Score

Webull

United States|2-5 years|

United States|2-5 years| https://www.webull.com/

Website

Rating Index

Contact

Licenses

Licenses

Licensed Institution:ウィブル証券株式会社

License No.:関東財務局長(金商)第48号

Basic information

United States

United StatesUsers who viewed Webull also viewed..

XM

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

STARTRADER

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

MultiBank Group

- 10-15 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

GO MARKETS

- Above 20 years |

- Regulated in Australia |

- Market Making(MM) |

- MT4 Full License

Website

Most visited countries/areas

Puerto Rico

United States

Canada

webull.co.jp

Server Location

Japan

Website Domain Name

webull.co.jp

Server IP

13.113.33.209

webull.com

Server Location

China

Most visited countries/areas

India

Website Domain Name

webull.com

ICP registration

湘ICP备16011740号-2

Website

WHOIS.REGISTRAR.AMAZON.COM

Company

AMAZON REGISTRAR, INC.

Domain Effective Date

2005-05-08

Server IP

203.107.43.165

Company Summary

| Aspect | Information |

| Registered Country/Area | Japan |

| Company Name | Webull Securities Co., Ltd. |

| Regulation | Regulated by Japan's Financial Services Agency (FSA) |

| Maximum Leverage | Up to 4x day-trade buying power (Eligibility criteria apply), Up to 2x overnight buying power |

| Spreads | Not specified (may be embedded in trading prices) |

| Trading Platforms | Webull Desktop, Webull Mobile App, Web Platform |

| Tradable Assets | Stocks, Options, ETFs, OTC Stocks (availability may vary) |

| Account Types | Individual (Cash and Margin), IRA (Traditional, Roth, Rollover) |

| Demo Account | Available (Paper Trading Feature) |

| Customer Support | Dedicated support with various extensions, Phone: +1(888)828-0618 |

| Payment Methods | ACH, Wire Transfers |

| Educational Tools | Extensive Learning Center with articles, market analysis, trading strategies, technical and fundamental analysis, risk management, platform tutorials, and investment insights |

Webull Securities Co., Ltd., based in Japan, operates as a brokerage platform regulated by Japan's Financial Services Agency (FSA), providing retail forex trading services in adherence to strict financial regulations. Offering a range of trading platforms, including Webull Desktop, Webull Mobile App, and Web Platform, Webull caters to traders interested in stocks, options, ETFs, and OTC stocks (availability may vary). The brokerage offers individual accounts, both cash and margin, as well as various types of IRAs, including Traditional, Roth, and Rollover IRAs. Traders can also utilize a demo account for practice trading. With dedicated customer support and a comprehensive Learning Center offering a wide array of educational resources, Webull aims to provide traders with tools and knowledge to enhance their trading skills and decision-making. Payment methods include ACH and wire transfers, though specific details such as minimum deposits are not provided in the available information. The platform offers leverage options of up to 4x day-trade buying power (subject to eligibility) and up to 2x overnight buying power. While spreads are not explicitly mentioned, they may be embedded in trading prices, and customer support can be reached at +1(888)828-0618 for various inquiries and extensions.

Regulation

Webull is regulated by the Financial Services Agency (FSA) in Japan, holding a Retail Forex License. This license, with the registration number 関東財務局長(金商)第48号, signifies that Webull is authorized to offer retail forex trading services in compliance with Japanese financial regulations.

Under the supervision of the FSA, Webull is required to adhere to strict standards and guidelines to ensure the security and integrity of its financial services. This regulation is designed to protect the interests of Japanese investors and maintain the stability of the financial markets in Japan.

Webull Securities Co., Ltd. is the licensed institution responsible for providing these financial services in accordance with the FSA's requirements. The effective date of this license would need to be verified through official sources to ensure accuracy.

