Score

MaxiMarkets

Marshall Islands|2-5 years|

Marshall Islands|2-5 years| https://maximarkets.to

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Marshall Islands

Marshall IslandsUsers who viewed MaxiMarkets also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

maximarkets.to

Server Location

United States

Website Domain Name

maximarkets.to

Server IP

172.67.216.172

Company Summary

| Aspect | Information |

| Company Name | MaxiMarkets |

| Registered Country/Area | Marshall Islands |

| Founded Year | 2-5 years ago |

| Regulation | Unregulated |

| Market Instruments | Currency pairs, stocks, indices, precious metals, energy commodities |

| Account Types | Mini, Standard, Silver, Gold, Platinum, VIP, ECN |

| Minimum Deposit | Mini: $500 |

| Maximum Leverage | N/A |

| Spreads | As low as 1.1 pips |

| Trading Platforms | XCritical Platform and MaxiMarkets Trading Terminal |

| Customer Support | Phone(+7 965 1435972, +44 203 7695108, or +7 965 1435981), email(support@maximarkets.email), live chat, Skype |

| Deposit & Withdrawal | Visa, Mastercard, WebMoney, Qiwi, Western Union, Moneybookers |

| Educational Resources | Video tutorials, articles |

Overview of MaxiMarkets

MaxiMarkets, founded 2-5 years ago in the Marshall Islands, offers a wide range of trading assets, including 170+ instruments like currency pairs, stocks, indices, precious metals, and energy commodities.

Its competitive advantages include multiple payment methods, with spreads as low as 1.1 pips, user-friendly platforms, personalized VIP support, and advanced trading tools.

However, the broker is unregulated, requiring a $500 minimum deposit for a Mini account, with limited educational resources.

Despite these drawbacks, its intuitive interface and varied payment options attract traders seeking convenient access to global financial markets.

Regulatory Status

MaxiMarkets operates without regulation, lacking oversight from any authority.

This absence of regulation raises risks about investor protection and financial transparency. Without regulatory scrutiny, there's a risk of fraudulent activities, unfair trading practices, and insufficient safeguards for clients' funds.

Pros and Cons

| Pros | Cons |

| Various trading instruments | High minimum deposit for Mini account of $500 |

| Multiple payment methods for user convenience | Unregulated |

| Competitive spreads as low as 1.1 pips | Limited educational resources compared to some brokers |

| User-friendly trading platforms with intuitive interfaces | Negative feedbacks about withdrawal issues |

| Personalized support for VIP account holders | |

| Availability of advanced trading tools for experienced traders |

Pros:

Various Trading Instruments: MaxiMarkets offers a wide range of trading instruments, including currency pairs, stocks, indices, precious metals, and energy commodities.

Multiple Payment Methods for User Convenience: MaxiMarkets supports multiple payment methods, including Visa, Mastercard, WebMoney, Qiwi, Western Union, and Moneybookers. This variety of payment options offers users flexibility and convenience in funding their trading accounts.

Competitive Spreads as Low as 1.1 Pips: MaxiMarkets offers competitive spreads on various currency pairs, starting as low as 1.1 pips. These tight spreads enhance trading efficiency and potentially reduce trading costs, allowing traders to maximize their profit potential and optimize their trading strategies.

User-Friendly Trading Platforms with Intuitive Interfaces: MaxiMarkets provides user-friendly trading platforms equipped with intuitive interfaces. These platforms are designed to streamline the trading process and enhance user experience, allowing traders to navigate the platforms effortlessly and execute trades efficiently.

Personalized Support for VIP Account Holders: VIP account holders at MaxiMarkets receive personalized support tailored to their individual needs and preferences. This VIP treatment includes dedicated account managers, priority customer service, exclusive market insights, and customized trading strategies.

Availability of Advanced Trading Tools for Experienced Traders: MaxiMarkets offers advanced trading tools and features tailored to the needs of experienced traders. These tools include technical indicators, charting tools, trading signals, and risk management tools, empowering traders to analyze markets effectively and make informed trading decisions.

Cons:

High minimum Deposit for Mini Account: $500: The minimum deposit requirement for a Mini account at MaxiMarkets is $500. It could pose a barrier to entry for those with limited trading capital or budget constraints.

