Score

AMCC

France|1-2 years|

France|1-2 years| https://amccmarkets.com

Website

Rating Index

Contact

Licenses

Licenses

No valid regulatory information, please be aware of the risk!

Single Core

1G

40G

1M*ADSL

- It has been verified that this broker currently has no valid regulation. Please be aware of the risk!

Basic information

France

FranceUsers who viewed AMCC also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

CPT Markets

- 10-15 years |

- Regulated in United Kingdom |

- Market Making(MM) |

- MT4 Full License

IC Markets Global

- 15-20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

HFM

- 10-15 years |

- Regulated in Cyprus |

- Market Making(MM) |

- MT4 Full License

Website

amccmarkets.com

Server Location

United States

Website Domain Name

amccmarkets.com

Server IP

104.21.73.68

Company Summary

| Aspect | Information |

| Registered Country | China |

| Company Name | AMCC Markets Limited |

| Regulation | Unregulated |

| Minimum Deposit | $50 |

| Maximum Leverage | Up to 1:1000 |

| Spreads/Fees | Starting spread of 0.6 pips |

| Trading Platforms | Desktop and mobile versions available |

| Tradable assets | Forex, commodities, precious metals, energy markets |

| Payment Methods | Credit cards, debit cards, bank transfers, electronic wallets |

| Customer Support | WhatsApp, Telegram, Email |

Overview

AMCC Markets Limited, headquartered in China, operates as an unregulated broker, offering trading services with a minimum deposit requirement of $50 and maximum leverage of up to 1:1000. The platform boasts competitive trading conditions with a starting spread of 0.6 pips and provides accessibility through desktop and mobile trading platforms. Traders have access to a variety of tradable assets including forex, commodities, precious metals, and energy markets. Customer support is available via WhatsApp, Telegram, and email, while payment methods include credit cards, debit cards, bank transfers, and electronic wallets. However, the current unavailability of their website raises suspicions about the platform's legitimacy, urging potential investors to exercise caution.

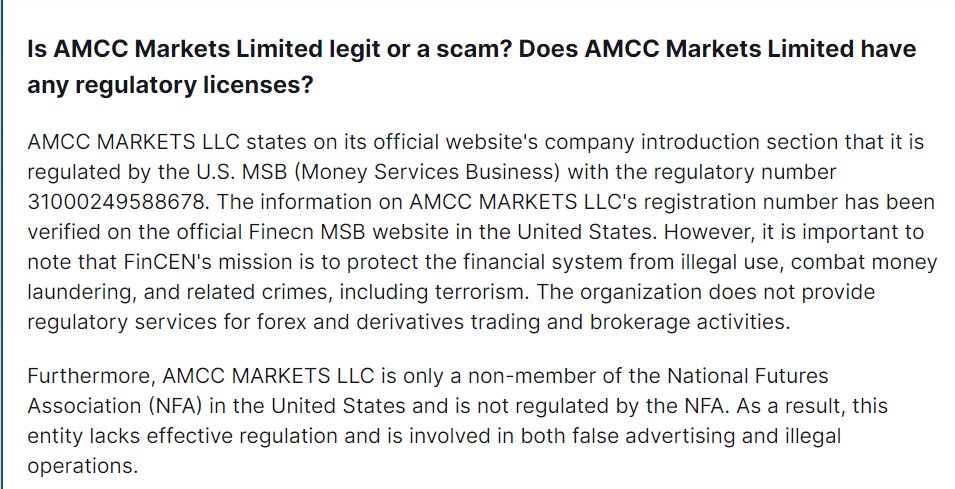

Regulation

AMCC operates as an unregulated broker, which means it may lack oversight from financial regulatory authorities. Clients should exercise caution when engaging with unregulated brokers, as they may not adhere to the same standards of transparency and investor protection as regulated entities. Conducting thorough research and understanding the risks involved is crucial before entrusting funds to such platforms.

Pros and Cons

AMCC Markets Limited offers some competitive trading conditions with low spreads, accessibility through multiple payment methods, and a user-friendly trading platform available on desktop and mobile devices. However, the lack of regulatory oversight, suspicion of fraudulent activities, and concerns regarding operational legitimacy raise significant red flags for potential investors. It's crucial for traders to weigh these pros and cons carefully before engaging with the platform.

| Pros | Cons |

|

|

|

|

|

|

|

|

|

|

Market Instruments

AMCC Markets Limited offers trading services primarily in forex, commodities, precious metals, and energy markets. Their trading products include:

Forex: Access to a wide range of currency pairs for trading, providing opportunities for speculation on currency exchange rates.

Commodities: Trading options in various commodities such as agricultural products, metals, and energies, allowing investors to diversify their portfolios.

Precious Metals: Opportunities to trade precious metals like gold and silver, which are often considered safe-haven assets during times of market uncertainty.

Energy: Trading instruments related to energy markets, including crude oil, natural gas, and other energy products, enabling investors to capitalize on price movements in this sector.

However, it's important to note that AMCC Markets Limited operates as an unregulated broker with suspicion of fraudulent activities, as indicated by the lack of regulatory oversight and concerning information about its website and registration details. Therefore, investors should exercise extreme caution or avoid engaging with this platform altogether.

