Score

TMGM

Australia|10-15 years| Benchmark AA|

Australia|10-15 years| Benchmark AA|https://www.tmgm.com/

Website

Rating Index

Benchmark

Benchmark

AA

Average transaction speed (ms)

MT4/5

Full License

TradeMaxGlobal-Demo

Influence

A

Influence index NO.1

Australia 7.44

Australia 7.44Benchmark

Speed:A

Slippage:AAA

Cost:AA

Disconnected:AAA

Rollover:A

MT4/5 Identification

MT4/5 Identification

Full License

China

ChinaInfluence

Influence

A

Influence index NO.1

Australia 7.44

Australia 7.44Contact

Licenses

Licenses

Single Core

1G

40G

1M*ADSL

- The number of the complaints received by WikiFX have reached 17 for this broker in the past 3 months. Please be aware of the risk and the potential scam!

Basic information

Australia

AustraliaAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed TMGM also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Vantage

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Benchmark

Total Margin Trend

| VPS Region | User | Products | Closing time |

|---|---|---|---|

HoChiMinh HoChiMinh | 543*** | ETHUSD | 01-11 15:35:56 |

Hongkong Hongkong | 480*** | ETHUSD | 01-11 15:25:28 |

| 305*** | ETHUSD | 01-11 14:47:05 |

Stop Out

0.70%

Stop Out Symbol Distribution

6 months

Sources

Language

Mkt. Analysis

Creatives

Website

fxtmg.com

Server Location

United States

Website Domain Name

fxtmg.com

Server IP

104.21.82.184

tmgm10years.com

Server Location

Singapore

Website Domain Name

tmgm10years.com

Server IP

170.33.8.140

tmgmasia.com

Server Location

Singapore

Website Domain Name

tmgmasia.com

Server IP

170.33.8.140

Genealogy

VIP is not activated.

VIP is not activated.GCG

Fake TRADE MAX

Fake TradeMax

Company Summary

Let's Start Here:

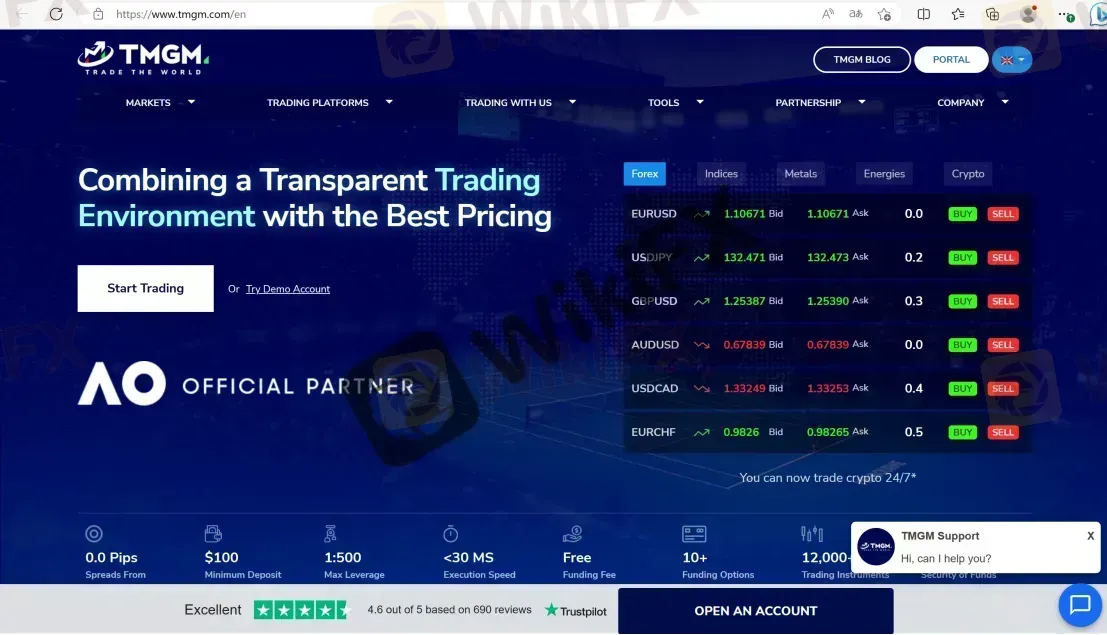

TMGM appears to a respected forex broker, presenting access to more than 12,000 spanning forex, CFDs, and cryptocurrencies. Traders can enjoy competitive spreads across various instruments, exemplified by the EUR/USD currency pair with an average spread of around 0.1 pips. Besides, TMGM extends a diverse set of trading platforms, notably including MetaTrader 4 and MetaTrader 5. Morever, TMGM enriches the trading journey with rich educational resources and trading tools. Lastly, 24/7 multilingual customer support stands ready. However, the question remains: Does TMGM truly live up to its claims? Let's explore more.

| TMGM Review Summary in 10 Points | |

| Founded | 2013 |

| Headquarters | Sydney, Australia |

| Regulation | ASIC, VFSC (Offshore) |

| Market Instruments | forex, indices, shares, futures, precious metals, energies and cryptocurrencies |

| Demo Account | Available |

| Leverage | 1:500 |

| EUR/USD Spread | 1.0 pips |

| Trading Platforms | MT4, MT5 |

| Minimum deposit | $100 |

| Customer Support | Live chat, phone, email |

TMGM Information

Founded in 2013 and headquartered in Sydney, Australia, TMGM is an online ECN/STP broker. Notably, in 2016, TMGM introduced its MetaTrader 5 platform. Subsequently, the company achieved FCA membership in the UK during 2017. The year 2019 witnessed the launch of TMGM's mobile trading app, further enhancing accessibility. By 2021, TMGM's reach expanded to encompass over 200 countries worldwide.