Unregulated: MaxiMarkets operates without regulation from any financial authority.

Limited Educational Resources Compared to Some Brokers: While the brokerage provides basic educational materials such as video tutorial, these resources are not be as comprehensive or extensive as those offered by competitors.

Negative Feedbacks About Withdrawal Issues: MaxiMarkets has received negative feedback from some users regarding withdrawal issues. These complaints involve delays in processing withdrawal requests, difficulty accessing funds, or encountering obstacles during the withdrawal process, leading to frustration and dissatisfaction among affected traders.

Market Instruments

MaxiMarkets offers a wide selection of trading assets. These assets encompass various financial instruments, including currency pairs, stocks, indices, precious metals, and energy commodities.

Currency pairs are a prominent feature, providing opportunities for traders to speculate on the exchange rate fluctuations between different currencies.

Stocks enable traders to invest in shares of publicly traded companies, while indices represent the performance of a group of stocks.

Precious metals such as gold and silver serve as alternative investment options, while energy commodities like oil and natural gas offer exposure to the energy markets.

Account Types

MaxiMarkets offers 7 account types for users. The details are as follows:

The Mini account type is tailored for novice traders seeking to delve into Forex trading with minimal risk exposure. With an initial deposit of $500, it provides an ideal opportunity for newcomers to learn the ropes of Forex trading without undue financial pressure, offering a low-risk environment to gain valuable experience.

Standard accounts serve more experienced traders ready to engage in substantial trading activities. With a minimum deposit of $5,000, this account grants access to all platform features, including daily forecasts and signals via email, enabling traders to make informed decisions based on market analysis.

Silver accounts offer enhanced trading conditions, ideal for those seeking opportunities for profit growth. With a minimum deposit of $7,500, traders gain access to additional trading techniques, beginner courses at the Trading Academy, and weekly analyst consultations, providing valuable insights for profitable trading strategies.

Gold accounts are tailored for traders aiming for profitability with specialized trading conditions. Requiring an initial deposit of $10,000, this account offers advanced features such as two trading techniques, advanced Trading Academy courses, and a 50% co-financing option on deposits, enhancing trading capabilities and potential returns.

Platinum accounts provide extensive opportunities for profitable trading with personalized support and bonuses. Requiring a minimum deposit of $25,000, this account offers advanced features such as three trading techniques, long-term SMS signal subscriptions, and personalized support, suitable for experienced traders seeking maximum benefits and support.

VIP accounts are premium offerings designed for high-level traders seeking maximum benefits and support. With no specified minimum deposit, VIP accounts provide unparalleled advantages such as high deposit co-financing, daily analyst consultations, and participation in focus groups, offering a comprehensive suite of services for elite traders.

ECN accounts offer advanced trading conditions with direct transactions in the interbank market. Requiring a minimum deposit of $50,000, ECN accounts provide features such as zero spreads, high liquidity, and complete anonymity and security.

| Account Type | Description | Initial Deposit | Features and Benefits |

| Mini | Ideal for beginner traders looking to explore Forex with minimal risk. Allows learning without unnecessary financial exposure. | $500 | - Ideal for new traders - Opportunity to learn Forex without excessive risk |

| Standard | For serious traders ready to engage in substantial trading. Provides access to all platform features, daily forecasts, and signals. | $5,000 | - Access to all platform features - Daily forecasts and signals via email |

| Silver | Offers enhanced trading conditions and opportunities for profit. Includes one current trading technique, trading academy course, and analyst consultation. | $7,500 | - Additional trading technique - Beginner course at Trading Academy - Weekly analyst consultation |

| Gold | Tailored for profitable trading with specialized conditions. Provides two trading techniques, advanced Trading Academy course, and increased deposit bonus. | $10,000 | - Two trading techniques - Advanced Trading Academy course - Bi-weekly analyst consultation - Subscription to SMS signals for one month - 50% co-financing on deposit |

| Platinum | Offers extensive opportunities for profitable trading with personalized support and bonuses. Includes three trading techniques, advanced Trading Academy courses, and long-term SMS signal subscription. | $25000 | - Three trading techniques - Advanced Trading Academy courses - Subscription to SMS signals for six months - Connection of stocks and indices for six months - Individual investment portfolio - Currency devaluation - Bi-weekly analyst consultation |

