In the financial world, the cost structure is a key factor in choosing a broker, as it can greatly impact an investor's overall return. In this industry, the gap in trading costs can be quite significant, ranging from zero-commission online brokers to full-service brokers who charge high fees per trade. For most investors, especially beginners and infrequent traders, reducing trading costs is a critical way to increase returns.

Therefore, in 2025, we see major brokers attracting and retaining customers by reducing trading fees. In order to help our readers navigate through the forex trading world, we will be ranking and reviewing the brokers with the lowest fees in 2025 to help you find the most cost-effective forex trading broker.

How Did WikiFX Choose the Cheapest Brokers?

WikiFX determined the cheapest forex brokers based on several key criteria, with a primary focus on trading costs. The inclusion criterion was limited to brokers facilitating real stock trading, excluding those offering stocks solely through Contracts for Difference (CFDs).

The rankings were calculated considering trading fees across various asset classes, including stocks, as well as fees indirectly associated with trading, such as withdrawal fees.

To further enhance the evaluation, brokers offering a diverse range of asset classes received higher scores. This is attributed to the added complexity of maintaining low fees across multiple asset classes, presenting a significant advantage for investors.

In addition to fee-related factors, WikiFX incorporated supplementary criteria to assess the overall quality of brokers. Elements like the account opening process, customer service, and other aspects contributed to the overall score, providing a comprehensive evaluation beyond just cost considerations.

List of Cheapest Forex Brokers

competitive fee structure with diverse account types

Charges no account, inactivity, deposit or withdrawal fees.

Low trading fees (free stock and ETF trading).

Superb desktop trading platform. Great customer support.

Fast and easy account opening. Great trading platforms.

Commission-free trading for US-listed stocks, ETFs and options

more

Comparison of Cheapest Brokers

Forex Broker

License

Minimum Spread

Maximum Leverage

Minimum Deposit

Open account

Details

Compare

Cheapest Forex Brokers Overall

①Saxo Bank

Saxo Bank's fee structure is quite competitive. Starting with a minimal deposit of $0, it allows clients to access its services without any upfront commitment.The bank does not charge any inactivity fees and offers 190 currency pairs for trading, featuring a reasonable EUR/USD spread of 0.8. Both deposits and withdrawals can be processed via bank transfers and credit/debit cards, with no withdrawal fee.

