Score

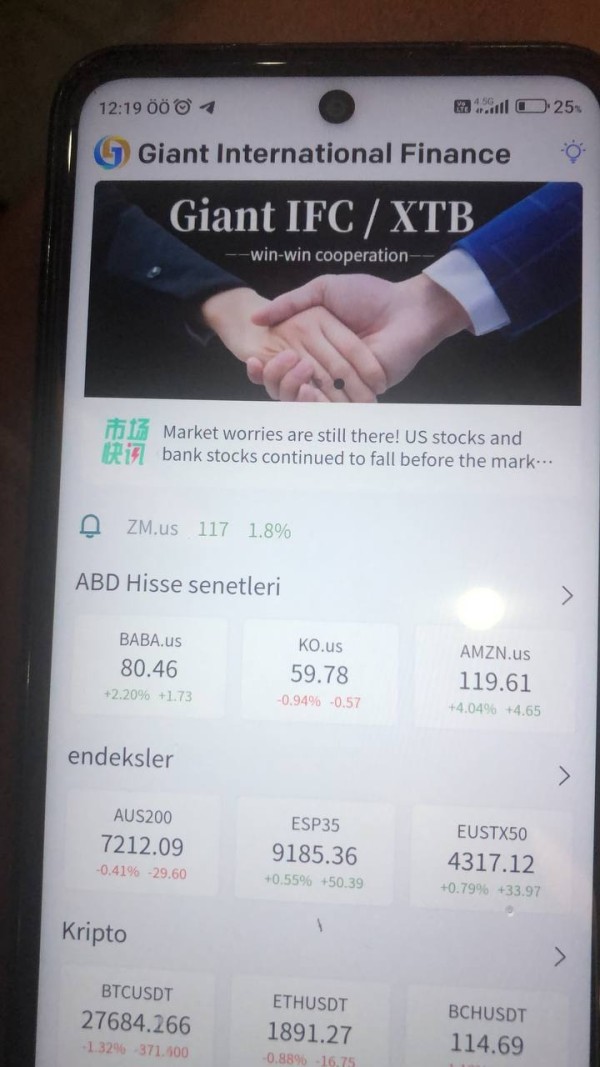

Giant IFC

United Kingdom|2-5 years|

United Kingdom|2-5 years| https://giantifc.cc/

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

United Kingdom

United KingdomUsers who viewed Giant IFC also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Neex

