Score

FinPros

Seychelles|2-5 years|

Seychelles|2-5 years| https://finpros.com/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomContact

Licenses

Licenses

Licensed Institution:FinPros Financial Ltd

License No.:SD087

Single Core

1G

40G

1M*ADSL

- The Seychelles FSA regulation with license number: SD087 is an offshore regulation. Please be aware of the risk!

Basic information

Seychelles

SeychellesAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed FinPros also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Exness

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

finpros.com

Server Location

Germany

Website Domain Name

finpros.com

Server IP

35.156.119.100

Genealogy

VIP is not activated.

VIP is not activated.BNB Smart Chain Bots

Premium FX Crypto

World FX Market

Company Summary

| Key Information | Details |

| Company Name | FinPros |

| Years of Establishment | 2-5 years |

| Headquarters | Seychelles |

| Office Locations | CT House, Office 4A, Providence, Mahe, Seychelles |

| Regulation | The Seychelles Financial Services Authority(FSA) |

| Tradable Assets | Currencies, Metals, Stocks, Energies, Indices, Cryptos |

| Account Types | Raw+, Edge, ClassiQ, Vantage |

| Minimum Deposit | $100 |

| Leverage | Up to 1:500 |

| Spread | As low as 0.0 pips |

| Deposit/Withdrawal Methods | Local Payment Methods, Credit Card, Bank Wire, Crypto, E-wallets |

| Trading Platforms Available | MetaTrader 5 |

| Customer Support Options | Email, LiveChat, Phone |

Overview of FinPros

FinPros is a Seychelles-based brokerage firm established within the past 2-5 years. They offer retail forex trading services and are regulated by the Seychelles Financial Services Authority. The company provides a range of trading accounts, including Raw+, Edge, ClassiQ, and Vantage, each with varying minimum deposit requirements, leverage ratios, and spreads. While the ClassiQ account allows for a minimum deposit of $100, other accounts demand a more substantial $800.

Traders have access to MetaTrader 5 as their trading platform. FinPros supports multiple deposit methods, including local payment methods, credit cards, bank wires, cryptocurrencies, and various online payment options, although specific withdrawal methods are not mentioned. Customer support is available through email, live chat, and phone, offering multiple communication channels for clients.

Regulation

FinPros operates under offshore regulation from the Seychelles Financial Services Authority. Their license, identified as a Retail Forex License with the license number SD087, authorizes them to engage in retail forex trading activities. This type of license generally focuses on overseeing and permitting forex trading services for retail clients.

Offshore regulation, in the context of financial services, typically refers to the practice of conducting financial activities in a jurisdiction outside one's home country. Offshore regulations can carry inherent risk of limited oversight, potentially less stringent investor protections, and challenges in dispute resolution. Therefore, traders have fewer protections against prospective fraud with offshore regulated brokerages.

Pros and Cons

| Pros | Cons |

| Wide Account Variety | High Minimum Deposit |

| Multiple Account Options | Limited Regulatory Protection |

| Regulation | Withdrawal methods not disclosed |

| Multiple account types |

Pros:

Low Spreads: FinPros offers low spreads, with some account types having spreads as low as 0.0 pips, which can be advantageous for traders looking to minimize trading costs.

Multiple Account Options: The broker provides a range of account types, including Raw+, Edge, ClassiQ, and Vantage, catering to various trading preferences and risk tolerances. This variety allows traders to choose an account that aligns with their individual needs.

Regulated: FinPros is regulated by the Seychelles Financial Services Authority, providing a degree of oversight and regulatory compliance, which can enhance trust among traders.

Cons:

High Minimum Deposit: The minimum deposit requirement for most account types, excluding ClassiQ, is relatively steep at $800, potentially limiting access for traders with lower capital.

Limited Regulatory Protection: Despite being regulated, FinPros falls under offshore regulation, which may not provide the same level of investor protection as regulations in more established financial jurisdictions, necessitating caution.

Withdrawal methods not disclosed: Some essential details, such as withdrawal methods, are not disclosed in the provided data, hindering complete transparency about the broker's services.

Market Instruments

FinPros provides a range of market instruments, including Forex, Metals, Stocks, Energies, Indices, and Cryptocurrencies. Details are as follows:

Forex: FinPros offers a variety of currency pairs for forex trading. These pairs include major currencies like EUR/USD and GBP/USD, as well as minor and exotic pairs. Traders can speculate on the exchange rate fluctuations of these currency pairs.

Metals: The broker provides access to precious metals such as gold (XAU/USD) and silver (XAG/USD). These metals are traded as spot contracts, allowing traders to invest in physical commodities without owning the actual assets.

