Score

GMT Markets

Australia|5-10 years|

Australia|5-10 years| https://gmtmarkets.com

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:FORTUNE PRIME GLOBAL CAPITAL PTY LTD

License No.:400364

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Australia

AustraliaUsers who viewed GMT Markets also viewed..

ATFX

- 5-10 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GTCFX

- 10-15 years |

- Regulated in United Kingdom |

- Straight Through Processing(STP) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

gmtmarkets.com

Server Location

Singapore

Website Domain Name

gmtmarkets.com

Server IP

184.168.111.69

gmtmarkets.com.au

Server Location

United States

Website Domain Name

gmtmarkets.com.au

Website

WHOIS.AUDA.ORG.AU

Company

AU-NIC

Server IP

166.62.30.147

Company Summary

| Aspect | Information |

| Registered Country | Australia |

| Founded Year | 5-10 years |

| Company Name | GMTK Global Pty Limited |

| Regulation | Potentially questionable ASIC license (400364) |

| Minimum Deposit | $500 |

| Maximum Leverage | 1:200 |

| Spreads | Fixed starting at 1.5 pips, varying by pair |

| Trading Platforms | MetaTrader 4 (MT4) |

| Tradable Assets | Forex, CFDs, Gold & Silver, Commodities, Cryptocurrencies |

| Account Types | Single account type |

| Demo Account | Not specified |

| Customer Support | Phone, email, social media, physical address |

| Payment Methods | Visa/Mastercard, Bank Wire Transfer, Bpay, Poli |

| Educational Tools | Market analysis, economic calendar, news feed, articles, webinars, seminars |

General Information

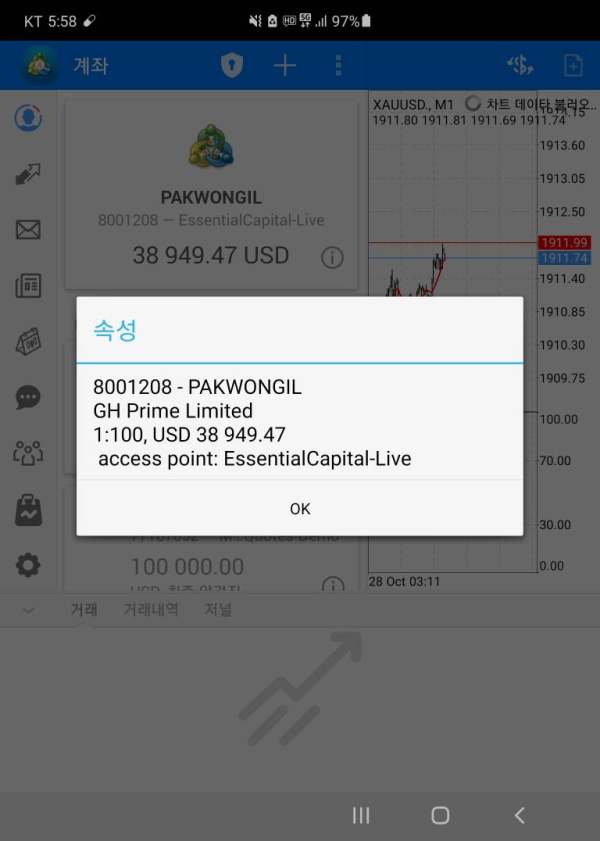

GMT Markets is a provider of Forex & CFD trading services which was granted in 2011. GMT Markets is the registered business name of GMTK Global Pty. Ltd. , licensed and regulated by the Australian Securities and Investment Commission (ASIC) with license number 400364. GMT Markets is also a member of the Australian Financial Complaints Authority (AFCA), as well as a member of the External Dispute Resolution Scheme in Australia which handles all retail clients complaints. GMT Markets provides traders with a range of financial markets on MT4 platform, including forex trading, commodities trading, and precious metals.

GMT Markets offers a range of market instruments, including Forex, CFDs, precious metals like gold and silver, commodities, and cryptocurrencies. They provide a single account type with a minimum deposit requirement of $500 and a fixed spread system, with spreads starting at 1.5 pips. Leverage of up to 1:200 is available for trading. While they offer the widely recognized MT4 trading platform, there have been mixed reviews and complaints from traders about issues such as slippage, high service fees, difficulties with withdrawals, and concerns about the broker's regulatory status.

In conclusion, GMT Markets presents significant regulatory uncertainties and has received mixed reviews from traders, with some expressing dissatisfaction and raising concerns about the broker's activities. Potential clients should exercise caution and conduct thorough research before considering GMT Markets as their trading platform.

