Score

WB

Hong Kong|5-10 years|

Hong Kong|5-10 years| https://www.hkwb100.com/

Website

Rating Index

MT4/5 Identification

MT4/5 Identification

White Label

China

ChinaContact

Licenses

Licenses

Licensed Institution:富格林有限公司

License No.:100

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

Hong Kong

Hong KongAccount Information

Formal full license MT4/5 traders will have sound system services and follow-up technical support. Generally, their business and technology are relatively mature and their risk control capabilities are strong

Users who viewed WB also viewed..

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FP Markets

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

hkwb100.com

Server Location

Hong Kong

Website Domain Name

hkwb100.com

Server IP

18.162.142.208

wbc852.com

Server Location

Hong Kong

Website Domain Name

wbc852.com

Server IP

16.162.77.132

fgl100.com

Server Location

Hong Kong

Website Domain Name

fgl100.com

Website

GRS-WHOIS.HICHINA.COM

Company

ALIBABA CLOUD COMPUTING (BEIJING) CO., LTD.

Domain Effective Date

2016-09-12

Server IP

115.160.133.89

Company Summary

| Aspect | Information |

| Registered Country/Area | Hong Kong |

| Founded year | 5-10 years |

| Company Name | WB Corporation Limited |

| Regulation | Suspicious Regulatory License |

| Minimum Deposit | $1,000 (Jinfu Account), $3,000 (Superior Account), $10,000 (Excellence Account), $30,000 (Premium Account) |

| Maximum Leverage | Up to 1:50 |

| Spreads | London Gold: $37 per lot (Jinfu Account), $35 per lot (Superior Account), $34 per lot (Excellence Account), $33 per lot (Premium Account) |

| London Silver: $20 per lot (Jinfu Account), $28 per lot (Superior Account), $35 per lot (Excellence Account), $38 per lot (Premium Account) | |

| Trading Platforms | MT4 |

| Tradable assets | Gold, Silver (Chinese market only) |

| Account Types | Jinfu Account, Superior Account, Excellence Account, Premium Account |

| Demo Account | Available |

| Islamic Account | Not specified |

| Customer Support | Email: cs@wb100hk.com |

| Phone: +852 35808081 | |

| Payment Methods | Real-time online payment, bank remittance, online cross-border remittance |

| Trading Tools | International Financial News, Asian Market Updates, European and American Market Updates, Commentary and Analysis, Real-Time Forecasts, Economic Calendar, Subscription to Investment Updates |

| Additional Information | Suspicious Clone, High potential risk, Chinese (Simplified), Website: https://www.wbc852.com |

General Information

WB Corporation Limited is a financial brokerage that offers trading services in the Chinese market. The company provides an online platform for trading market instruments, with a focus on London Gold and London Silver contracts. However, it is important to note that WB Corporation Limited has been flagged as a suspicious clone. The company claims to have been in operation for 5-10 years but lacks proper regulation from recognized authorities.

The brokerage offers four types of accounts, namely Jinfu Account, Superior Account, Excellence Account, and Premium Account, with varying minimum deposit requirements and trading conditions. WB Corporation Limited provides leverage up to 1:50, allowing traders to amplify their positions and potentially increase their returns. However, it is essential for traders to be aware of the associated risks and exercise caution when engaging in leveraged trading.

Customers can access the MetaTrader 4 (MT4) trading platform, a widely-used platform known for its user-friendly interface and advanced charting capabilities. WB Corporation Limited also provides a mobile version of the trading platform, enabling traders to participate in the global markets on the go. The company offers various trading tools such as market updates, economic calendars, and real-time forecasts to assist customers in making informed trading decisions.

While WB Corporation Limited presents trading opportunities, it is crucial for potential investors to consider the lack of proper regulation and the company's suspicious status. Conducting thorough research, seeking advice from reputable financial authorities, and exercising caution are recommended to protect investments and personal information.

Pros and Cons

It is crucial to thoroughly evaluate the pros and cons in order to make an informed decision when considering WB Corporation Limited as a potential financial brokerage. While the company offers certain advantages such as a variety of trading options and user-friendly platforms, it is equally important to acknowledge the concerns related to trustworthiness, lack of regulation, and potential risks associated with leveraged trading. Traders should exercise caution, conduct thorough research, and seek advice from reputable financial authorities before engaging with WB Corporation Limited or any similar entities.

| Pros | Cons |

| MetaTrader 4 platform with user-friendly | Flagged as a suspicious clone |

| Offers trading in London Gold and Silver | Low trustworthiness score (1.54/10) |

| Multiple account options with varying trading conditions | Lack of proper regulation |

| Provides trading tools and resources for informed decision-making | Limited information on company |

| Leverage up to 1:50 available | Potential risks associated with leverage |

| Lack of transparency and regulatory oversight | |

| Suspicion regarding the company's authenticity |

Is WB Legit?

