Score

CMS

Hong Kong|15-20 years|

Hong Kong|15-20 years| http://www.cmschina.com.hk/en/

Website

Rating Index

Influence

Influence

C

Influence index NO.1

Hong Kong 4.46

Hong Kong 4.46Surpassed 59.00% brokers

Contact

Licenses

Single Core

1G

40G

Contact number

+852 3189 6368

+44 (0) 207 423 4000

+82 02 6292 4031

Other ways of contact

Broker Information

More

China Merchants Securities Co., Ltd

CMS

Hong Kong

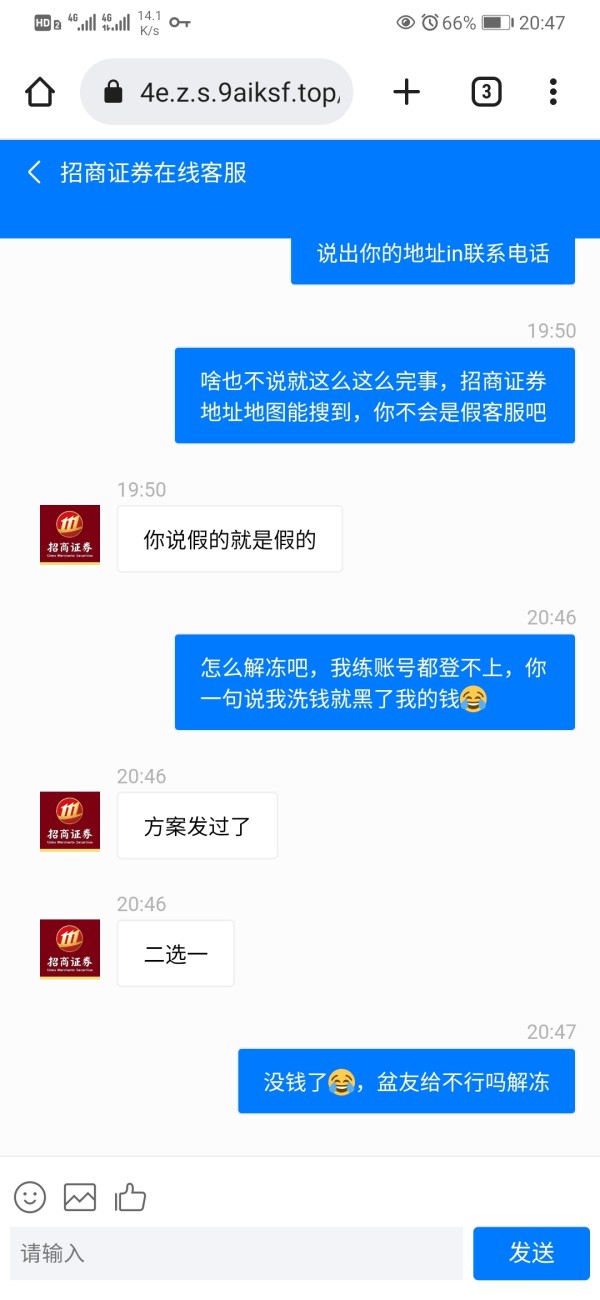

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