Regulation

GMT Markets claims to be regulated by the Australia Securities & Investment Commission (ASIC) with license number 400364, but there are suspicions of it being a clone license. The regulatory status of GMT Markets is currently questionable, and it is advised to exercise caution when dealing with this broker due to the lack of valid regulation and potential risks associated with it.

Pros and Cons

GMT Markets presents several advantages and disadvantages. On the positive side, it provides traders with access to a diverse range of trading instruments, including cryptocurrency options, and offers leverage of up to 1:200. Additionally, the broker supports multiple deposit methods without imposing fees. It also utilizes the widely recognized MT4 trading platform. However, concerns arise due to the questionable regulatory status, the use of fixed spreads that may not accurately reflect market conditions, limited educational resources, a higher minimum deposit requirement compared to some competitors, and mixed reviews along with trader complaints.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Market Instruments

GMT Markets offers its clients 32 forex pairs with some exotic currencies like the Singapore Dollar and the Chinese Yuan. The broker also offers CFDs on spot metal like silver and gold, energy commodities like oil and natural gas, agricultural commodities like cotton, cocoa, sugar, and coffee, as well as the US Dollar Index. Still as we do not see any crypto assets in the list.

Forex: GMT Markets offers a range of Forex trading instruments, allowing traders to speculate on the exchange rates of various currency pairs. Some examples include EUR/USD, GBP/JPY, and USD/JPY.

CFDs: GMT Markets provides Contract for Difference (CFD) trading, enabling traders to speculate on the price movements of various financial instruments without owning the underlying assets. This includes CFDs on stock indices like the S&P 500, FTSE 100, and NASDAQ.

Gold & Silver: The broker offers trading opportunities in precious metals like gold and silver. Traders can engage in price speculation on these commodities, for instance, trading Gold (XAU/USD) and Silver (XAG/USD).

Commodities: GMT Markets allows traders to access the commodities market, offering the opportunity to trade various commodities such as crude oil, natural gas, and agricultural products like wheat and corn.

Cryptocurrencies: The platform also provides access to cryptocurrency trading, allowing traders to buy and sell digital currencies. Examples of cryptocurrencies available for trading include Bitcoin (BTC), Ethereum (ETH), and Ripple (XRP).

| Pros | Cons |

| Diverse range of trading instruments | Fixed spreads may not accurately reflect market conditions |

| Access to cryptocurrency trading | Lack of dynamic market conditions |

| Opportunity to trade precious metals and commodities | Limited insight into underlying asset ownership |

Minimum Deposit

There seems only one Standard account type, with the minimum deposit is $500, which is much higher than the sector average. Most brokers require a $250 minimum deposit for a standard account. Moreover, a demo account is also available for new traders to exercise their trading skills, to make preparation for a live account.

Leverage

GMT Markets offers leverage of up to 1:200 for trading, allowing clients to potentially amplify their positions in the market.

Spreads & Commissions

The spreads are fixed 1.5 pips on EUR/USD, which is quite in line with the industry standard.