Offering a diverse array of more than 12,000 trading instruments spanning forex, commodities, cryptocurrencies, and stocks, TMGM caters to traders through popular platforms including MT4 and MT5.

Pros & Cons

| Pros | Cons |

| • ASIC regulation | • No US clients accepted |

| • Competitive spreads and low commissions | • Inactivity fees applied |

| • Over 12000 trading instruments | |

| • MT4 and MT5 platforms offered | |

| • 24/7 multilingual cutsomer support | |

| • Multiple account types with flexible options | |

| • Rich educational resources | |

| • High leverage up to 1:500 |

Is TMGM Legit?

TMGM, a regulated broker, holds authorization from the tier-one regulator ASIC and is also licensed by the New Zealand Financial Markets Authority (FMA). Additionally, TMGM's international operations are overseen by the VFSC in Vanuatu offshore. Now, let's quickly delve into TMGM's regulations and licenses, which will shed light on how the broker ensures compliance with industry standards and protects clients.

| Regulated Country | Regulated Authority | Regulated Entity | License Type | License Number |

| ASIC | TRADEMAX AUSTRALIA LIMITED | Market Making(MM) | 436416 |

| VFSC | Trademax Global Limited | Retail Forex License | 40356 |

Under the oversight of ASIC, a prominent tier-1 regulatory authority, TMGM's Australian branch known as TRADEMAX AUSTRALIA LIMITED operates with regulatory number 436416. This entity is licensed for Market Making (MM). As per the stringent rules set by ASIC, which is globally recognized, brokers must ensure the safety of clients' funds.

Since TMGM claims to obtain the ASIC license, an investigation team from WikiFX visited the company's registered address in Australia. This visit, conducted in person, revealed that the company is operating smoothly and on a large scale. This direct observation by the investigator enhances our confidence in TMGM's legitimacy and highlights its strong and credible operations under ASIC's regulation.

TMGM's international branch, Trademax Global Limited, operates under the regulation and authorization of VFSC offshore, holding a license for retail forex activities.

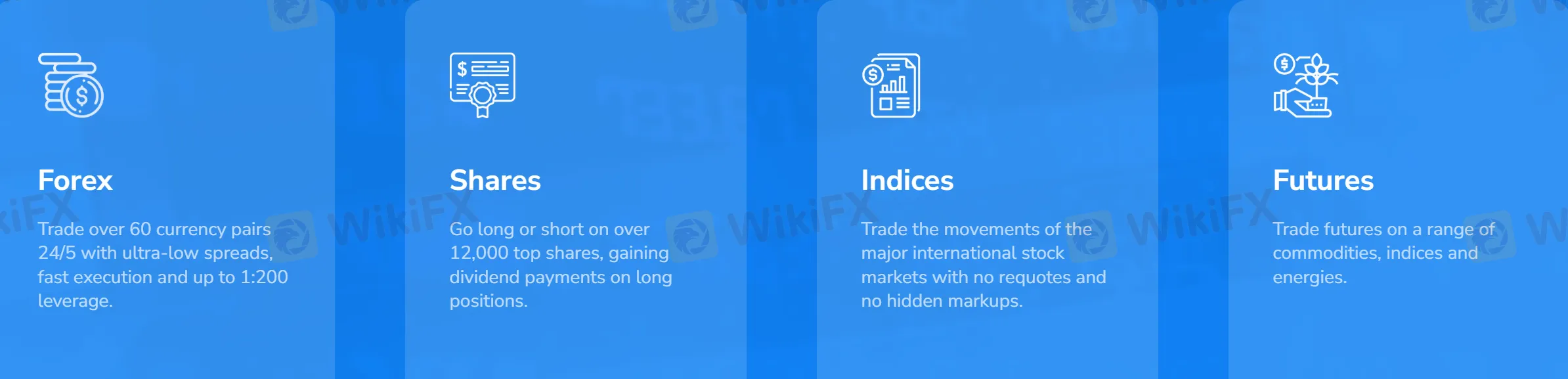

Market Instruments

TMGM goes above and beyond by offering an impressive collection of 12,000+ trading instruments, setting it apart as a broker with an exceptional range of options, covering 60 currency pairs, indices, and stocks sourced from major global exchanges. Moreover, TMGM extends its offerings to include futures, as well as sought-after precious metals like gold and silver. Adding to the mix are energies such as oil and natural gas, not to mention a selection of 10 cryptocurrencies like Bitcoin, Ethereum, and Litecoin.

| Trading Assets | Available |

| Forex | |

| Shares | |

| Energies | |

| Indices | |

| Precious Metals | |

| Cryptocurrencies | |

| Futures | |

| Indices CFD Dividend | |

| Shares CFD Dividend | |

| ETFS | |

| Stocks | |

| Options |

Account Types

TMGM tailors its account types to match the chosen trading platform. If you're using the MetaTrader 4 platform, they provide EDGE and CLASSIC accounts. Plus, for those who prefer Swap Free accounts or want to practice with demo accounts, TMGM offers those options as well.