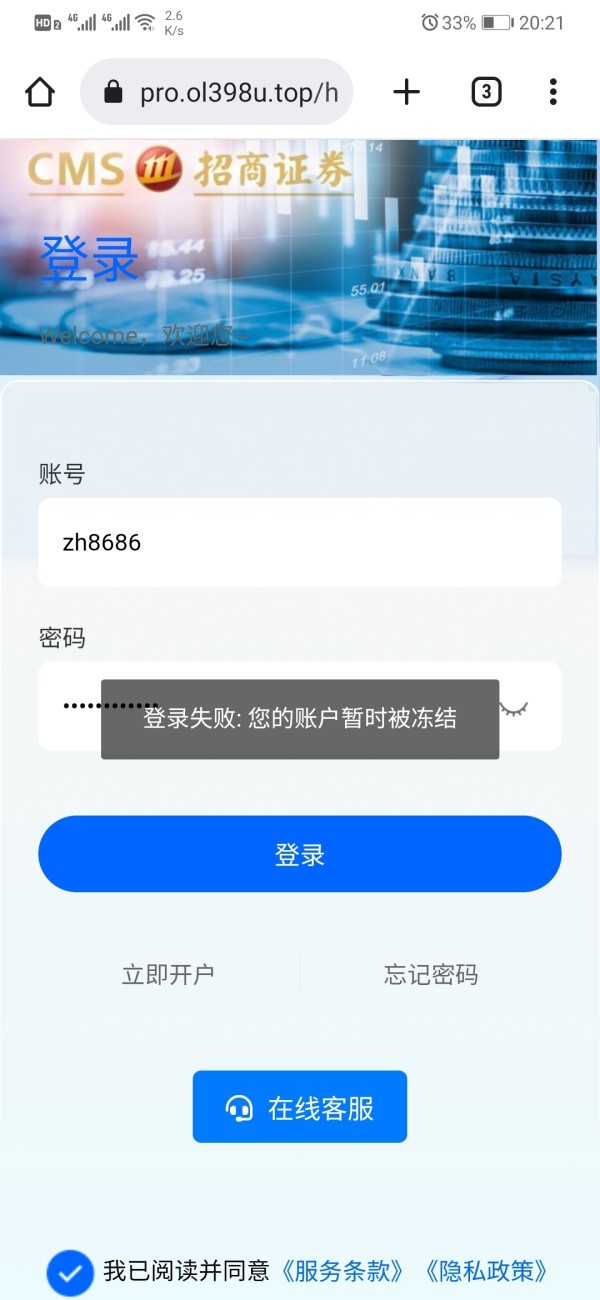

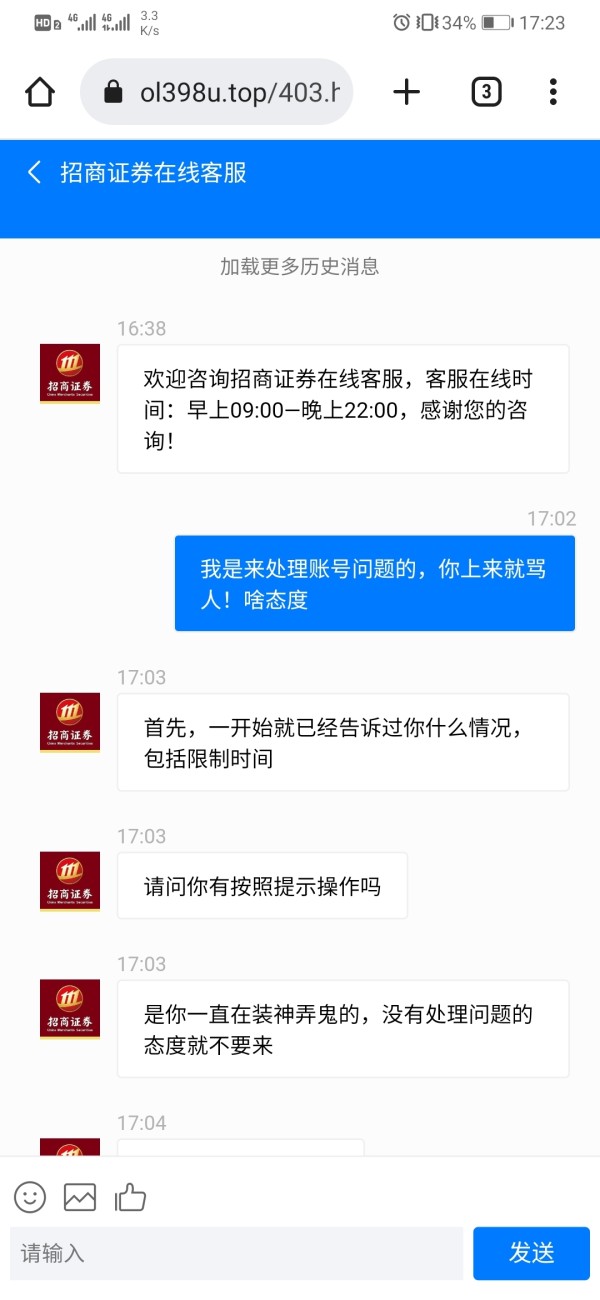

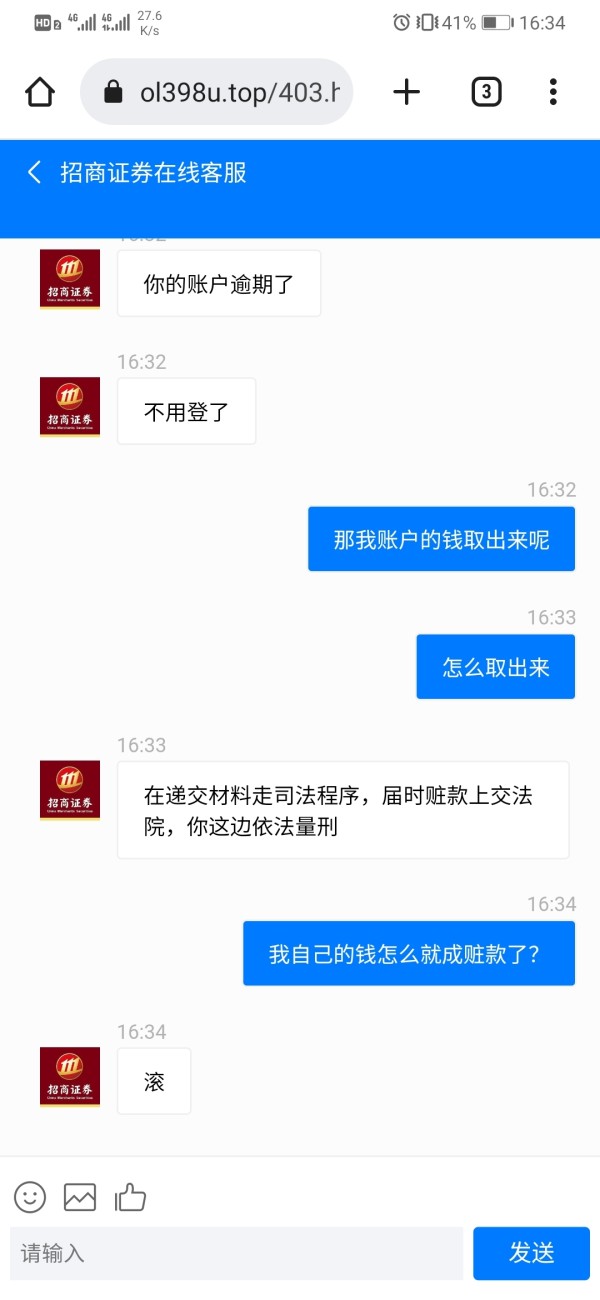

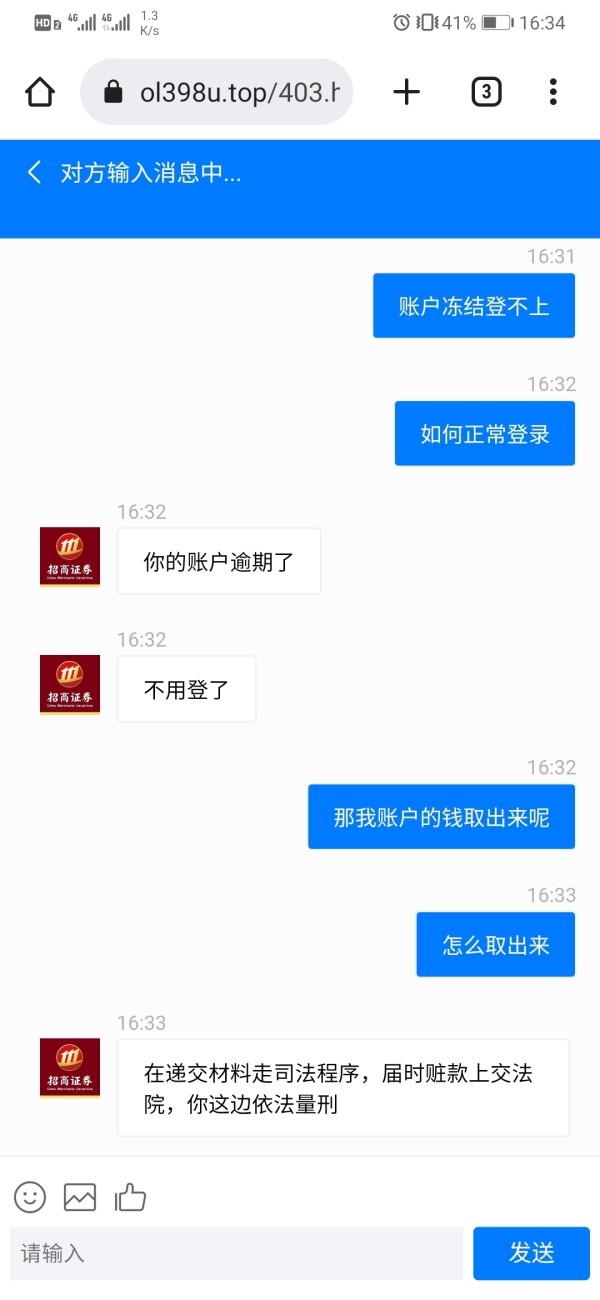

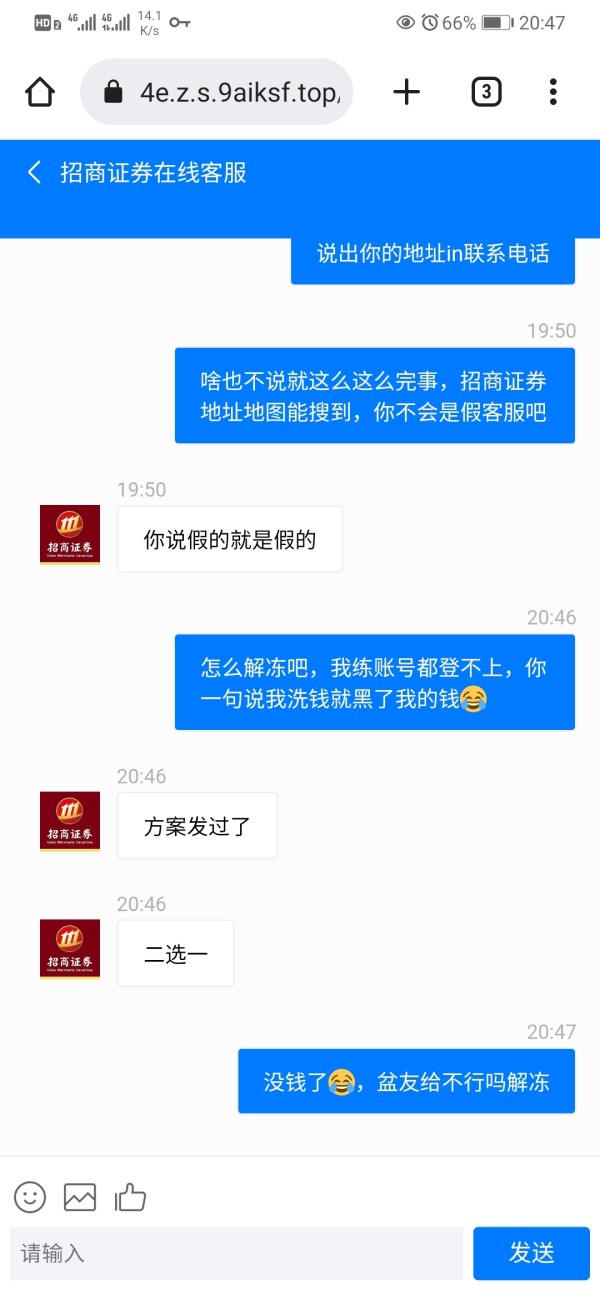

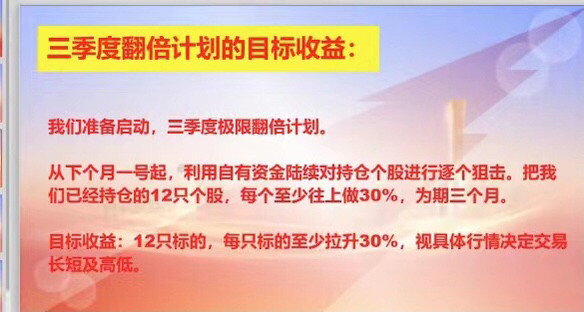

