Often referred to as Islamic accounts, swap-free accounts cater to those Forex traders who wish to comply with the principles of Islamic finance, which prohibits earning or paying interest. These accounts don't charge swaps on overnight positions, hence living up to their name - 'swap-free'. To make our selection, we reviewed various critical points, including but not limited to, overall customer satisfaction, spreads, fees, trade execution speed, software platform reliability, depth of offered services, regulatory compliance, and customer support quality. We have poured many hours into this research, a testament to our commitment to provide in-depth and reliable information to simplify your trading journey and decision-making process.

Best Swap Free Account Forex Brokers

more

Comparion of Best Swap Free Account Forex Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

① BlackBull Markets

Best overall swap free forex broker 2024

New Zealand's own BlackBull Markets is a reputable and committed broker that gives retail clients the feeling of trading at an institutional level. The company covers everything from Forex to commodities and indices.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Swap Free | Yes (ECN Std/ECN Prime account) |

| Execution Speed | Not publicly specified, using Equinix servers for reliable low-latency trading |

| Min Deposit | $0 |

| Regulation | FMA, FSA |

| Tradable Instruments | 26,000+, forex, shares, commodities, futures, indices, crypto |

| Max. Leverage | 1:500 |

| Spreads & Commissions | From 0.8 pips + no commission (ECN Std account) |

| Trading Platforms | TradingView, MT4, MT5, cTrader, BlackBull CopyTrader, BlackBull Shares |

| Deposits & Withdrawals | Visa, MAsterCard, Fasapay, UnionPay, Neteller, Skrill, Bank Transfer |

| Customer Support | 24/7 live chat, phone, email |

| Regional restrictions | Residents of the European Union, the United Kingdom nor any non-resident of New Zealand are excluded. |

BlackBull Markets Swap Free Account Features

BlackBull Markets' swap-free accounts, available for both ECN Standard and ECN Prime account types, are designed specifically for traders who, due to religious beliefs, cannot receive or pay interest.

Wide range of tradable instruments: This includes forex, shares, commodities, futures, indices, and cryptocurrencies.

High leverage: BlackBull Markets offers a high leverage of up to 1:500 on these accounts, providing traders with the opportunity to increase their exposure with a smaller initial capital.

Zero minimum deposit for ECN Standard account: This allows traders to start trading without having to make a substantial initial deposit.

However, the swap-free option is not available for their ECN Institutional account.

② XM

Best for offering swap free accounts without any hidden costs

With its origins dating back to 2009, XM is a respected international investment firm. They're known for swift order execution, tight spreads, and offering a diverse selection of over 1,000 financial instruments which include everything from Forex to commodities.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

