Score

IB

Hong Kong|Above 20 years|

Hong Kong|Above 20 years| https://www.interactivebrokers.com.hk/en/home.php

Website

Rating Index

Capital Ratio

Capital Ratio

Perfect

Capital

Influence

AAA

Influence index NO.1

United States 9.42

United States 9.42Capital Ratio

Capital Ratio

Perfect

Capital

Influence

Influence

AAA

Influence index NO.1

United States 9.42

United States 9.42Contact

Licenses

Licenses

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker has been disclosed by National Futures Association. Please be aware of risks!

Basic information

Hong Kong

Hong KongAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed IB also viewed..

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

EC Markets

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Sources

Language

Mkt. Analysis

Creatives

Website

Most visited countries/areas

Hong Kong

Canada

Singapore

United Arab Emirates

China

interactivebrokers.ca

Server Location

Japan

Website Domain Name

interactivebrokers.ca

Server IP

23.77.204.201

interactivebrokers.co.jp

Server Location

Hong Kong

Website Domain Name

interactivebrokers.co.jp

Server IP

103.38.90.34

interactivebrokers.com.hk

Server Location

Hong Kong

Most visited countries/areas

Hong Kong

Website Domain Name

interactivebrokers.com.hk

Website

WHOIS.HKIRC.HK

Company

-

Server IP

103.38.90.35

Genealogy

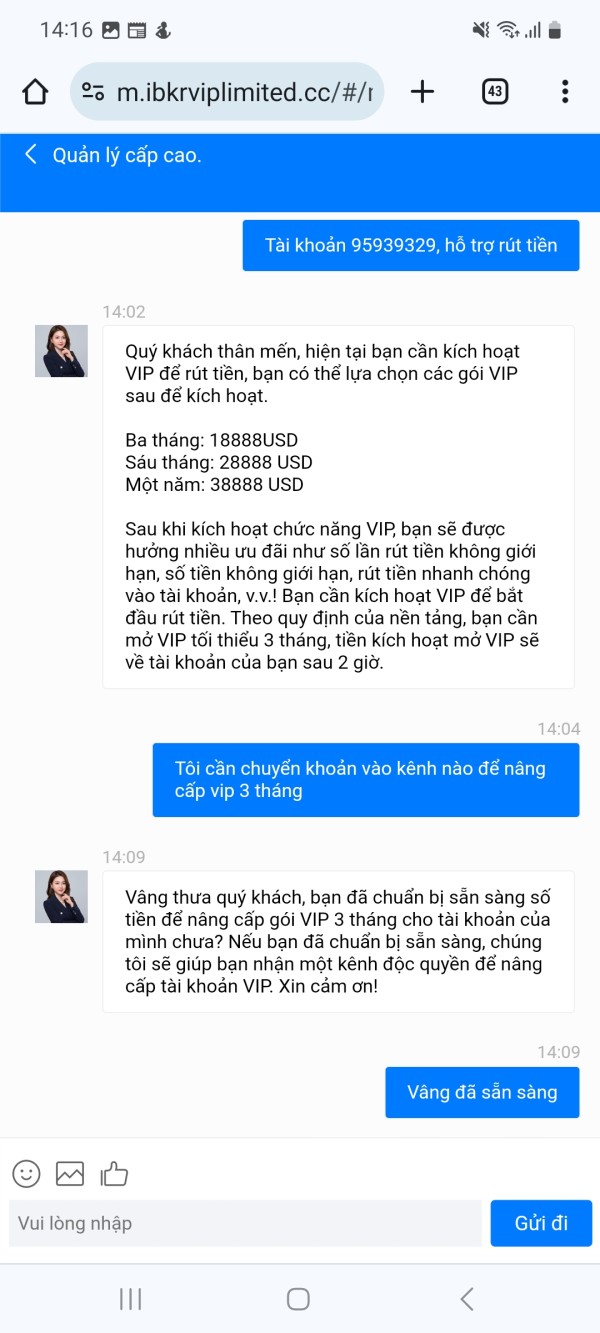

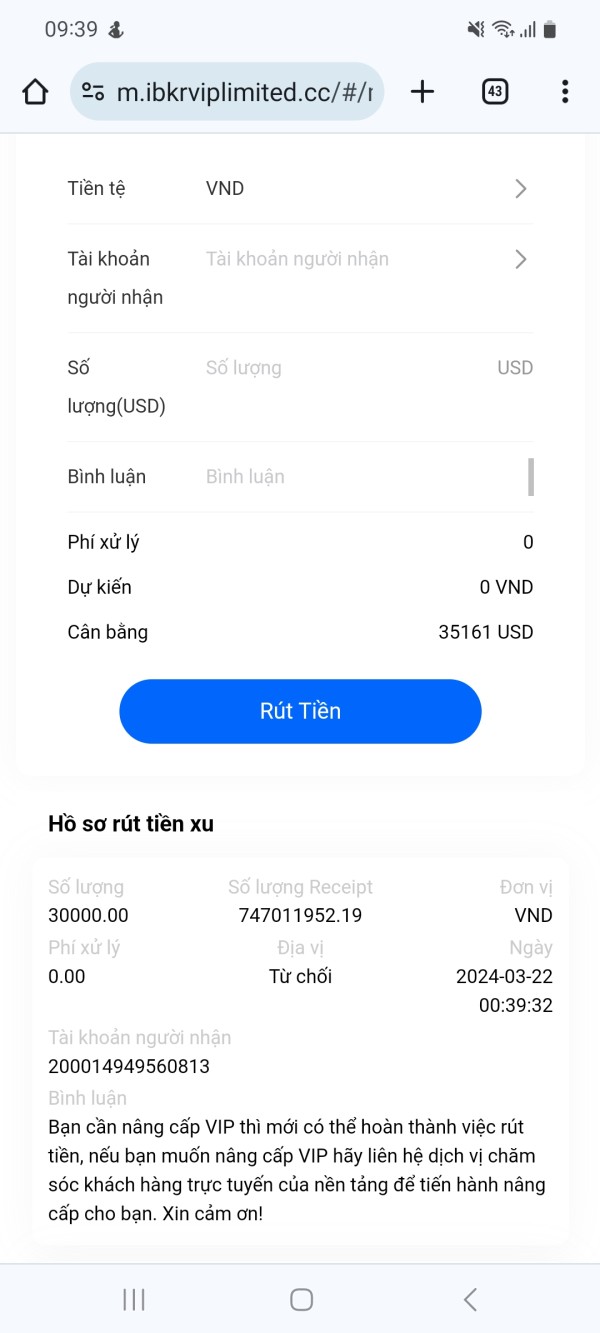

VIP is not activated.

VIP is not activated.HENGTAI INTERNATIONAL

Interactive Brokers

Company Summary

| IB Review Summary in 10 Points | |

| Founded | 1978 |

| Headquarters | Greenwich, Connecticut, United States |

| Regulation | ASIC, FCA, FSA, SFC, CIRO |

| Market Instruments | Stocks, options, futures, currencies, bonds and funds |

| Demo Account | ✅ |

| Leverage | 1:400 |

| Spread | From 0.1 pips |

| Trading Platform | IBKR GlobalTrader, Client Portal, IBKR Desktop, IBKR Mobile, Trader Workstation (TWS), IBKR APIs, IBKR ForecastTrader, IMPACT |

| Minimum Deposit | $0 |

| Customer Support | Live chat, phone, email, FAQs |

IB Information

IB, or Interactive Brokers, is a discount brokerage firm founded in the United States in 1978. It is headquartered in Greenwich, Connecticut, and has offices in several other countries, including the United Kingdom, Hong Kong, and Australia. The company provides electronic brokerage services to individual and institutional clients, offering a range of financial products, including stocks, options, futures, forex, bonds, and funds. Interactive Brokers is regulated by several financial authorities, including ASIC (Australia), FCA (UK), FSA (Japan), SFC (Hong Kong), and CIRO (Canada).

Pros & Cons

Interactive Brokers (IB) has many advantages, including low commissions, access to a wide range of financial products, and a highly customizable trading platform. Additionally, IB is known for its advanced research tools and competitive pricing.

However, complex pricing structures and trading platforms are not suitable for all investors.

Below is a table outlining the pros and cons of Interactive Brokers (IB):

| Pros | Cons |

| • Wide range of trading instruments | • Complex platform and steep learning curve |

| • Advanced trading platform with many features | • Monthly inactivity fee if account balance is below $100,000 |

| • Low trading fees and commissions | |

| • Access to international markets and exchanges | |

| • Multiple account types to choose from | |

| • Strong regulatory oversight and safety of client funds |

Note: This table is based on general observations and may not represent the experience of every individual user.

Is IB Legit?

Interactive Brokers is a well-established and reputable broker. The company is publicly traded and regulated by multiple top-tier financial authorities around the world, including ASIC (Australia), FCA (UK), FSA (Japan), SFC (Hong Kong), and CIRO (Canada). Furthermore, the broker has a long history of providing high-quality services to its clients, with a track record of financial stability and reliability. Therefore, based on these factors, it can be concluded that IB is a legitimate broker.

