Score

Fidelity

Japan|15-20 years|

Japan|15-20 years| https://www.fidelity.jp/

Website

Rating Index

Influence

Influence

B

Influence index NO.1

Japan 8.25

Japan 8.25Surpassed 79.80% brokers

Contact

Licenses

Single Core

1G

40G

Contact number

+81 0120-140-460

Other ways of contact

Broker Information

More

Fidelity Securities Co., Ltd

Fidelity

Japan

Pyramid scheme complaint

Expose

Check whenever you want

Download App for complete information

WikiFX Verification

Users who viewed Fidelity also viewed..

XM

ATFX

FP Markets

Vantage

Sources

Language

Mkt. Analysis

Creatives

Fidelity · Company Summary

| Fidelity Review Summary | |

| Company Name | Fidelity Securities K.K |

| Founded Year | 1998 |

| Registered Country/Region | Japan |

| Regulation | FSA (Regulated) |

| Trading Products | Investment Trusts (Funds), Stocks, ETFs/ETNs, REITs, NISA |

| Commission | 0% |

| Customer Support | Phone: +81 0120-140-460; 0120-405-606 (Weekdays 8:30-17:00); Facebook |

| Company Address | 東京都港区六本木7丁目7番7号 |

| Language Supported | Japanese Only |

What is Fidelity?

Fidelity Securities Co., Ltd, a significant player in the financial trading landscape, founded in 1998, is a part of the prominent global asset management group, Fidelity International. Recognized and regulated by the Japanese Financial Services Agency (FSA), it can offer a relatively high security level. Fidelity Securities exclusively supports the Japanese language as its mode of communication, tailored to meet the needs of its largely local clientele.

Pros & Cons

| Pros | Cons |

|

|

|

|

|

Pros:

Experienced Broker: With a history spanning 15 to 20 years, Fidelity Securities brings substantial experience to the table. This wealth of experience speaks not only of their expertise in the financial market but also provides reliability and trust for their clients.

Regulated by FSA: Being regulated by the FSA or the Japanese Financial Services Agency assures clients that the company complies with strict financial rules and regulations, thereby offering a higher level of financial protection to its clients' investments.

Featured “0 Online Plan”: A unique feature offered by Fidelity Securities is the “0 Online Plan.” This might imply that the company offers a 0% commission fee scheme for certain online transactions. This could potentially enable clients to save on their trading costs.

Cons:

Website Supports Only the Japanese Language: The company's website supporting only the Japanese language limits its accessibility to non-Japanese-speaking clients. This could possibly hinder the broker's ability to reach broader client demographics.

Is Fidelity Safe or Scam?

Fidelity Securities Co., Ltd is authorized and regulated by the Japanese Financial Services Agency (FSA), one of Japan's primary financial regulatory bodies. The company holds a Retail Forex License (Regulated), with license number 関東財務局長(金商)第152号, as issued by the Financial Services Agency.

The company's regulatory status came into effect on September 30, 2007, and is currently in good standing. Though the expiry date and specific contact details of the licensed institution are not mentioned, the company's address is listed as 東京都港区六本木7-7-7, and the company can be reached at the phone number 03-4560-5000.

Also, 6iTrade has implemented several security measures. These include:

Separate Management of Customer Assets: 6iTrade employs a system for the separate management of customer assets. This ensures that customer funds are kept distinct from the company's own operational funds, reducing the risk of misappropriation or misuse.

Participation in Investor Protection Funds: 6iTrade participates in Investor Protection Funds, which serve as a financial safety net for investors. These funds can provide compensation to eligible investors in case of insolvency or financial difficulties faced by the brokerage.

Japan Investor Protection Fund: Specifically, 6iTrade mentions its involvement with the Japan Investor Protection Fund. This is an additional layer of protection for customers trading on the Japanese market. In the event of unforeseen circumstances, this fund can help safeguard customer investments.

Services

Fidelity Securities Co., Ltd specializes in the selling of investment trusts to retail investors. As such, the company has proved its proficiency and commitment to helping its clients diversify their portfolios through investment trusts.