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

FXCM

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

giantifc.cc

Server Location

United States

Website Domain Name

giantifc.cc

Server IP

172.67.200.106

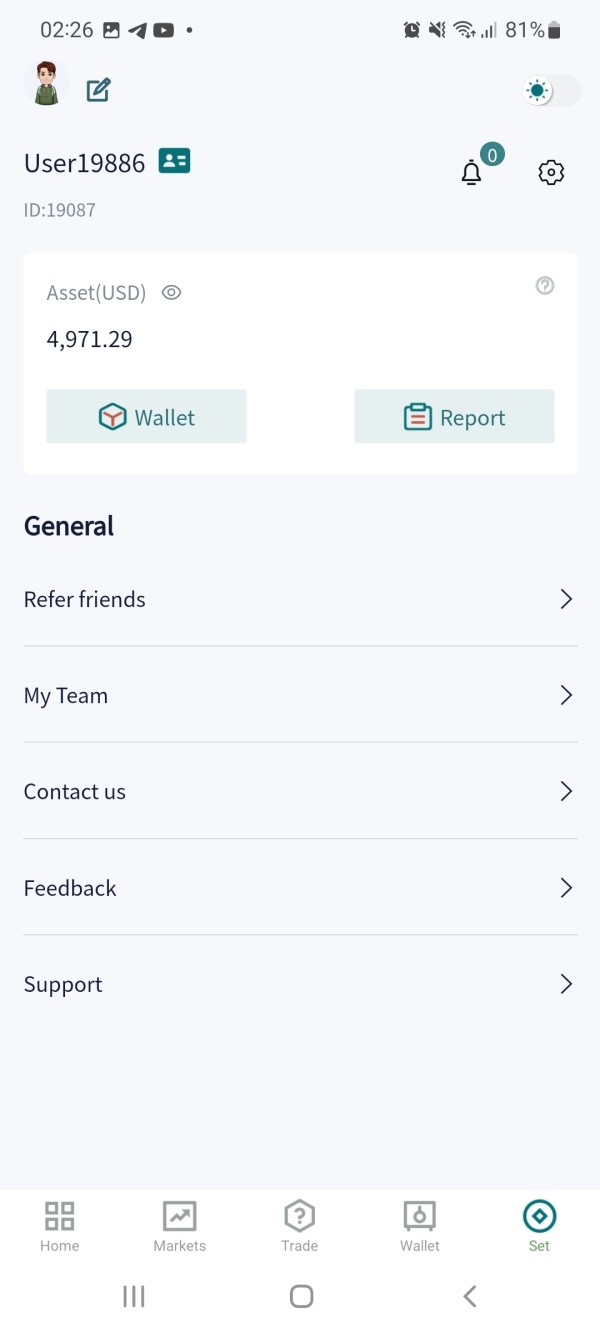

Company Summary

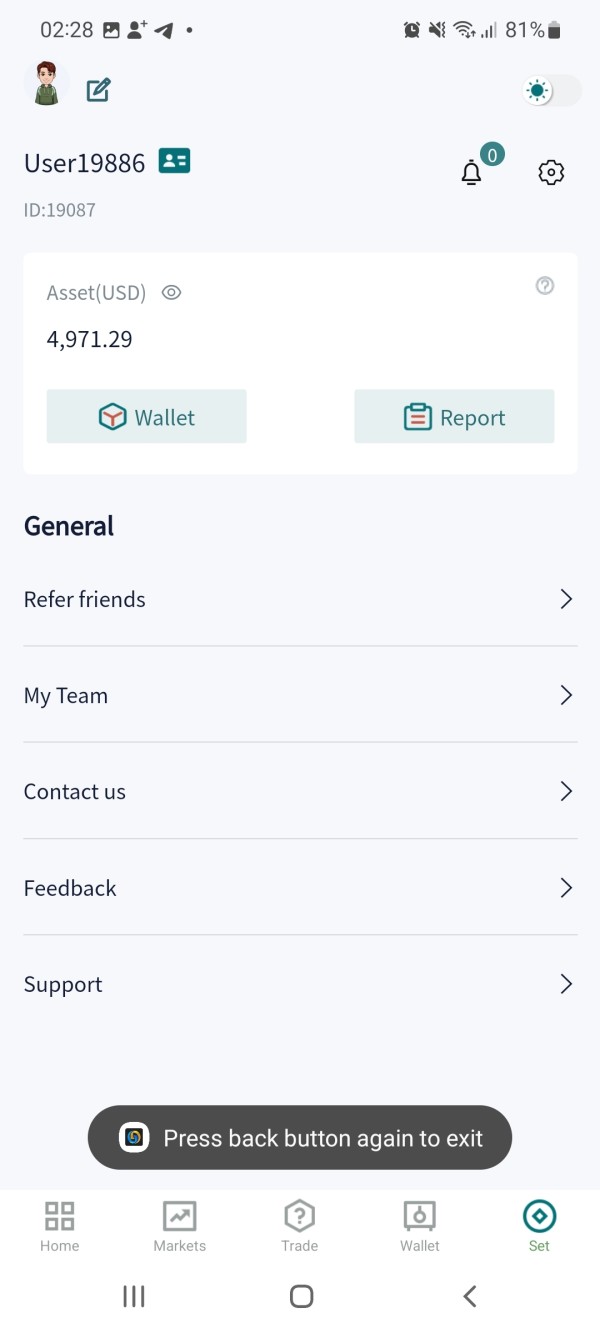

| Aspect | Giant IFC |

| Company Name | Giant IFC |

| Registered Country/Area | Not specified |

| Founded Year | Not specified |

| Regulation | No valid regulation |

| Minimum Deposit | Not specified |

| Maximum Leverage | Not specified |

| Spreads | Not specified |

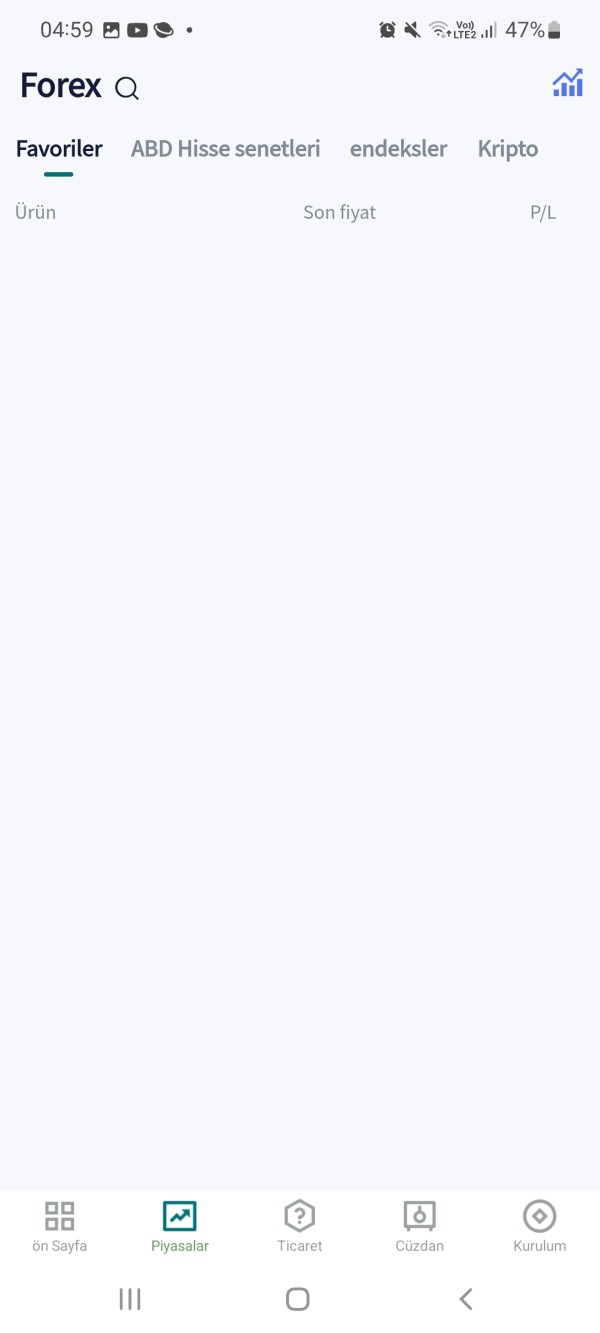

| Trading Platforms | Not specified |

| Tradable Assets | Forex currency pairs, indices, commodities, shares, futures |

Risk Warning

Giant IFC lacks valid regulation and currently faces difficulties in accessing its website. Consequently, it is advised that traders exercise caution and refrain from engaging in trading activities with this broker. Trading with an unregulated entity poses inherent risks, and there is a possibility of financial losses. It is advisable to consider reputable and regulated alternatives to ensure the safety of your investments.

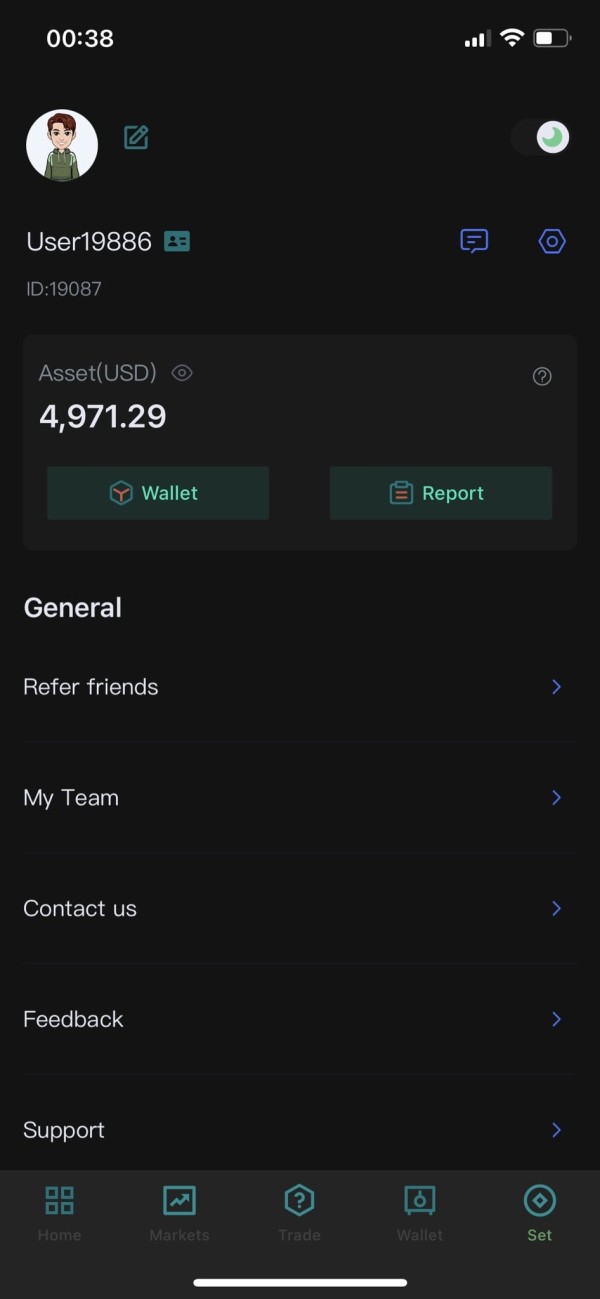

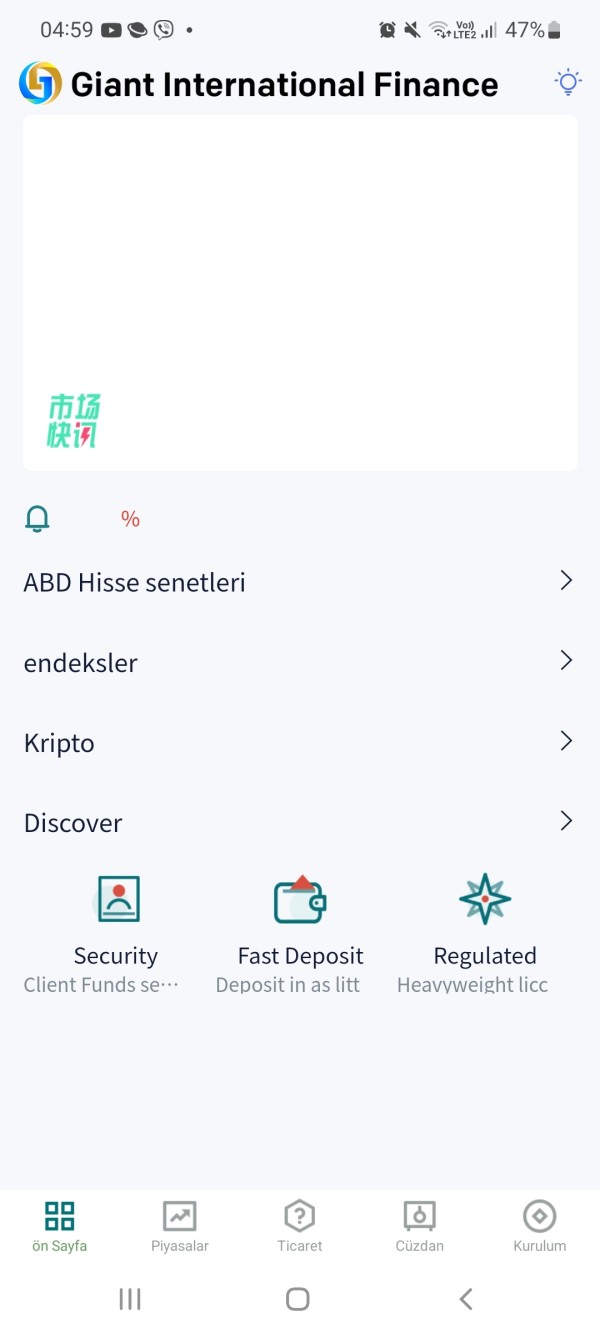

Overview of Giant IFC

Giant IFC is an investment banking firm offering a wide range of financial services, backed by a professional team providing tailored solutions and rigorous analysis. The company prioritizes employee development, business ethics, and transparency. However, it lacks valid regulation, faces website accessibility issues, exceeds regulated business scope, and has received negative customer reviews. Traders should exercise caution, evaluate reliability, and consider regulated alternatives to ensure the safety of their investments.

Is Giant IFC legit or a scam?

Giant IFC is currently operating without any valid regulation, posing potential risks to traders. It is important to exercise caution and be aware of the associated risks when dealing with this broker. The regulatory status of Giant IFC with the United States NFA (license number: 0555557) is abnormal, and it is listed as unauthorized. Moreover, this broker exceeds the business scope regulated by the United States NFA, specifically the National Futures Association-UNFX Non-Forex License. Traders should exercise caution and carefully evaluate the reliability and suitability of this broker before engaging in any transactions.

Pros and Cons

Giant IFC offers a wide range of tradable financial instruments, including forex currency pairs, indices, commodities, shares, and futures. This allows traders to diversify their portfolios and tailor their investments based on their individual preferences and strategies. The company also has a professional team that provides rigorous analysis and research, helping clients make informed investment decisions. Additionally, Giant IFC emphasizes employee development and maintains a positive work environment, offering ample training and growth opportunities. They prioritize the interests of their customers, employees, and society at large, conducting business with transparency and compliance to high ethical standards.