Based on the information you provided, it appears that WB Corporation Limited is currently not regulated by any valid regulatory agency. The regulatory agency mentioned, the Chinese Gold & Silver Exchange Society (CGSE), is not listed as the regulator for WB Corporation Limited. Additionally, the information suggests that WB Corporation Limited is a suspicious clone and has received complaints, indicating potential risks and a possible scam.

It's important to note that this information is based on the details provided and the detection by WikiFX. To ensure accuracy and verify the current regulatory status of WB Corporation Limited, it is advisable to consult official regulatory sources or contact reputable financial authorities in Hong Kong. It's crucial to exercise caution when dealing with unregulated or suspicious entities in the financial industry to protect your investments and personal information.

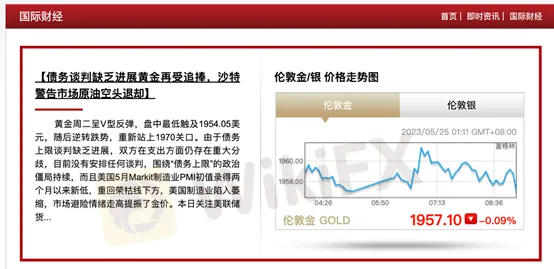

Market Instruments

WB offers two major market instruments: London Gold and London Silver. These instruments provide traders with the opportunity to engage in trading activities related to the price movements of gold and silver in the London market.

1. London Gold: WB allows traders to trade London Gold contracts, which are based on the price of gold in the London market. The contract unit for London Gold is 100 troy ounces per lot. Traders can take advantage of price fluctuations in gold to potentially generate profits. The minimum trading volume for London Gold is 0.1 lots, and the maximum trading volume is 10 lots.

2. London Silver: WB also provides the option to trade London Silver contracts. These contracts are based on the price of silver in the London market. The contract unit for London Silver is 5,000 troy ounces per lot. Similar to London Gold, traders can speculate on the price movements of silver and take positions accordingly. The minimum trading volume for London Silver is 0.1 lots, and the maximum trading volume is 10 lots.

Both London Gold and London Silver instruments have specific price fluctuations, which represent the minimum price movements allowed for trading. Traders can benefit from the price differentials between buying and selling, aiming to capitalize on market volatility.

| Pros | Cons |

| Opportunity to trade London Gold and Silver | Limited market diversity beyond gold and silver |

| Potential to benefit from price fluctuations | Reliance on price movements of London market |

| Opportunity to capitalize on market trends | Limited information on trading conditions and spreads |

| Ability to speculate on market volatility | Lack of comprehensive details on transaction volumes |

| Potential for profit generation | Potential risk exposure to gold and silver price changes |

| Availability of different contract sizes | Dependence on market conditions and liquidity |

Account Types

WB Corporation Limited offers four types of accounts for customers to choose from based on their investment preferences and capital.

1. Jinfu Account: The Jinfu Account requires a minimum deposit of $1,000. The account allows for trading with a minimum transaction size of 0.1. The gold spread for this account is $37 per lot, and the silver spread is $20 per lot.

2. Superior Account: The Superior Account requires a minimum deposit of $3,000. It offers slightly lower spreads compared to the Jinfu Account, with a gold spread of $35 per lot and a silver spread of $28 per lot. The minimum transaction size for this account is 0.3.

3. Excellence Account: The Excellence Account is designed for more experienced traders who are willing to invest a higher amount. It requires a minimum deposit of $10,000 and allows for trading with a minimum transaction size of 1.0. The gold spread for this account is $34 per lot, and the silver spread is $35 per lot.

4. Premium Account: The Premium Account is the top-tier account offered by WB Corporation Limited. It requires a minimum deposit of $30,000, making it suitable for high-net-worth individuals or institutional traders. The account provides additional benefits and features, although specific details are not mentioned in the provided information. The gold spread for this account is $33 per lot, and the silver spread is $38 per lot.

Customers can choose the account type that aligns with their investment goals and deposit the corresponding minimum amount to access the trading services and features associated with that account. It's important to review the complete terms and conditions, including any additional benefits and services offered with each account type, before making a decision to open an account with WB Corporation Limited.

| Pros | Cons |

| Multiple account options to suit different investment preferences and capital | Limited information on additional benefits and features of the Premium Account |

| Lower minimum deposit requirements for Jinfu and Superior accounts | Potential lack of clarity on the specific services and benefits associated with each account type |

| Higher account tiers offer potentially enhanced benefits and features | Lack of detailed information on the Premium Account |

| Spread variations for gold and silver among account types |

How to Open an Account?

To open an account with WB Corporation Limited, there are a few steps you can follow:

1. Online Account Opening: Visit WB's website and click on the “Open Live Account” option. Fill in your personal information, such as your name, date of birth, nationality, contact address, email address, mobile phone number, and any referral information if applicable. Choose the appropriate document type and provide the document number. Confirm the information you have entered.

2. Manual Account Opening: If you prefer a manual account opening process, you can contact the online customer service representative through the “Live800” chat service. Provide the necessary account opening data to the customer service representative, who will assist you in filling out the account application form.