How Are You Protected?

Interactive Brokers (IB) provides a range of security measures to protect its clients' funds and personal information. Some of the key security measures include:

| Protection Measure | Detail |

| Regulatory Oversight | ASIC, FCA, FSA, SFC, CIRO |

| Account Protection | SIPC protection (up to $500,000) and additional third-party insurance coverage (up to $30 million) |

| Two-Factor Authentication | adding an extra layer of security to their accounts |

| Secure Login System | a proprietary security measure that requires users to have a security device to log in to their accounts |

| Privacy Policy | outlines how it collects and uses customer data |

| Secure Website | uses SSL encryption on its website to protect user data and prevent unauthorized access |

| Cybersecurity Measures | firewalls, intrusion detection systems, and encryption, to protect against cyber threats |

It's important to note that while no investment platform can completely eliminate risk, IB's measures are designed to mitigate risk and protect its clients as much as possible.

Our Conclusion on IB Reliability:

Based on the information provided, Interactive Brokers is a reliable broker with a strong focus on client protection and security measures. It is regulated by multiple authorities and has a history of being in the industry for several decades.

Market Instruments

IB offers a wide range of trading instruments across multiple asset classes, including:

- Stocks: IB provides access to over 135 markets and 35 countries, with more than 9,000 stocks available to trade.

- Options: IB offers options trading across a variety of markets, including stocks, indices, and futures.

- Futures: IB offers futures trading on over 70 global markets, including indices, commodities, and currencies.

- Forex: IB provides access to forex trading in over 100 currency pairs.

- Bonds: IB offers trading in bonds, including corporate, municipal, and government bonds.

- Funds: IB offers trading in funds from over 250 fund families.

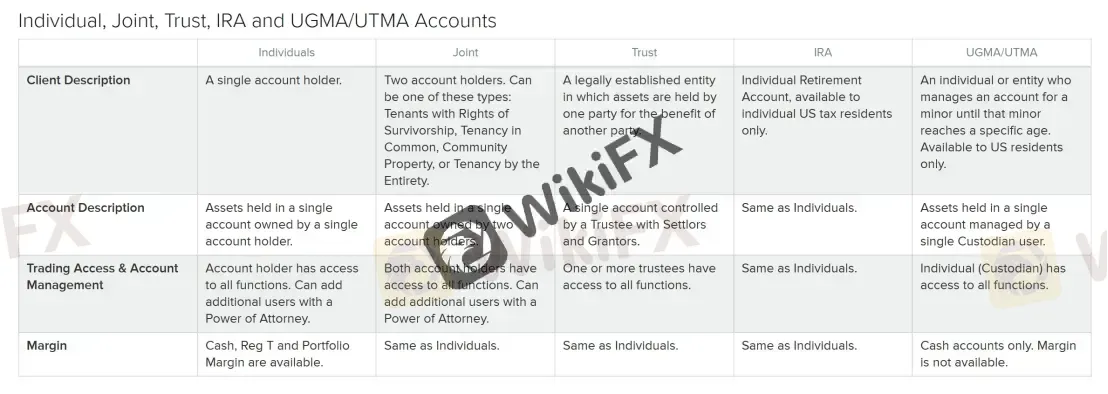

Account Types

Interactive Brokers (IB) offers various types of accounts for different trading needs, including individual, joint, corporate, and trust accounts. The following is a brief overview of the main IB account types:

- Individual: A standard account for individual traders that allows access to all trading products and services provided by IB.

- Joint: An account for two or more individuals who share ownership of the account and have equal rights to trade and manage the account.

- Corporate: An account for corporations, partnerships, LLCs, and other business entities that require a tax ID number to establish an account.

- Trust: An account for trusts and estates, which must be established with proper documentation and verification of the trustee's authority.

- Advisor: An account for registered investment advisors (RIAs) who manage assets for clients and require tools for managing multiple accounts.

- Friends and Family: An account for multiple individuals who are related or known to each other, and who want to trade together while maintaining separate account ownership.

- Proprietary Trading Group: An account for proprietary trading firms that require multiple sub-accounts, customizable risk management tools, and other advanced trading features.

Margin & Leverage

While the margin rates that IB offers are the same for all customers, local regulators may impose different or higher rates. Regulatory requirements for margin deposits in a given jurisdiction will take precedence over those set by the IB if they are greater.

And since high-risk leverage is regulated differently in different countries, your ability to use it will vary based on the trading instrument you use and the law where you live. As a result, IB provides a convenient online tool to let you quickly and easily view all applicable margins, allowing you to select the optimal trading conditions.

For customers who come under the jurisdiction of the Australian Securities and Investments Commission (ASIC), the maximum leverage available on Forex trades is 1:400.

It is important to keep in mind that the greater the leverage, the greater the risk of losing your deposited capital. The use of leverage can both work in your favour and against you.

Spreads & Commissions

Spreads:

- Forex: IB offers competitive spreads on major forex pairs, with typical spreads ranging from 0.1 to 0.3 pips for EUR/USD, 0.1 to 0.6 pips for USD/JPY, and 0.3 to 0.7 pips for GBP/USD.

- Stocks: IB offers tiered pricing for stocks, with spreads ranging from $0.0035 to $0.01 per share, depending on monthly volume. For example, the spread for a trade of 100 shares of Apple (AAPL) would be $0.35 to $1.00, depending on the monthly volume.

- Options: IB offers competitive spreads on options, with typical spreads ranging from $0.10 to $0.30 per contract for major options.

Commissions:

A tiered commission of $0.0035 per share for a monthly volume of fewer than 300,000 shares, $0.002 per share for a monthly volume of 300,001-3,000,000 shares, $0.0015 per share for a monthly volume of 3,000,001-20,000,000 shares, and $0.0015 per share for a monthly volume of 20,000,000 shares. $0.001 per share for a monthly volume of 20,000,001-100,000,000 shares and $0.0005 per share for a monthly volume of 100,000,000 shares or more. The minimum commission is $0.35, and the maximum commission is 1% of the trading volume. The commission for metals trading is 0.15 basic points of the volume, with a minimum of $2.

Trading Platforms

IBKR GlobalTrader, Client Portal, IBKR Mobile, Trader Workstation (TWS), IBKR APIs, IBKR Event Trader, and IMPACT are different trading platforms and tools offered by Interactive Brokers (IB) to its clients.

- IBKR GlobalTrader is a web-based platform designed for trading and managing international accounts. It provides access to 125 global markets and 31 countries. It also allows clients to trade in multiple currencies and offers currency conversion at competitive rates.

- Client Portal is a web-based platform that enables clients to manage their accounts, view balances and positions, access research and news, and monitor trading activity. It also provides account management tools such as funding, withdrawals, and statements.

- IBKR Mobile is a mobile application that allows clients to manage their accounts, place trades, and access real-time market data. It is available for both iOS and Android devices.

- Trader Workstation (TWS) is a desktop trading platform that provides advanced trading tools, real-time market data, and research. It is designed for professional traders and investors who require advanced trading capabilities.

- IBKR APIs are a set of programming interfaces that allow clients to integrate their own software and applications with IB's trading systems. This enables clients to automate their trading strategies and access real-time market data.

- IMPACT (Interactive Brokers Market Place and Corporate Technology) is an online marketplace that offers a range of third-party applications and services to clients. These include trading tools, research, analytics, and other resources to enhance trading capabilities.

Overall, IB offers a variety of trading platforms and tools that cater to the needs of different types of traders and investors. These platforms provide access to a wide range of markets and instruments, advanced trading tools, real-time market data, and research resources. Additionally, the IBKR APIs enable clients to customize and automate their trading strategies.

Deposits & Withdrawals

There are several major options for traders to deposit and withdraw funds from their accounts, including bank wire transfers, ACH, BPAY, EFT, online bill payment and more.

Note that the availability of deposit and withdrawal methods may vary depending on your location and account type.

Minimum deposit requirement

The minimum deposit requirement for Interactive Brokers (IB) varies depending on the account type and the location of the account holder. For example, the minimum deposit for a US-based individual account is $0 for IBKR Lite and $0 for IBKR Pro, while for a non-US-based individual account, the minimum deposit is $0 for IBKR Lite and $10,000 for IBKR Pro. However, the minimum deposit for other account types, such as institutional accounts or margin accounts, may be higher.

IB minimum deposit vs other brokers

| IB | Most other | |

| Minimum Deposit | $0 | $/€/£100 |

Fees

IB charges a variety of fees to its clients, including account fees, and market data fees. Account fees include a monthly activity fee of $10, which is charged to clients who do not generate a minimum monthly commission of $10 in trades or who do not maintain a minimum account balance of $100,000.

Market data fees are charged by exchanges and other data providers for real-time and delayed market data. IB offers a variety of market data packages to suit different trading needs, with fees ranging from free to several hundred dollars per month depending on the package and the markets covered.

Overall, while IB's fee structure may seem complex at first, it is generally transparent and competitive compared to other brokers. Clients can use IB's fee calculator tool on its website to estimate their total trading costs.