Stocks: FinPros offers the opportunity to trade individual company stocks, allowing investors to take positions in publicly traded companies like Apple (AAPL) and Microsoft (MSFT). Traders can profit from price movements in these stocks.

Energies: Traders can engage in energy trading with products like crude oil (WTI) and natural gas (NG). These energy contracts enable speculation on the price movements of these crucial commodities.

Indices: The broker provides access to a selection of global indices, including popular ones like the S&P 500 and the FTSE 100. These indices represent the performance of a basket of stocks and are used as indicators of market sentiment.

Cryptocurrencies: FinPros allows traders to invest in various cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Litecoin (LTC). Cryptocurrency trading provides opportunities to profit from the volatility of digital assets.

Here's the table comparing FinPros to other competing brokerages based on the available market instruments:

| Broker | Market Instruments |

| FinPros | Currencies, Metals, Stocks, Energies, Indices, Cryptos |

| FXPro | Forex, Shares, Indices, Commodities, Metals, Energies, Cryptocurrencies |

| IC Markets | Forex, Indices, Commodities, Stocks, Bonds, Cryptocurrencies |

| FBS | Forex, Metals, Energies, Cryptocurrencies, Stocks, Indices |

| Exness | Forex, Metals, Energies, Cryptocurrencies, Indices, Stocks, Commodities, Bonds |

Account Types

FinPros offers six account types: Edge, Raw+, Vantage, ClassiQ, Pro, and Social. However, in the detailed information, only four accounts—Edge, Raw+, Vantage, and ClassiQ—are compared, with less information available for the other two accounts.

Raw+ Account: The Raw+ account offered by FinPros is designed for traders seeking tight spreads and lower trading costs. With a minimum deposit requirement of $800, this account type offers spreads starting from 0.0 pips, making it suitable for scalpers and traders focused on cost-efficient trading. Traders can enjoy a maximum leverage of 1:400.

Edge Account: The Edge account is suitable for traders who prefer low spreads with a minimum deposit of $800. While the spreads start from 0.4 pips, this account type offers a slightly higher spread than the Raw+ account. It also provides a maximum leverage of 1:400

ClassiQ Account: FinPros offers the ClassiQ account for traders looking for a lower minimum deposit requirement, set at $100. However, the spreads for this account type are comparatively higher, starting at 1.5 pips. The ClassiQ account offers a maximum leverage of 1:500, making it suitable for traders with lower capital who still want to participate in forex trading.

Vantage Account: The Vantage account caters to traders who prefer a maximum leverage of 1:200 with a minimum deposit requirement of $800. While the spreads for this account type start at 1.6 pips, it provides an opportunity for traders to access the forex market with slightly higher leverage.

All accounts offer market execution from the London LD4 server location, accommodating various trading strategies and ensuring robust trade execution standards.

| Account Type | Minimum Deposit | Minimum Spread | Maximum Leverage | Supported EA | Commission |

| Raw+ | $800 | 0.0 pips | 1:400 | Yes | From $2/lot per side |

| Edge | $800 | 0.4 pips | 1:400 | Yes | $3.5/lot per side |

| ClassiQ | $100 | 1.5 pips | 1:500 | Yes | No Commission |

| Vantage | $800 | 1.6 pips | 1:200 | Yes | No Commission |

How to open an account?

Visit the Website: Start by visiting the FinPros official website using a web browser.

Registration: Look for the “Start Now” button on the website's homepage and click on it.

Personal Information: Fill out the registration form with your personal details. This may include your name, email address, phone number, and residential address. Ensure that you provide accurate information.

Account Type Selection: Choose the type of trading account that best suits your needs. FinPros typically offers several account types with varying features.

Verification: As part of the account creation process, you may be required to verify your identity. This often involves providing a copy of your identification document (e.g., passport or driver's license) and proof of address (e.g., utility bill or bank statement).

Minimum Deposit

The minimum deposit rates at FinPros vary based on the type of trading account. While accounts such as Raw+ and Edge previously listed a minimum deposit of 800 USD with the status “Enquire,” it's most likely that these rates remain at 800 USD. Additionally, the ClassiQ account features a lower minimum deposit requirement, set at 100 USD, making it accessible to traders with smaller capital. The Vantage account, on the other hand, maintains the 800 USD minimum deposit. These varying minimum deposit requirements cater to traders with different financial resources and preferences, ensuring a range of options for account funding.

