Many Forex brokers require a minimum deposit to open a live trading account. Higher minimum deposits are often associated with premium accounts, while lower deposits are used to attract new customers.

Low-deposit brokers are ideal for beginners, and they provide quick and easy access to financial markets. Unlike many platforms that require thousands, these brokers often have minimal or no cash requirements. We'll discuss their benefits and drawbacks, along with top choices.

A low-deposit account lets you test the broker's platform without significant investment. You can also use it to live-test trading strategies in real market conditions. What's more, low-deposit brokers allow you to diversify your risk by allocating smaller amounts to multiple strategies or brokers.

7 Best Forex Brokers with $10 Minimum Deposit

- Provides unlimited leverage suitable for high risk strategies.

- Offers very competitive spreads to clients.

- Supplies access to a broad variety of tradable asset classes.

- Maintains top-tier 24/7 multilingual customer service support.

- Operates innovative copy trading platforms to mirror expert portfolios.

- Streamlined interface allowing effortless access for trading beginners.

more

Comparison of the Best Forex Brokers with $10 Minimum Deposit

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Best Forex Brokers with $10 Minimum Deposit Overall

| Brokers | Logo | Why are they listed as the Best Forex Brokers with a $10 Minimum Deposit? |

|

✅ A well-established broker, trusted and reputable, with a solid operation for years. ✅$10 trading account allows access to more products with lower fees. |

|

|

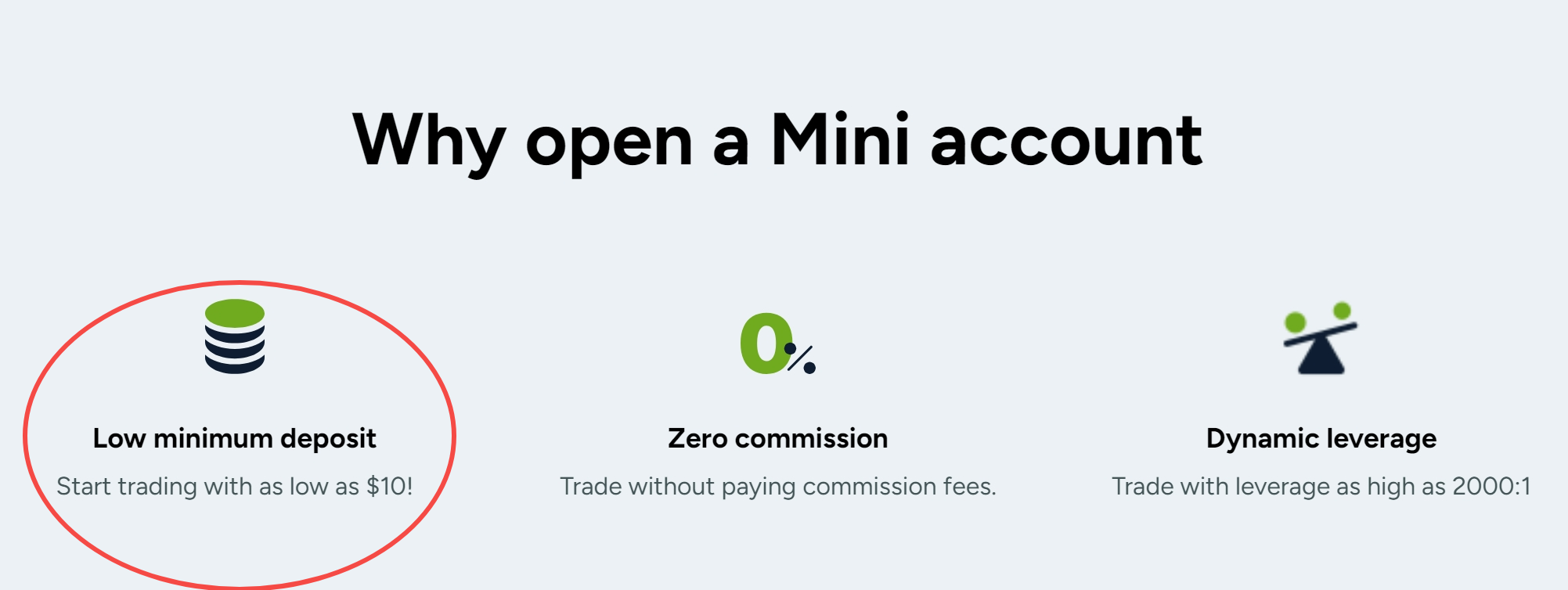

✅ Heavily regulated, sharing extremely competitive FX trading fees, copy trading allowed. ✅ $10 Mini account providing access to over 50 tradable products, trading wthout paying commissions. |