MT4 Accounts: EDGE and CLASSIC

Both accounts require a minimum deposit of $100, quite reasonable for most regular traders to get started.

| Classic | Edge | |

| Min Deposit | $100 | $100 |

| Min Lot Size | 0.01 Lot | 0.01 Lot |

| Max Leverage | 1:500 | 1:500 |

| Funding | Free | Free |

| Execution Type | ECN | ECN |

| EA Available | ||

| Islamic Account | ||

| Hedging Allowed |

STANDARD, PREMIUM and GOLD Account types:

The minimum deposit requirement is $5,000 for STANDARD Account, $10,000 for PREMIUM Account, and $50,000 for GOLD Account. When it comes to fees, the Standard account entails a platform fee of $35 USD or $45 AUD per month. The Premium and Gold account holders, on the other hand, enjoy fee-free access to the platform. Additionally, all account types are subject to a data fee for each exchange they use.

| Standard | Premium | Gold | |

| Minimum Deposit | $5,000 | $10,000 | $50,000 |

| Platform Fee | $35 or A$45/per month | No Fee | No Fee |

| Data Fee | For Every Exchange | ||

| Min. Commission | $10 | Not mentioned | |

| Commission Rate (cps) | 2.25 | 7 | 1.8 |

| Minimum(Trade Size) | 333Shares | Not mentioned | |

| Financing | Libor+3.5%/-3.5% | Libor +3%/-3% | Libor +2.5%/-2.5% |

Swap-Free Account

TMGM also provides a Swap Free account for those who are unable to pay or receive interest owing to their religious convictions. To open a Swap-Free account, you'll need to have an Edge account, which requires a minimum of $100 and a minimum lot size of 0.01.

Demo Account

Demo trading accounts are available through TMGM for anyone interested in testing the waters before opening a real account. These accounts allow you to test out the broker's services before committing any real money. In addition, it provides a means of learning as much as possible about TMGM before you commit to an investment account.

The MetaTrader4 trading platform (which we'll come to in a moment) is available to demo accounts for an entire year. However, in the event of inactivity for six months, your access will be terminated. A $5,000, $10,000, or $50,000 virtual currency balance is available to you.

Leverage

TMGM offers quite a high trading leverage up to 1:500 on all account types. Forex products trading can use leverage of up to 1:500, indices and energy with leverage of 1:100, and precious metals featuring 400x leverage.

Here's a table comparing leverage provided by major industry players. Notably, TMGM offers relatively higher leverage, though it appears somewhat more cautious compared to the other three competitors. However, users should remember that high leverage is a two-edged tool with potential risks.

| Broker | TMGM | Exness | FXTM | IC Markets |

| Max. Leverage | 1:500 | 1:Unlimited | 1:2000 | 1:500 |

Spreads & Commissions

TMGM offers competitive spreads and commissions on their trading instruments. The exact spreads and commissions vary depending on the account type and trading platform used. The spreads on CLASSIC accounts start at 1.0 pips, with no commission charged, while the spreads on EDGE accounts start at 0.0 pips, and a commission of $7 (round turn) is charged per lot.

Generally, TMGM offers tight spreads on major forex pairs such as EUR/USD, with spreads as low as 0.0 pips. Commissions may be charged on some trading instruments, such as shares and futures. However, these commissions are generally competitive compared to other brokers in the industry.

Below is a comparison table about spreads and commissions charged by different brokers:

| Broker | EUR/USD Spread | Commission |

| TMGM | 0.0 pips | $7 per round turn |

| Pepperstone | 0.09 pips | $3.5 per lot |

| eToro | 1.0 pips | $0 |

| IG | 0.6 pips | $0 |

| Plus500 | 0.8 pips | $0 |

| XM | 0.9 pips | $0 |

Trading Platforms

TMGM offers popular trading platforms for their clients: MetaTrader4 (MT4) and MetaTrader5 (MT5).

| Available Devices | PC, Mac, Mobile (iOS and Android) |

| Language | English |

| Scalping | |

| Hedging | |

| Automated Trading | |

| One-click Execution | |

| Web-based Trading | |

| Mobile Trading | |

| MT5 | |

| cTrader | |

| Proprietary Platform |

MT4 is a popular and widely used platform that provides advanced charting tools, technical analysis indicators, and customizable trading robots. It also supports a variety of order types and execution modes, allowing for flexible and efficient trading.