3. Confirming Account and Personal Information: Once the account opening data is provided, it is important to review and confirm the accuracy of the trading conditions and personal information associated with your account.

4. Account Activation and Payment: After confirming your account details, you will proceed with the account activation process. Choose a suitable payment method and complete the payment. Retain the payment receipt as proof and contact the customer service representative.

5. Additional Documentation: Before making your first withdrawal, you may be required to submit copies of your identification document (such as an ID card or passport) and copies of your bank card (or passbook).

Once your account is activated and verified, you can start trading with WB Corporation Limited. It is important to carefully follow the instructions provided by the company and maintain communication with their customer service team throughout the account opening process to ensure a smooth experience.

Leverage

WB offers leverage to its customers, allowing them to amplify their trading positions and potentially increase their potential returns. The maximum leverage provided by WB is up to 1:50. Leverage enables traders to control larger positions in the market with a smaller amount of capital. With the leverage offered by WB, traders can potentially magnify their trading opportunities. However, it is important to note that leverage also carries risks, as it amplifies both profits and losses. Traders should exercise caution and have a thorough understanding of leverage and risk management strategies before engaging in leveraged trading.

Spreads & Commissions

WB Corporation Limited offers competitive spreads and commissions for trading in London Gold and London Silver.

For London Gold, the spreads are as follows: Jinfu Investment Account offers a spread of $37 USD per lot, the Superior Investment Account offers a spread of $35 USD per lot, the Excellence Investment Account offers a spread of $34 USD per lot, and the Premium Investment Account offers the lowest spread of $33 USD per lot. These spreads indicate the difference between the buying and selling prices of London Gold and represent the transaction cost for traders.

When it comes to London Silver, WB Corporation Limited provides cash rebates for each lot traded. The spreads for London Silver are as follows: Jinfu Investment Account offers a spread of $20 USD per lot, the Superior Investment Account offers a spread of $28 USD per lot, the Excellence Investment Account offers a spread of $35 USD per lot, and the Premium Investment Account offers a spread of $38 USD per lot. These cash rebates can add value to the trading experience by providing additional benefits or incentives to traders.

It's worth noting that WB Corporation Limited does not charge any commission for trading. This means that traders can focus solely on the spreads and market conditions without incurring any additional fees for their transactions.

| Pros | Cons |

| No commission charges for trading | Lack of detailed information on commission fees |

| Cash rebates provided for London Silver | Limited transparency on additional transaction costs |

| Lack of information on withdrawal fees |

Non-Trading Fees

WB Corporation Limited imposes certain non-trading fees that clients should be aware of. These fees are outlined in the trading terms and conditions provided by the company.

Firstly, WB does not charge any commissions on trades conducted through their online trading system. This means that clients can execute trades without incurring additional commission fees.

Regarding margin requirements, WB specifies different levels for instant and overnight margins. For trading London Gold, the instant margin is set at $3,000 per contract, while the overnight margin is set at $6,000 per contract. For London Silver, the instant margin is $1,800 per contract, and the overnight margin is $3,600 per contract.

In terms of forced liquidation, WB enforces certain conditions. During trading hours, if the equity-to-margin ratio falls below 20%, the company may initiate forced liquidation of positions. During weekends and holidays, if the equity-to-margin ratio drops below 200%, forced liquidation may also be triggered.

WB also applies a lock-up margin policy. This means that for locked positions, 25% of the total margin of the locked orders must be maintained as lock-up margin. To unlock the position, clients need to add funds to cover the original margin requirement, which is $3,000 for London Gold and $1,800 for London Silver.

Regarding interest rates, WB applies an annual interest rate of 1.25% for buying and 0.75% for selling. Clients are required to pay interest for both buying and selling transactions.

It's important to note that the trading hours for WB are from Monday 8:00 AM to Saturday 3:00 AM during daylight saving time and Monday 8:00 AM to Saturday 4:00 AM during standard time.

Trading Platform

WB Corporation Limited offers the MetaTrader 4 (MT4) trading platform, which combines user-friendly operation with professional charting and data analysis capabilities. The platform allows traders to place orders, close positions, set limit orders, stop losses, take profits, view reports, and analyze data. It is widely used by international institutional investors and professional individual investors. With features such as setting stop-loss and take-profit prices, traders can ensure the protection of their interests without constantly monitoring the market. MT4 is currently the most popular platform for spot gold trading globally, with retail trading volume accounting for over 90% of the market.

In addition, WB provides a mobile version of the trading platform, allowing users to participate in the global market anytime, anywhere. By simply entering their account credentials, users can log in and access their account information, view quotes, monitor positions, and execute trades. The mobile platform supports commission-free bidirectional trading and provides real-time market quotes and competitive spreads, with transaction costs as low as $24 per lot. This allows traders to seize profitable opportunities quickly and conveniently.