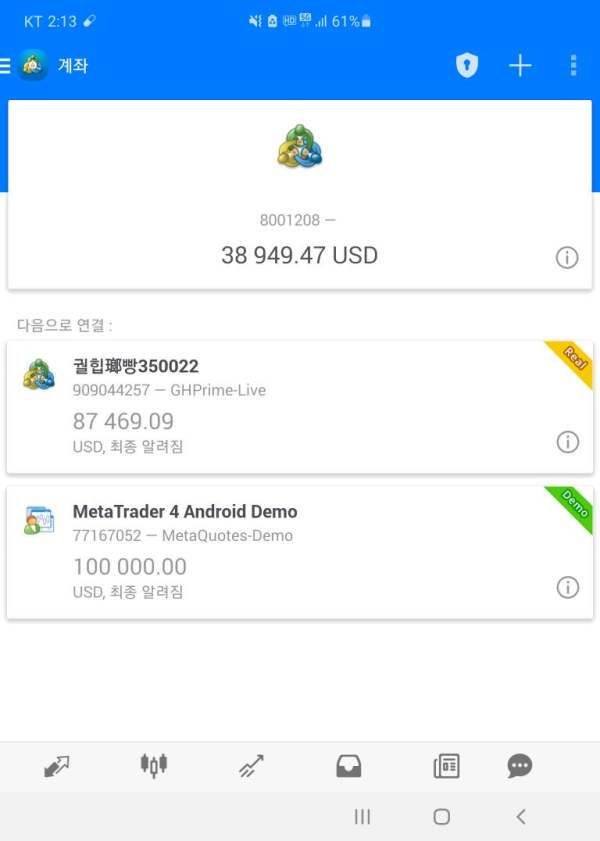

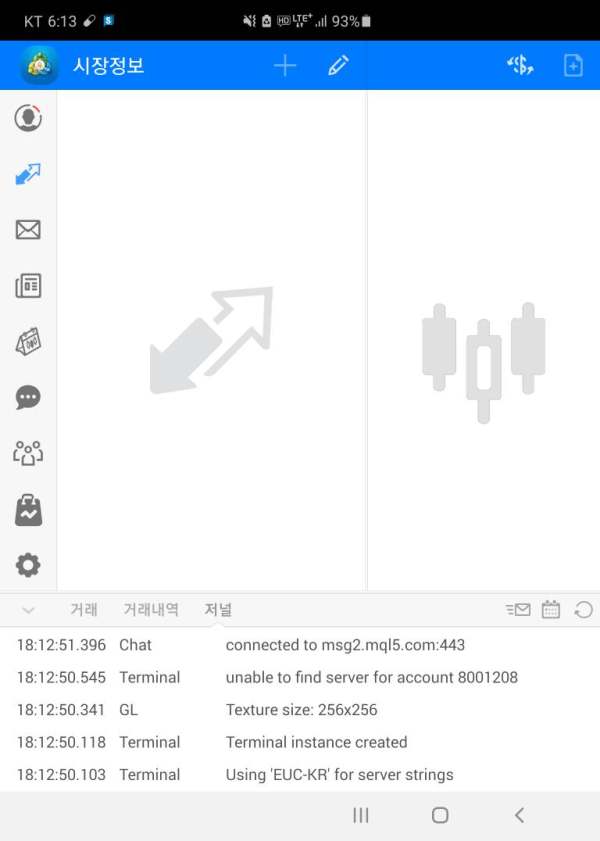

Trading Platform of GMT Markets

GMT Markets provides the most popular trading platform MetaTrader 4, whichi is available for Windows, Apple devices, and Android devices. MT4 remains still the most popular trading platform because it is light and reliable, featuring an user-friendly interface, various charting tools and more than 50 market indicators.

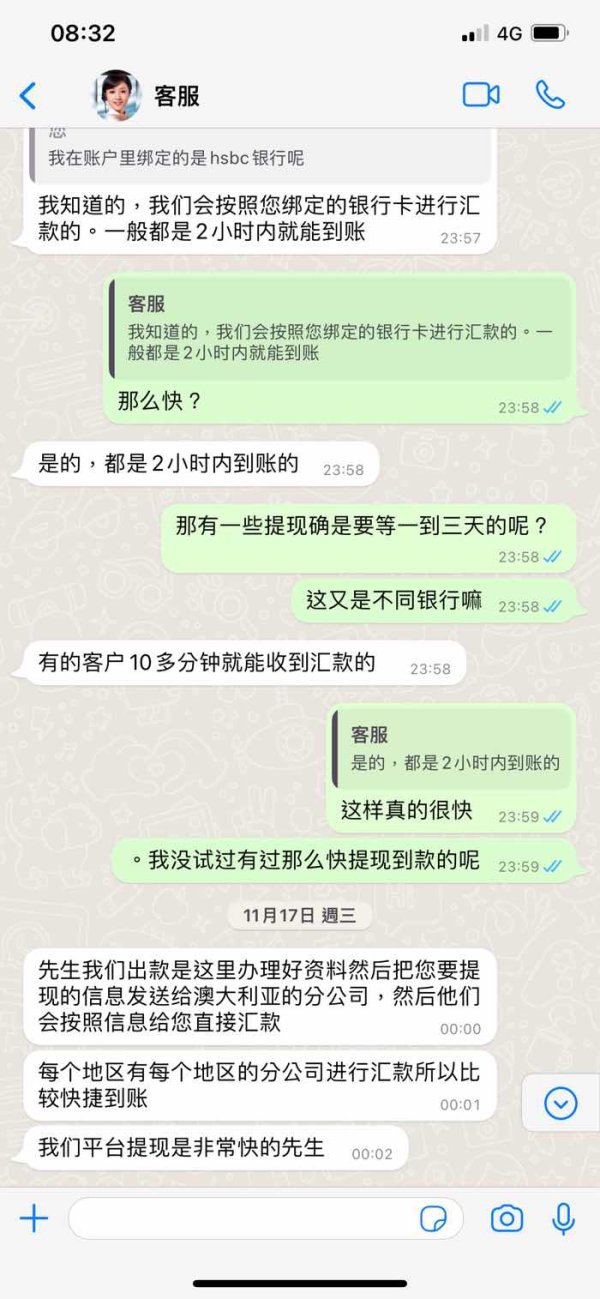

Deposit & Withdrawal

There are several deposit and withdrawal options accepted by GMT Markets. Traders may deposit or withdraw via MasterCard, Visa, bank/wire transfer, UnionPay, Bpay, Poli Internet Banking. Some popular e-wallet systems are missing such as Neteller, Skrill, and Paypal. There is no Bitcoin and other cryptocurrencies option too.

