Score

CMV CAPITALS

Anguilla|2-5 years|

Anguilla|2-5 years| https://cmvcapitals.com

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

Full License

United Kingdom

United KingdomContact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Anguilla

AnguillaAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed CMV CAPITALS also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

AUS GLOBAL

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

cmvcapitals.com

Server Location

India

Website Domain Name

cmvcapitals.com

Server IP

192.46.215.131

Company Summary

| Aspect | Information |

| Company Name | CMV Capitals |

| Registered Country/Area | Anguilla |

| Founded Year | 2021 |

| Regulation | Not regulated |

| Market Instruments | Forex, CFDs, stocks, commodities |

| Account Types | PRO, ZERO, CENT, PREMIUM |

| Minimum Deposit | €100 |

| Maximum Leverage | Up to 1:500 |

| Spreads | Variable, starting as low as 0 pips |

| Trading Platforms | MetaTrader 5 (MT5) Desktop, MT5 Mobile |

| Customer Support | UAE and Anguilla offices, email(support@cmvcapitals.com), and phone contact(04 271 4466) |

| Deposit & Withdrawal | Various options: credit/debit cards, e-wallets, wire transfers |

| Educational Resources | Lack of comprehensive educational materials |

Overview of CMV Capitals

CMV Capitals, an Anguilla-based brokerage, commenced operations in 2021, operating without regulatory oversight. The platform offers a diverse range of market instruments, including Forex, CFDs, stocks, and commodities. Traders can opt for four distinct account types: PRO, ZERO, CENT, and PREMIUM, each catering to varying preferences. A relatively accessible minimum deposit of €100 enables traders to engage with the platform.

The maximum leverage provided reaches up to 1:500, enhancing trading potential. Spreads vary across asset classes and are influenced by specific details related to each. Utilizing MetaTrader 5 (MT5) in both desktop and mobile versions, CMV Capitals ensures flexibility and accessibility for traders. The brokerage provides customer support through offices in UAE and Anguilla, along with email and phone contacts.

Is CMV CAPITALS legit or a scam?

CMV CAPITALS operates without regulation from any governing authority, a factor that can raise considerable concerns regarding transparency and oversight within the exchange.

Unregulated platforms lack the crucial oversight and legal safeguards offered by regulatory bodies. This absence significantly heightens the risk of encountering fraudulent activities, market manipulation, and potential security breaches. Users might face challenges in seeking redress or resolving disputes in the absence of proper regulatory frameworks. Moreover, the dearth of regulatory oversight contributes to a less transparent trading landscape, posing challenges for users to evaluate the exchange's credibility and reliability accurately.

Pros and Cons

| Pros | Cons |

| Diverse Assets | Lack of Regulation |

| Various Accounts | Limited Educational Resources |

| Convenient Payments | Potential Fees |

| User-Friendly Platforms | Regional Restrictions |

Pros:

1.Diverse Assets: CMV Capitals offers a wide range of trading instruments, providing access to various markets like Forex, CFDs, and cryptocurrencies. This diversity allows traders to explore and diversify their portfolios based on their preferences and strategies.

2. Various Accounts: The platform provides multiple account types suitable for different trading needs. These account variations often cater to traders at different skill levels, offering flexibility and options that align with their trading strategies and preferences.

3. Convenient Payments: CMV Capitals supports multiple payment methods, including credit/debit cards, e-wallets, and wire transfers. This variety of options makes it easier for traders to deposit and withdraw funds, catering to different user preferences and needs.

4. User-Friendly Platforms: The trading platforms offered by CMV Capitals are user-friendly and equipped with advanced features. This ease of use benefits both novice and experienced traders, allowing them to navigate the platform efficiently and execute trades seamlessly.

Cons:

1.Lack of Regulation: CMV Capitals operates without regulatory oversight, which might raise concerns about transparency and investor protection. The absence of regulation could potentially expose traders to risks related to fund security and dispute resolution.