The mobile trading platform offers various features and functions, including chart viewing, real-time quotes for all products, placing market and pending orders, modifying or deleting orders, managing open positions, checking equity, profit, and margin levels, and viewing trade history and details. The platform is available for both Android and iPhone devices.

| Pros | Cons |

| User-friendly interface with advanced charting tools | Lack of transparency and regulatory oversight |

| Mobile trading platform for convenient access | Flagged as a suspicious clone |

| Provides trading tools and resources for informed decision-making | Potential risks associated with leverage |

Trading Tools

WB offers a range of trading tools to help customers stay informed and make informed trading decisions. These resources include:

1. International Financial News: WB provides updates on global financial news, keeping customers informed about the latest developments and events that may impact the financial markets.

2. Asian Market Updates: WB offers insights and analysis specific to the Asian markets, providing valuable information on market trends, economic indicators, and news relevant to traders in this region.

3. European and American Market Updates: Customers can access market updates and analysis focused on the European and American markets. This information helps traders understand the dynamics of these markets and make informed decisions.

4. Commentary and Analysis: WB provides expert commentary and analysis on various financial topics, including market trends, trading strategies, and economic events. This helps customers gain deeper insights into the markets and enhances their understanding of trading dynamics.

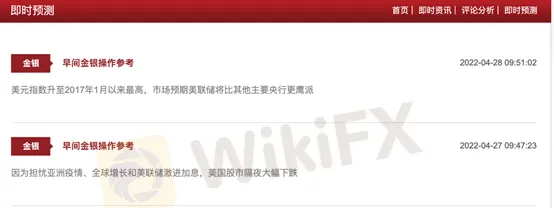

5. Real-Time Forecasts: Customers can access real-time forecasts, enabling them to stay updated on market trends and potential trading opportunities. These forecasts are based on thorough analysis and can assist traders in making timely decisions.

6. Economic Calendar: WB offers a comprehensive economic calendar, highlighting key economic events, announcements, and indicators from around the world. This allows traders to plan their strategies and be aware of potential market-moving events.

7. Subscription to Investment Updates: Customers have the option to subscribe to investment newsletters or updates, receiving regular market insights, trading tips, and educational content to enhance their trading knowledge and skills.

Trading Hours

Summer time is from Monday 8:00 to Saturday 3:00, and winter time is from Monday 8:00 to Saturday 4:00.

Customer Support

WB Corporation Limited provides customer support services to assist its clients. Customers can reach out to the company through various channels.

For general inquiries or assistance, customers can contact WB's customer support team via email at cs@wb100hk.com. They can send their queries, concerns, or requests for information to this email address.

Alternatively, customers can also contact WB's customer support hotline at 852-35808081. This phone number allows customers to directly speak with a customer support representative who can provide assistance and address any questions or issues they may have.

In addition to these contact options, WB also offers a quick online account opening service. Customers can visit WB's website to access the online account opening feature, which enables them to swiftly initiate the account opening process and start trading with WB's services.

Conclusion

In conclusion, WB Corporation Limited has several disadvantages that potential investors should consider. The company lacks valid regulatory oversight, raising concerns about its legitimacy and potential risks. There have been reports of WB being a suspicious clone and receiving complaints, further highlighting the need for caution. Additionally, the limited focus on the Chinese market and the high potential risk associated with trading London Gold and London Silver may deter some investors. However, WB does offer multiple account types, leverage options, and a user-friendly trading platform in the form of MetaTrader 4 (MT4). While these advantages may be appealing, it is crucial to thoroughly research and consider the risks before engaging with WB Corporation Limited.

FAQs

Q: Is WB Corporation Limited a legitimate company?

A: Based on the information provided, WB Corporation Limited appears to be suspicious and not regulated by a valid regulatory agency. There are potential risks and complaints associated with WB Corporation Limited, indicating a possible scam. It is recommended to verify the company's regulatory status with official sources or reputable financial authorities before engaging with them.

Q: What market instruments does WB offer?

A: WB offers two major market instruments: London Gold and London Silver. These instruments allow traders to participate in trading activities related to the price movements of gold and silver in the London market.

Q: What are the pros and cons of trading with WB?

A: The pros of trading with WB Corporation Limited include the availability of different account types to suit various investment preferences and capital levels, competitive spreads and commissions, convenient deposit and withdrawal options, and access to the MetaTrader 4 (MT4) trading platform. However, the cons include the lack of regulatory oversight, suspicious clone status, and high potential risk associated with WB.

Q: How can I open an account with WB?

A: To open an account with WB Corporation Limited, you can follow these steps:

1. Visit WB's website and click on the “Open Live Account” option. Fill in your personal information.

2. Alternatively, you can contact the customer service representative through the “Live800” chat service for a manual account opening process.

3. Review and confirm your account and personal information.

4. Proceed with the account activation and payment process.

5. Provide any additional documentation if required before making your first withdrawal.

Q: What leverage does WB offer?

A: WB offers leverage of up to 1:50, allowing traders to amplify their trading positions and potentially increase their returns. However, leverage also carries risks and traders should have a thorough understanding of it and risk management strategies.

Q: What are the spreads and commissions for trading with WB?