Leverage

AMCC Markets Limited offers a maximum trading leverage of up to 1:1000. Leverage enables traders to control larger positions with a relatively small amount of capital. With a leverage ratio of 1:1000, traders can amplify their trading positions by up to 1000 times the amount of their initial investment. While high leverage can potentially magnify profits, it also significantly increases the risk of losses, as even small market movements can result in substantial gains or losses. Therefore, traders should exercise caution and implement risk management strategies when trading with high leverage to mitigate potential losses. Additionally, it's important to note that trading with high leverage may not be suitable for all traders, especially those with limited trading experience or smaller account balances.

Spreads and Fees

AMCC Markets Limited advertises competitive trading conditions, including a starting spread of 0.6 pips, which is quite appealing to traders seeking low-cost trading opportunities.

The firm applies overnight interest charges, also known as swap fees, which are costs or profits incurred for holding positions open overnight. This is a standard practice in the forex market, but the specific rates are not disclosed, leaving potential users in the dark about the costs associated with long-term positions.

Deposit & Withdrawal

AMCC Markets Limited facilitates a relatively straightforward process for depositing and withdrawing funds, designed to accommodate the needs of its diverse client base. The platform supports a variety of payment methods, including credit cards, debit cards, bank transfers, electronic wallets, and other unspecified payment options. This wide range of payment methods is aimed at ensuring that clients from various regions can easily fund their accounts and access their money.

Deposit Process

Minimum Deposit: The brokerage sets a relatively low barrier for entry with a minimum deposit requirement of $50. This is aimed at attracting both novice and experienced traders who wish to test the platform's features without committing a significant amount of capital initially.

Payment Methods: Clients can choose from multiple payment options, including traditional banking methods and modern digital wallets, providing flexibility in how they manage their funds.

Withdrawal Process

Minimum Withdrawal: AMCC has set a minimum withdrawal amount at $10, which is beneficial for traders wishing to access small amounts of their earnings without having to wait to accumulate a larger balance.

Accessing Funds: To initiate a withdrawal, clients need to log in to their accounts and navigate to the “Withdraw” section within the member area. Here, they will find instructions and the available payment methods for withdrawing their funds.

While the process for depositing and withdrawing funds at AMCC Markets Limited appears user-friendly and accommodating, potential clients should approach with caution. The brokerage's lack of regulatory oversight and the red flags raised concerning its operational legitimacy are significant concerns. Investors are advised to prioritize security and regulatory compliance when choosing a brokerage, ensuring their funds are protected and the brokerage adheres to industry standards and legal requirements.

Trading Platforms

Desktop and Mobile Versions: The broker ensures accessibility and convenience for its traders by offering both desktop and mobile versions of its trading platform. This dual availability caters to the modern trader's demand for flexibility, allowing users to monitor markets, execute trades, and manage their accounts from anywhere, at any time.

Designed for AMCC Clients: By choosing to offer its own trading platform, AMCC Markets Limited can directly incorporate feedback from its user base into the platform's development and updates. This could result in a highly user-friendly and efficient trading environment, assuming the platform is well-designed and regularly updated to meet traders' evolving needs.

Customer Support

WhatsApp: Clients can reach AMCC's customer support team via WhatsApp at +17153795028. This option allows for real-time messaging with support staff, offering a convenient way for traders to get quick responses to their inquiries or issues.

Telegram: For those who prefer Telegram, AMCC has made available a contact number (+1(646)409-1001) for reaching their support team. Telegram, being a popular messaging app, provides an efficient and secure way for clients to communicate with the broker.

Email: AMCC also offers support through email (info@amccmarkets.com), catering to clients who may have more detailed queries or those who prefer a formal channel of communication. Email communication is essential for resolving complex issues or when there is a need to have a detailed record of the correspondence.

Conclusion

In conclusion, while AMCC Markets Limited offers an array of trading instruments and competitive trading conditions, such as low spreads and accessible deposit and withdrawal processes, the lack of regulatory oversight raises significant concerns about the platform's legitimacy and operational transparency. Additionally, the high leverage offered and the absence of disclosed overnight interest charges further highlight the potential risks for traders. Moreover, the current unavailability of their website adds to the suspicion surrounding the platform. Therefore, investors are strongly advised to exercise caution and prioritize security and regulatory compliance when considering engaging with AMCC Markets Limited or any similar unregulated brokerage, ensuring the safety of their funds and adherence to industry standards.

FAQs

Q1: Is AMCC Markets Limited regulated?

A1: No, AMCC operates as an unregulated broker, lacking oversight from financial regulatory authorities.

Q2: What trading instruments does AMCC offer?

A2: AMCC provides trading services primarily in forex, commodities, precious metals, and energy markets.

Q3: What is the maximum leverage offered by AMCC?

A3: AMCC offers a maximum trading leverage of up to 1:1000.

Q4: What is the minimum deposit required by AMCC?

A4: The brokerage sets a relatively low barrier for entry with a minimum deposit requirement of $50.

Q5: How can clients contact AMCC's customer support?

A5: Clients can reach AMCC's customer support team via WhatsApp, Telegram, or email for assistance.

