Score

Monfex

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://www.monfex.com/

Website

Rating Index

Influence

Influence

D

Influence index NO.1

Indonesia 2.62

Indonesia 2.62Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomUsers who viewed Monfex also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FBS

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MiTRADE

- 10-15 years |

- Regulated in Australia |

- Market Making(MM)

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

monfex.com

Server Location

United States

Website Domain Name

monfex.com

Server IP

172.67.73.86

Company Summary

| Monfex Review Summary in 6 Points | |

| Regulation | Unregulated |

| Market Instruments | Crypto, Forex, Stocks, Commodities, Indices |

| Leverage | Up to 1:400 |

| Trading Platforms | Proprietary platform |

| Minimum Deposit | USD250 |

| Customer Support | Email, contact us form |

What is Monfex?

Monfex is a brokerage firm that offers more than 200 financial instruments to its clients including cryptocurrencies, forex, stocks, commodities, and indices. However, it's important to note that Monfex currently operates without valid regulation from any recognized financial bodies which should be treated as a warning sign to traders.

In the upcoming article, we will comprehensively analyze this broker's attributes from various angles, delivering clear and well-organized information. If you find this topic intriguing, we encourage you to continue reading. At the conclusion of the article, we will provide a concise summary to offer you a quick grasp of the broker's key features.

Pros & Cons

| Pros | Cons |

| • No deposit fees | • Unregulated |

| • No commissions | • Limited customer support channels |

| • Does not accept clients from the USA | |

| • No MT4/5 trading platform | |

| • Withdrawal fees charged |

Pros:

No Deposit Fees: You won't incur any charges when adding funds to your account when trading with Monfex.

No Commissions: Monfex doesn't charge commissions on trades, which can be beneficial for active traders.

Cons:

Unregulated: Since Monfex is unregulated, there's less oversight and recourse if you encounter issues.

Limited Customer Support: They only offer email and a contact form for assistance, lacking live chat or phone support which can be inconvenient for some users.

Does Not Accept Clients from Certain Countries: Monfex restricts access to users from the US or any jurisdiction where Monfex services are not offered. Be sure to check their eligibility requirements before attempting to sign up.

No MT4/5 Trading Platform: Popular platforms like MT4/MT5 are not available, so if you're familiar with those interfaces, you'll need to adapt to Monfex's web-based platform.

Withdrawal Fees Charged: While deposits are free, there are fees associated with withdrawing your money. Be sure to check with Monfex directly to understand their withdrawal fee structure.

Is Monfex Legit or a Scam?

When considering the safety of a brokerage like Monfex or any other platform, it's important to conduct thorough research and consider various factors.

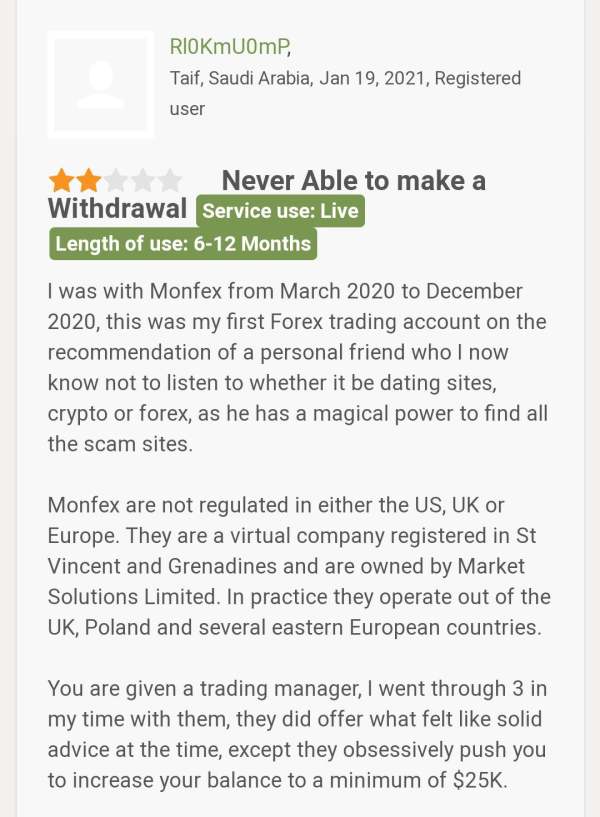

Regulatory sight: The absence of valid regulations under which the broker operates signifies potential risks, as it lacks the guarantee of comprehensive protection for traders engaging on its platform.

User feedback: There are three reports regarding withdrawal issues on WikiFX which should be considered a notable red flag for Monfex , urging traders to be cautious and make investigations before considering any engagement with the broker.

Security measures: Monfex implements robust security measures, including Two-Factor Authentication (2FA) and cold storage, ensuring the safety of clients' assets. These measures bolster protection against unauthorized access and enhance the security of funds.