A: WB Corporation Limited offers competitive spreads for trading in London Gold and London Silver. The spreads vary depending on the type of account. Additionally, WB does not charge any commission for trading, focusing solely on the spreads and market conditions.

Q: Are there any non-trading fees associated with WB?

A: WB Corporation Limited imposes certain non-trading fees. These may include margin requirements, forced liquidation conditions, lock-up margin policy, and interest rates. It's important to review the trading terms and conditions provided by the company for detailed information on these fees.

Q: What are the options for depositing and withdrawing funds with WB?

A: WB provides three methods for depositing funds: real-time online payment, bank remittance, and online cross-border remittance. Withdrawal requests are typically processed promptly, and the funds arrive within a short period of time. WB covers the fees associated with wire transfers.

Q: What trading platforms does WB offer?

A: WB Corporation Limited offers the MetaTrader 4 (MT4) trading platform, known for its user-friendly operation, professional charting, and data analysis capabilities. There is also a mobile version of the platform available for both Android and iPhone devices.

Q: What trading tools does WB provide?

A: WB offers various trading tools, including updates on international financial news, market analysis specific to Asian, European, and American markets, commentary and analysis on financial topics, real-time forecasts, an economic calendar, and the option to subscribe to investment updates.

Q: How can I contact WB's customer support?

A: You can contact WB's customer support team via email at cs@wb100hk.com or by calling their hotline at 852-35808081. Additionally, WB provides a quick online account opening service on their website.

Keywords

- 5-10 years

- Suspicious Regulatory License

- White label MT4

- Regional Brokers

- High potential risk

Review 16

Content you want to comment

Please enter...

Review 16

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

FX3190909879

Hong Kong

Under the banner of poverty alleviation, they did shady things, frequently placing orders, causing slippage, closing trading accounts, and not allowing withdrawals. It’s a black platform fraud company.