Customer Service

Interactive Brokers (IB) provides customer service to its clients through various channels, including phone, email, live chat, and a knowledge base. Here is some information about IB's customer service:

- Phone support: IB offers 24/7 customer service through phone support. Clients can call IB's toll-free numbers from their registered phone number to receive assistance in several languages.

- Email support: Clients can send an email to IB's customer service team at any time. IB aims to respond to emails within 1 business day.

- Live chat: IB offers live chat support through its website and trading platforms. Clients can chat with IB's customer service representatives in real-time to receive assistance with their account.

- Knowledge base: IB has an extensive knowledge base that includes frequently asked questions, user guides, and tutorials. Clients can search the knowledge base for answers to their questions or to learn more about IB's products and services.

You can also follow IB on some social networks such as Facebook, Instagram, LinkedIn, Twitter and YouTube.

Education

Interactive Brokers offers a variety of educational resources for traders, including webinars, courses, videos, and articles.

The education section of their website includes topics such as trading basics, options trading, technical analysis, and trading strategies. They also offer a wide range of educational videos on their YouTube channel.

In addition, Interactive Brokers offers a simulated trading account that allows traders to practice trading with virtual funds before risking real money. This is a useful tool for beginners who are learning to trade.

Conclusion

In conclusion, Interactive Brokers is a reputable and reliable broker that offers a wide range of investment products and trading platforms to its clients. The broker is known for its low commission rates and competitive pricing structure, making it a good choice for active traders and investors.

IB also provides a high level of security and protection to its clients, through various measures such as SIPC and excess SIPC insurance, and two-factor authentication. The broker also offers educational resources, customer support, and a variety of account types to meet the needs of different traders.

However, IB may not be the best fit for beginners due to its complex trading platforms and sophisticated tools.

Overall, Interactive Brokers is a good choice for experienced traders and investors who are looking for a reliable broker with low commissions and a wide range of investment products.

Frequently Asked Questions (FAQs)

| Q 1: | Is IB regulated? |

| A 1: | Yes. It is regulated by ASIC, FCA, FSA, SFC, and CIRO. |

| Q 2: | Does IB offer industry-standard MT4 & MT5? |

| A 2: | No. Instead, it offers IBKR GlobalTrader, Client Portal, IBKR Desktop, IBKR Mobile, Trader Workstation (TWS), IBKR APIs, IBKR ForecastTrader, IMPACT. |

| Q 3: | What is the minimum deposit for IB? |

| A 3: | There is no minimum initial deposit with IB. |

| Q 4: | Is IB a good broker for beginners? |

| A 4: | No. Beginners may find IB's trading platforms are difficult to uderstand. It is more suitable for experienced traders. |

Keywords

- Above 20 years

- Regulated in Australia

- Regulated in United Kingdom

- Regulated in Japan

- Regulated in Hong Kong

- Regulated in Canada

- Regulated in United States

- Market Making(MM)

- Retail Forex License

- Dealing in futures contracts & Leveraged foreign exchange trading

- Common Financial Service License

- Self-developed

- Global Business

- Australia Investment Advisory License Revoked

- Hong Kong Dealing in futures contracts & Leveraged foreign exchange trading Revoked

- Suspicious Overrun

- High potential risk

Disclosure

Interactive Brokers pays $832,500 penalty for ‘negligent’ and ‘reckless’ conduct

Country/Region

AU ASIC

Disclosure time

2023-09-20

Disclose broker

"Bappebti Blocks 760 Website Domains, Reminds of the Risk of Transactions in Unlicensed PBK Entities"

Country/Region

ID BAPPEBTI

Disclosure time

2022-09-20

Disclose broker

NFA orders Connecticut-based Interactive Brokers LLC to pay a $250,000 fine

Country/Region

US NFA

Disclosure time

2022-04-14

Disclose broker

FCA fines Interactive Brokers (UK) Limited £1,049,412 for poor market abuse controls and failure to report suspicious client transactions

Country/Region

UK FCA

Disclosure time

2018-01-25

Disclose broker

News

News Interactive Brokers Boosts IBKR Desktop with Advanced Tools

Interactive Brokers upgrades IBKR Desktop with powerful tools like MultiSort, Option Lattice, and enhanced charting, simplifying global trading for all skill levels.

2024-12-18 16:25

News SFC Freezes $91M in Client Accounts Amid Fraud Probe

SFC freezes $91M in client accounts at IBHK, SBI, Monmonkey, and Soochow over suspected hacking and market manipulation during unauthorized online trades.

2024-11-25 14:02

News Interactive Brokers Launches Tax-Friendly PEA Accounts in France

Interactive Brokers introduces tax-advantaged PEA accounts, offering French clients low-cost access to European stocks and ETFs for diversified savings.

2024-11-21 14:15

News Interactive Brokers Opens New Office in Dubai DIFC

Interactive Brokers opens a new office in Dubai DIFC, offering advanced global trading platforms to investors in the Middle East, and enhancing access to international financial markets.

2024-10-17 16:40

News Interactive Brokers Adds Cboe Australia and CME Group Derivatives

Interactive Brokers adds new derivatives from Cboe Australia and CME Group, enhancing investment options for traders to diversify portfolios and manage risk.

2024-10-16 17:09

News Interactive Brokers Launches BookTrader for Optimized Trading

Interactive Brokers introduces BookTrader, a tool offering real-time data, advanced order management, and customizable features to optimize trading performance.

2024-10-15 15:22

Review 32

Content you want to comment

Please enter...

Review 32

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Risk Warning

This broker is disclosed by National Futures Association. Please be aware of risks.

老李4458

Hong Kong

According to the requirements, I submitted a lot of documents. They froze and closed my account on the grounds that my account was not compliant. I went to withdraw the remaining funds and confirmed the withdrawal over the phone. Until now, customer service, all consultation forms, and emails have not been replied to. It's really disappointing. This is how they treat us Chinese customers on such a big platform.