| VIP | Premium account with maximum benefits including high deposit co-financing, personalized support, and full Trading Academy course. | N/A | - Up to 70% co-financing on deposit - Daily analyst consultation - Indefinite SMS signal subscription - Individual trading strategies - Participation in focus groups - Account insurance - Risk management monitoring - Extension of open position expirations - Individual investment portfolio |

| ECN | Offers advanced trading conditions with direct transactions in the interbank market. Features high liquidity, zero spreads, and complete transparency of quotes. | $50000 | - No slippage or requotes - Low commission - High liquidity - Zero spreads - Complete anonymity and security |

How to Open an Account?

Visit the MaxiMarkets website: Navigate to the official MaxiMarkets website using your preferred web browser.

Click on “Open an Account”: Look for the “Open an Account” or “Sign Up” button on the homepage or in the website's header menu, and click on it to initiate the account opening process.

Fill out the registration form: You'll be directed to a registration form where you'll need to provide personal information such as your full name, email address, phone number, and country of residence. Ensure all details are accurate and up-to-date.

Verify your identity and fund your account: After submitting the registration form, you need to verify your identity by providing additional documents such as a government-issued ID or proof of address. Once verified, you can proceed to fund your account using the available deposit methods supported by MaxiMarkets, such as bank transfer or credit/debit card.

Trading Platform

MaxiMarkets offers varying spreads across different account types, with differences in spread values for each currency pair.

For instance, considering the AUD/USD pair, the spread ranges from 2.7 pips for Mini accounts to 1.2 pips for Platinum accounts. Similarly, the EUR/GBP pair exhibits a spread of 2.8 pips for Mini accounts, decreasing to 1.3 pips for Platinum accounts.

When compared to spreads offered by other popular brokers, MaxiMarkets' spreads appear competitive, particularly for traders with larger account balances who can access tighter spreads. This platform may be suitable for experienced traders and those who prioritize competitive fees over other features.

Trading Platform

MaxiMarkets offers two distinct trading platforms: the XCritical Platform and the MaxiMarkets Trading Terminal.

The XCritical Platform is renowned for its enhanced performance and intuitive interface, boasting a wide range of trading tools and 170 available instruments, including stocks, indices, metals, and energy carriers.

With features like timely risk management tools and comprehensive transaction control, traders can effectively monitor their positions and make informed decisions.

Additionally, the integration of Autochartist's technical advisor and MaxiMarkets TV provides valuable insights and market analysis in real-time, enhancing trading strategies and decision-making processes.

On the other hand, the MaxiMarkets Trading Terminal offers instant account replenishment options and a convenient overview of past trades, along with flexible timeframes and advanced order placement functionalities.

Deposit & Withdrawal

MaxiMarkets provides multiple payment methods, including Visa, Mastercard, WebMoney, Qiwi, Western Union, and Moneybookers. These options offer users flexibility and security in funding their accounts.

Minimum deposit requirements vary based on the chosen account type. For instance, Mini accounts require a $500 deposit, while more advanced accounts like Silver, Gold, Platinum, VIP, and ECN demand higher deposits ranging from $7,500 to $50,000, suitable for experienced and high-volume traders.

Customer Support

MaxiMarkets provides comprehensive customer support through various channels.

Clients can reach out via telephone at +7 965 1435972, +44 203 7695108, or +7 965 1435981. Additionally, connections are available through Skype at maximarkets or maximarkets-vip for VIP clients.

Direct contacts are suitable for specific inquiries, such as trading and account-related questions at support@maximarkets.email, assistance with opening new accounts at support@maximarkets.email, personalized service and training at customers@maximarkets.email, and partnership or marketing queries at partners@maxipartners.email.

They also provide a feedback form on their website for inquiries and suggestions.

Educational Resources

MaxiMarkets offers basic educational resources designed to enhance traders' knowledge and skills.

Their video library covers various topics, including an introduction to the foreign exchange market and addressing common problems encountered in stock trading.