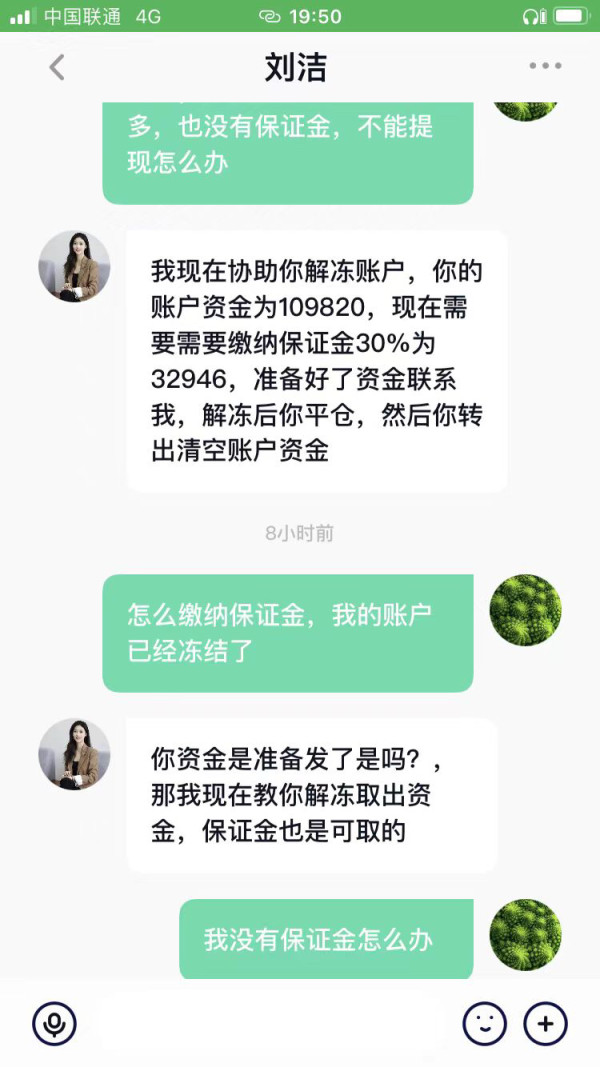

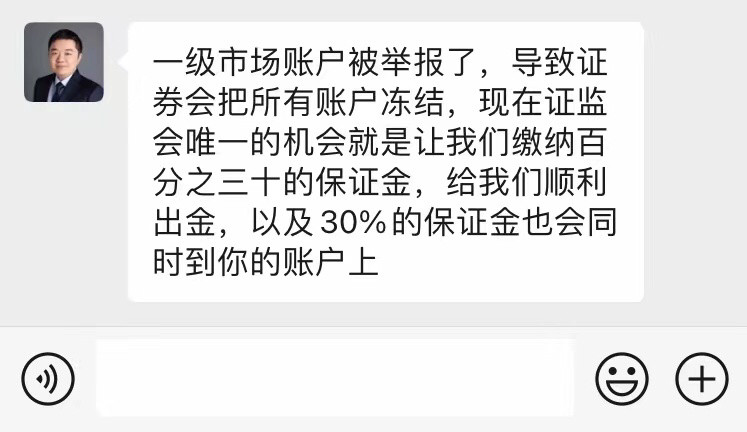

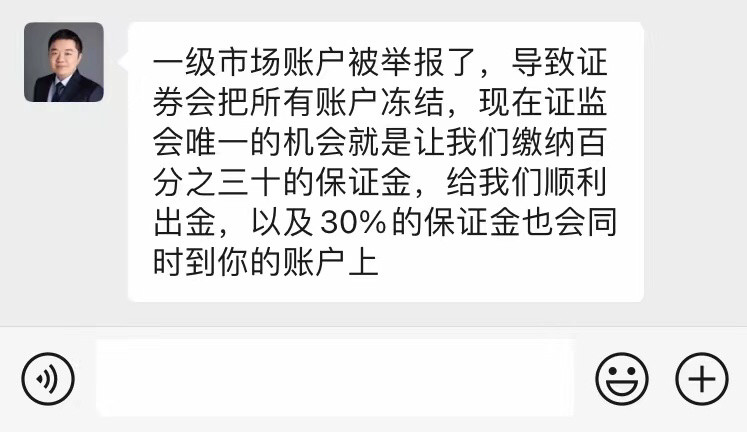

- The number of this brokers's negative field survey reviews has reached 1. Please be aware of the risk and the potential scam!