|

|

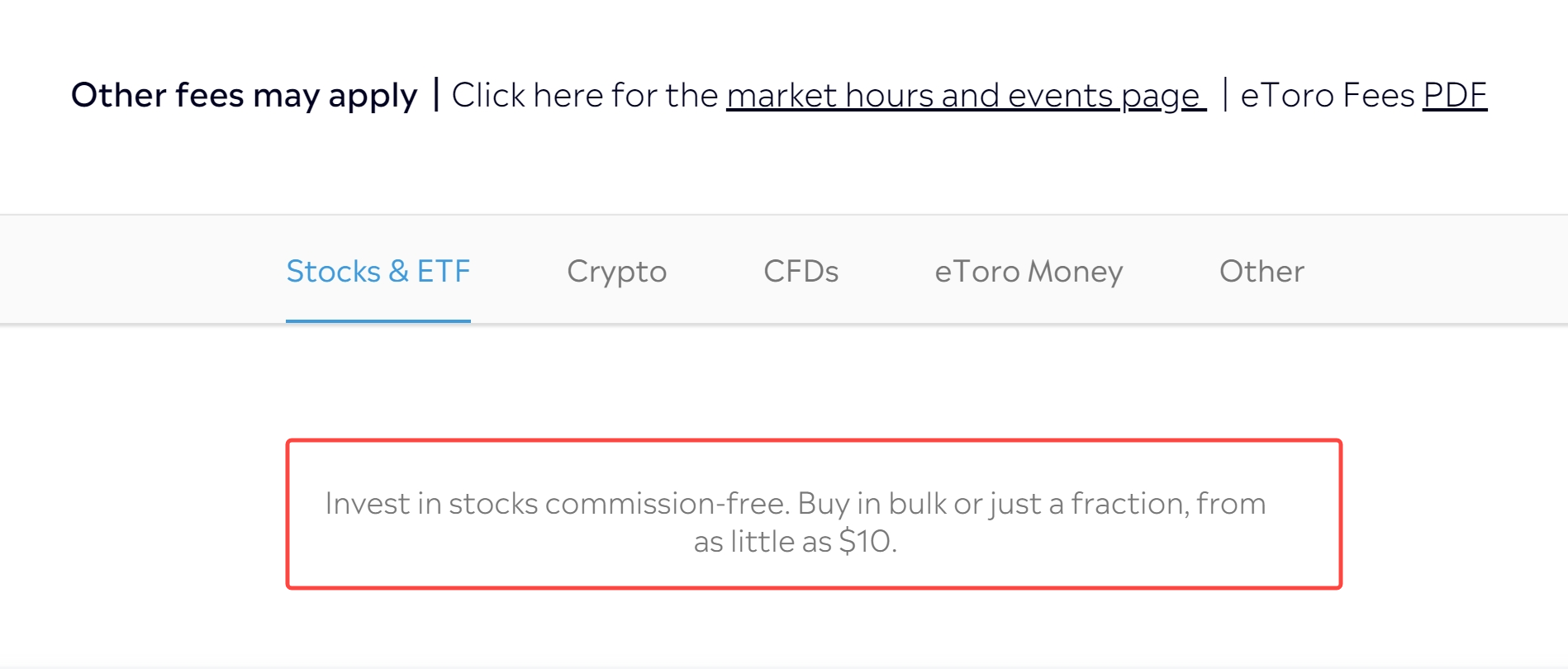

✅An innvoative social trading platform that has wonmillions of traders' hearts. ✅$10 to enter real markets,trading in an extremly superb trading environment. |

