If you want to participate in this promotion, you need a currency broker. Many stock trading celebrities do not offer this feature. The market is so diverse that you also need to value your Forex brokers differently from stockbrokers. Trading with a trusted Forex broker is a key factor in success in the international Forex market. As a Contract for Difference (CFD) trader or Forex investor, you may have specific needs related to your platform, trading tools, or research requirements. By learning more about your investment style needs, you can decide which Forex broker is best for you. Forex trading in the Philippines, unlike stock markets and investment trusts, is not yet in the limelight, but it is a great option for diversifying your investment. Domestic Forex trading may not be that big yet, but it is gradually gaining attention on many Forex trading platforms available today.

Philippines Financial Regulatory

Philippines Securities and Exchange Commission (SEC)

Insurance Commission (Komisyon ng Seguro)

Bangko Sentral ng Pilipinas (Central Bank of the Philippines)

Philippine Deposit Insurance Corporation (PDIC)

Department of Finance (DOF)

Philippine Stock Exchange (PSE)

Bureau of Treasury

Foreign Exchange Market in the Philippines

The Bangko Sentral ng Pilipinas (BSP) maintains a floating exchange rate system. Exchange rates are determined based on supply and demand in the foreign exchange market. The role of the BSP in the foreign exchange market is principal to ensure orderly conditions in the market. The market determination of the exchange rate is consistent with the Governments commitment to market-oriented reforms and outward-looking strategies of achieving competitiveness through price stability and efficiency. In the Philippines, peso-dollar trading among Bankers Association of the Philippines (BAP) member-banks and between these banks and the BSP are done through the Philippine Dealing System (PDS). Most of the BAP-member banks which participate in peso-dollar trading use an electronic platform called the Philippine Dealing and Exchange Corp. (PDEx). The BAP appointed PDEx as the official service provider for the US Dollar (USD) / Philippine Peso (PHP) spot trading (which involve the purchase or sale of the US dollar for immediate delivery, i.e., within one day for US dollars), and Reuters, as the exclusive distributor of all PDEx data. Trading through the PDEx allows nearly instantaneous transmission of price information and trade confirmations. Meanwhile, banks that do not subscribe to PDEx can continue to deal with peso-dollar spot transactions via their Reuters Dealing screens.

Best Forex Brokers in the Philippines 2024

Competitive trading fees, including a tight spread of only 0.0 pips, potentially help traders save on their overall trading costs.

A variety of advanced trading platforms, including MetaTrader 4, with numerous features and tools that can help you to trade more effectively.

A Stringently Regulated Broker, Reliable and Safe to Trade With, The Choice of Over 3500,000 Clients from Over 190 Countries.

Quick & Easy to Start Your Real Trading by Funding As Low As 5 USD, Lower & Friendlier Cost Structure Available, Advanced Trading Platforms & Tools Drive You Succeed into the Forex World.

Both ASIC & CYSEC Regulated Financial Provider offers You Excellent Security.

24/7 Professional and Multilingual Customer Support Easy to Reach.

more

Comparison of the Best Forex Brokers in the Philippines

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Forex Brokers in the Philippines FAQs

Is Forex Trading legal in the Philippines?

Forex trading on all types of local securities accounts is illegal in the Philippines. This is due to various forex fraud and fake financial masters who have cost Filipinos thousands of dollars. However, although a bit more complicated than most countries, there is a way to overcome this legal barrier without doing anything that could cause problems.

For Forex beginners, learning about Forex, attending seminars, opening a demo account with Forex brokers, and practicing is perfectly fine. Strictly speaking, it is illegal to trade forex from a group of Filipino people and seek funds to run a forex trading business or a brokerage firm.

This means that you can trade Forex using a foreign broker, but you are not covered by SEC insurance or protection. You can only trade at your own risk. The SEC advised the public not to open a securities account, but doing so is not prohibited, it is only encouraged.

In summary, it's okay to trade with foreign international brokers with your own money, but it's okay to trade with others. Education, research, and advice are completely legal, although it is not possible to initiate intermediaries as there are currently no forex regulations in the Philippines.

How to start trading Forex in the Philippines?

First, you need a computer or phone with internet access. Next, you need to open an account with an international broker. Next, you need to make a deposit – preferably via an e-wallet such as PayPal or Skrill.

Depositing in a securities account is easy, but banks may ask you questions when you withdraw your hard-earned winnings. In this case, the profits are from overseas investments and you should submit transaction documents as needed.

Don't worry, the bank may want to check these records to see if you have done anything illegal. In addition, most brokers have a clear fee report. That is, it provides a detailed list of all transactions on the trading platform. This can be shown to those who want to see it.

Once all are covered, you can start trading with just the first deposit. Keep in mind, however, that these restrictions aren't enforced for no reason even if you avoid fraud by going to a reputable broker like the one above, you're still on risky financial products like binary options and CFDs. Please be careful. A solid forex trading strategy to follow.

What are the terms in Forex you should know?

Forex trading is not complicated once you get used to it, but to get used to it, you need to know what all the jargon means. Here are some of the key terms you need to know to understand your forex trading platform and strategy.