Exposure

10-18

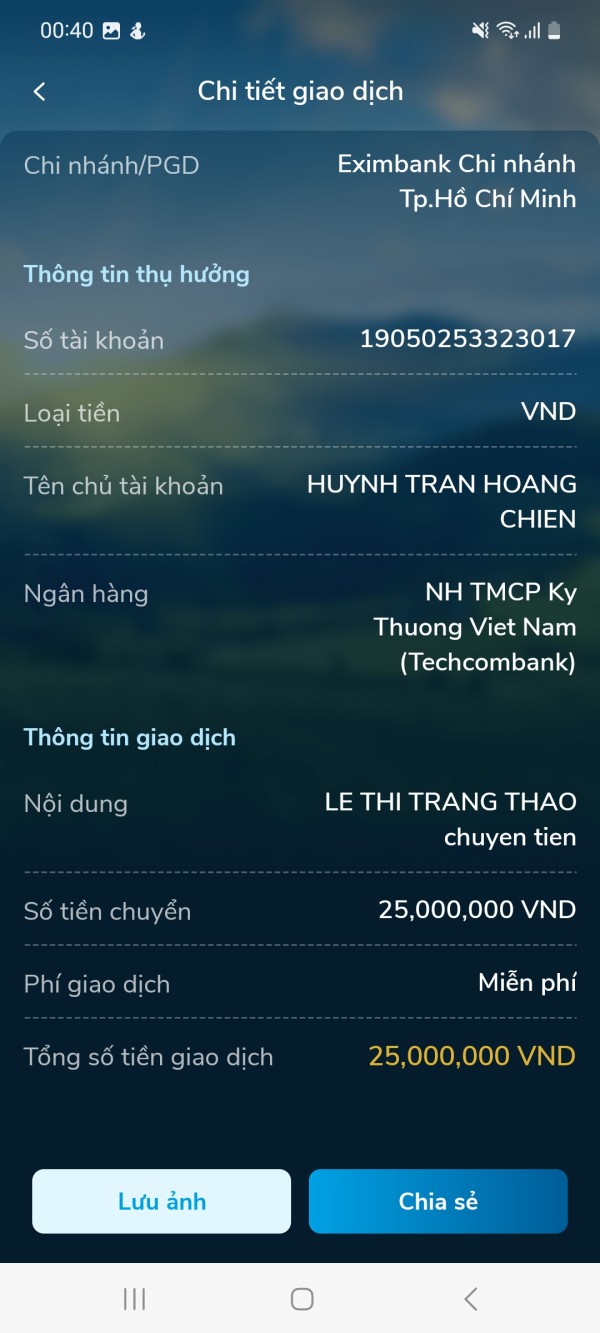

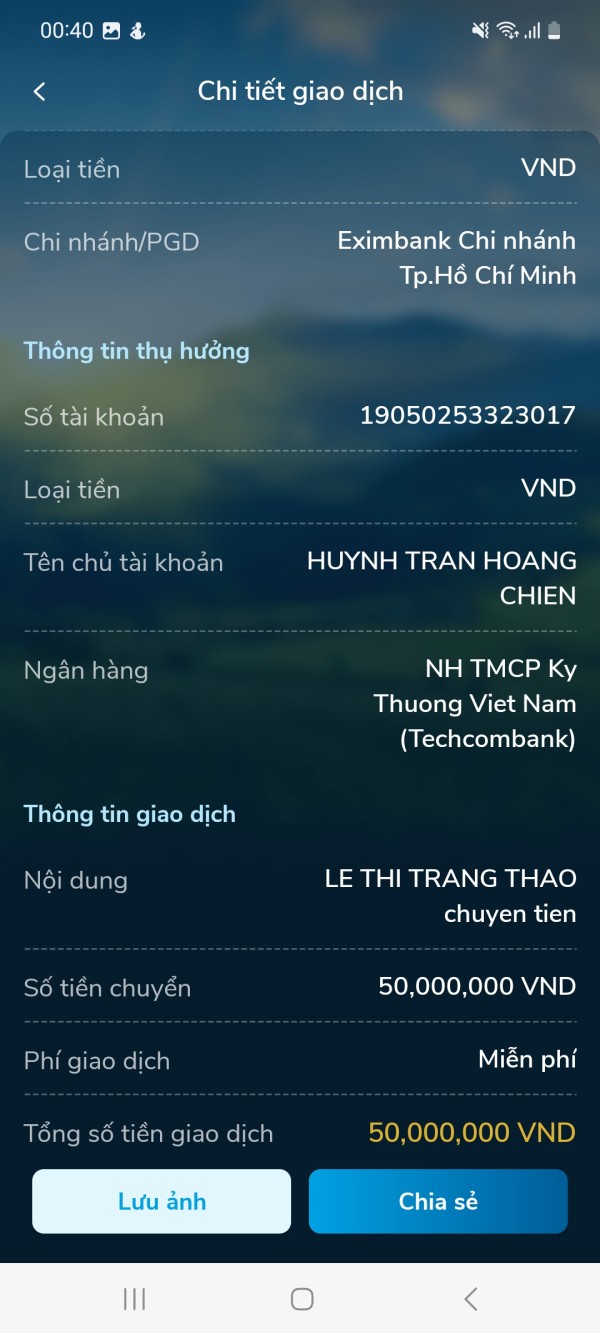

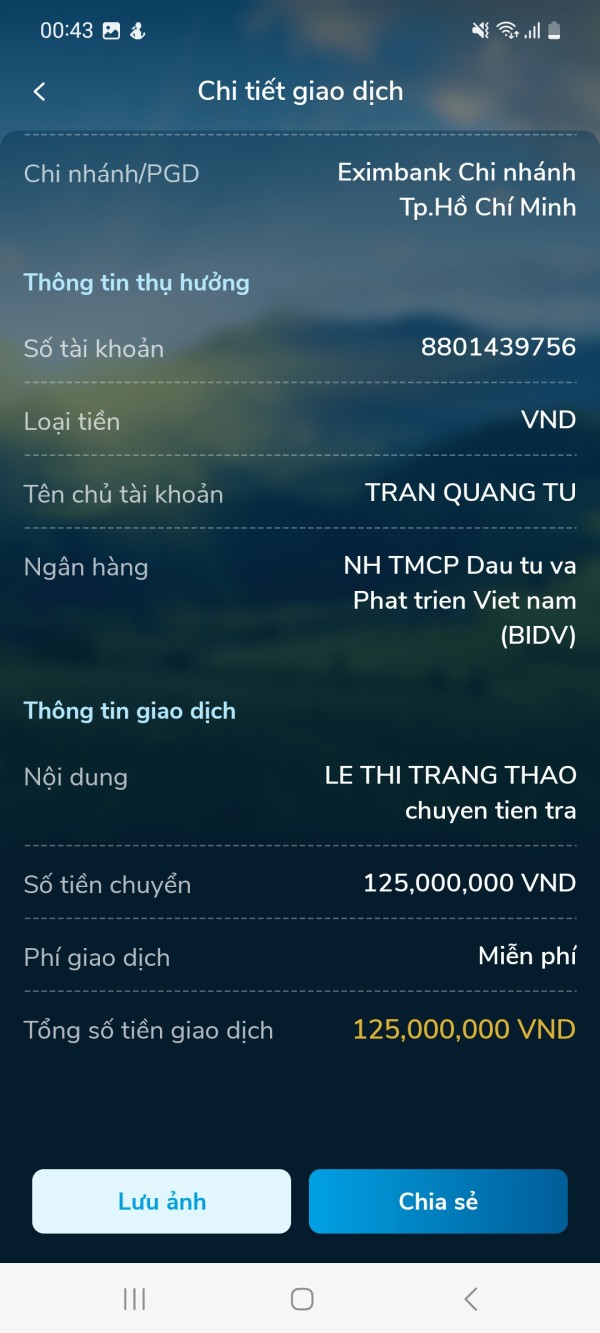

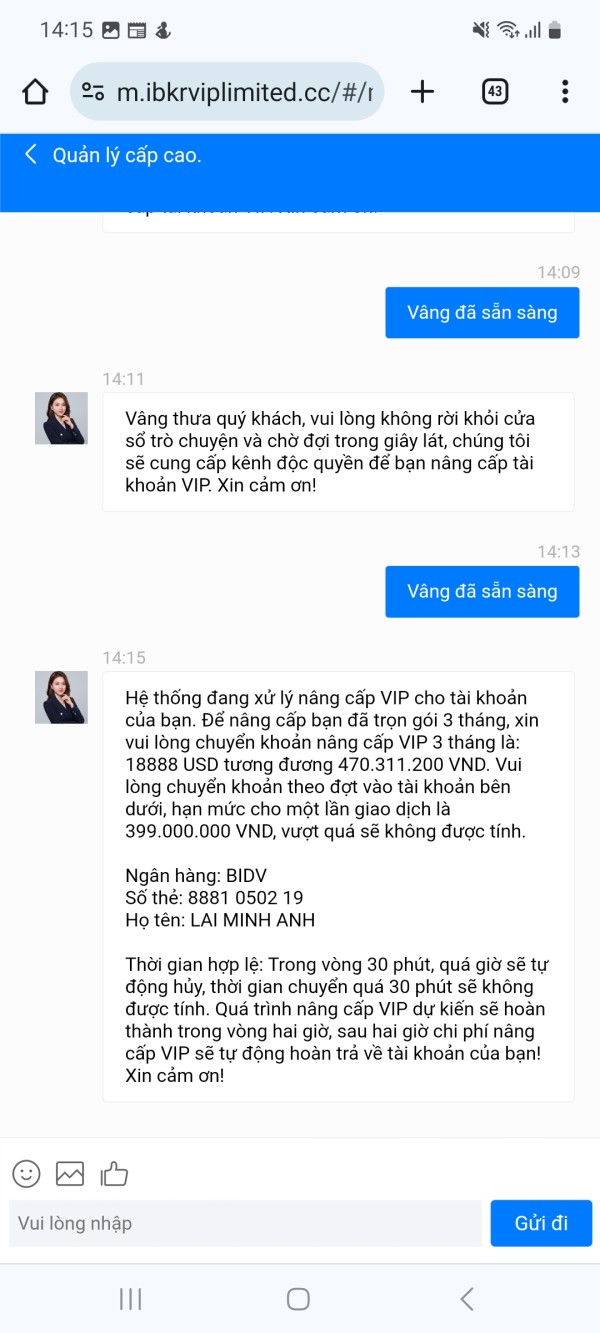

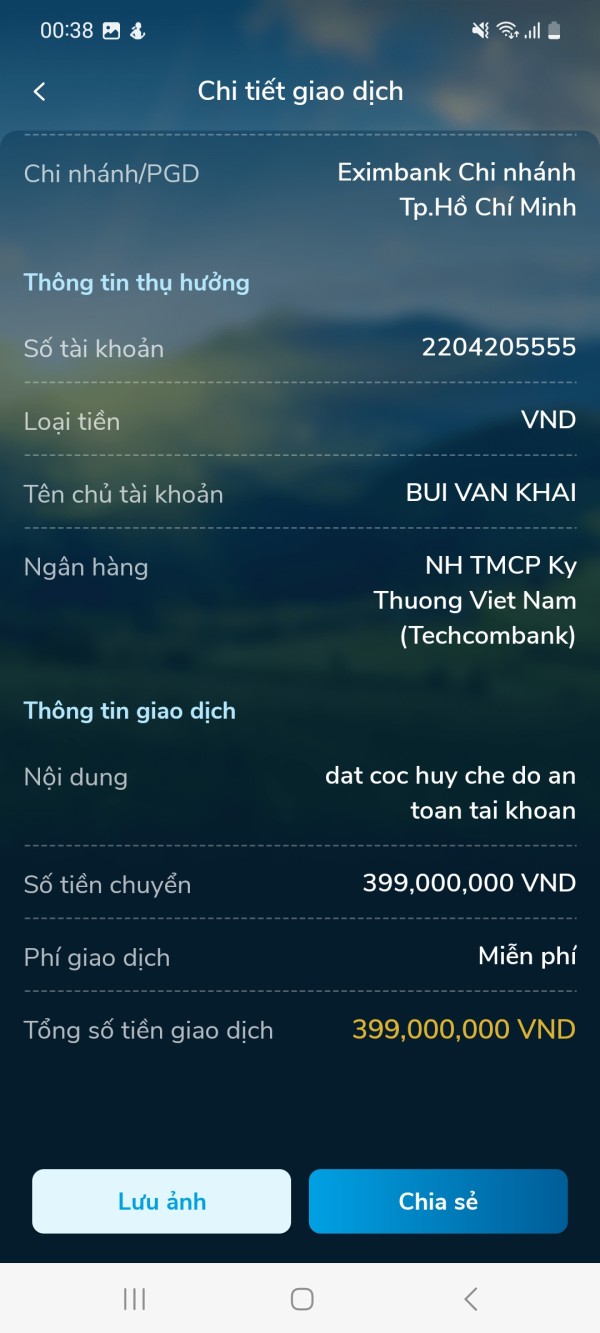

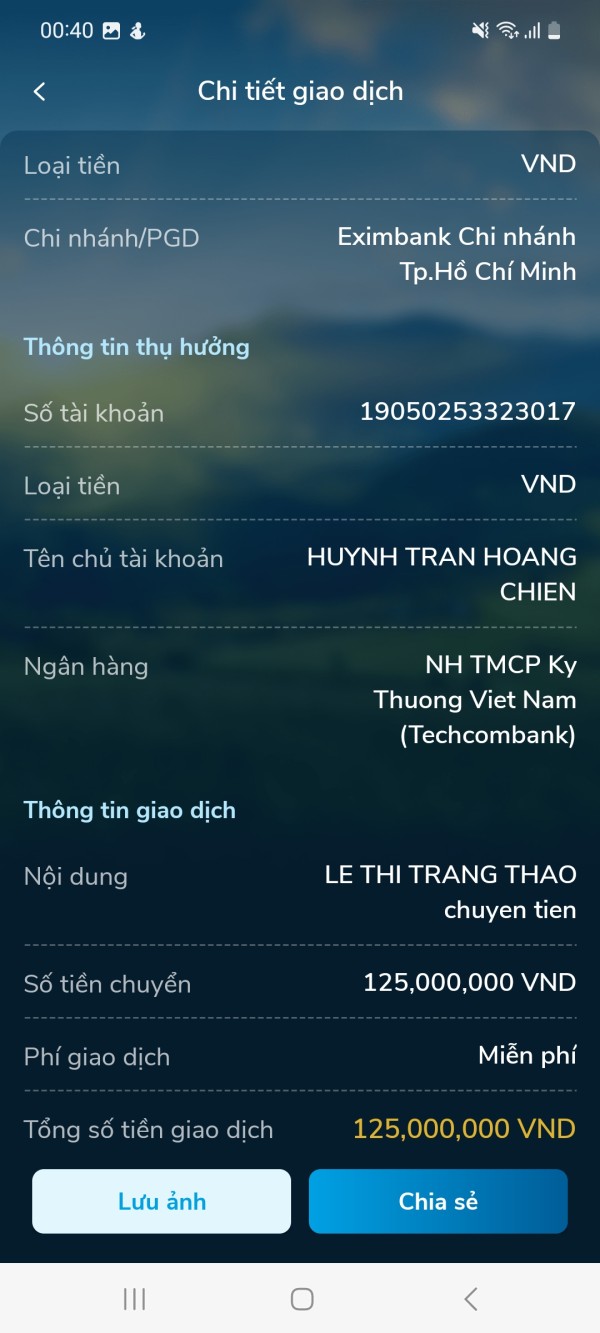

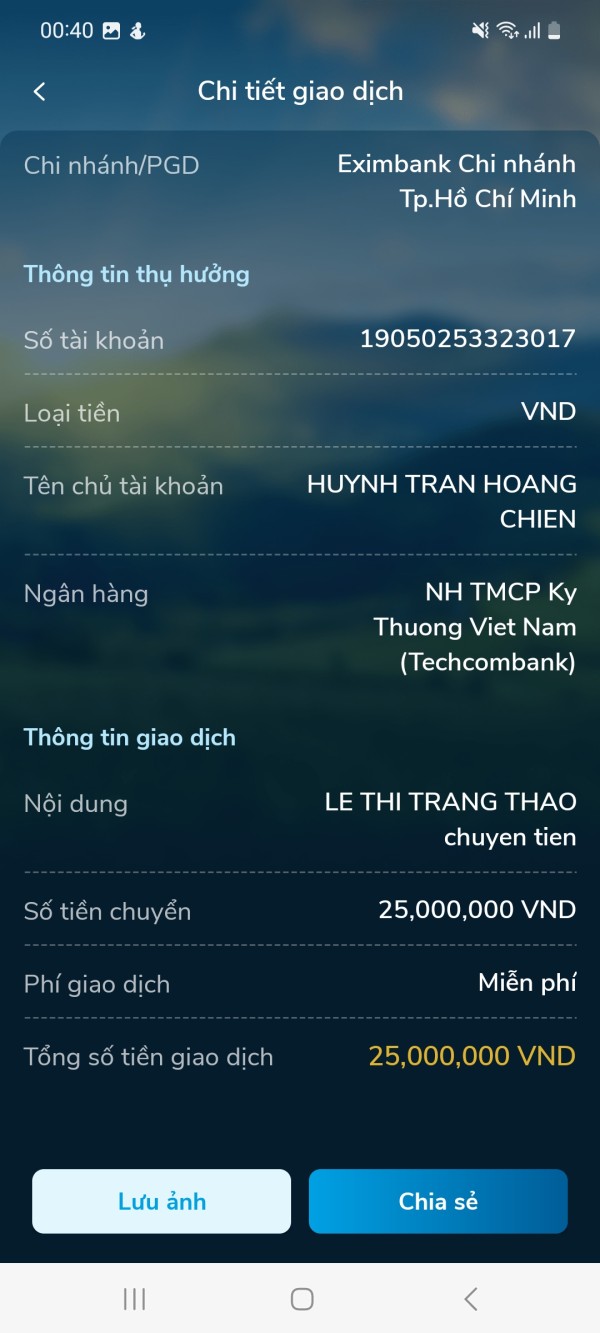

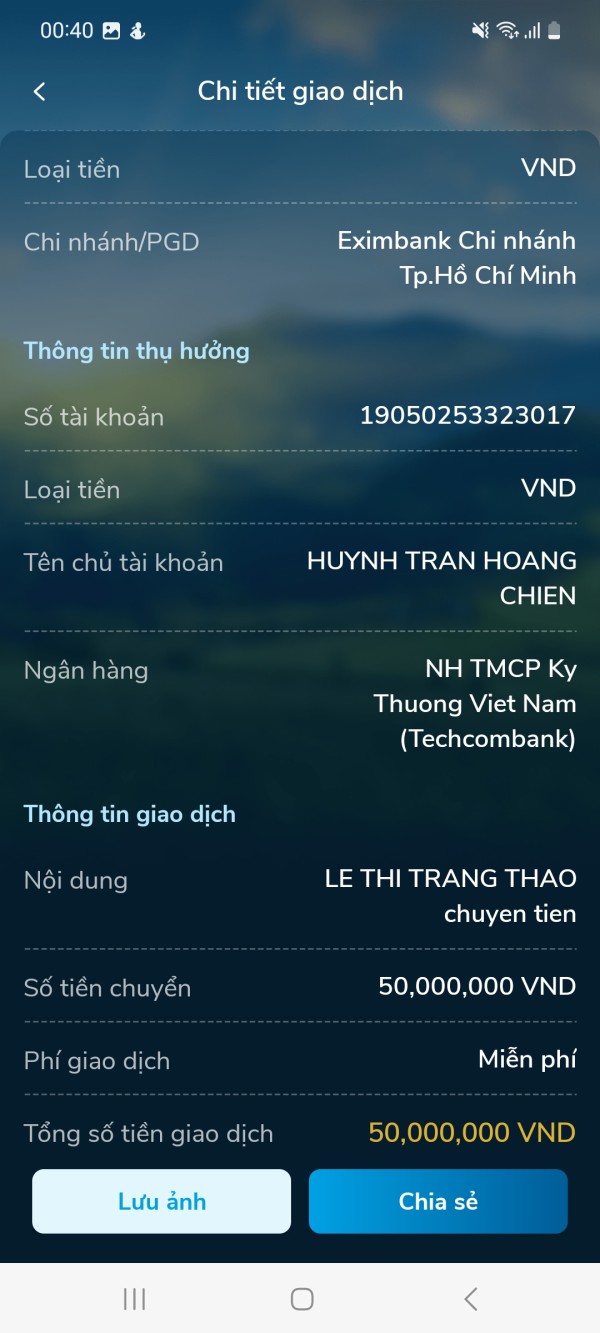