| Saxo Bank |  |

| Minimum deposit | $0 |

| Inactivity fee | No |

| Withdrawal fee | $0 |

| Deposit methods | Bank transfer, Credit/debit cards |

| Withdrawal methods | Bank transfer |

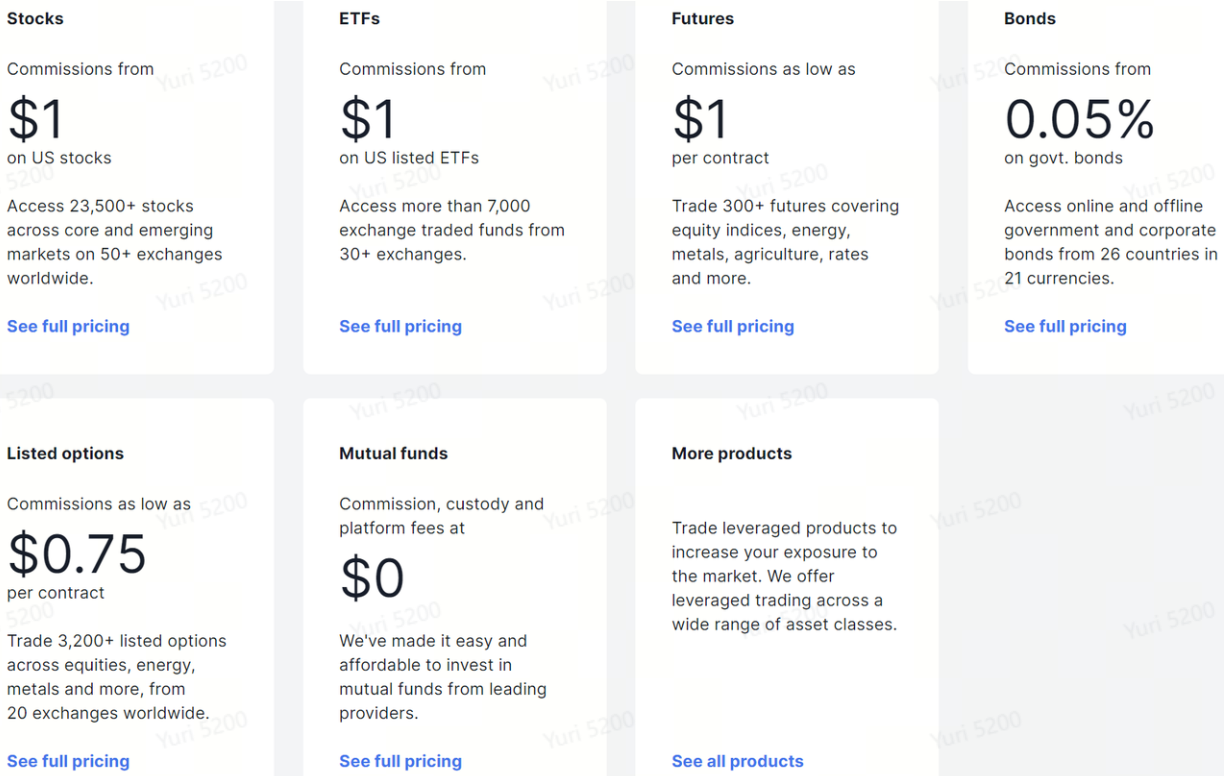

The detailed fee information for each trading product is as follows:

| Product | Commissions |

| Stocks | $1 on US stocks |

| ETFs | $1 on US listed ETFs |

| Mutual Funds | $0 |

| Options contract | $0.75 |

| Futures contract | 1 |

| Bonds | 0.05% on govt.bonds |

Saxo Bank has average average trading and non-trading fees. The structure is quite mixed, with great differences between the fees for various asset classes. Saxo also pays interest on uninvested cash, which is a plus.

Pros

Low stock/ETF fees

Low FX fees

No withdrawal fee

Cons

High custody fee

High fees for options and futures

②GO Markets

GO Markets provides a competitive fee structure for traders. In the GO Plus+ account, EURUSD and GBPUSD trades incur a $2.50 commission per lot, coupled with low average spread costs of 0.0 and 0.8 pips, respectively, during peak hours. For S&P 500 CFDs, fees are included in the spread, averaging 0.6 points during peak trading hours. Notably, there is no inactivity fee, offering traders flexibility in managing their accounts.

GO Markets charges no account, inactivity, deposit or withdrawal fees.

| GO Markets |  |

| FX commission per lot | $0 or $2.5 |

| Minimum deposit | $0 |

| Inactivity fee | No |

| Currency pairs | 49 |

| EUR/USD spread | 0.0 or 0.8 |

| Deposit methods | Bank transfer, Credit/debit cards, Skrill, Neteller, DotPay, Nuvei, fasapay |

| Withdrawal methods | Bank transfer, Skrill, Neteller, DotPay, Nuvei, fasapay |

| Withdrawal fee | $0 |

GO Markets offers traders a choice between two account types: GO Plus+ and Standard. The GO Plus+ Account comes with a commission of $2.50 per side on standard lots, ultra-low spreads starting from 0.0 pips, and leverage of up to 500:1.On the other hand, the Standard Account operates on a commission-free model, featuring competitive spreads from 0.8 pips and the same leverage of up to 500:1.