Trading Tools

TMGM provides its traders with various trading tools to enhance their trading experience. These tools include:

- Trading Calendar: A calendar that shows the dates and times of upcoming economic events, including central bank meetings, interest rate decisions, and other important announcements.

- Market Sentiment Tool: A tool that allows traders to gauge market sentiment by analyzing the number of long and short positions held by other traders.

- ForexVPS: A virtual private server that allows traders to run their trading strategies 24/7 without the need for a personal computer.

- Trading Central: A research platform that provides traders with market analysis, trading ideas, and technical analysis tools to help them make informed trading decisions.

- Traders Terminology: Type the keyword or term that you are looking for or select the letters to see the list of words.

- Max-Calculator : The Max-Calculator is one of the best ways to help traders quickly evaluate the possible outcome of potential transactions or actions. In addition, this calculator will also help you calculate the margin easily.

| Educational Contents | Available |

| HUBx | |

| Trading Calendar | |

| Market Sentiment Tool | |

| ForexVPS | |

| Trading Central | |

| Traders Terminology | |

| Max-Calculator |

Deposits & Withdrawals

TMGM minimum deposit vs other brokers

| TMGM | Most other | |

| Minimum Deposit | $100 | $100 |

The minimum deposit and withdrawal amount is both $100. Depositing doesn't cost anything, but the time it takes and the currency options depend on your chosen payment method. Be aware, though, that some deposit methods like Union Pay, FasaPay, Visa, and MasterCard can't be used for withdrawals.

| Payment Options | Currencies | Min.Deposit | Min.Withdrawal | Fees | Processing Time ( Deposit) | Processing Time ( Withdrawal) |

| NZD, USD, AUD, EUR, CAD | $100 | $100 | $0 | 1-3 Working Day | 1 Working Day |

| USD | Instant | ||||

| NZD | Not mentioned | 1 Working Day | Not mentioned | ||

| USD | $100 | Instant | 1 Working Day | ||

| USD, EUR, GBP, AUD, NZD, CAD | 1 Working Day | ||||

| ||||||

| CNY | Not mentioned | Instant | Not mentioned | ||

| $100 | 1 Working Day | ||||

| USD | Not mentioned | Not mentioned | |||

| USD, EUR, GBP, AUD, NZD, CAD | 3 Working Days | ||||

| MYR, THB, IDR, VND | $100 | Instant | |||

| USD, EUR, GBP, AUD, NZD, CAD | Not mentioned | ||||

|

Other Fees

TMGM charges various fees, including spreads and commissions that we have mentioned before, as well as overnight financing fees. The specific fees vary depending on the type of account and trading platform used. TMGM does not charge any deposit or withdrawal fees, but clients may incur fees from their payment providers.

Additionally, TMGM charges an inactivity fee of $10 per month if there is no activity in the trading account for a period of six months or more. This fee will be deducted from the available balance of the account. However, if the available balance is less than $10, no inactivity fee will be charged. It is important to note that the inactivity fee is a common practice in the industry and is designed to encourage active trading and to offset the costs of maintaining inactive accounts.

See the fee comparison table below:

| Broker | Deposit Fee | Withdrawal Fee | Inactivity Fee |

| TMGM | Free | Free | $10/month after 6 months of inactivity |

| Pepperstone | Free for Australian Bank Transfer, $20 for International Transfer | $0 after 12 months of inactivity | |

| eToro | $5 | $10/month after 12 months of inactivity | |

| IG | $1 for AUD, CAD, and USD, £1 for GBP, €1 for EUR | $18/month after 24 months of inactivity | |

| Plus500 | $1.5-$10 depending on withdrawal method | $10/month after 3 months of inactivity | |

| XM | Free | $5/month after 90 days of inactivity |

Customer Support

TMGM offers customer support through multiple channels including live chat, phone, email, and social media (YouTube, Twitter, Facebook, Instagram and LinkedIn).

| Contact Channels | Details |

| +612 8036 8388 |

| support@tmgm.com |

| 24/7 |

| Sydney office, Melbourne Office, Adelaide Office, Canberra Office, Auckland Office |

| https://www.facebook.com/TMGMgroup |

| https://twitter.com/TMGMgroup |

| https://www.youtube.com/tmgmgroup |

| https://www.instagram.com/tmgmgroup/ |

| https://www.linkedin.com/company/tmgmgroup |

| https://api.whatsapp.com/send/?phone=61452597488&text&app_absent=0 |

You'll find an extensive and user-friendly FAQ section right on their website, covering a wide range of topics, from account setup to trading strategies, making it an invaluable tool for traders of all levels.

| Pros | Cons |

| • Multiple languages supported | • No dedicated account manager or personal service |

| • Quick response times to inquiries | • Limited availability on weekends and holidays |

| • Personalized service with tailored solutions |

Frequently Asked Questions (FAQs)

Is TMGM regulated?

Yes. It is regulated by ASIC, and VFSC (offshore).

At TMGM, are there any regional restrictions for traders?