|

|

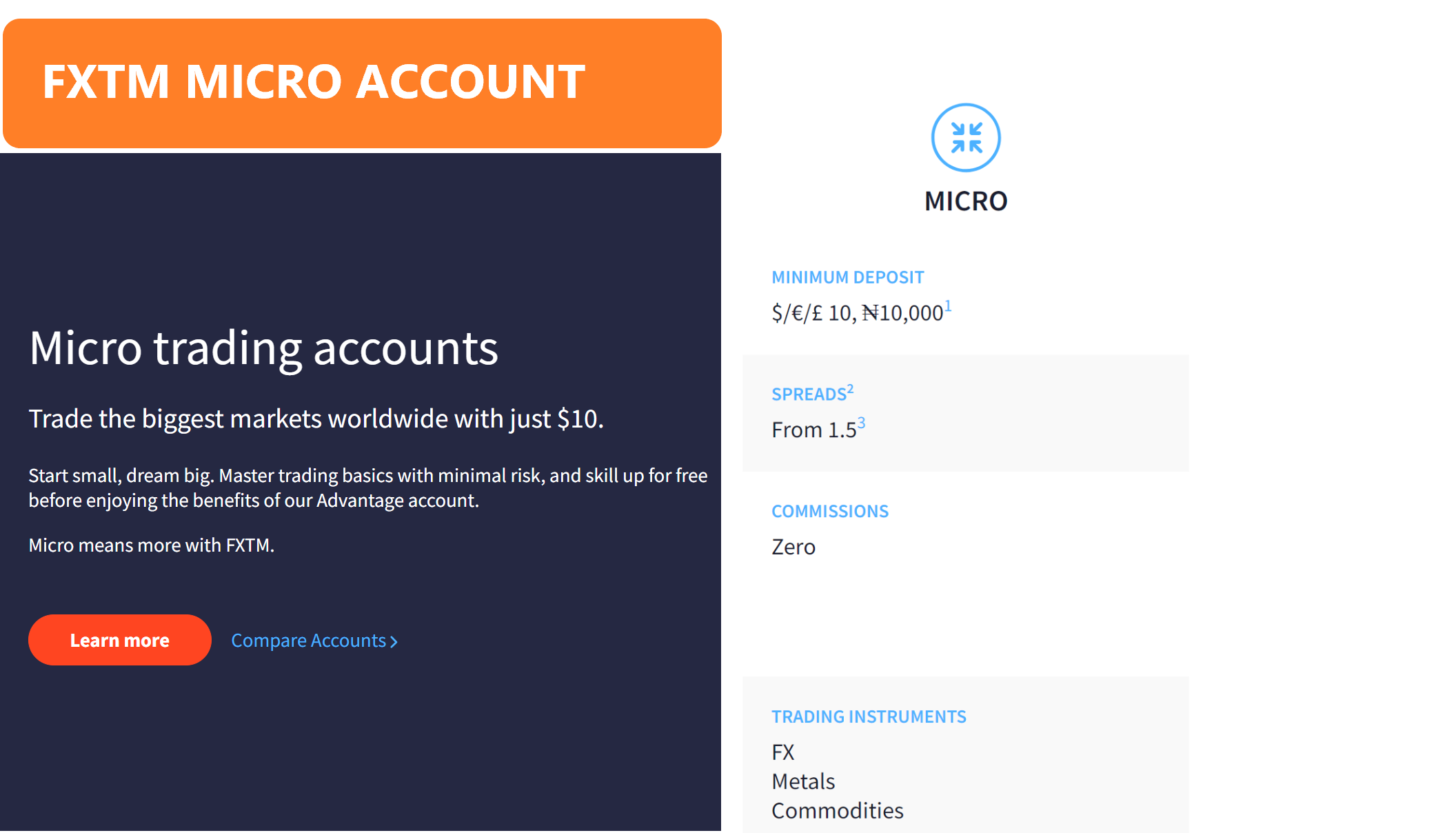

✅Operating under tier-1 and tier-2 regulations, featuring its own copy trading solutions. ✅$10 to trade on FX, metals, and commodities makets, enjoying zero-commisson trading. |

|

|

✅ A trusted broker offering solid educational content, competitive trading fees. ✅ $10 to trade all assets on its platform, spreads from 1.3 pips, no commissions. |

|

|

✅A solid broker operating for years, always offering competitive trading conditions. ✅Only $10 to open an account across multiple types, giving traders the biggest choices. |

|

|

✅Regulated by CYSEC, offering services to most countries. ✅$10 trading accounts, granting access to full assets with competitive trading fees. |