One major concern is that Giant IFC lacks valid regulation. This means it operates without proper oversight, posing potential risks to traders. Additionally, difficulties in accessing the website have been reported, which can hinder the trading experience and make it challenging to manage investments effectively. Another issue is that Giant IFC exceeds the regulated business scope set by the United States NFA, raising compliance concerns. Furthermore, negative customer reviews and complaints have been raised, which may indicate issues with reliability and trustworthiness.

| Pros | Cons |

| Wide range of tradable financial instruments | Lack of valid regulation |

| Professional team providing rigorous analysis and research | Difficulties in accessing the website |

| Emphasis on employee development and positive work environment | Exceeding regulated business scope |

| Prioritizes the interests of customers, employees, and society | Abnormal regulatory status with the United States NFA |

| Negative customer reviews and complaints |

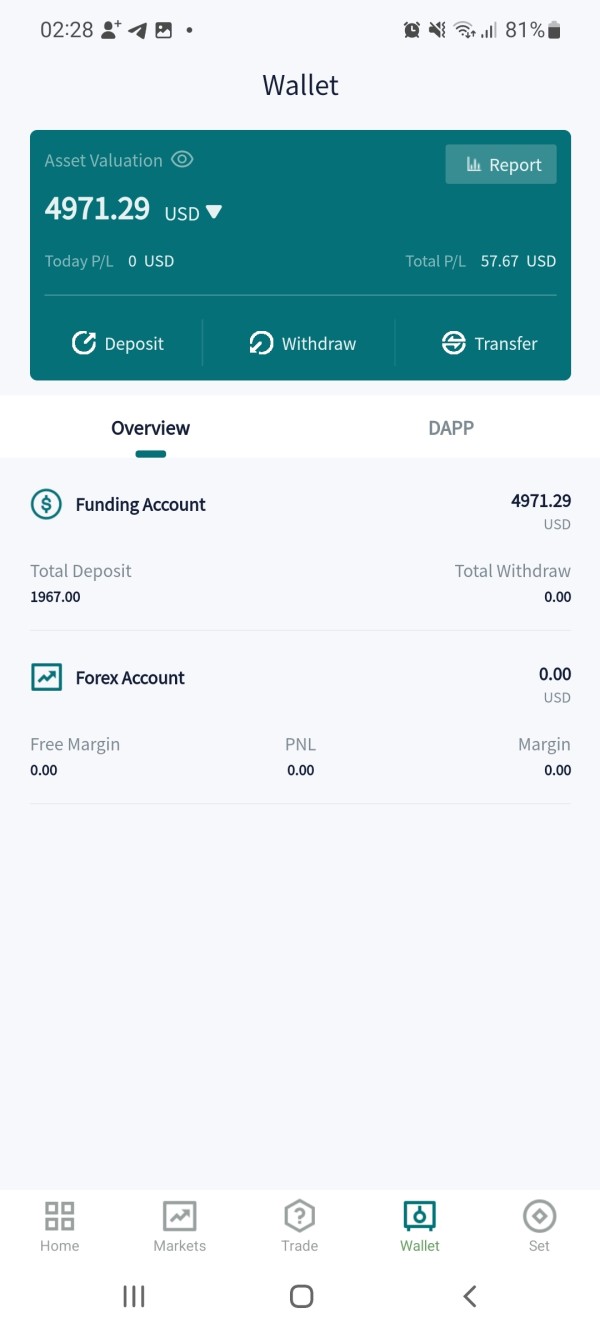

Market Instruments

Giant IFC provides a wide range of tradable financial instruments, allowing clients to access diverse investment opportunities. Traders can explore a comprehensive selection of assets on the platform, including Forex currency pairs, indices, commodities, shares, and futures. This extensive offering enables traders to diversify their portfolios and tailor their investments based on their individual preferences and strategies.

When it comes to trading products, Giant IFC offers a variety of options. These include:

1. Forex Currency Pairs: Traders can engage in the dynamic forex market, speculating on the fluctuations in exchange rates between different currencies to potentially generate profits.

2. Indices: Trading on indices allows traders to take positions on broader market trends, providing opportunities for diversification and exposure to specific sectors or markets.

3. Commodities: Giant IFC offers access to a range of commodities, including precious metals like gold and silver, energy resources like oil and natural gas, and agricultural products. Traders can take advantage of price movements in these commodities to potentially capitalize on market trends.

4. Shares: Through trading shares, traders can participate in the equity markets and make informed investment decisions based on their analysis of specific companies' performance and market conditions.

5. Futures: Trading futures contracts can serve various purposes, including hedging against price fluctuations, speculative trading, or risk management strategies.

How to Open an Account?

Its official website is not open for the time being, if it is open, you can follow the steps below to open an account:

1. Visit the official website: Go to Giant IFC's official website by typing the URL into your web browser.

2. Locate the account opening section: Look for a prominent button or link that says “Open Account” or something similar. This is usually located on the homepage or in the main menu of the website.

3. Fill out the registration form: Click on the “Open Account” button to access the registration form. Provide the required information, which typically includes your personal details such as your full name, email address, phone number, and country of residence.

4. Agree to the terms and conditions: Read through the terms and conditions, privacy policy, and any other legal agreements presented to you. Make sure you understand and agree to the terms before proceeding.

5. Complete any additional verification steps: Depending on the broker's requirements, you may need to go through additional verification steps to confirm your identity. This may involve providing identification documents or proof of address.

6. Fund your account: Once your registration is complete and verified, you will need to fund your trading account. Giant IFC usually offers various payment methods, such as bank transfer or online payment systems. Follow the instructions provided to make a deposit into your account.

7. Start trading: Once your account is funded, you can access the trading platform provided by Giant IFC and begin trading. Familiarize yourself with the platform's features and tools to make informed trading decisions.

Customer Review

Giant IFC has received numerous negative reviews, and traders who have conducted transactions with this broker have expressed various complaints and concerns about their experiences. It is important to take these reviews and complaints into consideration when evaluating the reliability and trustworthiness of the broker. It is advisable to exercise caution and conduct thorough research before engaging in any trading activities with Giant IFC.

Alternative Brokers

Since Giant IFC is unregulated and its website is difficult to open, traders are advised to choose other traders.

1. XYZ Brokerage: XYZ Brokerage is a reputable and well-regulated trading firm known for its comprehensive range of tradable assets, including Forex currency pairs, indices, commodities, stocks, and cryptocurrencies. They offer competitive spreads, advanced trading platforms, and a user-friendly interface. With a strong emphasis on customer satisfaction, XYZ Brokerage provides excellent customer support and educational resources to help traders enhance their trading skills.

2. ABC Investments: ABC Investments is a trusted brokerage firm that offers a wide selection of trading products, including Forex, CFDs, commodities, and indices. They provide a user-friendly trading platform, competitive pricing, and reliable execution. ABC Investments is known for its robust regulatory oversight, ensuring a secure and transparent trading environment. They also offer comprehensive educational materials and market analysis tools to assist traders in making informed investment decisions.

3. DEF Securities: DEF Securities is a respected trading provider offering a diverse range of tradable instruments, including Forex, commodities, indices, and stocks. With a strong focus on customer satisfaction, DEF Securities provides excellent customer support, advanced trading platforms, and competitive pricing. They are regulated by reputable authorities, ensuring the safety and security of clients' funds. DEF Securities also offers educational resources and research tools to help traders stay informed and make educated trading decisions.

Conclusion

In conclusion, Giant IFC offers a wide range of tradable financial instruments and has a professional team that provides rigorous analysis, which can be advantageous for traders. The company also emphasizes employee development and prioritizes the interests of customers, employees, and society. However, the lack of valid regulation, difficulties in accessing the website, exceeding regulated business scope, and negative customer reviews are significant disadvantages to consider. These factors raise concerns about the safety, reliability, and trustworthiness of Giant IFC as a trading broker. Traders are advised to exercise caution, conduct thorough research, and explore reputable and regulated alternatives to ensure the security and integrity of their investments.

FAQs

Q: Is Giant IFC regulated by any financial authorities?

A: Giant IFC currently operates without any valid regulation, which raises concerns about its oversight and accountability.

Q: Are there any alternatives to Giant IFC that are reputable and regulated?

A: Yes, there are reputable and regulated alternative brokers available in the market. It is advisable to consider these alternatives to ensure the safety and security of your investments.

Q: What types of financial instruments can I trade with Giant IFC?

A: Giant IFC offers a wide range of tradable assets, including forex currency pairs, indices, commodities, shares, and futures.

Q: Are there any negative customer reviews or complaints about Giant IFC?

A: Yes, there have been negative customer reviews and complaints about Giant IFC.

Q: Can I trust Giant IFC with my investments despite the lack of regulation?

A: Trading with an unregulated broker like Giant IFC poses inherent risks.

Q: What steps should I take to ensure the safety of my investments?

A: It is advisable to conduct thorough research, consider regulated alternatives, and consult with financial professionals before engaging in trading activities.

Keywords

- 2-5 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 10

Content you want to comment

Please enter...

