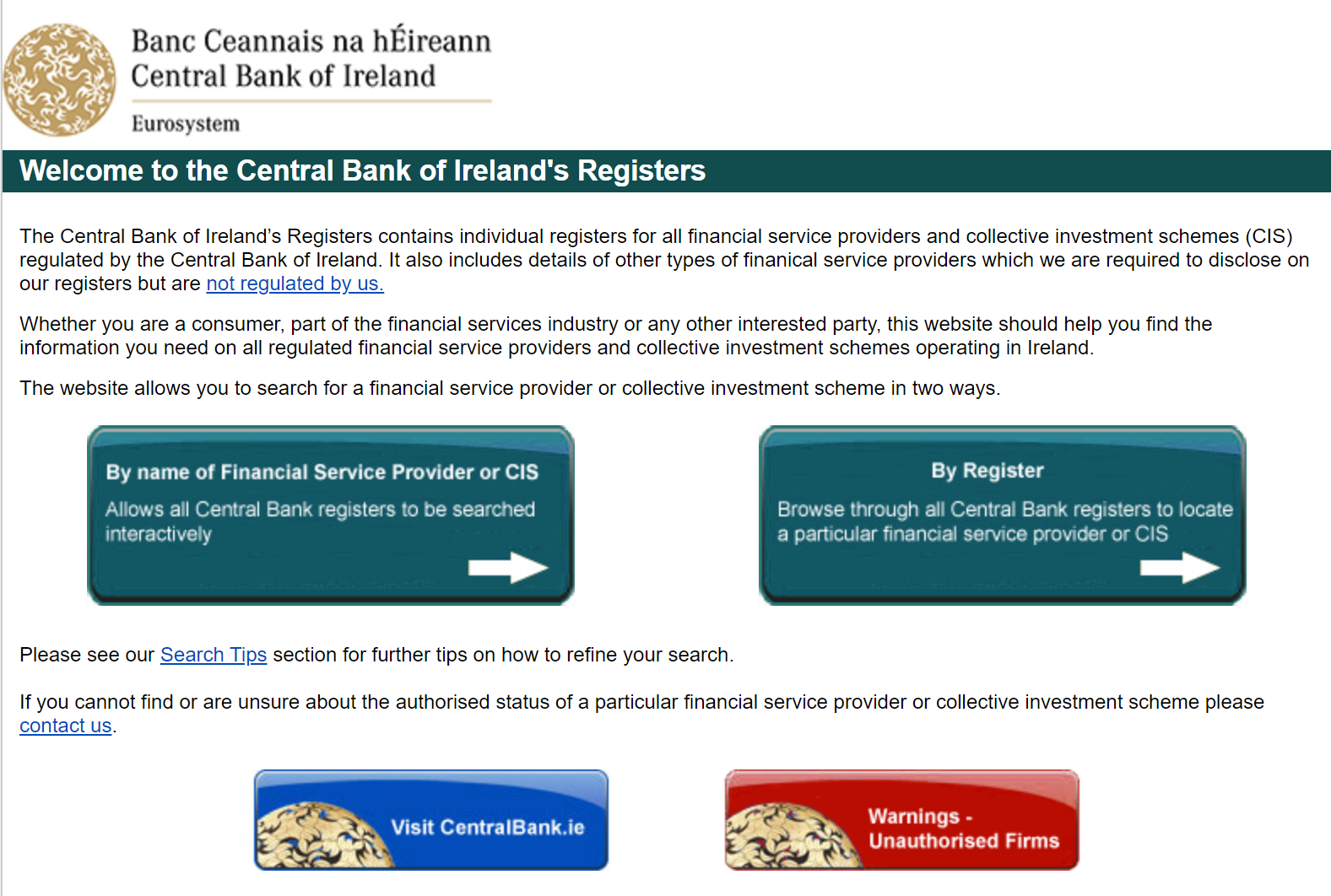

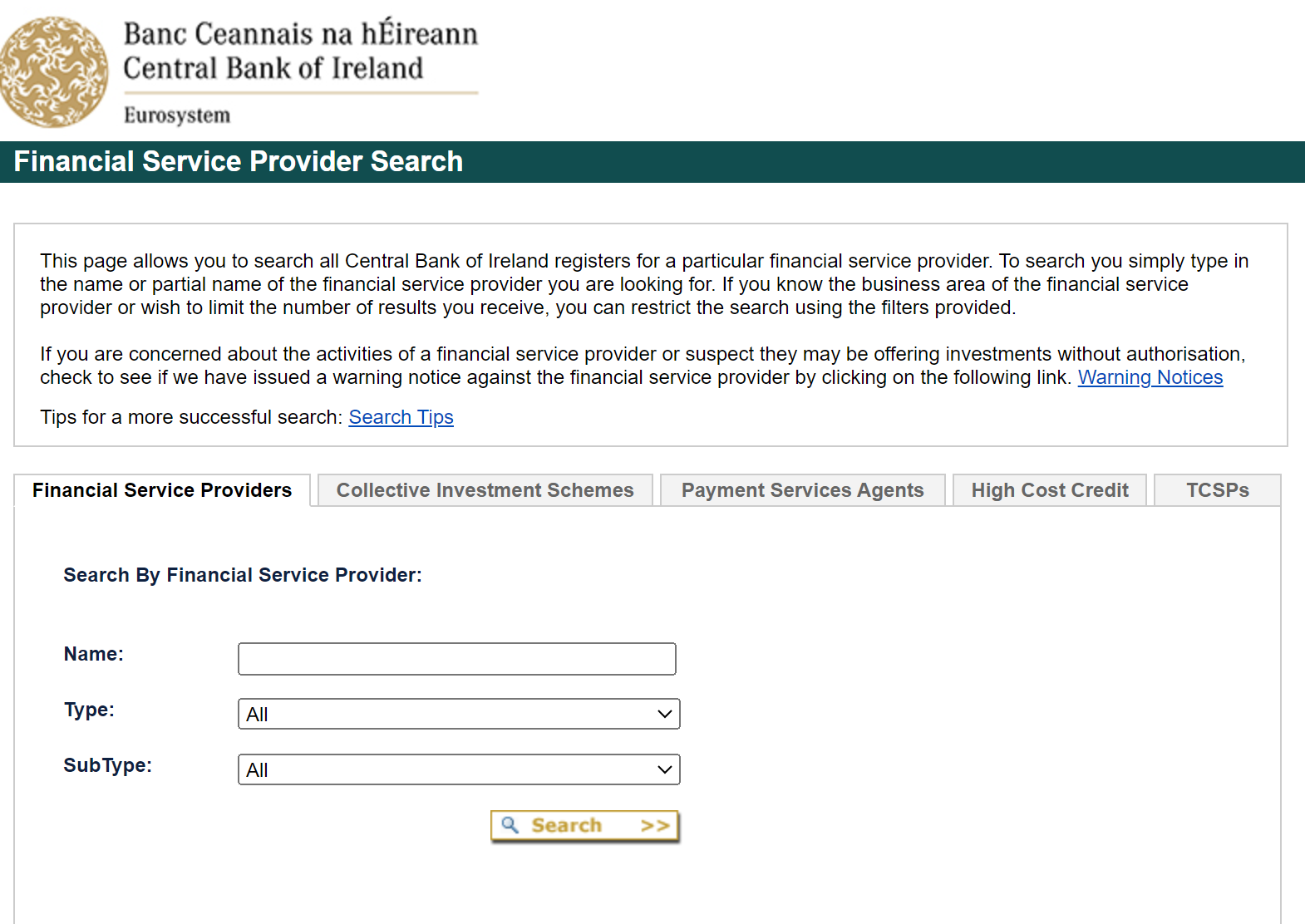

Here we provide you with a concise guide on verifying a broker's regulatory status under the Central Bank of Ireland (CBI).

Begin by accessing the official website of the Central Bank of Ireland athttps://www.centralbank.ie/. From there, you'll need to locate and access the “registers of firms” section to move forward.

Next, navigate to the section labeled “By name of Financial Service Provider or CIS” on the following page, and click on this particular button.

Subsequently, a search page will appear. For instance, to check the regulation status of Avatrade's European entity, you can enter “AVA Trade EU Limited” in the search bar to see if it is actually regulated.

CBI Regulation in Ireland

The Central Bank of Ireland (CBI) has a wide range of powers to enforce its regulations, including the power to investigate forex brokers, impose fines, and withdraw licenses. Here are some of the specific penalties that can be imposed on forex brokers who break the rules in Ireland:

Fines: The Central Bank of Ireland (CBI) has the authority to levy fines, with penalties reaching up to $1 million for each violation of regulations.

Withdrawal of licenses: In cases where forex brokers breach regulations, the CBI, holds the power to suspend or entirely withdraw their licenses.

Criminal prosecution: Should a forex broker commit a severe violation, the CBI can refer the case to the Garda Síochána (Irish police) for potential criminal prosecution.

Furthermore, the CBI possesses the authority to mandate corrective measures for forex brokers, including enhancements to internal controls or elevating customer service standards.

The CBI's stringent approach toward rule-breakers results in substantial implications for forex brokers. Consequently, compliance with the CBI's regulations is a standard practice among forex brokers in Ireland.

Which Currency Pairs can I Trade in Ireland?

When you join a top-tier forex broker in Ireland, you'll gain access to a vast range of currency pairs, containing majors, minors, and exotics.