Ultimately, the choice to trade with Monfex is a personal decision. It is important to thoroughly assess the risks and benefits before arriving at a conclusion.

Market Instruments

Monfex presents an extensive range of trading instruments, each offering unique opportunities for market participation. Traders can access over 200 instruments, including:

Forex: Trade major currency pairs like Euro/USD, GBP/USD, as well as exotic pairs such as NZD/USD and AUD/USD.

Stocks: Engage in CFD trading on popular stocks like Apple, Amazon, Google, and Tesla, allowing for exposure to movements in leading companies' share prices.

Cryptocurrencies: Seize opportunities in the digital asset space with trading options for Bitcoin, Ethereum, Litecoin, Ripple, EOS, Monero, and more, capitalizing on the volatility of the cryptocurrency market.

Indices: Gain exposure to global stock market performance by trading CFDs on indices such as the Dow Jones, S&P 500, DAX, and FTSE, reflecting movements in major stock indices.

Commodities: Diversify portfolios with CFD trading on commodities like Gold, Silver, Oil, Natural Gas, and Palladium, enabling traders to capitalize on fluctuations in commodity prices.

Account

Monfex offers a live account option for those interested in real-time trading. To get started, you'll need to fund this account with a minimum deposit of $250 USD. This minimum deposit might not be the most attractive compared to other brokers who offer lower starting amounts. However, if you're comfortable with this initial investment, a live account allows you to participate in the markets and potentially earn returns on your trades.

How to Open an Account?

To open an account with Monfex, you have to follow below steps:

Visit the Monfex website, locate and click on the “Register” button on the right corner of the mainpage.

Fill in the necessary personal details required and choose to “Create Account”.

Complete any verification process for security purposes.

Once your account has been approved, you can set up your investment preferences and start trading.

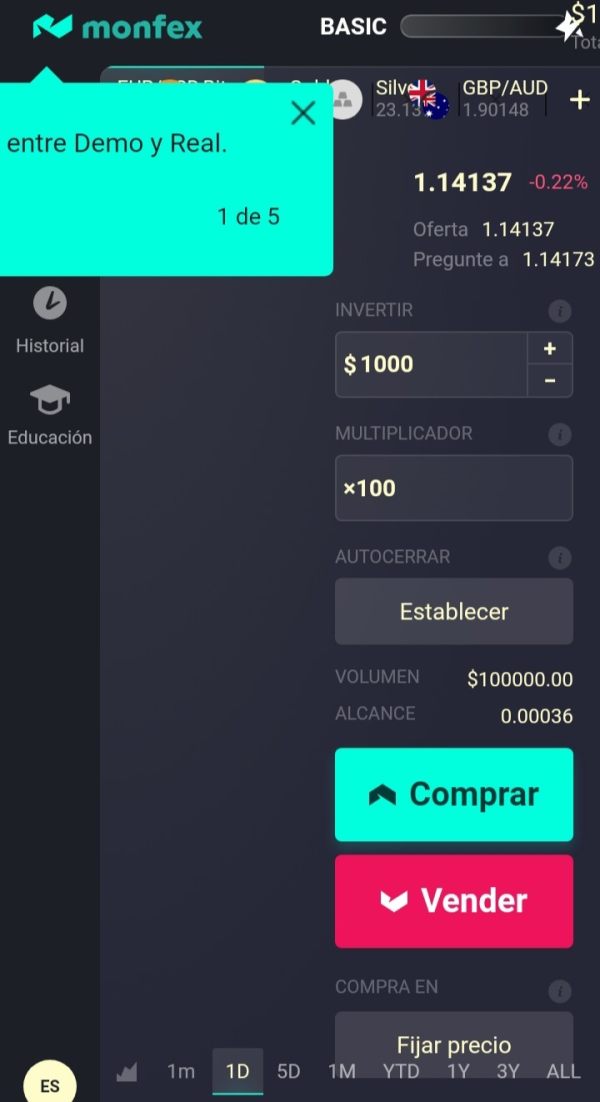

Leverage

Leverage plays a pivotal role in amplifying trading opportunities, and Monfex provides competitive leverage options across its diverse range of instruments.

With leverages of up to 200x for forex, 200x for stocks, 10x for cryptocurrencies, 100x for indices, and commodities, traders can maximize their capital efficiency and potentially magnify their returns.

Per its website, it also boast a maximum leverage of 400x among the 200 instruments.

However, it's essential for traders to fully understand the risks associated with leveraged trading, as increased leverage also heightens the potential for both profits and losses.

Spread & Commission

Monfex advertises 0% commission fees on their trading platform, which can be a significant advantage for active traders who frequently buy and sell securities.