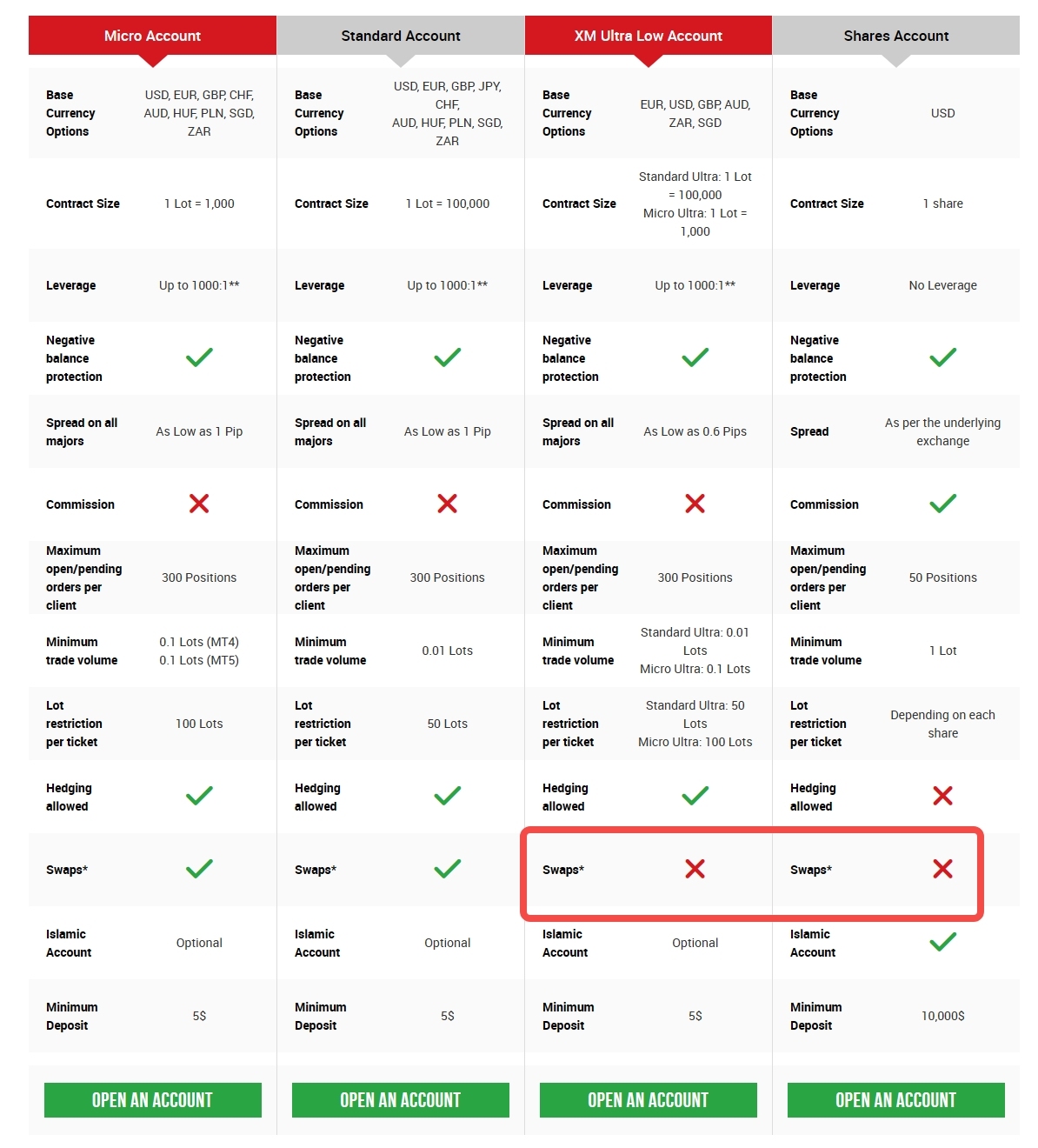

| Swap Free | Yes (XM Ultra Low/Shares account) |

| Execution Speed | 99.35% of trades are executed in less than a second |

| Min Deposit | $5 |

| Regulation | ASIC, CySEC, FSC, DFSA |

| Tradable Instruments | 1000+, forex, CFDs on indices, commodities, stocks, metals and energies |

| Max. Leverage | 1:1000 |

| Spreads & Commissions | From 1 pip + no commission (Std account) |

| Trading Platforms | MT4, MT5, XM WebTrader |

| Deposits & Withdrawals | Credit/debit cards, Paypal, Skrill Moneybookers, Neteller, WebMoney, CashU, GiroPay |

| Customer Support | 24/7 live chat, phone, email |

| Regional restrictions | XM does not provide services for the residents of the United States of America, Canada, Israel and the Islamic Republic of Iran. |

There is a swap fee on the Micro account and Standard account, while swap free for the XM Ultra Low account and Sshares account.

XM Swap Free Account Features

XM offers swap-free versions of their XM Ultra Low and Shares accounts.

Multiple base currencies, catering to traders worldwide.

The XM Ultra Low Account offers as low as 0.6 pips spread on all majors, ensuring competitive trading costs.

The Shares Account allows trading on a per share basis.

Both accounts offer negative balance protection.

High maximum leverage of up to 1:1000 for the XM Ultra Low Account, providing a high level of risk management flexibility.

These accounts allow hedging.

A minimum deposit of $5 for the XM Ultra Low account and $10,000 for the Shares Account. This caters for both low and high volume traders.

High limit for maximum open/pending orders per client.

③ Roboforex

Best for allowing traders to hold positions indefinitely without fees

Hailing from 2009, RoboForex is a globally functioning broker that extends its market opportunities to several segments including Forex, commodities, indices, ETFs, and even cryptocurrencies.

|

|

| Overall Rating | ⭐⭐⭐⭐⭐ |

| Swap Free | Yes (R StocksTrader/ProCent/Pro account) |

| Execution Speed | Over 90% of orders executed within 60 milliseconds |

| Min Deposit | $10 |

| Regulation | CySEC, NBRB, FSC |

| Tradable Instruments | 8 asset classes - Forex, Stocks, Indices, CFDs on Futures, Energies, Commodities, Cryptocurrencies, ETFS |

| Max. Leverage | 1:2000 |

| Spreads & Commissions | Floating from 0 points (Prime account) |

| Trading Platforms | MT4, MT5, MobileTrader, StocksTrader, WebTrader |

| Deposits & Withdrawals | Free for most deposits, withdrawal fees vary on the method - Visa, MasterCard, bank transfer, Skrill, Neteller, etc. |

| Customer Support | 24/7 live chat, phone, email |

| Regional restrictions | They don't work in the territory of the USA, Canada, Japan, Australia, Bonaire, Brazil, Curaçao, East Timor, Indonesia, Iran, Liberia, Saipan, Russia, Sint Eustatius, Tahiti, Turkey, Guinea-Bissau, Micronesia, Northern Mariana Islands, Svalbard and Jan Mayen, South Sudan, and other restricted countries. |

Roboforex Swap Free Account Features

RoboForex offers swap-free accounts for the R StocksTrader, ProCent and Pro accounts.