Pros

Low forex fees

No withdrawal fee

No inactivity fee

Generous leverage

Cons

Commission fees of GO Plus+ Account

③TD Ameritrade

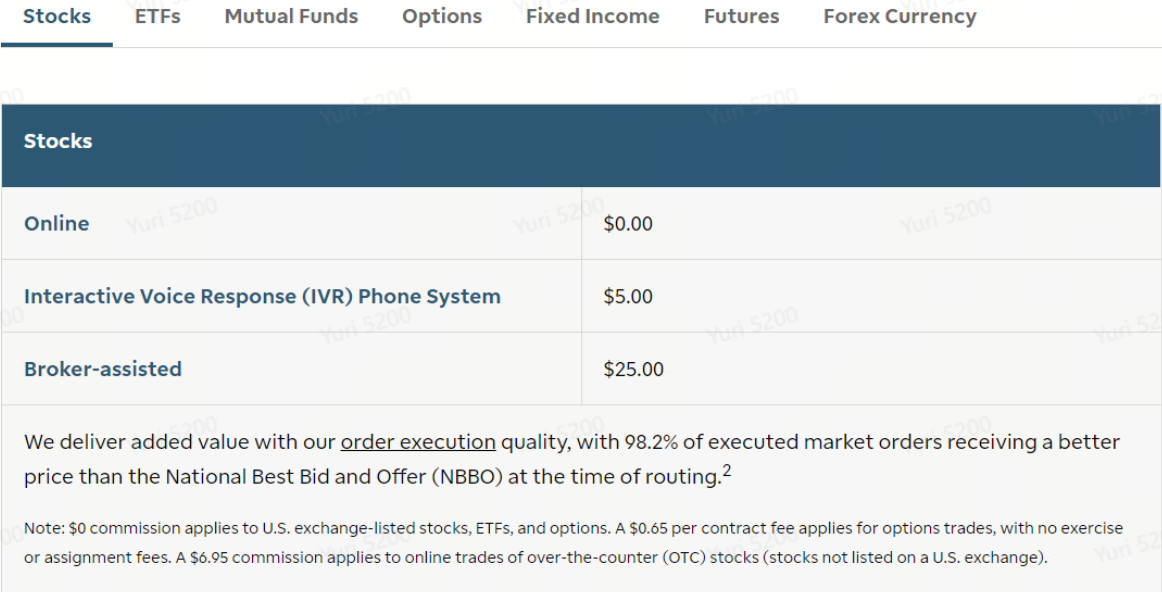

TD Ameritrade, now a part of Charles Schwab, emerged as one of the most cost-effective brokers following a pricing competition in October 2019. In response to this market trend, TD Ameritrade, along with several other online brokers, significantly reduced its stock and ETF trades rate from $6.95 to $0.

This broker distinguishes itself by offering $0.00 commissions, devoid of platform fees, data fees, or trade minimums. Online stock, ETF, and option trades incur no commissions. The comprehensive pricing details for various trading products can be found on the company's official website at https://www.tdameritrade.com/pricing.html. While the online trading system is fee-free, additional services such as phone-based transactions and broker assistance may entail separate charges.

For mutual funds, the cost structure at TD Ameritrade generally involves a purchase fee of $49.95 and no charge for selling, though exceptions exist where the purchase fee is $74.95. It is essential to be aware that NTF funds held for 180 days or less before being sold may incur a short-term redemption fee of $49.99.

| TD Ameritrade |  |

| FX commission per lot | $0 |

| Minimum deposit | $0 |

| Inactivity fee | No |

| Currency pairs | 70+ |

| EUR/USD spread | 1.3 |

| Deposit methods | Bank transfer, Credit/debit cards, Skrill, Neteller, DotPay, Nuvei, fasapay |

| Withdrawal methods | Bank transfer, Skrill, Neteller, DotPay, Nuvei, fasapay |

| Withdrawal fee | $0 |

| Product | Fee(per trade) |

| Stocks | $0.00 |

| Options | $0.00 |

| ETFs | $0.00 |

| Mutual Fund | Varies |

| Options Contracts | $0.65 |

| Futures Contracts | $2.25 |

Pros

Wide range of educational content available in many different formats

Expansive trading tools and resources for all types of investors

Well-designed mobile app and website

Excellent client support

Cons

Fractional shares are not offered

No direct crypto trading

No automatic enrollment for the cash sweep program

Post-merger TD Ameritrade/Schwab platform unknown

④Ava Trade

Ava Trade requires a minimum deposit of $100 to start trading, offering a fee-friendly environment with free trading for US stocks and ETFs, and no inactivity fees. For US tech funds, a higher fee of $49.95 or $75 for buying is applicable, but selling is free, and there are around 3,600 free mutual funds to choose from.