Exposure

01-03

幸运蓝

Hong Kong

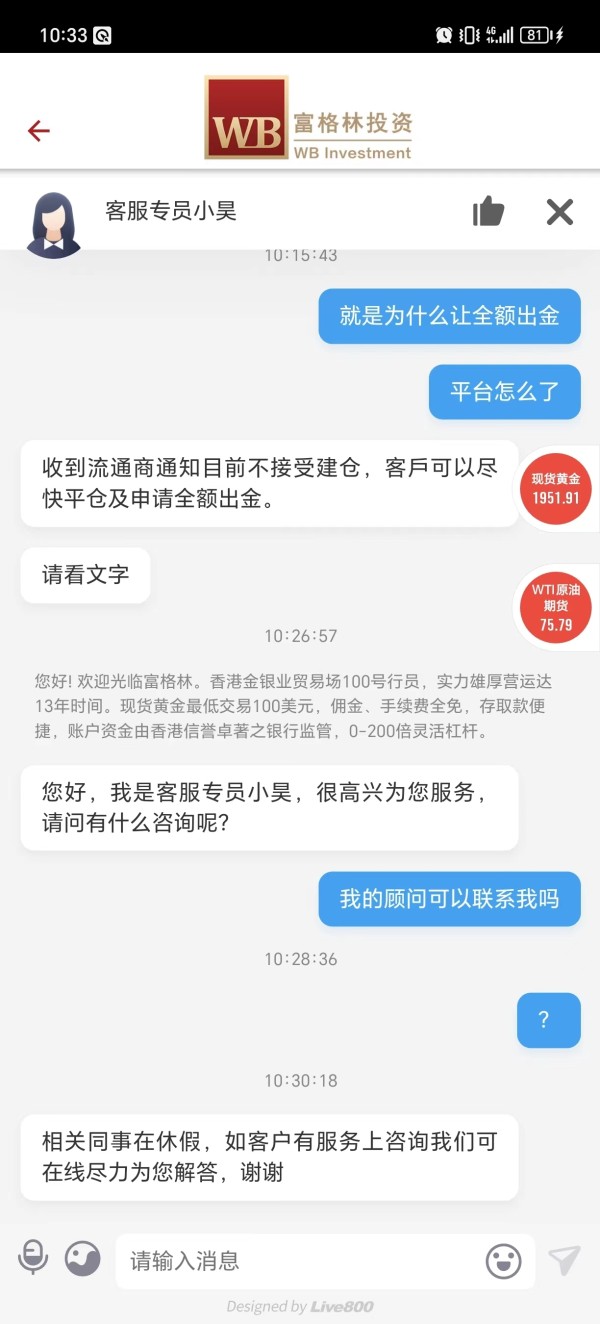

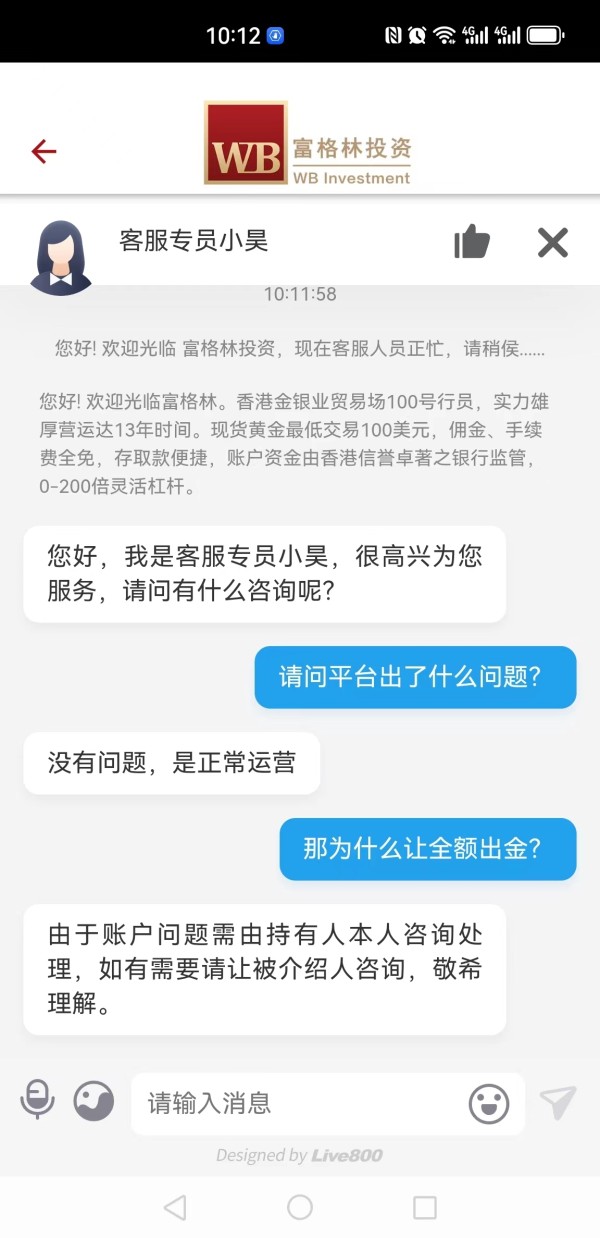

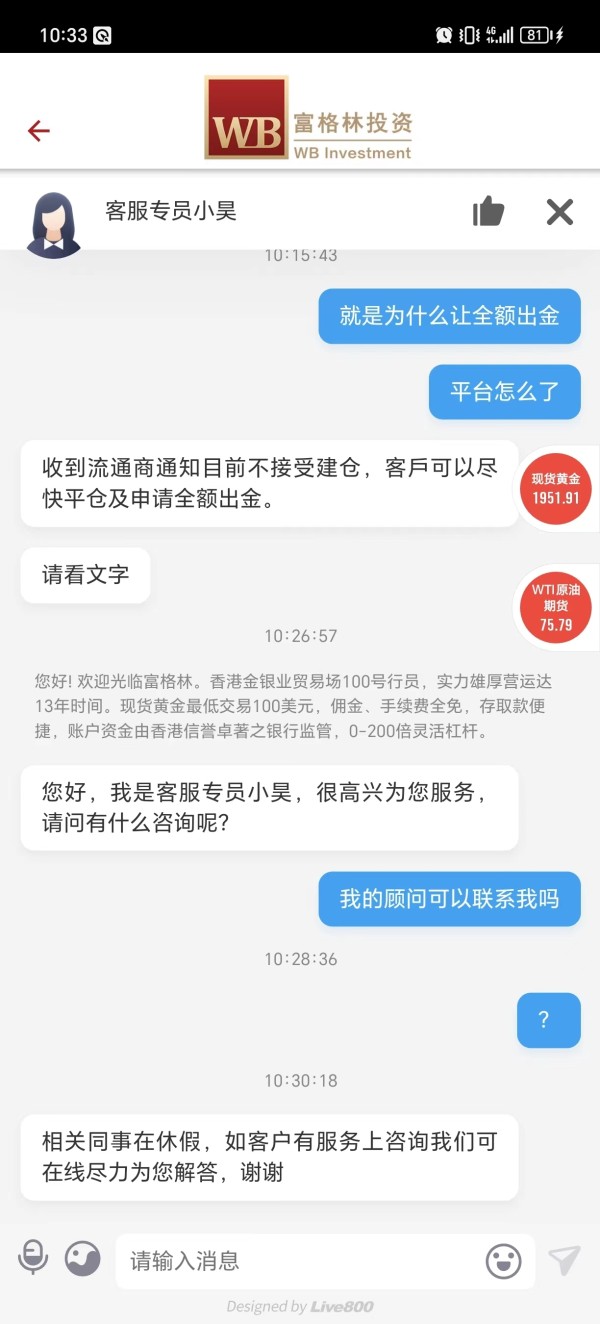

In the early morning of November 9, I suddenly couldn't place an order during the transaction. I went to ask the customer service, and the customer service told me, "I received a notice from the circulation dealer that positions are not accepted at the moment. You can close the position as soon as possible and apply for a full withdrawal." Then I withdrew the money and was told that I would have to wait 1-3 working days. They didn't want me to withdraw. The customer service was also irritating and the consultant couldn't be found. It felt like it was being delayed. They don't want me to withdraw money. Then it's the weekend and he can delay it even more.

