Score

ASFX

United Kingdom|2-5 years|

United Kingdom|2-5 years| http://asfxfirst.com/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomAccount Information

Users who viewed ASFX also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

asfxfirst.com

Server Location

United States

Website Domain Name

asfxfirst.com

Server IP

192.185.129.112

Company Summary

| Feature | Information |

| Company Name | ASFX |

| Registered In | United Kingdom |

| Regulated | Unregulated |

| Years of Establishment | 1-2 years |

| Trading Instruments | Forex, Commodities, Indices, Cryptocurrencies |

| Account Types | Micro, Mini, Prime, Luxury, Islamic |

| Minimum Initial Deposit | $100 (for Micro and Mini accounts) |

| Maximum Leverage | 1:500 |

| Trading Platform | MetaTrader 5 |

| Deposit and Withdrawal Methods | Wire transfers, Debit/Credit cards, e-wallets like Neteller and Fasapay |

| Customer Service | Phone and email |

Overview of ASFX

ASFX is an online broker located in the United Kingdom. The platform uses MetaTrader 5 software and offers a variety of trading options including forex, commodities, indices, and cryptocurrencies. Though it advertises multiple account types and an extensive range of trading instruments, potential users should be aware of the significant concern that is the absence of regulatory oversight. Regulatory oversight is essential in the financial sector as it offers a level of protection and security to investors.

In the case of ASFX, the lack of regulation could pose a considerable risk to users. With its variety of services and absence of regulatory credentials, ASFX presents itself as an enigma in the trading community. Understanding the full scope of what ASFX offers and the risks associated requires a comprehensive evaluation.

Is ASFX Legit or a Scam?

Prioritizing the safety of your investments is crucial when selecting a broker for online trading. One trusted method to gauge credibility of a broker is to verify if it is regulated. Regulatory oversight provides assurance that the broker adheres to strict financial standards, safeguards investors' funds, ensures fair trading practices, and regularly audits all financial transactions.

However, upon scrutinizing ASFX, it has been verified that the broker is currently operating without any valid regulation. Despite its broad range of market offerings and vast list of features, the absence of regulatory oversight places ASFX in an unfavorable light. Working without regulation increases the probability of dishonest or unfair practices which can adversely affect the safety of trader's funds.

Pros and Cons

| Pros | Cons |

| Multiple Account Types | Unregulated |

| Wide Range of Market Instruments | Potential for Undisclosed Fees |

| MetaTrader 5 Software | Uncertain Transaction Transparency |

| High Maximum Leverage (1:500) | Limited Customer Support Accountability |

Pros:

Multiple Account Types: ASFX provides five different account types to cater to diverse investment needs.

Wide Range of Market Instruments: The platform offers trading across six asset classes, adding flexibility for traders.

MetaTrader 5 Software: ASFX uses the well-known MetaTrader 5 platform, offering a user-friendly experience and a variety of charting tools.

High Maximum Leverage (1:500): The platform allows traders to potentially magnify gains through high leverage options.

Cons:

Unregulated Platform: ASFX operates without regulatory oversight, posing a risk to traders' fund safety.

Potential for Undisclosed Fees: Lack of regulation could mean undisclosed fees or unfavorable trading conditions.

Uncertain Transaction Transparency: Without regulation, there's no guarantee of transparency in transactions.

Limited Customer Support Accountability: The lack of regulation raises concerns about the effectiveness and accountability of customer support.

Market Instruments

ASFX offers an extensive palette of trading instruments spread across 6 distinguished asset classes, catering to various investor preferences. Their diversified offerings include over 500 trading instruments. Forex trading is facilitated by providing access to a comprehensive range of currency pairs, supported by an extensive list of trading terms and definitions available for easy reference.

For those interested in the digital currency market, ASFX offers a range of cryptocurrencies and also provides free learning courses to enrich your knowledge base. For traders looking to diversify their portfolio, they can engage in trading global indices and craft their own strategies. Their energy and commodities sectors also operate on a similar model, encouraging users to trade informed by utilizing prominent news stories.