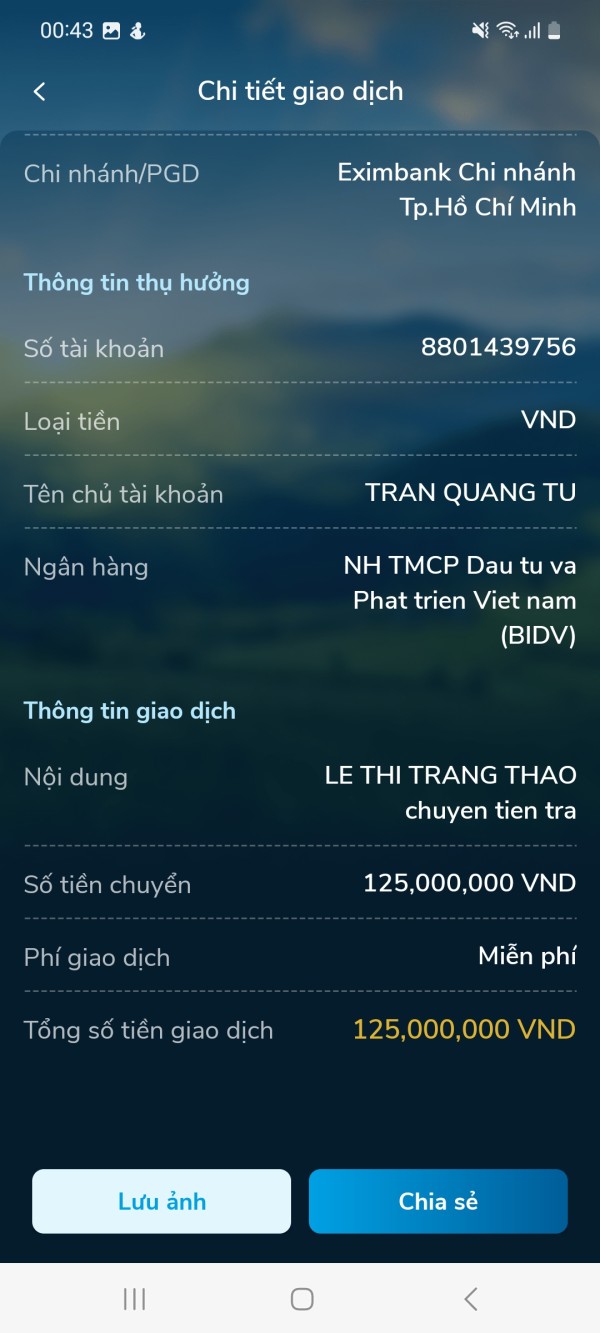

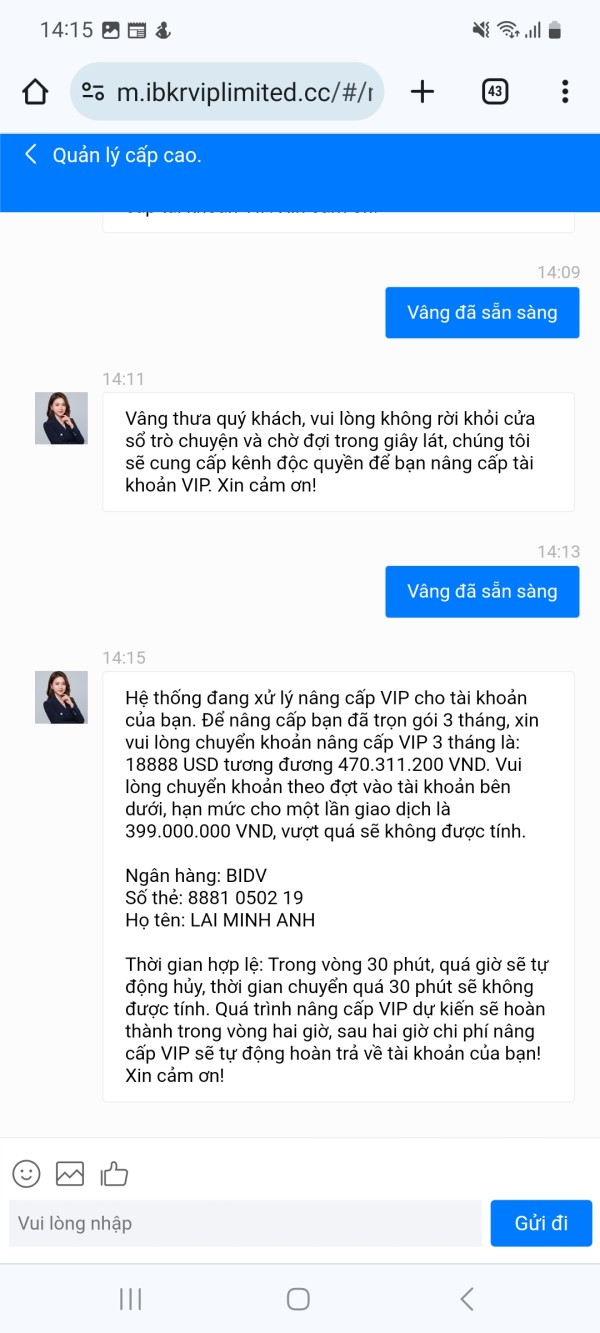

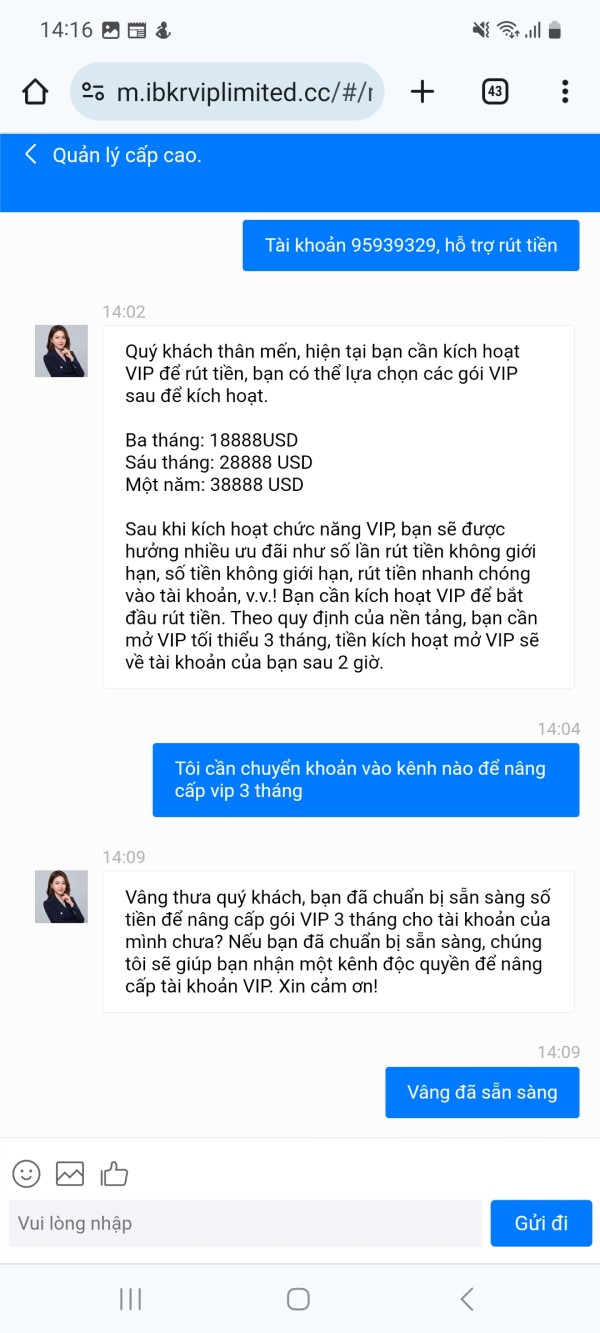

Thao3542

Vietnam

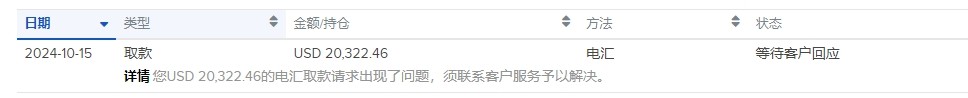

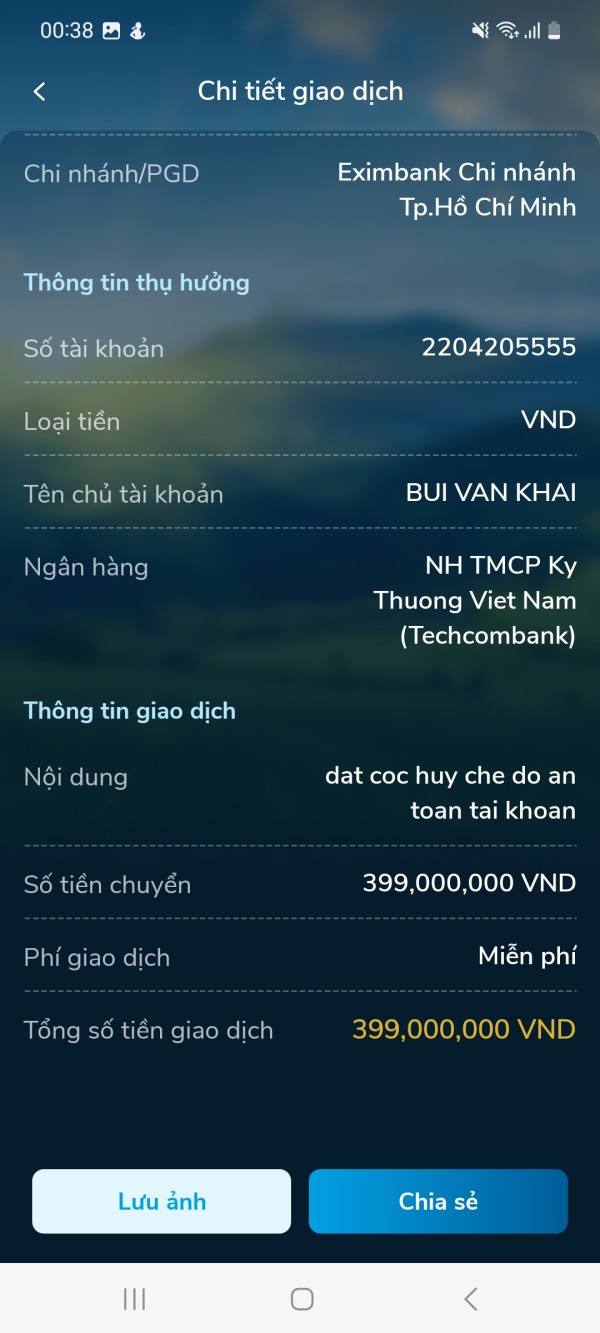

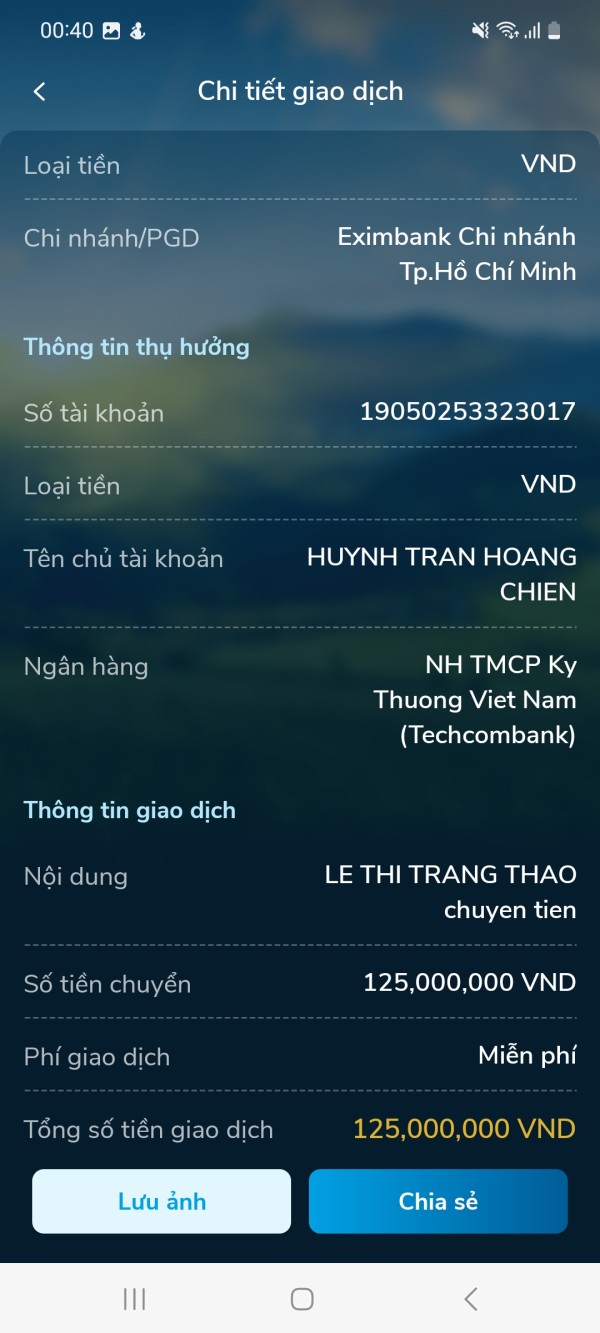

Fraudulent platform, intentionally not allowing withdrawals. Up to now, I have intentionally locked