Exposure

2023-11-09

Ginko

Hong Kong

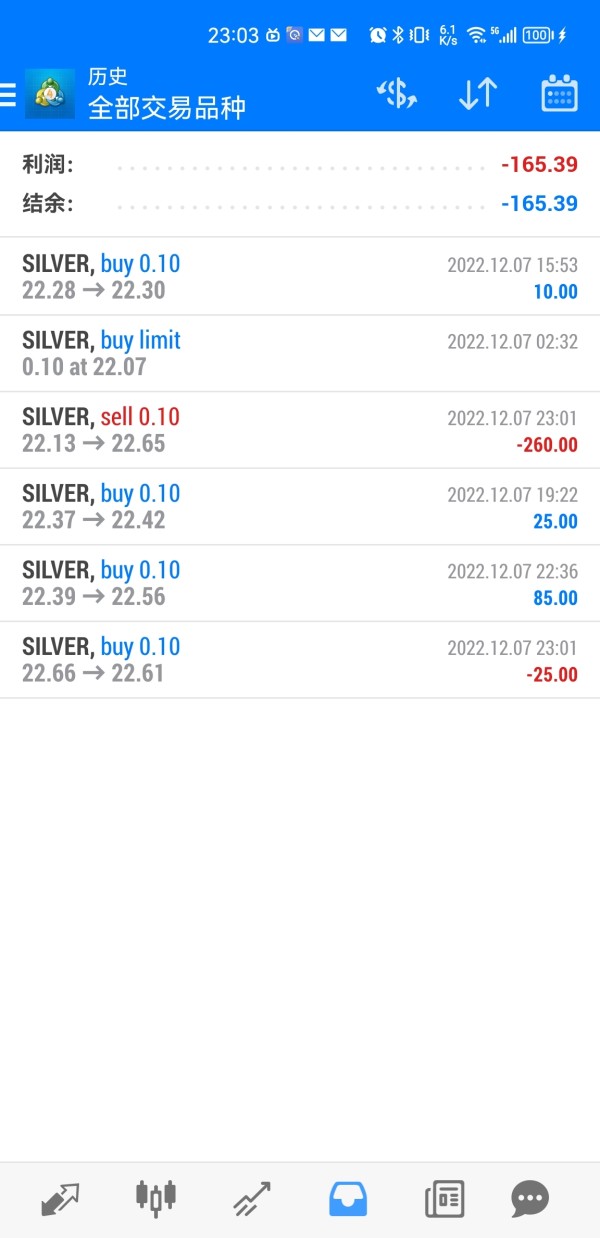

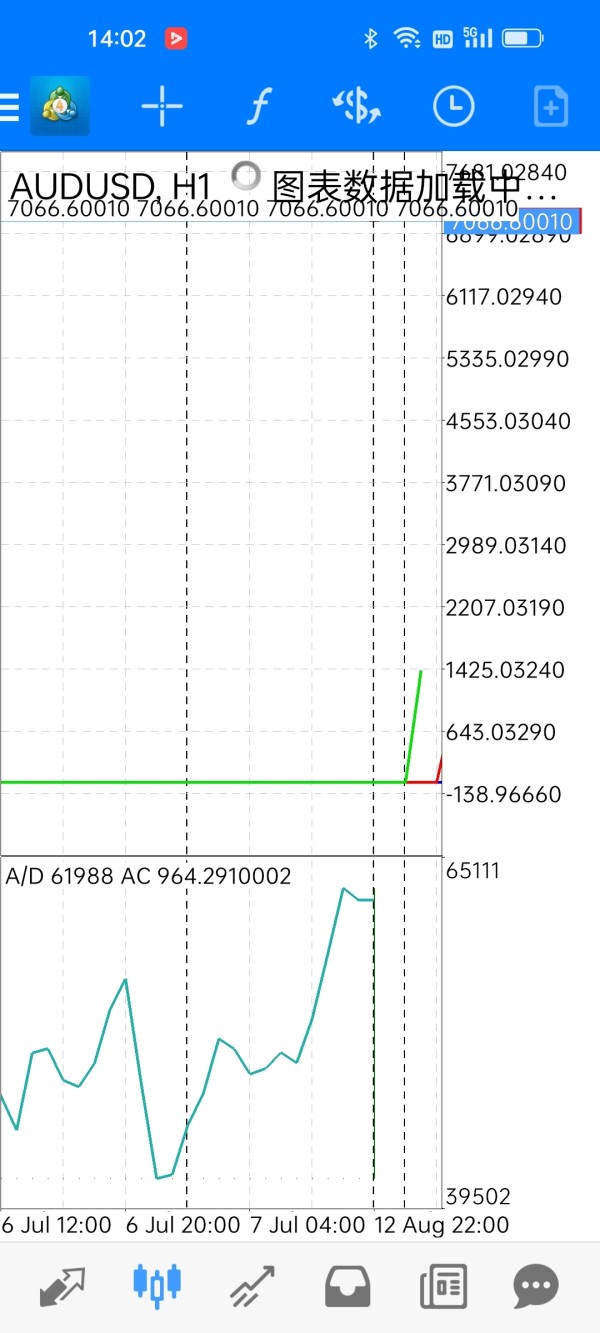

I mainly reported a few issues with WB: First, the platform’s profiteering spreads caused the “small fluactuation market”, investors “scalped” back and forth, and most of the profits were taken away by the platform. For WB's MT4 gold (marked as "GOLD" in the system), the spread of 0.1 standard lot is 5 dollars, and the spread of silver (marked as "Silver" in the system) is 20 dollars; every fluctuation of silver (0.01 dollars) is 5 dollars, while gold is $0.5; while spot silver (XAGUSD.S) of the same species only needs a spread fee of $15 in another platform CWG, and a fluctuation is $2.5, and gold (XASUSD.S) only needs 1.5 US dollar spread fee, a fluctuation of 0.1 US dollars, which is equivalent to 2 fluctuation and more expensive than silver, and 5 times more expensive than gold. Second, there are serious bug in the lock-up operation of the platform: I bought 0.1 lot of silver from Sell 22.13 on the WB mt4 platform. Due to the continuous rise in subsequent prices and the problem with the amount of my funds, I had to take the same amount to buy more Buy 0.1 lot of silver is 22.66, and because follow-up operations may have an impact on the long order, I closed the long position at 23:01 on 2022/12/07, with a loss of 25 US dollars, but the platform immediately triggered the stop loss, resulting in my empty order directly It was considered liquidated by the system and forced to close the position, and there was no money left in the end. Seriously affect subsequent operations

Exposure

2022-12-08

FX3190909879

Hong Kong

Under the banner of poverty alleviation, Hong Kong WB Co., Ltd. is doing shameful things. Illegal and frequent place orders and lags, freeze account and do not allow withdrawal.

Exposure

2022-10-29

FX3190909879

Hong Kong

Under the banner of poverty alleviation, Fuglin Co., Ltd. is doing shameful things. The customer service manager said that there are big non-agricultural markets and big market conditions, which will induce you to deposit funds, illegally and frequently call orders, freeze, slippage, freeze accounts, and do not allow withdrawals.

Exposure

2022-09-27

FX3190909879

Hong Kong

The No. 100 member platform of Fuggin is a fraud platform of fraudulent companies, which frequently calls for orders illegally casuing a serious loss of 420,000 yuan. The account is also frozen to prevent withdrawals. The account has been frozen for three months, just looking for an excuse to deny withdrawal. This kind of fraud platform should be seriously investigated