Account Types

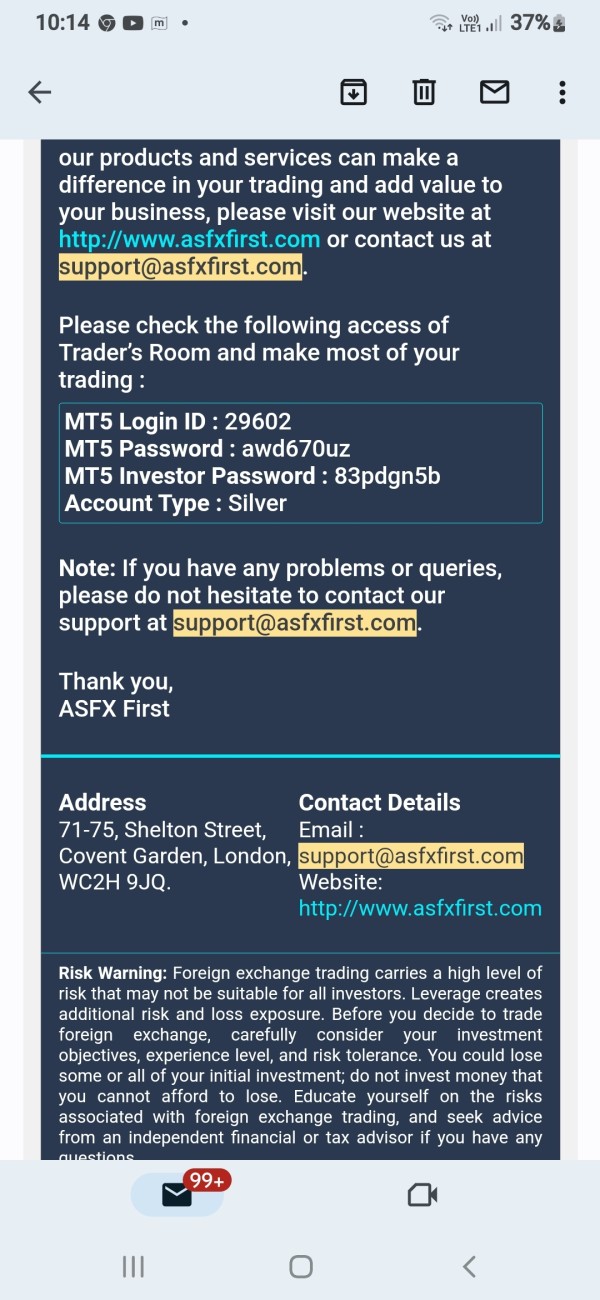

With five distinct account types—Micro, Mini, Prime, Luxury, and Islamic—ASFX offer service to a wide range of users. At one end of the spectrum, ASFX offers the Micro and Mini accounts, both with a minimum deposit of $100, but offering different leverage options and spread types to suit various trading styles. The Micro account offers a leverage of 1:400 with normal spreads, while the Mini account offers a higher leverage of 1:500 with regular spreads. Both these accounts enable users to receive daily market reviews and come with the convenience of a demo account.

For more advanced and high-volume traders, ASFX introduces Prime, Luxury, and Islamic accounts. The Prime account, with a minimum deposit requirement of 5,000, extends access to tighter spreads and a leverage of 1:500. The Luxury account is designed for high net worth traders, demanding a hefty minimum deposit of5,000,extends access to tighter spreads and aleverage of 1:500. The Luxury account is designed for high networth traders, demanding a hefty minimum deposit of 50,000 but in return providing competitive spreads and the same high leverage of 1:500.

Lastly, adhering to the principles of Islamic finance, the Islamic account facilitates swap-free trading with a minimum deposit of $20,000. All these accounts come equipped with advanced trading tools, an award-winning platform, fast automated execution, expert news & analysis, and tax-free spread betting profits. Deposit methods include wire or bank transfers, debit/credit cards, and e-wallets like Neteller and Fasapay.

How to Open an Account?

Opening an account with ASFX can be done in five straightforward steps:

Visit the official ASFX website: Log on to http://asfxfirst.com/

Select the 'Register' option: This option is generally located at the top right corner of the homepage.

Fill out the Registration form: The form typically asks for your personal details like your name, country of residence, email address, and phone number. Ensure you provide accurate information.

2. Choose the Account Type: ASFX offers a variety of account types such as Micro, Mini, Prime, Luxury, and Islamic. Select the one that suits your trading style and requirements.

3. Fund your Account: After your account is registered and approved, you need to deposit funds into it. ASFX offers multiple deposit options that include wire transfers, debit/credit cards, and e-wallets like Neteller.

Leverage

ASFX accommodates its users by providing a fairly high maximum leverage of 1:500, facilitating significant trading volume even with a smaller initial capital. The leverage offered ranges from 1:400 to 1:500, the highest being 1:500, which means an investor can trade up to 500 times their respective original investment. However, while higher leverage can drive substantial profits if trades go well, it simultaneously magnifies potential losses when trades don't favor the investor. Thus, the leverage should be utilized judiciously, factoring in the risk-appetite and investing strategy of the individual.

Spreads & Commissions

ASFX advertises zero commissions and varying spreads based on the account type. Though zero commissions and competitive spreads might initially appear attractive, these features cannot mitigate the risks associated with the platform's lack of regulatory oversight. In an unregulated environment, the absence of commissions could be offset by other fees or less favorable trading conditions, which may not be disclosed upfront.