Risk Warning

Online trading carries substantial risk, potentially leading to the total loss of invested funds. It may not be appropriate for all traders or investors. It's crucial to fully comprehend the associated risks before engaging in trading activities. Additionally, the content of this review is subject to change, reflecting updates in the company's services and policies. The review's creation date is also relevant, as information could have become outdated. Readers should confirm the latest information with the company prior to making any investment decisions. The responsibility for utilizing the information provided herein lies exclusively with the reader.

Keywords

- 1-2 years

- Suspicious Regulatory License

- Suspicious Scope of Business

- High potential risk

Review 4

Content you want to comment

Please enter...

Review 4

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

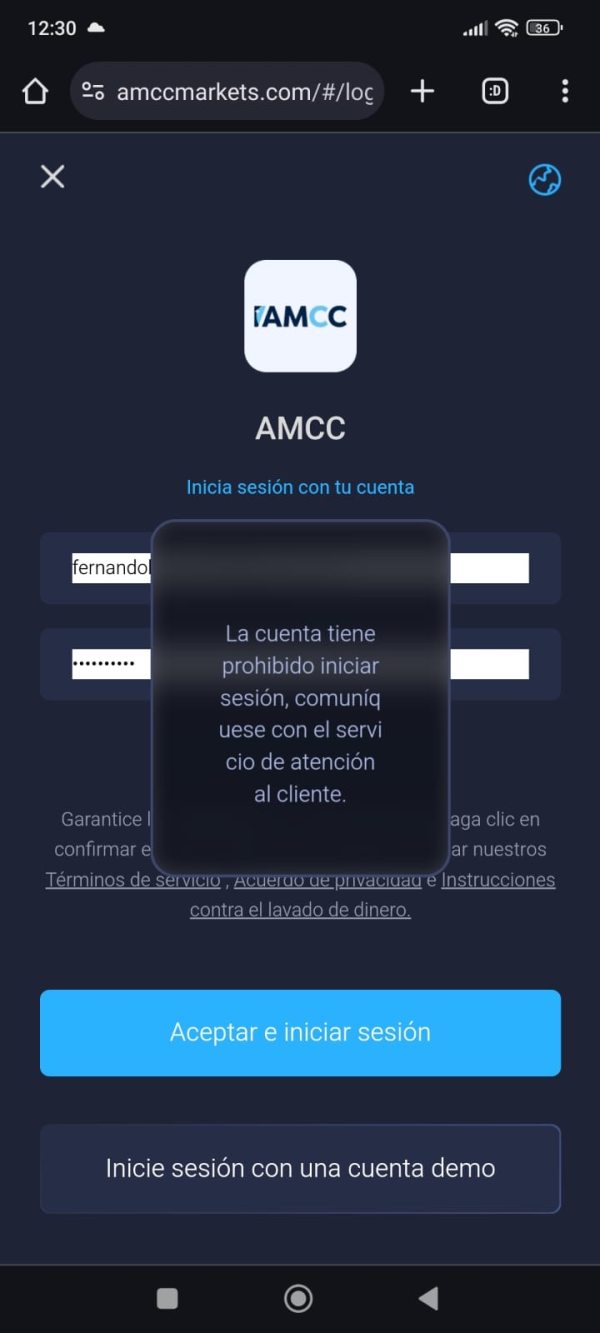

campeón

Mexico

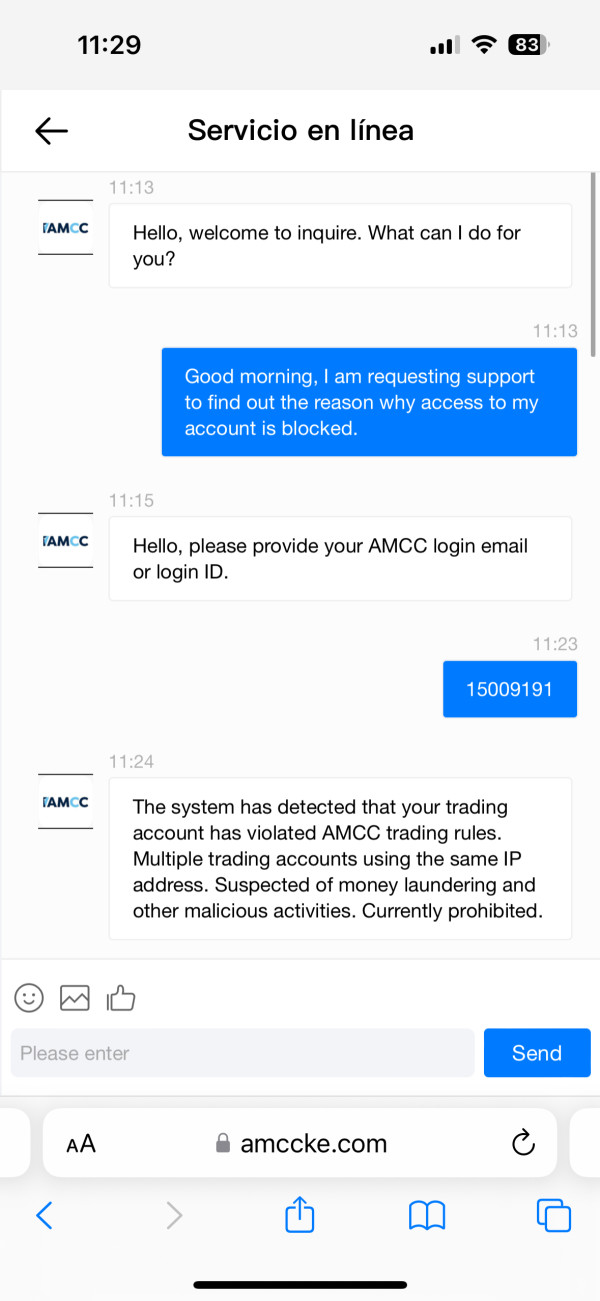

The reason for my message is to know the status of my account that was blocked, I have already sent all the documentation as requested. I want to clarify that a direct family member invited me to be part of the AMCC platform, linked to Binance, used to upload and download economic funds. The main mentor of this platform in which I was on her team is called LAYLA with a Facebook name: Shirley Leong. She asked us to develop a team of 10 people to be able to operate within AMCC, in such a way that we received a guest reward of five dollars for her, five dollars for the mentor above her, to which this led me to invite my own family to be part of this project. I want to ask you in the most cordial and respectful way to release my account since we were not aware that using the same IP or Wi-Fi network would violate AMCC rules. My wife and I used the same Wi-Fi network, we never noticed. The mentor LAYLA who sent the commercial signals only threatened to cancel our accounts and not be able to continue trading. The accounts were not operated by a bot, we are natural persons, with documents that are NOT illegal, I request that my situation be resolved as soon as possible, I respectfully address AMCC and the team that make up this support to release my account, a cordial Greetings, I am attentive to any proof you request to facilitate the process of releasing my account.