| Pros | Cons |

| Multiple deposit methods available, including Visa/Mastercard, Bank Wire Transfer, Bpay, and Poli, with no additional deposit fees. | Absence of e-wallet options like Skrill and Neteller for deposit. |

| Third-party deposits not accepted, ensuring all deposits come from the client's account. | Lack of information about specific withdrawal fees, especially for Bank Wire transfers. |

| Secure withdrawal policy requiring withdrawals to go to accounts in the client's name. | Withdrawal processing times can be relatively long, with international transfers taking 3-5 business days. |

Educational Tools

GMT Markets provides clients with several educational resources, including daily market analysis, an economic calendar, a news feed, exclusive articles, online webinars, and free seminars. These resources are designed to offer foundational knowledge rather than in-depth expertise, making them accessible for traders seeking to grasp the basics of trading.

Customer Support

GMT Markets provides customer support through various channels. Clients can reach them by phone at 1800 468 658 within Australia or at (+61) 3 7022 9688 for international inquiries. They can also contact the broker via email at info@gmtmarkets.com. The company is located at Level 1, 493 St Kilda Road, Melbourne, Victoria, Australia 3004, with a mailing address at PO BOX 6301 Melbourne VIC 3004. Additionally, GMT Markets maintains a presence on social media platforms such as Twitter, Facebook, Instagram, and YouTube for further engagement and information sharing.