Trading Platform

ASFX uses MetaTrader 5, a trading software known for its user-friendly interface and variety of charting tools. Although MetaTrader 5 is a reputable trading platform, it does not compensate for the lack of regulatory oversight. Without regulation, even a reliable trading software cannot guarantee the safety of user funds or fair trading conditions.

Deposit & Withdrawal

The deposit and withdrawal process at ASFX includes multiple options like wire transfers, debit/credit cards, and various e-wallets. While the presence of multiple options may seem like an advantage, it should be understood in the context of a lack of regulation, which poses a risk to the safety of deposited funds and the transparency of transaction processes.

Customer Support

Reaching out to ASFX customer support is relatively straightforward. They operate from their main office located on the 4th Floor, 107 Leadenhall Street, London EC3A 4AF, United Kingdom. For more instant communication or for addressing more immediate concerns or queries, customers are able to contact them via phone at +44 117 230 9573.

For those who prefer written correspondence or have more complex or detailed issues, they can be reached through email at info@asfxfirst.com. Regardless of the medium, they are committed to providing information and solving issues for their customers. However, customer service experience and problem resolution efficiency may vary depending on multiple factors.

Educational Resources

ASFX offers robust resources for educational purposes tailored for users at different expertise levels. For novice traders, the 'Beginner Course' provides an understanding of the fundamental concepts of forex trading, the structure of this market, and the benefits of being a part of it. Then, they provide 'Trading Tools', where users can acquaint themselves with advanced strategies and utilize ASFX's specific trading toolkit—a valuable resource for elevation to the next trading tier.

Users can also delve into 'Stocks and CFDs', where they can gain in-depth insights into the world of CFD trading and the subtleties of the CFD market together with the factors that drive market dynamics. Furthermore, ASFX provides a comprehensive exploration of a full range of cash and leveraged products for a deeper understanding of these financial instruments.

Conclusion

ASFX presents itself as a multi-faceted trading platform offering a wide range of market instruments and account types. However, it operates without the security net of a regulatory body, making it a high-risk platform. Potential users must consider the significant risks involved before making any trading decisions. The array of features offered by ASFX does not compensate for the fundamental issue of lack of regulation.

FAQs

Q: Is ASFX a regulated trading platform?

A: No, ASFX is not a regulated platform, which poses a considerable risk to the safety of traders' funds.

Q: What types of market instruments does ASFX offer for trading?

A: ASFX offers a wide array of market instruments across six asset classes, including forex, commodities, indices, cryptocurrencies, stocks, and energy sectors.

Q: What are the account types available on ASFX?

A: ASFX provides five distinct account types: Micro, Mini, Prime, Luxury, and Islamic, catering to traders of varying investment capabilities.

Q: What leverage options does ASFX provide?

A: ASFX offers leverage ranging from 1:400 to 1:500, allowing traders to potentially amplify their gains, though this also increases the risk of losses.

Q: Does ASFX charge commissions on trades?

A: ASFX advertises zero commissions but spreads may vary based on the account type, and the lack of regulation raises concerns about undisclosed fees.

Q: What trading platform does ASFX use?

A: ASFX employs the MetaTrader 5 platform, which is known for its user-friendly interface and a variety of charting tools.

Q: How can I get in touch with ASFX's customer support?

A: You can reach ASFX's customer support either via phone at +44 117 230 9573 or through email at info@asfxfirst.com.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

