In this article, we delve into the fascinating world of Forex trading, with an exclusive focus on the Australian Securities and Investments Commission (ASIC). For the unversed, ASIC is an independent Commonwealth Government body, established with the purpose of regulating Australian companies, financial markets, and financial services organisations and professionals.

|

Established | 1998 |

| Country | Australia | |

| Website | https://asic.gov.au/ |

Here, we turn our attention to brokers regulated by ASIC, and present you with a definitive top 10 list. After extensive research, employing an effective methodology that encapsulates user reviews, trading conditions, platform capabilities, customer service quality and regulatory adherence, we have managed to prepare this detailed ranking. This article will not only unveil the 10 Best ASIC regulated Forex Brokers, but also aim to serve as an invaluable resource for individuals venturing into Forex trading.

Best ASIC Regulated Forex Brokers

more

Comparion of Best ASIC Regulated Forex Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best ASIC Regulated Forex Brokers Reviewed

① Pepperstone

Best overall for cost-efficient trading

Pepperstone is an Australian-based online Forex and CFD Broker that was established in 2010. It's recognized as one of the premier brokers offering access to a range of markets including forex, commodities, indices, currency indices, cryptocurrencies, shares, and ETFs.

Known for its advanced technology, Pepperstone utilizes popular trading platforms such as MT4, MT5, cTrader, and TradingView. They provide exemplary trading conditions, with tight spreads and a competitive commission structure. Pepperstone's commitment to transparency and customer service excellence differentiates it from its peers and positions it as a trusted choice for traders worldwide.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| ASIC No. | 414530 |

| Regulation | ASIC, CYSEC, FCA, DFSA, SCB (Offshore) |

| Min. Deposit | $0 |

| Market Instruments | Forex, shares, ETFs, indices, commodities, currency indices, cryptocurrencies, CFD forwards |

| Demo Account | ✅(30 days, $50,000 virtual funds) |

| Max. Leverage | 1:200 (Retail)/1:500 (Professional) |

| Spreads & Commissions (Forex) | Average 1.1 pips & commission-free (Standard account) |

| Trading Platforms | TradingView, MT4/5, Pepperstone platform, cTrader |

| Deposits & Withdrawals | Apple Pay, Google Pay, Visa, MasterCard, Bank Transfer, PayPal, Neteller, Skrill, Union Pay, and USDT |

| Customer Support | 24/7 - phone, email |

Pros:

√ Access to Global Markets: Pepperstone provides low-cost access to a 1,200+ global markets, including forex, commodities, indices, currency indices, cryptocurrencies, shares, and ETFs.

√ Advanced Platforms: It offers advanced trading platforms such as MT4, MT5, cTrader, and TradingView that are chosen by many traders.

√ Competitive Spreads and Commissions: Pepperstone provides average spreads of 1.1 pips and no commisions on the Standard account.

Cons:

× High Minimum Deposit: Pepperstone requires a minimum deposit of $200 for swap-free accounts.

× No clear info on deposits and withdrawals: Pepperstone does not specifically set the 'Deposit & Withdrawal' on the menu like other brokers. Traders can only get fragmented information from their website.

② AvaTrade

Ideal for diversified trading options and education

AvaTrade is a globally recognized broker that offers Forex and CFD trading services. Founded in 2006, AvaTrade provides traders with a wide range of trading instruments across forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, and FX options.

Located in Ireland, AvaTrade is regulated by several leading financial authorities globally, including the Central Bank of Ireland (CBI), Australian Securities and Investments Commission (ASIC), and the Japan Financial Services Authority (FSA), among others. They offer multiple platforms including MetaTrader 4, MetaTrader 5 and their own AvaSocial and AvaOptions. The broker also offers extensive educational resources making it a suitable platform for both experienced traders and beginners alike.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| ASIC No. | 406684 |

| Regulation | ASIC, FSA, FFAJ, ADGM, CBI, FSCA |

| Min. Deposit | $100 |

| Market Instruments | Forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, FX options |

| Demo Account | ✅ ($10,000 in virtual capital, lasts for 21 days and can be renewed upon request) |

| Max. Leverage | 1:30 (retail)/1:400 (professional) |

| Spreads & Commissions (Forex) | Typical 0.9 pips on (EUR/USD) & commission-free |

| Trading Platforms | AvaTrade Mobile App, Mobile WebTrader, AvaSocial, AvaOptions, DupliTrade, MT4/5 |

| Deposits & Withdrawals | MasterCard, Visa, PayPal, Skrill, Neteller, Wire Transfer, Perfect Money, Boleto |

| Customer Support | Live chat, contact form, WhatsApp, phone |

Pros:

√ Wide Range of Trading Instruments: AvaTrade offers various trading instruments including forex, indices, commodities, crypto CFD, stocks, ETFs, bonds, and FX options.

√ Multiple Trading Platforms: Besides offering popular platforms like MetaTrader 4 and MetaTrader 5, AvaTrade also provides its own AvaSocial and AvaOptions platforms to cater to various trading needs.

√ Strong Regulatory Oversight: AvaTrade is regulated by several leading financial authorities globally, including the Central Bank of Ireland (CBI), Australian Securities and Investments Commission (ASIC), and the Japan Financial Services Authority (FSA), among others.

√ Educational Resources: It offers comprehensive educational resources beneficial for both beginners and experienced traders.