Overview of Best Forex Brokers with $10 Minimum Deposit

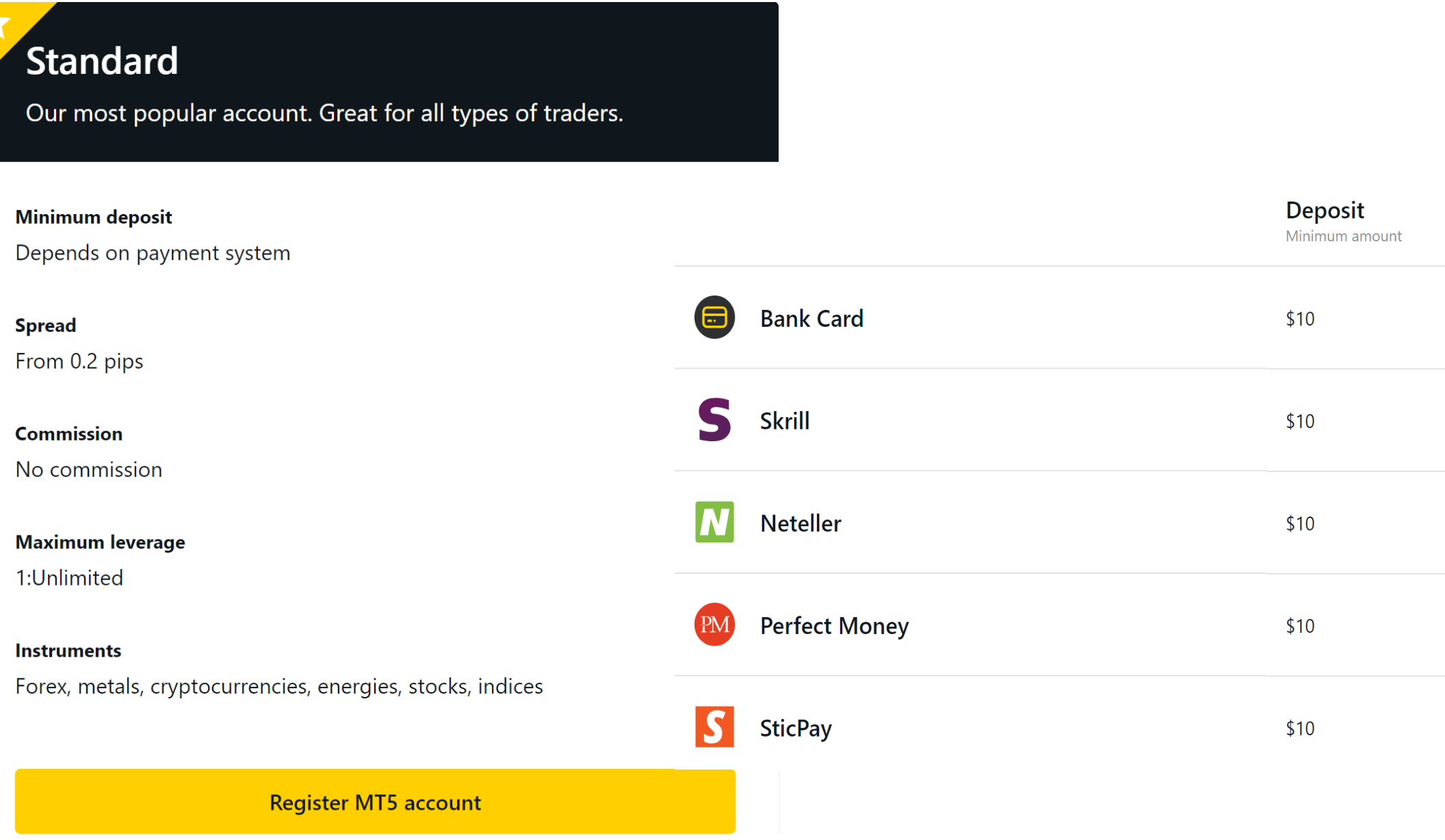

Exness- Best $10 Minimum Deposit Broker for Solid Educational Contents

Broker |

|

Regulated by |

CYSEC (Cyprus), FCA ( UK), FSCA (South Africa), FSA (Seychelles) |

Min.Deposit |

$10 |

Tradable Instruments |

Forex CFD, Stock CFD, Commodities CFD, Stock CFD, Indices CFD, Crypto CFD |

Trading Platform(s) |

Exness Trade App, Exness Terminal, MT4, MT5, MetaTrader WebTerminal, MetaTrader Mobile |

Leverage |

1:Unlimited |

Trading Fees |

Spreads from 0 pips, with commissions from $0.2 each side per lot |

Payment Methods |

VISA, MasterCard, Skrill, Neteller |

Copy Trading |

✅ |

Bonus |

No |

Customer Support |

7/24 |

Pros |

✅Heavily regulated, a well-established broker with solid reputation ✅Low minimum deposit for standard accounts, unlimited leverage ✅ Convenient deposit & withdrawal, 7/24customer support in 13 languages ✅Copy trading solutions ✅Fast trade execution speeds and high liquidity access |

Cons |

❌ Mostly focused on FX and CFDs ❌ Lacks phone support |

Exness is an online forex and CFD brokerage founded in 2008 that allows clients to trade on popular CFD products, including Forex CFD, Stock CFD, Commodities CFD, Stock CFD, Indices CFD, Crypto CFD. To keep competitive, XM has also introduced copy trading soloutions, allowing traders to follow trading strategies of successful traders. Known for its focus on technology, Exness offers various trading features like an Economic Calendar, Forex Analytics, Autochartist, and MT4 Virtual Hosting.

One major advantage Exness offers traders is low minimum deposits, which start at just $10 across all standard accounts. The $10 minimum can be met through various payment methods including credit/debit cards, e-wallets like Neteller, wire transfers, and more. By keeping initial deposits low, Exness allows more aspiring traders to open accounts and access global trading opportunities.

ThinkMarkets-Best $10 Minimum Deposit Broker for Strong Regulation

Broker |

|

Regulated by |

ASIC (Australia), FSA (Japan), FCA (UK), CYSEC (Cyprus), FSA (Seychelles) |

Min.Deposit |

$10 |

Tradable Instruments |

Forex, Indices, Precious Metals, Cryptocurrency, Share CFDs, CFDs, Commodities |

Trading Platform(s) |

MT4, MT5, ThinkPortal, ThinkTrader, ThinkCopy |

Leverage |

2000:1 |

Trading Fees |

Spreads on eur/usd pair from 0.0 pips |

Payment Methods |

Visa, MasterCard, Swift SEPA, Skrill, Neteller, Cryptos, Google Play, Perfect Money, and more |

Copy Trading |

✅ |

Bonus |

No |

Customer Support |

7/24 |

Pros |

✅ Access to CFDs on 4,000 tradable instruments ✅Offering ThinkCopy for copy trading solutions ✅Low trading fees on FX trading ✅Useful trading tools, including signal center |

Cons |

❌Limited product portfolios |

ThinkMarkets is an established global multi-asset brokerage founded in 2010 that provides access to 50+ currency pairs, global indices, commodities, metals, and cryptocurrencies. Traders can get access to popular platforms such as MetaTrader 4 & 5, as well as proprietary platform called ThinkTradertrader CFDs on global financial markets. One stand-out offering is ThinkCopy, which allows novice investors to automatically mimic profitable traders. Traders can also take advantage of leverage rates up to 1:500 depending on their region and instrument.