Pip

“Pip” stands for “Percentage of Points” and is used to measure price fluctuations. The pip is exactly 0.0001 for the currency and you can use this measurement to determine how much profit you have and how much the price of the currency has risen or fallen. For example, if you say that the EUR / USD is up 5 pips, it means that the EUR is up 0.05% against the USD.

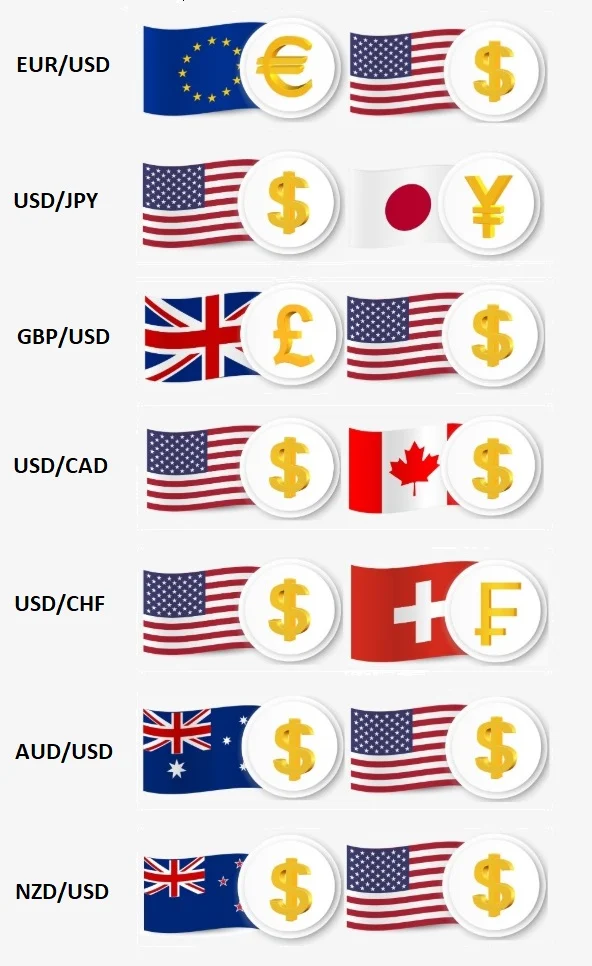

Currency Pairs

Forex trading means exchanging one currency for another. Currency pairs are simply two currencies to exchange. Major Pairs – “Major” is the most popular currency pair and occupies up to 85% of the total market, making it extremely liquid and easy to trade. Key pairs include EUR / USD, GBP / USD, USD / JPY, USD / CHF, AUD / USD, USD / CAD, and NZD / USD.

Cross Pairs and Exotic Pairs

These are all other currency pairs. Non-major does not include US dollars and is less popular, so it is usually more volatile, less liquid, and has higher transaction fees.

Bid and Ask Price

The bid price is the price at which the buyer agrees to buy something. In contrast, the selling price is the price that the seller is willing to sell it is the price they “request” to sell what you want.

Spread

This is the difference between the bid price and the asking price. For example, if the bid price is 0.99997 and the asking price is 0.99992, the spread is 0.00005 (or 5 pips). Spreads determine how much you win or lose in a trade.

Leverage

Forex trading requires a lot of money to make a profit, but you don't have to spend your own. All Forex brokers provide you with leverage, which means you can borrow trading money based on your current account balance. For example, if your account has $ 1,000 and the leverage available is 30: 1, you can trade $ 30,000. However, leverage also means that your balance can be negative. Make sure your broker has negative balance protection set to prevent this from happening.

Lots

A “lot” is equivalent to 100,000 units of the currency you are trading-this is a large number, but forex traders are usually large in forex trading due to leverage. There are also smaller trading units. Mini, micro, and nano lots are in 10,000, 1,000, and 100 currency units, respectively. Margin – This is the minimum amount of money required to access leverage. Brokers need some insurance before lending their money, so set a margin. If you fall below the limit set using leverage, a margin call will occur. That is, you need to fund your account. If you do not meet the requirements, you will not be able to use the same. The action of the lever.

Trading Platform

All brokers have software that allows you to trade using your computer or smartphone. These platforms typically have a list of tradable products, price charts, research tools, as well as news feeds, and other useful features. Some of the most popular platforms you will likely encounter are MetaTrader 4, MetaTrader 5, and cTrader.

Volatility

If a price is volatile, it means it can go up or down significantly. Volatility makes prices unpredictable and risky, but it can also be very potentially profitable. For example, Bitcoin investment is the risk of that volatility. In other words, the price can fall out and fall out of hundreds of dollars at a level of one hour.

What Forex strategy must apply when trading Forex in the Philippines?

After completing the 6 steps outlined in the previous section, you will have a margin account for a broker who can trade forex from the Philippines. You will probably want to develop a trading strategy that you can incorporate into your trading plan to increase your chances of success.

Below are five popular trading strategies that may be suitable for retailers, both from the Philippines and elsewhere in the world.