Exposure

2022-09-13

FX3190909879

Hong Kong

Under the banner of poverty alleviation, they do thing that illegal, and frequently call you to place orders illegally, resulting in a loss of 4.3 trillion yuan. The account is also frozen and the withdrawal is not allowed. Deposits and receipts are all from different private accounts and there are more than 30 bank cards. This is a scam company.

Exposure

2022-09-12

FX3190909879

Hong Kong

Freeze account, do not allow withdrawals, frequently call orders, lose 4.3 trillion fraud platform

Exposure

2022-09-12

火火59261

Hong Kong

Unable to withdraw. Freeze the account and deceive you to pay 20% margin.

Exposure

2022-07-31

FX2369035177

Hong Kong

Everything is gone, the data can be cleared by themselves, and deposits and withdrawals are all transferred via private accounts

Exposure

2022-07-05

FX2369035177

Hong Kong

Customer service calls and the National Anti-Fraud Center calls immediately, as long as the number starting with 000 is all liars

Exposure

2022-07-04

浮生若梦78729

Hong Kong

Their company keeps calling, not operating on their platform, and calling me an idiot once I lose money on other platforms. [d83d][de12] Junk platform, no wonder the rating is so low, the quality of customer service is desperately poor, you can see the whole story at a glance.

Exposure

2022-01-27

O࿆utsider༢59415

Hong Kong

I wanna withdraw funds last night but I haven’t received the money yet. Am I cheated?

Exposure

2021-04-14

。4825

Hong Kong

I was asked to pay a margin within one hour before making withdrawals. Otherwise, my account will be banned.

Exposure

2020-07-15

高端装饰设计公司

Hong Kong

The analyzer of WB gave frequent order recommendations,saying that one can double profits in the coming cocking market of non-farm payrolls and EIA.There was often light profits and heavy losses by following the instruction.Until having lost of $18000,did I disilluded! When I argued with the customer service for their illegal order recommendation,which led to clients’ losses,and asked for compensation,I was ignored.I has to call the police,while they locked my account! Absolute fraud platform! My fellow victims,call the police to report it together!

Exposure

2019-09-06

高端装饰设计公司

Hong Kong

The order recommendation given by the teacher in WB led to clients’ great losses.When clients inquired about it,their accounts were blocked by the platform directly!

Exposure

2019-09-04