| AvaTrade |  |

| FX commission per lot | $3.00 commission per lot per trade |

| Minimum deposit | $100 |

| Inactivity fee | Yes |

| Currency pairs | 55 |

| EUR/USD spread | 0.9 |

| Deposit & Withdrawal methods | Bank transfer, Credit/debit cards, PayPal, Neteller, Skrill, Klarna, Webmoney, POLi, Boleto, Perfect Money |

| Withdrawal fee | $0 |

AvaTrade has low CFD fees and average forex fees. Deposits and withdrawals are free, but inactivity fees are quite high.

Pros

Low forex fees

No withdrawal fee

Cons

High inactivity fees

FX trading fees are average

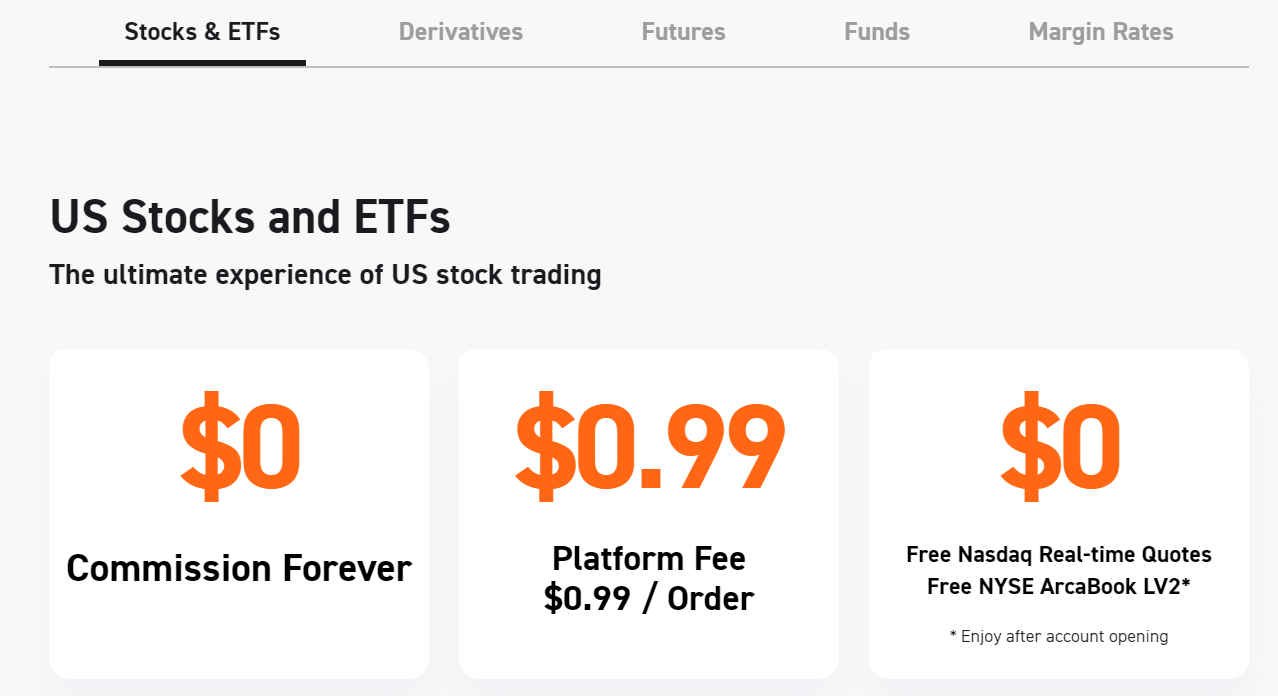

⑤Webull

Webull distinguishes it as one of the most affordable trading platforms due to its commitment to leveraging technology for increased trader profitability and economic freedom. The platform offers transparent pricing with zero commission trades and no deposit minimums. Unlike traditional brokers, Webull eliminates commissions and relies on back-end revenue streams such as stock loans, interest on free credit balances, margin interest, and payment for order flow to sustain its operations.