Majors are the most popular pairings, featuring the US Dollar against other major currencies.

Minors involve at least one of the Euro, British Pound, or Japanese Yen paired with other major currencies, excluding the US Dollar.

Exotics, on the other hand, pair a major currency with a developing economy's currency. Examples of exotic pairs include GBP/HUF, EUR/MXN, and JPY/ZAR.

Is MT4 Available in Ireland?

Yes, MetaTrader 4 or MetaTrader 5 are all legal in Ireland. To utilize MetaTrader software for forex trading in Ireland, you'll need to have an account with a regulated Irish forex broker. All live trades executed through MetaTrader will be processed via the broker's trading platform.

What's the Minimum Forex Trade Size in Ireland?

Want to start Forex trading in Ireland? You need to know the minimum trading volume. In general, the Irish forex market uses 0.01 lots as the minimum trading unit, which is 1000 benchmark currencies. This unit is often referred to as the “miniature hand.” The standard hand is 100,000 base currencies.

What is the Most Famous Forex Broker in Ireland?

Undoubtedly, born and bred in Ireland, Avatrade stands as the pinnacle among forex brokers. With an illustrious operational legacy of nearly 20 years, this broker operates under the watchful eyes of multiple regulatory bodies, including the Central Bank of Ireland, ensuring a secure trading environment for all. As a proud member of the Investor Compensation Scheme (ICS), Avatrade offers an unmatched reputation built on its expansive accessible markets, cutting-edge trading platforms, transparent fee structures, and more, globally recognized and trusted by millions of traders.

How to Choose the Best Forex Brokers in Ireland?

Choosing the best forex broker in Ireland can be a daunting task, as there are many factors to consider. Here are a few tips to help you make the best decision for your needs:

Know your trading style

What's your trader profile: novice or seasoned? Are you inclined towards manual trading or prefer automated trading? Are you looking for an extensive array of trading instruments or just a handful of major ones? Once you've figured out your trading preferences and level of expertise, you can streamline your choices.

Compare regulation and reputation

Necessarily ensure the forex broker you choose is regulated by a reputable authority, such as the Central Bank of Ireland (CBI). Then delve into online reviews and forums to see what other traders have to say about the broker's standing.

Evaluate trading platforms and tools

The trading platform serves as the software you'll use to execute trades, with popular ones like MetaTrader platforms and some brokers offering TradingView or proprietary platforms. Ensure the platform's ease of use and availability of essential features like charting tools and technical indicators.

Consider fees and commissions

Various forex brokers impose varying fees and commissions. Comparing these fees among different brokers can help you secure the best deal aligned with your trading volume. In today's competitive market, brokers often tout zero spreads or commission-free structures to attract traders. Absolutely crucial is the need to verify any potential hidden fees that might apply.

Read the fine print

Prior to establishing an account with a forex broker, ensure to meticulously read through the fine print. Take time to review the terms and conditions, the risk disclosure statement, as well as the fee schedule. These documents provide essential details about the broker's services, potential risks involved, and the cost structure.

Open a demo account

Most forex brokers, especially reputable ones, offer demo accounts that are funded with large amounts of virtual money for traders to test the trading environment or practice trading skills without risking your own capital. Therefore, traders must cherish this tool to check if there are any potential issues with the broker, like high slippage, intermittent trading platform connections, absence of customer support, and more.

Contact customer support

Make sure the forex broker you choose offers good customer support in case you have any questions or problems. Contact them first to make sure they will respond anytime you need help. Otherwise, inadequate support during live trading might directly contribute to potential losses.

Once you have considered all of these factors, you can start to narrow down your choices and choose the best forex broker in Ireland for your needs.