R StocksTrader Account: Features more than 12,000 trading instruments, USD/EUR account currency, ability to trade US stocks, CFDs on stocks, Currencies and ETF, and CFDs on oil, metals and futures. The first deposit requirement starts from 100 USD.

ProCent Account: This is primarily a smooth transition account for testing strategies, transitioning from a demo account to real trading, or for micro trades. The account currency can be USD, EUR, or GOLD. It provides access to 36 currency pairs and metals.

Pro Account: This account is most popular with beginning traders looking to step into real currency and CFD trading. The account offers a variety of trading instruments, and the ability to trade with USD, EUR, or GOLD as the account currency.

These accounts also offer other features such as Market Execution, extraordinary leverage of up to 1:2000, low minimum deposits, floating spreads from 0 pips and One-click trading. They also provide a history of the trading account for a given period.

④ HFM

Best for transparent swap-free trading conditions and a wide range of tradable assets

HFM, or as some may know it, HF Markets, is highly noted for its exhaustive array of financial instruments. HF Market's coverage is inclusive of Forex, commodities, indices, metals, and a versatile range of CFDs.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

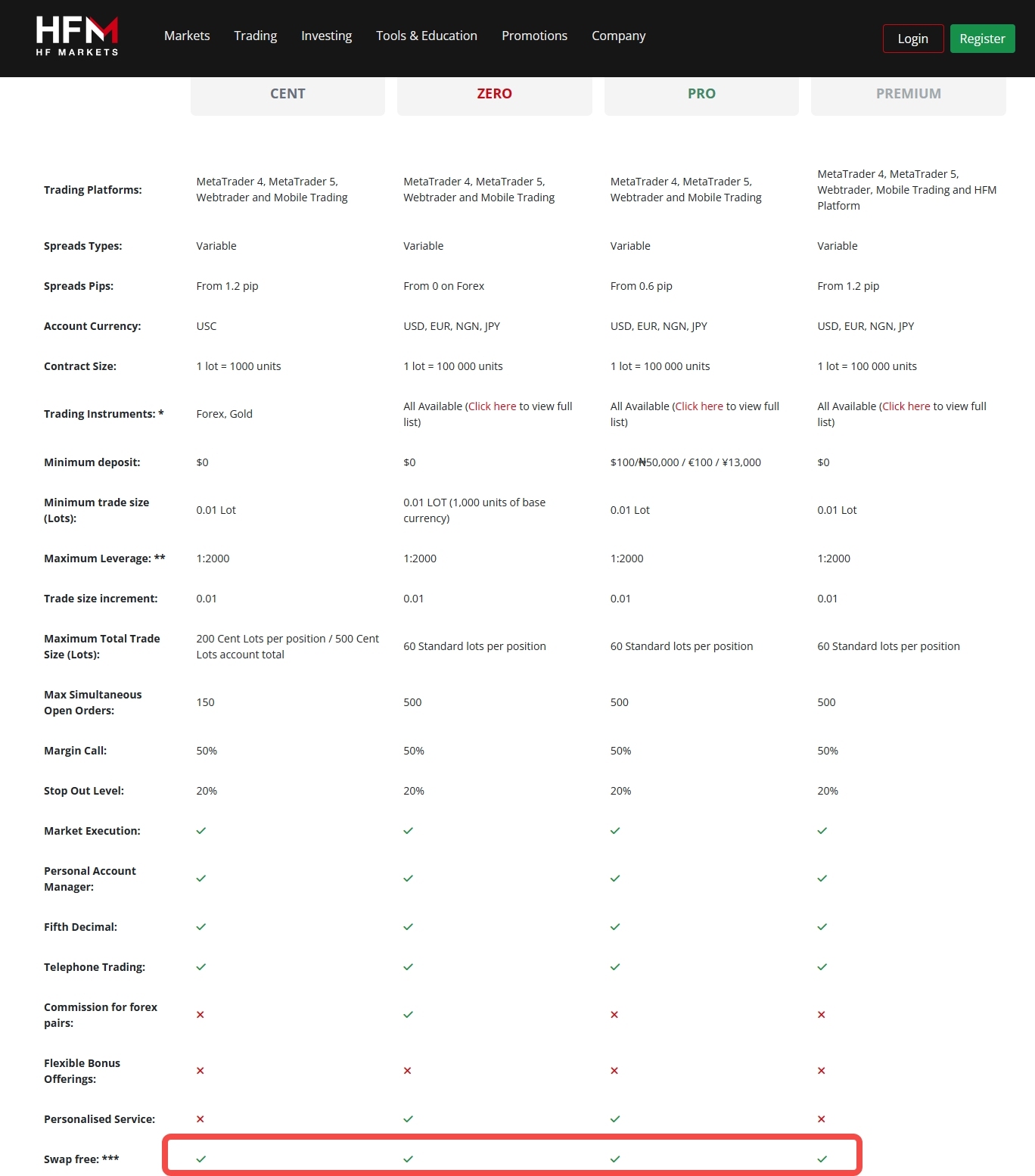

| Swap Free | Yes (all account types - Cent/Zero/Pro/Premium) |

| Execution Speed | Not publicly specified, reliable and quick trade execution |

| Min Deposit | $0 |

| Regulation | CySEC, FCA, DFSA, FSA, CNMV |

| Tradable Instruments | 1000+ CFDs on Forex, Commodities, Bonds, Metals, Energies, ETFs, Indices, Cryptos, Stocks |