Cons:

× Withdrawal and inactivity fees: AvaTrade charges a withdrawal fee and an inactivity fee after a certain period of non-use.

③ Vantage

Suitable for diverse user needs with high service quality

Vantage is an Australian-based regulated forex broker that offers access to more than 1,000 CFDs on forex, indices, precious metals, soft commodities, energy, ETFs, share CFDs, and bonds through two of the leading platforms in online trading: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

Established in 2009, Vantage FX is known for offering competitive spreads, transparent fees, and a seamless withdrawal process. Its services cater well to both casual traders and experienced professionals. Being regulated by the Australian Securities and Investments Commission (ASIC) and the Financial Conduct Authority (FCA) in the UK adds to its credibility as a trusted forex broker.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| ASIC No. | 428901 |

| Regulation | ASIC, FCA, CIMA/VFSC (Offshore), FSCA (General Registration) |

| Min. Deposit | $50 |

| Market Instruments | 1,000+ CFDs on forex, indices, precious metals, soft commodities, energy, ETFs, share CFDs, bonds |

| Demo Account | ✅ |

| Max. Leverage | 1:500 |

| Spreads & Commissions (Forex) | From 1.1 pips & commission-free (Standard account) |

| Trading Platforms | Vantage App, MT4/5, TradingView, ProTrader |

| Deposits & Withdrawals | Visa, MasterCard, Apple Pay, Google Pay, PayPal, Neteller, Skrill, Fasapay, Perfect Money, JCB, bitwallet, Sticpay, India UPI, Bank Transfer, International ETF, Domestic Fast Transfer (Australia Only), Astropay, Broker-to-Broker Transfer |

| Customer Support | 24/7 live chat, contact form, email, Help Center |

Pros:

√ Wide Range of Financial Instruments: Vantage FX offers access to more than 1,000 CFDs on forex, indices, precious metals, soft commodities, energy, ETFs, share CFDs, and bonds.

√ Favourable Trading Platforms: It supports two of the leading platforms in online trading: MetaTrader 4 (MT4) and MetaTrader 5 (MT5).

√ Competitive Spreads: Known to offer competitive spreads from 1.1 pips on the Standard account, which are advantageous for traders.

√ Strong Regulatory Oversight: Vantage FX is regulated by the Australian Securities and Investments Commission (ASIC), the Financial Conduct Authority (FCA) in the UK, and more.

Cons:

× Limited Availability: Vantage FX does not service traders from Canada, China, Romania, Singapore, the United States and jurisdictions on the FATF and EU/UN sanctions lists.

④ IC Markets Global

Good for tech-savvy traders seeking faster trade speeds

IC Markets Global is an Australian-based online forex broker that was established in 2007. It primarily caters to algorithmic traders through its offering of low spreads, fast execution, and strong international regulation. IC Markets provides a full suite of trading platforms catered to all levels of traders, including MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

The broker is known for its transparency, quality execution, and outstanding customer support. IC Markets is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), ensuring a high level of security for traders.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| ASIC No. | 335692 |

| Regulation | ASIC, CYSEC |

| Min. Deposit | $200 |

| Market Instruments | 2,250+, CFDs on 61 currency pairs, 24 commodities, 2,100+ stocks, 25 indexes, 9 bonds, 21 cryptocurrencies, 4 futures |

| Demo Account | ✅ |

| Max. Leverage | 1:1000 |

| Spreads & Commissions (Forex) | From 0.8 pips & commission-free (Standard account) |

| Trading Platforms | MT4/5, cTrader, TradingView (Windows, Web, Android, Mac, iOS) |

| Deposits & Withdrawals | MasterCard, Visa, PayPal, Neteller, Skrill, UnionPay, Wire Transfer, Bpay, Broker to Broker, POLi, Thai Internet Banking, Rapidpay, Klarna, Vietnamese Internet Banking |

| Customer Support | 24/7 live chat, contact form, phone, email |

Pros:

√ Competitive Spreads and Commissions: IC Markets offers spreads from 0.8 pips and commission-free for the Standard account.

√ A Range Of Trading Platforms: IC Markets provides a wide range of platforms including MetaTrader 4, MetaTrader 5, cTrader, and TradingView.

√ Strong Regulatory Oversight: IC Markets is regulated by leading financial authorities including the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

Cons:

× High Minimum Deposit: IC Markets requires a high minimum deposit requirement of $200, while most brokers have no initial deposit threshold.

× Availability: IC Market services are not available in certain countries, including the United States of America, Canada, Brazil, Israel, New Zealand, Iran and North Korea (Democratic People's Republic of Korea).

⑤ eToro

Best for social/copy trading

eToro is a global social trading platform that was launched in 2007. It is well-known for popularizing “social”, or “copy” trading, where users can follow and replicate the trades of successful individuals. With eToro, traders and investors have the ability to invest in 7,000+ finaicial instruments including 6,202 stocks, 703 ETFs, 42 commodities, 55 currences, 18 indices, and 106 cryptocurrencies.

Major features of eToro include social news feeds, copy trading options, and innovative investing tools. eToro's simplified trading platform is also suitable for beginners. It is regulated by the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC) and the Australian Securities and Investments Commission (ASIC).