Exposure

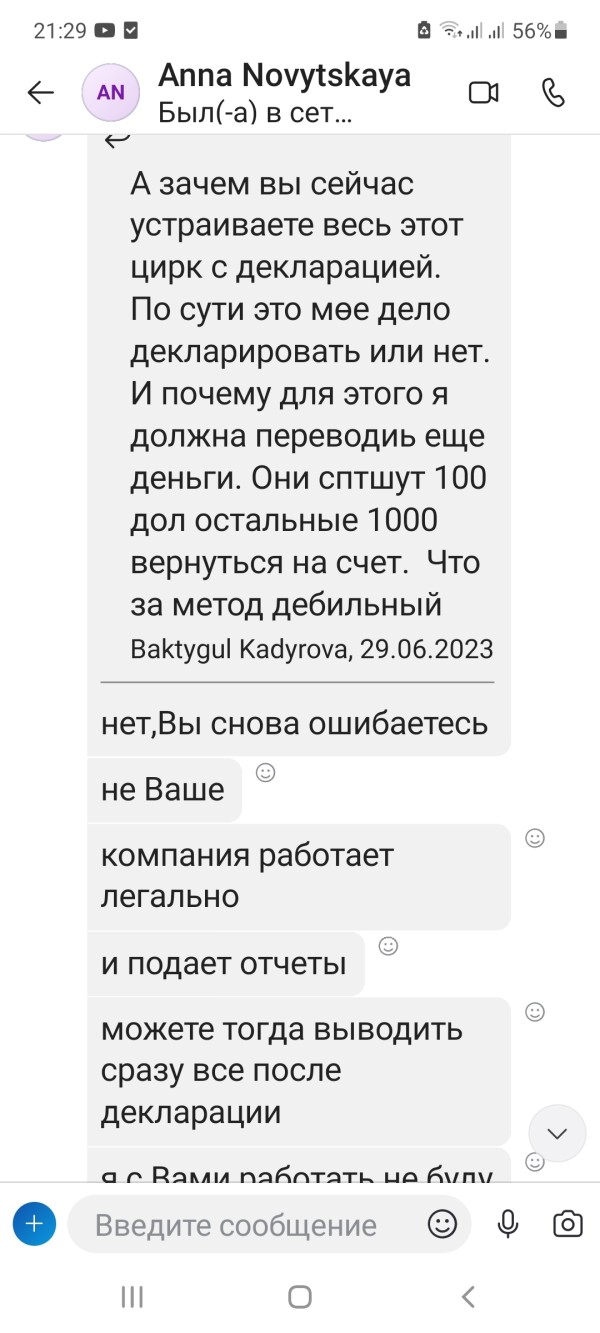

MaxiMarkets has faced user exposure, including complaints related to pyramid schemes, withdrawal issues, and account blocks demanding additional payments.

One user reported investing $2000, seeing their account grow to $4300, yet facing obstacles withdrawing even $500 and being pressured to pay income taxes by depositing an additional $1100. Such exposure can erode trust and deter potential traders from using the platform, impacting its reputation negatively.

Conclusion

In conclusion, MaxiMarkets presents a mixed picture for traders.

Its wide range of trading instruments, competitive spreads as low as 1.1 pips, and user-friendly platforms offer compelling advantages.

However, with an unregulated status and limited educational resources compared to competitors, traders face risks and encounter obstacles in their learning journey.

While the $500 minimum deposit for a Mini account provides accessibility, withdrawal issues reported by some users raise risks of operational efficiency.

FAQs

Question: What trading instruments does MaxiMarkets offer?

Answer: MaxiMarkets offers a wide range of trading instruments, including currency pairs, stocks, indices, precious metals, and energy commodities.

Question: Is MaxiMarkets regulated?

Answer: No, MaxiMarkets operates without regulation from any financial authority.

Question: What is the minimum deposit required to open an account?

Answer: The minimum deposit for a Mini account is $500.

Question: What are the available payment methods for deposits and withdrawals?

Answer: MaxiMarkets supports multiple payment methods, including Visa, Mastercard, WebMoney, Qiwi, Western Union, and Moneybookers.

Question: Are there any educational resources provided by MaxiMarkets?

Answer: Yes, MaxiMarkets offers basic educational resources such as video tutorials and articles.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Content you want to comment

Please enter...

Review 1

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now