Review 10

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

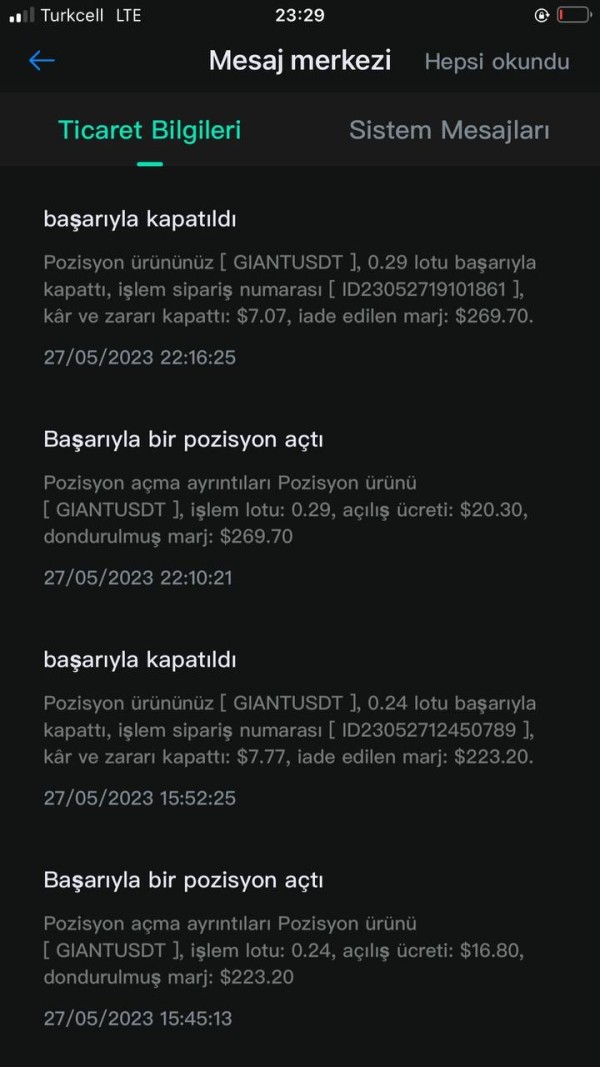

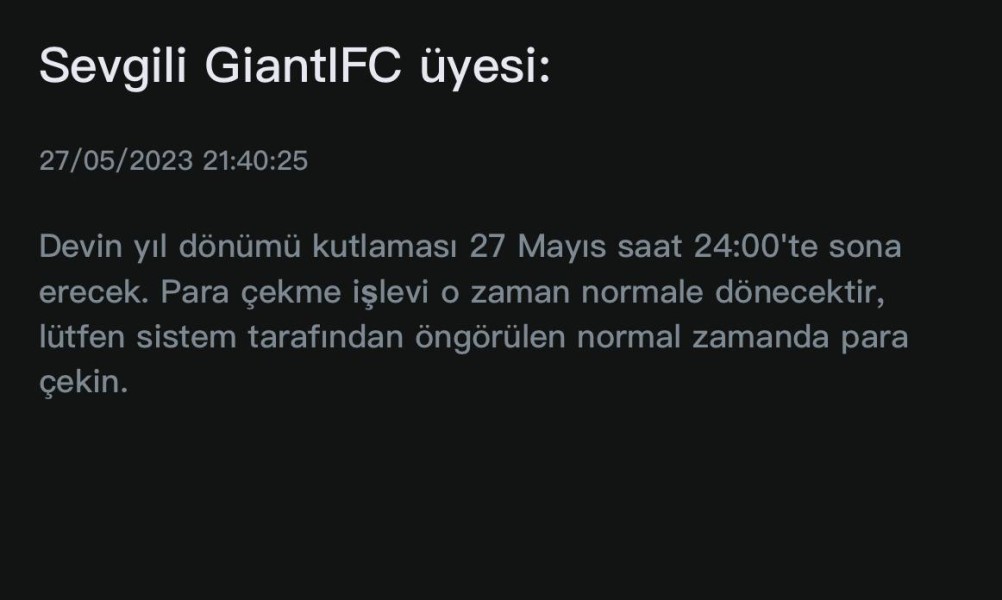

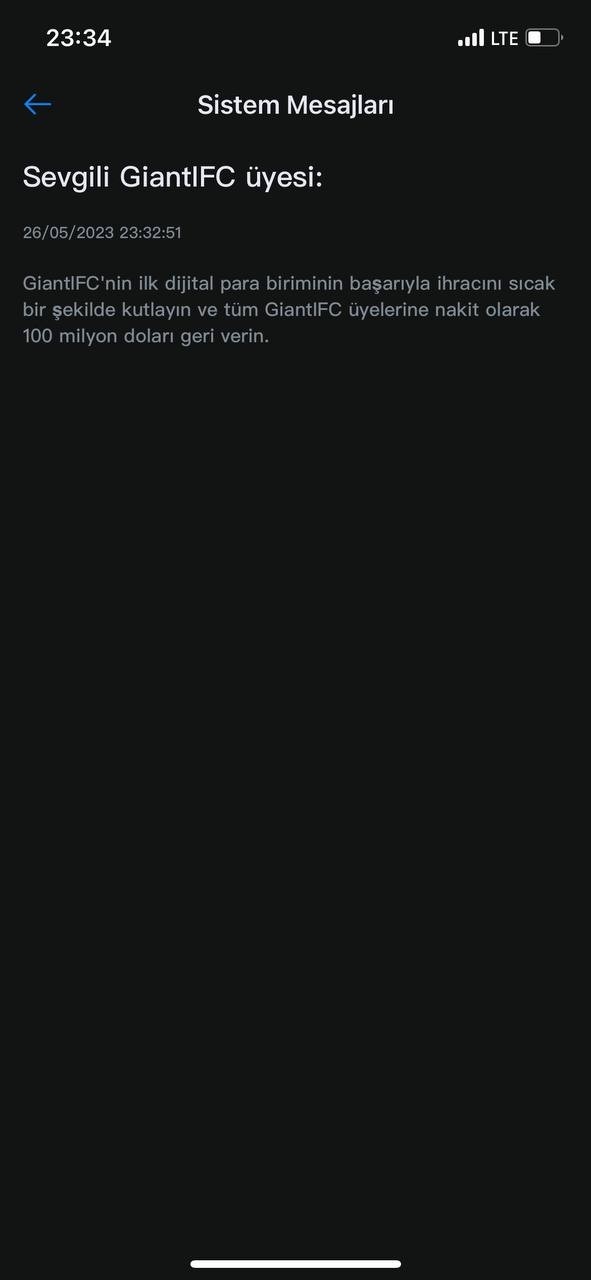

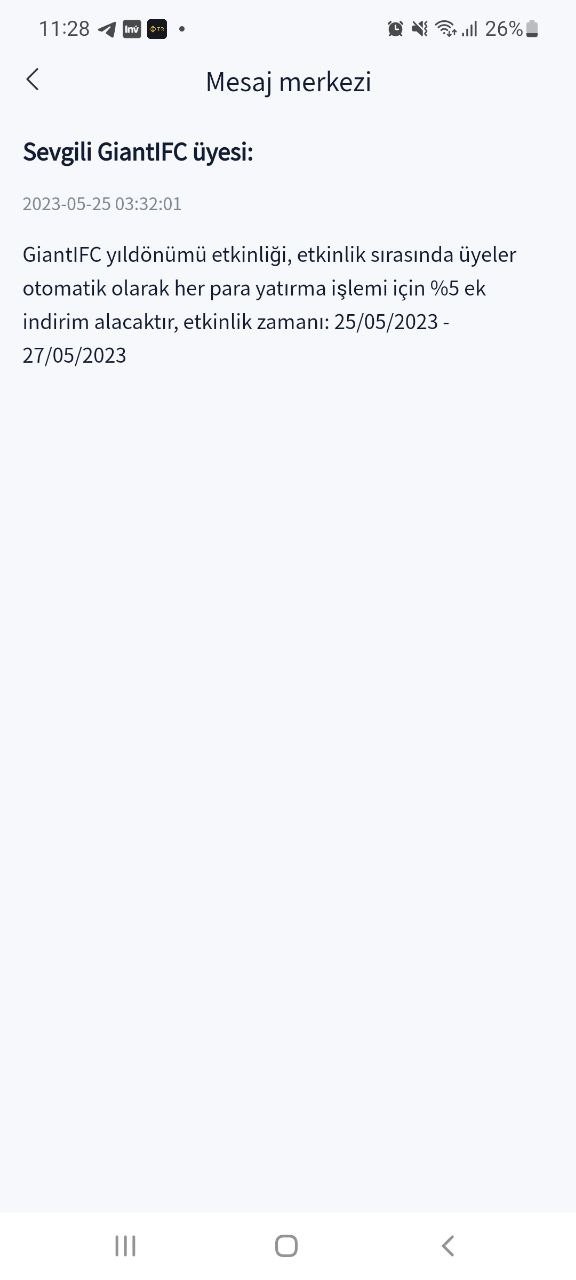

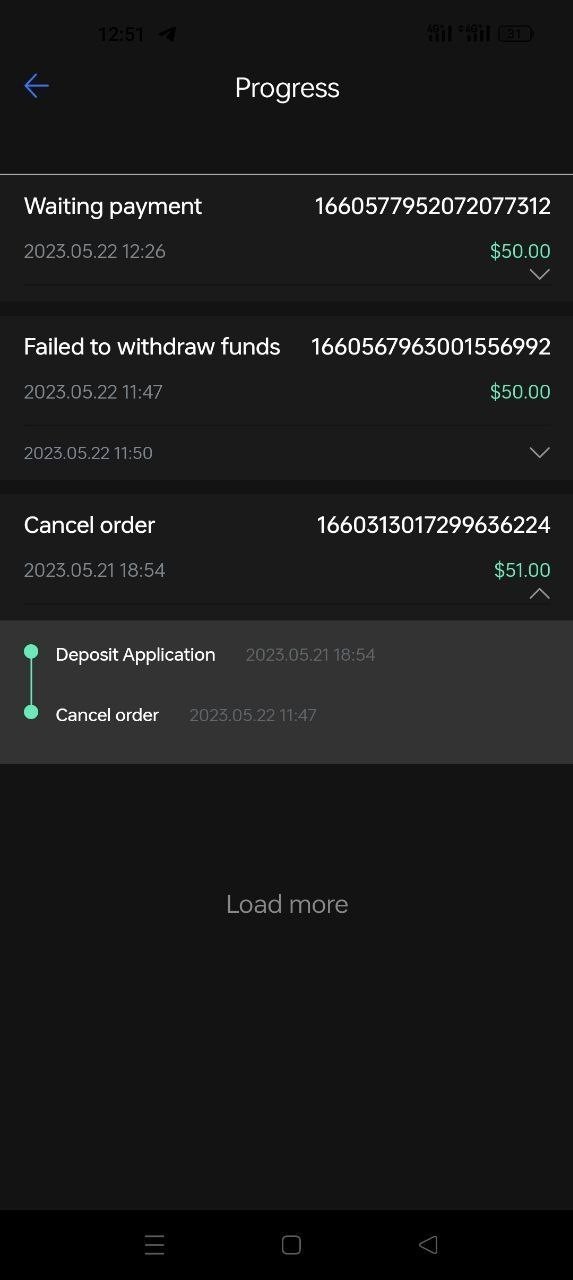

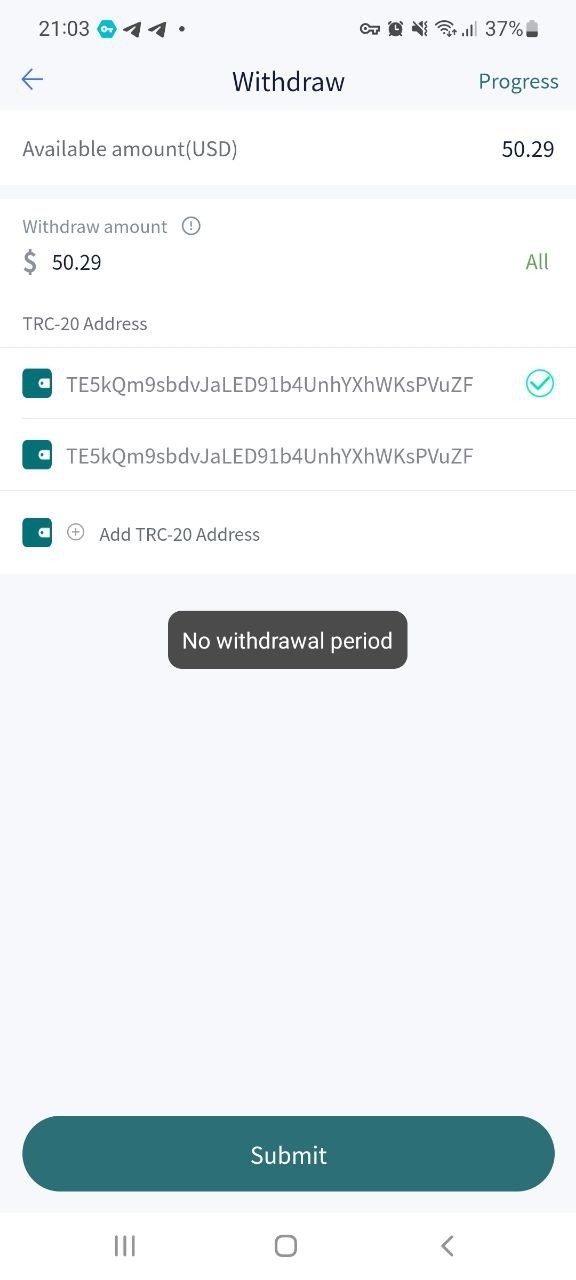

Sam4936

Turkey

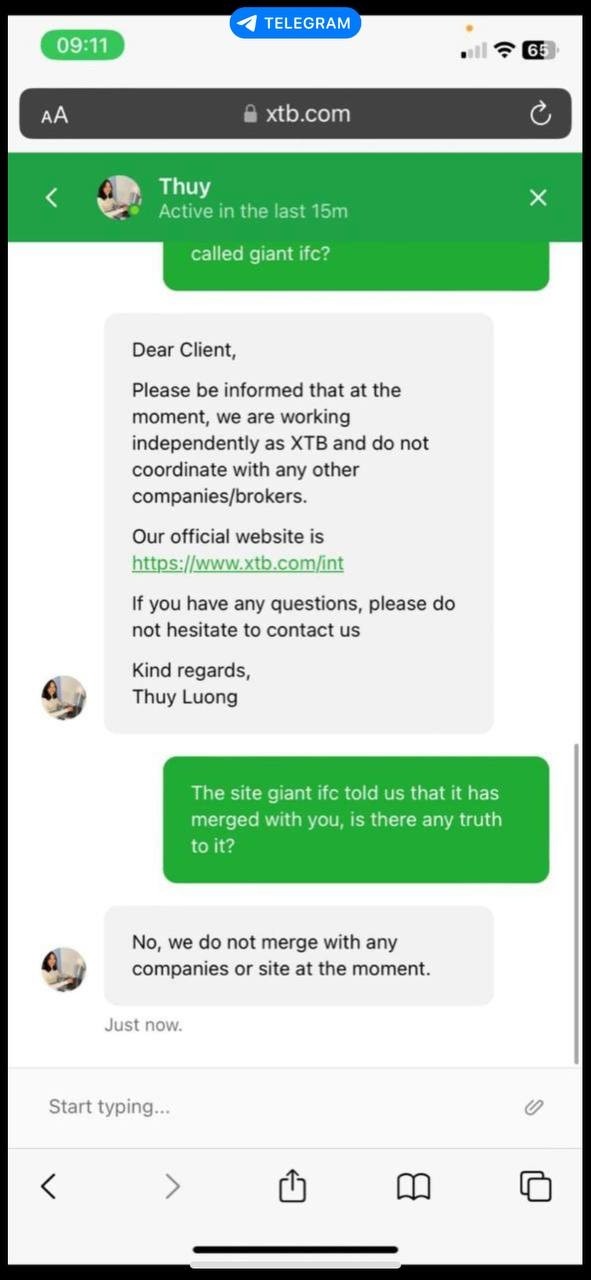

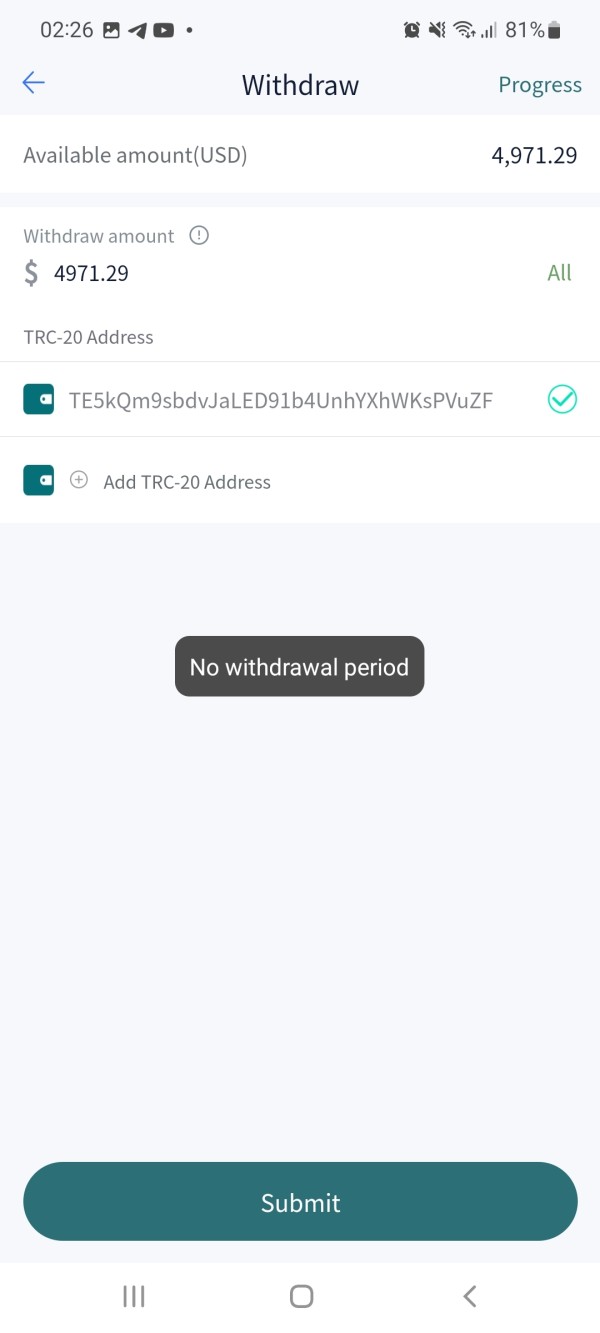

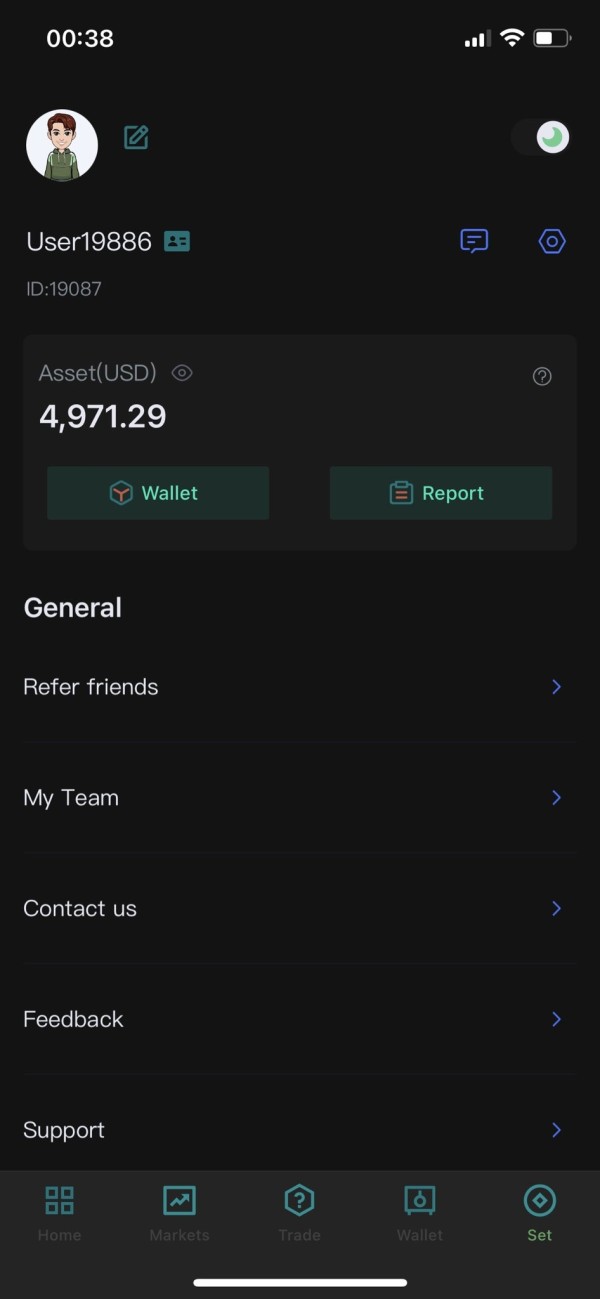

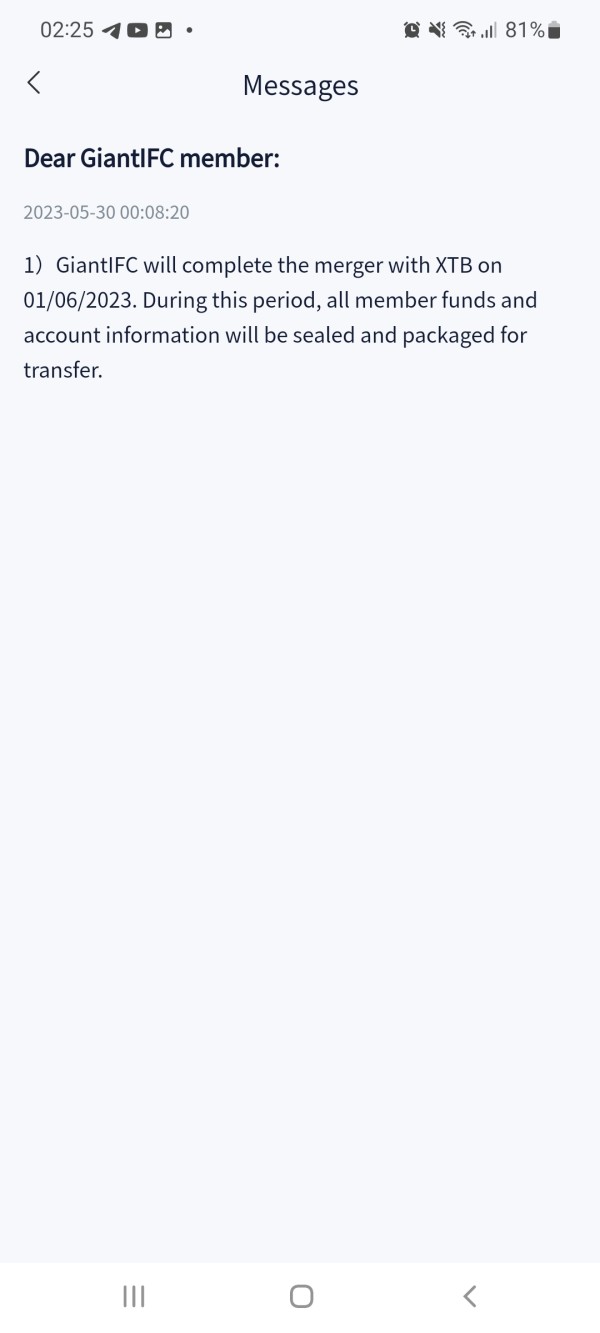

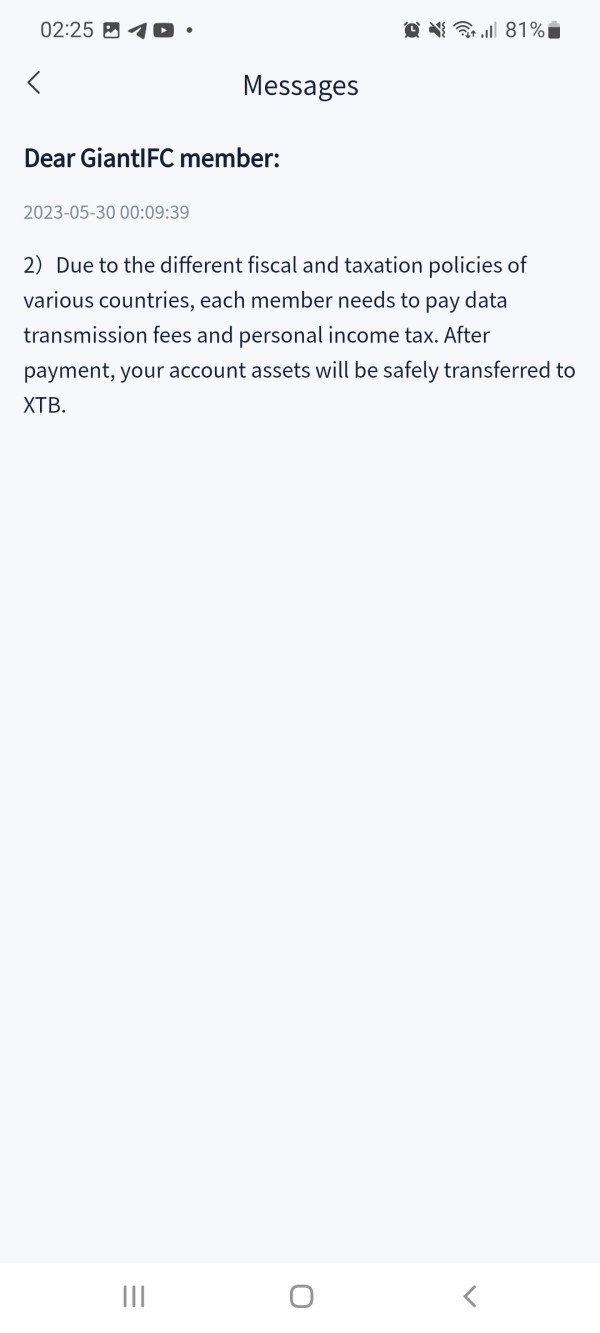

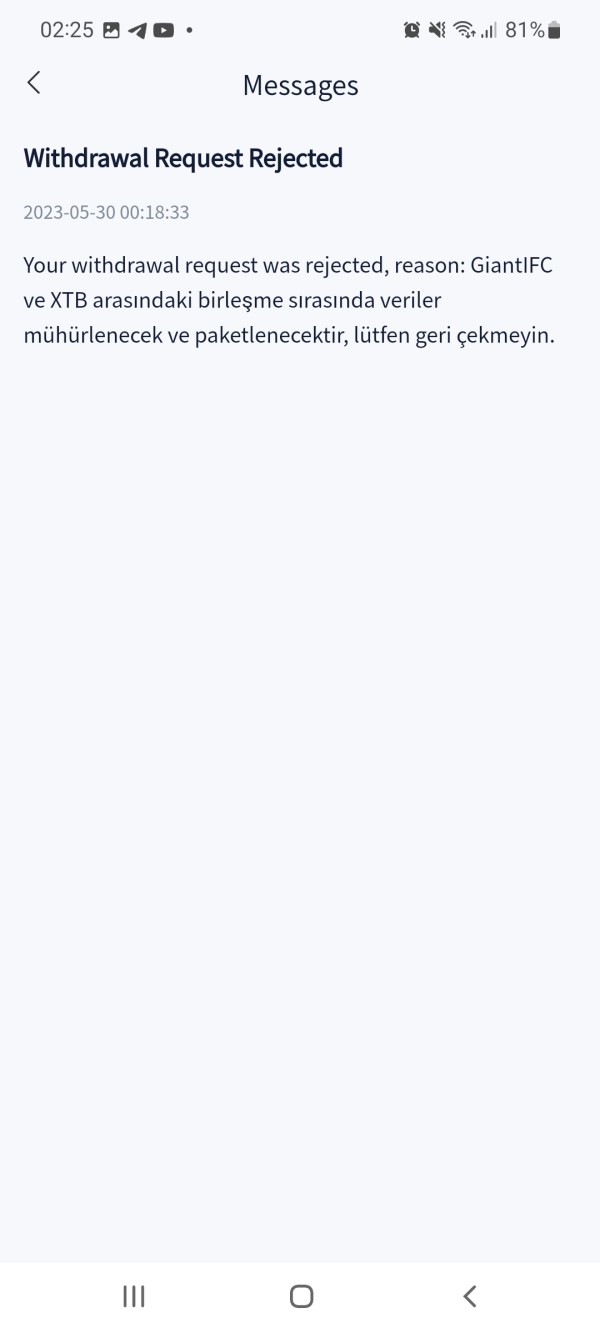

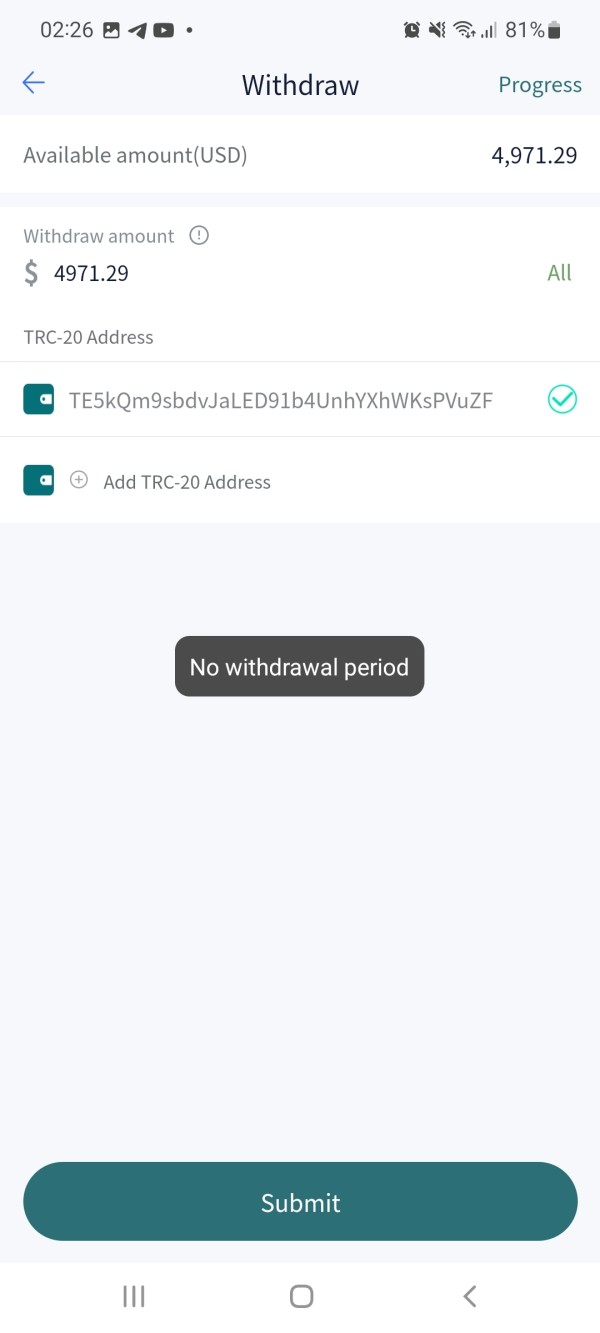

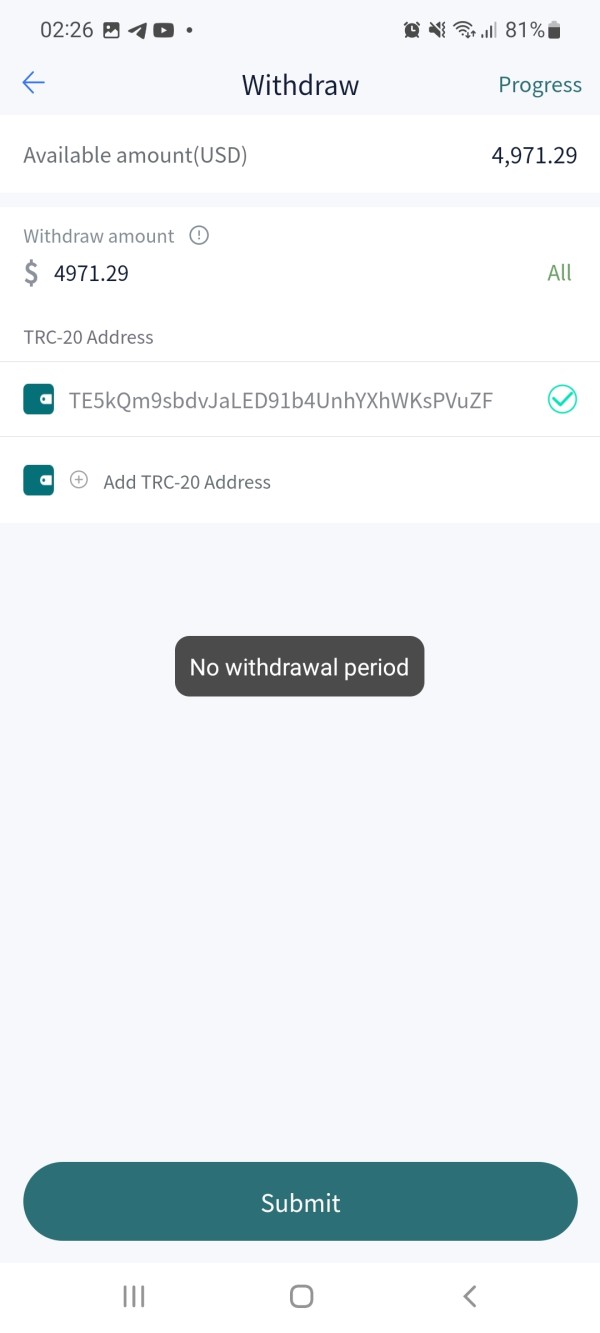

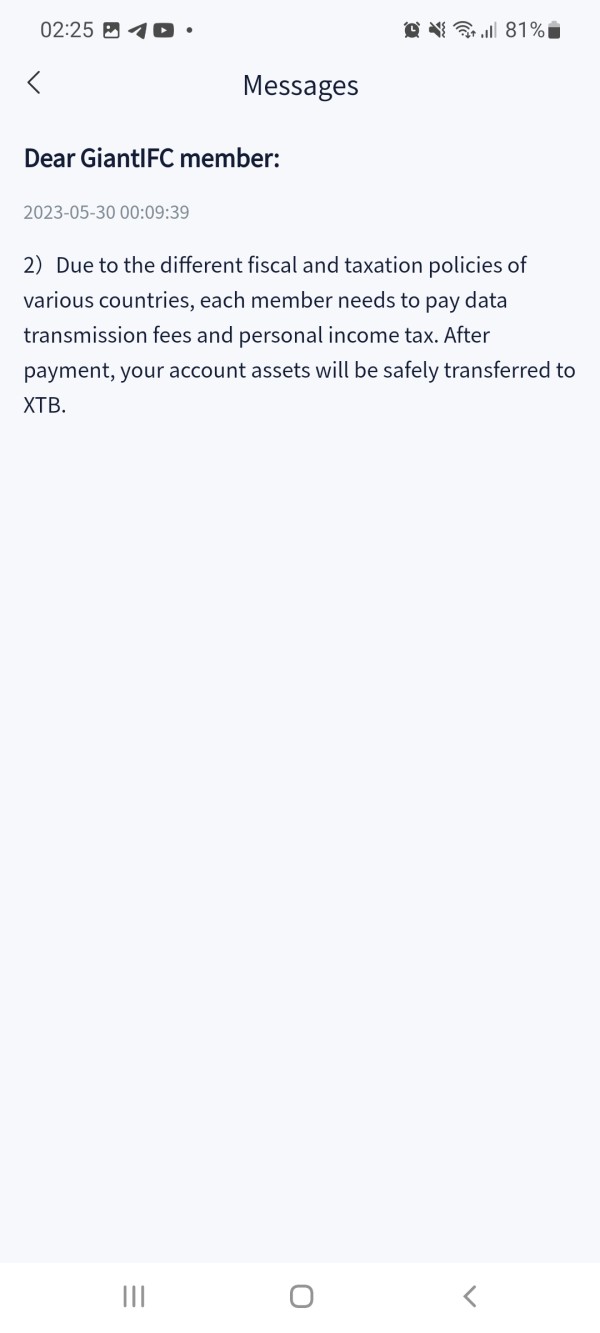

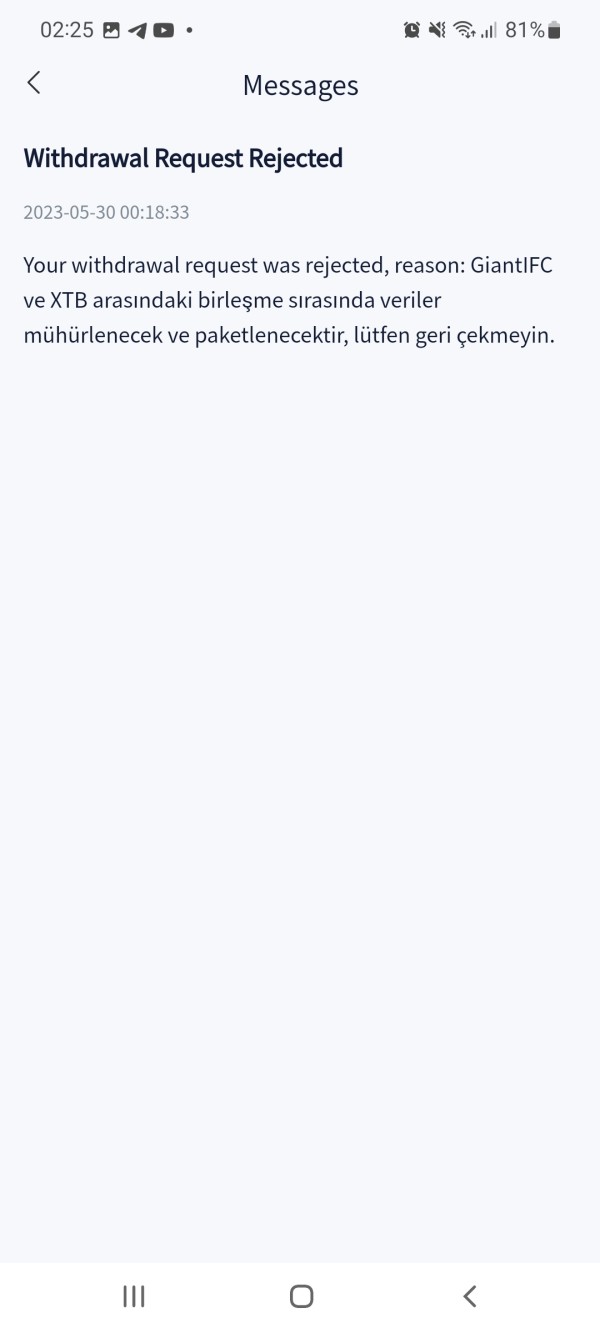

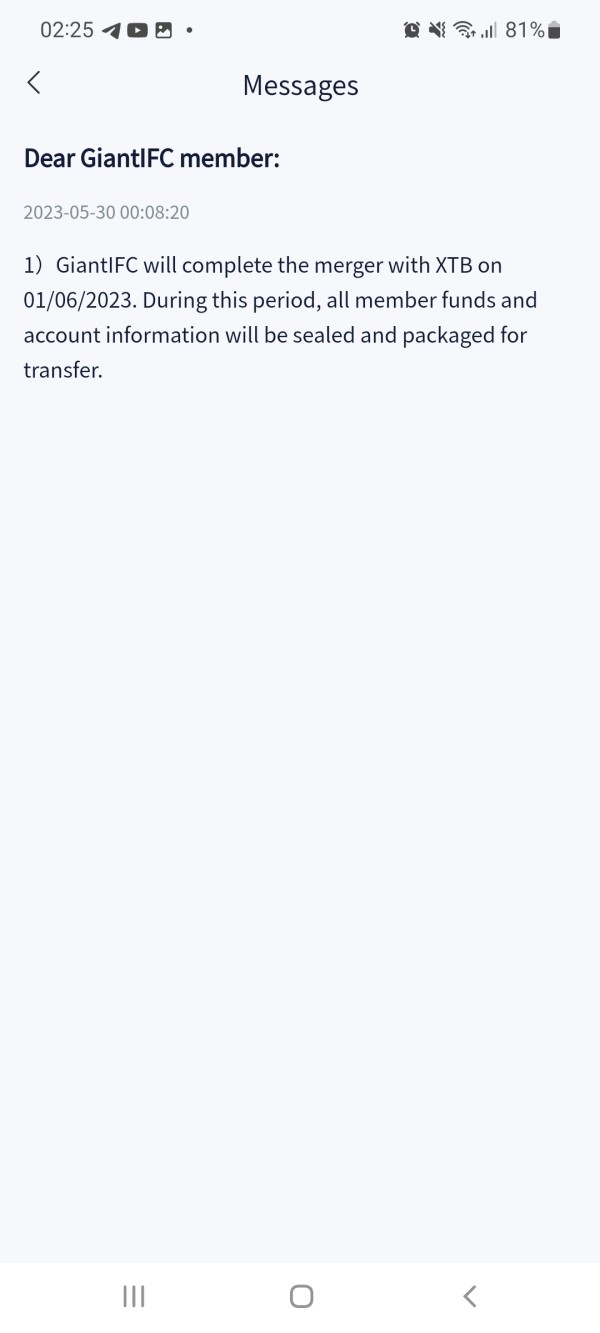