Yes. Products and Services offered on their website are not intended for residents of the United States.

Does TMGM offer demo accounts?

Answer 3: Yes.

Does TMGM offer the industry-standard MT4 & MT5?

Yes. It supports MT4 and MT5.

What is the minimum deposit for TMGM?

The minimum initial deposit at TMGM to open an account is $100.

Keywords

- 10-15 years

- Regulated in Australia

- Regulated in Vanuatu

- Market Making(MM)

- Retail Forex License

- MT4 Full License

- MT5 Full License

- Global Business

- High potential risk

- Offshore Regulated

News

News TMGM – Featured Broker in WikiFX SkyLine Guide

WikiFX, as a leading global third-party information service platform, is dedicated to providing investors with the most reliable information services. To cater to the localized and personalized needs of investors in different regions, WikiFX has launched the SkyLine Guide, which first selected 25 outstanding brokers in Thailand. Additionally, WikiFX will release a series of related reports, with this article focusing on one of the featured brokers — TMGM.

2024-11-01 14:36

News TMGM Review 2024: A Complete Guide for Traders

TMGM Broker Review 2024: A comprehensive overview of TMGM's regulatory status, trading platforms, and customer support to guide traders in making informed decisions.

2024-10-03 16:16

News Don't Miss out!! TMGM Global Trading Contest

Attention all traders! Are you ready to test your skills and strategies? TMGM has announced its Global Trading Contest. The TMGM Global Trading Competition allows you to demonstrate your talent. You have an opportunity to win cash from a pool worth $468,600.

2024-09-30 17:45

Exposure ASIC Halts TMGM Retail Trader Onboarding for 21 Days

ASIC imposes a 21-day suspension on TMGM for inadequate checks in its retail trader onboarding process.

2024-05-23 17:54

Exposure Massive Complaints Against TMGM Revealed: Can You Still Trust TMGM?

For many years, TMGM has been considered a reputable broker that was welcomed by many traders. However, recently, we received a lot of complaints against this broker. The concern has been raised due to the reliability of this broker. We wonder if this broker is still trustworthy.

2023-12-08 19:31

Exposure Massive Complaints Against TMGM Revealed: Can You Still Trust TMGM?

For many years, TMGM has been considered a reputable broker that was welcomed by many traders. However, recently, we received a lot of complaints against this broker. The concern has been raised due to the reliability of this broker. We wonder if this broker is still trustworthy.

2023-12-07 18:29

Review 48

Content you want to comment

Please enter...

Review 48

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Grace5452

Singapore

The liquidated capital is 1000. There has been no reply since last week.

Exposure

2023-12-11

Grace5452

Singapore

Deposit 1,000 principal in your company. As a result, I couldn't close the position when I made a profit in trading. And my position was liquidated.

Exposure

2023-12-07

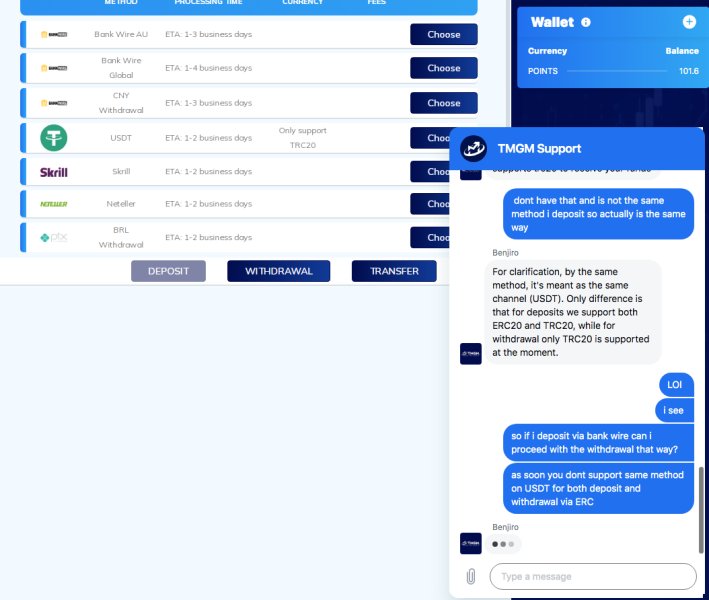

tinha

United Kingdom

TMGM they are scamers. refer you to deposit via methods that dont provide to withdrawal. not allowing withdrawal of your funds