- This broker exceeds the business scope regulated by United Kingdom FCA(license number: 610534)Investment Advisory Licence Non-Forex License. Please be aware of the risk!

- The number of the complaints received by WikiFX have reached 4 for this broker in the past 3 months. Please be aware of the risk!

WikiFX Verification

Users who viewed CMS also viewed..

XM

Neex

FP Markets

AUS GLOBAL

Sources

Language

Mkt. Analysis

Creatives

CMS · Company Summary

| Aspect | Information |

| Registered Country | Hong Kong |

| Founded Year | 15-20 years |

| Company Name | China Merchants Securities Co., Ltd |

| Regulation | Regulated by the Securities and Futures Commission of Hong Kong |

| Minimum Deposit | Not specified |

| Maximum Leverage | Not specified |

| Spreads | Not specified |

| Trading Platforms | CMS HK App Platform 1.0, CQG Trader, CQG Web, SPTrader Pro HD |

| Tradable Assets | HK Equities, HK Futures, Bonds, Funds, ETFs, Overseas Equities, Stock Options, Global Commodities and Futures, Indices |

| Account Types | Securities Account, Futures Account |

| Demo Account | Not specified |

| Customer Support | Hong Kong Customer Service Hotline, Mainland China Toll-Free Numbers, Complaint Hotline, Trade by Phone services, Physical service centers in Hong Kong, International access points in London and Seoul |

| Payment Methods | Fund transfers, online banking, cheque deposits, same-day bank transfers, eDDA (Electronic Direct Debit Authorization) |

| Educational Tools | Technical Analysis Tools, Trading Calendar, Market Data Analysis |

Overview of CMS

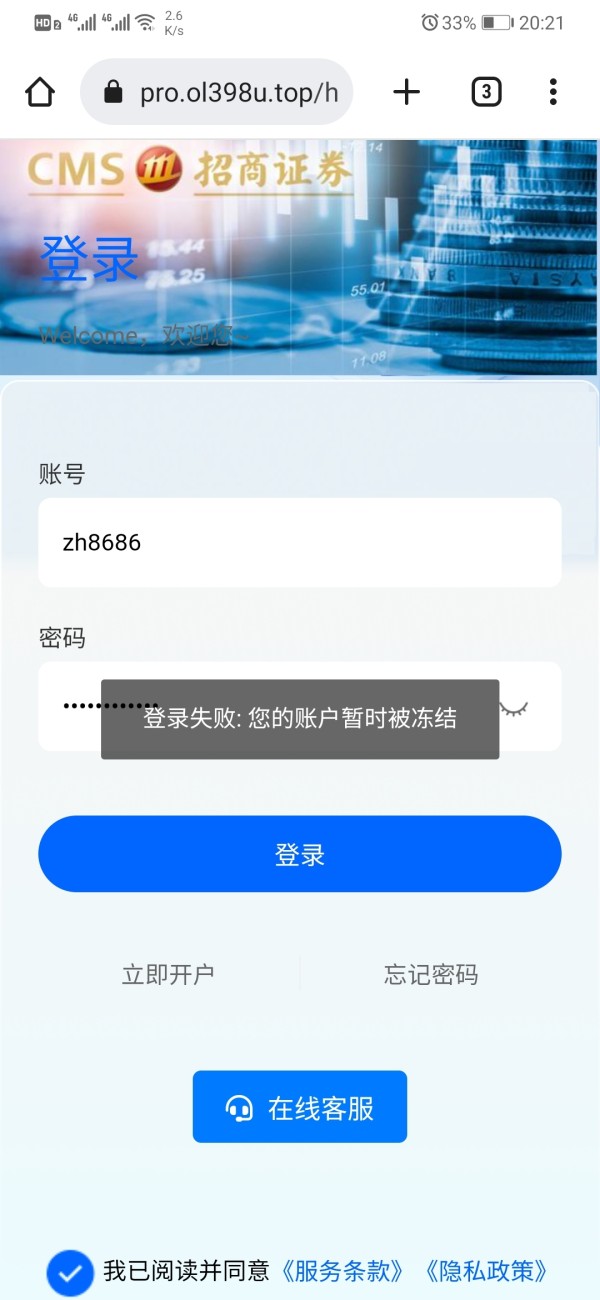

China Merchants Securities (HK) Co., Limited (CMS), a subsidiary of China Merchants Securities Co., Ltd, operates as a regulated entity under the Securities and Futures Commission of Hong Kong. Holding license number AAI650 since January 26, 2005, CMS is situated at Exchange Square Phase 1, Central, Hong Kong. While the company offers diverse investment services, including equities, futures, bonds, funds, and derivatives, there have been concerns raised regarding negative reviews and potential risks associated with its operations. Clients are advised to exercise caution and maintain awareness of regulatory and operational aspects.

CMS provides an array of market instruments for Hong Kong equities, encompassing stocks, IPO subscriptions, stock options, and bonds trading, facilitating a broad scope for investment opportunities. The company offers futures trading, including Hang Seng Index Futures and H-shares Index Futures, and provides access to overseas equities markets, allowing clients to diversify globally. Additionally, CMS extends its services to private equity investments, asset management, and global commodities trading, enhancing its offerings to cater to varied client needs.