ashu6812

India

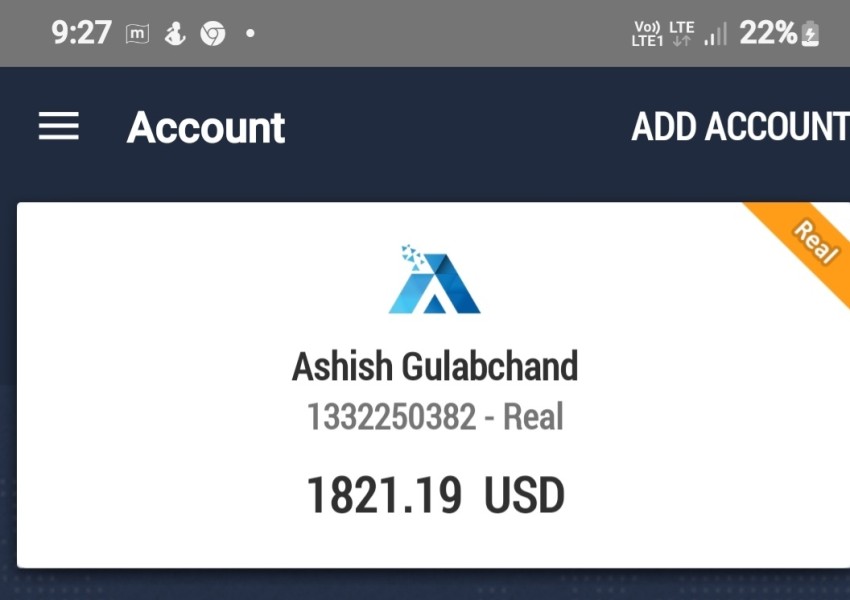

My withdrawal request is pending since 8 to 9 months. I mailed so many times to support@asfxfirst.com, but there is no response from company side. This is the harassment with me from company side. The company trader Mr. Sagar Shinde is not attending my call and making false commitment every time on what's app. This is the fraud activity that I feel with me from company trader side. I feel very poor working experience with company and their traders. My withdrawal amount is 1821$. Why Govt allowed such fraud company like ASFX to work in our great country? The Govt should banned and kicked off such fraud company from our place because they promote innocent customers to do crime to recover their harder money. kindly help me to recover my harder money if possible.

Exposure

2023-09-05

Ajit singh

India

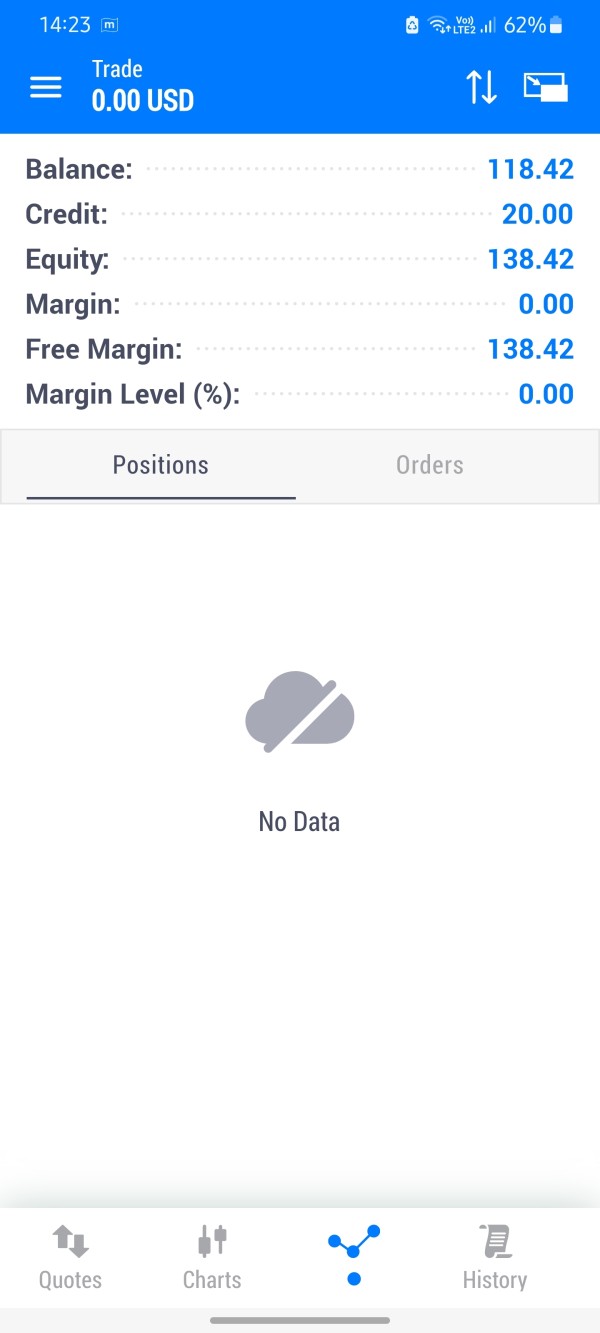

Dear Team my self Ajeet singh my amount in A/C -118.42 USD from last two days i am trying to withdraw money but no response from this broker side.

Exposure

2023-07-30

FX1474173659

Hong Kong

When I first heard about ASFX, I didn't know much about this brokerage company, but their website gave me a lot of information and advice. Registration is very easy, but in real trading, I ran into some problems. Their order execution was sometimes slow, causing me to miss some trading opportunities. Also, I found that their customer service wasn't always able to respond to my questions promptly.

Neutral

2023-03-31

胡叔

Hong Kong

Hello everyone, a while ago I was tired of losing my money with an investor or scam companies who just want to get your money and see you in bankruptcy good thanks ASFX my days bad already left because thanks to this company I have been able to generate very good income thanks to their knowledge of how to be a good beneficiary I already have the necessary knowledge to grow every day more thanks to them for me they are number one I highly recommend them.

Positive

2023-02-21