Giant IFC has deceived more than 50,000 investors and has stolen more than $560 million!!! Withdrawals were suspended on May 24. There was this notification saying that those who deposit 5% will receive bonuses. On May 30, another notification came: “If you want to save your accounts, you need to send to the platform from $100 to $300.” Of course I did not send any money, but after tracking the address on Tronscan, I found that thousands of people had sent $300. And on June 1, at 17:00, the platform was closed. Giant IFC sent a notification which says that they are moving to the XTB platform and also attached a partner photo on the platform. We wrote to the XTB service, who informed us that there was no such agreement. As a result of the shutdown of the platform, more than 50,000 investors, most of whom are from Turkey, have lost most of their funds. We are filing a criminal lawsuit against Giant IFC. It is currently unknown where the fraudster is.

Exposure

2023-06-05

Sam4936

Turkey

Since December, Giant IFC has been like a safe exchange, there were advertisements and calls for investments everywhere. As a result, from 05/23/2023, the withdrawal is prohibited, and on Monday, May 29, the platform was completely turned off and more than 50,000 investors left with millions of dollars, data and money from them.

Exposure

2023-06-04

Sam4936

Turkey

This platform does not allow withdrawals from May 23, 2023 . Delete my personal information on June 2/2023. I have not violated any rules. As a result, thousands of investors were left behind.

Exposure

2023-06-01

FX1550833472

United Arab Emirates

witdrow closing this is scam

Exposure

2023-05-30

Sam4936

Turkey

The broker does not allow any withdrawal of funds!!!!

Exposure

2023-05-30

Sam4936

Turkey

They stole funds from over 3000 investors. Don't trust them. There are evidences.

Exposure

2023-05-30

Clementine

Ukraine

