简体中文

繁體中文

English

Pусский

日本語

ภาษาไทย

Tiếng Việt

Bahasa Indonesia

Español

हिन्दी

Filippiiniläinen

Français

Deutsch

Português

Türkçe

한국어

العربية

Avoid Signing Up This Unlicensed FX Broker Monfex

Abstract:Choosing a reliable broker is the first step toward successful forex trading. Finding a reputable broker is tough enough, but the growing number of brokers makes things much more complicated. This article outlines how scam brokers, such as "Monfex," fool customers with bogus information, attract them into profitable agreements, steal their money, and then flee.

A Brief Overview of Monfex

Monfex (https://www.monfex.com/) is an offshore broker that offers online trading in a variety of financial markets. The broker, which was founded in 2018, promises to provide over 200 trading assets. Forex, commodities, equities, indices, and cryptocurrency are among the markets it supports. Clients have access to a web-based trading interface that is also available on mobile devices. The instructional library of the broker, which includes blogs, drinks, and how-to instructions, is also included in the packages. Customers may contact the company's customer service via phone or email. However, the broker does not provide a live chat service.

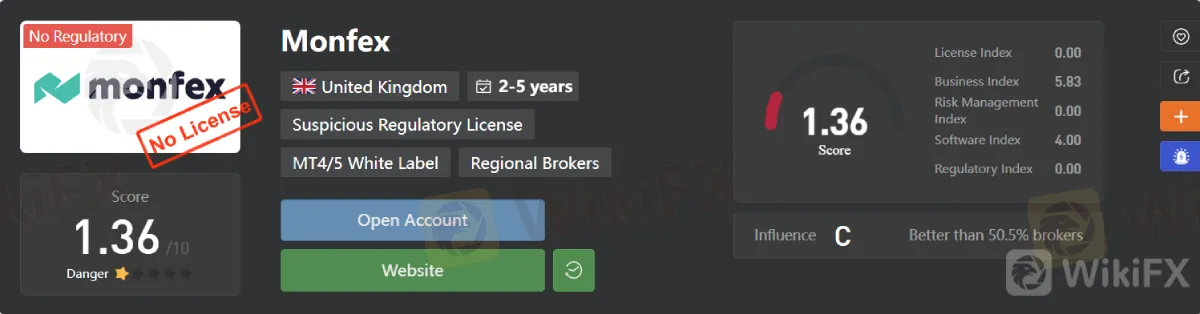

Is Monfex Regulated?

Nowhere in the world is the broker regulated.

It originally claimed to be a subsidiary of SWISS-SVG HOLDING LTD and to be subject to “regulations” issued by the Financial Services Authority of Saint Vincent and the Grenadines (SVG FSA). After being discovered by multiple independent reviews, the corporation seems to have deleted the material from its website.

Notably, the SVGFSA does not license forex traders or brokers, nor does it manage, monitor, oversee, or authorize foreign firms engaged in forex trading or brokerage. As a result, even if it had not removed the information concerning the SVG FSA, it was still an unregulated broker.

Client Feedback Received by WikiFX

Monfex, like many other scam brokers, has a bad reputation among its traders. Some of the company's concerns include fund withdrawal delays, slow transaction executions, slippage issues, and bad customer support.

View all complaints by following this link: https://www.wikifx.com/en/exposure/exposure/3626588079.html

What Makes Monfex a Scam?

Monfex looks to be a fraud for a variety of reasons.