However, they are less transparent about their spreads, which are the difference between the buy and sell price of an asset and represent a key cost of trading. While Monfex claims to offer low spreads, they don't disclose specific details on their website. If you're considering using Monfex, it's important to contact them directly to get a better understanding of their spreads for the specific assets you're interested in trading. Knowing the spreads will help you calculate your total trading costs and make informed decisions.

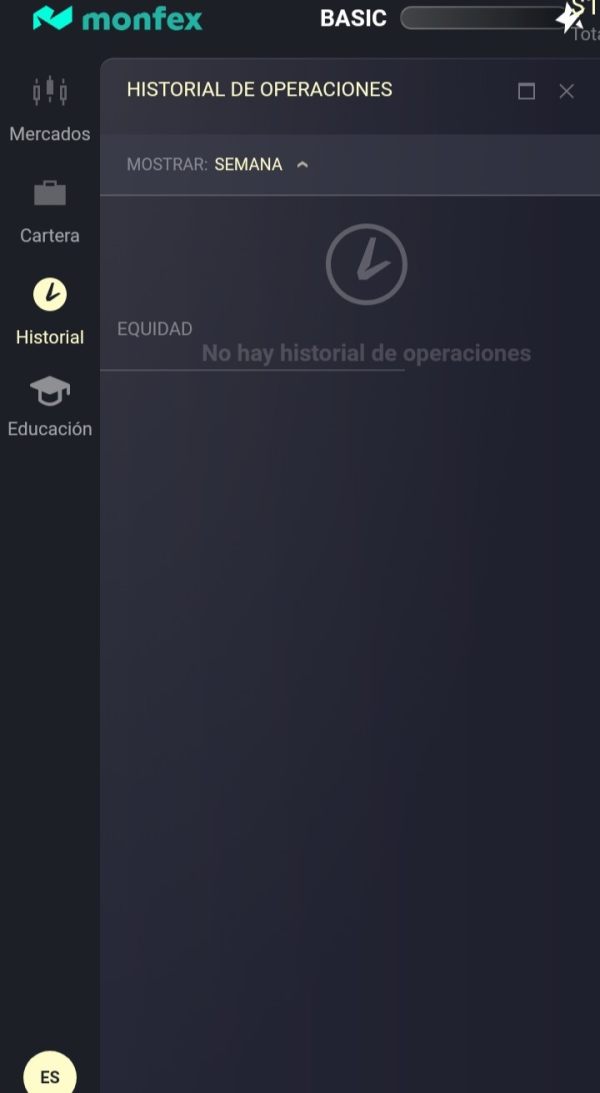

Trading Platforms

Monfex offers a web-based trading platform designed for both mobile and desktop users, accessible directly through their website. This eliminates the need to download any additional software. Instead, you can simply visit their website on your phone's web browser, as the platform is mobile responsive and adapt to your device's screen size. They also boast a user-friendly web platform for your computer.

Additionally, Monfex's undergoes daily maintenance downtime from 4:55 to 5:05 pm EST. During this window, you won't be able to enter or exit trades, but financing fees will still be charged or paid.

Deposit & Withdrawal

You can deposit funds using popular methods like Visa/Mastercard or wire transfer, and they don't charge any deposit fees. That's a plus if you want to get started quickly without any upfront costs. If you run into any issues funding your account, their support team can be reached at support@monfex.com.

However, it's important to be aware of withdrawal fees before you start trading. While Monfex boasts withdrawal processing within 48 hours, they do charge fees for taking your money out. The specific amount of these fees isn't disclosed on their website, so be sure to contact them directly to get a clear understanding of withdrawal costs before you commit to any trades. This way, you can factor those fees into your overall trading strategy.

User Exposure on WikiFX

The presence of three reports on WikiFX regarding issues with withdrawals should be regarded as a significant warning sign. We strongly advise all traders to conduct thorough investigations and meticulously analyze all available information before engaging in any actual trades.

Our platform is dedicated to serving as a comprehensive tool that assists traders in making well-informed decisions. If you have experienced financial fraud or encountered similar issues, we encourage you to share your experiences in our 'Exposure' section. Your contribution is highly valuable. Please rest assured that our dedicated team remains committed to addressing such challenges and continuously strives to offer effective solutions for complex situations

Customer Service

While Monfex offers a user-friendly platform, their customer support options are limited. If you encounter issues, you can only reach them via email (support@monfex.com; FinanceDepartment@monfex.com) or a contact us form on their website. There's no live chat or phone support available, you should take this into consideration if you care a lot about timely and responsive support.

Education

Monfex offers a range of educational resources to equip you for navigating the crypto trading world.

Their Trading Academy provides in-depth guidance on developing trading strategies and capitalizing on market opportunities.

If you're unfamiliar with crypto terminology, their Financial Dictionary acts as a glossary, deciphering key terms and definitions.