Pros and Cons

| Pros | Cons |

| Commission-Free Trading for Stocks, ETFs, and Most Options | Limited Availability of Certain Securities Depending on Location |

| User-Friendly Trading Platforms, Including Webull Desktop and Mobile App | Higher Risk with Margin Trading and Leverage |

| Diverse Market Instruments, Including Stocks, Options, ETFs, and OTC Stocks | OTC Stocks Can Be Riskier and Less Liquid |

| Access to Paper Trading for Practice | Limited Availability of Some Account Types |

| Range of Account Types, Including IRAs | Leverage Amplifies Both Gains and Losses |

| Leverage Available for Margin Trading | Regulatory Fees Apply to Certain Transactions |

| Extensive Learning Center for Trader Education | Withdrawal Errors Can Incur Fees |

| Dedicated Customer Support with Various Extensions | |

| Regulatory Oversight by Japan's Financial Services Agency (FSA) |

Webull offers several advantages to traders, including commission-free trading, user-friendly platforms, a variety of market instruments, and access to paper trading for practice. The platform provides different account types, including IRAs, and offers leverage for margin trading. Webull also features an extensive Learning Center and dedicated customer support. However, it's important to consider the limited availability of certain securities, the higher risk associated with margin trading and leverage, and the potential fees, including regulatory fees and withdrawal-related costs. Overall, Webull is a versatile platform with both benefits and considerations for traders.

Market Instruments

Webull is a brokerage platform that offers a range of market instruments to its users. Here's a brief description of the market instruments available on Webull:

Stocks: Webull allows users to trade a wide variety of stocks from different stock exchanges, including major U.S. exchanges like the New York Stock Exchange (NYSE) and the NASDAQ. Users can buy and sell shares of publicly traded companies.

Options: Webull provides access to options trading, allowing users to trade options contracts. Options are financial derivatives that give traders the right (but not the obligation) to buy or sell an underlying asset, such as stocks, at a specified price (strike price) on or before a predetermined date (expiration date).

ETFs (Exchange-Traded Funds): Users can trade ETFs on Webull. ETFs are investment funds that hold a diversified portfolio of assets, such as stocks, bonds, or commodities. They are traded on stock exchanges like individual stocks and offer diversification benefits to investors.

OTC (Over-The-Counter) Stocks: Webull also allows trading of OTC stocks. These are stocks of companies that are not listed on major stock exchanges but are traded directly between parties, often through electronic communication networks (ECNs). OTC stocks can be riskier and less liquid compared to stocks on major exchanges.

Paper Trading: Webull offers a paper trading or virtual trading feature. This allows users to practice trading without risking real money. Users are provided with a simulated account balance to test their trading strategies and gain experience in a risk-free environment.

It's important to note that while Webull offers these market instruments, trading involves risks, and users should conduct thorough research, have a clear understanding of the instruments they are trading, and consider their risk tolerance before participating in financial markets. Additionally, the availability of these instruments may vary depending on the user's location and regulatory restrictions.

Account Types

Webull offers several types of accounts to cater to different investment needs and goals. Here's a description of the account types you can open with Webull:

Individual Account (Cash and Margin):

Cash Account: This is a standard brokerage account where you can trade using the cash you deposit. You cannot borrow funds (leverage) in a cash account.

Margin Account: A margin account allows you to borrow funds from the broker to trade. This can increase your buying power, but it also comes with higher risk. You need to meet specific eligibility criteria and agree to the terms and conditions of margin trading to open a margin account. Each user can have one cash account and one margin account.

IRA (Individual Retirement Account):

Traditional IRA: Contributions to a Traditional IRA may be tax-deductible, and the earnings grow tax-deferred until you withdraw them during retirement.

Roth IRA: Contributions to a Roth IRA are made with after-tax money, but qualified withdrawals are tax-free. Roth IRAs also have no required minimum distribution (RMD) during your lifetime.

Rollover IRA: This type of IRA is used to consolidate assets from a qualified retirement plan (such as a 401(k)) when you change jobs or retire. It allows you to maintain the tax-advantaged status of your retirement savings.

Webull offers various types of IRAs, including:

It's important to note that you must have an individual account before opening an IRA with Webull. Additionally, each user can have one of each type of individual account (cash and margin) and one IRA.

When considering which type of account to open, it's essential to consider your financial goals, risk tolerance, and tax implications. IRAs, for example, offer potential tax advantages for retirement savings, while margin accounts involve borrowing and may carry additional risks. Always consult with a financial advisor or tax professional to make informed decisions about the type of account that best suits your needs.