2. Limited Educational Resources: The platform lacks comprehensive educational materials, such as user guides, video tutorials, or live webinars. This deficit can pose challenges for new traders in learning the platform's functionalities and trading strategies, potentially leading to suboptimal decision-making or increased risk.

3. Potential Fees: While the platform offers convenient payment methods, there might be potential fees associated with certain transactions, such as deposits or withdrawals. These fees could impact the overall trading costs for users, affecting profitability.

4. Regional Restrictions: CMV Capitals might not be available in all countries or regions. This limitation restricts individuals residing in these areas from accessing the platform's services, potentially excluding a segment of potential users based on their geographical location.

Market Instruments

CMV CAPITALS offers a diverse range of trading assets across multiple categories:

FX (Forex): Traders can access 182 FX spot pairs and 140 forwards encompassing majors, minors, exotics, and metals. The platform provides competitive spreads starting as low as 0.2 pips, allowing users to engage in the foreign exchange market efficiently.

CFDs (Contracts for Difference): With over 9,000 instruments available, users can take both long and short positions. CMV CAPITALS offers tight spreads and low commissions, with spreads starting from 0.4 on US500, enabling traders to explore various markets and instruments.

Stocks: Access an extensive portfolio of over 19,000 stocks from core and emerging markets across 36 global exchanges. The platform facilitates trading with commissions starting from $3 on US stocks, presenting diverse opportunities for stock trading enthusiasts.

Commodities: Traders can engage in commodities trading with a wide range of options, including CFDs, futures, options, spot pairs, and more. CMV CAPITALS offers competitive spreads starting as low as $1.25 per lot, providing access to various commodity markets.

Account Types

CMV CAPITALS offers a comprehensive range of four distinct account types tailored to accommodate various trading preferences and skill levels.

The PRO account is a standout choice for traders seeking competitive advantages, boasting low spreads and leveraging capabilities of up to 1:500. This account type excels by eliminating commissions, providing traders with the unique benefit of zero spreads, allowing seamless engagement across diverse markets. Additionally, the PRO account ensures a swap-free environment, affording traders more flexibility and reducing overnight fees.

The ZERO account caters to traders interested in a cost-efficient trading experience. With a focus on zero commissions and leveraging capacities of 1:500, this account type is designed to minimize transaction costs while offering the added benefit of zero spreads. Moreover, the ZERO account operates in a swap-free environment, allowing traders to execute strategies without incurring overnight fees.

For those inclined towards cent-based trading, the CENT account presents an ideal choice. With zero commissions and a swap-free feature, traders can engage in transactions in cents, ensuring a cost-effective and flexible trading environment. This account type allows traders to trade in smaller denominations while eliminating additional charges, enhancing accessibility for a broader spectrum of traders.

The PREMIUM account stands out for its flexibility and accessibility, featuring zero commissions and leveraging capabilities of up to 1:500. Unique to this account type is the absence of a minimum deposit requirement, ensuring traders can access the diverse trading opportunities offered by CMV CAPITALS without being constrained by minimum deposit amounts. This account type provides traders with a commission-free environment and significant leverage to amplify their positions without imposing any specific minimum deposit obligation.

| Account Type | Spreads | Commissions | Leverage |

| PRO | Low | Zero | Up to 1:500 |

| ZERO | Zero | Zero | Up to 1:500 |

| CENT | Zero | Zero | Up to 1:500 |

| PREMIUM | Zero | Zero | Up to 1:500 |

How to Open an Account?

Here's a step-by-step guide on how to open an account with CMV CAPITALS:

1.Visit the CMV CAPITALS Website: Access the official CMV CAPITALS website to begin the account opening process.

2. Click on 'Open Account': Look for the 'Open Account' or 'Register' section on the website's homepage or the designated account creation page.

3. Fill in Personal Information: Complete the required fields with accurate personal information, including your full name, contact details, residency information, and other necessary details as prompted.

4. Choose Account Type: Select the desired account type that best aligns with your trading preferences and needs. Options may include PRO, ZERO, CENT, or PREMIUM accounts, each offering different features and benefits.