my account and not allowed me to access it. Currently, this floor has signs of fraud.

Exposure

04-05

Thao3542

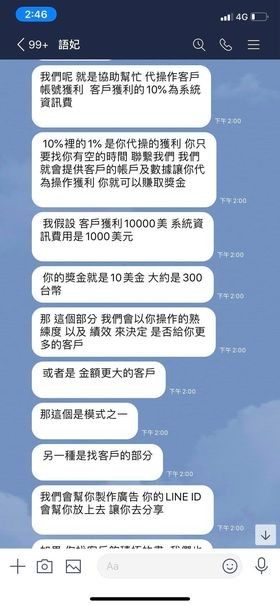

Vietnam

I requested to withdraw the deposited money but I couldn't because the floor required a 3-month VIP upgrade. I sent a message to the customer base asking how to withdraw money but was not informed about this issue.

Exposure

04-01

FX3453383040

Taiwan

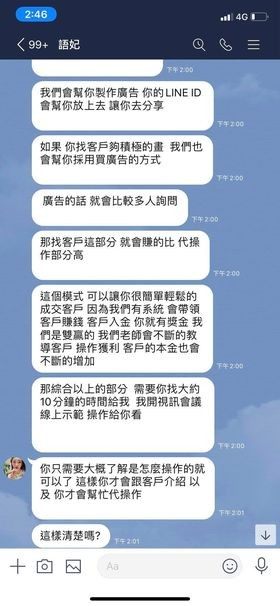

The money in the account can’t be withdrawn, even if it’s delayed, it’s still asked me to pay the different fees. I can’t get the money. It is ok, but I will not give you any penny, and I want to find other people to be victimized by myself. Serious fraud.