Leverage

Webull offers margin trading with specific leverage limits for both day-trading and overnight positions. Here's a description of the leverage options provided by Webull:

Day-Trade Buying Power:

Webull offers up to 4x day-trade buying power. This means that, with a margin account, you can potentially trade up to four times the amount of your available cash balance on the same trading day. However, this leverage is subject to eligibility requirements and your account must have at least $2,000 to qualify.

Overnight Buying Power:

For overnight positions held into the next trading day, Webull provides up to 2x overnight buying power. This allows traders to potentially hold positions worth up to twice their available cash balance overnight.

It's important to note that leverage in margin trading amplifies both gains and losses, making it a higher-risk trading strategy. The specific leverage you can access may vary based on your account balance, trading experience, and the assets you intend to trade. Additionally, Webull's margin rates are variable and determined by the size of the margin loan, as indicated in the provided information.

As leverage involves borrowing funds to trade, it's crucial for traders to fully understand the risks involved and to use leverage responsibly. Trading on margin can result in substantial losses, and traders should have a clear risk management strategy in place. It's advisable to consult with a financial advisor or conduct thorough research before engaging in leveraged trading.

Spreads & Commissions

Webull's fee structure encompasses spreads and commissions, which can fluctuate based on the trading accounts and asset types:

Commissions:

Webull does not charge commissions for trading stocks, ETFs, and most options listed on U.S. exchanges, making it a cost-effective choice for many traders. However, there is a nominal $0.55 per contract fee for certain options trades, which applies in specific cases.

Spreads:

The information provided does not explicitly mention spreads for trading assets. Spreads typically refer to the difference between the bid (buying) and ask (selling) prices of an asset. In Webull's case, this spread cost may be embedded in the trading prices offered on the platform.