Reviews

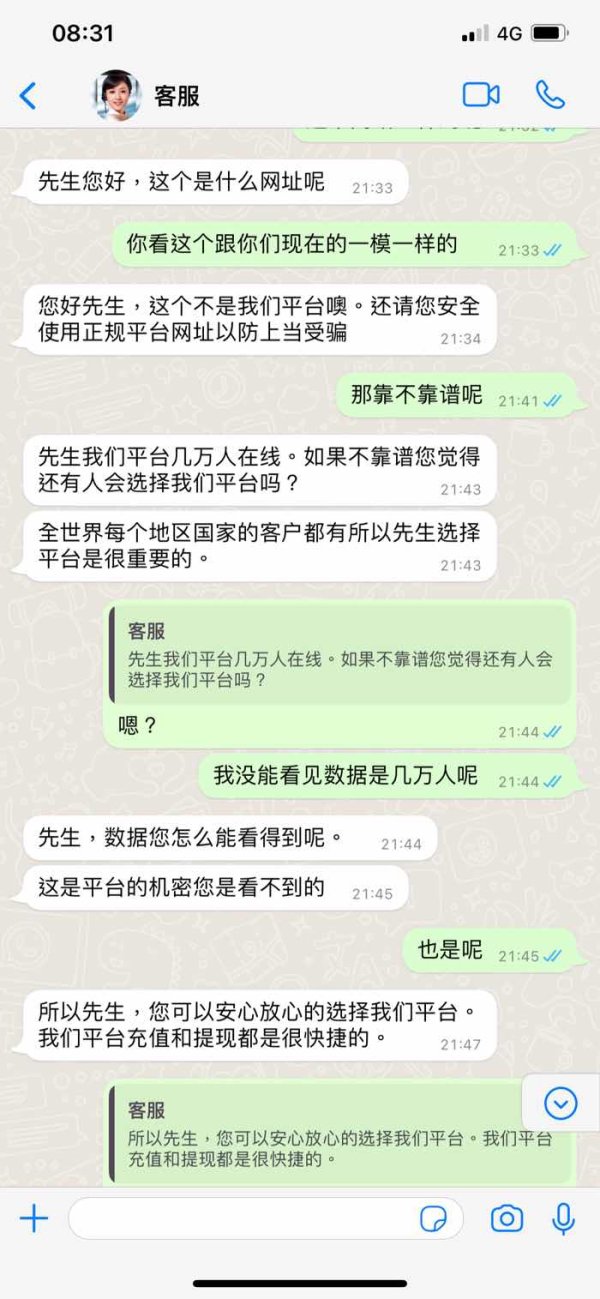

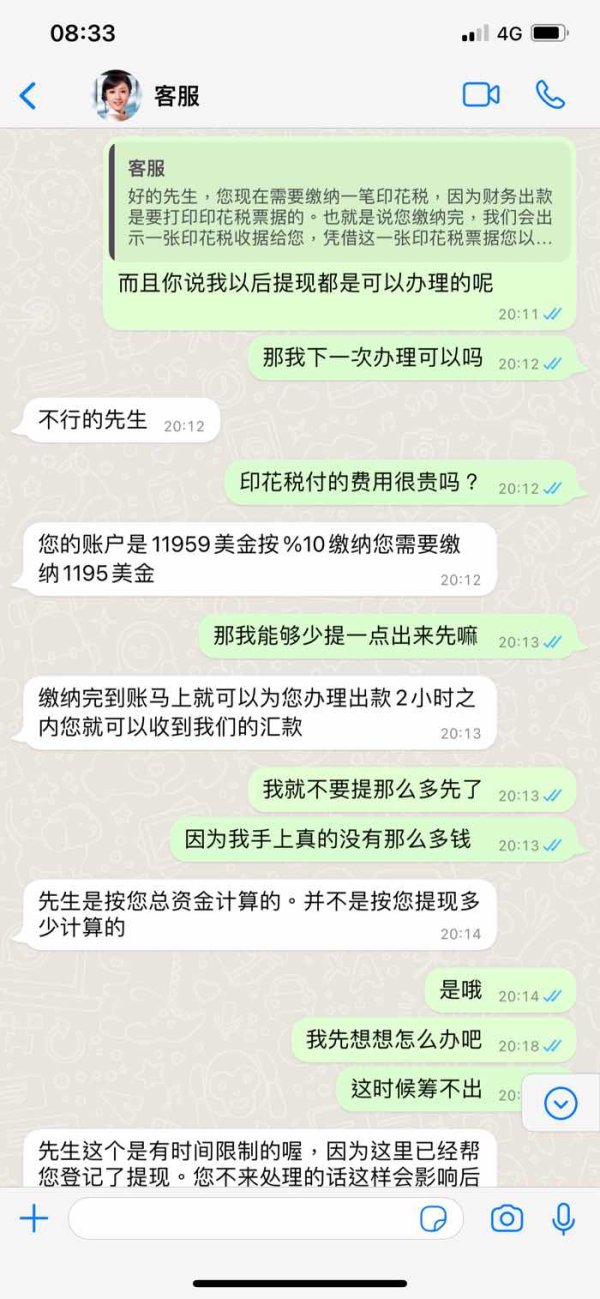

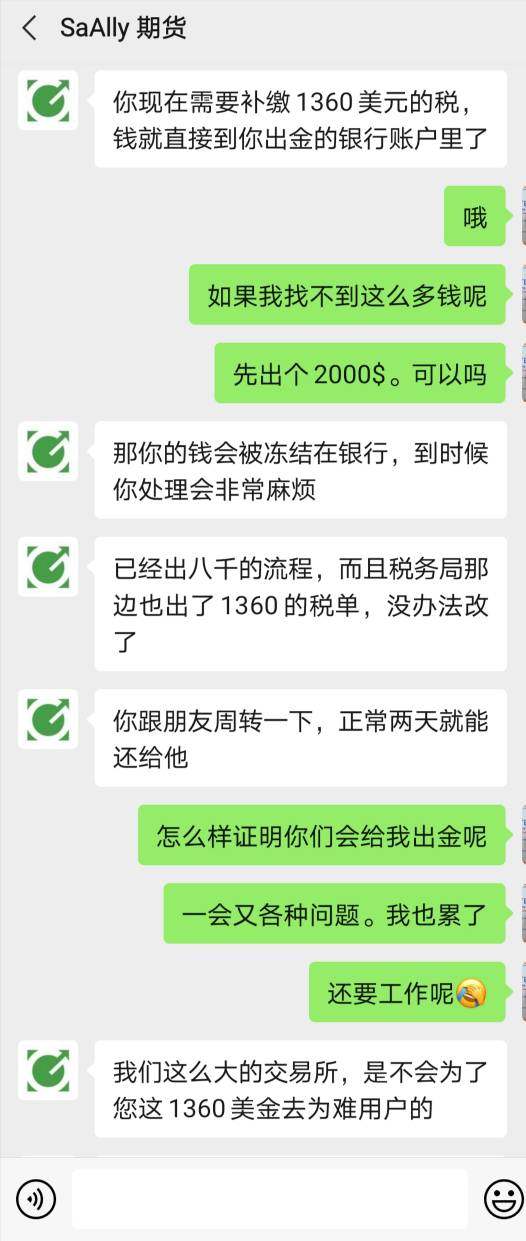

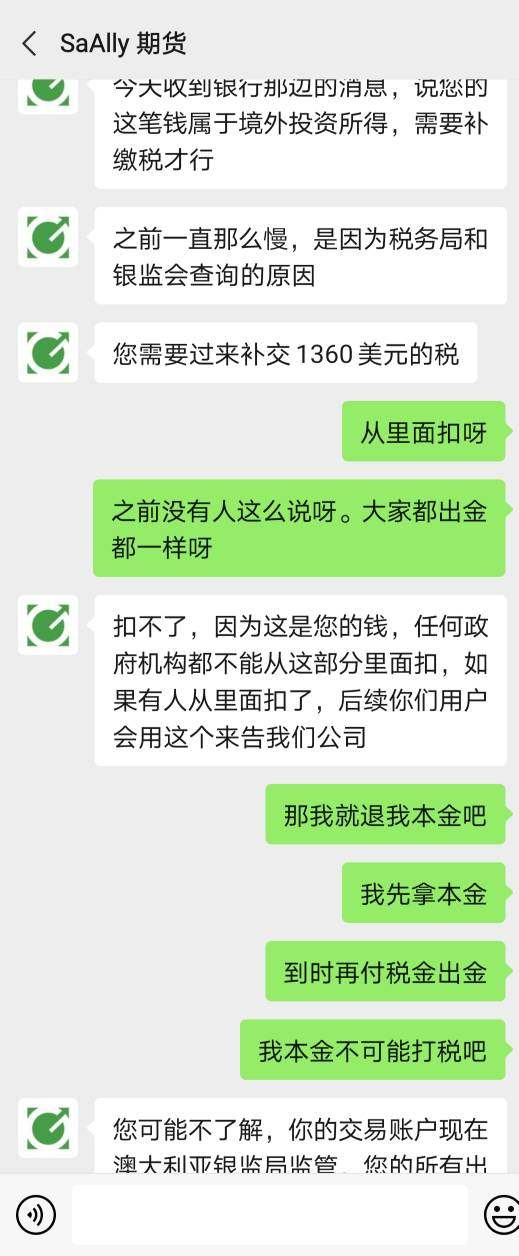

GMT Markets has received mixed reviews on WikiFX. Some traders have complained about issues like severe slippage, high service fees, and difficulties with withdrawals. One trader expressed frustration with their account being frozen after following GMT analyst advice. Additionally, there are allegations that GMT Markets is unregulated, with warnings from the UK's Financial Supervisory Authority (FCA) about the company's fraudulent activities, targeting British clients and other countries. Investors are cautioned to exercise caution and be wary of GMT Markets due to these concerns.

Conclusion

In conclusion, GMT Markets presents both advantages and disadvantages for potential traders. On the positive side, the broker offers a variety of trading instruments, including Forex, CFDs, precious metals, commodities, and cryptocurrencies. They also provide leverage of up to 1:200, potentially amplifying trading positions. Furthermore, GMT Markets utilizes the widely recognized MT4 trading platform and offers some educational resources.

However, there are notable concerns regarding the legitimacy of GMT Markets' regulatory status, as suspicions have arisen about the validity of their license. This ambiguity raises potential risks for traders. Additionally, the fixed spread system employed by GMT Markets may result in higher spreads for certain currency pairs, impacting trading costs. The minimum deposit requirement of $500 may also be a barrier for some traders. Furthermore, there have been reported issues, including slippage, high service fees, difficulties with withdrawals, and allegations of fraudulent activities.

FAQs

Q: Is GMT Markets a legitimate broker?

A: GMT Markets claims to be regulated by ASIC, but there are doubts about the validity of its license. Caution is advised due to the lack of clear regulation.

Q: What trading instruments are available on GMT Markets?

A: GMT Markets offers Forex, CFDs, Gold & Silver, Commodities, and Cryptocurrencies for trading.

Q: What are the account types and requirements at GMT Markets?

A: GMT Markets offers one account type with a minimum deposit of $500, fixed spreads, and a maximum leverage of 1:200.

Q: How does GMT Markets handle deposits and withdrawals?

A: GMT Markets accepts deposits through various methods but doesn't support e-wallets or cryptocurrency deposits. Withdrawals are processed to accounts in the client's name.

Q: What trading platform does GMT Markets use?

A: GMT Markets uses the popular MetaTrader 4 (MT4) platform, known for its user-friendly interface and tools for automated trading.

Keywords

- 5-10 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 8

Content you want to comment

Please enter...