Exposure

2022-05-25

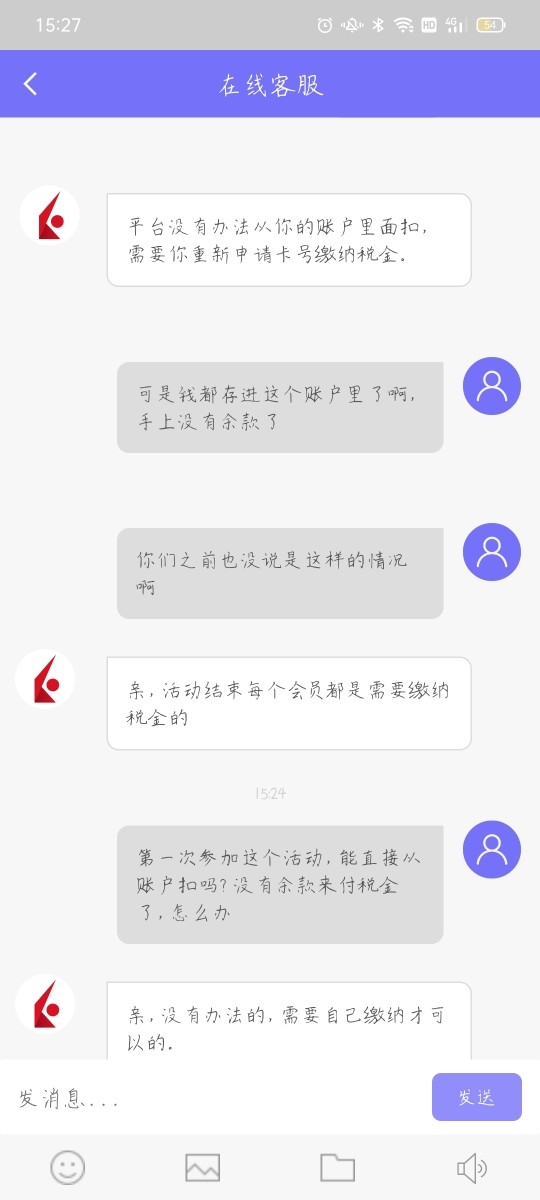

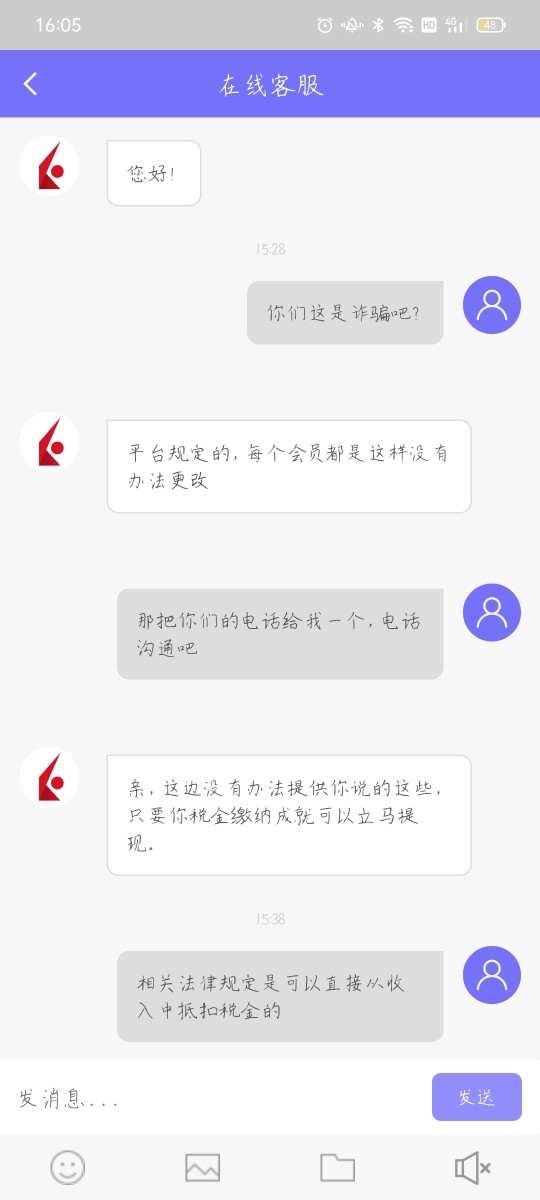

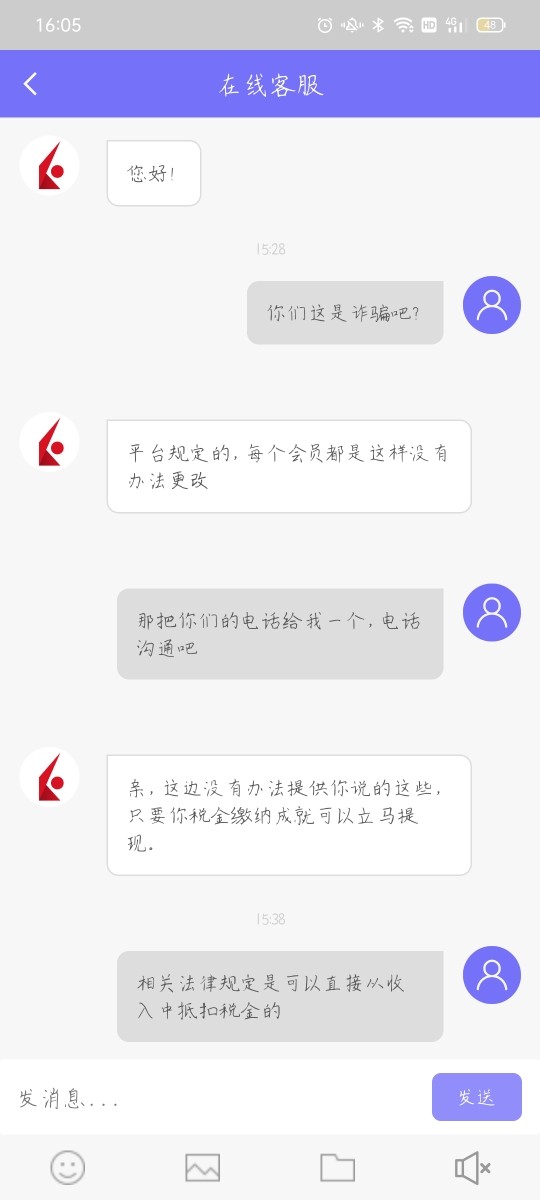

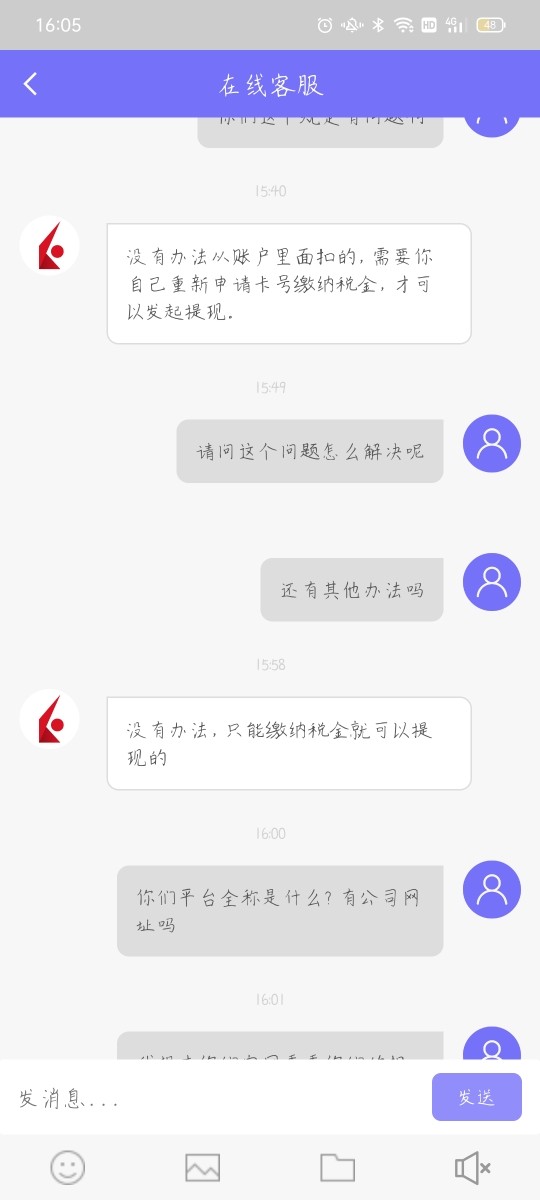

有玲♥浅笑

Hong Kong

This forex trading platform operates fake activities to induce customers to participate. After the customer makes profit, they say that they have to pay 20% of the tax and tax must be paid separately and cannot be deducted from the account. I already deposit all my money and there is no more left for paying tax. This regulation was not stated before activities. This is fraud.

Exposure

2021-11-22

FX5944873722

Malaysia

Stay away from it. They rejected my withdrawal of $7000 and ran away.

Exposure

2021-09-23

Rey

Philippines

I beg you all in the name of God, dont ever trade with Interative Brokers. They are worse than the devil… They wont give me my $7000, i worked hard to earn that amount trading almost 24hours, i asked for withdrawal, they begin stupid stories… They claim they are regulated by cysec… Amy Parker one of the top people in interactive option, was with iOption that went bankrupt before, she knows all about this crime they are committing… She ran with people’s money @ iOption… If you have money there, better take out your funds, they wont even give you. and if you know anyone that wants to deposit with this thief broker, advise them not to ever… Because you will be trading for this company and not yourself… you will make money and they wont give you. Devil is nicer than this company, thats how bad they are…

Exposure

2021-09-21

Mayaz Ahmad

Bangladesh

A client has complained about the very poor customer service of this broker and also claimed they do not allow transfer and steals people's money.

Exposure

2021-07-30

Mayaz Ahmad

Bangladesh

Many clients have complained about the poor customer service of this broker and so their queries remain unanswered by the broker.

Exposure

01-03

自然26950

Hong Kong

Unable to withdraw money, always fail to pass the review, contact them and ignore it

Exposure

2021-01-16

chương

Vietnam

The chart was manipulated. I wanted to make the withdrawal, while IB gave no access to it, suffering huge losses.

Exposure

2020-08-11

↑笔间字迹,续写,,,,

Hong Kong

The platform gives no access to withdrawal with excises including wrong bank information, inadequate credit score and even unpaid individual tax. I have paid all fees, but the withdrawal is still unavailable.

Exposure

2020-01-22

刚63227

Hong Kong

I’ve never encountered with such situation. I don’t know whether it is a scam.

Exposure

2020-01-03

大光

Hong Kong

The withdrawal hasn’t been received yet for 7 days.No one replies to the email.

Exposure

2019-11-16

Daniel324

United Kingdom

I appreciate the advanced trading tools and analytics that IBKR provides. They cater to both professional and retail investors, which I find beneficial. However, I must admit that the complexity of the platform can be overwhelming for beginners.

Neutral

09-05

Huikn

Belarus

After having some recent issues with the Company, they fully redeemed themselves and when it comes to the quality of the service they really are on top of their game. One thing that tis super annoying, however, is that their site keeps crashing. It's been happening for the past week now. For obvious reason, you don't want this to happen to your stocks. I hope they will address this and fix it soon.

Neutral

04-19

FX1161331972

Singapore

When I first set foot in the trading industry, I used Interactive Brokers as a platform. Big platform transactions are very formal. I did not lose money on this platform, but when I traded later, I found that the transaction fees on this platform were getting higher and higher, and the quality of customer service was not very good, so I switched to other platforms.

Neutral

2022-12-15

mama9831

United States

very smooth and easy to trade in it.

Neutral

2022-12-09

掌门

Hong Kong

Terrible experience, I made a profit of $1000 on my forex trading, and when I want to withdraw my funds. This platform always delayed my withdrawal requests. I suggest investors not choose this broker, anyway. You will never get what you want.

Neutral

2022-11-16

Miguel Pinesela

Hong Kong

I want to try!! Can someone tell me more details about withdrawal process?

Neutral

2022-11-15