The company offers multiple account types, such as Cash and Margin Accounts for securities trading and Futures Accounts for futures transactions. Its fee structure varies across services, with details like brokerage commissions, transaction levies, and trading fees for different trading categories. CMS also provides deposit and withdrawal methods, including electronic direct debit authorization (eDDA), streamlining fund management processes for clients. The trading platforms offered by CMS cater to stock and futures trading, emphasizing security through Two-Factor Authentication options. The company also offers technical analysis tools, trading calendars, and real-time market data analysis tools, aiding traders in making informed decisions. With comprehensive customer support channels and global access points, CMS addresses diverse geographical needs and provides assistance to clients in different regions.

Pros and Cons

China Merchants Securities (HK) Co., Limited (CMS) presents a range of advantages and challenges. On the positive side, the company operates under the regulation of Hong Kong's SFC, providing a sense of security. It offers diverse market instruments and overseas equities trading opportunities, along with comprehensive investment services and fund administration options. Additionally, CMS engages in private equity investment and equities research. On the flip side, some clients have voiced negative reviews and potential risks. While the company provides multiple account types and various trading platforms, there's limited information on trading platforms and educational tools. Furthermore, fees and commissions may be intricate, with varying structures in overseas markets. The availability of global commodities services is counterbalanced by limited cash deposit options, and while extensive customer support is provided, operational hours are restricted. Careful consideration of these pros and cons is essential for making informed decisions regarding CMS's services.

| Pros | Cons |

| Regulated by SFC | Negative reviews and potential risks |

| Diverse market instruments | Limited information on specific fees and commissions |

| Overseas equities trading | Limited positive feedback |

| Comprehensive investment services | Some clients may find fees high |

| Fund administration services | Varying fee structures in overseas markets |

| Private equity investment | Limited information on trading platforms |

| Equities research | Limited educational tools |

| Global commodities services | Limited cash deposit options to CMS securities settlement bank accounts |

| Multiple account types | Fees and commissions can be complex |

| Various trading platforms | Cut-off time for fund withdrawal processing |

| Extensive customer support | Limited operational hours |

Is CMS Legit?

China Merchants Securities (HK) Co., Limited, also known as CMS, is regulated by the Securities and Futures Commission of Hong Kong. It holds a license for dealing in futures contracts, with license number AAI650, granted since January 26, 2005. The company operates under the regulatory oversight of Hong Kong and is located at 48th Floor, Exchange Square Phase 1, 8 Connaught Place, Central, Hong Kong. While it offers a range of services, including investment advisory, it's important to note that there have been some concerns raised about negative reviews and potential risks associated with its business scope. It is advised to exercise caution and stay informed about the regulatory and operational aspects of the institution.

Market Instruments

HK Equities: CMS offers a variety of market instruments for trading in Hong Kong equities. These include Hong Kong stocks, oversea stocks, Shanghai-Hong Kong Stock Connect, Shenzhen-Hong Kong Stock Connect, futures, IPO subscriptions, stock options, stock borrowing and lending, securities margin financing, bonds trading, and structured products. These instruments allow clients to engage in a wide range of investment opportunities within the Hong Kong equities market.

HK Futures: CMS provides futures trading in Hong Kong, including Hang Seng Index Futures, H-shares Index Futures, and Mini-Hang Seng Index Futures, each with specific minimum fluctuation and contract value. Hang Seng Index Options and H-shares Index Options are also available, with similar minimum fluctuation and contract value specifications. These futures and options offer diverse avenues for trading and investment strategies.

Bonds: CMS offers bonds trading, with information available on credit ratings from S&P, Moody's, and Fitch, providing clients with opportunities to invest in fixed income securities.

Funds: CMS offers unit trust funds that pool money from investors to create diversified portfolios managed by professional fund managers. Various fund types are available, including Equity Funds, Bond Funds, and Balanced Funds. Funds are categorized based on sectors or geography, allowing investors to tailor their investment strategies.

ETFs: CMS provides both physical and synthetic ETFs. Physical ETFs replicate benchmark composition, while synthetic ETFs use derivatives. These ETFs offer exposure to various assets and investment strategies, enhancing portfolio diversification.

Overseas Equities: CMS enables trading in overseas stock markets, allowing clients to diversify investments globally. Access is provided to 12 different markets, including the U.S., Canada, Australia, and Asian markets. The online trading platform offers real-time quotes and trading hours, offering opportunities for cross-border investments.

Stock Options: CMS offers stock options trading, providing clients with additional investment choices and strategies.

Global Commodities and Futures: CMS offers electronic trading solutions for global commodities and futures, including energy and precious metals, catering to clients' trading needs.

Indices: CMS provides access to various indices, including the Hang Seng Index, with real-time data on index values and changes, allowing clients to monitor and analyze market trends.

| Pros | Cons |

| Diverse range of market instruments | Limited information on specific fees and costs |

| Access to both local and overseas markets | Complexities in understanding different options |

| Offers exposure to various asset classes | Potential risks associated with trading strategies |

Products & Services

Corporate Finance and Capital Markets The Corporate Finance and Capital Markets segment of CMS encompasses a range of services, including sponsorship for initial public offerings (IPOs), fundraising in equity and debt capital markets, underwriting, and corporate advisory. This business division offers expertise in facilitating mergers and acquisitions, catering to diverse corporate needs.