ThinkMarkets offers a Mini account with a minimum deposit of just $10. Despite the small initial outlay, Mini account holders still gain access to over 50 tradable instruments including all major forex pairs, commodities like oil and gold, leading global stock indices, and major digital currencies.

eToro-Best $10 Minimum Deposit Forex Broker for Copy Trading and Crypto Trading

Broker |

|

Regulated by |

ASIC (Australia), CYSEC (Cyprus), FCA (UK) |

Min.Deposit |

$10 |

Tradable Instruments |

51 Currencies, 4127 Stock, 32 Commodities, Cryptocurrency, 21 Indices, 421 ETFs, 74 Crytos |

Trading Platform(s) |

eToro App, Social Trading Platform |

Leverage |

500:1 |

Trading Fees |

Low and transparent fees, 0% commissions on stock |

Payment Methods |

Credit/Debit Card, Bank Transfer, Klarna, Sofort, E-Wallets, eToro Money, Trustly |

Copy Trading |

✅ |

Bonus |

No |

Customer Support |

7/24 |

Pros |

✅ Access to 3,000 tradable instruments ✅An execellent platorm for copy trading and crypto trading ✅0% commissions on stocks ✅Advanced trading features in its mobile app |

Cons |

❌No crypto to crypto trading pairs ❌Only one single account ❌FX conversion, inactivity fees apply ❌$5 fixed withdrawal fees |

eToro is a multi-asset investment platform founded in 2007 that allows users to invest in stocks, ETFs, currencies, cryptocurrencies, and CFDs. eToro stands out for its social trading features, including CopyTrader, which enables novice investors to copy the strategies used by top performing traders on the network. Beyond accessing global markets, users also benefit from innovative offerings like eToros virtual portfolio capability that allows practice trading using real market data.

For those eager to start exploring financial markets, eToro has a very low barrier to entry requiring a minimum deposit of just $10 to start live trading stocks, crypto, or other assets. With the small account minimum, new eToro users can experiment with investing strategies in a low-risk environment using real money.

FXTM-Best $10 Minimum Deposit Forex Broker for Stock Trading

Broker |

|

Regulated by |

CYSEC (Cyprus), FCA (UK) |

Min.Deposit |

$10 |

Tradable Instruments |

Forex, Spot Metals, CFD Commodities, Stock Trading, Stock CFDs, CFD on Indices, Crypto CFDs |

Trading Platform(s) |

MT4, MT5, Mobile Trading |

Leverage |

2000:1 |

Trading Fees |

Low and transparent fees, 0% commissions on stock |

Payment Methods |

Credit/Debit Card, Bank Transfer, Klarna, Sofort, E-Wallets, eToro Money, Trustly |

Copy Trading |

✅ |

Bonus |

No |

Customer Support |

7/24 |

Pros |

✅ Strong regulated, offering solid educational contents ✅ FXTM INVEST for copy trading ✅ Tiered trading accounts, plus demo accounts ✅ Competitive spreads on advtange account |

Cons |

❌ High CFD fees |

FXTM is a leading global forex and CFD broker founded in 2011 offering exposure to over 1,000 trading instruments acrossForex, Spot Metals, CFD Commodities, Stock Trading, Stock CFDs, CFD on Indices, Crypto CFDs. Traders can utilize FXTM's industry-leading trading platforms including MT4 and MT5 or copy successful traders via their unique FXTM Invest service.

Catering to novice traders and those with limited capital, FXTM offers a Micro Account that can be opened with just $10. Despite the low barrier to entry, the account provides access to all major asset classes including forex, metals, and commodities as well as educational resources and full customer support. Micro account holders also retain access to FXTMs entire suite of platforms and trade copy tools.