| Webull |  |

| FX commission per lot | $0 |

| Minimum deposit | $0 |

| Inactivity fee | No |

| Currency pairs | 17 |

| EUR/USD spread | 0.2 |

| Deposit & Withdrawal methods | Bank transfer, Credit/debit cards, PayPal, Neteller, Skrill |

| Withdrawal fee | $0 |

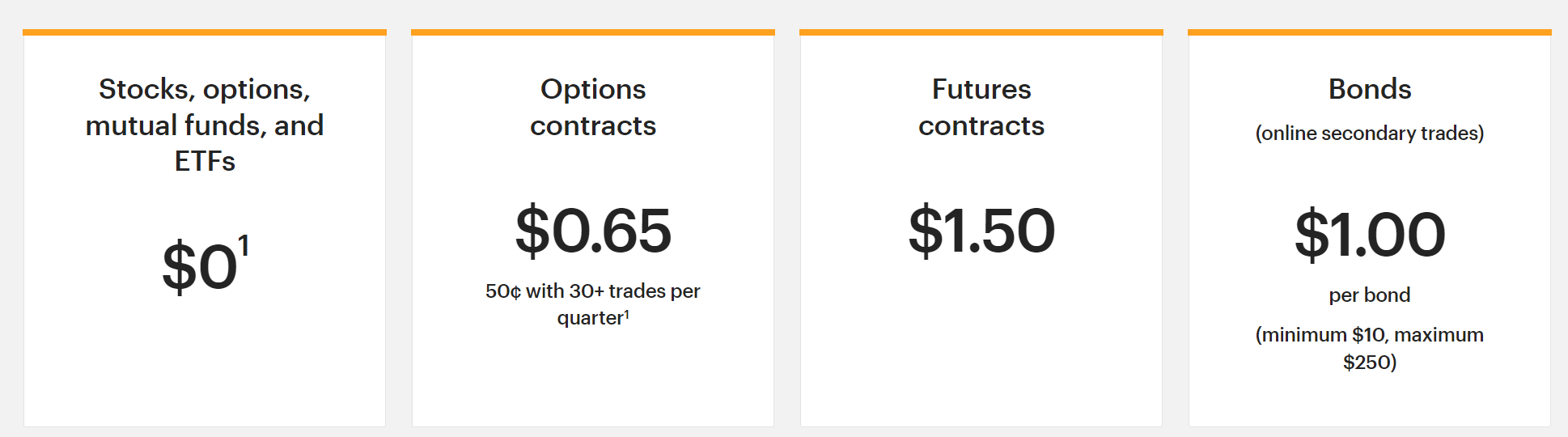

| Product | Fee(per trade) |

| Stocks | $0 |

| Options | $0 |

| ETFs | $0 |

| Mutual Funds | $0 |

| Options Contracts | $0.65 |

| Futures Contracts | $1.50 |

| Bonds (online secondary trades) | $1.00 |

Webull offers commission-free trading for US-listed stocks, ETFs and options. It currently pays 5% interest on idle cash. There is no withdrawal fee for ACH transfers and no inactivity fee, but wire transfer fees are high.

Pros

No commission (for stocks, ETFs, options)

High, 5% interest on cash balance

ACH transfers are free for funding & payout

Cons

High wire transfer costs

⑥moomoo

moomoo, a relative newcomer on the US stockbroker market, provides commission-free US stock, ETF and options trading with no inactivity fees. Its value proposition is backed up by high-quality research and educational tools. It pays high interest on uninvested cash.

On the downside, some popular asset classes such as bonds or mutual funds are not available at moomoo. Like many similar US brokers, moomoo doesnt offer convenient deposit/withdrawal methods such as credit/debit cards or electronic wallets.

| moomoo |  |

| Commissions | $0 per trade |

| Inactivity fee | No |

| Withdrawal fee | $0 |

| Minimum deposit | $0 |

| Products offered | Stock, ETF, Fund, Options, Futures |

Moomoo offers commission-free trading of US stocks and ETFs. Pays 5.1% interest on uninvested cash. Options trading on the other hand has a fee of $0.65 per trade.