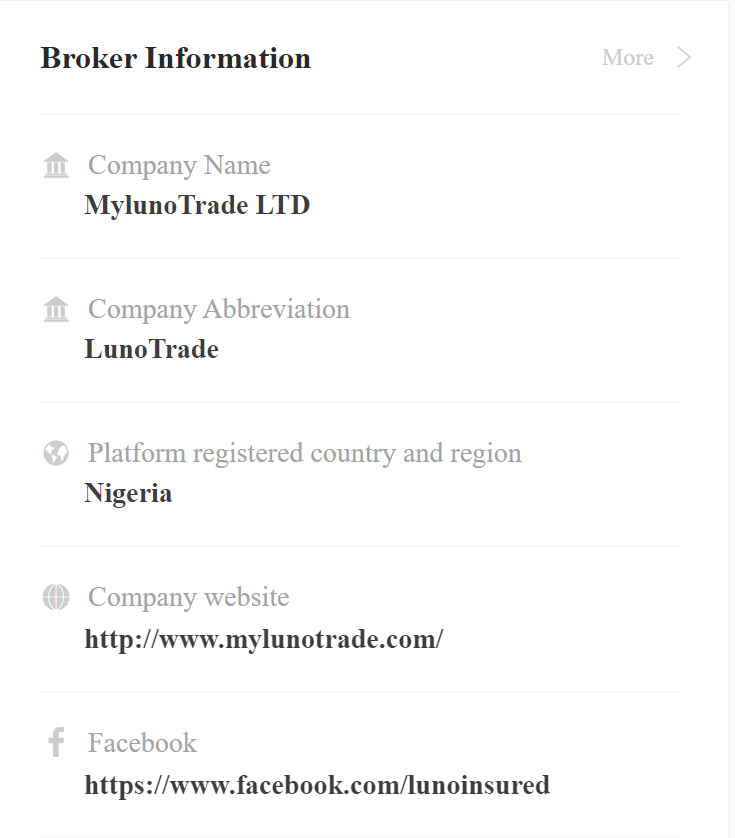

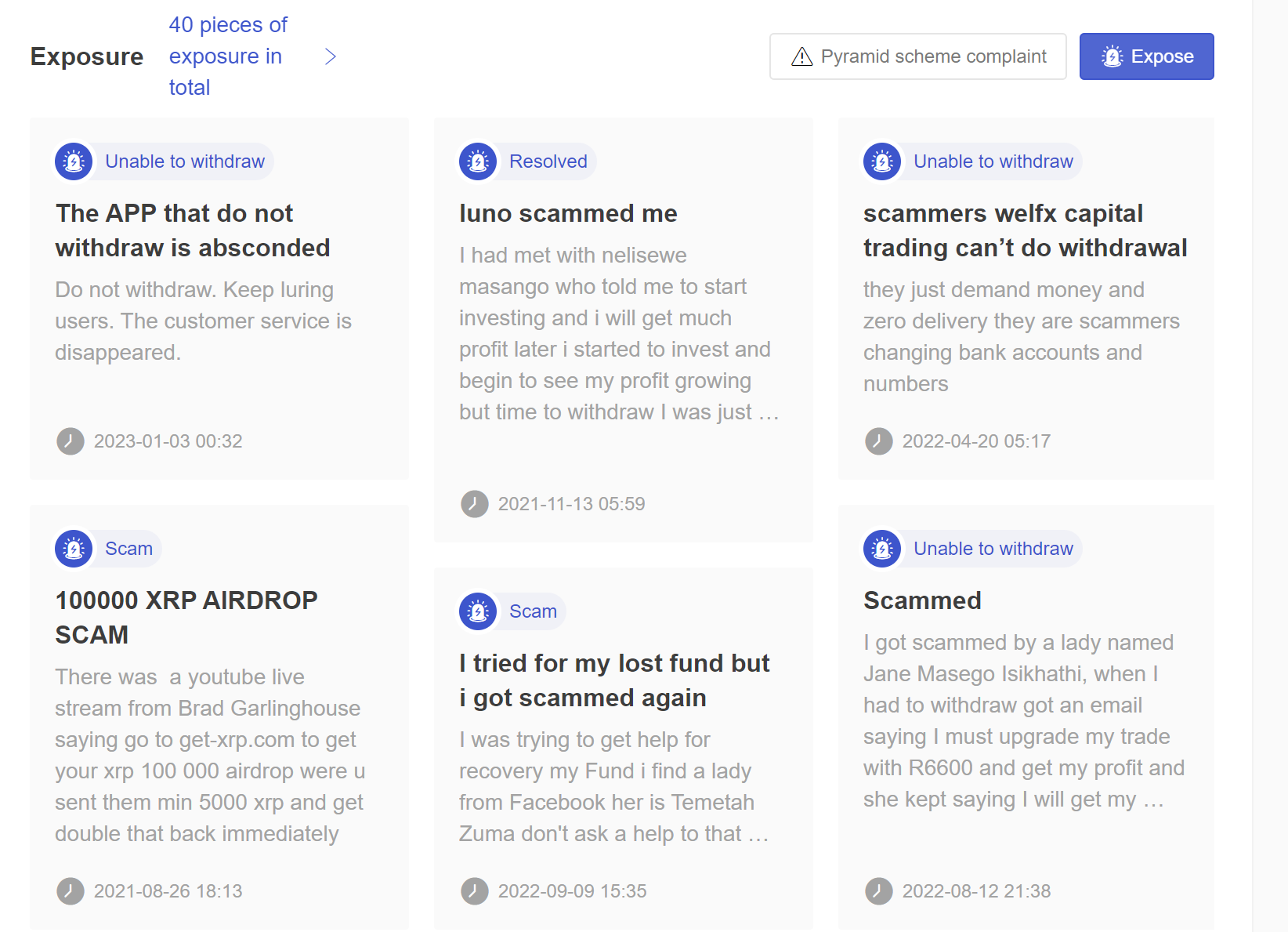

What are Scam Brokers that Traders Should Avoid in Ireland?