| Max. Leverage | 1:2000 |

| Spreads & Commissions | From 1.2 pips pips + no commission (Cent account) |

| Trading Platforms | MT4, MT5, HFM App |

| Deposits & Withdrawals | Free for most deposits & withdrawals, Bank transfer, credit/debit cards, crypto, Fasapay, Neteller, PayRedeem, Skrill, bitpay |

| Customer Support | Live chat, phone, email |

| Regional restrictions | Residents of the USA, Canada, Sudan, Syria, North Korea, Iran, Iraq, Mauritius, Myanmar, Yemen, Afghanistan, Vanuatu and EEA countries are excluded. |

HFM Swap Free Account Features

HFM offers swap-free accounts for their Cent, Zero, Pro, and Premium account types.

Trading Platforms: All these account types support MetaTrader 4, MetaTrader 5, Webtrader and Mobile Trading. Additionally, the Premium account also supports HFM Platform.

Spreads: Variable for all account types. Starting from 1.2 pip for Cent and Premium accounts, from 0 on Forex for Zero account and from 0.6 pip for Pro account.

Account Currency: USC for Cent account and USD, EUR, NGN, JPY for Zero, Pro and Premium accounts.

Contract Size: 1 lot equals 1000 units for Cent account and 1 lot equals 100 000 units for Zero, Pro and Premium accounts.

Trading Instruments: Forex and Gold for Cent and all available for Zero, Pro and Premium account types.

Minimum Deposit: 0 for Cent, Zero and Premium accounts. Pro account requires a minimum deposit of 100/₦50,000 / €100 / ¥13,000.

Minimum Trade Size: 0.01 Lot for all account types.

Maximum Leverage: 1:2000 for all account types.

Maximum Total Trade Size: 200 Cent Lots per position / 500 Cent Lots account total for Cent account and 60 Standard lots per position for Zero, Pro and Premium accounts.

Max Simultaneous Open Orders: 150 for Cent account and 500 for Zero, Pro and Premium accounts.

Margin Call: 50% for all account types.

Stop Out Level: 20% for all account types.

⑤ Exness

Best for tight spreads, fast execution, and flexible leverage up to 1:Unlimited

Known for tempting trading conditions and some of the fastest order execution times in the market, Exness sets itself apart. The broker gives access to a great number of trading tools with a variety that extends to more than 120 currency pairs.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