Exposure

03-27

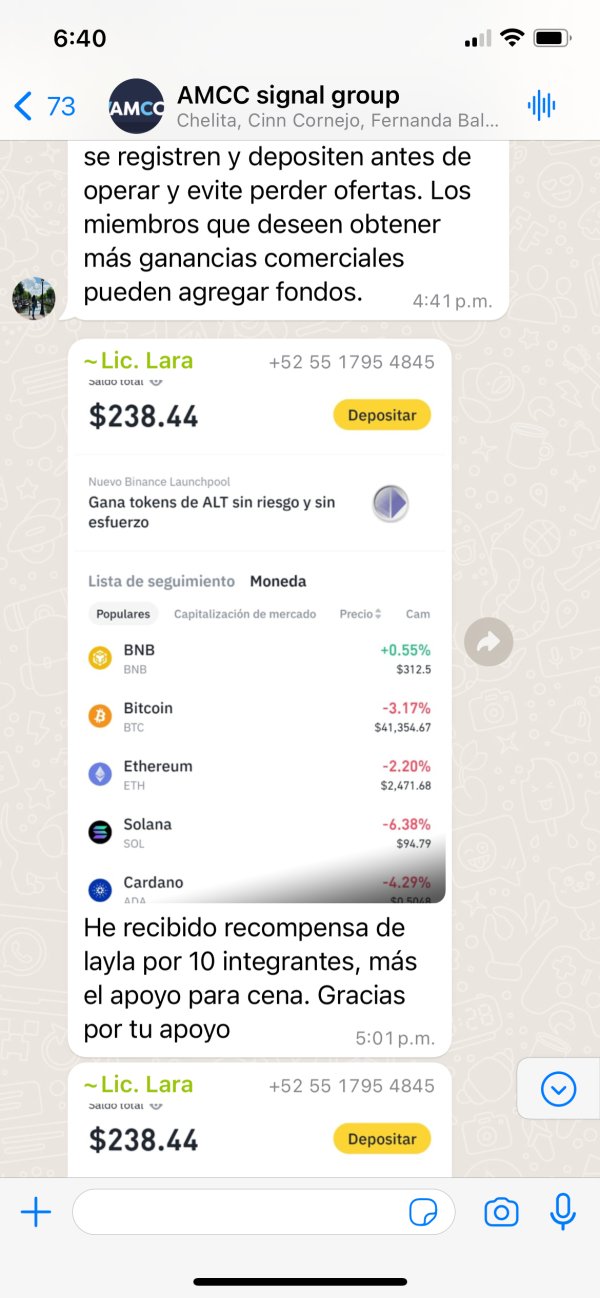

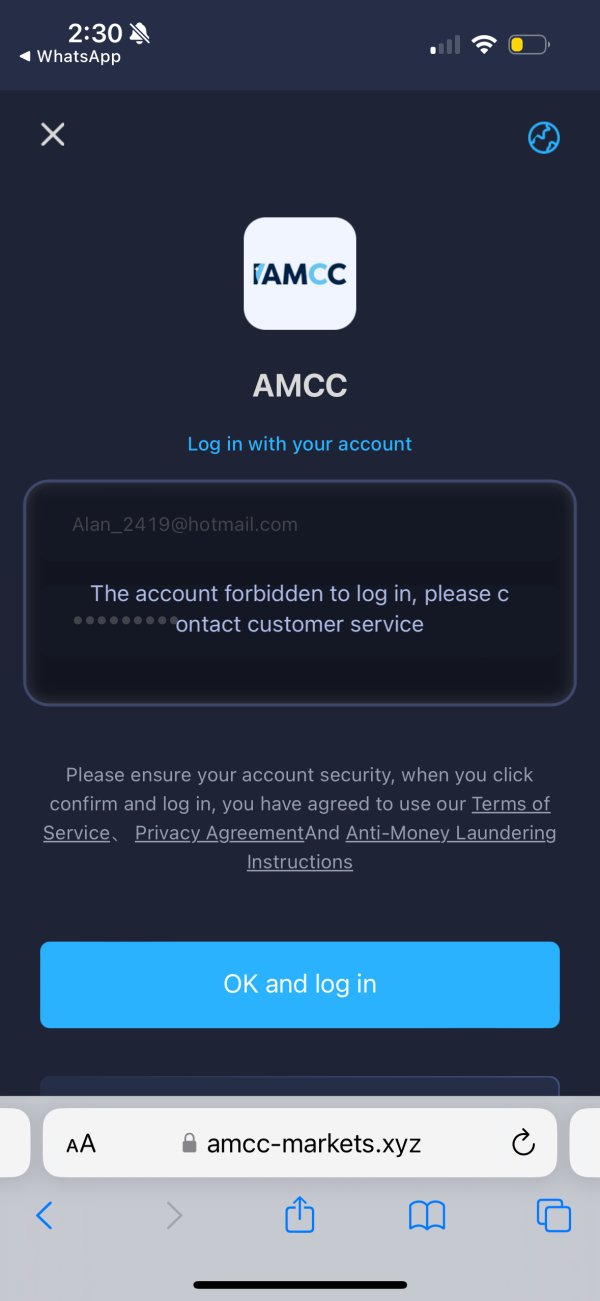

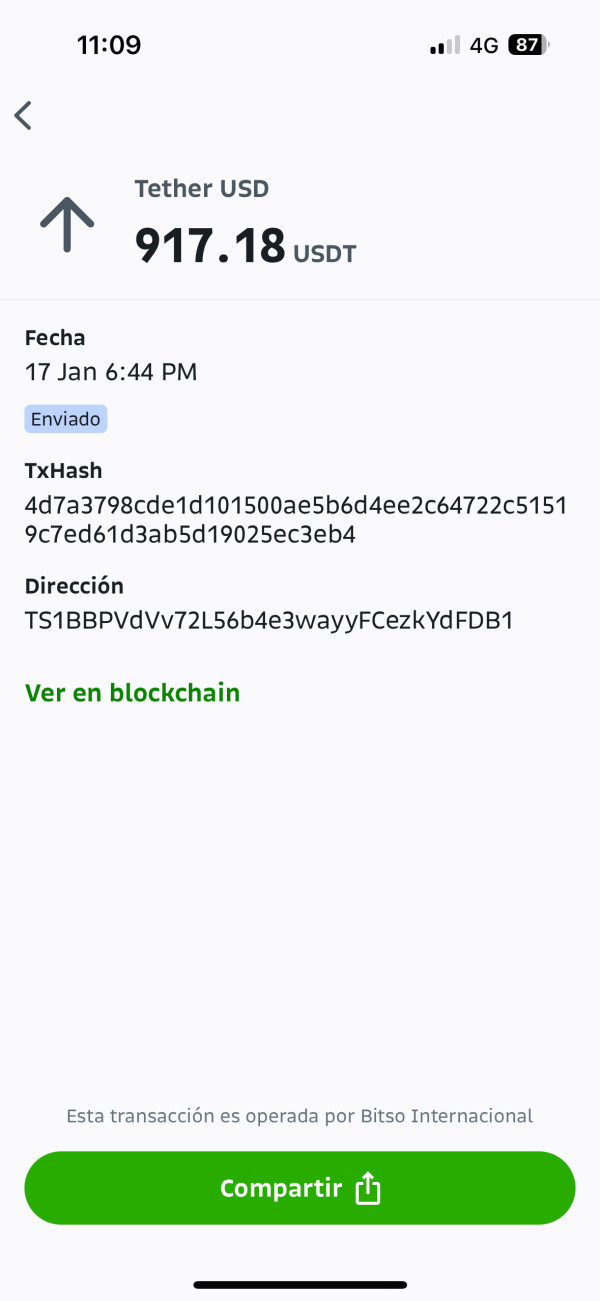

TigerEsq

Mexico

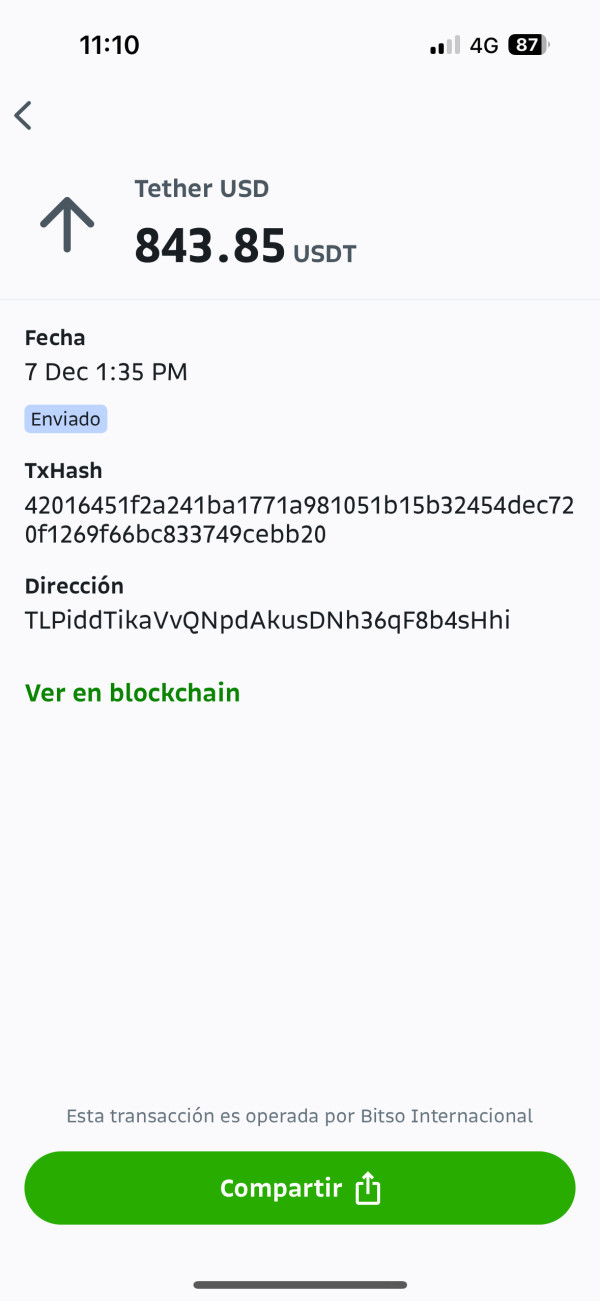

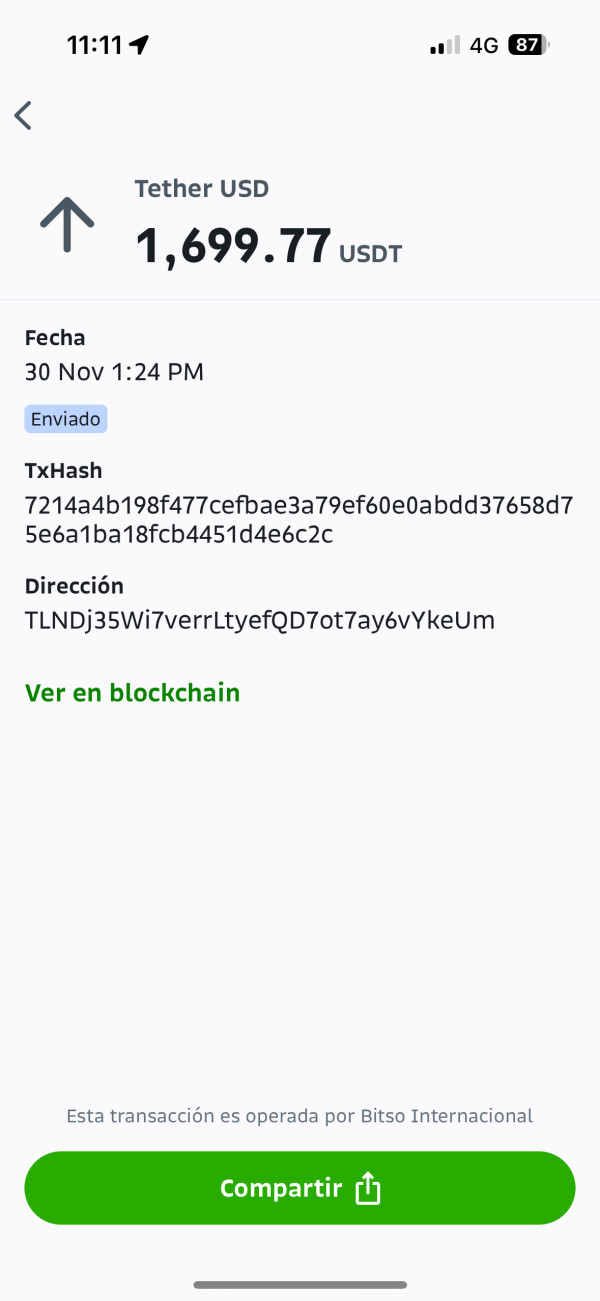

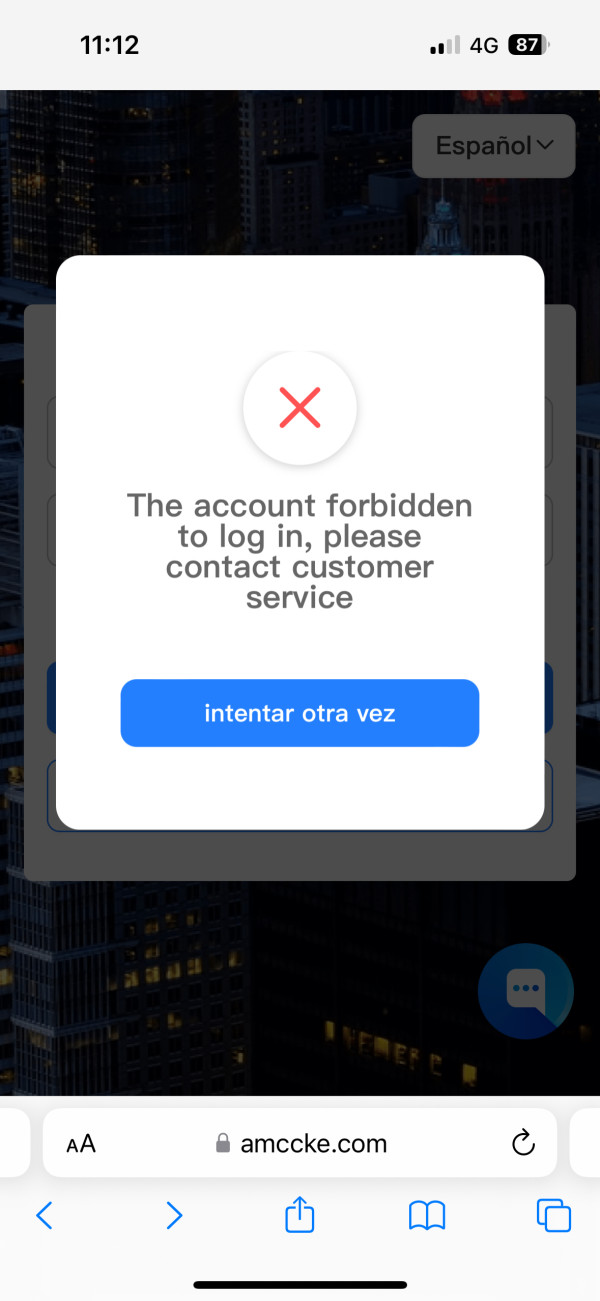

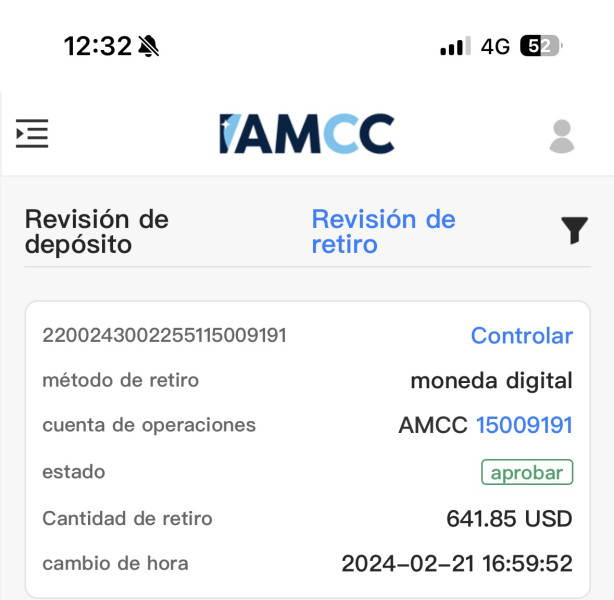

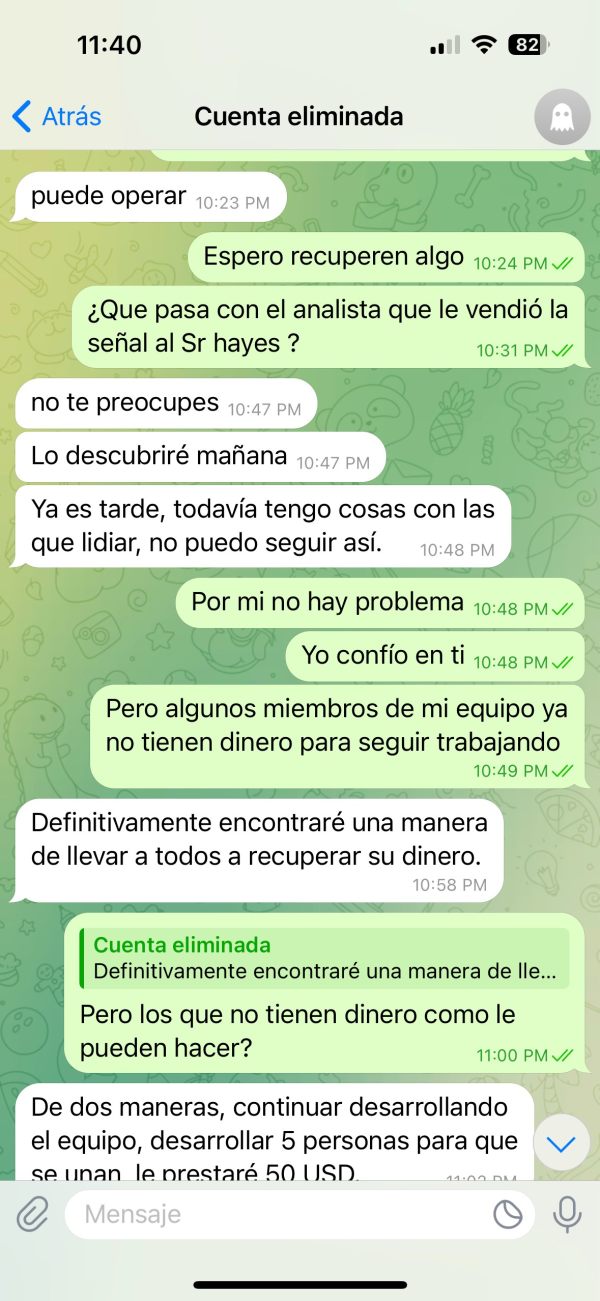

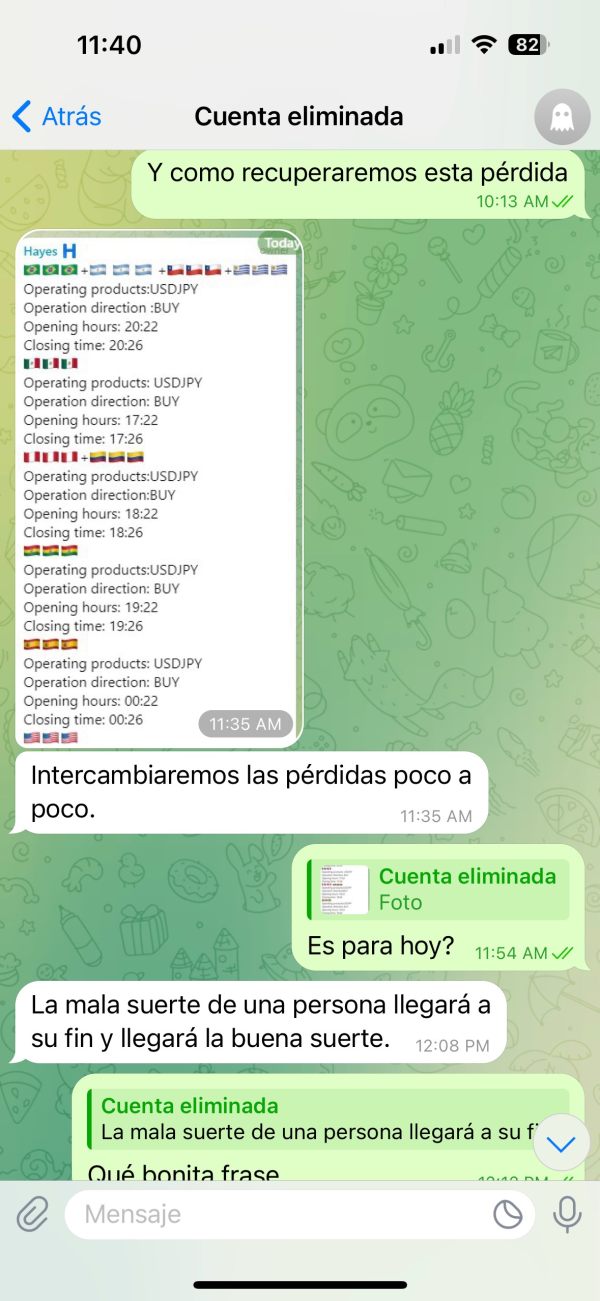

I was invited to the AMCC platform to make investments with commercial signals where you earned from 2 to 12 percent of your