Pros

Commission-free stock and ETF trading

No inactivity fee

Pays 5.1% on uninvested cash

Cons

Options trading carries a fixed fee

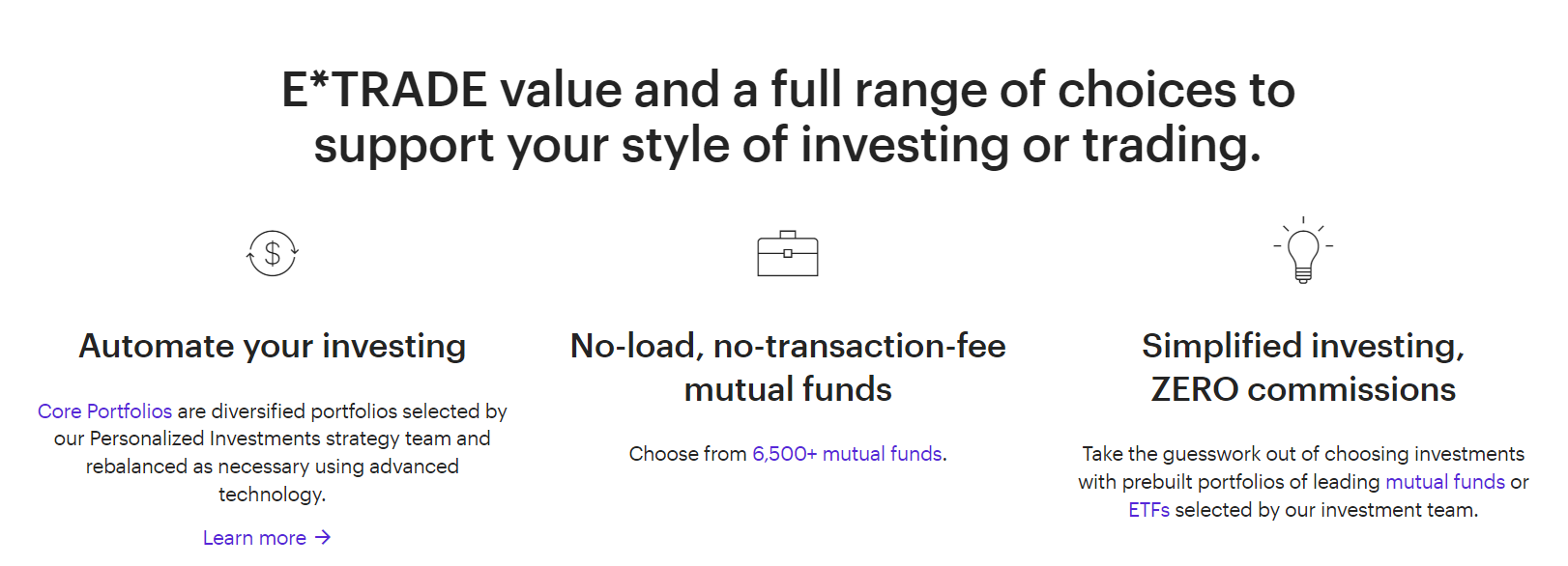

⑦E*TRADE

E*TRADE is recognized as one of the most cost-effective trading platforms for several reasons. Regular stock and ETF trades are commission-free, and option trades are competitively priced at $0.65 per contract. A notable feature is the absence of fees for mutual fund trading, eliminating transaction costs and early redemption fees. The platform offers real-time streaming quotes at no additional charge, although a $1,000 minimum balance is required to access this feature. E*TRADE distinguishes itself by providing a diverse selection of over 6,500 mutual funds with zero commissions.

Overall, E*TRADE's commitment to cost-effectiveness is evident, offering a comprehensive range of investment options at competitive prices, making it an appealing choice for traders seeking value in their investment platform.

| E*TRADE |  |

| FX commission per lot | $0 commission |

| Minimum deposit | $0 |

| Inactivity fee | No |

| Currency pairs | 56 |

| EUR/USD spread | 0.2 |

| Deposit & Withdrawal methods | Bank transfer, Credit/debit cards, PayPal, Neteller, Skrill, Klarna |

| Withdrawal fee | $0 |

| Product | Fee(per trade) |

| Stocks | $0 |

| Options | $0 |

| ETFs | $0 |

| Mutual Funds | $0 |

| Options Contracts | $0.65 |

| Futures Contracts | $1.50 |

| Bonds (online secondary trades) | $1.00 |

Pros

Easy-to-use tools.