5. Complete Verification: Fulfill the account verification process, which typically involves submitting identification documents such as a government-issued ID, proof of address, and possibly additional financial information. This step ensures compliance with regulatory standards.

6. Fund Your Account: Deposit funds into your newly created trading account using the available payment methods provided by CMV CAPITALS. These methods may include bank transfers, credit/debit cards, or other designated payment options.

Once these steps are completed, you'll gain access to the trading platform provided by CMV CAPITALS, enabling you to explore the available trading instruments, execute trades, and manage your investments. Always ensure to review and understand the terms and conditions associated with trading on the platform before proceeding.

Leverage

CMV CAPITALS offers a maximum leverage of up to 1:500 for traders across various account types. This substantial leverage allows traders to potentially amplify their positions by up to 500 times the initial capital invested, significantly magnifying potential profits (as well as potential losses).

Such high leverage can provide traders with increased trading power and the ability to take larger positions in the market, but it also necessitates cautious risk management strategies to mitigate the inherent risks associated with leveraged trading.

Spreads & Commissions

CMV CAPITALS offers a diverse range of account types catering to various trading preferences. The PRO account stands out with low to zero spreads and zero commissions, providing traders with a competitive edge and a swap-free environment, allowing for seamless engagement across multiple markets.

In contrast, the ZERO account features zero spreads and zero commissions, prioritizing cost-efficient trading while operating in a swap-free environment. The CENT account offers variable spreads but with zero commissions, facilitating cent-based trading and ensuring a flexible and cost-effective trading environment. Lastly, the PREMIUM account combines variable to competitive spreads with zero commissions, offering significant leverage up to 1:500 and no minimum deposit requirement, providing traders with flexible access to diverse trading opportunities.

| Account Type | Spreads | Commissions |

| PRO | Low | Zero |

| ZERO | Zero | Zero |

| CENT | Variable | Zero |

| PREMIUM | Variable/Competitive | Zero |

Trading Platform

CMV CAPITALS provides traders with a robust and versatile trading experience through the MetaTrader 5 (MT5) platform, available both on desktop and mobile devices.

MT5 Desktop:

CMV MT5 Desktop delivers a comprehensive multi-asset trading environment via the advanced MetaTrader 5 platform. It caters to both novice and seasoned traders, offering a plethora of sophisticated tools and cutting-edge features designed to capitalize on diverse market conditions. This desktop platform empowers users to make informed decisions and execute trades efficiently.

MT5 Mobile:

CMV MT5 Mobile brings the power of MetaTrader 5 to traders' fingertips, accessible via iPhone and iPad applications. Offering unparalleled accessibility, this mobile platform allows traders to manage their accounts anytime, anywhere. It leverages the intuitive features of iOS devices, enabling easy navigation between landscape and portrait views for seamless trading experiences. Additionally, the mobile application boasts one-click trading, customizable layouts, and advanced charting tools, ensuring traders experience flexibility without compromising execution speed or quality.

These applications are optimized to provide traders with a comprehensive suite of tools, ensuring they can execute trades, conduct analyses, and manage their portfolios effortlessly on the go.

Deposit & Withdrawal

CMV Capitals offers a selection of secure and convenient payment methods to cater to your trading needs. Whether you're a seasoned pro or just starting out, they have an option that works for you. Here's a closer look at their popular payment solutions:

Credit/Debit Cards: Visa, Mastercard, and Maestro are all accepted for deposits and withdrawals. Deposits are processed instantly, allowing you to fund your account and start trading right away. Withdrawals typically take 1-3 business days to reflect in your account. A processing fee of 2.5% (minimum €20) applies to both deposits and withdrawals, so be sure to factor that in when planning your transactions.

E-wallets: Skrill, Neteller, and Perfect Money provide a fast and efficient way to manage your CMV Capitals account. Deposits are instant, giving you immediate access to your funds. Withdrawals are also processed quickly, usually within 24 hours. While CMV Capitals doesn't charge fees for e-wallet transactions, your e-wallet provider might have their own charges, so check their terms beforehand.