| Scam Broker | Logo | Registered Country | Regulatory Status | Establishment of years | Trading Platform | Customer Support | Additional Notes |

| LunoTrade |  |

Nigeria |  |

2-5 years | Unknown | No | 40 pieces of scam exposure |

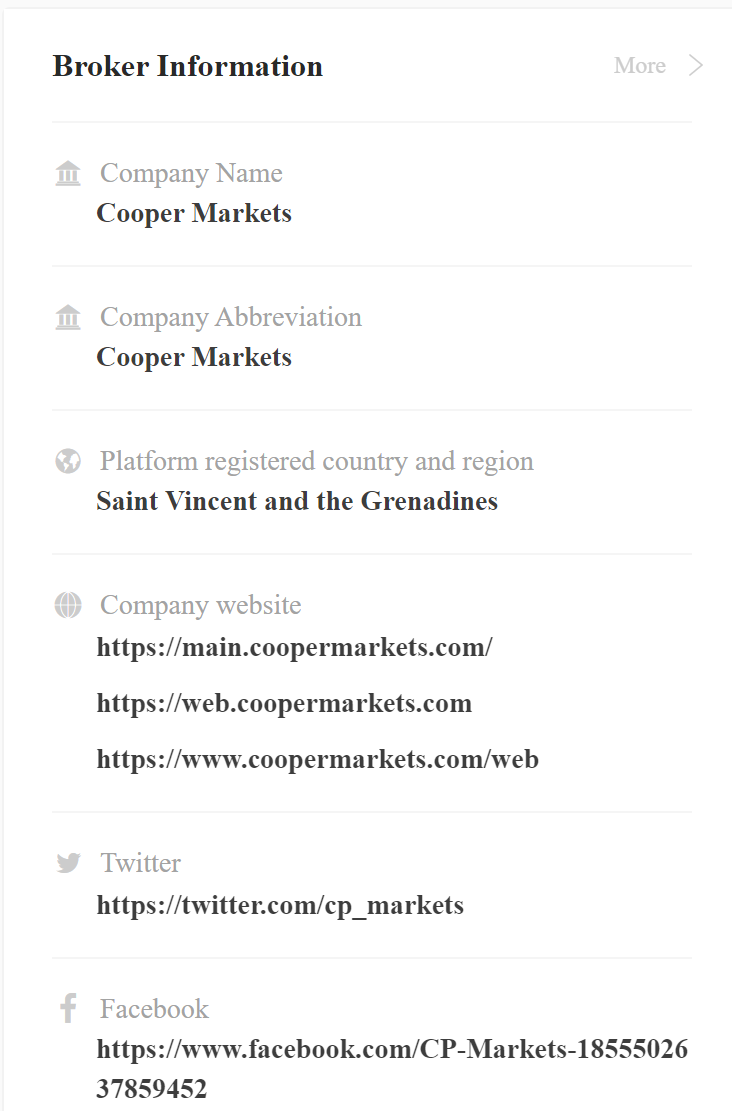

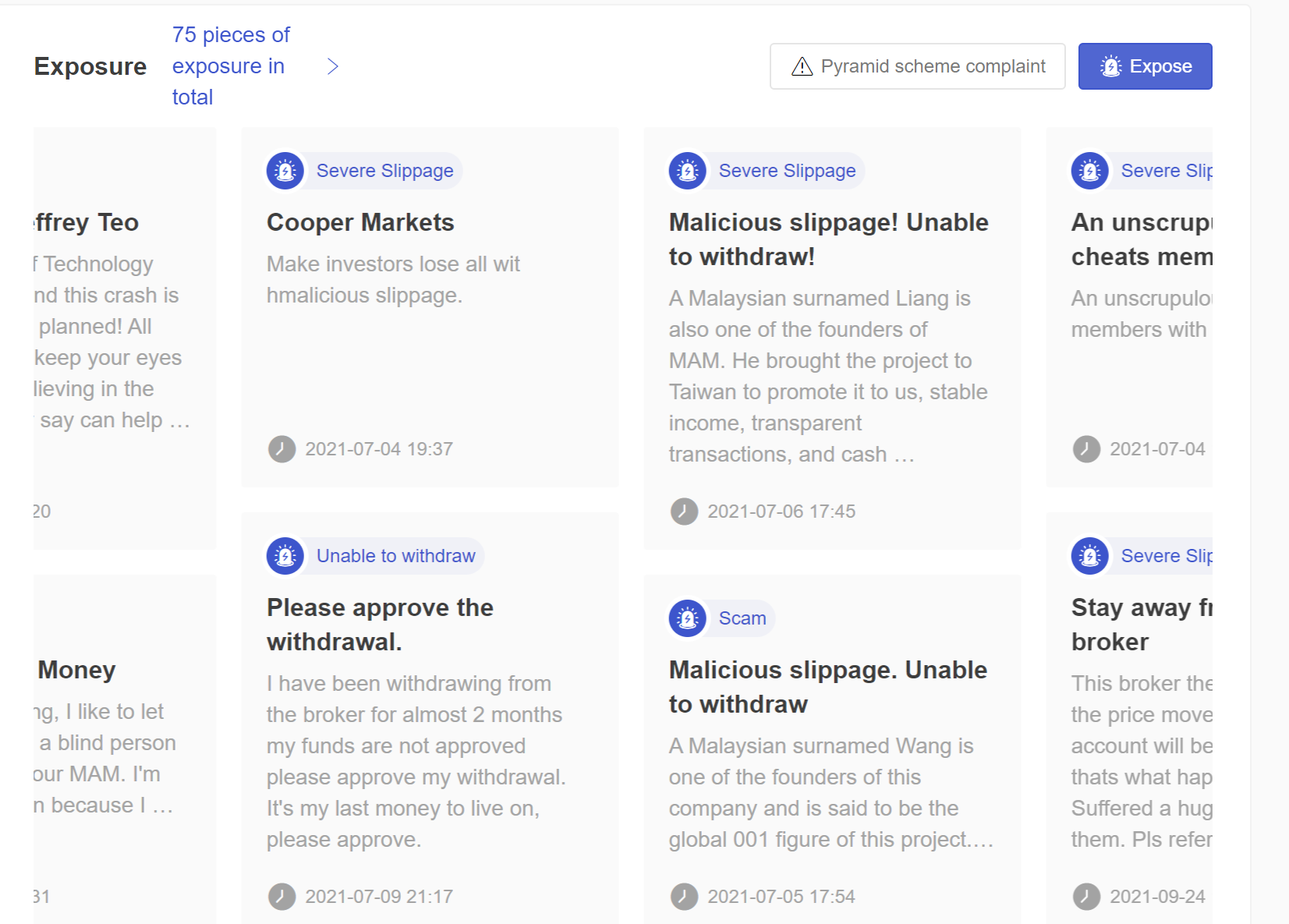

| Cooper Markets |  |

Saint Vincent and the Grenadines |  |

2-5 years | MT4 | Telephone & Email, not answering | 75 pieces of scam exposure |