Exposure

2023-10-13

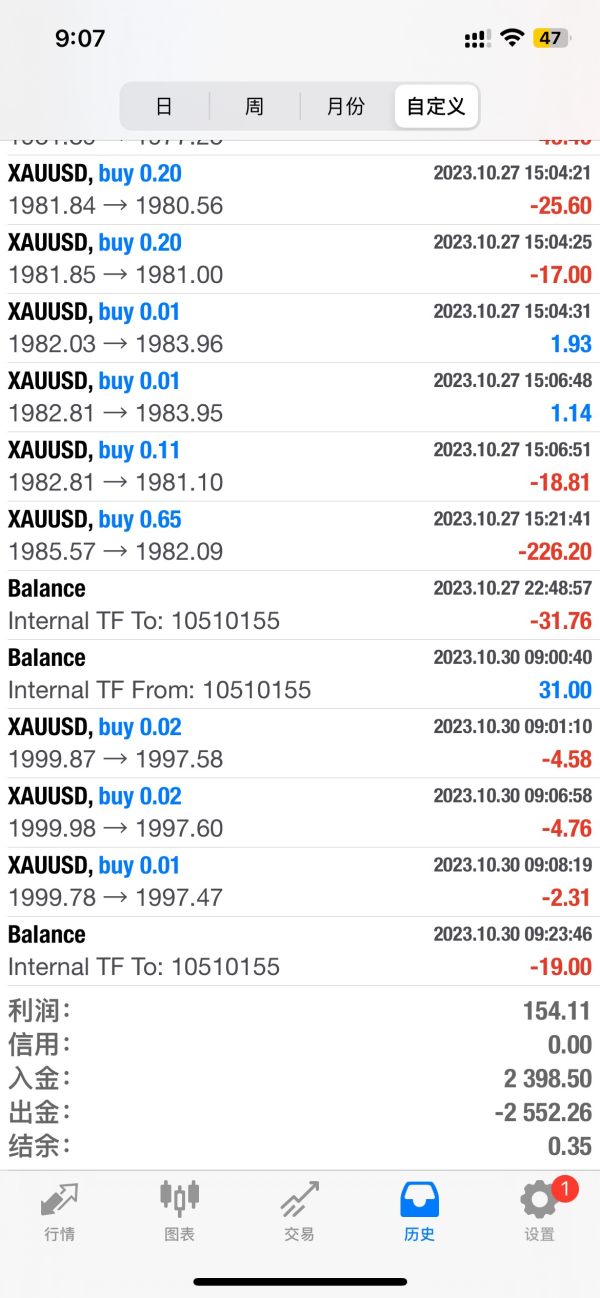

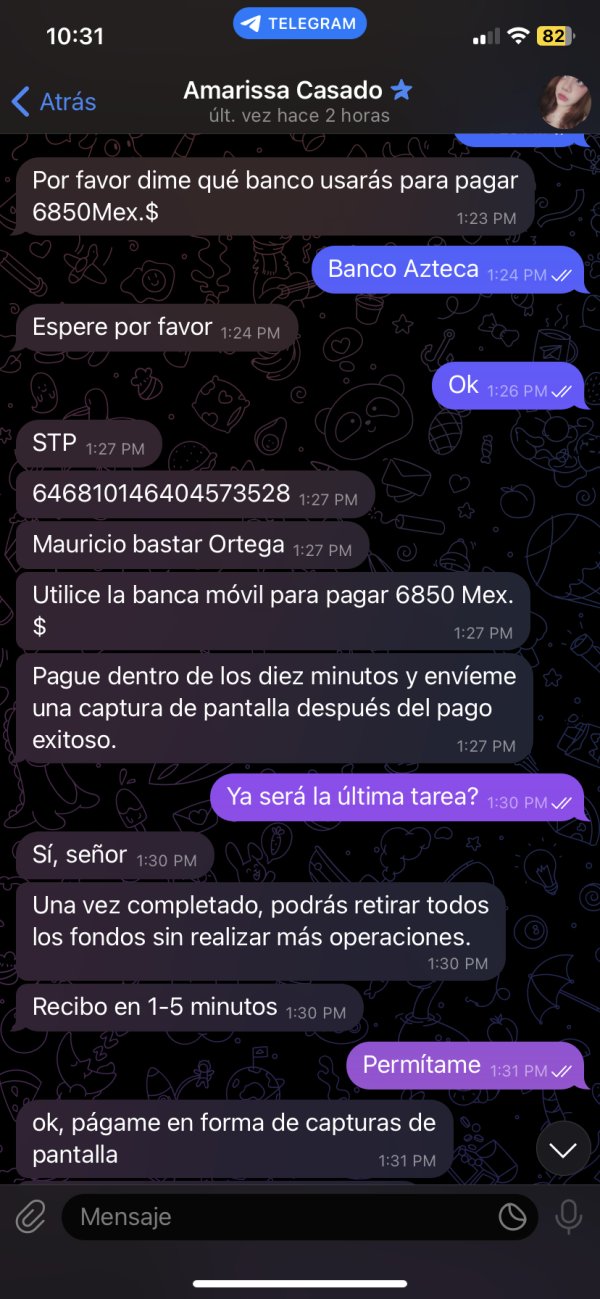

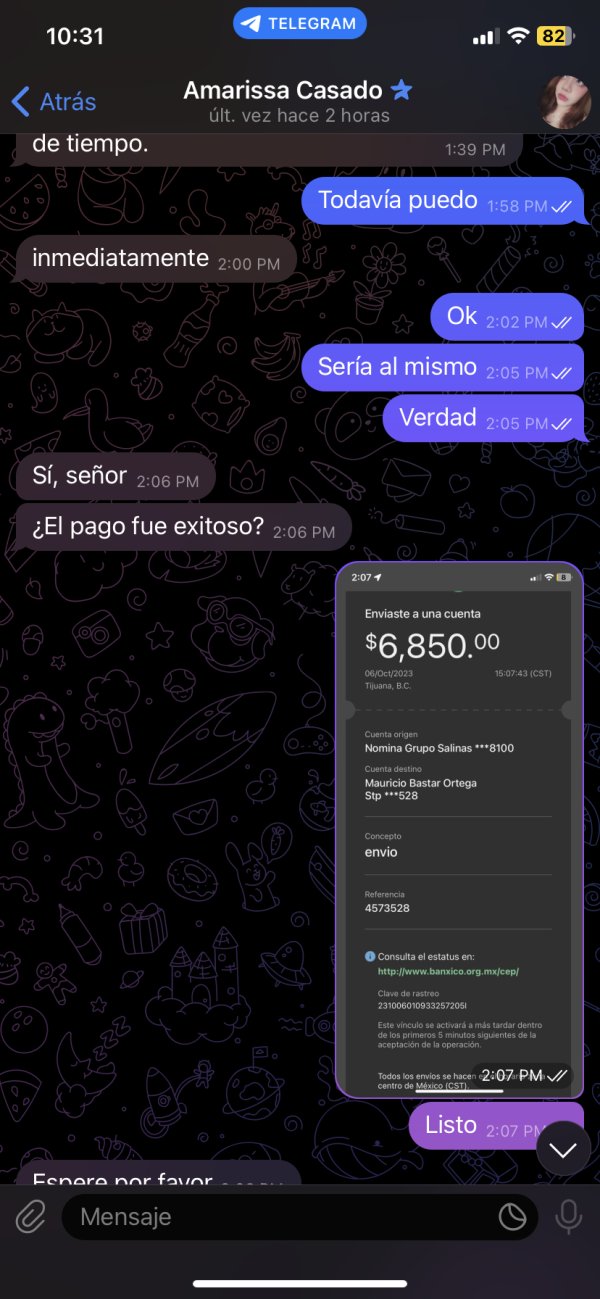

Miguel872

Mexico

I make a transfer 1️⃣: Choose 6850 investment amount 40% profit (commission 2740) 2️⃣: Choose 8640 investment amount 40% profit (commission 3456) 3️⃣: Choose 9760 investment amount 60% profit (commission 5856) AND I made the transfer of 6850 so that they would give me profits but they didn't give me anything. The account that I made the transfer to is 646810146404573528 And the name of the account holder is Mauricio Bastar Ortega Please help me

Exposure

2023-10-07

12580

United States

Tmgm You closed my account privately, slippage is serious, causing me liquidation, rogue behavior, give me back my money! Tmgm, you are an irregular platform! Don't cheat people again!

Exposure

2023-10-05

Domias

United States

People, TMGM is a scam exchange. To allow withdraw, you will need permission from someone who brought u there. I don’t even know if the trading is real, every feels wrong, call and put,?u got to select whether to go long or Short first . The morning I’m set eth withdraw.,lost it of course, left with 700, tried to make a withdrawals, it’s still stuck there , guess I’ll never see that again. Once your money is in there, it’s up to them whether to let u withdraw or not, we can’t withdraw at will, it’s a trap. Feel free to call the scammer to ask her about the the exchange, she will be more then helpful