Though Fidelity Securities does not operate any retail branches, it places a high priority on client service. To accommodate any queries or issues, Fidelity has assembled a dedicated customer service team located at their headquarters in Minato-ku, Tokyo. This team is responsible for assisting clients and providing the necessary information and support that clients might need in their investment journey.

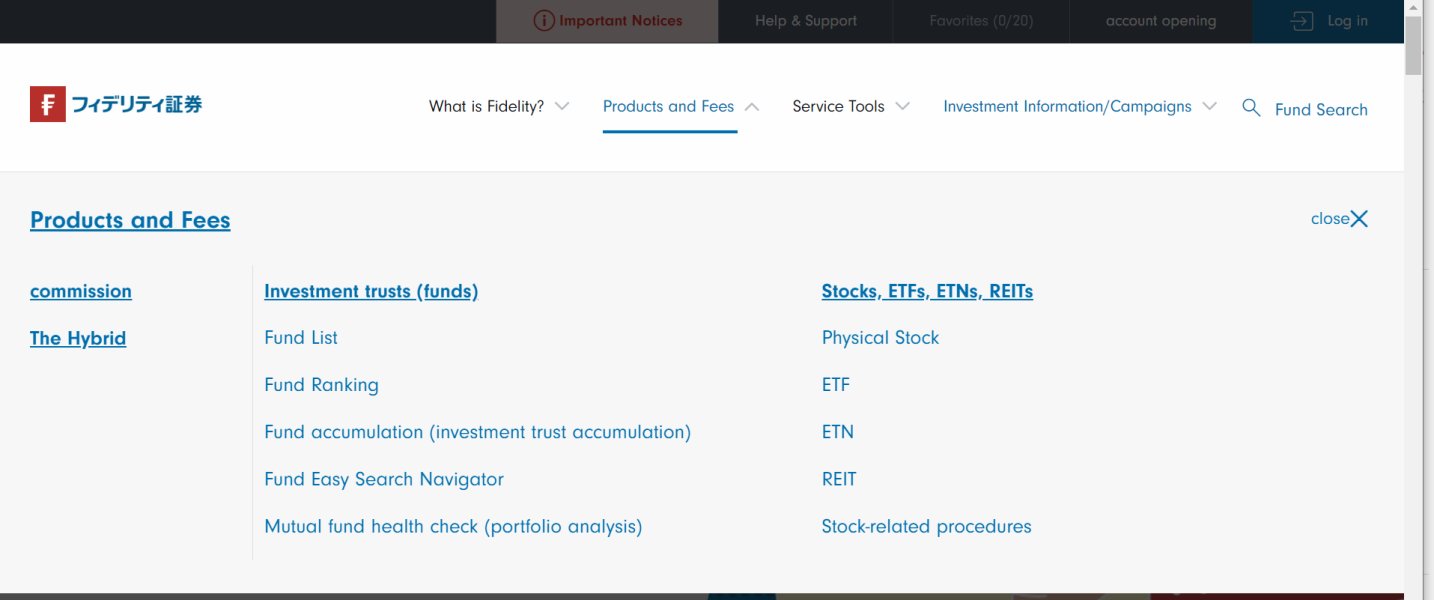

Trading Products

Investment Trusts (Funds): These allow investors to pool their money together to invest in a diverse portfolio of stocks, bonds, or other assets managed by professional fund managers.

Stocks: Fidelity provides an extensive selection of domestic and international stocks, allowing investors to buy ownership shares in individual companies.

ETFs/ETNs (Exchange-Traded Funds/Notes): These are investment funds traded on stock exchanges. ETFs typically aim to track the performance of specific indexes. ETNs, meanwhile, are unsecured debt securities that track an underlying index of securities and trade on major exchanges like a stock.

REITs (Real Estate Investment Trusts): These are companies that own, operate, or finance income-producing real estate. They offer a way for investors to earn returns from real estate without having to buy, manage, or finance the property themselves.

NISA (Nippon Individual Savings Account): A tax-exemption scheme in Japan, NISA allows residents to invest in designated investment products such as stocks and mutual funds without having to pay taxes on dividends and capital gains for a certain period.