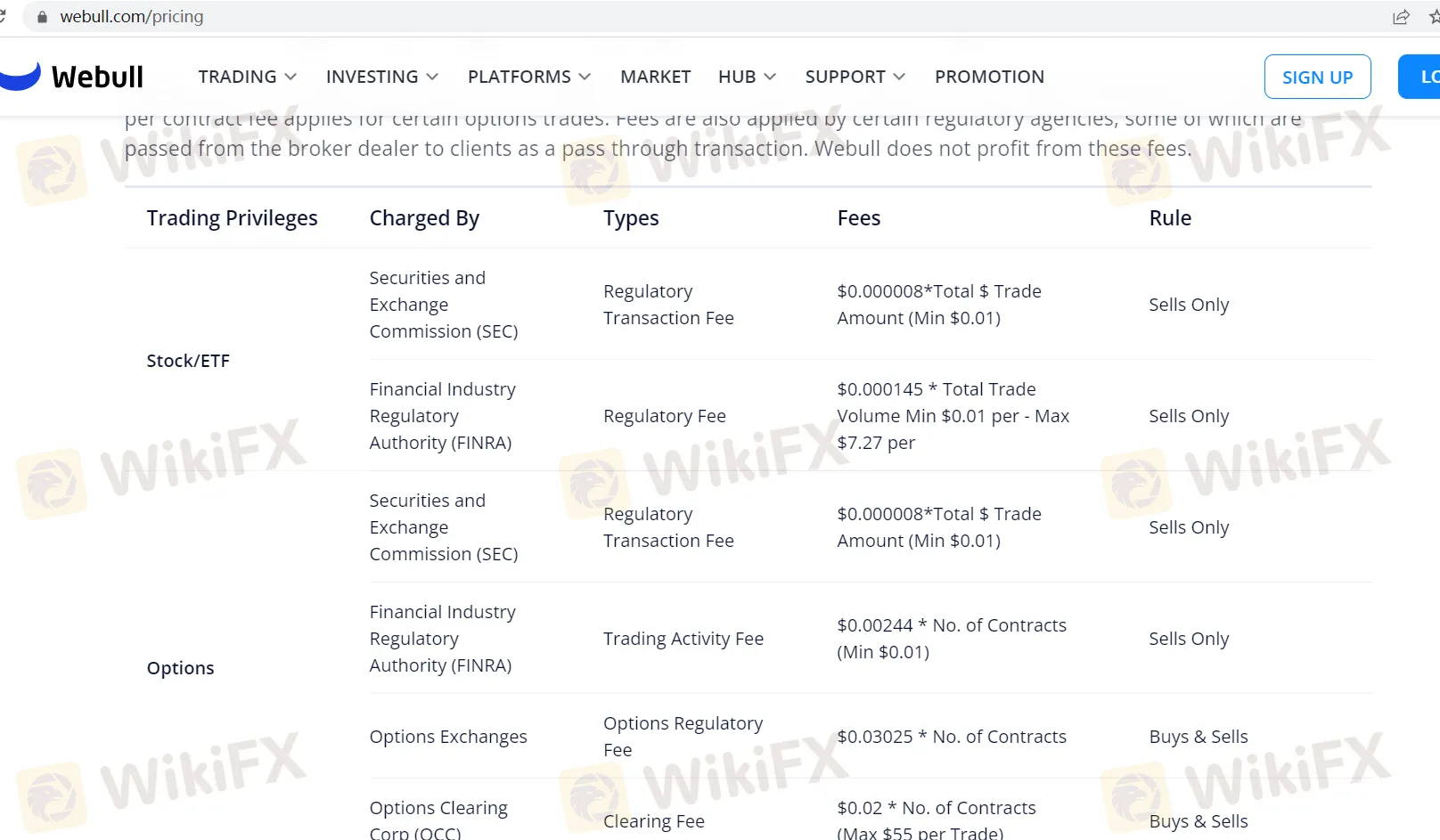

Regulatory Fees:

In addition to commissions and spreads, Webull traders should be aware of regulatory fees associated with certain transactions. These fees are not directly retained by Webull but are passed on to traders as a “pass-through” transaction cost. These regulatory fees include:

SEC Regulatory Transaction Fee: Based on the total dollar amount of your trades.

FINRA Regulatory Fee: Calculated based on the total trade volume.

Options Exchange Fees: Fees assessed by options exchanges on their members.

OCC Clearing Fee: Charged by The Options Clearing Corp (OCC) for options trades.

Other Relevant Fees: Fees for various actions such as deposit and withdrawal, stock transfers, and postage may apply.

It's important for traders to consider the overall cost structure, including spreads, commissions, and regulatory fees, when evaluating the cost-effectiveness of their trading activity on Webull. Different trading accounts and asset types may have varying fee structures, so it's advisable to review the specific terms and conditions related to your trading account and the assets you intend to trade. Additionally, fees are subject to change, so staying informed about the latest fee updates is essential for traders using the Webull platform.

Deposit & Withdrawal

Deposits:

ACH Deposits:

To initiate an ACH deposit on the Webull mobile app:

Navigate to the homepage by selecting the Webull logo in the middle of the bottom navigation bar.

Swipe to access the “Transfers” tab at the top of the screen.

Click “Deposit” to begin the process.

ACH transfers typically take approximately 4 business days to settle. During this time, you may have access to Instant Buying Power, allowing you to start trading before the deposit fully settles.

The estimated arrival time for deposits depends on the time of initiation:

Deposits made before 4:00 pm ET settle at around 9:30 AM on the fourth business day.

Deposits made after 4:00 pm ET settle at around 9:30 AM on the fifth business day.

Instant Buying Power is granted based on various factors, including your deposit amount, account type, cash balance, market value of your positions, and incoming funds. However, certain institutions may not be eligible for provisional credit on ACH deposits.

Wire Transfers:

To initiate a wire withdrawal:

Go to the home page of the mobile app.

Swipe to the “Transfers” tab.

Tap “Withdraw.”

Select your bank account or add a new one.

Enter the withdrawal amount (within available funds) and submit the request.

Domestic wire transfers generally take about 2 business days to complete, while international wire transfers may take up to 5 business days. It's crucial to ensure the accuracy of beneficiary bank account information to avoid reversals and associated fees.