Trading with Giant IFC has been a mixed bag for me. On one hand, the range of market instruments and their dedication to transparency and ethical standards impressed me. However, the fact that they operate without valid regulation made me feel insecure about the safety of my funds. Coupled with difficulties when trying to access their website, I was left with a feeling of uncertainty, which is something I'd prefer to avoid in my future trading experiences.

Neutral

2023-12-07

Clarabelle

Ukraine

My trade experience with Giant IFC has left me with some concerns. While their diverse financial instruments and professional analysis provided me with a variety of trading options, the lack of regulation has kept me on edge. I constantly questioned the safety of my investment and if I made the right decision. The technical difficulties with their website only added to my discomfort. Based on this experience, I believe future trading would be more comfortable with a regulated broker.

Neutral

2023-12-06

FX1505448098

Russia

Oi, let me spill the beans about Giant IFC. Despite their flashy offerings, the lack of valid regulation is a real buzzkill. It's like riding a roller coaster without a seatbelt, mate. And the website access? It's like trying to find a needle in a haystack! It's a real pain in the neck to navigate and manage my investments. They need to get their act together and sort out these issues, or else traders like me will be outta here!

Neutral

2023-07-03

FX1505430520

United States

Giant IFC is the real deal, mate! They offer a massive range of trading options, from forex to commodities, indices, shares, and futures. It's like a one-stop shop for all my trading needs! They've got something for everyone, whether you're a newbie or an experienced trader. Cheers to their diverse tradable assets!

Positive

2023-07-03