Leverage

FinPros offers varying maximum leverage ratios depending on the chosen trading account. For instance, the Raw+ and Edge accounts provide a maximum leverage of 1:400, which can be suitable for traders seeking higher leverage. The ClassiQ account offers a maximum leverage of 1:500, catering to traders looking for even greater leverage. In contrast, the Vantage account offers a maximum leverage of 1:200. The availability of different leverage options allows traders to select the account type that aligns with their risk tolerance and trading strategy.

Here's a table comparing the maximum leverage offered by FinPros to maximum leverage ratios for other brokers:

| Broker | Forex | Metals | Stocks | Energies | Indices | Cryptos |

| FinPros | 1:400 | 1:400 | 1:400 | 1:400 | 1:400 | 1:400 |

| FXPro | 1:500 | 1:500 | 1:10 | 1:10 | 1:10 | 1:2 |

| IC Markets | 1:400 | 1:500 | 1:10 | 1:10 | 1:10 | 1:5 |

| FBS | 1:500 | 1:500 | 1:20 | 1:20 | 1:20 | 1:3 |

| Exness | 1:500 | 1:500 | 1:5 | 1:5 | 1:5 | 1:3 |

Spread

FinPros offers various spreads across its various trading account types. The spreads are notably tight, starting from 0.0 pips for the Raw+ account and 0.4 pips for the Edge account. However, the ClassiQ account features comparatively higher spreads, starting at 1.5 pips. The Vantage account, while providing access to the forex market, also offers spreads starting at 1.6 pips. These spreads can be appealing to traders looking for cost-effective trading options, particularly those utilizing scalping strategies or seeking to minimize trading costs. The range of spreads accommodates different trading styles and preferences, allowing traders to select an account type that aligns with their specific needs.

Deposit & Withdrawal

FinPros offers a range of deposit methods, providing traders with flexibility in funding their accounts. These methods include Credit Card, Bank Wire, Crypto, Korapay, Ozow, Click, and Pix. While this variety caters to different preferences, it's important to note that the broker has not disclosed its withdrawal methods. This omission is a significant concern, as transparency regarding withdrawal options is crucial for traders. The absence of information on withdrawal methods raises a significant red flag, as customers have no way of checking the withdrawal methods prior to account creation or contacting customer support. This lack of transparency can impact the overall user experience and trustworthiness of brokerage.

Trading Platforms

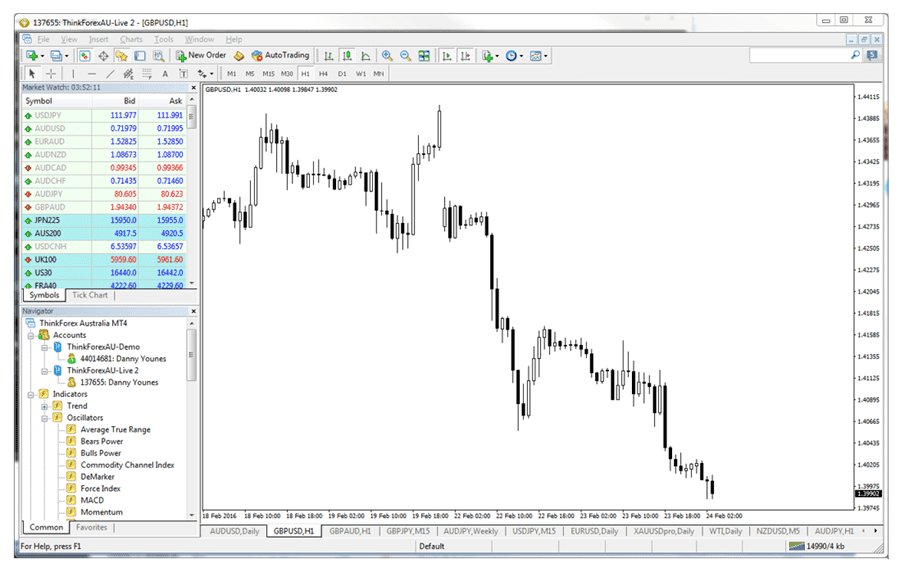

FinPros offers the popular MetaTrader 5 (MT5) trading platform for its clients. MT5 is known for its advanced charting capabilities, technical analysis tools, automated trading through Expert Advisors (EAs), and a user-friendly interface, making it a versatile choice for traders.