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| ASIC No. | 491139 |

| Regulation | ASIC, CYSEC, FCA |

| Min. Deposit | $10 |

| Market Instruments | 7,000+, 6,202 stocks, 703 ETFs, 42 commodities, 55 currences, 18 indices, 106 cryptocurrencies |

| Demo Account | ✅ ($100,000 in virtual funds) |

| Max. Leverage | 1:30 (retail)/1:400 (professional) |

| Spreads & Commissions (Forex) | Around 3 pips (EUR/USD) & commission-free |

| Trading Platforms | MT4, eToro proprietary platform |

| Deposits & Withdrawals | $5 withdrawal fee for $30 withdrawal amount, eToro Money, credit/debit cards, PayPal, Neteller, Skrill, Rapid transfer, iDEAL, Klarna / Sofort Banking, bank transfer, Online Banking – Trustly (EU region), Przelewy 24 |

| Inactivity Fee | $10/month, this monthly fee applies to accounts with no logins in the previous 12 months. |

| Customer Support | 24/5 live chat, email |

Pros:

√ Social Trading: eToro is known for its social trading feature, which allows users to follow and copy the trades of successful traders.

√ Wide Variety of Assets: eToro offers 7,000+ trading instruments including 6,202 stocks, 703 ETFs, 42 commodities, 55 currences, 18 indices, and 106 cryptocurrencies.

√ User-Friendly Platform: eToro's platform is easy to use and suitable for beginners.

√ Strong Regulatory Oversight: eToro is regulated by several leading authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC).

Cons:

× Fees: eToro has higher fees compared to some other brokers, including withdrawal fees and inactivity fees.

× Limited Technical Analysis Tools: For advanced traders, eToro might lack in-depth technical analysis tools.

⑥ XM

Recommended for diverse platform selection and deposit options

XM is a multi-regulated and internationally recognized forex and CFD broker that was established in 2009. Based in Cyprus, XM provides a full-service trading experience by offering 1,400+ trading instruments, such as forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, and thematic indices. In terms of platforms, they offer MetaTrader 4 and MetaTrader 5, catering to the needs of both beginner and experienced traders.

XM is known for its good quality educational resources, tight spreads, fast execution, and excellent customer service. The broker has strong regulatory oversight, being regulated by the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC) and the Financial Services Commission (FSC) of Belize, providing traders with a high level of security.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| ASIC No. | 443670 |

| Regulation | ASIC, CySEC, DFSA, FSC (Offshore) |

| Min. Deposit | $5 |

| Market Instruments | 1,400+, forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, thematic indices |

| Demo Account | ✅ (30 days) |

| Max. Leverage | 1:1000 |

| Spreads & Commissions (Forex) | From 1 pip & commission-free (Standard account) |

| Trading Platforms | MT4/5, XM App |

| Deposits & Withdrawals | Credit/debit cards, bank transfers, e-wallets |

| Customer Support | Live chat, phone |

Pros:

√ Wide Variety of Trading Instruments: XM offers 1,400+ trading instruments including forex, commodities, precious metals, shares, Turbo stocks, equity indices, energies, and thematic indices.

√ User-Friendly Trading Platforms: XM provides well-known and reliable platforms: MetaTrader 4 and MetaTrader 5.

√ Quality Educational Resources: XM is known for offering comprehensive educational materials, which can benefit both new and experienced traders.

√ Strong Regulatory Oversight: XM is regulated by several major financial regulatory bodies including the Cyprus Securities and Exchange Commission (CySEC), the Australian Securities and Investments Commission (ASIC), and the Financial Services Commission (FSC) of Belize.

Cons:

× Regional Restrictions: Clients from the United States of America, Canada, Argentina, Israel and the Islamic Republic of Iran are not allowed.

⑦ FP Markets

Ideal for traders focused on education resources

FP Markets is a top-tier, highly regarded online forex and CFD broker that was established in 2005. Based in Australia, FP Markets offers a wide array of trading instruments including forex, indices, commodities, stocks, and cryptocurrencies. It provides both the MetaTrader 4 and MetaTrader 5 platforms, complemented by TradingView, cTrader, and Mobile App.

FP Markets is known for its tight spreads, fast execution speed, and extensive educational resources, making it a good fit for novice and experienced traders alike. The broker operates under the regulation of the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC), which underscores its reliability and commitment to upholding high standards of business conduct.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| ASIC No. | 286354 |

| Regulation | ASIC, CySEC |

| Min. Deposit | $100 AUD or equivalent |

| Market Instruments | 70+ forex currency pairs, 10,000+ stocks, 19 indices, commodities, bonds, metals, digital currencies |

| Demo Account | ✅ (30 days) |

| Max. Leverage | 1:500 |

| Spreads & Commissions (Forex) | From 1.0 pips & commission-free (Standard account) |

| Trading Platforms | MT4/5, TradingView, cTrader, FP Markets Trading App |

| Deposits & Withdrawals | Free deposits & fees for withdrawals- Visa, MasterCard, BPAY, UnionPay, POLi, PayPal, Skrill, Neteller, Fasapay, Bank Transfer |

| Customer Support | 24/7 live chat, phone, email |

Pros:

√ Multiple Trading Platforms: It provides the MetaTrader 4 and MetaTrader 5 platforms, complemented by TradingView, cTrader, and Mobile App..

√ Competitive Spreads and Fast Execution: FP Markets is known for its tight spreads and quick execution speed.