Wire Transfers: For larger deposits or situations where security is paramount, wire transfers offer a reliable option. They typically take 2-5 business days to complete, depending on your sending and receiving banks. While CMV Capitals doesn't charge fees, intermediary banks might, so be aware of potential additional costs.

Payment Processing Time: Credit/debit card withdrawals are the slowest at 1-3 business days, while e-wallets offer the fastest turnaround at 24 hours. Wire transfers fall somewhere in the middle, taking 2-5 business days. Remember, these are just estimates, and actual times may differ based on your bank and other factors.

Customer Support

CMV Capitals offers comprehensive customer support across multiple channels. Whether you have inquiries or need assistance, their dedicated team is available to help. You can connect with them through various avenues, including email at support@cmvcapitals.com or by phone at 04 271 4466. Additionally, they have physical office locations in UAE and Anguilla, ensuring accessibility for clients seeking personalized assistance. This multi-faceted approach demonstrates their commitment to addressing concerns promptly and providing comprehensive support to traders.

Educational Resources

CMV Capitals faces a shortage of educational materials, posing challenges for new users in familiarizing themselves with the platform and cryptocurrency trading. Absent are crucial resources like comprehensive user guides, video tutorials, live webinars, and informative blogs.

This deficit impedes new traders' learning curve, potentially resulting in errors and financial losses, subsequently discouraging their involvement in trading activities. Improving educational resources could significantly benefit users, fostering a more informed and confident trading experience while mitigating potential setbacks for newcomers.

Conclusion

CMV Capitals presents a platform with diverse trading assets, multiple account options, and convenient payment methods.

However, the absence of regulatory oversight poses significant concerns regarding transparency and investor protection. The platform's limited educational resources might hinder new traders' learning curve, potentially leading to trading errors. Additionally, while offering user-friendly platforms and a variety of accounts, potential fees for transactions and limited accessibility in some regions add further considerations for prospective users, warranting careful evaluation of advantages against notable disadvantages before engaging with CMV Capitals.

FAQs

Q: Is CMV Capitals regulated?

A: No, CMV Capitals currently operates without regulatory oversight.

Q: What assets can I trade on CMV Capitals?

A: CMV Capitals offers a range of assets including Forex, CFDs, stocks, and commodities.

Q: Are there fees for transactions on CMV Capitals?

A: Yes, some transactions may incur fees which vary based on the nature of the transaction.

Q: Does CMV Capitals provide educational resources?

A: Unfortunately, CMV Capitals lacks comprehensive educational materials for traders.

Q: How quickly are withdrawals processed on CMV Capitals?

A: Withdrawals are typically processed within specific timeframes depending on the chosen method.

Q: Where is CMV Capitals available?

A: CMV Capitals might have restrictions in certain regions or countries, so it's essential to check availability before attempting to use the platform.

Keywords

- 2-5 years

- Suspicious Regulatory License

- MT5 Full License

- Regional Brokers

- High potential risk

Review 12

Content you want to comment

Please enter...