Here's a table comparing the trading platforms offered by FinPros to those offered by other select brokers:

| Broker | Trading Platforms |

| FinPros | MetaTrader 5 (MT5) |

| FXTM | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Exness | MetaTrader 4 (MT4), MetaTrader 5 (MT5) |

| Pepperstone | MetaTrader 4 (MT4), MetaTrader 5 (MT5), cTrader |

| FP Markets | MetaTrader 4 (MT4), MetaTrader 5 (MT5), IRESS, cTrader |

Social Trading

FinPros' social trading feature allows users to emulate the trades of their top traders in real time through the FinPros Social Trading app. This service is ideal for beginners who are still learning the basics of trading or for those who lack the time to analyze markets themselves. By using the app, users can automatically copy the trades made by FinPros' most successful traders directly into their own accounts, effectively trading alongside seasoned professionals.

The FinPros Social Trading app is available for download on both Android and Apple iOS platforms, making it accessible to a wide range of users across different devices.

Customer Support

FinPros offers multiple customer support channels, including email, LiveChat, and phone support, providing clients with various means to seek assistance and receive timely responses to their inquiries or concerns.

Email Support: FinPros offers email support through the address SupportPros@FinPros.com.Clients can reach out via email to seek assistance or inquire about various aspects of their trading accounts or services.

LiveChat Support: The company provides LiveChat support, allowing clients to engage in real-time text-based communication with customer support representatives. This channel offers immediate assistance and is often preferred for quick queries and problem resolution.

Phone Support: For direct and immediate assistance, clients can contact FinPros via phone at +357 25 263 263. This phone support option provides a direct line to customer support representatives who can address inquiries and issues promptly.

Conclusion

FinPros is a brokerage with an offshore regulated status, governed by the Seychelles Financial Services Authority. Established within the past 2-5 years, the company offers a range of trading accounts tailored to cater to a variety of trading preferences. With a minimum deposit requirement that can start as low as $100 and go up to $800, FinPros accommodates traders with varying capital resources.

While the broker primarily operates in the realm of forex trading, it extends its offerings to metals, stocks, energies, indices, and cryptocurrencies, diversifying the assets available for trading. Traders can access the highly regarded MetaTrader 5 (MT5) platform, known for its robust features and trading tools.

FAQs

Q: How does FinPros ensure regulatory compliance?

A: FinPros operates under the regulatory oversight of the Seychelles Financial Services Authority.

Q: What is the minimum deposit required for the ClassiQ account?

A: The ClassiQ account requires a minimum deposit of $100.

Q: Can traders access live customer support?

A: Yes, traders can reach out to customer support through live chat, email, and phone.

Q: Which trading platform does FinPros offer?

A: FinPros provides access to the MetaTrader 5 (MT5) trading platform.

Q: What types of assets are available for trading?

A: Traders can access forex, metals, stocks, energies, indices, and cryptocurrencies.

Keywords

- 2-5 years

- Regulated in Seychelles

- Retail Forex License

- MT5 Full License

- Global Business

- Medium potential risk

- Offshore Regulated

Review 7

Content you want to comment

Please enter...

Review 7

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

zhao juan

Malaysia

I've been intermittently trading with FinPros for a long time. Overall, I've had a positive experience with instant withdrawals and deposits, a well-designed website and mobile apps, and 24/7 customer support in various languages. However, the "Real-3" server on mt4 is slow and unresponsive, which has been frustrating as it's linked to my "Master account." Despite this issue, everything else about FinPros is excellent.

Neutral

04-30

Dyshmliy

United Kingdom

FinPros is my favorite new broker, fast withdrawals, excellent trading conditions, low spreads, good function, professional account manager. I am totally satisfied with this broker.

Neutral

2023-02-23

FX1049448248

Spain

Originally, I thought their trading conditions were attractive and wanted to give it a try, but found out that they don't offer demo accounts. There are very few brokers that do not offer a demo account these days. So I decided to choose another broker. Their licenses are even offshore.

Neutral

2022-11-27

CXM~TINA

New Zealand

Only MT5 is available here, so if you want to use MT4 to trade, you will have to choose brokers. Besides, $100 minimum initial amount and 1.5 pips on the ClassicQ account are just comparable to the industry average. However, up to 1:500 leverage is indeed very generous.

Neutral

2022-11-24

信仰41409

Hong Kong

Jesus! High minimum deposit scare me too much! I swear that I would never trade with this kind of brokerage, though its offerings seem attractive… they’re just gonna lose me unless they lower the entry threshold… How can I say? hmmm… very unfriendly.

Neutral

2022-11-24

Vxero

Malaysia

Overnight interest rates are fair, allowing me to maximize my profits.And Trading transparency is key, and this platform delivers in every way.

Positive

08-01

刘建39723

Taiwan

So far my experience is pretty good. The account setup was quick and hassle-free, and their customer service is responsive and helpful. Trading execution is smooth with no issues on fills or slippages.

Positive

06-17