capital and the minimum investment to enter was $50. AMCC is based on developing your team up to level C, level A is the member who enters with your invitation, level B is the one who enters with the invitation of your level A, and so on until reaching level C. The leader put pressure To develop the team larger with the belief that we would earn more commissions and help more people earn money, we were motivated to withdraw the little money earned to gain more confidence and thus invest more money to have better profits. I was trading for approximately 5 months and everything was going well, I earned well and could withdraw, but when I had a team of almost 30 people, all with their money invested, they sent us a false signal and we all lost almost all the money we had invested, to recover it They told us to invest more and continue trading, they sent us new signals for 3 days and again there was another loss, we tried to withdraw the little that was left and the money never reached the bito account, they blocked our access to the platform. AMCC with the excuse that we were carrying out money laundering and they would investigate us, but that is not true, we never did anything like that, we only operated with the signals they sent us, our leader called Vera is from Thailand and her boss's name is Mr. Hayes, but none of them have given a clear answer as to what happened and they just stopped answering us, my leader Vera already deleted me from social networks, changed my WhatsApp number and deleted her account on Telegram, they disappeared with our money. I share the screenshots of the last withdrawal attempt I made which never reached Bitso the deposits I made, the message from the platform where my access was blocked, also the conversation with my leader, please request support.

Exposure

03-15

Crocodile tears

United Kingdom

I traded with this broker for merely $50 and quit when they wanted more money.

Neutral

08-07

Aldam

Hong Kong

The trading platform of this trader is very convenient to use for me, but its lack of regulatory authority to supervise it ,which makes me worried about the security of trading.

Neutral

07-01