√ Strong Regulatory Oversight: FP Markets is regulated by the Australian Securities and Investments Commission (ASIC) and the Cyprus Securities and Exchange Commission (CySEC).

√ Extensive Educational Resources: FP Markets provides a variety of educational materials, useful for both new and experienced traders.

Cons:

× Fees: FP Markets only offer free deposits. As for withdrawals, traders have to pay some fees.

× Regional Restrictions: Clients from Afghanistan, Cuba, Islamic Republic of Iran, Iraq, Liberia, Libya, Myanmar, Palestine, Russian Federation, Somalia, Syrian Arab Republic, Sudan, Yemen, and United States are not allowed.

⑧ Plus500

Suitable for traders seeking simplicity and diverse trading instruments

Plus500 is a leading provider of Contracts for Difference (CFDs), delivering trading facilities on cryptos, indices, forex, commodities, shares, and ETFs, using innovative trading technology. Founded in 2008, Plus500 is headquartered in Israel and is available in over 50 countries and in more than 30 languages. The broker is known for its proprietary trading platform where it offers a user-friendly and easy-to-navigate platform.

In terms of regulation, Plus500 is regulated by several international financial authorities, including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities Exchange (CySEC), the Australian Securities and Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS). This extensive regulatory oversight can help ensure a safe and secure trading experience.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| ASIC No. | 417727 |

| Regulation | ASIC, FSA, CySEC, FCA, FMA, MAS |

| Min. Deposit | $/€/£100 |

| Market Instruments | 2,800 CFDs, cryptos, indices, forex, commodities, shares, ETFs |

| Demo Account | ✅ |

| Max. Leverage | 1:300 |

| Trading Costs (Forex) | Around 0.6 pips & commission-free |

| Trading Platforms | Proprietary trading platform (desktop, web, and mobile) |

| Deposits & Withdrawals | Visa, MasterCard, PayPal, Skrill, Apple Pay, Google Pay |

| Customer Support | 24/7 |

Pros:

√ Wide Range of Trading Instruments: Plus500 offers 2,800 CFDs on cryptos, indices, forex, commodities, shares, and ETFs.

√ User-friendly Platform: Plus500 provides a proprietary platform that is known for its ease of use and navigation.

√ Strong Regulatory Oversight: Plus500 is regulated by several leading financial authorities including the Financial Conduct Authority (FCA) in the UK, the Cyprus Securities Exchange (CySEC), the Australian Securities and Investments Commission (ASIC), and the Monetary Authority of Singapore (MAS).

Cons:

× Charges: Plus500 charges an inactivity fee of up to USD 10 per month if you do not log in to your trading account for a period of at least 3 months.

× Limited Educational Resources: Plus500 doesn't offer as extensive educational resources as some other platforms, which may be a drawback for beginners.

⑨ IG

Good for extensive market access and great customer service

IG is a leading global forex broker that provides access to a wide range of markets including forex, indices, shares, commodities, and cryptocurrencies. The company was founded in 1974 and is headquartered in the UK. IG is known for its robust trading platform, competitive spreads, and high-quality educational resources. Traders can choose to trade through the web-based platform, or mobile apps, or advanced platforms such as MetaTrader 4.

IG also provides direct market access for advanced, high-volume forex traders. The broker is regulated by several internationally recognized financial authorities including the UK's Financial Conduct Authority (FCA), and the Australian Securities and Investments Commission (ASIC).

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| ASIC No. | 515106 |

| Regulation | ASIC, FCA, FSA, FMA, MAS, DFSA |

| Min. Deposit | $0 |

| Market Instruments | 17,000+, forex, indices, shares, commodities, cryptocurrencies |

| Demo Account | ✅ ($20,000 in virtual capital) |

| Max. Leverage | 1:400 |

| Spreads & Commissions (Forex) | From 0.6 pips (EUR/USD) |

| Trading Platforms | L2 dealer, ProRealTime, MT4, TradingView |

| Deposits & Withdrawals | Credit/debit cards (MasterCard/Visa), bank transfer |

| Customer Support | 24 hours a day, except 6 am - 4pm on Saturday (UTC+8) - live chat |

Pros:

√ Wide Range of Trading Instruments: IG offers 17,000+ markets including forex, indices, shares, commodities, and cryptocurrencies.

√ Advanced Trading Platforms: IG has robust trading platforms, with options to trade through web-based platforms, mobile apps, as well as more advanced platforms like MetaTrader 4.

√ Quality Educational Resources: IG is known for providing high-quality educational resources which can be beneficial for both beginners and experienced traders.

√ Strong Regulatory Oversight: IG is regulated by several key financial authorities including the UK's Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), and more.

Cons:

× Limited Customer Support: Some users have reported that IG's customer service is not available 24/7, which could be a potential drawback for some traders.

× Regional Restrictions: US clients are not accepted.

⑩ Fusion Markets

Ideal for price-sensitive, high-frequency traders

Fusion Markets is an online forex and CFD broker founded in Melbourne, Australia in 2010. Fusion Markets aim to provide a low-cost, high-quality, and fair trading experience to all types of traders. The broker offers 250+ tradable instruments, including forex, energy, precious metals, equity indices, and stocks.

Fusion Markets operates on the MetaTrader 4 and MetaTrader 5 platforms, widely recognized for their user-friendly interfaces and comprehensive tools. In addition to the trading platform, Fusion Markets also offers an abundance of educational resources, webinars, and expert advise to boost the trading knowledge of their clients.