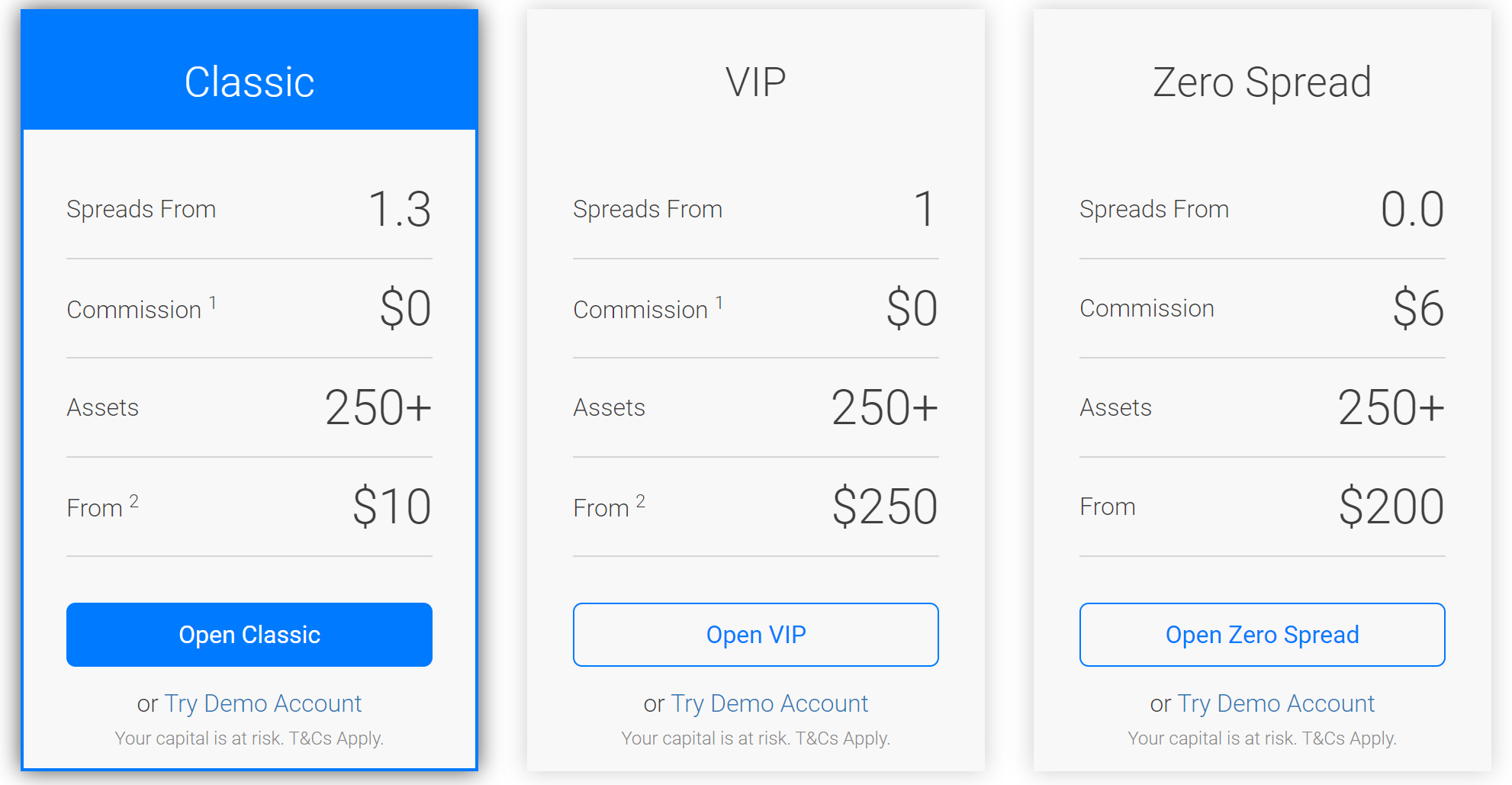

BDSWISS-Best $10 Minimum Deposit Forex Broker for Robust Trading Tools

Broker |

|

Regulated by |

CYSEC (Cyprus), FSA (Seychelles) |

Min.Deposit |

$10 |

Tradable Instruments |

Forex, Commodities, Shares, Indices, Cryptocurrencies |

Trading Platform(s) |

MT4, MT5, BDSwiss Mobile App, BDSwiss WebTrader |

Leverage |

Default Leverage up to 1:400 Dynamic Leverage up to 1:2000 |

Trading Fees |

Spreads from 0.0 pips, commissions at $6 per lot on Zero spread account |

Payment Methods |

Visa, MasterCard, Skrill, Neteller, Bank Transfer, Cryptos, Online Banking, Astropay, and many more. |

Copy Trading |

✅ |

Bonus |

No |

Customer Support |

5/24 |

Pros |

✅ A well-established broker under strong regulation of CYSEC ✅ Comprehensive trading tools ✅ No fees on deposit or withdrawals via credit card ✅ Professional trading academy, offering solid educational materials |

Cons |

❌ Instant withdrawal only for 2,000 €/$/£ credit card withdrawals ❌ Personal account manager service needs a deposit of at least $1,000 ❌ 5/24 customer support ❌ A monthly fee of $30 charged for no trading activity for over 90 consecutive days |

BDSwiss is an award-winning forex and CFD brokerage founded in 2012 that grants access to over 250 trading instruments across Forex, Commodities, Shares, Indices, Cryptocurrencies. Focusing on being a solid and client-oriented broker, BDSwiss shines at providing various quality educational contents including research and analysis, advanced trading tools, as well as a trading academy.

Those eager to test out trading have a low barrier of entry with BDSwiss. Opening a Classic Account requires just a $10 initial deposit which grants access to the full suite of platforms, training materials all over 250 assets. Within this account, traders can enjoy a zero-commission trading environment, with spreads from 1.3 pips. Along with the live markets, traders can also try demo trading and draw on a deep library of educational resources focusing on forex and CFD fundamentals.

RoboForex-Best $10 Minimum Deposit Forex Broker for Bonus Programs

Broker |

|

Regulated by |

CYSEC (Cyprus), FSC (Belize), NBRB (Belarus) |

Min.Deposit |

$10 |

Tradable Instruments |

Stocks, ETFs, Metals, Indices, Currencies, Futures, Energy Commodities |

Trading Platform(s) |

R StocksTrader, R MobileTrader/R WebTrader, MT4, MT5 |

Leverage |

500:1 |

Trading Fees |

Low spreads, commissions apply for ECN account |

Payment Methods |

Bank Transfers (SEPA), Local Bank Transfer, Bank Cards, Astropay, Skrill, Neteller, Perfect Money, STICPAY, QR & Vouchers |

Copy Trading |

✅ |

Bonus |

$30 welcome bonus |

Customer Support |

5/24 |

Pros |

✅ Four types of trading accounts can be opened for just $10 ✅ Multiple advanced trading platforms offered ✅ A$30 no deposit bonus, as well as other generous bonus programms ✅Advanced copy trading system |

Cons |

❌No deposit bonus not available with many account types ❌ Tradable instruments with ProCent limited to currencies and metals only |

RoboForex is an online brokerage focused on forex and CFD trading that was founded in 2009. Traders can access over 12,000 instruments spanning currency pairs, crypto, commodities, stocks and indices through the brokers suite of MetaTrader platforms, as well as its proprietary trading platforms like R StocksTrader, R MobileTrader/R WebTrader. Besides, RoboForex offers social trading via its CopyFX tool, which allows copying strategies from expert traders. RoboForex also shines at providing generous bonus programms, including $30 no deposit bonus.