Brokerage CMS offers a comprehensive array of investment services, both locally and internationally. This includes assistance in stocks, futures, bonds, funds, and derivatives. Additionally, the company extends margin financing, along with stock borrowing and lending services to its clients, enhancing their investment options.

Fund Administration CMS provides integrated fund administration services tailored to the unique demands of Hong Kong and offshore funds. This service streamlines administrative processes, addressing the intricacies associated with fund management.

Private Equity Investment Through managed private equity funds and principal capital, CMS engages in strategic investments in companies with significant growth potential. These investments target sectors such as Technology, Media, and Telecommunications (TMT), Healthcare, and Consumer industries within Greater China. The emphasis lies on creating enduring value for investors.

Asset Management CMS offers diversified asset management and investment advisory services to domestic and foreign investors in Hong Kong's financial markets. This encompasses a range of financial instruments and opportunities, allowing clients to manage and optimize their investment portfolios.

Research

CMS's Equities Research team provides comprehensive coverage of the Hong Kong equity market and U.S.-listed Chinese stocks. Their research offerings encompass market analysis, macroeconomic insights, and industry assessments. Investors benefit from a range of research products, advisory services, and investment-related guidance.

Global Commodities China Merchants Securities Global Commodities specializes in providing professional investors, financial institutions, and natural resources corporations with various commodities-related products and services. These offerings include over-the-counter precious metals and energy derivatives, spot margin bullion, and precious metals physical trading and leasing solutions.

| Pros | Cons |

| Expertise in IPOs, equity, and debt markets | Limited information on fee structure |

| Comprehensive investment services | Limited availability of cash deposit options |

| Diversified asset management and advisory | Limited information on trading platforms |

Account Types

Securities Account: CMS offers two primary types of securities accounts: Cash Account and Margin Account. In a Cash Account, customers are required to make full payment for securities purchased, and trading on margin or with borrowed funds is not allowed. On the other hand, a Margin Account enables customers to borrow money using purchased securities or other securities held as collateral. It's important to note that the securities or collateral might be re-pledged or managed by China Merchants Securities (HK) Co., Limited (the “Company”).

Futures Account: The Futures Account is designed specifically for trading futures contracts. This type of account allows customers to engage in transactions involving futures contracts, providing them with a platform to participate in futures trading activities.

| Pros | Cons |

| Clear differentiation between account types | Limited details on re-pledging or management of securities/collateral |

| Cash Account encourages full payment | Lack of information on potential risks associated with borrowing on Margin Account |

| Margin Account enables borrowing | Potential complexity in managing borrowed funds and collateral |

Fees & Commissions

China Merchants Securities (HK) Co., Limited (CMS) applies a comprehensive fee structure for its services. In the Securities Trading Services category, fees include a brokerage commission of 0.25% (minimum HKD 100), transaction levy of 0.0027%, and trading fee of 0.00565%. Stamp duty of 0.13% is applied on sold notes. Equally, the Equity Options Trading Services involve a commission of HK$40 per contract per side, with a minimum of HK$100 for executed orders. CMS charges a custody fee of 0.04% of market value annually for its Bonds Trading Services, along with a US$30 trading fee and US$80 early redemption fee.

In various overseas markets, such as the U.S., Singapore, Japan, and others, CMS's fee structure varies, generally amounting to a percentage of transaction value with minimum charges. For instance, in the U.S., the brokerage terminal fee is 0.3% of the transaction amount (minimum USD 30), with additional costs like SEC fee and ADR depositary fee.

Deposit & Withdrawal

CMS provides multiple methods for both depositing and withdrawing funds. For deposits, clients can use methods like fund transfers into designated bank accounts, including Standard Chartered Bank and Bank of China, or through online banking via China Merchants Bank Hong Kong Branch (CMBHK). Additionally, cheque deposits and same-day bank transfers are available for specific local banks. For withdrawals, clients can initiate fund withdrawal through various methods, such as the online trading platform, though there is a cut-off time of 11:00am on business days for processing. Cheque and remittance options are also available for withdrawing funds, with certain service fees and cut-off times. Note that cash deposits to CMS securities settlement bank accounts are not permitted.

eDDA (Electronic Direct Debit Authorization) enables fast fund deposits within 1 minute during HK Trading Days, supporting both HKD and RMB. Bank account authorization and fund deposit are fee-free.

| Pros | Cons |

| Multiple deposit methods | Cut-off time for fund withdrawal processing on business days |

| Various withdrawal options | Service fees and cut-off times for cheque and remittance options |

| eDDA enables fast and fee-free fund deposits | Cash deposits not permitted to CMS securities settlement bank accounts |

Trading Platforms

Stock Trading Platforms:

CMS offers several stock trading software options for different devices. The CMS HK App Platform 1.0 is available for iPhone and Android devices, providing access to the CMS HK trading platform. Additionally, Two-Factor Authentication Tokens are available for HK, US, and AB stock markets, enhancing security for online trading. Clients can also use the CQ Key app for overseas stock trading, adding an extra layer of authentication.