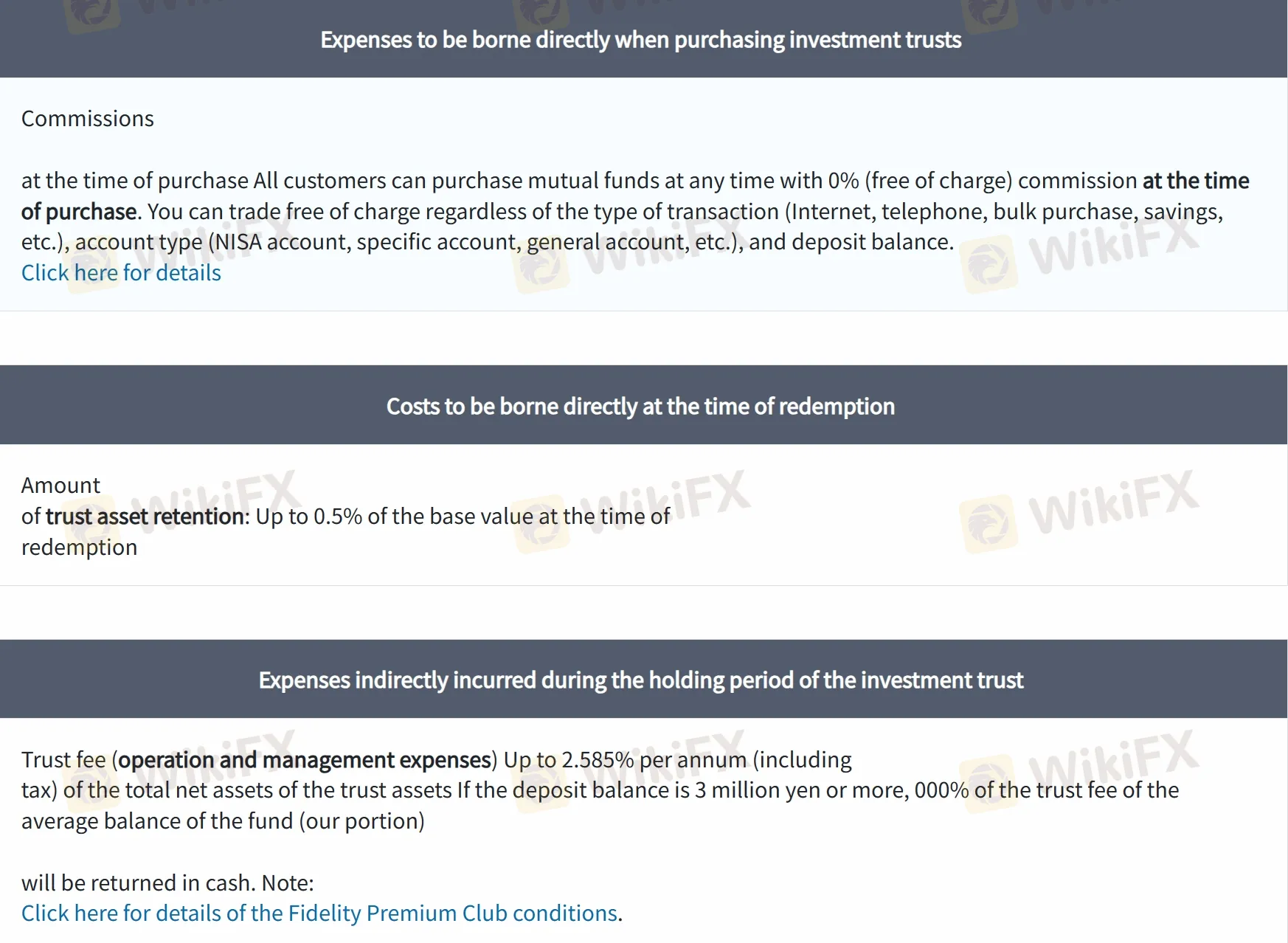

Commissions & Fees

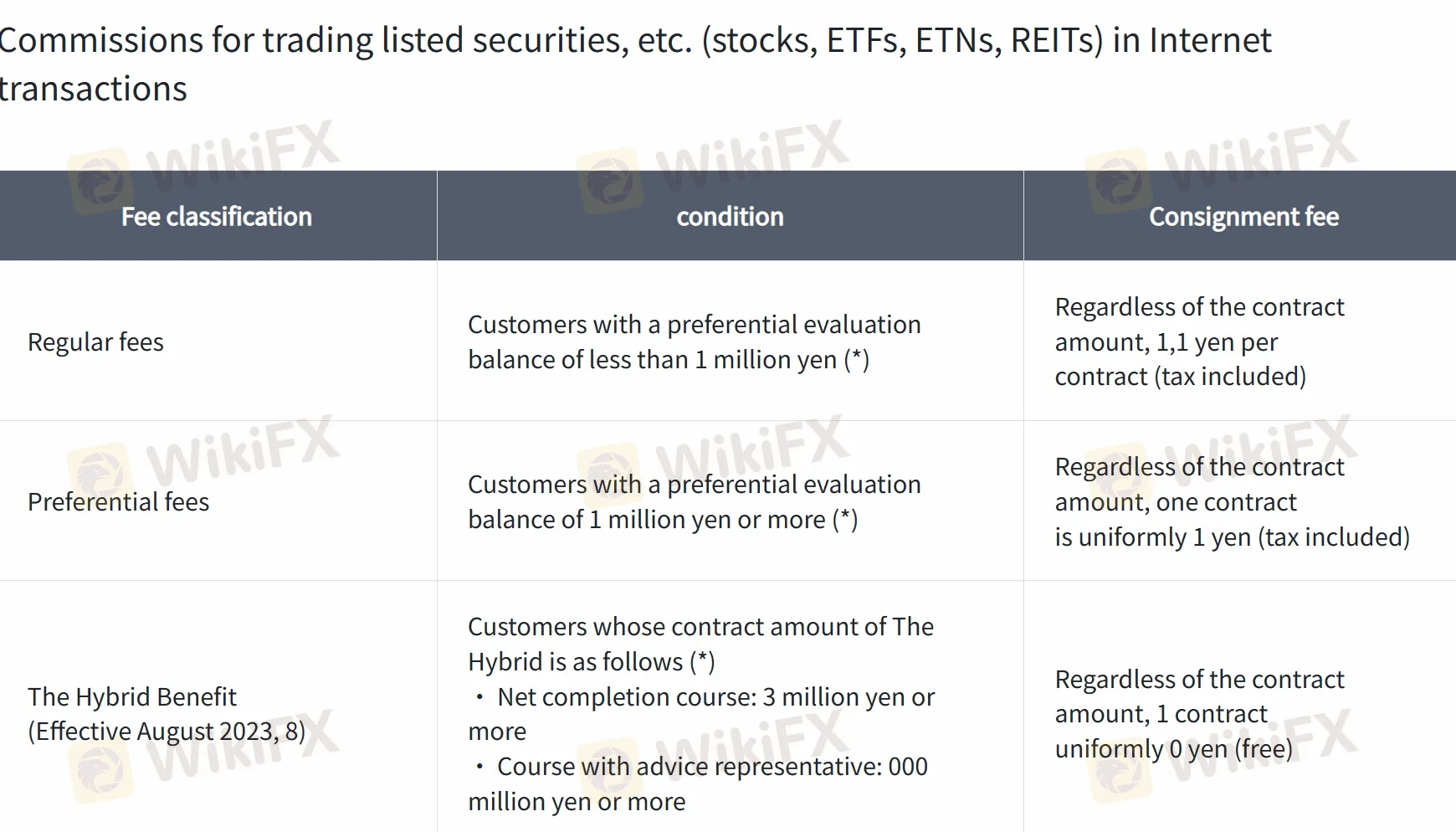

| Fee Classification | < 1 million yen balance | >= 1 million yen balance | The Hybrid Customers |

| Consignment Fee | 1,1 yen per contract | 1 yen per contract | 0 yen (free) |

| Purchase of Investment Trusts | 0% commission (free of charge) | ||

| Redemption of Investment Trusts | Up to 0.5% of the base value at redemption | ||

| Trust Fee (operational and management expenses) | Up to 2.585% per annum of the total net assets | Based on the average balance of the fund | |

Please note, that redemption fees and trust fees apply to all customers regardless of their preferential evaluation balances or the type of customer they are (regular, preferential, or hybrid customers). All customers can purchase mutual funds with a 0% commission.