A major advantage for novice traders is the ability to open an account across multiple offerings for just $10. Whether opting for the Prime account with tight fixed spreads or the ECN account for raw market access, $10 grants admission. Lowering the barriers to funding an account allows individuals to test drive RoboForexs brokerage services and find the right fit for their strategies. For those needing to cap risk when first starting out, having multiple account options accessible for the price of a single stock share is a key perk.

IQ Option-Best $10 Minimum Deposit Forex Broker for Proprietary Trading Platform

Broker |

|

Regulated by |

CYSEC (Cyprus) |

Min.Deposit |

$10 |

Tradable Instruments |

Forex, Stocks, Cryptos |

Trading Platform(s) |

A proprietary trading platform |

Leverage |

1000:1 (Non-EU countries) |

Trading Fees |

0.6 pips on EUR/USD, commissions vary based on assets |

Payment Methods |

Wire Transfer, Bank Card, e-payments & crypto payments in some countries |

Copy Trading |

❌ |

Bonus |

❌ |

Customer Support |

7/24 |

Pros |

✅Regulated by CYSEC ✅Trading services available to most countries ✅Proprietary trading platform ✅Crypto Trading Available |

Cons |

❌ No MetaTrader platform available ❌ Limited product ranges ❌Traders from US not accepting |

IQ Option is an innovative online trading platform founded in 2013 offering CFDs and binary options on over 380 underlying assets including forex, cryptocurrencies, stocks, commodities and ETFs. IQ Option stands apart with over 8 million registered users, up to 15,000 logging in daily to trade the $30 million+ in monthly volume. Traders praise the broker for innovations like instantly opening deals straight from charts, panic sell buttons, and IQ Options proprietary self-developed trading platform.

Traders also appreciate the ability to get started in live markets with just a $10 minimum deposit – granting access to tools & tutorials plus the brokers full array of assets.

Forex Trading Knowledge Questions and Answers

Can I trade multi-assets with a $10 trading account?

Yes, you can absolutely trade multiple asset classes with a $10 trading account. Brokers typically offer higher leverage ratios on micro accounts with $10 minimum deposits, providing more flexibility to diversify product portfolios. For instance, with a leverage of 500:1, a $10 deposit can control a $5,000 position size. This allows opening decent-sized trades across forex pairs, commodities like gold or oil, leading stock indices, or major cryptocurrencies. So traders can gain exposure to assets across global markets.

Trading multiple uncorrelated assets can reduce overall portfolio risk and exposure to any single asset's price fluctuations. Consider this, you open a long EUR/USD position, a short gold position, and a long position on the S&P 500 index. By spreading the risk across different global markets, losses in one asset class may be offset by gains in another.

What types of trading accounts are offered by a $10 minimum forex broker?

Typically, the trading accounts offered by forex brokers with a $10 minimum deposit include Micro, Mini, and Cent accounts. These account types are geared towards novice traders or those looking to trade small volumes.

Some defining features of Micro, Mini and Cent accounts are high leverage ratios, competitive spreads compared to standard accounts, and fewer tradable products. For example, a Micro account may provide 500:1 leverage allowing higher volumes with just $10, have spreads from 1 pip, but only offer spot forex and a select number of CFDs. Meanwhile, however, these $10 accounts tend to offer variable trade sizes down to 0.01 lots, providing precise risk management.

Why does a $10 account often offer higher leverage?

We do notice an interesting fact that a $10, or even lower minimum deposit account tends to offer higher leverage instead, while standard accounts, or ECN accounts come with a lower leverage cap. There are some resons behind it.

Firstly, by providing extremely high leverage such as 1:1000 or more, brokers are able to market these $10 accounts as an easy way for beginner traders to enter the market. Even with a small deposit, the high leverage allows new traders to open larger sized positions. This builds interest and draws new clients to the brokerage.

Secondly, providing ample leverage enables new traders with very little capital to still open positions with some volume, while capping total exposure based on the deposit amount. For example, with a $10 deposit, even 500:1 leverage will only allow $5,000 worth of trades - still limiting risk compared to a $100,000 account trading at 1:100 leverage.

Lastly, high leverage ratios encourage new traders to actively place trades and gain exposure, despite small balances. More trading volume translates to more potential spread captures for the broker. So amplified leverage entices participation critical for these micro accounts to be viable for the brokerage

Can I make profits with a $10 forex account?

Of course, it is absolutely possible to generate profits trading with only $10 in your forex account. Honestly, making profits with a $10 forex account lies in your correct strategies and persistence.