As for regulations, Fusion Markets is overseen by the Australian Securities and Investments Commission (ASIC), which ensures the broker operates with transparency and integrity. It also adheres to the strict financial standards set forth by ASIC, including capital adequacy and audit requirements.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| ASIC No. | 385620 |

| Regulation | ASIC, FSA (Offshore) |

| Min. Deposit | $0 |

| Market Instruments | 250+, forex, energy, precious metals, equity indices, stocks |

| Demo Account | ✅ |

| Max. Leverage | 1:500 |

| Spreads & Commissions (Forex) | From 0.9 pips & commission-free (Classic account) |

| Trading Platforms | MT4/5, TradingView, cTrader |

| Deposits & Withdrawals | Free - Bank Wire Transfer, Visa/MasterCard, Interac, PayPal, PayID, Crypto, BinancePay, Skrill, Neteller, Jetonbank, MiFinity, AstroPay, SticPay, ZotaPay, DragonPay, VNPay, VAPay, XPay, DuitNow, FasaPay, DurianPay, FPX, Pix, MPESA, UPI |

| Customer Support | Live chat, contact form, phone, email |

Pros:

√ Low Cost Trading: Fusion Markets is known for offering some of the lowest cost trading in the industry.

√ Excellent Trading Platform: Fusion Markets uses MetaTrader 4, MetaTrader 5, TradingView and cTrader platforms, which are famed for their ease of use and multifaceted tools.

√ Strong Educational Resources: It provides a wealth of educational resources, webinars, and expert advice.

√ Reliable Regulatory Oversight: Fusion Markets is regulated by the Australian Securities and Investments Commission (ASIC), ensuring a high level of administrative transparency and integrity.

Cons:

× No 24/7 Customer Support: Live customer support is not available 24/7, which may affect traders who operate in different time zones.

ASIC Regulated Forex Brokers FAQs

What is ASIC?

The Australian Securities and Investments Commission, also known as ASIC, is a tier-1 regulator. It is an independent Australian government body that acts as Australia's corporate regulator. ASIC's role is to enforce and regulate company and financial services laws to protect Australian consumers, investors and creditors. It oversees Australia's financial markets, and ensures transparency and fair practices among financial firms and companies. Being regulated by ASIC is often seen as a positive by traders and investors, as it adds a level of trust and accountability to a broker's operations.

How does ASIC Work?

The Australian Securities and Investments Commission (ASIC) works by overseeing and regulating the operation of financial markets, organizations, and professionals dealing with financial services and products. They license and monitor businesses to ensure they are operating fairly, efficiently, and transparently.

Some of ASIC's responsibilities include:

- Registering corporations and businesses and ensuring they meet necessary legal requirements.

- Supervising Australian financial markets and system infrastructure.

- Monitoring financial companies' behavior and operation to prevent fraud and unethical practices.

- Enforcing and giving effect to the law, seeking appropriate penalties and remedies where the law is broken.

- Receiving, assessing, and acting on reports from the public about potential breaches of the corporations legislation.

- Promoting the adoption of improved systems and procedures for managing risk and providing information and guidance about the operation and obligations under the various laws it administers.

ASIC collects a vast amount of information, including from the businesses it regulates, the public at large, other regulators, and intelligence it gains from its own regulatory activities. It uses this information to inform its regulatory approach and strategies to ensure the stability and integrity of the Australian financial market.

What does ASIC-regulated Mean for Forex Traders?

ASIC-regulated means that the Forex broker is authorized and overseen by the Australian Securities and Investments Commission (ASIC). This makes the trading environment safer for traders as these brokers are required to adhere to strict regulatory standards set by ASIC, which include capital adequacy norms, measures to prevent fraud and financial misconduct, regular audits, and clear disclosure of trading policies and conditions. This can provide traders with greater reassurance of the broker's reliability and the protection of their investment.

What are ASIC Requirements for Forex Brokers?

The Australian Securities and Investments Commission (ASIC) has a range of requirements that Forex brokers must meet in order to gain and maintain their license. These include:

License Application

Forex brokers must apply for a license and meet all necessary criteria to demonstrate they are qualified to provide financial services.

Minimum Capital Requirement

Brokers must hold a certain amount of capital to protect themselves from bankruptcy and to protect their clients' investments.

Segregated Accounts

Brokers are required to keep clients' funds in separate accounts from their company funds. This ensures that the clients' money can't be used by the broker for operational expenses.

Record Keeping

ASIC requires stringent record-keeping practices from brokers, including keeping track of all transactions, managing financial records properly, and reporting to ASIC periodically.

Compliance Plan

Brokers need to have a suitable compliance plan in place, along with a dedicated compliance officer, to ensure they adhere to all the ASICs regulations.

Audits

Regular audits by independent and certified auditors are necessary to ensure ongoing compliance with ASIC regulations.

Fair Marketing Practices

Company's advertisements must not be misleading or deceptive and must adhere to the rules set by ASIC.

Investor Protection

ASIC requires brokers to have a dispute resolution system in place, usually involving membership in an approved dispute resolution scheme.

Training Standards

Employees of the Forex broker need to meet certain training standards to ensure competency.