0% Online Plan

The “0% Online Plan” is a distinctive service offered by Fidelity Securities Co., Ltd. This service essentially enables clients to buy mutual funds online without incurring any commission fee, thus providing significant cost benefits. Notably, there is no restriction on the duration for which clients can avail of this plan.

To begin utilizing this 0% Online Plan, clients are required to complete a paperless trading process. This digital trading process not only eliminates the hassle of handling physical documents but also streamlines the overall trading experience.

Service Hour

Fidelity Securities Co., Ltd provides comprehensive customer service. Their skilled and accommodating customer service team assists clients in navigating over 600 mutual fund offerings from more than 40 management companies, and their customer service hotline, 0120-140-460, is operational from 8:30 a.m. to 6:00 p.m. on weekdays.

Customer Support

For prospective customers: Those who do not have an account with Fidelity Securities and need inquiries about account opening procedures, products, campaigns, etc. can call at 0120-140-460 on weekdays between 8:30-17:00 or email at cs@fidelity.co.jp.

For existing customers: Those who have an account with Fidelity Securities and need queries about transactions by phone or how to use the 'My Page', can reach out at 0120-405-606 from weekdays between 8:30-17:00 or email at cs@fidelity.co.jp.

Fidelity also maintains a presence on Facebook, providing an additional point of contact and a way to keep up-to-date with news and updates.

Conclusion

In summary, Fidelity Securities Co., Ltd leverages its years of experience, regulatory backing, and a strong parent company to offer reliable and trusted financial trading services predominantly to the Japanese market.

Frequently Asked Questions (FAQs)

Q: What languages are supported by Fidelity?

A: The company supports only the Japanese language.

Q: What regulatory agency is Fidelity regulated by?

A: The firm is authorized and regulated by the Japanese Financial Services Agency (FSA).

Q: Are there any fees associated with opening or managing an account with Fidelity?

A: No, the company does not charge any fees for opening or managing an account.

Q: Is it safe to trade on Fidelity?

A: Since its regulatory status is currently in good standing, combined with the security measures it applies, we can say it is relatively safe to trade on Fidelity.

Risk Warning

Online trading involves significant risk, and you may lose all of your invested capital. It is not suitable for all traders or investors. Please ensure that you understand the risks involved and note that the information provided in this review may be subject to change due to the constant updating of the company's services and policies.

In addition, the date on which this review was generated may also be an important factor to consider, as information may have changed since then. Therefore, readers are advised to always verify updated information directly with the company before making any decision or taking any action. Responsibility for the use of the information provided in this review rests solely with the reader.

News

NewsTo Attract Younger Investors, Fidelity has Opened a Building in the Metaverse

The Fidelity Stack was developed on Decentraland, a web application that simulates a city, complete with commerce areas, offices, and event spaces. It is available to everyone, however, the age range is 18-35. Fidelity established the Fidelity Metaverse ETF as part of the "Fidelity Stack," providing investors with access to firms engaged in virtual environments such as the metaverse, where users may work, interact, and play on various devices.

WikiFX

WikiFX

NewsThe Easiest Ways to Become Rich in the Stock Market

Investing in the stock market is one of the finest methods to build money around the globe. One of the stock market's key advantages is that there are several methods to benefit from it.

WikiFX

WikiFX

NewsFidelity Bank sensitizes customers on emerging opportunities in FX

The Central Bank of Nigeria’s (CBN) efforts towards actualising $200 billion in Foreign Exchange (FX) repatriation from non-oil exports over the next five years have been given a major boost with a recently held workshop for exporters and investors in Akure, Ondo State.

WikiFX

WikiFX

Review 2

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now