Scalping

Large and very short-term transactions. This includes getting in and out of the market quickly to win a few pips at a time. You can repeat this process multiple times a day if desired.

Day Trading

Start and end trading during a single trading session to avoid the additional risks associated with taking an overnight position. Trading decisions are often based on technical analysis, and if you want to make informed decisions, you need to understand past trends.

News Trading

Use strategies that take advantage of extreme exchange rate volatility that occurs shortly after the release of important news or economic data. Current events often push up currency prices and you need to know what is happening every minute during a transaction.

Swing Trading

Market entry and exit are usually based on vigorous technical indicators, and the general goal is to buy low and sell high. Swing traders can enter a position overnight, hoping that the position will improve when the market opens.

Trend Trading

Look for established directional movements called trends and incorporate long-term strategies to trade them until the end of the trend. In such cases, act for the future.

What time does the Forex market open in the Philippines?

The time at which the Forex market is opened in the Philippines is listed below:

| DAYS | TIME |

| Monday - Friday | 9:00 AM to 5:00 PM |

| Saturday, Sunday | Closed |

Time zones

You can refer to the following table to understand the time zone division of the currency market abbreviated as Forex market.

What is the best way of learning Forex Trading, YouTube, books, forums, or another way?

It is a private hobby to select the “best” way. You can research foreign exchange buying and sell from books or social media, something fits you in case you are a self-taught man or woman and might now no longer care approximately paying luxurious instructional charges to the marketplace. If now no longer, it's far beneficial you do one of the following things:

You will try and pay reasonably-priced lessons charges to the marketplace with the aid of using hiring a skilled train to manual you via all of them getting-to-know barriers.

Using an excellent forex robot. You can bypass the want for getting to know superior analysis, control of funds, and so on. You can right away start to make money.

What are the advantages and disadvantages of Forex trading?

Advantages

The forex market is the world's largest and therefore the most liquid in terms of the daily trading volume. 3 This makes it easy to open and close positions in one of the major currencies with a small spread in less than a second. Most market conditions.

The forex market trades 24 hours a day, 5 and a half days a week, starting daily in Australia and ending in New York. Wide duration and coverage give traders multiple opportunities to make a profit or cover their losses. The main foreign exchange market centers are Frankfurt, Hong Kong, London, New York, Paris, Singapore, Sydney, Tokyo, and Zurich.

Extensive use of leverage in forex trading means that you can start with a small amount of capital and increase your profits.

Forex market automation is suitable for the rapid execution of trading strategies.

Forex trading usually follows the same rules as regular trading and requires much less initial capital. Therefore, it is easier to start trading forex compared to stocks.

The foreign exchange market is more diversified than the traditional stock and bond markets. There is no decentralized exchange that controls forex trading, and it is unlikely to be manipulated through inside information about companies and stocks.

Disadvantages

Despite being the most liquid market in the world, forex trading is much more volatile than the regular market.

Extreme leverage has caused many traders to unexpectedly default.

Forex market banks, brokers, and dealers enable a high level of leverage. In other words, traders can control large positions with relatively little money. Leverage in the 100: 1 range is not uncommon in Forex. Traders need to understand the use of leverage and the risks it poses to their accounts.

Trading currencies requires a productive understanding of economic fundamentals and indicators. Forex traders need a complete understanding of the economies of different countries and how they are interconnected to understand the fundamentals that determine currency values.

The decentralized nature of the FX market means less accountability to regulation than other financial markets. The level and type of regulation in the forex market depend on the jurisdiction of the transaction.

What are currency pairs?

Currency pairs measure the value of one currency against another.

They are divided into the base currency and secondary quote currency. An example is probably the most traded currency pair in the world, the EUR / USD. This price reflects the amount of the US dollar, which is the estimated currency required to buy one unit of the base currency, the euro.

Each currency pair has a bid rate and an asking rate. The bid price is defined as the highest price the buyer is willing to pay for the currency, the asking price is defined as the lowest price the seller is willing to accept the currency, and the bidasque spread has two price differences. Indicates that it represents a currency. In some cases, Forex traders prefer to trade currency pairs with low or narrow spreads to reduce the overall cost associated with the transaction. However, some traders prefer to trade volatile currency pairs with wide spreads and low liquidity to take advantage of fluctuating price gaps.

You Also Like

Best Forex Brokers in Turkey for 2024

Review top 9 forex brokers in Turkey, elevating their trading pros and cons to give traders more useful guidance.

Best Forex Brokers for Beginners in the United Arab Emirates for 2024

Select the top forex brokers for beginners in UAE from the many available to ensure a safe trading environment.

Best Swiss Forex Brokers for 2024

Explore top 10 forex brokers in Switzerland, elevating their trading pros and cons to give traders more useful guidance.

Best Stock Brokers in the US for 2024

When choosing an online broker, finding the platform that best fits your investment needs is crucial. With the rise in popularity of online trading, more brokers are offering free stock trading and commission-free transactions for various assets. It has become a challenge for users to select suitable brokers.