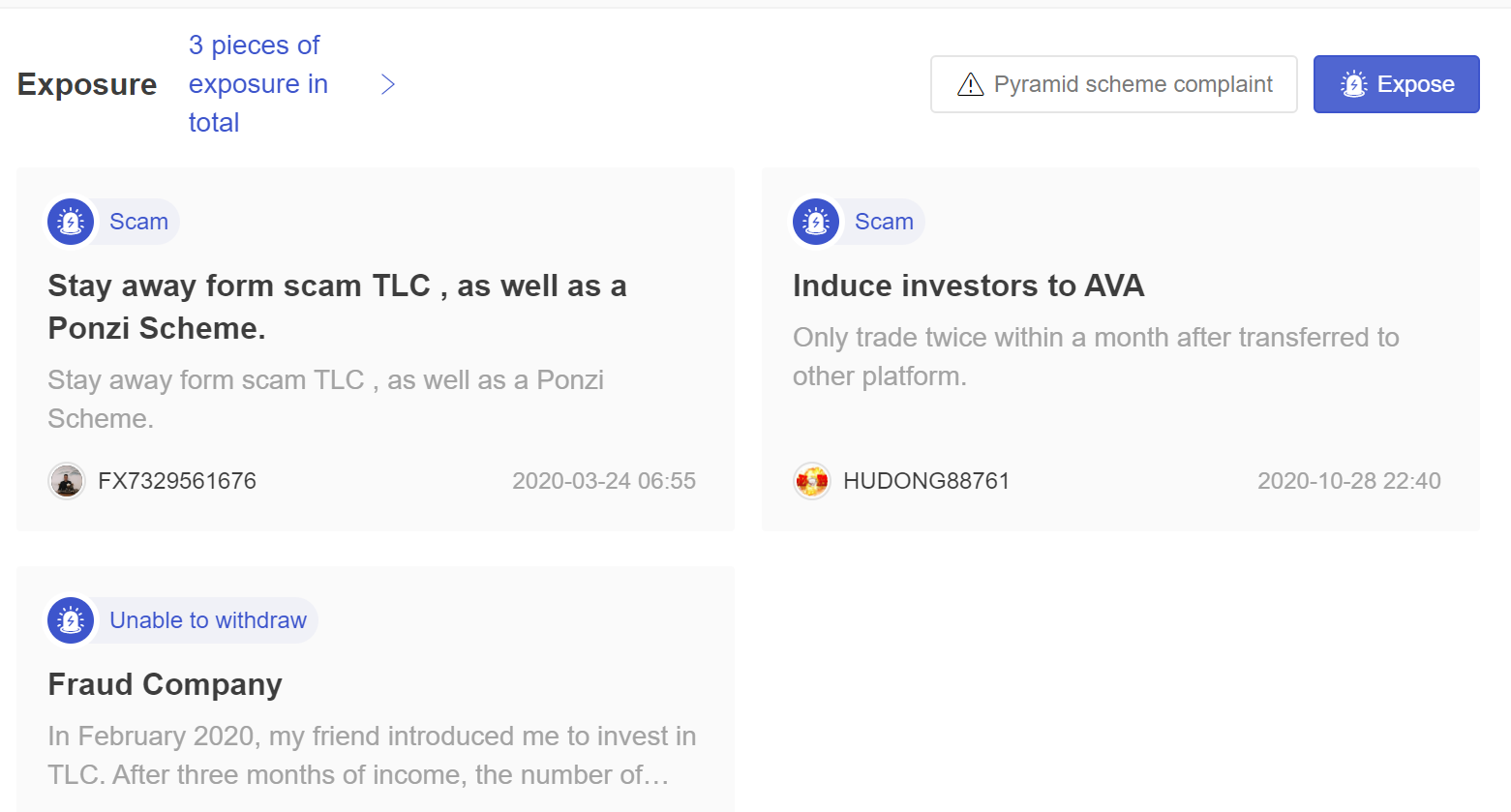

| TLS |  |

Hong Kong |  |

2-5 years | Unknown | Phone & Email | 3 pieces of scam exposure |

| QIMI |  |

United Kingdom |  |

5-10 years | Counterfeit MT4 | Email & Phone | Fake License & 1 scam exposure |

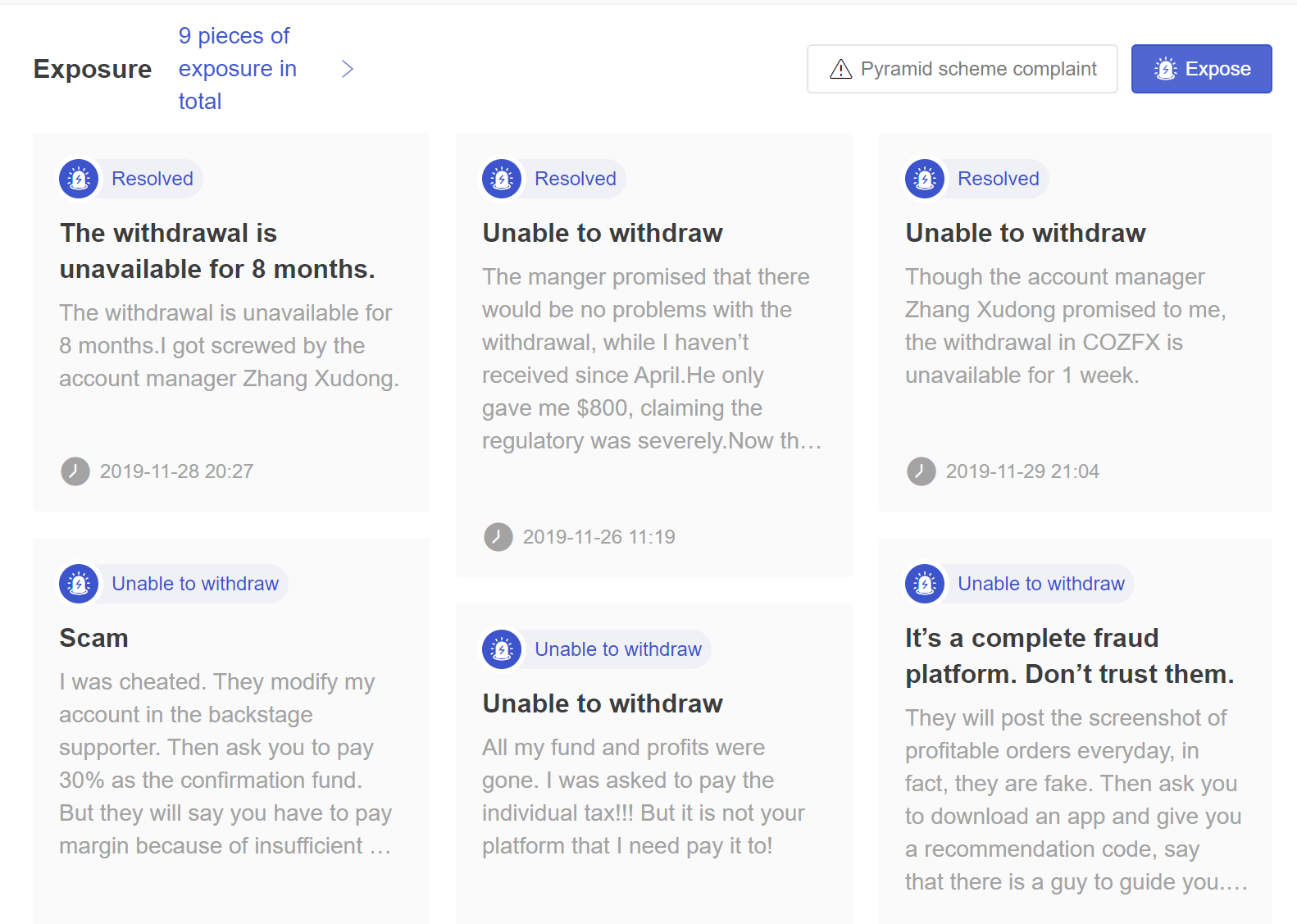

| COZFX |  |

United Kingdom |  |

5-10 years | MT4 & MT5 | United Kingdom | 9 pieces of scam exposure & finding no office |

LunoTrade, run by MylunoTrade LTD, claims Nigeria as its base, but the lack of substantial information on their website raises serious concerns. With over 40 scam exposures documented on WikiFX, numerous defrauded traders have presented evidence of falling victim to this dubious broker. Given the overwhelming evidence, investors in Ireland should exercise extreme caution and steer clear of LunoTrade.

Cooper Markets, an online forex broker claiming registration in the dubious offshore location of Saint Vincent and the Grenadines, a favored haunt for scammer brokers. However, our database reveals that Cooper Markets is an unregulated entity with no trace of ever being registered anywhere. The broker maintains a presence on two social media platforms, both inaccessible. To compound the issue, the scam exposure count for this broker has soared to a staggering 75, a truly alarming figure. Many unsuspecting individuals have fallen prey to this broker's deceit, enduring significant losses. Traders in Ireland must exercise extreme caution and steer clear of this notorious entity.

Another questionable player in the forex scene is TLC, a broker claiming affiliation with THRONE LEGACY CAPITAL. Despite asserting its establishment in 2019 with a Hong Kong headquarters, a closer look reveals a website domain privately registered in January 2019. The lack of regulatory oversight raises significant concerns.

Adding to the suspicion, the images showcased on TLC's website supposedly depicting its Hong Kong headquarters are nothing more than shots of uninhabited furnished office space. Such inconsistencies in their narrative warrant a closer examination.

Notably, WikiFX has received numerous scam exposures from traders, complete with compelling evidence. Three such cases stand out, painting a concerning picture of TLC's practices.