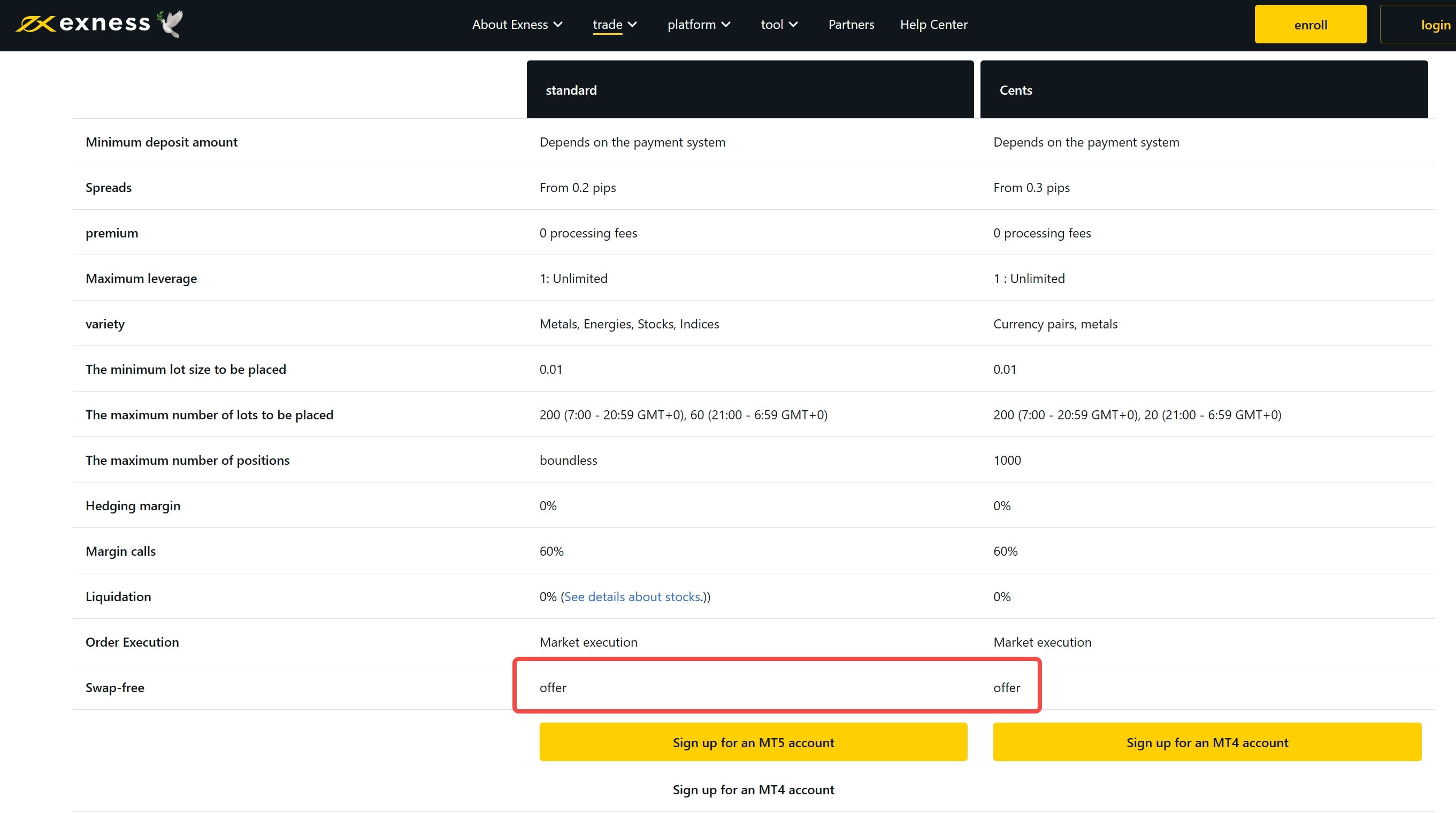

| Swap Free | Yes (all account types - Standard/Cent/Bare Spot/Zero/Pioneer) |

| Execution Speed | Execute the majority of trades in under 0.1 seconds |

| Min Deposit | $10 |

| Regulation | FSCA, CYSEC, FCA, FSA |

| Tradable Instruments | currency pairs, metals, energies, stocks, indices |

| Max. Leverage | 1: Unlimited |

| Spreads & Commissions | From 0.2 pips + no commission (Std account) |

| Trading Platforms | Exness trading app, Exness Web, MT4, MT5 |

| Deposits & Withdrawals | Free - Bank Card, MyPay, OTC, Skrill, Neteller, ChipPay, SticPay |

| Customer Support | 24/7 live chat, phone, email |

| Regional restrictions | Residents of the United States, Iran, North Korea, Europe, the United Kingdom, and other jurisdictions are excluded. |