Excellent customer support.

Advanced mobile app.

Commission-free stock, options, mutual fund and ETF trades.

Cons

Website can be difficult to navigate.

Low interest rate on uninvested cash.

Why Do We Consider Fees as the Most Important Factors?

When we choose a broker, the most important factors to consider are whether they are regulated and whether the fees are low. Fees are very important because they determine the cost of our trades. Choosing a broker with low fees can increase investment returns.

Low cost: Choosing a broker with low fees can greatly reduce trading costs, which can save a lot of fees for investors who trade frequently.

For example, suppose you want to open an investment account of 10,000 USD and invest 1,000 USD per month. You can choose between two brokerage firms: one charges a fee equivalent to 0.5%, and the other charges an annual fee of 1%. This difference may seem negligible, but over a period of 10 years, assuming a return rate of 4%, choosing the second brokerage firm will cost you about 5,000 USD in fees. Over 30 years, the additional fees paid will increase to over 55,000 USD. If you use a taxable account to help expand your retirement portfolio, you have 55,000 reasons to look for a broker with the lowest possible fees.

Increased returns: Because trading costs are saved, investment returns will naturally increase. Especially for those small investors whose returns are not very high for each trade, low transaction fees can significantly increase their net earnings.

Encourage more trading: For some investors who adopt high-frequency trading strategies, low transaction fees can better motivate them to engage in more trading activities.

Reduce financial pressure: For some investors with tight funds, choosing a broker with low fees can help them to some extent alleviate financial pressure.

Components of Trading Costs

Consider trading fees as the premium you pay for investment services. When you want to buy or sell shares of a specific investment, you have to pay a trading fee. Also known as a commission, this fee is paid to the broker in exchange for facilitating the trade on the platform. Traditional brokerage firms may also charge these fees.

Trading fees may be associated with different types of investments, including stocks, mutual funds, exchange-traded funds, or options. These fees can vary greatly depending on the type of security traded and the broker. In addition, some brokers may charge a flat trading fee, regardless of how many shares you buy. Other brokers may charge a per-share commission.

In terms of all these costs, online trading fees can range from a few dollars per trade to as high as 20 dollars, depending on the brokerage firm. The typical industry standard fee for options trading is between 65 cents and 1 dollar per contract. If you trade through a traditional brokerage firm, the fees could be much higher.

Trading fees are:

Trading fees are charges that investors and traders incur when buying or selling financial instruments, such as stocks, bonds, options, or cryptocurrencies, on various financial markets. These fees contribute to the revenue of the financial intermediaries or platforms that facilitate the trading process. The specific fees and their structures can be different according to the type of financial instrument and the trading platform. Here are some common types of trading fees:

Commission Fees: Many brokerage firms charge a commission for each trade executed on behalf of a trader. This can be a fixed fee per trade or a percentage of the total trade value. Some brokers offer commission-free trading for certain instruments or under specific conditions.

Spread: In the case of forex trading and some other financial markets, the spread is the difference between the buying (ask) price and the selling (bid) price of a currency pair or other assets. Traders pay the spread as a cost of entering a trade.

Exchange Fees: When trading on organized exchanges, such as stock exchanges or commodity futures exchanges, traders may be subject to fees imposed by the exchange itself. These fees help cover the costs of maintaining and operating the exchange infrastructure.

Clearing and Settlement Fees: These fees are associated with the clearing and settlement process, where trades are matched, confirmed, and settled. Clearinghouses facilitate this process, and traders may incur fees for these services.

Regulatory Fees: Some financial markets impose regulatory fees to fund regulatory bodies overseeing the markets. These fees are intended to ensure fair and transparent trading practices.