Exposure

2023-08-26

12580

United States

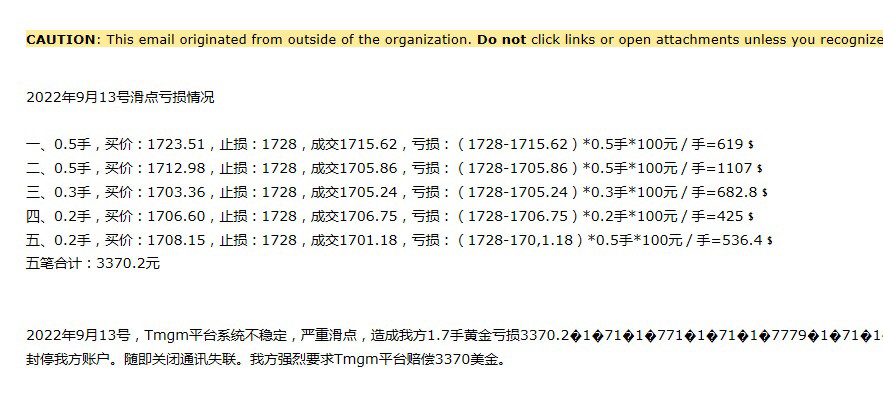

On September 13, 2022, the Tmgm platform system was unstable and had serious slippage, causing our 1.7 lots of gold to lose 3370.2[d83d][dcb2]. After the incident, it was reported to the platform account manager that the account manager had an arrogant attitude. At noon the next day, without our consent, my account was blocked at will, and the account balance of 614[d83d][dcb2] was not refunded. Immediately close the communication loss. We strongly request the Tmgm platform to compensate USD 3370 and refund USD 614, total: USD 3984. Slippage loss situation on September 13, 2022 1. 0.5 lot, bid price: 1723.51, stop loss: 1728, transaction 1715.62, loss: (1728-1715.62) * 0.5 lot * 100 yuan / lot = 619﹩ 2, 0.5 lot , bid price: 1712.98, stop loss: 1728, transaction 1705.86, loss: (1728-1705.86) * 0.5 lot * 100 yuan / lot = 1107﹩ 3. 0.3 lot, bid price: 1703.36, stop loss: 1728, transaction 1705.24, Loss: (1728-1705.24)*0.3 lots*100 yuan/lot=682.8﹩ Fourth, 0.2 lots, buying price: 1706.60, stop loss: 1728, transaction 1706.75, loss: (1728-1706.75)*0.2 lots*100 yuan/ Lot = 425﹩ 5. 0.2 lot, bid price: 1708.15, stop loss: 1728, transaction 1701.18, loss: (1728-170,1.18) * 0.5 lot * 100 yuan / lot = 536.4﹩ five strokes total: 3370.2

Exposure

2022-09-16

12580

United States

On September 13, 2022, the Tmgm platform system was unstable and had serious slippage, causing our 1.7 lots of gold to lose 3370.2[d83d][dcb2]. After the incident, it was reported to the platform account manager that the account manager had an arrogant attitude. At noon the next day, without our consent, my account was blocked at will, and the account balance of 614[d83d][dcb2] was not refunded. Immediately close the communication loss. We strongly request the Tmgm platform to compensate USD 3370 and refund USD 614, total: USD 3984.

Exposure

2022-09-16

12580

United States

The Tmgm platform is a fake platform. It is a gambling platform that cannot make a profit. It has a stop loss and still cannot close a position. The account manager explained that the market was very big yesterday. If the market is very big, the stop loss and profit may be broken. Excuse me, who is still playing on your platform, watching losses and liquidating their positions? This is not the first time that such a thing has happened, and the last time it was impossible to close the position, resulting in serious losses! Tmgm pay back my hard-earned money!

Exposure

2022-09-14

FX57947855

United States

This is fraud it took me a while to realize. Only this TMGM charges brokerage fees to investors in order to withdraw investment and profit. my profit in my trading account was denied withdrawal I invested a lot of money with this firm TMGM, but I haven't yet received any returns from my hard earned money.

Exposure

2022-08-14

FX3106486361

Canada

I blamed myself for a long time for not being more cautious but at first i was able to withdraw $200 and for this reason i was blinded to every other faults this broker had I didn't see how this was a gimmick till the fintrack/ org group made me realize i was being ripped off and put together a case got me my deposits from this broker, It will be wise to stay clear of this scam outfit that is TMGM.

Exposure

2022-08-05

NayLaHtun

Myanmar

withdrawal apply again &again bank wire fail, not receive sea method fail not receive thief ceo ,thief Broker thief account Manager

Exposure

2022-07-25

FX2725421751

Pakistan

Trading account 7131296 TMGM is fraud broker, they have cancel my trade 55.43. I're trade in NOVAVAX sell on 53.02. They were cancel my trade before 1 minutes closing of market. On that time price never goes higher from 53.30, but I amazed how can closed my trade on 55.43. I were multiple emails, chat support team is very non-professional behaviour, they always said we will investigate within 24~48 hours. This is clear scam , what type of investigation required the they did close my trade.

Exposure

2022-05-10

FX9990765162

Vietnam

The fraud tmgm platform doesn't process orders nor compensates customers who slip more than 100 pips but still says it's customer;s error and doesn't compensate. Stay away from tmgm platform

Exposure

2022-03-17

FX3465673907

Philippines

cannot withraw and keeps asking for too many fees. have paid 45k already

Exposure

2022-02-16

FX2642099491

Egypt

The fraud broker doesn't allow u to withdraw funds It only allows you to top up money, not withdraw coins, there are many requirements,

Exposure

2021-07-01

FX1690263401

Nigeria

l deposited $123 on pennywise wealth management. On August 18th they said we should pay sum of $50 for Account maintenance that they'll back by 29th of August but i was wondering why are they not yet back till now.[d83d][de13]

Exposure

2020-09-30

Dream天汇Fx天启

United States

Give you false account and you can’t transfer the money. Charge service fee when return to the bank. The account manager Alice said she would pay for the fee and transfer the money to me on 15th. However, she delayed to give me the fee and said she should be responsible for my fault. This is the way how they work. Attach the screenshot of our chat.

Exposure

2020-09-15

晕乎乎

Estonia

Frankly speaking, this platform is quite reliable to use.

Neutral

2024-12-03

Gavinn

Singapore

I was drawn to TMGM for its vast range of instruments and low spreads, particularly the appealing 0.1 pips on EUR/USD. The platform options like MetaTrader 4 seemed promising for diverse trading needs. However, the excitement dimmed with the realization of inactivity fees.

Neutral

2024-06-04