These conditions are designed to ensure that the broker functions with transparency, integrity, and in a manner that places their clients' interests first.

How is ASIC Compared to Other Forex Regulators?

The Australian Securities and Investments Commission (ASIC) is well-respected globally for its strong regulatory protocols and diligent oversight of the forex market.

| Feature | Detail |

| Stringency | ASIC is known for its rigorous guidelines, much like the Financial Conduct Authority (FCA) in the UK and the National Futures Association (NFA) in the US. |

| Investor Protection | ASIC requires brokers to segregate client funds, ensuring they are separate from the broker's operational funds. This provides high levels of protection for traders' assets. |

| Global Reach | ASIC-regulated brokers can offer their services to traders around the world, except where local laws prohibit them. This broader reach is comparable to other prominent regulators like the Cyprus Securities and Exchange Commission (CySEC). |

| Client Education | ASIC places emphasis on educating consumers about forex trading, similar to organizations like the Commodity Futures Trading Commission (CFTC) in the US. |

Why Trade with ASIC Regulated Forex Brokers?

Trading with ASIC regulated forex brokers comes with several benefits:

Security of Funds

ASIC regulated brokers are required to keep clients' funds in separate trust accounts. This means that your money is kept separately from the broker's operational funds, providing an additional level of security.

Fair Trading Practices

ASIC requires brokers to adhere to strict standards and operate with transparency and honesty. This helps prevent unfair practices like price manipulation.

Regular Audits

ASIC conducts regular audits of its regulated brokers. This ensures that these brokers are always compliant with the necessary regulations and that their business practices remain fair and ethical.

Protection from Bankruptcy

If a broker becomes insolvent, ASIC's regulation guarantees that traders can recover their funds.

Dispute Resolution

ASIC provides mechanisms for dispute resolution, providing a safety net if any issues arise between the trader and the broker.

Market Confidence

ASIC's rigorous standards help promote investor confidence in the security of the financial markets.

How to Check If a Forex Broker is Regulated by ASIC?

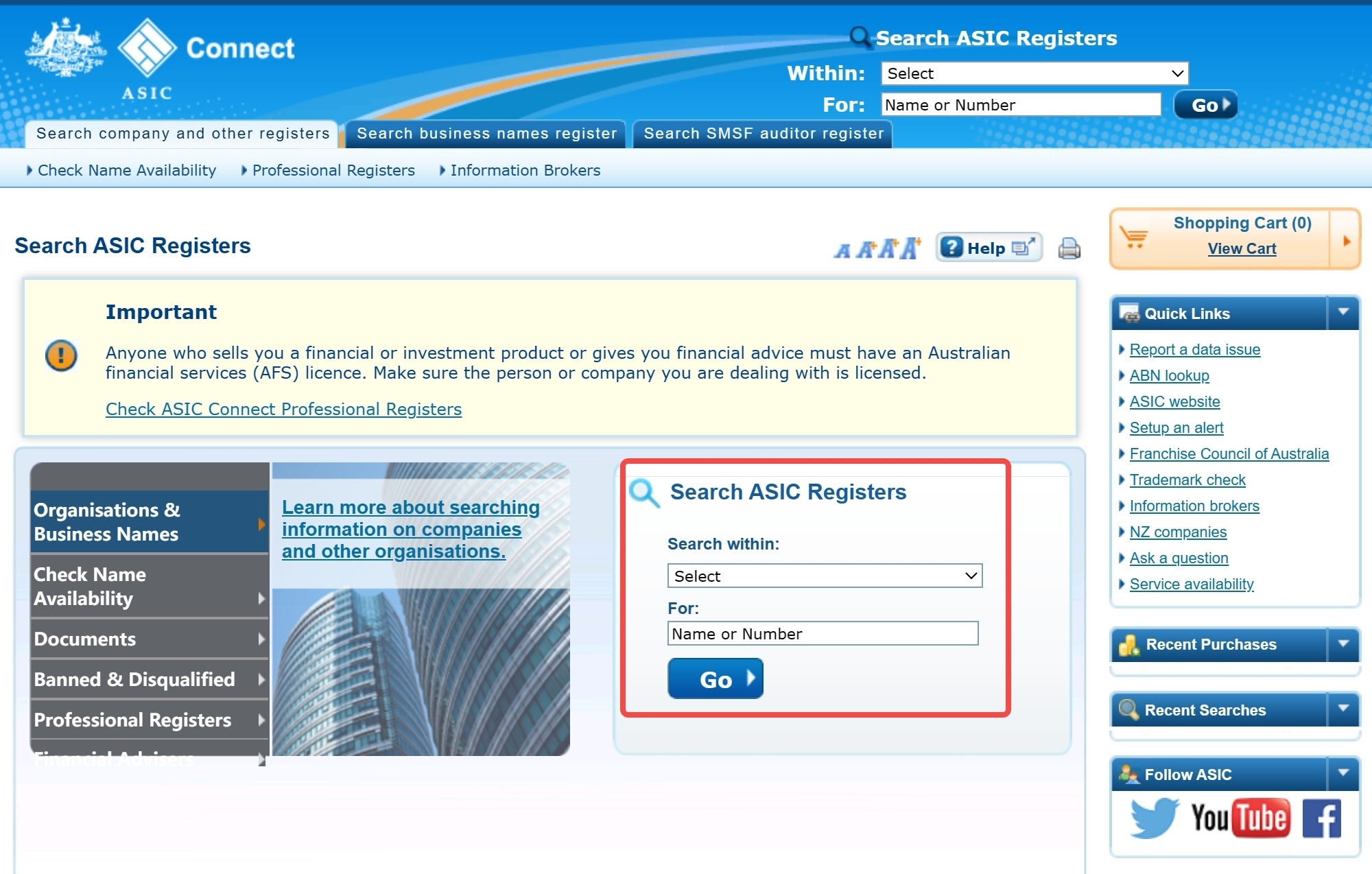

You can check if a Forex broker is regulated by ASIC by following these steps:

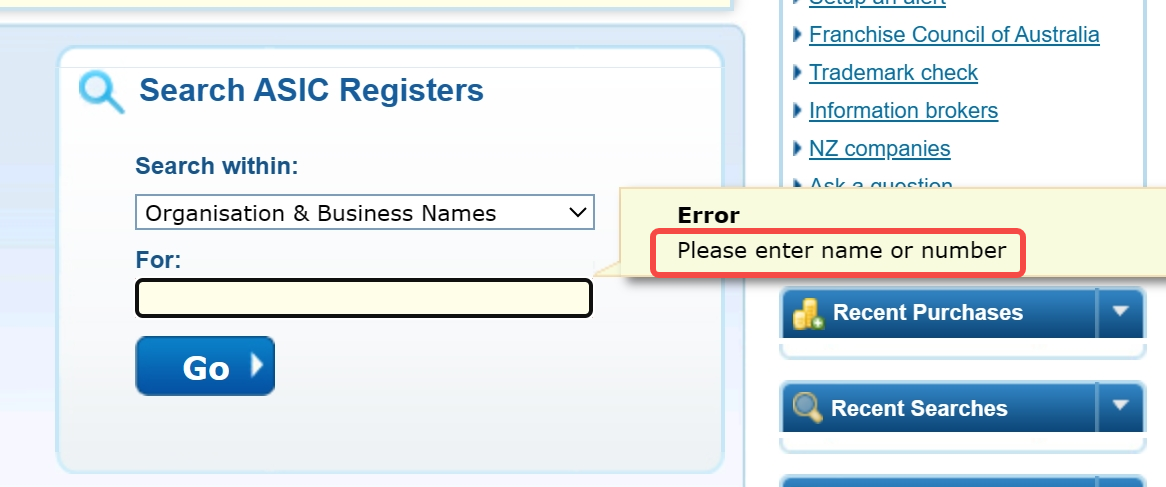

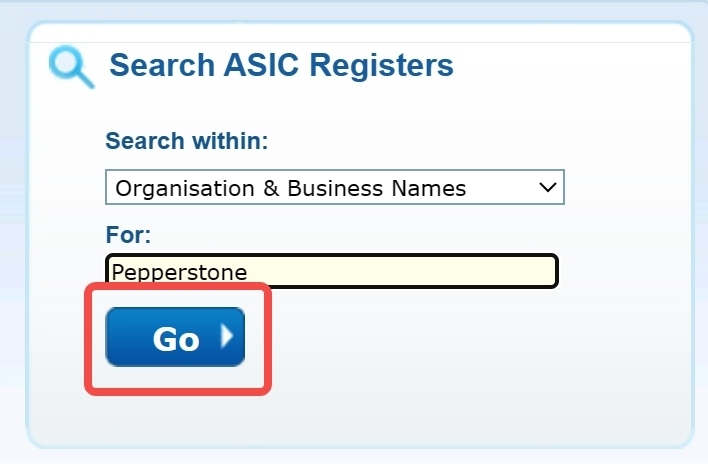

Step 1: Visit ASIC's professional registers page on their website.

Step 2: Click the provided link to access the 'Search ASIC Registers' page.

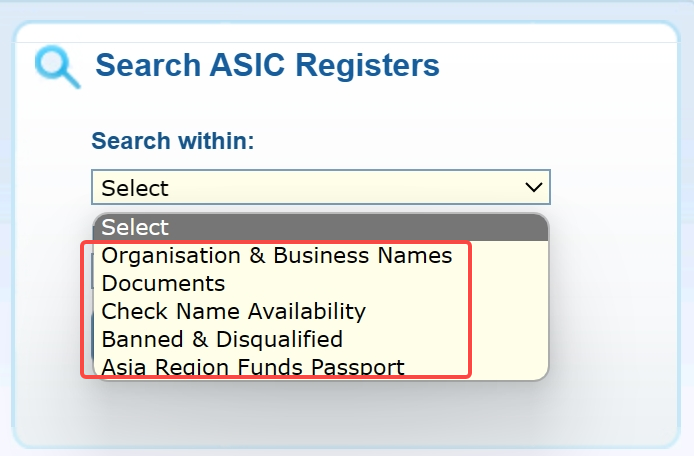

Step 3: You'll notice five search options. To check a broker's ASIC regulation status, choose 'Organisation & Business Names'.

Step 4: Enter the broker's name and then click 'Go'

If the broker is regulated, it will appear in the search results along with details about its license, including the license number, licensing dates, and what kind of financial services it is licensed to provide. If the broker does not appear in the ASIC database, it means it is not regulated by this authority.