Withdrawals:

ACH Withdrawals:

ACH withdrawals can be initiated using the Webull mobile app:

Go to the homepage.

Access the “Transfers” tab at the top of the screen.

Click “Withdraw” to proceed.

ACH withdrawals usually take 1-2 business days to complete.

Wire Transfers:

To initiate a wire withdrawal, follow these steps on the mobile app:

Access the homepage.

Navigate to the “Transfers” tab.

Tap “Withdraw.”

Select your bank account or add a new one.

Enter the withdrawal amount (within available funds) and submit the request.

Domestic wire transfers are typically completed within 2 business days, while international wire transfers may take up to 5 business days. Ensure the accuracy of beneficiary bank account information to prevent reversals and associated fees.

It's essential to use your own personal bank account for initiating wire transfers, as third-party wires are not accepted. Additionally, always double-check your information to prevent any withdrawal errors or complications.

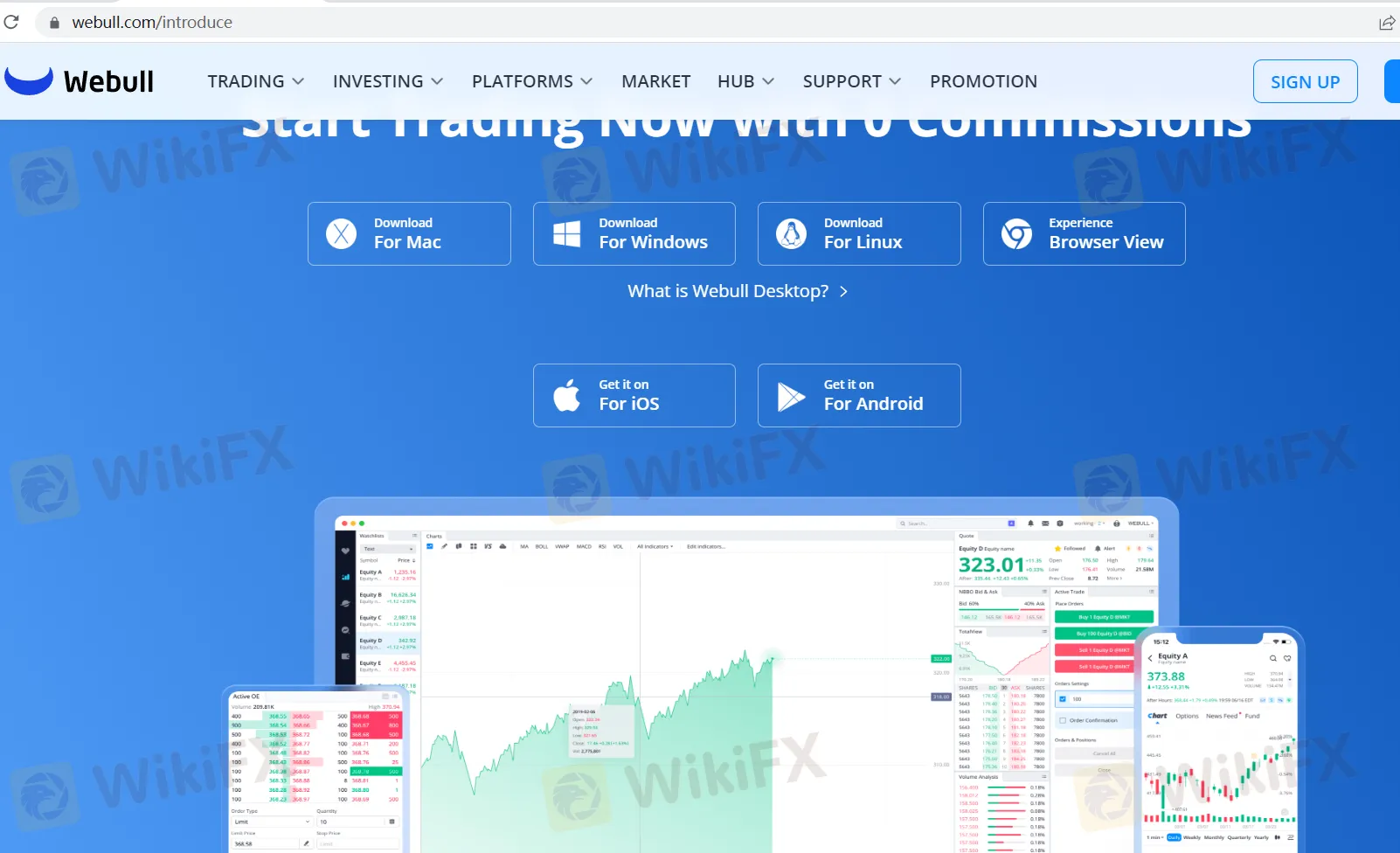

Trading Platforms

Webull offers a variety of user-friendly trading platforms to suit your trading preferences:

Webull Desktop:

A powerful desktop trading platform for Mac, Windows, and Linux.

Commission-free trading for stocks, ETFs, and options.

Features a wide range of order types and trading tools.

Provides intuitive charts, screeners, fundamental data, and news.

Highly customizable for personalized trading styles.

Webull Mobile App:

Commission-free trading on the go for stocks, ETFs, and options.

Offers trading tools, intuitive charts, and in-depth analysis.

Supports 60+ technical indicators and options trading features.

Enhanced screeners and alerts for informed decisions.

Web Platform:

No downloads required; trade directly in your web browser.

Access real-time stock quotes, research, and trade functions.

Compatible with major browsers for easy access.

Webull's platforms provide commission-free trading, customizable features, and in-depth analysis tools for traders of all levels.

Customer Support

Webull provides dedicated support services for traders:

Promotion Questions: Refer to the help center for promotion inquiries.

Account Maintenance (Ext. 2): Get help with login, password resets, and app/desktop guidance.

Banking and Operations (Ext. 3): Assistance with deposits, withdrawals, ACH issues, wire transfers, and corporate actions.

Trading (Ext. 4): Questions about stocks, options, crypto, margin, buying power, and orders.