Review 8

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

Laura3354

Hong Kong

Broker IB, leaving the staff Hu Wanliang, in order to earn a substantial commission, luring Weimiao students to invest in foreign exchange hosting, its core curriculum is to publicize the foreign exchange earnings high, low risk. He knew that the students do not understand at all, told students to make money do not need to learn on their own, so that we give the account to him and his team management. He asked us for the account password, not even an agreement contract. Hundreds of millions of funds by his escrow operation. A few months later, the students account huge losses, the principal is almost gone, and even only 10% left. The students were horrified, looking for other professional friends to help, found that it has malicious swiping, no strict risk control 。。。。

Exposure

2023-10-10

小黄1886

Australia

GMT? fast withdrawal? Don't question the platform ? Say a bunch of useless words.What the hell you doing with not withdrawing for me?

Exposure

2021-12-01

FX2163686582

South Korea

I just followed GMT analyst's adcixe but my account got frozen..Why[3f] I want my money back.Help me

Exposure

2020-11-13

舟游世界

Hong Kong

I bought one lot and it cost me $25 of the service fee. I didn't profit that much.

Exposure

2020-09-18

芳92711

Singapore

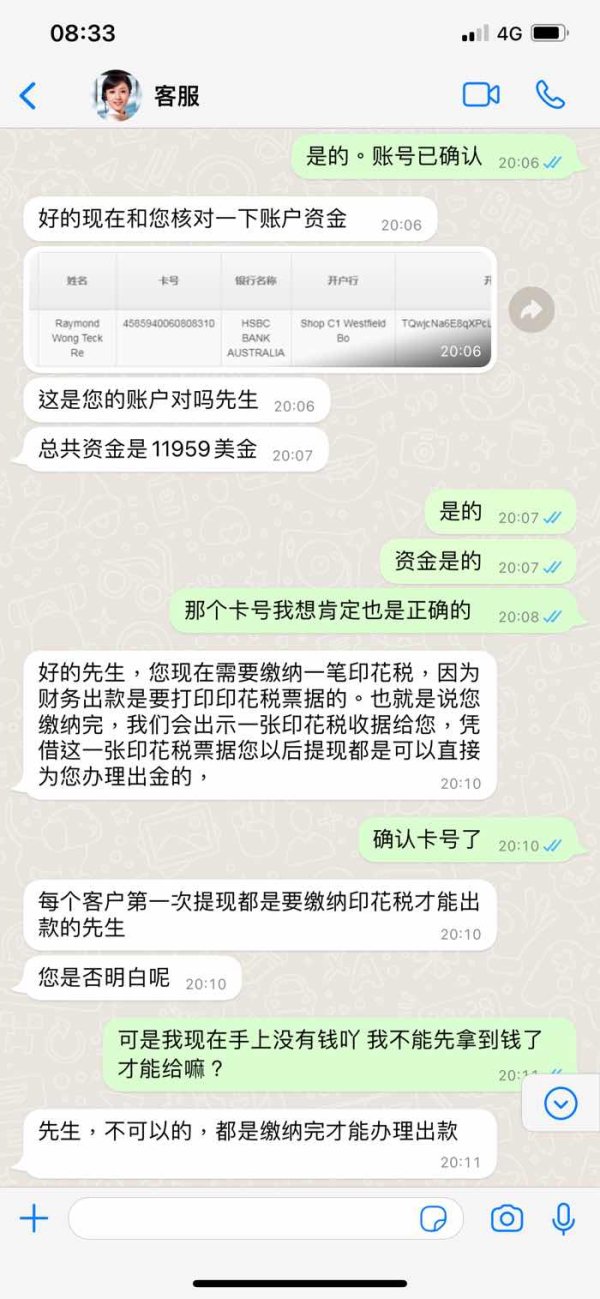

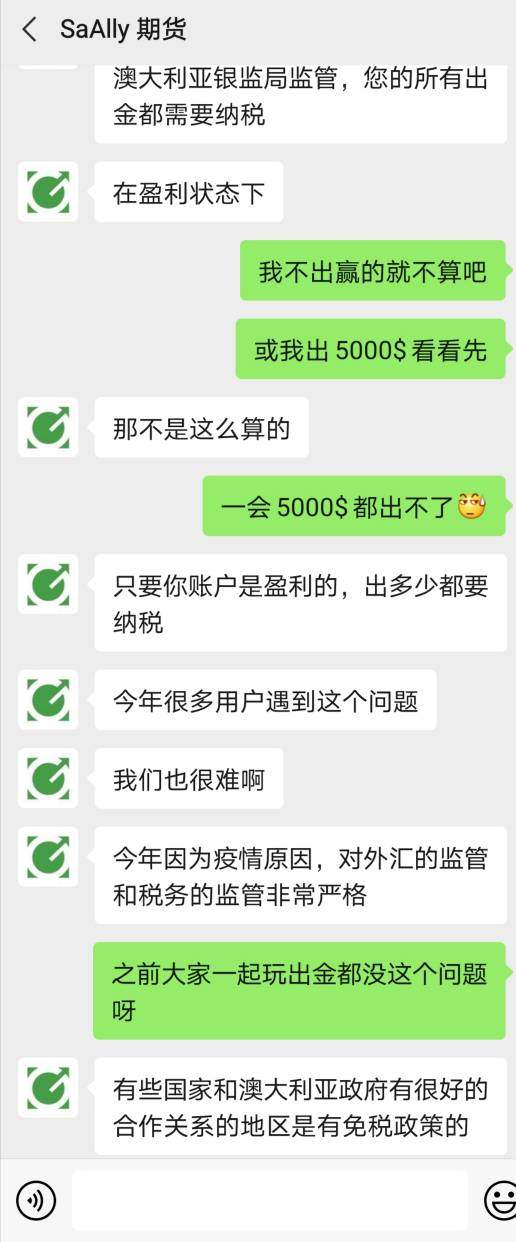

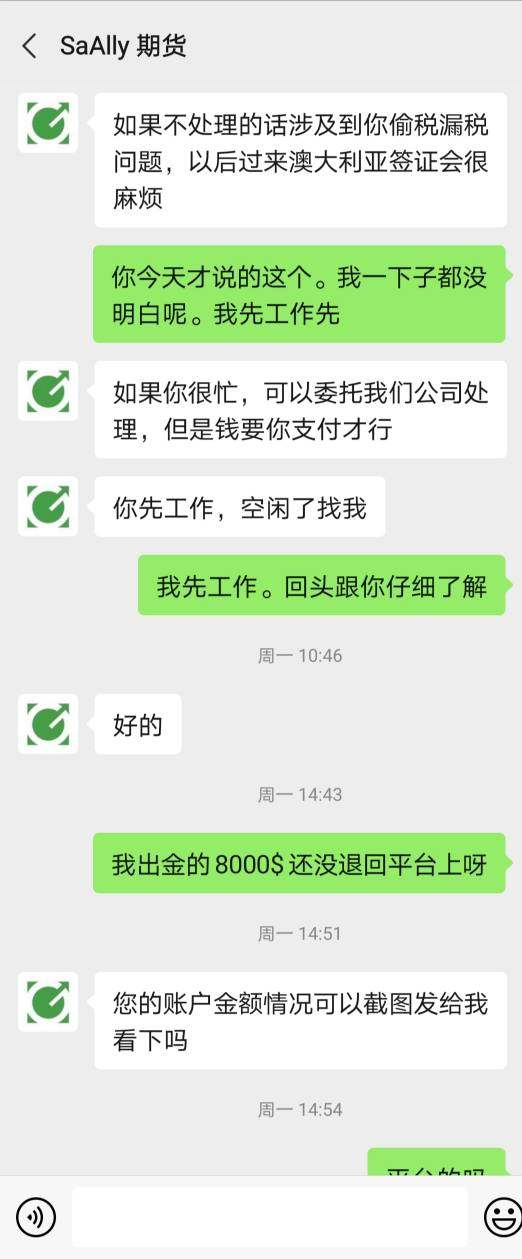