QIMI, this scam broker, asserts operation under QI Financial Solutions Limited. However, upon verification, this broker lacks any form of regulation. This unscrupulous broker has absconded, abandoning an inactive official website and providing bogus contact details.

COZ FOREX, purportedly a licensed broker under the authorization of the FCA, has been confirmed as a scam broker across multiple dimensions. Firstly, despite the broker's claim of being regulated by the FCA, an inspection of the FCA's official records clearly indicates otherwise – this broker lacks any form of FCA regulation. Secondly, an attempt to visit their registered office address was futile; no trace of their claimed office was found. Adding to the concern, the scam exposure count for this broker has escalated to a considerable 9, indicative of numerous incidents.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like:

Best Forex Brokers in Turkey for 2024

Review top 9 forex brokers in Turkey, elevating their trading pros and cons to give traders more useful guidance.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Swiss Forex Brokers for 2024

Explore top 10 forex brokers in Switzerland, elevating their trading pros and cons to give traders more useful guidance.

Best Stock Brokers in the US for 2024

When choosing an online broker, finding the platform that best fits your investment needs is crucial. With the rise in popularity of online trading, more brokers are offering free stock trading and commission-free transactions for various assets. It has become a challenge for users to select suitable brokers.

Best MT5 Forex Brokers in 2024

Here is our pick of the best MT5 Forex Brokers and this list includes only regulated brokers that are highly ranked and come highly recommended for trading.

8 Best Forex Trustworthy Brokers in 2024

Stay informed and avoid forex scams with our list of 8 Top Trustworthy Brokers – trade with peace of mind and profitable potential.

Best Brokers with Smartwatch Apps for 2024

This guide compares the best brokers and their smartwatch app features- a quick way to manage your portfolio.

Best Mac Forex Trading Platforms for 2024

Forex traders, particularly Mac users, need suitable platforms. This article examines the top Mac Forex trading platforms' brokers.