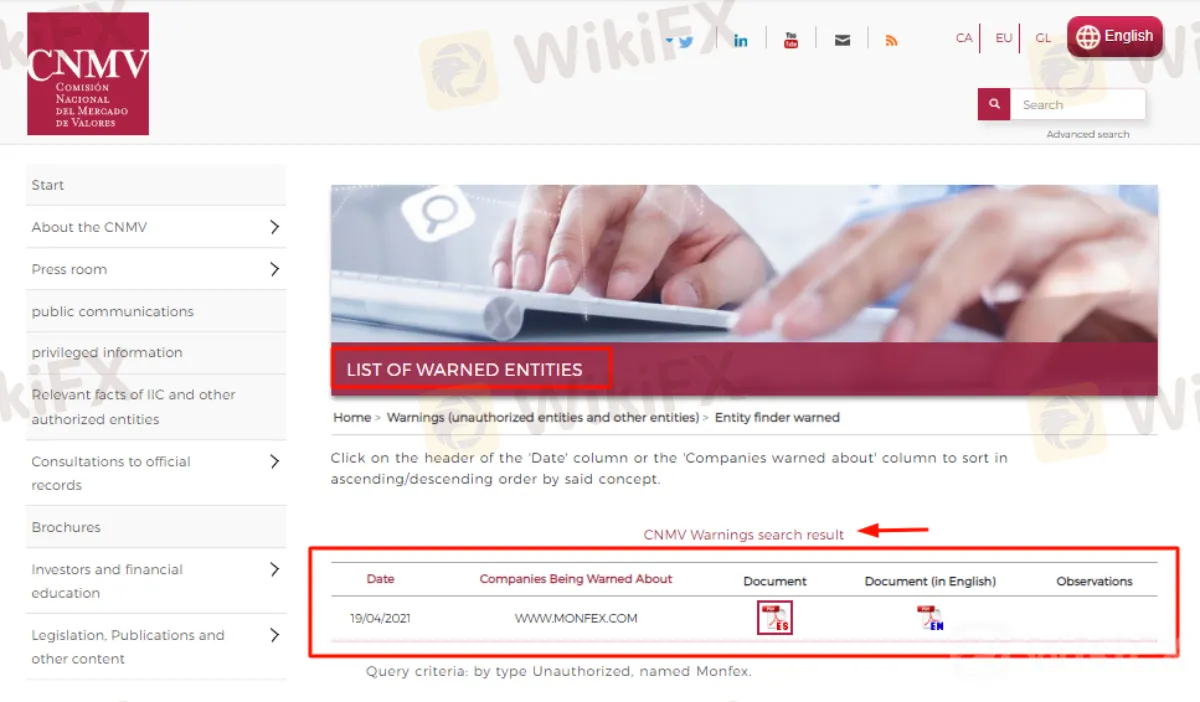

First and foremost, the Spanish National Securities Market Commission (CNMV) has informed the corporation about its improper activities in the nation.

Second, there is no access to any recognized third-party trading platforms, such as MetaTrader or cTrader, via the broker. Instead, it requires customers to utilize its custom-built online interface to access the markets, which entails some risk.

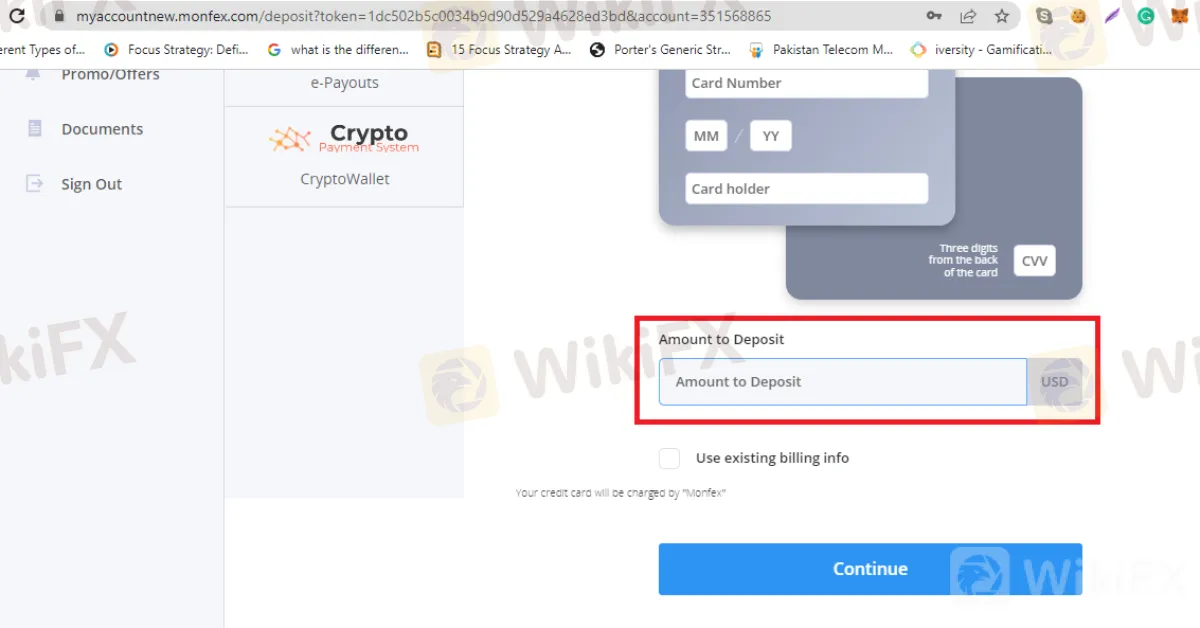

Third, the firm does not need you to provide KYC papers before depositing cash into your account. Legitimate brokers do not enable customers to use the site until they have submitted the necessary documentation and verified their accounts. That is not the case with Monfex. You may put as much money as you like into your account since the broker knows it will not refund a single cent.

Fourth, it is an uncontrolled entity with no fixed location. There is no information available about the company's physical address.

Finally, negative customer feedback reflects the company's inadequate code of behavior.

How does Monfex Scam Customers?