Additionally, the comprehensive Crypto Knowledgebase dives deep into blockchain technology and various cryptocurrencies, providing a strong foundation for informed trading decisions.

Finally, Monfex Tutorials walk you through the specifics of using their trading platform, ensuring you can navigate its features with ease.

Conclusion

Monfex provides a range of market instruments, including Crypto, Forex, Stocks, Commodities, and Indices. However, the absence of regulation from recognized authorities raises concerns for investors since regulation typically ensures financial oversight, safeguarding clients from malpractices. Therefore, individuals contemplating Monfex should be cautious and explore alternative, regulated brokers who prioritizes transparency, security, and client protection.

Frequently Asked Questions (FAQs)

| Q 1: | Is Monfex regulated? |

| A 1: | No. It has been verified that this broker is currently under no valid regulation. |

| Q 2: | Does Monfex offer demo account? |

| A 2: | No. |

| Q 3: | Is Monfex a good broker for beginners? |

| A3: | No. It is not a good choice for beginners because it is unregulated by any recognized financial authorities. |

| Q 4: | Does Monfex offer the industry leading MT4 & MT5? |

| A 4: | No. |

| Q 5: | Whats the minimum deposit does Monfex request? |

| A 5: | Monfex requires a minimum deposit of USD250. |

| Q 6: | On Monfex, are there any regional restrictions for traders? |

| A 6: | Yes, Monfex does not provide services to residents of the United States or any jurisdiction where Monfex services are not offered. |

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

News

News Scam Alert: Stay Away from Unlicensed FX Broker Monfex

Successful forex trading begins with selecting a trustworthy broker.

2022-12-29 17:28

News Avoid Signing Up This Unlicensed FX Broker Monfex

Choosing a reliable broker is the first step toward successful forex trading. Finding a reputable broker is tough enough, but the growing number of brokers makes things much more complicated. This article outlines how scam brokers, such as "Monfex," fool customers with bogus information, attract them into profitable agreements, steal their money, and then flee.

2022-09-22 13:59

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

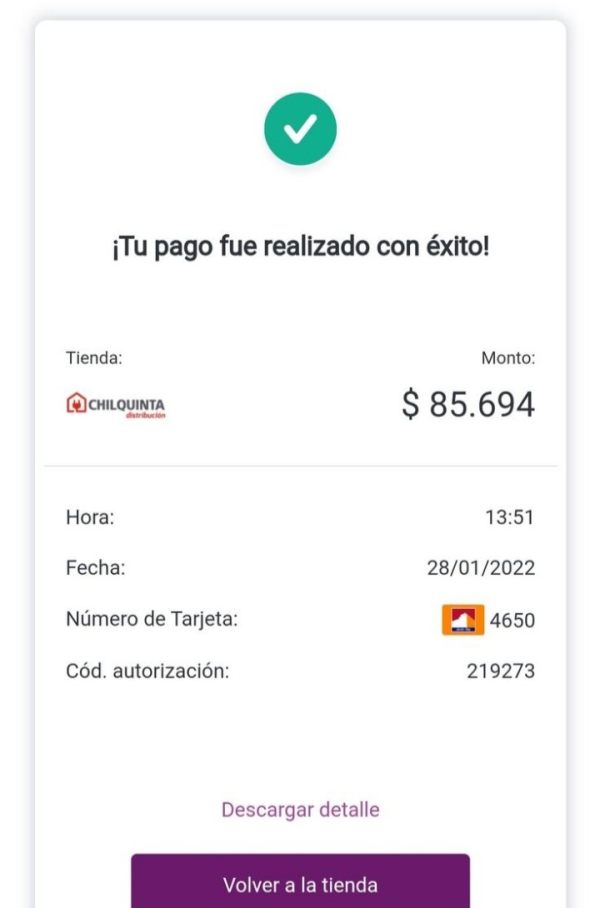

FX2592829574

Venezuela

My investment of $85,694 that I made has been lost, because they tell me that unfortunately everything has been lost and that it is not their fault, so they will not return my money. Please, I demand a solution and also report them.

Exposure

2022-02-09

Mayaz Ahmad

Bangladesh

A client has complained about his terrible experience while trading with Monfex that he ha d a really hard time in withdrawing his deposits as it took months and lots of hassles. He claims Monfex works fine until a client wants to withdraw.

Exposure

2021-06-30

FX3893157152

Colombia

I wanna sue Monfex. They tried to pursuade me to invest $20,000 here. And if I wanna withdraw my money, I should deposit another $20,000. But in the end, I lost all. They are thieves. And they semm to disappear now

Exposure

2021-06-17

TLC腾乐资本

Egypt

When I traded with Monfex, they would ask me to pay additional withdrawal fees, basically 20% to 30%. Customer support staff’s altitude is so rude, and finally I made a concession.

Neutral

2023-03-02