Diversify your product prtfolios. Use the high leverage ratios offered on $10 accounts judiciously to diversify positions across various markets-this reduces risk. For example, you can invest major currency pairs, gold, oil, indices to gain broad market exposure.

Proper risk Management. Apply strategic stop losses and take profits to manage risk on all open positions. For examples, close out any trades that move 20 pips out of the money. Also take partial profits when reaching a 1:2 risk-reward ratio. These quantified limits defend against outsized losses.

Avoid High Leverage. Do not use the maximum 1:1000 leverage just because it is available. Start with lower 1:100 leverage matching your experience level. As skills improve over several months, then consider cautiously increasing margins.

Not Pursuing on High Profitability. Initially target modest returns in the 5-10% monthly range. Targeting a 20-30% return would mean aiming to make $400-600 in a month. Not only is that an ambitious target, but striving for it typically motivates over-active trading. You may end up forcing lower probability trades or sizes too large to account risk tolerance. Moderated targets align with the account balance.

Avoid Emotional Trading. The worst situation for a trader is caring too much about current losses. When a trader experiences a loss, it is natural to feel compelled to immediately deposit more funds to try and recover. However, this emotional reaction often backfires, directly contributing to further failures rather than profits. Trading requires a reasonable, composed approach not dictated by the highs and lows of each trade.

Which is the best $10 minimum deposit forex broker?

Here we compare the 7 forex brokers with $10 minimum deposit based on their regulation, as well as core account offering to pick the best one. Evidently, Exness's micro account stands out with the most advantageous trading offerings. Micro account holders enjoy a wide range of tradable instruments, competitive trading fees, and even a free VPS service. Equally significant is Exness's reputation as a trusted and respected forex broker, favored by countless traders worldwide. Its stringent regulation provides traders with added security in their forex trading endeavors.

| Broker | Exness | ThinkMarkest | eToro | FXTM | BDSwiss | RoboForex | IQ Option |

| Regulations | CYSEC, FCA, FSCA, FSA | ASIC,FSA FCA, CYSEC, FSA | ASIC, CYSEC, FCA | CYSEC, FCA | CYSEC, FSA | CYSEC, FSC, NBRB | CYSEC |

| Min.Deposit | $10 | $10 | $10 | $10 | $10 | $10 | $10 |

| Tradable Assets | Forex, Metals, CryptocurrEncies, Energies, Stocks, indices | Forex, Indices, Commodities, and Cryptocurrencies | Forex, Metals | FX,Metals and Commodities | All Assests | 36 CFDs on Forex, CFDs on Metals | All Assests |

| Spreads | From 0.2 pips | From 2.5 pips | From 0.6 pips | From 1.5 pips | From 1.3 pips | From 1.3 pips | From 0.6 pips |

| Commissions | NO | NO | NO | NO | NO | NO | NO |

| Trading Platforms | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4, MT5 | MT4, MT5 |

| Free VPS Service | ✅ | ✅ | ✅ | ❌ | ✅ | ❌ | ❌ |

| Demo Accounts | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ | ✅ |

| Customer Support | 7/24 | 7/24 | 7/24 | 7/24 | 5/24 | 5/24 | 7/24 |

To Wrap Up

Until here, we've reviewed the top forex brokers requiring only a $10 minimum deposit. They are stand out among numerous brokers to offer more favorable trading conditions with their geniune sincerity. However, here is a tip: traders should move beyond just the low account barrier when weighing these brokers, and holistically evaluate regulatory oversight, fee transparency, platform sophistication, and customer service. After all, entering is just the first step, what comes next matters a lot more.

Pros and Cons of Using a Forex Broker with a $10 Minimum Deposit

A $10 minimum deposit offers several advantages for Forex trading, including a low barrier to entry, reduced financial risk, and the flexibility to experiment with different strategies without substantial capital.

However, brokers with such low minimums may have limitations like fewer trading instruments, potentially wider spreads, and potential fees for deposits and withdrawals.

About WikiFX

On WikiFX.com, our evaluations of online forex brokers, along with their offerings and services, are derived from the data we've gathered and the informed insights and professional perspectives of our expert researchers.

We conduct a thorough review of each broker's regulatory compliance, commission rates and charges, minimum deposit needs, leverage availability, performance of the trading platform, and the speed of withdrawal processes. Through our technologically-backed assistance, we strive to ensure you have a solid understanding of these aspects.

We sincerely maintain an updated leaderboard of top brokers and offer extensive forex guides. With a catalog of over 50,000 brokers regulated by 30+ authorities,boosting confidence and simplifies trading experiences for your forex journey.

Disclaimer: All information published in this article is intended for informational purposes only, and it should not be considered as individual recommendations.

You Also Like

Best DMA Forex Brokers (Direct Market Access) for 2024

Delve into the world of DMA Forex Brokers with our guide. Discover top picks and know how DMA brokers operate, their pros and cons.

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Cheapest Brokers 2024 | We List the Best Brokers with low fees

Slash forex trading costs: find the cheapest brokers, avoid hidden fees, and boost your returns!

Best Zero Spread Forex Brokers in 2024

Dive into zero-spread forex trading: explore its perks, pitfalls, and discover top brokers to optimize your journey.