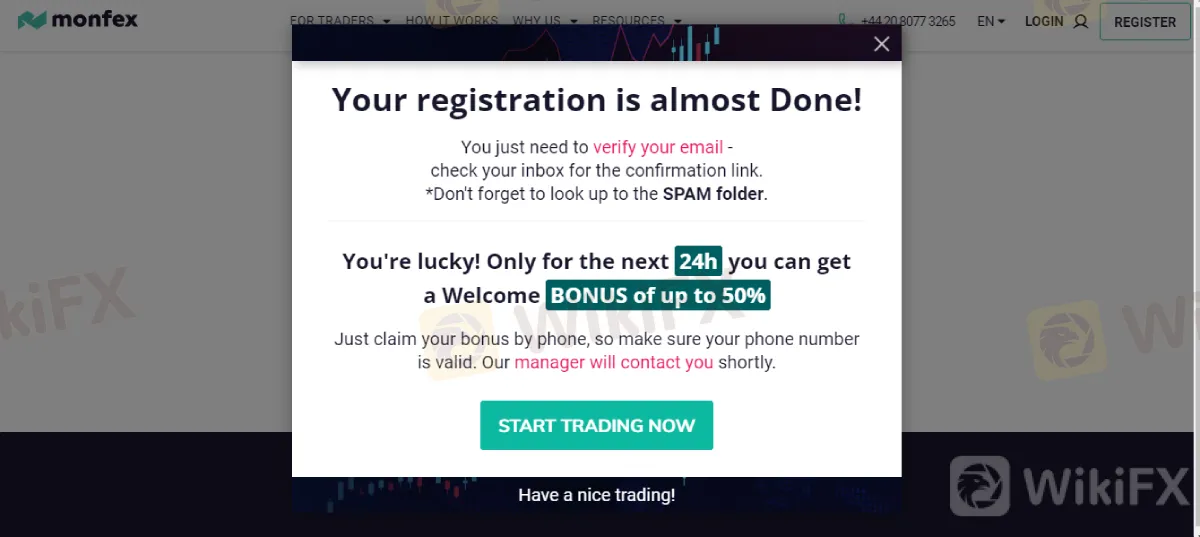

When you join up with the firm, a flash screen appears informing you that you are one of the lucky clients who may get a 50% bonus. Everyone who registers with the broker receives the same message.

The broker's marketing staff will then contact you through email or phone. A guy pretending to be your account manager approaches you and requests deposits. The fraudster pressures you to contribute a specified amount to obtain the bonus offer. However, once you've filled out your account, your money is gone forever since the fraudster never returns it to you.

About WikiFX

WikiFX is a platform for searching worldwide corporate financial information. Its primary duty is to give the included foreign exchange trading organizations with basic information searching, regulatory license seeking, the credit assessment, platform identification, and other services.

Over 39,000 brokers, both licensed and unregistered, are listed on the network. WikiFX's staff has been hard at work with 30 financial authorities from across the world to verify that the information supplied is factual and correct.

In conclusion

We've investigated a number of fraud companies, and we think Monfex is one of them. Despite being identified as a scam company several times and obtaining a warning from a regulator, it continues to operate. Perhaps the firm expects to capture more customers until authorities aggressively take down its domain. In any case, please be advised to avoid it.

Stay tuned for more broker news.

Download the WikiFX App from the App Store or Google Play Store.

Disclaimer:

The views in this article only represent the author's personal views, and do not constitute investment advice on this platform. This platform does not guarantee the accuracy, completeness and timeliness of the information in the article, and will not be liable for any loss caused by the use of or reliance on the information in the article.

Related broker

Read more

What would happen if Harris and Trump tie in the Electoral College?

As the 2024 U.S. presidential race approaches, investors worldwide are closely watching potential outcomes and their implications for global markets. While a 269-269 Electoral College tie between Vice President Kamala Harris and former President Donald Trump remains unlikely, its occurrence would set the stage for an unprecedented period of political uncertainty, triggering a contingent election decided by Congress. Such uncertainty would ripple across forex, stock, and oil markets, where stability and predictability are prized. Here’s a look at how a tie could affect these key financial sectors.

Social Media Investment Scam Wipes Out RM450k Savings

A former finance officer in Malaysia lost RM450,000 in savings after being deceived by an investment scheme advertised on social media.

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

A 50-year-old Malaysian woman experienced a devastating loss exceeding RM80,000 after falling victim to an online investment scam that preyed on her aspirations for substantial returns. The victim, a former secretary at a private firm, had initially hoped to secure a profitable investment opportunity but instead found herself deceived by a fraudulent scheme.

CMC Markets and ASB Bank Form Strategic Partnership

CMC Markets partners with ASB Bank to offer NZ clients advanced trading technology, access to global markets, and enhanced investment tools on ASB's digital platforms.

WikiFX Broker

Latest News

How Sentiment Analysis Powers Winning Forex Trades in 2024

Capital One Faces Potential CFPB Action Over Savings Account Disclosures

Malaysian Woman's RM80,000 Investment Dream Turns into a Nightmare

Social Media Investment Scam Wipes Out RM450k Savings

FP Markets Received Three Major Awards

Can Blockchain Technology Protect Your Money from Risk?

How can the forex fix be manipulated?

CMC Markets and ASB Bank Form Strategic Partnership

FX SmartBull Review! Read first, then Invest

Bangladesh steps up payments to Adani Power to avoid supply cut

Currency Calculator