Futures Trading Platforms:

For futures trading, CMS provides various software choices. The CQG Trader Futures Trading Software is available, along with CQG Web Futures Trading. These platforms offer comprehensive tools for futures trading and are complemented by Two-Factor Authentication options for added security. Additionally, the SPTrader Pro HD mobile app is supported by China Merchants Futures (HK) Co., providing improved speed and reliability for futures trading on both iOS and Android devices. Another option is the Sharp Point Futures Trading Software, designed to facilitate futures trading with its features.

| Pros | Cons |

| Multiple stock trading software options for various devices | Limited details on trading platform features and functionalities |

| Two-Factor Authentication Tokens available for added security | Lack of information on user interface and ease of use |

| Comprehensive tools and options for futures trading, including Two-Factor Authentication | Potential variations in platform performance and reliability across different devices |

Educational Tools

Technical Analysis Tools: CMS offers traders educational resources focused on technical analysis, including indicators like RSI and MACD. These tools help traders interpret market trends and potential price movements, aiding in making informed trading decisions.

Trading Calendar: The Trading Calendar provided by CMS assists traders in planning their activities by highlighting trading sessions, market closures, and holidays. This tool covers both Hong Kong's and overseas stock markets, enabling traders to schedule their trades across global markets.

Market Data Analysis: CMS provides real-time market data analysis tools that offer insights into stock performance. Traders can access essential information such as price movements, trading volume, bid/ask prices, and turnover rates. This empowers traders to evaluate stocks and make informed decisions based on current market conditions.

Customer Support

CMS offers a comprehensive array of customer support channels, including a Hong Kong Customer Service Hotline [(852) 3189 6368] and toll-free numbers for Mainland China [400 1200 368, 400 8888 199]. The Complaint Hotline is reachable at (852) 3189 6191. Trade by Phone services for equities and futures dealing are available through various contact numbers. Physical service centers are located in Hong Kong's Central and Kowloon's Kwun Tong areas, with operational hours from Mon-Fri, 9am-6pm. Additionally, CMS provides international access points in London and Seoul, catering to diverse geographical needs.

Conclusion

In conclusion, China Merchants Securities (HK) Co., Limited (CMS) offers a range of market instruments and investment services, operating under the regulatory oversight of the Securities and Futures Commission of Hong Kong. The company provides opportunities for trading in Hong Kong equities, futures, bonds, funds, derivatives, and overseas stock markets. It also offers asset management, private equity investment, and research services. While CMS provides various trading platforms, technical analysis tools, and customer support channels, potential investors should remain cautious due to concerns about negative reviews and potential risks associated with its business scope. It's advisable to stay informed about the regulatory and operational aspects of the institution before engaging in any investment activities.

FAQs

Q: Is China Merchants Securities (HK) Co., Limited (CMS) a legitimate company?

A: Yes, CMS is regulated by the Securities and Futures Commission of Hong Kong and holds a valid license for dealing in futures contracts.

Q: What market instruments does CMS offer for trading in Hong Kong?

A: CMS provides a range of market instruments, including Hong Kong stocks, overseas stocks, futures, IPO subscriptions, stock options, bonds trading, and structured products.

Q: Can I trade overseas stocks through CMS?

A: Yes, CMS enables trading in overseas stock markets, giving clients access to global investment opportunities.

Q: What services does CMS offer for corporate finance and capital markets?

A: CMS provides services such as IPO sponsorship, fundraising in equity and debt markets, underwriting, and corporate advisory.

Q: What types of accounts does CMS offer?

A: CMS offers securities accounts (Cash and Margin) and a Futures Account for trading futures contracts.

Q: What are the fees and commissions for trading with CMS?

A: Fees include brokerage commission, transaction levy, trading fee, and other charges depending on the type of service and market.

Q: How can I deposit and withdraw funds with CMS?

A: CMS offers various methods for depositing and withdrawing funds, including bank transfers, online banking, and remittance options.

Q: What trading platforms does CMS provide?

A: CMS offers stock trading platforms and futures trading platforms with added security features.

Q: What educational tools does CMS offer?

A: CMS provides technical analysis tools, a trading calendar, and real-time market data analysis to support traders.

Q: How can I contact customer support at CMS?

A: CMS offers a Hong Kong Customer Service Hotline, toll-free numbers for Mainland China, and physical service centers in Hong Kong.

Q: Is CMS suitable for private equity investments?

A: Yes, CMS engages in strategic investments through managed private equity funds and principal capital.

Q: Can I trade commodities and futures with CMS?

A: Yes, CMS offers electronic trading solutions for global commodities and futures, including energy and precious metals.

Q: Does CMS provide asset management services?

A: Yes, CMS offers diversified asset management and investment advisory services.

Q: What research services does CMS offer?

A: CMS provides comprehensive equities research covering Hong Kong and U.S.-listed Chinese stocks.

Q: How can I access trading platforms for futures?

A: CMS offers various futures trading platforms, including CQG Trader and SPTrader Pro HD.

Q: Does CMS have international access points?

A: Yes, CMS provides international access points in London and Seoul to cater to diverse geographical needs.

Q: What type of funds does CMS offer?

A: CMS offers unit trust funds, including Equity Funds, Bond Funds, and Balanced Funds.

Q: Can I engage in stock options trading with CMS?

A: Yes, CMS offers stock options trading, providing additional investment choices and strategies.

Q: What indices does CMS provide access to?

A: CMS provides access to various indices, including the Hang Seng Index, for monitoring and analyzing market trends.

Review 7

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now