Account Services (Ext. 5): Help with account opening, transfers, taxes, and IRA queries.

Contact: +1(888)828-0618

Webull's streamlined support system covers a wide range of topics, ensuring traders can quickly get assistance across all aspects of their trading journey.

Educational Resources

Explore Webull's extensive Learning Center, accessible at Webull's Learning Center. This resource hub is brimming with educational articles and materials crafted to enhance your trading prowess.

Here's what you'll discover:

In-Depth Articles: Find a diverse array of articles covering various trading topics, suitable for traders at all levels.

Market Analysis: Stay updated with insightful market trends and analyses to inform your trading decisions.

Trading Strategies: Learn about different strategies tailored to your trading style and risk tolerance.

Technical and Fundamental Analysis: Dive into the worlds of technical and fundamental analysis, empowering your trading approach.

Risk Management: Master essential risk management techniques to safeguard your investments.

Platform Tutorials: Navigate Webull's platforms effectively with step-by-step tutorials.

Investment Insights: Gain valuable insights into stocks, ETFs, options, and cryptocurrencies.

Webull's Learning Center is your go-to resource for trading education, catering to both beginners and experienced traders. Explore it now to boost your trading skills and market knowledge. Access it here.

Summary

Webull is a regulated brokerage platform that offers a diverse range of market instruments, account types, and trading options to cater to the needs of both beginner and experienced traders. Regulated by the Financial Services Agency (FSA) in Japan, Webull ensures compliance with Japanese financial regulations to safeguard investor interests and market stability. Users can access various market instruments such as stocks, options, ETFs, OTC stocks, and paper trading while choosing from individual accounts (cash and margin) and Individual Retirement Accounts (IRAs) to align with their financial goals. Leverage options are available for margin trading, with commission-free trading for stocks, ETFs, and most options, although nominal fees may apply in specific cases. Deposits and withdrawals can be made through ACH transfers or wire transfers, with varying settlement times, and Webull offers versatile trading platforms with customization options and in-depth analysis tools. The platform's comprehensive support system and extensive Learning Center enhance the trading experience for users of all levels.