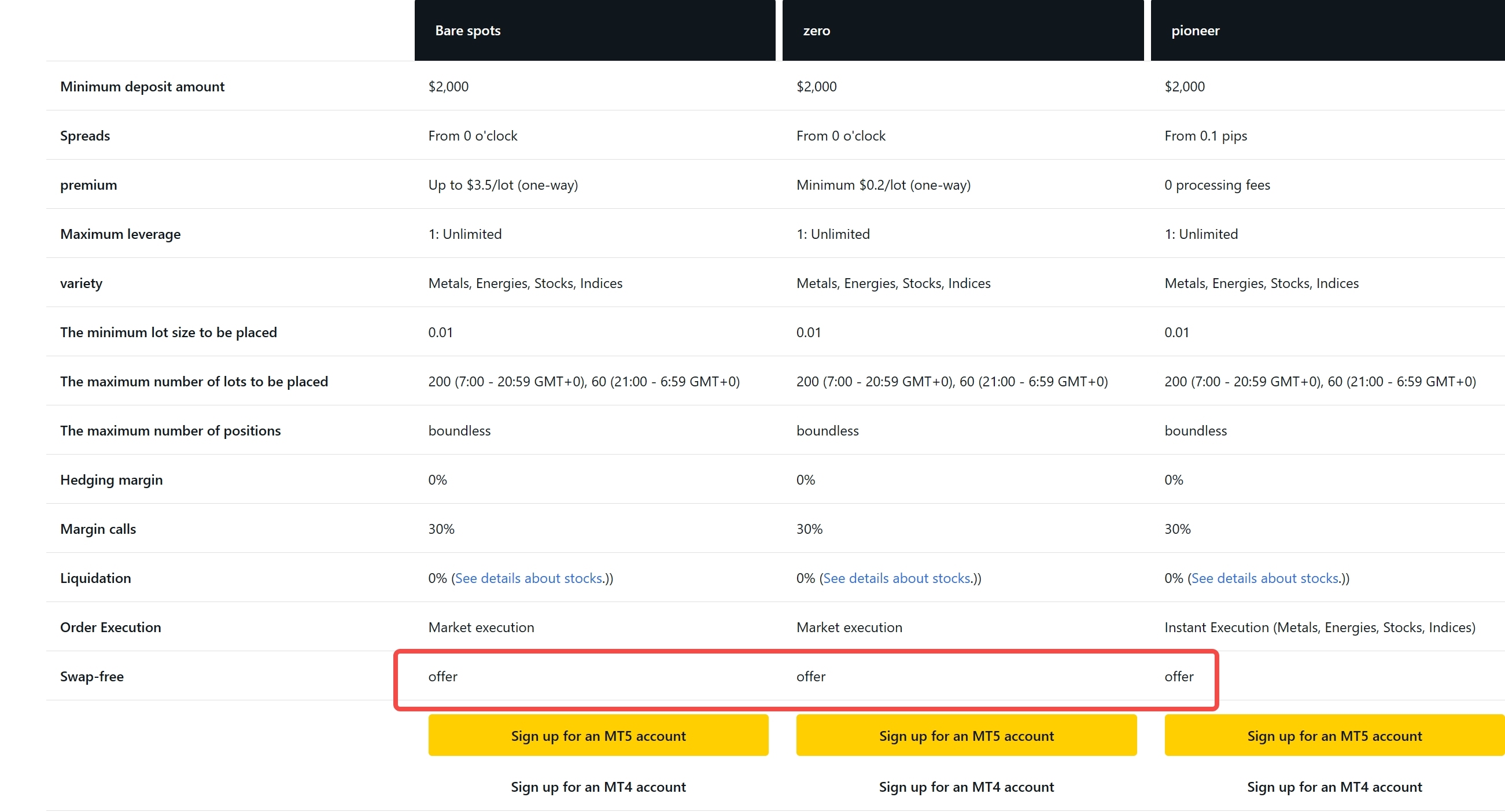

Exness Swap Free Account Features

Exness offers a Swap-Free option for all account types, including Standard, Cent, Bare Spot, Zero, and Pioneer accounts.

Standard Account

Swap-free Pip spread starting from 0.2

Leverage up to 1:Unlimited

The minimum lot size to be placed: 0.01

The maximum number of positions: Boundless

Cent Account

Swap-free Pip spread starting from 0.3

Leverage up to 1:Unlimited

The minimum lot size to be placed: 0.01

The maximum number of positions: 1000

Bare Spot Account

Swap-free Pip spread from 0

Leverage up to 1: Unlimited

The minimum lot size to be placed: 0.01

The maximum number of positions: Boundless

Zero Account

Swap-free Pip spread from 0

Leverage up to 1: Unlimited

The minimum lot size to be placed: 0.01

The maximum number of positions: Boundless

Pioneer Account

Swap-free Pip spread starting from 0.1

Leverage up to 1: Unlimited

The minimum lot size to be placed: 0.01

The maximum number of positions: Boundless

⑥ Octa

Best for low minimum deposit requirement and competitive spread

Known for offering lower spreads, OctaFX garners attention with regular contests that give traders a chance to win account funding money. OctaFX's market offering is quite comprehensive with Forex, commodities, indices, metals, and cryptocurrencies included.

|

|

| Overall Rating | ⭐⭐⭐⭐ |

| Swap Free | Yes (all account types - OctaTrader/MT5/MT4) |

| Execution Speed | Not publicly specified, fast and efficient |

| Min Deposit | $25 |

| Regulation | CySEC |

| Tradable Instruments | 300+, currency pairs, stock derivatives, indices, commodities, cryptocurrencies, shares |

| Max. Leverage | 1:500 |

| Spreads & Commissions | From 0.6 pips + no commissions (all account types) |

| Trading Platforms | OctaTrader, MT4, MT5, Octa trading app |

| Deposits & Withdrawals | Free - Neteller, Skrill, Visa, MasterCard, cryptocurrencies |