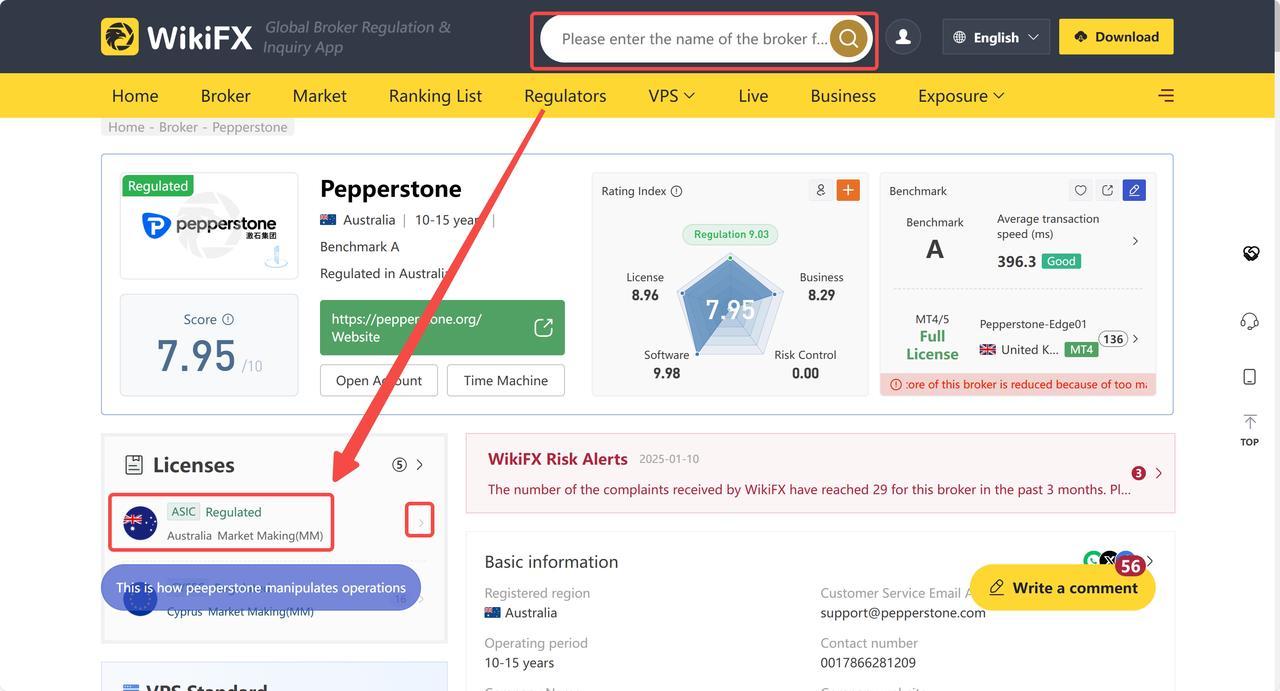

For a more straightforward approach, you can use WikiFX. Visit wikifx.com, type in the name of the broker in the search bar as shown in the screenshot below, and press enter.

In the broker's WikiFX page, look for the “Licenses” section on the left, locate the ASIC license, and click on it. Here, you can find the complete ASIC licence. This method will help you conveniently verify your broker's ASIC regulation status.

How to Choose an ASIC Regulated Forex Broker?

Choosing an ASIC regulated Forex broker involves several steps:

Reputation

Look for a broker with a good reputation. User reviews can give you valuable insight into the broker's customer service, the platform's usability, and the overall trading experience.

Range of Trading Instruments

Consider the range of trading instruments the broker offers. Some brokers offer a wide range of financial instruments, including forex, stocks, commodities, and indices, giving you more options to diversify your trading portfolio.

Fees and Spreads

Look at the broker's fee structures and compare them with others in the market. A broker with competitive spreads can considerably lower your trading costs.

Trading Platform

An easy-to-use and reliable trading platform is essential. Features to look out for include charting tools, technical and fundamental analysis tools, and automated trading options.

Easy Withdrawals and Deposits

Ease and cost of funds deposit and withdrawal should be a consideration. You should be able to deposit funds easily and withdraw your earnings without undue delays or costs.

Education and Resources

Some brokers offer free educational resources such as webinars, guides, and market analysis. These can be very helpful, particularly if you are a new trader.

Customer Service

Good customer service is vital, particularly for new traders. Ensure the broker offers prompt and helpful service, preferably 24/7 and in multiple languages.

Forex Risk Disclaimer

Trading Forex (foreign exchange) carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, risk appetite, and the possibility of incurring losses. There is a possibility that you may sustain a loss of some or all of your initial investment and therefore you should not invest money that you can not afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

You Also Like

Beware: 10 Fake Forex Brokers in the UK in 2026

With the need for caution in the UK's flourishing forex market, this article points out 10 fake brokers to avoid amidst numerous reputable entities.

Best CySEC Regulated Forex Brokers 2026

Delving into CySEC-regulated forex trading, this article presents a top 9 list of brokers, spotlighting the benefits of regulatory compliance.

Best SCA-regulated Forex Brokers in the United Arab Emirates (UAE)2026

This article explores the best SCA-regulated forex brokers in the United Arab Emirates, which provides you the useful guidance when choosing a forex broker within this region.

Best Forex Brokers in Italy for 2026

Compare top forex brokers in Italy with robust regulation, excellent platforms and broker reviews for secure trading.