FAQs

Q1: What is Webull's regulatory status?

A1: Webull is regulated by the Financial Services Agency (FSA) in Japan, holding a Retail Forex License, ensuring compliance with Japanese financial regulations.

Q2: What market instruments can I trade on Webull?

A2: Webull offers stocks, options, ETFs, OTC stocks, and a paper trading feature, allowing users to practice without real money.

Q3: What types of accounts are available on Webull?

A3: Webull offers individual accounts (cash and margin) and Individual Retirement Accounts (IRAs) including Traditional, Roth, and Rollover IRAs.

Q4: Does Webull offer leverage for trading?

A4: Yes, Webull provides leverage for margin trading, with specific limits for day-trading and overnight positions.

Q5: How can I contact Webull's customer support?

A5: You can reach Webull's customer support at +1(888)828-0618, with dedicated extensions for various inquiries, including account maintenance, banking, and trading questions.

Keywords

- 2-5 years

- Regulated in Japan

- Retail Forex License

- Suspicious Scope of Business

- Medium potential risk

News

News Webull Canada Expands Options Trading to TFSAs and RRSPs

Webull Canada launches options trading for TFSAs and RRSPs, offering Canadian investors tax-free growth and retirement savings optimization opportunities.

2024-12-19 11:49

News Webull Canada Expands Trading Hours with Options Trading

Webull Canada now offers extended trading hours from 4 a.m. to 5:30 p.m. ET, plus options trading. Gain flexibility and manage risk in an ever-changing market.

2024-11-27 15:29

News Webull Partners with Coinbase to Offer Crypto Futures

Webull partners with Coinbase Derivatives to offer crypto futures, providing US investors access to Bitcoin and Ethereum contracts with lower entry barriers.

2024-11-21 15:30

News Webull Introduces 24/5 Overnight Trading to Extend U.S. Market Access

Webull has announced the launch of a new 24/5 Overnight Trading feature for U.S. users, developed in partnership with Blue Ocean ATS. This feature allows Webull’s clients to trade stocks and ETFs outside traditional market hours, from 8:00 pm to 4:00 am ET, Sunday through Thursday.

2024-11-13 17:29

News Webull Thailand Launches US Stock Options, Pioneering in Local Market

Webull Thailand debuts US stock options, offering Thai investors new avenues for portfolio diversification and risk management with zero commissions for the first month.

2024-11-11 17:24

News Webull Thailand Launches 120-Day Free Access to Nasdaq TotalView

Webull Thailand offers new users 120 days of free Nasdaq TotalView access, bringing institutional-level trading insights and index options to Thai investors.

2024-11-04 14:17

Review 5

Content you want to comment

Please enter...

Review 5

TOP

TOP

Chrome

Chrome extension

Global Forex Broker Regulatory Inquiry

Browse the forex broker websites and identify the legit and fraud brokers accurately

Install Now

洪玉2726

Japan

The broker was introduced by a friend. I want to withdraw but can't contact anyone. It only shows the withdrawal was unprocessed. The customer service can't be contacted either. I don't know how and ask whom to solve it.

Exposure

05-12

FX1669545234

Netherlands

What I like the most is the spreading cheaper compare to the other broker but there is need to improve a little bit that can make it more convenient when it comes during withdraw the money. If possible allow us to withdraw money directly to any card that we use to me deposit either credit or debit card. Other than that so far so good.

Neutral

04-30

FX1448000683

Hong Kong

I've heard about Webull from my buddies, and they seem to be pretty legit. However, I didn't choose them because they don't offer forex trading, which is a bummer. But overall, my friends have had good experiences with them, so they might be worth checking out if you're interested in other types of trading.

Neutral

2023-03-27

Arctant vecy

Malaysia

Webull's got legit regulators and user-friendly account options, so I didn't hesitate to trade with them!

Positive

07-31

千秋伟业:积少聚多

United Kingdom

The company's website looks great, there are no commissions, no minimum deposit requirements, and it offers a wide variety of trading instruments. But I didn't find a demo account, so I dare not deposit money rashly.

Positive

2023-02-28