| Customer Support | 24/7 live chat |

| Regional restrictions | N/A |

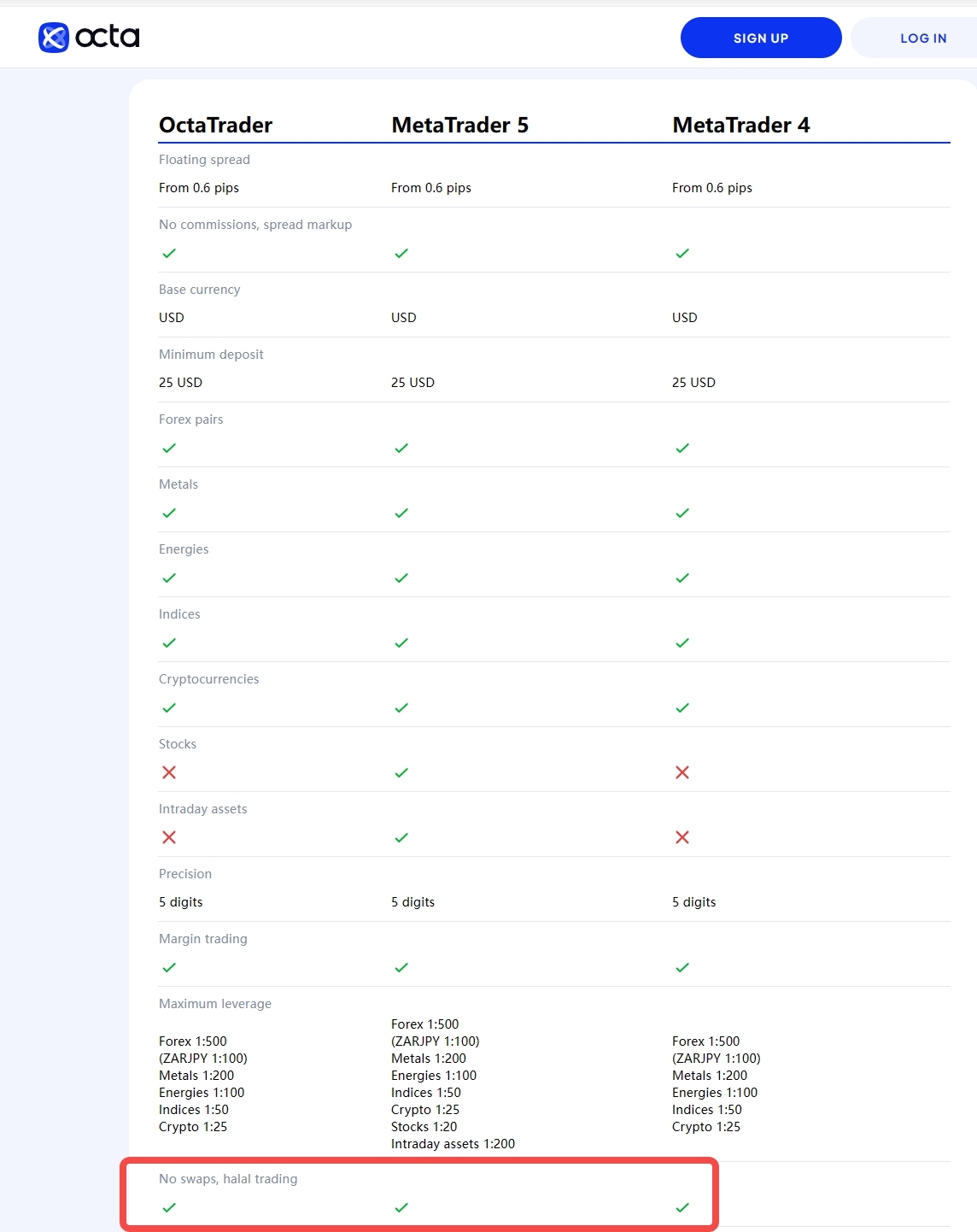

OctaFX Swap Free Account Features

OctaFX offers Swap-Free account options for all their trading platforms including OctaTrader, MetaTrader 5, and MetaTrader 4.

OctaTrader

Floating spread from 0.6 pips.

No commissions, spread markup.

Base currency: USD.

Minimum deposit: 25 USD.

Supports Forex pairs, Metals, Energies, Indices, Cryptocurrencies, Stocks, Intraday assets.

Precision of 5 digits.

Leverage: Forex 1:500 (ZARJPY 1:100), Metals 1:200, Energies 1:100, Indices 1:50, Crypto 1:25.

Minimum order size: 0.01 lot.

Maximum order size: 50 lots.

Market execution type.

MetaTrader 5

Similar features as above, with the addition of Stocks leverage of 1:20 and Intraday assets leverage of 1:200. Maximum order size for this account is 500 lots.

MetaTrader 4

Similar features as OctaTrader account, except for the maximum order size of 200 lots.

Swap Free Account Forex Brokers FAQs

What is a swap in forex trading?

In forex trading, a swap refers to a fee or charge that is incurred by the trader from holding a trading position overnight. This swap fee consists of the difference between the interest rates of the two currencies that are part of the currency pair being traded.

If the interest in the currency you bought is higher than the interest in the currency you sold, you earn the interest (positive swap). Conversely, if the interest in the currency you bought is lower, you will be charged the difference (negative swap).

Furthermore, the swap fee can differ and may either be credited or debited to the trader's account, depending on the trade's direction (long or short) and the interest rate differential.

What is a swap free forex account?

A swap-free forex account, also known as an Islamic Forex Account, is a trading account that does not incur any swap or rollover interest in overnight positions. This type of account is in compliance with Islamic Sharia law, which prohibits earning or charging interest.

Therefore, swap-free accounts are specifically designed for traders of the Muslim faith, although it can be used by anyone who prefers not to earn or pay interest for religious or other reasons.

How does a swap free forex account work?

A swap-free forex account operates much like any other trading account with one key difference – it does not incur any swap or rollover interest in positions that are kept open overnight.