Do you have to pay tax fee before withdrawal? Why can’t it be deducted from the account? Is it a fraud platform?

Exposure

2020-09-04

FX1329825630

Hong Kong

GMT Markets is unregulated and is a fraud company! UK's Financial Supervisory Authority (FCA) issued a warning to GMT Markets, an unregulated financial services provider. The provider’s target group is British clients, while it also carries out frauds in other countries, including China. The website is available in both Chinese and English! FCA reminds investors to be wary ofGMT Markets carrying out frauds in other places. This announcement mainly makes investors realize that GMT Markets is a fraud platform. Please investors should not be deceived. Company Name: GMT Markets Limited Address 1: Universal House, 88-94 Wentworth Street, London, E1 7SA Address 2: Hackwood Street, 14 Hackwood Street, Robertsbridge, East Sussex, TN32 5ER Phone: 0203 769 1597 Website: www.gmtmarkets.com Email: support@gmtmarkets.com Company Building Number: 09269674 Please be sure to be careful of this company and avoid being deceived.

Exposure

2018-12-05

荣贵五金机电

Australia

The trading conditions of this company look very attractive, but I saw that wikifx said that its regulatory license may be cloned... I decided not to trade here in order not to be the next victim.

Neutral

2022-12-07

Abbamusty

Nigeria

GMT market, it's so very great market am so glad to participate in your platform And am very sure no body would regret Partnership with your market May you people have more experience

Neutral

2022-12-05