Review 12

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

fxvo2200

Romania

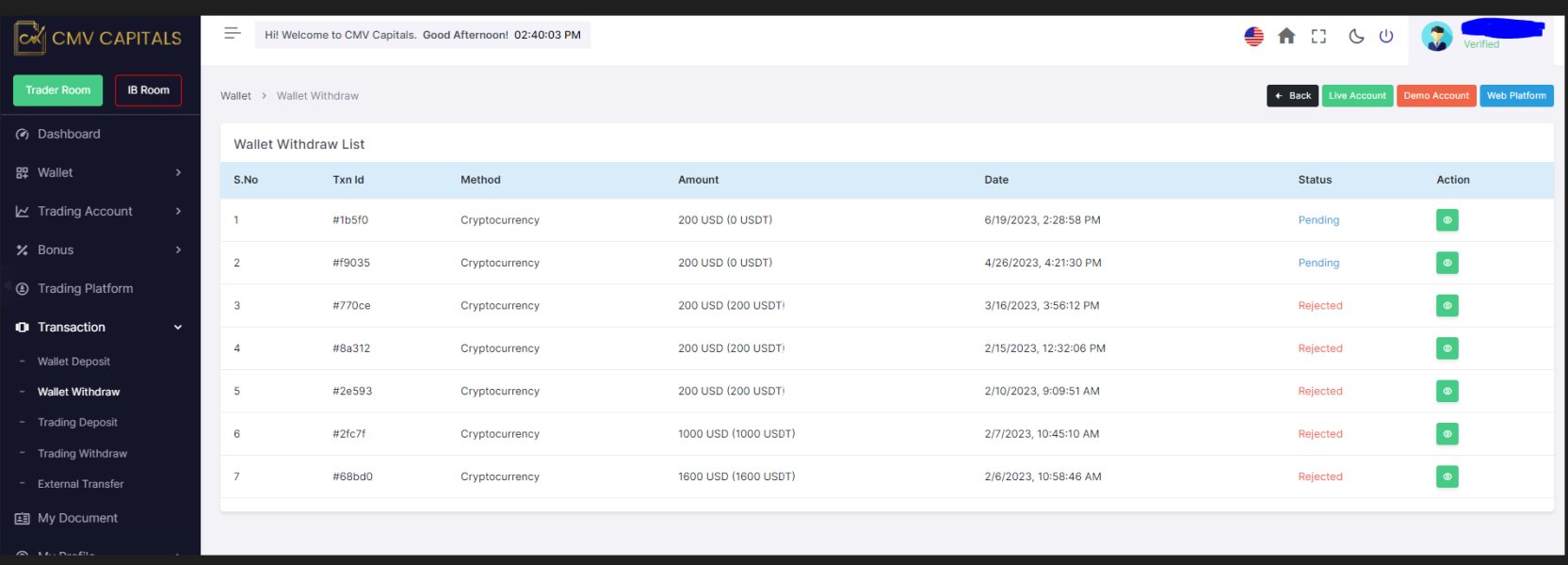

I was creating a withdrawal request with CMV Capitals since February 2023 and they still didn`t approve it.It's been over 6 months and placed a few withdrawal requests but they have been canceled every time.They don`t even want to give my deposit backSo far all I can say is that the broker is not accepting withdrawals.Avoid CMV Trading if you don`t want to lose your money!

Exposure

2023-07-11

潜龙勿用20773

Nigeria

I have mixed feelings about CMV CAPITALS. On the one hand, they offer three different account types to choose from, and their leverage is quite generous. Plus, their MT5 trading platform is pretty seamless and easy to use. On the other hand, I was a bit disappointed by the spreads, which were higher than I anticipated.

Neutral

2023-03-29

FX1104390305

Singapore

The trading terms offered by this company are very attractive! You only need $100 to open an account. But I decided not to go here after weighing the pros and cons as it doesn't have any regulatory information.

Neutral

2022-12-08

Marwa Kareem

Turkey

Excellent service and guaranteed profits.. I recommend everyone to subscribe with cmv company🙏

Positive

11-06

FX1777347445

Turkey

Great team , the best company in the stock market thank you for everyone thank you cmv capitals

Positive

11-06

FX8635451532

United Arab Emirates

its a good broker, it was so easy to deposit and withdraw😎

Positive

08-15

Geminy

Russia

Fund security protection measures are top-priority, which I appreciate.And cross-currency trading is a breeze, thanks to the platform's ease of use.

Positive

08-01

Sarah K

Japan

The charts and graphs are so clear and easy to understand. Make technical analysis is so easy.

Positive

06-27

benly nicks

United Arab Emirates

instant withdrawals, and good supporting team

Positive

2023-10-14

benly nicks

United Arab Emirates

good support for me, and good finance team they have

Positive

2023-10-14

ragunath

United Arab Emirates

100% genuine, fast withdrawal any time

Positive

2023-10-14

Za6713

United Arab Emirates

In the one I used CMV Capitals is a good broker Fast Withdraw 24 hours supporting It is worth it

Positive

2023-10-10