Traditional forex accounts charge or pay interest based on the “swap” rate, which is the interest rate differential between the two currencies in a pair. However, in a swap-free forex account, these charges are waived, and the account is not credited or debited with any overnight interest. This makes it suitable for traders who, for religious reasons such as compliance with Sharia law, or for any other reasons, wish to avoid paying or earning interest.

While swap charges don't apply, swap-free accounts may have other forms of fees to compensate for this benefit. This might include higher commission fees or administrative charges. Make sure that you have carefully reviewed the broker's terms and conditions when choosing a swap-free account.

Pros & cons of swap free forex accounts

| Pros √ | Cons × |

| · No Swap Fees | · Higher Trading Costs |

| · Compliance with Sharia Law | · Restrictions on Holding Periods |

| · Transparency | · Limited Availability |

Pros

No Swap Fees: You don't have to pay or earn interest on positions held open overnight, which can be beneficial if you tend to hold trades long-term.

Compliance with Sharia Law: For Muslim traders, swap-free accounts adhere to the Islamic principle of not paying or receiving interest, allowing them to trade within their religious beliefs.

Transparency: Since interest isn't charged or paid, it simplifies trade analysis because you don't have to take swap fees into account. You know exactly what they are paying in terms of trading costs.

Cons

Higher Trading Costs: To compensate for the lack of swap fees, some brokers charge higher commissions or other administrative fees on swap-free accounts, meaning overall trading costs might be higher.

Restrictions on Holding Periods: Some brokers place limits on how long positions can be held without swaps. After the limit is reached, hefty charges may be applied.

Limited Availability: Not all brokers offer swap-free accounts, and sometimes, they are only available to traders who can prove they are of Muslim faith. As we have shared before in this article, all these brokers on the list offer swap free accounts.

Who should use swap-free accounts?

Swap-free accounts are usually used by traders who are of the Muslim faith because these accounts adhere to the Islamic principle of not paying or receiving interest. Also, any trader who wants to avoid paying or earning interest on long-held positions can benefit from a swap-free account. This includes traders who prefer taking long-term positions, or ones that require keeping open trades overnight or for several days.

How to choose a swap-free account forex broker?

When choosing a forex broker for a swap-free account, you need to pay close attention to some important factors:

Regulation

Ensure the broker is regulated by a reputable authority like the Financial Conduct Authority (FCA), Australian Securities and Investments Commission (ASIC), the U.S. Commodity Futures Trading Commission (CFTC), or others. This will provide you with a certain level of protection and accountability.

On WikiFX, we strive to deliver the most relevant and up-to-date regulatory information about forex brokers. We understand how vital it is to know your broker's regulatory status before investing your hard-earned money. Our team conducts an extensive background check on forex brokers from around the globe to provide you with their regulatory data and other critical aspects.

By using WikiFX, you can easily verify a broker's regulatory status and steer clear of potential frauds or unregulated platforms. Knowledge is power - stay informed, stay safe and always check a broker's regulatory status on WikiFX before investing. It's easy, fast, and can save you from unnecessary losses.

Reputation

Check out online reviews and forums to learn about the experiences of other traders with that particular broker.

Islamic Compliance

For traders specifically looking for an Islamic swap-free account, it is beneficial to look for brokers that have their accounts approved by a reputable Islamic authority.

Trading costs

While swap-free accounts do not incur swap or rollover interest on overnight positions, some brokers might charge higher commissions or other fees to compensate for this. Make sure to thoroughly review their fee structure.

Platform and Tools

Confirm that the broker offers a user-friendly platform that accommodates your trading style and goals. The platform should include a variety of technical analysis tools, charts, and indicators to aid your trading decisions.

Account Terms

Be sure to read the account terms and conditions. Look specifically for any restrictions on holding periods for trades and what fees may apply if those limits are exceeded.

Customer Service

Efficient customer support is crucial, especially for beginners. Check if their support is available 24/7 and if they provide support in your native language.

Forex Risk Disclaimer

Trading Forex (foreign exchange) carries a high level of risk, and may not be suitable for all investors. Before deciding to trade foreign exchange, you should carefully consider your investment objectives, level of experience, risk appetite, and the possibility of incurring losses. There is a possibility that you may sustain a loss of some or all of your initial investment and therefore you should not invest money that you can not afford to lose. You should be aware of all the risks associated with foreign exchange trading and seek advice from an independent financial advisor if you have any doubts.

You Also Like

Best DMA Forex Brokers (Direct Market Access) for 2024

Delve into the world of DMA Forex Brokers with our guide. Discover top picks and know how DMA brokers operate, their pros and cons.

Best Forex Brokers for Beginners in Nigeria for 2024

Select the top forex brokers for beginners in Nigeria from many companies to ensure a safe trading environment.

Cheapest Brokers 2024 | We List the Best Brokers with low fees

Slash forex trading costs: find the cheapest brokers, avoid hidden fees, and boost your returns!

Best Zero Spread Forex Brokers in 2024

Dive into zero-spread forex trading: explore its perks, pitfalls, and discover top brokers to optimize your journey.