Withdrawal fees: Some brokers charge a fee when you withdraw money from your trading account. Usually, the fees depend on the withdrawal method (Bank transfer, credit card, online payment systems, etc.)

Inactivity fees: If you don't make any trades over a certain period of time, some brokers levy a fee. It's also sometimes referred to as the maintenance fee or dormant account fee.

Account maintenance fee: This is a fee charged by some brokers to keep your account open. This is different from the inactivity fee, which is charged for not trading.

Custody fee: This type of non-trading fee involves costs related to the holding of securities in an account.

Conversion fees: If your account is holding a different currency than your bank account, you might be charged conversion fees for withdrawals.

Account closing fee: Some brokers may charge you a fee for the account closure.

Other service charge: Some of the service fees that brokers charge, such as paper statement fees, special request fees, including Overnight mail, account transfers (outgoing), check copies.

Non-trading fees are:

Non-trading fees are charges not directly associated with buying and selling securities, but related to services provided by a broker. They often include, but aren't limited to, the following:

Commission-free Trading

While trading fees can reduce returns, there is also some good news. Now, more online brokers are providing investors with commission-free trading.

Commission-free trading means you can retain more of your investment returns, but there are some considerations to bear in mind. Most importantly, commission-free trading may not necessarily apply to all securities that you can trade via the online broker's platform.

For example, TD Ameritrade, a broker we will mention below, charges zero transaction fees for stock, ETF, and options trades. However, you will still need to pay transaction fees for traditional mutual funds and per-contract fees for options trades.

Other brokerage firms charge fees for stock trades but waive ETF transaction fees or offer free ETF trades and no-transaction-fee mutual funds. These no-commission funds do not charge trading sales fees. Some online investing platforms, such as Motif Investing, only offer zero-dollar commissions for next day trades, meaning you will still have to pay for real-time trades of stocks or other investments.

You can also pay fees for broker-assisted trades through online brokers. For instance, with TD Ameritrade, if you need this broker's help in conducting a trade, each transaction will cost $5.

How should beginners choose a broker that suits them?

In addition to fees, when choosing a broker that suits you, other factors need to be considered, including hard and soft aspects. The hard aspects include the broker's regulatory status, security, the trading platforms offered, and the type of accounts; the soft aspects include user reviews, and customer service attitude.

Choosing a broker can seem complex for beginners, but if you follow the guidelines below, it can simplify the process:

Research and Reputation: Start with some online research to find brokers with an excellent reputation. Look for company reviews and check their experience in the field. Avoid brokers with numerous complaints or legal issues.

Regulation: This is crucially important. Ensure the broker is registered with the appropriate financial regulatory authority in your country or region.

Evaluate Costs and Fees: Different brokers have different structures for fees, including transaction or commission fees, account maintenance fees, and inactivity fees. Make sure you understand all the costs involved before you choose a broker.

Trading Platforms: Check the broker's trading platform or tools they offer. Is it user-friendly? Does it have all the features and tools that you need for your trading?

Customer Service: Good customer support is important especially for beginners. Check if they can be reached easily via phone, email, or live chat. And ensure they can answer your questions adequately.

Account Options: Brokers usually offer several types of accounts. It could be a margin account where you can trade with borrowed money, or it could be a cash account where you can only trade with your own money. Choose a broker that offers a type of account you feel comfortable with.

Education and Resources: Some brokers provide educational resources such as webinars, videos, and articles to help their clients understand trading better. This can be very beneficial for beginners.

You Also Like

8 Best Forex Brokers With Segregated Accounts in 2026

Review the 8 Best Forex Brokers With Segregated Accounts. Analyze regulation, fund management practices, and compensation schemes for each.

4 Best $5 Minimum Deposit Forex Brokers in 2026

Explore forex trading with just $5 through the top four brokers, offering optimum services with minimal capital.

Best DMA Forex Brokers (Direct Market Access) for 2026

Delve into the world of DMA Forex Brokers with our guide. Discover top picks and know how DMA brokers operate, their pros and cons.

7 Best $10 Minimum Deposit Forex Brokers in 2026

Ultra-affordable Forex trading starts here! With only $10, join the Forex market with these seven champion brokers.